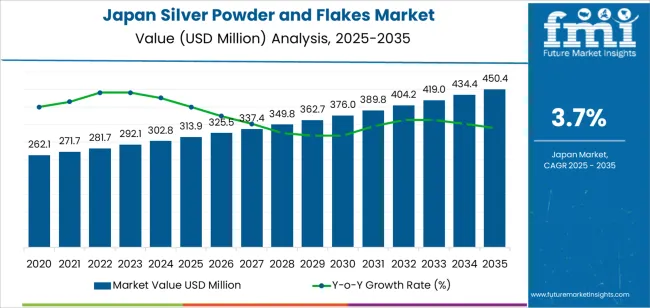

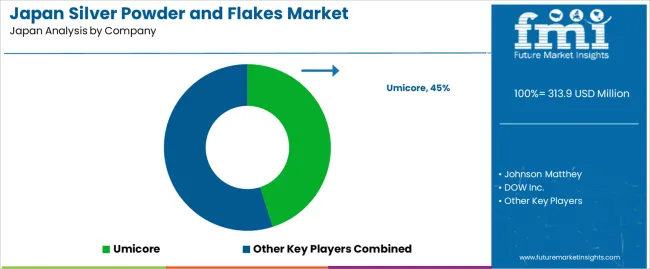

The demand for silver powder and flakes in Japan is projected to grow from USD 313.9 million in 2025 to USD 450.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.7%. Silver powder and flakes are widely used in applications such as electronics, automotive components, photovoltaic cells, and other industrial processes requiring high conductivity and precision. As Japan continues to advance in technology and renewable energy solutions, the demand for silver-based materials is expected to grow steadily, driven by the increasing use of silver in electronics and solar energy systems.

The growth in demand for silver powder and flakes will be influenced by both volume and price factors. The expansion of industries such as electronics, automotive, and renewable energy will lead to an increase in volume demand. As Japan continues to invest in next-generation technologies, including electric vehicles and solar panels, the use of silver powder and flakes will rise, particularly in applications like conductive inks and connectors. Simultaneously, the price growth will be influenced by fluctuations in the global silver industry, including supply chain dynamics, mining output, and demand from industries outside Japan.

Between 2025 and 2030, the demand for silver powder and flakes in Japan is expected to grow from USD 313.9 million to USD 325.5 million, with volume growth being the primary driver. This increase will be fueled by the expanding adoption of silver in high-demand sectors such as electronics, automotive components, and solar energy systems. As these industries continue to evolve and expand, the volume of silver required for conductive inks, connectors, and photovoltaic cells will rise steadily. During this period, the price contribution to demand growth will be moderate, with the overall increase primarily driven by volume.

From 2030 to 2035, the demand for silver powder and flakes is projected to increase more significantly, reaching USD 450.4 million. In this phase, both volume and price factors will contribute to growth. The volume growth will continue due to the ongoing expansion of industries such as renewable energy and electronics, which are increasingly relying on silver for advanced applications. However, the price of silver is expected to have a stronger influence during this period, influenced by global supply constraints and the increasing demand for silver from other global industries.

| Metric | Value |

|---|---|

| Demand for Silver Powder and Flakes in Japan Value (2025) | USD 313.9 million |

| Demand for Silver Powder and Flakes in Japan Forecast Value (2035) | USD 450.4 million |

| Demand for Silver Powder and Flakes in Japan Forecast CAGR (2025 to 2035) | 3.7% |

The demand for silver powder and flakes in Japan is growing due to their critical role in a wide range of high-tech applications, including electronics, solar panels, and catalysis. Silver powder and flakes are used in various manufacturing processes, such as in the production of conductive inks for printed electronics, photovoltaic cells, and soldering materials. These materials are essential for creating high-performance electronic components and energy-efficient technologies, which are driving the demand in Japan.

The increasing adoption of renewable energy technologies, such as solar power, is a key factor contributing to the growing demand for silver powder and flakes. Silver’s high conductivity makes it a vital component in photovoltaic cells, which are crucial for solar panel efficiency. As Japan continues to invest in renewable energy sources to meet durability targets, the need for silver in these applications is expected to rise.

Technological advancements in electronics, along with the continued expansion of the electronics manufacturing sector, are also fueling the demand for silver powder and flakes. The material’s role in improving the efficiency and performance of modern electronics, including mobile devices, automotive electronics, and LED lighting, is further supporting its growth. With Japan's ongoing focus on technological innovation and clean energy, the demand for silver powder and flakes is expected to continue growing steadily through 2035.

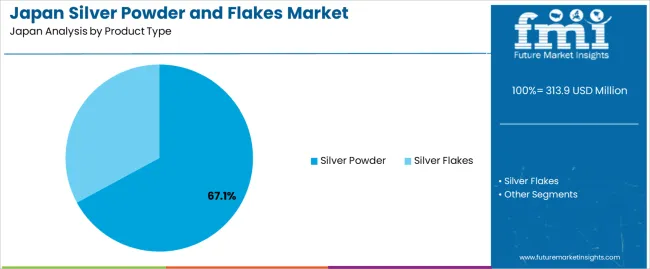

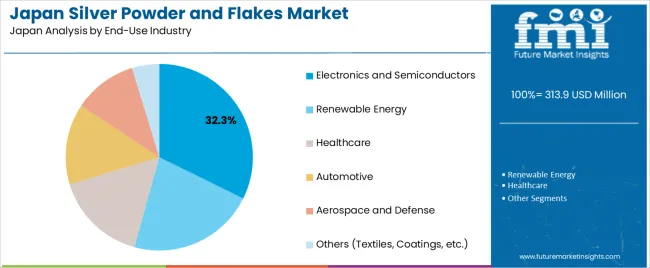

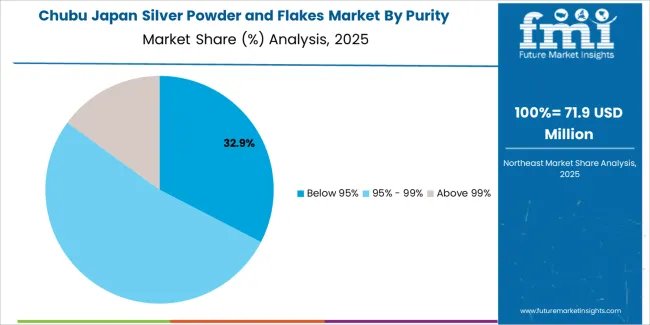

Demand for silver powder and flakes in Japan is segmented by product type, end-use industry, purity, and region. By product type, demand is divided into silver powder and silver flakes. The demand is also segmented by end-use industry, including electronics and semiconductors, renewable energy, healthcare, automotive, aerospace and defense, and others. In terms of purity, demand is divided into below 95%, 95%-99%, and above 99%. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Silver powder accounts for 67% of the demand for silver powder and flakes in Japan. Silver powder is favored for its versatility and effectiveness in various industrial applications, particularly in electronics and semiconductors, where it is used for conductive inks and pastes, component bonding, and thermal management.

The fine particle size of silver powder enhances its ability to conduct electricity and heat, making it ideal for these high-performance applications. Silver powder is preferred in renewable energy technologies, such as solar cells, due to its high conductivity and durability. Its ease of handling and compatibility with different manufacturing processes also make silver powder the preferred form in many industries. As the demand for electronics and energy-efficient devices continues to grow, particularly in the electronics and semiconductor sectors, silver powder will continue to dominate the industry due to its superior performance and wide range of applications.

The electronics and semiconductors industry accounts for 32.3% of the demand for silver powder and flakes in Japan. Silver is essential in the production of electronic components due to its excellent electrical conductivity, making it a critical material in semiconductors, circuit boards, and electronic connectors. Silver powder is widely used in the manufacture of conductive inks and pastes, which are crucial for producing printed circuit boards (PCBs) and other components. Silver’s thermal conductivity makes it valuable in heat dissipation applications in electronics.

As the demand for advanced electronics, smartphones, and renewable energy technologies like solar cells increases, the need for high-quality silver powder continues to rise. Japan’s advanced technological infrastructure and its position as a global leader in electronics manufacturing drive the significant demand for silver powder in this industry, ensuring that electronics and semiconductors remain the dominant end-use sector for silver powder and flakes.

In Japan, demand for silver powder and flakes is driven largely by its use in high‑performance electronics, conductive pastes and inks (for printed circuit boards, sensors and touch panels), automotive electronics (including EV and hybrid modules), and renewable‑energy applications (such as silver‑based contacts in solar modules). The trend toward miniaturization, higher reliability and advanced packaging in electronics also supports uptake. Key restraints include the high and volatile price of silver, tight purity/quality requirements (raising manufacturing cost), supply‑chain pressures (import dependence, refining capacity) and competition from alternative conductive materials (e.g., copper‑based, graphene composites) that might reduce silver usage in some applications.

Japan’s demand is growing because its electronics and automotive industries increasingly require materials that deliver excellent electrical and thermal conductivity—silver powder and flakes meet that need. As Japanese manufacturers ramp up advanced sensors, IoT devices, printed‑electronics products and EV/automotive modules, they turn to silver‑based materials for performance and reliability. Japan’s push in renewable energy (for example solar and energy storage) and high‑end industrial equipment further supports silver powder consumption. The country’s strong manufacturing base and focus on high‑quality, precision electronics also mean steady demand for premium conductive materials such as silver powder and silver flakes.

Technological innovations are fueling demand in Japan by enhancing material performance and enabling new applications. Improvements in silver powder particle size, morphology (flakes vs spherical), purity and surface treatment are making them more suitable for high‑precision electronics, fine conductive traces, printed electronics and advanced sensors. Process innovations (such as more efficient synthesis, improved dispersions for inks and adhesives) reduce defects and improve yield. Also, emerging applications such as 3D‑printed electronics or ultra‑thin film contacts rely on high‑quality silver powders/flakes. These advancements broaden the use‑case of silver in Japan’s advanced manufacturing environment and support growth in segments that demand high‑performance conductive materials.

Despite strong growth potential, several challenges limit broader adoption of silver powder and flakes in Japan. One major constraint is cost: silver is expensive and price fluctuations can make budgeting difficult for manufacturers. Some applications may switch to lower‑cost alternatives if performance trade‑offs are acceptable. Another challenge is supply‑chain and sourcing: high‑purity silver powders/flakes must meet stringent quality standards, and domestic refining or import dependency adds complexity. Manufacturing and handling such powders require specialised equipment and safety/quality controls, raising barriers for smaller producers. Competition from materials innovation (e.g., copper nano‑inks, carbon‑based conductors) poses substitution risk in some segments.

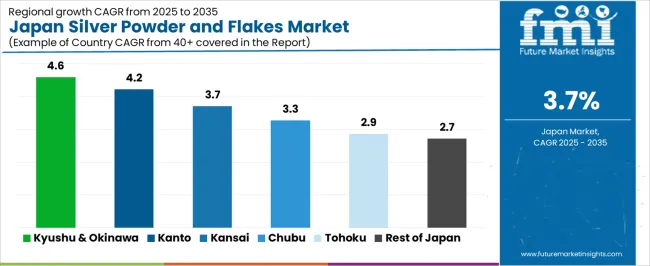

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.6% |

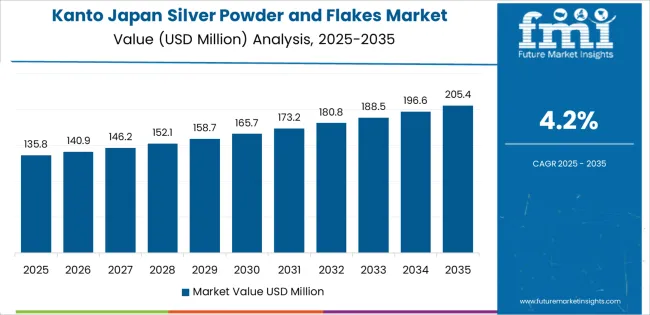

| Kanto | 4.2% |

| Kinki | 3.7% |

| Chubu | 3.3% |

| Tohoku | 2.9% |

| Rest of Japan | 2.7% |

Demand for silver powder and flakes in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 4.6% CAGR. Kanto follows closely with a 4.2% CAGR, fueled by its large electronics and semiconductor industries. Kinki shows a 3.7% CAGR, with strong demand from its automotive and electronics sectors. Chubu experiences a 3.3% CAGR, driven by its automotive industry’s shift to electric vehicles and the electronics sector’s need for silver in high-tech components. Tohoku shows a 2.9% CAGR, with steady demand mainly from renewable energy and electronics applications. The Rest of Japan has the lowest growth at 2.7%, but demand remains steady due to smaller-scale industrial and agricultural uses.

Kyushu & Okinawa are experiencing the highest demand for silver powder and flakes in Japan, with a 4.6% CAGR. The demand is primarily driven by the region’s growing electronics, semiconductor, and renewable energy sectors. Kyushu is a key hub for solar power and energy storage systems, where silver powder is used in photovoltaic cells, contributing to increased demand. The automotive sector in Okinawa and Fukuoka, which is transitioning to electric vehicles (EVs), further drives the need for silver in battery and electronic systems. The region’s strong manufacturing base, particularly in electronics and energy technologies, ensures that silver powder and flakes remain essential for producing high-conductivity components. As Kyushu & Okinawa continue to focus on ecological development and technological innovation, the demand for silver powder and flakes is expected to grow steadily, particularly in the renewable energy and advanced electronics sectors.

Kanto is seeing strong demand for silver powder and flakes in Japan, with a 4.2% CAGR. This growth is primarily driven by the region’s strong electronics, automotive, and semiconductor industries. Kanto, with major industrial hubs like Tokyo and Yokohama, has a high concentration of electronics manufacturers that use silver powder for producing high-performance components such as circuit boards, connectors, and conductive pastes. The automotive industry in Kanto, particularly the rise of electric vehicles (EVs), also contributes to the growing demand for silver, as silver powder is crucial for battery and electronic systems. The region’s emphasis on technological innovation and ecological manufacturing processes further supports this demand. As Kanto continues to lead in industrial and technological advancements, demand for silver powder and flakes will remain robust, particularly with the growing adoption of smart technologies, clean energy solutions, and electric vehicles.

Kinki is experiencing steady demand for silver powder and flakes in Japan, with a 3.7% CAGR. The region’s demand is driven by its strong manufacturing and automotive sectors, particularly in cities like Osaka and Kyoto, which are home to major manufacturers in the electronics and automotive industries. Silver powder is critical for producing high-performance components, including conductors, resistors, and capacitors, which are essential in electronics, automotive, and solar energy applications. Kinki’s automotive industry, especially in electric vehicles (EVs), is contributing to the demand for silver powder in batteries and motor components. As the region continues to focus on technological innovation and green energy solutions, the demand for silver powder and flakes is expected to grow steadily. The region’s efforts to improve manufacturing efficiency and expand its clean energy infrastructure will continue to drive the need for high-performance materials like silver powder and flakes.

Chubu is seeing moderate demand for silver powder and flakes in Japan, with a 3.3% CAGR. The region’s demand is largely driven by its automotive and electronics industries, particularly in cities like Nagoya, where major manufacturers like Toyota are increasingly adopting electric vehicles (EVs). Silver powder plays a crucial role in the production of high-performance batteries and electronic components used in EVs and renewable energy systems. Chubu’s strong automotive sector is driving the demand for silver in electrical systems, motors, and batteries. The region’s growing electronics industry further supports the need for silver powder in the production of circuit boards and other key components. As Chubu continues to expand its focus on ecological transportation and renewable energy, the demand for silver powder and flakes is expected to grow steadily, supported by advancements in clean energy and automotive technologies.

Tohoku is experiencing the lowest growth in demand for silver powder and flakes in Japan, with a 2.9% CAGR. The demand in this region is driven by its focus on renewable energy applications, particularly in solar energy, where silver powder is essential for the production of photovoltaic cells. While Tohoku’s industrial base is smaller compared to other regions, its increasing emphasis on clean energy solutions and improving infrastructure supports steady demand for silver powder and flakes. The region’s efforts to modernize its manufacturing and technology sectors, including electronics, contribute to the use of silver in high-performance components. As Tohoku continues to invest in renewable energy and technological advancements, demand for silver powder and flakes is expected to grow, albeit at a moderate pace compared to other regions.

The Rest of Japan is experiencing the lowest growth in demand for silver powder and flakes, with a 2.7% CAGR. This demand is primarily driven by smaller-scale industrial applications, particularly in electronics and telecommunications. The Rest of Japan’s agricultural and local manufacturing sectors also contribute to the use of silver powder in applications like soil treatment and small-scale electronic components. While the region’s industrial activity is smaller compared to major hubs like Kanto or Kyushu & Okinawa, its ongoing development in electronics, agriculture, and clean energy solutions supports consistent demand for silver powder. As the region continues to focus on improving local manufacturing and energy efficiency, the demand for silver powder and flakes will remain steady, driven by regional industrial growth and technological advancements in the clean energy sector.

In Japan the demand for silver powder and flakes is being driven by key sectors such as electronics manufacturing, renewable‑energy technologies, and high‑precision industrial applications. These materials are used in conductive inks, adhesives, printed circuits and solar cell metallisation, where their high electrical and thermal conductivity and excellent reliability are critical for performance.

Major suppliers active in the Japanese industry include Umicore with approximately a 45.1 % share, along with Johnson Matthey, DOW Inc., Mitsubishi Materials Corporation and Exelon. These companies differentiate by offering high‑purity silver powders and flakes, precise particle‑size control, tailored formulations for specialty applications (such as printed electronics or photovoltaic pastes), and strong technical service and supply‑chain logistics suited for Japan’s manufacturing ecosystem.

The competitive dynamics in Japan’s silver powder and flakes demand landscape are shaped by several factors. One driver is the continued growth of advanced electronics, EV components and solar‑metalisation technologies, which require premium conductive materials. A second driver is the premium placed on material performance, reliability and supply‑chain resilience by Japanese OEMs and electronics manufacturers. Key challenges include the high cost of silver feedstocks and volatility of silver prices, as well as competition from alternative materials or reduced‑silver architectures seeking cost‑savings. Suppliers that combine material‑science expertise, stable feed‑stock sourcing, best‑in‑class purity, and strong regional service support will be well positioned to succeed in Japan’s silver powder and flakes demand arena.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Silver Powder, Silver Flakes |

| Purity | Below 95%, 95% - 99%, Above 99% |

| End-Use Industry | Electronics and Semiconductors, Renewable Energy, Healthcare, Automotive, Aerospace and Defense, Others (Textiles, Coatings, etc.) |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Umicore, Johnson Matthey, DOW Inc., Mitsubishi Materials Corporation, Exelon |

| Additional Attributes | Dollar sales by product type and purity; regional CAGR and adoption trends; demand trends in silver powder and flakes; growth in electronics, renewable energy, and automotive sectors; technology adoption for semiconductor and healthcare applications; vendor offerings including silver-based materials and solutions; regulatory influences and industry standards |

The demand for silver powder and flakes in japan is estimated to be valued at USD 313.9 million in 2025.

The market size for the silver powder and flakes in japan is projected to reach USD 450.4 million by 2035.

The demand for silver powder and flakes in japan is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in silver powder and flakes in japan are silver powder and silver flakes.

In terms of purity, below 95% segment is expected to command 32.0% share in the silver powder and flakes in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Japan Baby Powder Market Analysis - Size, Share & Trends 2025 to 2035

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Powder Injection Molding in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Silver Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA