The rotational molding machine market is expanding as industries demand efficient, versatile, and sustainable solutions for manufacturing hollow plastic products. Manufacturers are advancing technologies to meet the needs of industries like automotive, construction, and consumer goods. By 2035, this market is projected to exceed USD 1420.6 million, growing at a compound annual growth rate (CAGR) of 3.7%.

The focus on cost efficiency, durability, and customization drives market growth. Companies deliver machines that enhance production speed, reduce material waste, and meet industry-specific requirements.

| Attributes | Description |

|---|---|

| Projected Market Value (2025F) | USD 1420.6 million |

| Value-based CAGR (2025 to 2035) | 3.7% |

Factors Driving Market Growth

Global Market Share & Industry Share

| Category | Market Share (%) |

|---|---|

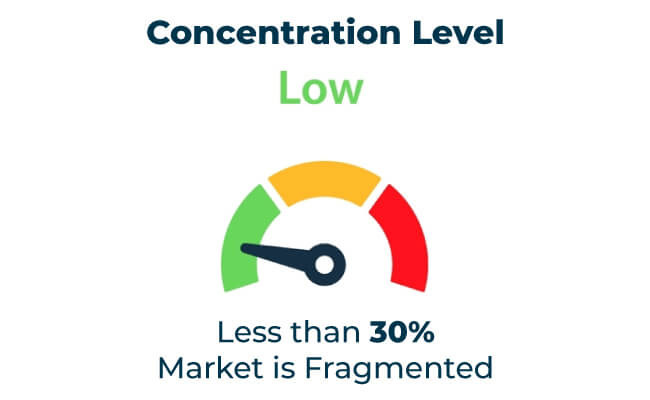

| Top 3 Players (Ferry Industries, Rotoline, Persico) | 13% |

| Rest of Top 5 Players (NAROTO, Reinhardt) | 08% |

| Next 5 of Top 10 Players | 04% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 25% |

| Next 20 Players | 43% |

| Remaining Players | 27% |

Year-on-Year Leaders

Emerging markets in Asia-Pacific, Africa, and Latin America offer significant growth potential. Increasing industrialization and demand for molded plastic products create opportunities for rotational molding machine manufacturers to expand globally. Exporters aligned with local preferences and regulations can capitalize on these growing markets.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Focuses on sustainability and advanced machinery. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Leads with eco-friendly practices and technological innovation. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Industrial growth and affordable production solutions drive demand. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 5% |

| Key Drivers | Emerging markets adopt advanced molding solutions. |

The rotational molding machine market will grow through advancements in automation, smart technologies, and sustainable practices. Companies investing in global market expansion and eco-friendly solutions will lead the industry. Collaboration with end-users and regulatory agencies will further enhance opportunities.

| Tier | Key Companies |

|---|---|

| Tier 1 | Ferry Industries, Rotoline, Persico |

| Tier 2 | NAROTO, Reinhardt |

| Tier 3 | Fixopan Machines, ZhongyunTech |

The rotational molding machine market is set for significant growth as sustainability, automation, and industrial demand shape industry trends. Companies prioritizing eco-friendly practices, advanced technologies, and global market expansion will lead the market. Collaboration with industry stakeholders and adherence to regulations will unlock additional growth opportunities.

Key Definitions

Abbreviations

Methodology

This report integrates primary research, secondary data, and expert insights. Findings are validated through interviews with industry professionals and end-users to ensure accuracy and reliability.

Market Definition

The rotational molding machine market includes the development and use of advanced, sustainable, and customizable equipment for producing hollow plastic products. These machines serve industries like automotive, construction, consumer goods, and industrial applications.

Industries like automotive, construction, consumer goods, and industrial applications rely heavily on rotational molding machines for manufacturing durable and lightweight products.

Manufacturers design energy-efficient machines and support the use of recyclable materials to reduce environmental impact.

North America and Europe lead the market due to advanced technologies and strong demand for eco-friendly solutions.

Challenges include high initial costs, regulatory compliance, and maintenance needs for advanced machinery.

Automation, smart control systems, and advanced materials are key innovations driving the market forward.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotational Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Molding Starch Market Size and Share Forecast Outlook 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Blow Molding Resin Market Growth – Trends & Forecast 2024-2034

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Rubber Molding Market Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Auto Glass Moldings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Particle Foam Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA