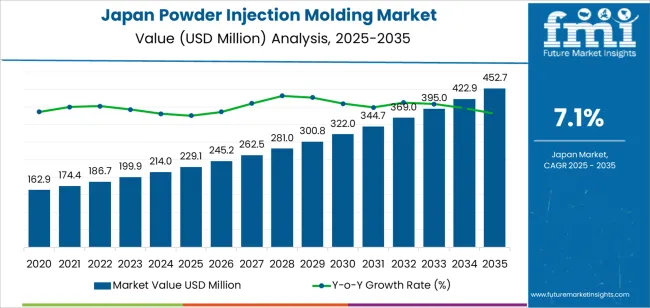

The Japan powder injection molding demand is valued at USD 229.1 million in 2025 and is estimated to reach USD 452.7 million by 2035, reflecting a CAGR of 7.1%. Demand is influenced by the need for high-precision, near-net-shape components in electronics, automotive systems, medical devices, and industrial machinery. Manufacturers adopt powder injection molding to achieve dimensional accuracy, complex geometries, and cost-effective mass production, particularly in applications where machining is inefficient or unsuitable. Consistent investment in miniaturized components and metal-ceramic hybrids also supports wider utilization.

Metal powders lead the material landscape. Their dominance reflects established performance in structural parts, gears, orthodontic brackets, surgical device components, and high-density industrial parts. Metal powders offer stable sintering behaviour and predictable mechanical properties, allowing manufacturers to meet strength, tolerance, and repeatability requirements across varied end uses.

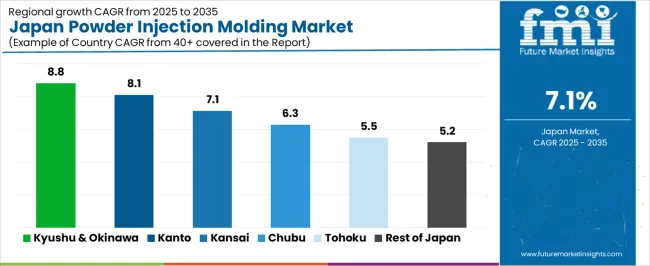

Kyushu & Okinawa, Kanto, and Kinki record the highest utilization levels due to their concentration of automotive suppliers, electronic-component manufacturers, medical-device producers, and specialist fabrication units. These regions maintain integrated supply chains for feedstock preparation, molding, debinding, and sintering processes, enabling stable production and shorter delivery cycles.

Key suppliers include Höganäs AB, Arburg GmbH + Co KG, Indo-MIM Pvt. Ltd., LPW Technology, and Schunk Sintermetalltechnik GmbH. These companies support Japan’s powder-injection-molding activities through metal-powder feedstocks, molding systems, furnaces, and process-engineering services used in precision-component manufacturing.

Year-on-year growth analysis shows a consistent and moderately rising pattern across the forecast horizon. Between 2025 and 2029, YoY gains are supported by stable adoption in automotive components, medical-device parts, and electronics housings where miniaturized, high-precision geometries are required. Annual increases in this phase remain steady as manufacturers expand use of metal and ceramic feedstocks to reduce machining requirements and improve part uniformity. These drivers produce reliable YoY increments with limited volatility.

From 2030 to 2035, YoY growth continues but follows a more balanced trajectory as utilization becomes embedded within established production lines. Demand is shaped by predictable procurement for surgical instruments, sensor housings, small mechanical assemblies, and industrial tooling. Advances in binder systems, higher sintering efficiency, and improved automation support incremental YoY expansion without generating sharp accelerations. The annual growth profile reflects a mid-range, stable pattern driven by long qualification cycles, consistent part-performance requirements, and sustained integration of powder-injection-molding technologies across Japan’s precision-manufacturing sector.

| Metric | Value |

|---|---|

| Japan Powder Injection Molding Sales Value (2025) | USD 229.1 million |

| Japan Powder Injection Molding Forecast Value (2035) | USD 452.7 million |

| Japan Powder Injection Molding Forecast CAGR (2025 to 2035) | 7.1% |

The demand for powder injection molding in Japan is increasing as manufacturers seek high-precision, near-net-shape metal and ceramic parts for sectors such as automotive, medical devices, electronics and industrial machinery. PIM allows production of complex geometries that traditional machining and casting may struggle to achieve, especially in light-weight and miniaturized components. Growth is supported by rising production of electric and hybrid vehicles in Japan, which drives demand for sophisticated metal-injection moulded components; and by expansion in medical device manufacturing that requires small, intricate parts with tight tolerances.

Japan’s advanced manufacturing ecosystem and emphasis on quality support adoption of PIM technologies. Constraints include higher tooling and setup costs for PIM compared with simpler manufacturing methods, the need for skilled processing of powders and binders and long sintering cycles. Some parts producers may prefer traditional machining or casting until PIM volumes or cost benefits are clearly realized.

Demand for powder injection molding in Japan reflects its role in producing high-precision parts for automotive systems, medical devices, electronics, and aerospace components. Material selection depends on dimensional requirements, mechanical strength, corrosion resistance, and surface-finish expectations. Technology preferences correspond to process stability, feedstock compatibility, and production efficiency needed for intricate geometries. End-use patterns show how Japanese manufacturers use powder injection molding for lightweight structures, miniaturized components, and near-net-shape parts that support consistent performance under operational stress.

Metal powders hold 55.8% of national demand and represent the leading material category. These powders support high-strength components used in automotive, aerospace, and industrial systems requiring durability, hardness, and controlled sintering behaviour. Ceramic powders account for 23.5%, serving components exposed to high temperatures, corrosion, or electrical insulation requirements. Plastic powders represent 20.7%, supporting lightweight, low-load parts used in consumer goods and electronic components. Material-type distribution reflects performance needs, sintering characteristics, and tolerances required across Japanese manufacturing environments relying on powder injection molding for small, complex shapes.

Key drivers and attributes:

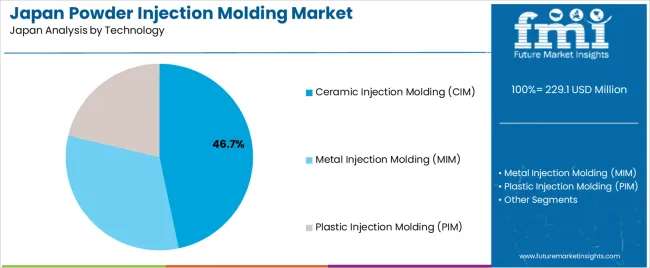

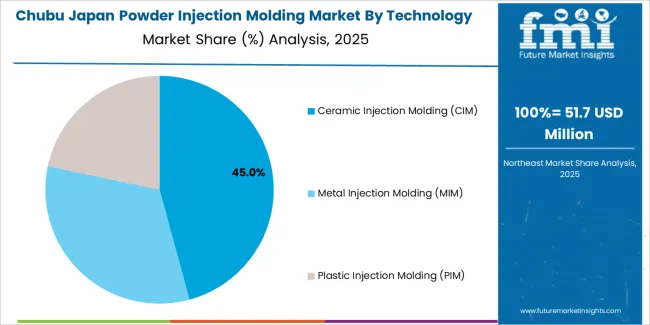

Ceramic injection molding (CIM) holds 46.7% of national demand and represents the leading technology category. CIM supports components requiring heat resistance, insulation, and wear durability, which are necessary for medical tools, aerospace parts, and precision electronics. Metal injection molding (MIM) accounts for 32.0%, enabling dense, high-strength components used in automotive and industrial assemblies. Plastic injection molding (PIM) represents 21.3%, providing flexibility for low-weight, low-temperature applications in consumer goods and small devices. Technology distribution reflects the manufacturing characteristics needed to achieve fine tolerances, stable shrinkage profiles, and repeatable shapes across Japanese industries.

Key drivers and attributes:

Automotive applications hold 39.7% of national demand and represent the dominant end-use category. Powder injection molding supports gears, brackets, locking components, and fuel-system parts requiring dimensional accuracy and mechanical consistency. Medical and healthcare uses account for 22.1%, supporting surgical instruments, dental components, and implant-adjacent parts requiring biocompatibility and precision. Aerospace represents 16.4%, followed by consumer goods at 10.0%, industrial machinery at 6.0%, and other industries at 5.8%. End-use distribution reflects part complexity, performance stability, and material compatibility across Japanese sectors using powder injection molding for small components with restricted tolerances.

Key drivers and attributes:

Rising demand for complex metal and ceramic components in automotive, medical and electronics sectors is driving growth.

In Japan, manufacturers are increasingly adopting powder injection molding (PIM) processes to produce high-precision, high-volume components made from metal or ceramic powders. The automotive industry’s focus on lightweight, high-strength parts for hybrids and electric vehicles supports interest in metal injection molding (MIM). Medical-device producers favour ceramic injection molding (CIM) for intricate implant and instrumentation parts. The electronics and industrial-machinery sectors, characterized by miniaturization and fine feature complexity, also fuel demand for PIM solutions that offer cost-effective near-net-shape manufacturing.

Higher tooling and process cost, specialized material supply and competition from alternative technologies restrain expansion.

PIM systems involve significant investment in tooling, powder feedstock development, binder formulation, debinding and sintering, which increases upfront cost. Some Japanese firms may delay or avoid PIM adoption due to uncertainty over return on investment or insufficient production volumes. The supply of high-quality metal and ceramic powders suitable for PIM remains limited domestically, which can raise cost and risk. Alternative technologies such as precision machining, additive manufacturing or advanced forging may provide viable substitutes in certain applications, reducing urgency for migration to PIM.

Growth of hybrid manufacturing workflows, increased use in electric‐vehicle drivetrain components and expansion of contract‐manufacturing PIM services define industry trends.

In Japan, PIM is being integrated into hybrid manufacturing models where PIM parts are combined with post-processing (machining or surface finishing) to optimize cost and performance. OEMs in the electric vehicle sector increasingly specify PIM for parts such as motor brackets, sensor housings and power‐electronic enclosures to benefit from material and process advantages. Contract manufacturers are investing in PIM capacity to serve multiple customers, which lowers entry barriers for smaller brands and expands the addressable industry. These developments indicate steady growth in the PIM industry in Japan.

Demand for powder injection molding (PIM) in Japan is rising through 2035 as manufacturers adopt metal and ceramic injection molding for high-precision, miniaturized, and complex components. Automotive suppliers, electronics producers, medical-device manufacturers, and aerospace firms expand reliance on PIM to achieve consistent density, dimensional accuracy, and scalable production. Rising interest in lightweight components, tolerance-critical assemblies, and parts consolidation strengthens adoption across industrial clusters. Clean-energy equipment, consumer devices, and specialized tooling also reinforce PIM demand as firms seek stable, repeatable manufacturing capabilities. Regional variation reflects industrial density, supplier networks, and access to technical expertise. Kyushu & Okinawa leads with 8.8%, followed by Kanto (8.1%), Kinki (7.1%), Chubu (6.3%), Tohoku (5.5%), and the Rest of Japan (5.2%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 8.8 |

| Kanto | 8.1 |

| Kinki | 7.1 |

| Chubu | 6.3 |

| Tohoku | 5.5 |

| Rest of Japan | 5.2 |

Kyushu & Okinawa grows at 8.8% CAGR, supported by active automotive-component production, semiconductor operations, and advanced manufacturing clusters across Fukuoka, Kumamoto, Oita, and surrounding areas. Automotive suppliers adopt PIM for gears, brackets, housings, and drivetrain components requiring high dimensional stability. Semiconductor and electronics manufacturers use PIM-based ceramic parts for heat resistance, insulation needs, and micro-component assemblies. Medical-device developers integrate PIM for surgical-instrument components and precision housings. Local industrial policies promoting high-precision manufacturing encourage broader adoption of metal and ceramic injection molding.

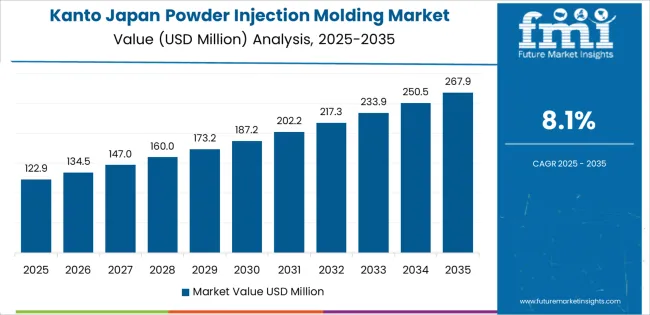

Kanto grows at 8.1% CAGR, driven by advanced electronics production, medical-device development, automotive R&D, and diversified manufacturing across Tokyo, Kanagawa, Chiba, and Saitama. Electronics producers rely on ceramic PIM components for heat-resistant, high-strength miniature parts in consumer devices and communication equipment. Medical-device firms adopt PIM for surgical instruments, implant-adjacent components, and precision connectors. Automotive design centers use PIM to support lightweight part development and prototype acceleration. High urban demand for compact, high-performance technology supports continued expansion of PIM applications.

Kinki grows at 7.1% CAGR, supported by machinery production, robotics development, electronics assembly, and medical-technology manufacturing across Osaka, Kyoto, Hyogo, and Nara. Robotics and machinery firms use PIM for complex gears, bearings, and housings requiring high durability. Electronics manufacturers integrate ceramic-based PIM components into heat-management assemblies. Medical-equipment producers rely on PIM for precision connector systems and instrument parts. Regional manufacturers advance miniaturization initiatives, reinforcing demand for high-accuracy component production.

Chubu grows at 6.3% CAGR, influenced by automotive manufacturing, industrial tooling, and machinery production across Aichi, Shizuoka, Gifu, and neighboring prefectures. Automotive suppliers adopt metal-injection molding for small drivetrain components, fuel-system parts, and structural elements requiring consistent material density. Machinery manufacturers incorporate PIM components into high-wear assemblies, valves, and miniature mechanisms. Tooling and industrial-equipment firms use ceramic PIM parts for heat-resistant and wear-resistant needs. Precision engineering across the regional supply chain supports continuous uptake of PIM solutions.

Tohoku grows at 5.5% CAGR, supported by electronics manufacturing, industrial modernization, and growing medical-device production across Miyagi, Iwate, Aomori, and Akita. Electronics manufacturers incorporate ceramic PIM components into insulating parts, structural supports, and compact assemblies. Industrial facilities adopt PIM for durable miniature mechanical components in equipment upgrades. Medical-device producers integrate PIM into surgical-instrument components and precision mechanisms. Regional industrial-park initiatives promote adoption of advanced manufacturing technologies.

The Rest of Japan grows at 5.2% CAGR, shaped by small-scale manufacturing, diversified tooling activity, and gradual adoption of precision-component technologies. Local producers adopt PIM for compact gears, connectors, and lightweight mechanical parts in consumer goods and industrial devices. Tooling manufacturers integrate wear-resistant ceramic PIM components to enhance product durability. Medical-device firms in smaller prefectures gradually expand PIM use for standardized precision parts. Incremental modernization of equipment supports continued adoption.

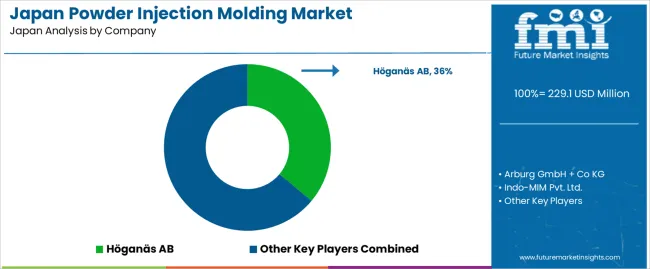

Demand for powder injection molding in Japan is shaped by a focused group of metal and ceramic-injection specialists supplying precision components for automotive systems, electronics, medical devices, and industrial equipment. Höganäs AB holds the leading position with an estimated 36.1% share, supported by controlled metal-powder production, consistent feedstock formulation, and long-standing supply relationships with Japanese manufacturers. Its position is reinforced by predictable sintering behaviour and reliable dimensional stability across high-precision applications.

Arburg GmbH + Co KG and Indo-MIM Pvt. Ltd. follow as significant participants. Arburg provides injection systems engineered for high-repeatability cycles, offering controlled temperature management and stable shot delivery essential for PIM operations. Indo-MIM maintains strong adoption through integrated feedstock-to-finished-part manufacturing, supplying components with tight tolerances and validated mechanical properties suited to automotive and medical applications prevalent in Japan.

LPW Technology contributes capability with high-purity metal powders tailored for both additive and injection processes, providing controlled particle-size distribution and dependable flow characteristics. Schunk Sintermetalltechnik GmbH supports additional demand with sintered components delivering stable strength, corrosion resistance, and consistent geometry in complex part designs.

Competition across this segment centers on feedstock uniformity, moulding precision, sintering reliability, material purity, and long-term mechanical performance. Demand continues to rise as Japanese industries pursue miniaturized, high-density, and near-net-shape components that reduce machining requirements and support advanced engineering applications in mobility, electronics, and healthcare.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material Type | Metal Powders, Ceramic Powders, Plastic Powders |

| Technology | Ceramic Injection Molding (CIM), Metal Injection Molding (MIM), Plastic Injection Molding (PIM) |

| End Use Industry | Automotive, Medical & Healthcare, Aerospace, Consumer Goods, Industrial Equipment & Machinery, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Höganäs AB, Arburg GmbH + Co KG, Indo-MIM Pvt. Ltd., LPW Technology, Schunk Sintermetalltechnik GmbH |

| Additional Attributes | Dollar sales by material type, technology type, and end-use industries; regional demand trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of powder injection molding manufacturers; developments in high-precision micro-component molding, advanced ceramic and metal feedstock formulations, and automation-driven PIM production; integration with automotive precision parts, medical implants, aerospace components, consumer electronics, and industrial machinery manufacturing across Japan. |

The demand for powder injection molding in japan is estimated to be valued at USD 229.1 million in 2025.

The market size for the powder injection molding in japan is projected to reach USD 452.7 million by 2035.

The demand for powder injection molding in japan is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in powder injection molding in japan are metal powders, ceramic powders and plastic powders.

In terms of technology, ceramic injection molding (cim) segment is expected to command 46.7% share in the powder injection molding in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Japan Baby Powder Market Analysis - Size, Share & Trends 2025 to 2035

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Demand for Silver Powder and Flakes in Japan Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA