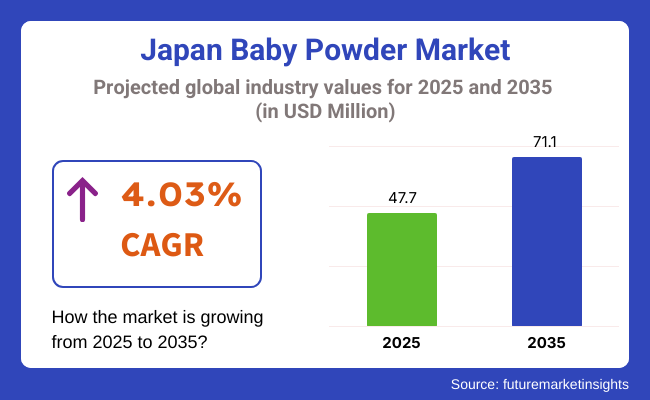

The Japan baby powder market is poised to register a valuation of USD 47.7 million in 2025. The industry is slated to grow at 4.03% CAGR from 2025 to 2035, witnessing USD 71.1 million by 2035. Growth of the market in Japan is powered by a synergistic combination of demographic, consumer health, and cultural trends.

Although Japan also faces a dwindling birth rate, the industry continues to prove resilient as the nation is further sensitized on infant care quality, hygiene, and safety. Japanese parents remain very sensitive regarding products used by their children, with them requiring top-quality hypoallergenic, skin-compliant baby products.

The product, once conventionally applied to avert diaper rash and maintain dry skin, is enjoying increased popularity for its natural and kinder formulations. Contemporary powders in Japan are more often talc-free and opt for substitutes such as cornstarch, rice powder, or natural minerals-so appealing to parents concerned about artificial ingredients.

There is also a quick increase in premium and organic baby care products, such as luxury powders with added botanical extracts, moisturizing ingredients, and environmentally friendly packaging. These are becoming increasingly popular in urban markets, where purchasing power is greater.

Growth in e-commerce and improved product availability have also helped niche and artisanal powder brands reach more consumers. Blogs and social media contribute to product awareness, with influencers usually featuring product safety, tips on use, and reviews.

Within the industry, trends differ among major end-use segments: households, maternity hospitals, and daycares. Within households, there is a strong movement toward natural, talc-free products as health-aware parents look for formulations prepared with cornstarch, rice powder, or botanicals.

Multi-functional powders for soothing and moisturizing are becoming increasingly popular, as are those with environmentally friendly packaging. Maternity hospitals are concerned with clinical-grade, hypoallergenic, and fragrance-free powders, typically in bulk formats compliant with demanding neonatal care requirements.

Certain institutions are heading toward alternative presentation such as cream-to-powder to limit airborne particles. Daycarecenters, weighing between safety and price, prefer mid-range products gentle to the skin, easy to apply, and more sustainable, with refill or low-waste packaging becoming the norm.

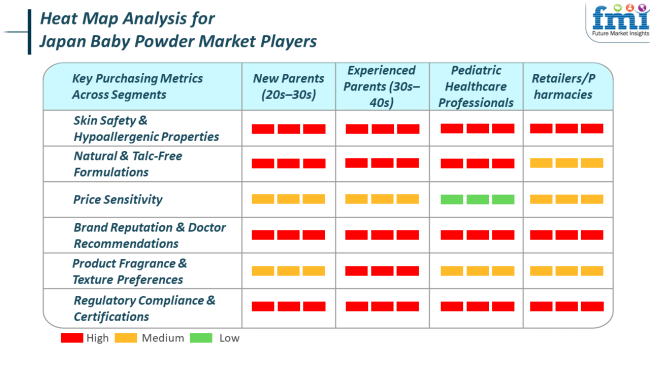

Buying criteria vary in these segments by use and responsibility. Household buyers consider ingredient safety, brand name, dermatologist endorsement, and easy-to-open packages-often as a result of web review and pediatric endorsement. Maternity hospitals make their decisions based on medical endorsement, testing for allergies, and product dependability, often purchasing from specialized medical distributors.

Daycarecenters seek low-priced, mess-free, and secure products for group use, prioritizing ease of application, storage, and vendor relationship. Throughout all of the segments, there is an ongoing stress on mild, skin-friendly formulas that mirror Japan's wider cultural prioritization of hygiene and high-quality care for infants.

Between 2020 and 2024, the Japan baby powder market experienced significant changes caused by concerns for health, changes in consumer preferences, and the overall effect of the COVID-19 pandemic. At the beginning of this period, demand for conventional talc-based powders significantly reduced, primarily because of growing public awareness of possible health threats.

Parents became more conscious of using talc-free, hypoallergenic, and natural ingredient options instead. Concurrently, Japanese consumers, who favor high-quality and safe skincare products, began preferring powders with extra benefits such as skin-soothing botanical ingredients.

Online channels also picked up hugely during this time, owing to pandemic-related measures and increasing adoption of online parenting networks and product opinions. Furthermore, minimalist and environmentally friendly packaging and refill models started to make an appearance as Japan's awareness and demand for sustainability in household products increased.

In the future, Japan's industry will further develop, shaped by innovation, sustainability, and demographic changes. Although the nation's falling birthrate will cap volume growth, the industry will gain from sharpened premiumization focus-with parents prepared to pay for superior, multi-tasking, and dermatologically sophisticated products.

Growing demand for organic, fragrance-free, and biodegradable powders will influence product formulation. Integration of technology, e.g., smart packaging with usage monitoring or QR codes referencing safety information, can become more prevalent.

In addition, with multi-generational households still common, traditional caregiving habits will continue to shape demand, maintaining the place of baby powder in infant care routines. Expansion of niche and boutique brands, particularly those centered on local or handmade offerings, is anticipated, particularly through direct-to-consumer models and social commerce. Overall, the future decade holds promise for a combination of tradition, innovation, and conscious consumerism for the Japan baby powder market.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Projected) |

|---|---|

| Rising safety fears, particularly over talc's possible health hazards, caused many Japanese consumers to steer clear of conventional formulas. This was the era of a visible trend toward talc-free versions, especially those based on cornstarch or rice powder, fueled by consumer desire for safer, more natural versions. | Plant-based ingredient formulas will be in control of the industry . Consumers are likely to choose more and more biodegradable, dermatologically tested powders that are in line with clean beauty philosophy. Brands will probably spend more on transparency and certifications to win over eco-aware, health-conscious parents. |

| As a result of pandemic-related lockdowns, there was an uptick in online shopping. Parents increasingly depended on digital channels, such as Amazon Japan, Rakuten , and parenting-oriented e-commerce websites, not just for buying but also for product reviews, tutorials, and recommendations. | Digital innovation is expected to take center stage, with features like QR-coded packaging for ingredient transparency, mobile-based skincare tracking, and even AI-driven product recommendations based on child skin type or seasonal needs. This will deepen brand-consumer engagement and trust. |

| Parents grew more selective about ingredients, choosing soft, low-key formulations. Pediacian -recommended and dermatologist-tested labels became popular, particularly in urban markets. | P owders will do more than absorb moisture-providing other functions such as anti-inflammatory action, skin repair aids, and calming botanical formulas. The premium segment will concentrate on high-performance baby skincare solutions and be backed by clinical data. |

| While still in its infancy, companies started looking for alternative packaging options that are more sustainable. Minimal designs and reusable containers have started showing up, especially among boutique and niche brands. | Sustainability will go from niche to mainstream. Refill systems, biodegradable material, and low-impact production will likely become normal practice, driven by government regulations and customers demanding eco-friendly practices. |

The Japan industry, although stable and niche, has a number of underlying risks that could affect its growth trajectory. The most notable among these is the declining birth rate in Japan, which continues to reduce the total addressable industry for infant care products with each passing year.

Fewer births annually naturally lower demand for basic baby care products, including baby powder, making it difficult to achieve long-term volume growth. This demographic change might restrict growth opportunities, particularly for mass-market or lower-end brands that depend on volume sales.

Another major threat is increasing regulatory and consumer vigilance over product safety and ingredient openness. With historical worldwide controversy over talc-based powders, even non-talc powders have to adhere to more stringent safety regulations.

Customers are more educated and careful than ever, and any adverse publicity or product recalls, even if they are not Japanese brand-related, would undermine confidence throughout the whole category. Moreover, changing chemical legislation and the necessity for hypoallergenic, dermatologically tested formulations raise R&D and compliance expenses for producers.

Cornstarch-based baby powders have gained popularity among Japanese parents, especially those looking for natural and plant-based options. Cornstarch is considered a less aggressive alternative, especially for sensitive babies' skin, and is not stigmatized like talc.

It is also biodegradable and is viewed as safer in case it is inhaled accidentally in small quantities. Although cornstarch-based powders may occasionally be heavier or less silky than talc, most Japanese consumers are willing to make this compromise for safety and peace of mind. This trend is also supported by the increasing popularity of organic and clean-label baby care products in urban areas.

In general, though talc-based powders continue to be available in the industry, particularly in more traditional or heritage products, the trend at present is obviously moving towards cornstarch-based products, particularly among new-generation parents.

This is in keeping with Japan's overall consumer values of simplicity, safety, and minimalism in skincare, particularly when it concerns infant health. As this consciousness continues to spread, cornstarch will most likely continue to be the base ingredient of choice in the coming years.

In Japan, conventional baby powders continue to constitute the vast majority of volume sales, but organic baby powders are gaining ground steadily and are being more and more sought after by a sizable segment of contemporary, health-protective parents.

Conventional powders, generally less expensive and widely distributed in pharmacies, supermarkets, and convenience stores, continue to enjoy popularity due to their familiarity, established brand recognition, and general availability.

They are particularly prevalent in multigenerational households where age-old caregiving traditions still encompass the use of traditional talc or cornstarch-based infant powders. Long-established Japanese brands, where the quality of the product remains constant and also the observance of safety criteria is ensured, support this level of demand.

Organic baby powders, however, have registered marked growth, notably in urban parts of the industry and among first-time parents. These powders, generally talc-free and composed of natural ingredients such as rice starch, arrowroot, and essential oils, attract customers who are strongly interested in skin sensitivity, allergies, and contact with synthetic chemicals.

In Japan's highly detail-conscious consumer culture, where skincare and product safety are a priority, organic products tend to be perceived as a safer, more considerate option-particularly for sensitive-skinned infants. The expansion of niche parenting sites and e-commerce has also facilitated access for organic brands to their target markets, enhancing awareness and sales.

The Japanese baby powder industry is dominated by high-end consumer expectations for safety, purity, and gentle skin care, with high demand for talc-free and hypoallergenic products. Domestic industry leader Pigeon continues to lead the industry by emphasizing talc-free, dermatologist-tested products specifically formulated for Japanese babies.

Its strategic focus is on building trust with clinical research, testing on sensitive skin, and marketing to new parents. Procter & Gamble utilizes its worldwide reach to bring in cleaner formulations and fragrance-free lines that meet Japan's increasing concern for health.

Mothercare and Mann & Schröder GmbH, meanwhile, compete within the high-end segment through the use of botanical and organic powders for mothers who look for European-standard skincare. Mamaearth, a younger company, is making headway through environmentally friendly formulations and online promotion, particularly attractive to younger, city-based consumers with a focus on sustainability. Overall, successful brands are those who are responding to growing desire for ingredient disclosure, skin sensitivity, and environmentally friendly packaging.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Pigeon | 12-15% |

| Procter & Gamble Co. | 8-10% |

| Mee Mee | 5-7% |

| Prestige Consumer Healthcare, Inc. | 4-6% |

| Mothercare | 3-5% |

| Mamaearth | 2-4% |

| PZ Cussons | 2-3% |

| Oriflame Holding AG | 1-3% |

| Osotspa Company Limited | 1-2% |

| Mann & Schröder GmbH | 1-2% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pigeon | Japan's leading baby care brand providing extremely trusted talc-free powders designed for sensitive baby skin. Products are created with dermatologists and pediatricians , with a focus on safety and delicacy. |

| Procter & Gamble Co. | Global player with baby powders as part of its popular baby care brands. Specializes in clean-label, moisturizing powders, and creating fragrance-free options for sensitive skin. |

| Mee Mee | Provides low-cost baby powders, combining calming ingredients such as aloe and chamomile. Although not originally from Japan, it has established a small market through online channels and family retail chains. |

| Prestige Consumer Healthcare, Inc. | Reputed for mild, over-the-counter baby powders emphasizing dryness and comfort of the skin. Markets through pharmacies and baby wellness stores, with USA-made trust branding. |

| Mothercare | Offers mid-to-premium quality talc-free powders, commonly infused with natural ingredients like lavender or olive oil. Targets Japanese parents and expat families in large cities who are health-conscious. |

| Mamaearth | Increasing market presence through social media influencer campaigns and online retailing, Mamaearth caters to organic, plant-based powders without artificial fragrances, targeting Japan's environmentally conscious consumers. |

| PZ Cussons | Provides baby powders with mild, plant-based ingredients. Boasts a history of gentle skin care products and is available in select baby specialty outlets and pharmacies. |

| Oriflame Holding AG | Provides European-style luxury baby care powders, typically with oat milk, chamomile, or calendula. Targets consumers who are looking for a premium skin care experience for babies. |

| Osotspa Company Limited | Generally associated with value-based baby powders in conventional talc-based formulations. Supplies price-sensitive markets and households with traditional tastes. |

| Mann & Schröder GmbH | Has expertise in high-quality, hypoallergenic baby powders formulated in Germany. Products contain no synthetic preservatives and address Japan's sensitive skin market. |

The Japanese market for baby powder is likely to keep changing with more emphasis on natural, talc-free products and environmentally friendly packaging options. Pigeon will continue to be a market leader, but international brands like Procter & Gamble and Mothercare will keep innovating by launching fragrance-free, hypoallergenic products to address increasing health issues.

The surge in organic offerings from retailers such as Mamaearth and Mann & Schröder GmbH matches Japan's consumer demand for clean-label, eco-friendly products that provide better skin safety for infants. Online communities and sustainability-centric brands will continue to grow in influence among younger, digitally native shoppers.

The marketplace is also experiencing a movement towards premium products, fueled by a health-conscious and wealthy segment that is willing to pay a premium for high-quality baby care. In general, as ingredient openness and sustainability move towards the forefront, those companies that position themselves for these shifts and build consumer trust will retain competitive position in the changing environment.

In terms of ingredient, the industry is bifurcated into talc-based and corn-starch-based.

With respect to price, the market is divided into mass and premium.

Based on nature, the market is bifurcated into organic and conventional.

On the basis of sales channel, the industry is classified into direct sales, modern trade, convenience stores, departmental stores, specialty stores, mono-brand stores, online retailers, drug stores, and other sales channels.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 47.7 million in 2025.

The industry is projected to witness USD 71.1 million by 2035.

The industry is projected to witness 4.03% CAGR during the study period.

Conventional products are widely sold.

Leading companies include Mee Mee, Mothercare, Oriflame Holding AG, Osotspa Company Limited, Pigeon, Prestige Consumer Healthcare, Inc., Procter & Gamble Co., PZ Cussons, Mamaearth, and Mann & Schröder GmbH.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 12: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 14: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 16: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 20: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 22: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 24: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 28: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 30: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 32: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 44: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 46: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 48: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 52: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 54: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 56: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 58: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 36: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 40: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 44: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 60: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 64: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 68: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 84: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 88: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 92: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 132: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 136: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 140: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 156: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 160: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 164: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 168: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA