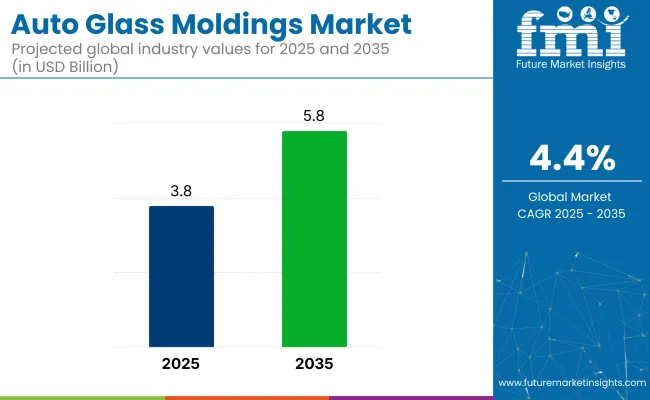

The auto glass moldings market is projected to grow from USD 3.8 billion in 2025 to USD 5.8 billion by 2035, registering a CAGR of 4.4% over the forecast period. Growth in the market is expected to be sustained by the increasing volume of vehicle production, rising replacement rates for damaged windshields, and greater demand for aerodynamic designs that require precision sealing solutions. Asia Pacific remains the dominant production hub, while North America and Europe continue to lead in aftersales demand.

In 2025, the auto glass moldings market holds a modest but functionally important share across its broader parent markets. Within the global automotive glass market, it contributes approximately 5-7%, as moldings are essential for securing and sealing windshields and windows. In the automotive components market, its share is around 1-2%, reflecting its niche status among thousands of parts.

Within the automotive exterior parts market, the contribution is estimated at 3-4%, driven by its role in weatherproofing and design continuity. In the automotive aftermarket, it holds about 2-3%, due to steady demand for replacement moldings. In the vehicle body parts market, the share stands near 1-2%, as moldings represent a small yet necessary component of overall body assembly.

Material innovation, especially with EPDM rubber, thermoplastics, and UV-resistant compounds, is enhancing molding longevity and flexibility. Automated molding application systems in OEM assembly lines are helping reduce labor costs and improve fit precision. As vehicle designs evolve with sleeker rooflines and panoramic windshields, auto glass moldings are becoming more complex in shape and function, positioning the category for steady growth across both OEM and aftermarket channels.

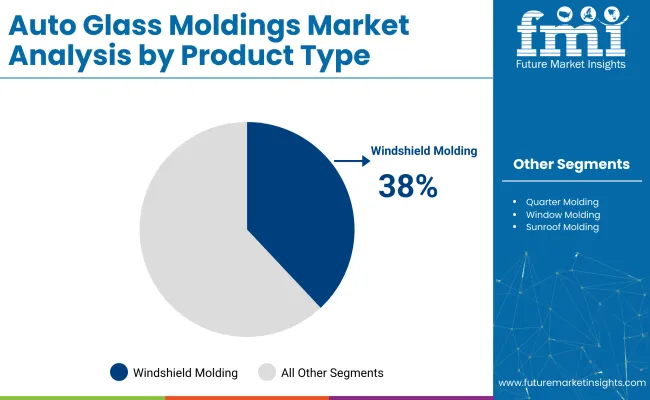

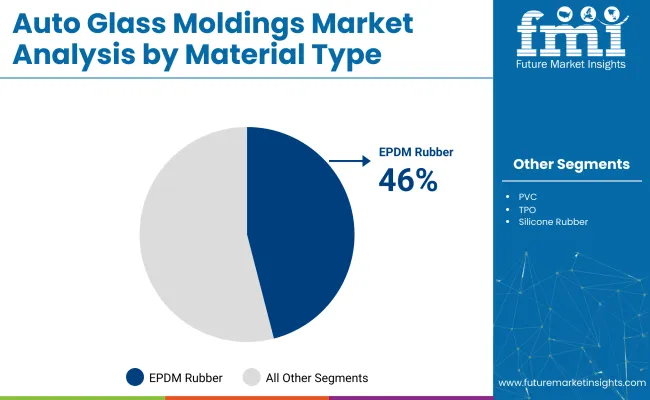

Windshield moldings are projected to dominate the product width segment with a 38% market share by 2025, while EPDM rubber is expected to lead the material type segment with a 46% share. Passenger cars are set to capture 70% of the end-use segment.

Windshield moldings are projected to lead the product width segment, accounting for 38% of the global market share by 2025. These components are essential for sealing the perimeter of the windshield and preventing water and air leakage.

EPDM rubber is projected to dominate the material type segment, capturing 46% of the global market share by 2025. This material is favored for its flexibility, weather resistance, and long service life.

Passenger cars are expected to lead the end-use segment, holding 70% of the global market share by 2025. This dominance is supported by the high volume of passenger vehicle production worldwide.

First fit (OEM) is projected to dominate the sales channel segment, securing 75% of the market share by 2025. This is due to increased vehicle production and integration of custom-fitted components at the manufacturing stage.

The auto glass moldings market is witnessing steady growth due to rising vehicle production, demand for aerodynamic designs, and greater emphasis on noise and weather insulation. OEMs and aftermarket suppliers are focusing on durability, precision fit, and material innovation to meet evolving design and performance standards across passenger and commercial vehicles.

Strong Demand for Windshield and Window Sealing Applications

Auto glass moldings are critical for sealing windshields, side windows, and rear glass to prevent water leakage, wind intrusion, and noise. These components enhance vehicle comfort, structural integrity, and safety. As automotive designs shift toward sleeker profiles and frameless windows, moldings are engineered to provide seamless integration and high adhesion to diverse glass types.

Adoption of Advanced Materials and High-Performance Coatings

Manufacturers are developing moldings using high-durability rubber, EPDM, and thermoplastic elastomers (TPEs) that offer UV resistance, flexibility, and long-term sealing. Co-extruded and flocked moldings are gaining popularity for improved performance in harsh environments. Special coatings are applied to resist weathering, improve bonding with adhesives, and enhance friction control during glass movement.

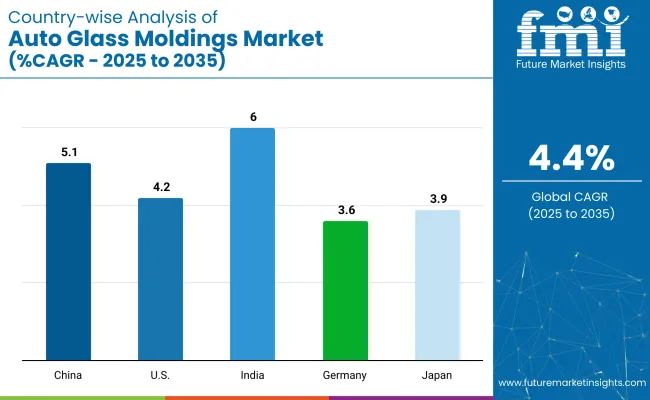

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

| China | 5.1% |

| United States | 4.2% |

| Japan | 3.9% |

| Germany | 3.6% |

The global auto glass moldings market is projected to grow steadily through 2035, supported by rising demand for precision-fit sealing, lightweight trim components, and improved aerodynamic insulation. Regional growth is influenced by OEM design shifts, EV platform integration, and localized molding production.

India leads the top five countries with a CAGR of 6.0%, followed by China at 5.1%, as both countries scale automotive manufacturing and local part sourcing. The United States (4.2%), Japan (3.9%), and Germany (3.6%) reflect consistent demand tied to vehicle refresh cycles, platform redesigns, and regulatory compliance.

BRICS economies such as China and India are focused on high-volume production and cost-efficient moldings. In contrast, OECD markets like Germany, Japan, and the United States are emphasizing quality, fit precision, and material sustainability.

The report covers insights across more than 40 countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 6.0%, supported by strong expansion in the domestic vehicle manufacturing sector and rising demand for localized part supply. The country is witnessing high demand from the compact and mid-size car segments, where cost-effective, easy-to-install moldings are prioritized. India's warm climate and dusty conditions also drive the need for UV- and abrasion-resistant materials in sealing applications. Local manufacturers are investing in extrusion capacity to serve growing demand from OEMs and aftermarket distributors.

China’s market is expected to grow at a CAGR of 5.1%, fueled by continued growth in electric vehicle manufacturing and a strong domestic supply base. Moldings are increasingly used in EV models to enhance noise insulation and reduce drag. Local joint ventures are expanding their capacity to produce co-extruded profiles that meet aerodynamic and aesthetic needs. China also benefits from its role as a major auto glass producer, allowing close integration between glass and molding systems during vehicle assembly.

The USA market is growing at a CAGR of 4.2%, driven by steady demand from both OEM platforms and aftermarket replacements. The USA market places strong emphasis on moldings that combine flame resistance, noise insulation, and structural flexibility. High-volume segments such as SUVs and light trucks are adopting custom profiles for improved water sealing and fit. Environmental compliance is also pushing manufacturers to explore recyclable materials in molding compounds for domestic assembly and service networks.

Japan’s market is forecast to expand at a CAGR of 3.9%, shaped by the country’s focus on compact vehicles and engineering precision. Moldings in Japan are often customized to meet ultra-low tolerance standards for hybrid cars and high-efficiency sedans. Local OEMs prefer seamless, single-piece profiles that reduce noise and improve cabin aerodynamics. Japan’s domestic rubber and polymer industries provide a reliable base for high-quality molding inputs, particularly for window and windshield applications.

Germany’s market is projected to grow at a CAGR of 3.6%, supported by demand from luxury OEMs and a strong focus on vehicle design precision. Germany stands out for its emphasis on flush-mounted windows, which require moldings that offer both sealing capability and visual continuity. Automakers are using advanced thermoplastic elastomers to meet performance requirements in premium electric and hybrid vehicles. The aftermarket also plays a role in maintaining molding quality across aging fleets.

The auto glass moldings market is moderately consolidated, with key players such as TOYODA GOSEI Co., Ltd., Cooper Standard Automotive, and HWASEUNG leading through strong OEM partnerships and material innovation. TOYODA GOSEI is widely recognized for its high-precision rubber and plastic moldings used in sealing systems for windshields and side windows. Cooper Standard Automotive offers a broad portfolio of weatherstrips and glass run channels, with a focus on lightweight and durable solutions for enhanced vehicle aerodynamics.

HWASEUNG contributes significantly with advanced EPDM-based moldings designed for both acoustic performance and environmental resistance. FlexiTrim (Meteor-creative) and Hebei Shida Seal Group serve regional and aftermarket needs, offering customized sealing solutions for passenger and commercial vehicles.

Recent Auto Glass Moldings Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.8 billion |

| Projected Market Size (2035) | USD 5.8 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Windshield Molding, Quarter Molding, Window Molding, Sunroof Molding |

| Material Types Analyzed (Segment 2) | EPDM, PVC, TPO, Silicone Rubber, Others |

| End Uses Analyzed (Segment 3) | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sales Channels Analyzed | First Fit, Aftermarket |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | FlexiTrim (Meteor-creative), Cooper Standard Automotive, TOYODA GOSEI Co., Ltd., Hebei Shida Seal Group, Bharat Seats Ltd., HWASEUNG |

| Additional Attributes | Dollar sales by product type and end use, growing vehicle production, rising aftermarket replacements, and increasing preference for weather-resistant and noise-insulating materials. |

The market is segmented by product type into windshield molding, quarter molding, window molding, and sunroof molding.

Based on material type, the market includes EPDM (Ethylene Propylene Diene Monomer), PVC (Polyvinyl Chloride), TPO (Thermoplastic Olefin), silicone rubber, and other materials.

By end use, the market is categorized into passenger cars, light commercial vehicles, and heavy commercial vehicles.

The sales channel segmentation includes first-fit and aftermarket segments.

Regionally, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The global market is expected to reach USD 5.8 billion by 2035.

The market size is projected to be USD 3.8 billion in 2025.

The market is forecast to grow at a CAGR of 4.4% during the period from 2025 to 2035.

Windshield moldings are expected to lead the product width segment with a 38% market share in 2025.

India is expected to grow at the highest CAGR of 6.0% during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA