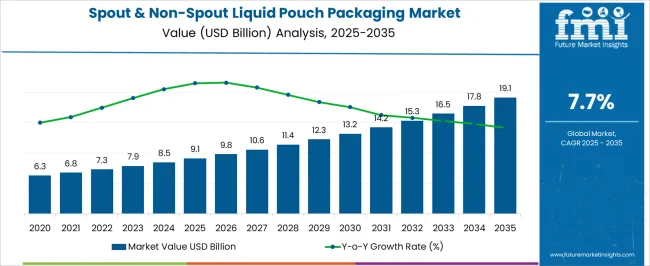

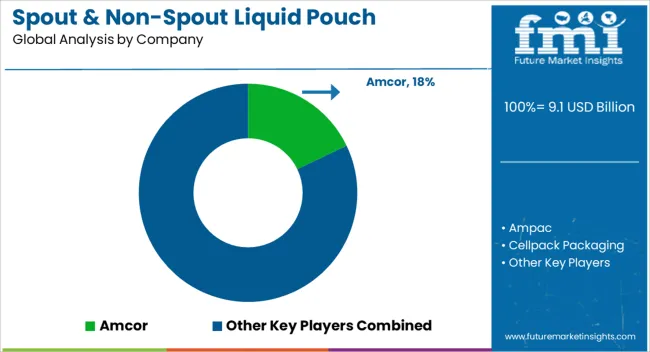

The Spout & Non-Spout Liquid Pouch Packaging Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 19.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period. An acceleration and deceleration pattern analysis shows a strong upward trajectory with some phases of faster growth followed by stabilization. Between 2025 and 2030, the market grows from USD 9.1 billion to USD 13.2 billion, adding USD 4.1 billion with a CAGR of 8.2%. This period reflects rapid adoption driven by the increasing demand for cost-effective, convenient, and sustainable packaging solutions in sectors such as food and beverages, personal care, and chemicals. The market experiences a strong acceleration as spout pouches gain popularity due to their reclosable, lightweight, and portable nature.

From 2030 to 2035, the market continues to grow, moving from USD 13.2 billion to USD 19.1 billion, contributing USD 5.9 billion in growth, with a slightly lower CAGR of 7.0%. This deceleration reflects a maturation phase, as the market reaches a higher level of adoption and further growth becomes more incremental. The slowdown is likely due to the saturation of certain end-user industries and a shift toward optimizing production efficiency in packaging. The market demonstrates strong acceleration in the early years, followed by stable, sustained growth in later years.

| Metric | Value |

|---|---|

| Spout & Non-Spout Liquid Pouch Packaging Market Estimated Value in (2025 E) | USD 9.1 billion |

| Spout & Non-Spout Liquid Pouch Packaging Market Forecast Value in (2035 F) | USD 19.1 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

Consumer preferences are increasingly favoring flexible formats over rigid alternatives due to convenience, reduced environmental impact, and ease of transportation. The rise in e-commerce and direct-to-consumer product distribution is also influencing packaging designs that offer durability, tamper resistance, and efficient shelf utilization. Manufacturers are prioritizing multi-layer barrier technologies to ensure product longevity while reducing material usage.

Regulatory support for recyclable and mono-material laminates is accelerating innovation in pouch construction. As FMCG and home care brands aim to reduce plastic waste and carbon footprint, flexible liquid pouch packaging formats are being widely adopted as a sustainable and cost-efficient solution across developed and emerging economies.

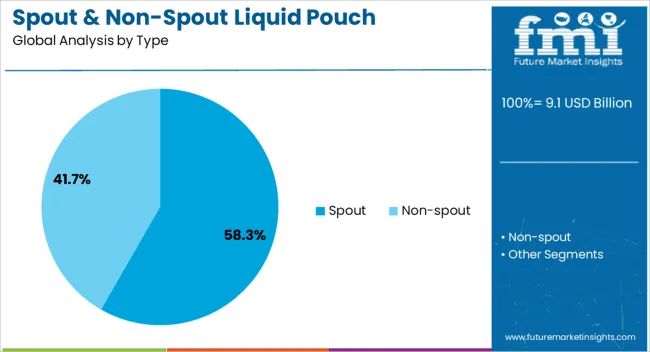

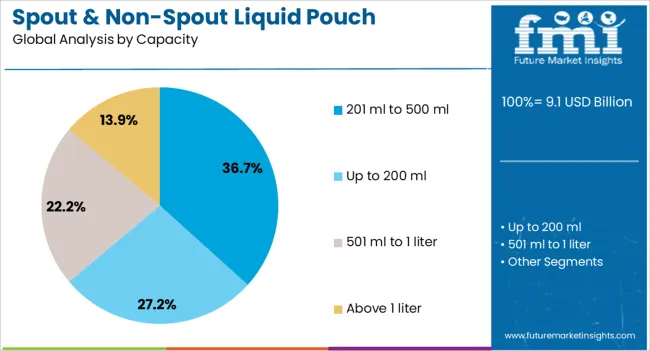

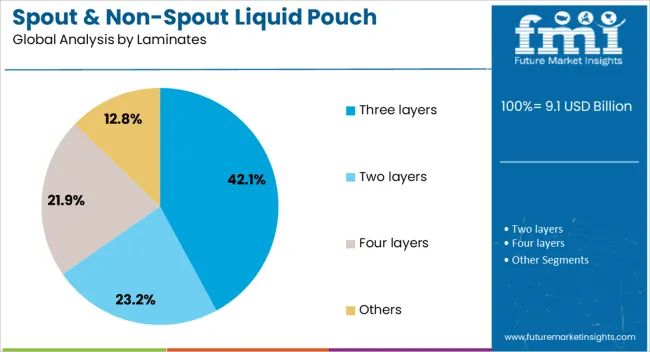

The spout & non-spout liquid pouch packaging market is segmented by type, capacity, laminates, application, and geographic regions. By type, the spout & non-spout liquid pouch packaging market is divided into Spout and Non-spout. In terms of capacity, the spout & non-spout liquid pouch packaging market is classified into 201 ml to 500 ml, up to 200 ml, 501 ml to 1 liter, and above 1 liter. The laminates of the spout & non-spout liquid pouch packaging market are segmented into four main categories: three-layer, two-layer, four-layer, and Others. The spout & non-spout liquid pouch packaging market is segmented into Food & beverages, Industrial, Personal care, Home care, and Pharmaceutical. Regionally, the spout & non-spout liquid pouch packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spout segment is projected to account for 58.30% of the total market revenue in 2025, establishing itself as the dominant packaging type. This leadership is being driven by the convenience and reusability offered by spout designs, particularly in liquid products requiring portion control or multiple-use consumption.

Enhanced consumer experience through easy dispensing, secure resealability, and reduced spillage has contributed to widespread adoption. Spouted pouches are also preferred in baby food, beverages, and hygiene products where hygiene and portability are crucial.

Their compatibility with a range of filling technologies and automated packaging lines has improved production scalability. As brands focus on minimizing secondary packaging and promoting refillable solutions, the spout type is expected to retain its leadership in the years ahead.

The 201 ml to 500 ml capacity range is forecast to hold 36.70% of the overall market share by 2025, making it the most prominent volume category. This segment's growth is being supported by its suitability for single-use and family-size consumption formats across a variety of end uses.

Brands targeting affordability and daily use have increasingly adopted this range due to its balance between portability and sufficient volume. The packaging size aligns well with consumer needs for personal care liquids, condiments, household cleaners, and beverages.

It also supports branding flexibility and efficient retail display. The capacity range is optimal for online and offline retail logistics, providing a favorable mix of storage efficiency and consumer handling convenience.

Three-layer laminates are anticipated to contribute 42.10% of the market’s revenue share in 2025, establishing themselves as the leading laminate configuration. This dominance is being reinforced by the combination of mechanical strength, barrier protection, and printability offered by three-layer structures.

These laminates typically combine layers such as PET, aluminum foil, and LDPE to ensure oxygen, moisture, and light resistance, which are essential for preserving the integrity of perishable liquids. Enhanced sealing properties and puncture resistance make them suitable for high-speed filling operations and transportation across varying climatic conditions.

As manufacturers seek packaging materials that strike a balance between performance, cost, and sustainability goals, three-layer laminates continue to be the preferred choice for diverse liquid packaging applications.

The spout and non-spout liquid pouch packaging market is expanding as consumers seek convenient, lightweight, and cost-effective packaging solutions for liquids. These pouches are used in a wide range of applications, including beverages, dairy products, sauces, and household liquids. The shift toward flexible packaging solutions, driven by consumer demand for portability and easy storage, is accelerating market growth. Technological advancements, such as innovations in spout designs and resealable features, are contributing to the expansion. Despite challenges like manufacturing complexity and waste management issues, there are growth opportunities in emerging economies and the development of eco-friendly packaging options.

The demand for convenient, flexible, and cost-effective packaging solutions is a significant driver for the spout and non-spout liquid pouch packaging market. These pouches offer easy handling, portability, and convenience, making them the preferred choice for packaging beverages, dairy products, sauces, and cleaning liquids. As the need for on-the-go consumption increases, especially in urban areas, liquid pouches provide an ideal solution for consumer convenience. Moreover, the lightweight nature of these pouches allows for efficient storage and transportation, especially in the food and beverage sector. The introduction of innovative spout designs and resealable features has further propelled their adoption across various industries, reinforcing their popularity among consumers.

The spout and non-spout liquid pouch packaging market faces challenges related to manufacturing complexity and waste management. The production of these pouches requires specialized machinery and materials, particularly when incorporating features like spouts and resealable caps. This adds to production costs and complexity. Additionally, the environmental impact of plastic waste generated by these pouches is a concern for both manufacturers and consumers. While alternatives such as recyclable materials are being explored, the complexity of developing and implementing these solutions remains a challenge. Efficient waste management, improved recycling technologies, and reduced reliance on single-use plastic are critical factors in overcoming these barriers and enhancing the long-term viability of liquid pouch packaging.

The spout and non-spout liquid pouch packaging market holds significant growth potential, especially in emerging markets. As urbanization increases and disposable incomes rise in regions such as Asia-Pacific, Latin America, and Africa, demand for packaged food and beverage products is surging. Liquid pouches provide a convenient solution for these growing populations, particularly in regions with expanding retail infrastructures. The growing preference for eco-friendly packaging is driving innovation in liquid pouch designs, such as biodegradable and recyclable materials. Manufacturers have the opportunity to capitalize on these trends by developing more sustainable and cost-efficient solutions that align with evolving consumer preferences for eco-conscious packaging.

The spout and non-spout liquid pouch packaging sector is seeing significant trends in technology integration and material innovation. Manufacturers are adopting digital technologies such as QR codes and RFID tags for enhanced consumer interaction and product traceability. These technologies offer more transparency and personalization, meeting consumer demands for connected products. Moreover, advancements in material science are enabling the development of lighter, more durable, and flexible pouches. Multi-layer films and laminates are increasingly being used to improve the shelf life and performance of liquid packaging. As consumer expectations for packaging that is both functional and user-friendly rise, the adoption of smart features and high-performance materials continues to shape the market.

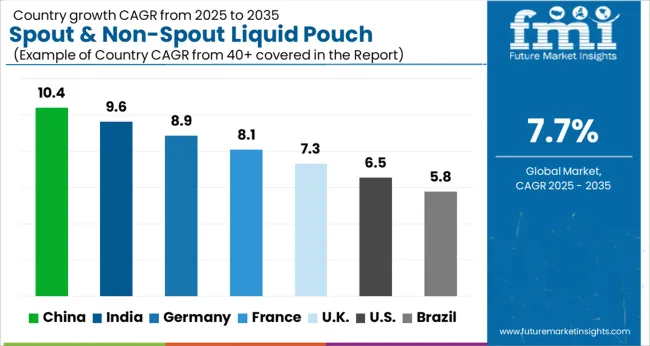

The spout & non-spout liquid pouch packaging market is projected to grow at a CAGR of 7.7% from 2025 to 2035. China leads at 10.4%, followed by India at 9.6%, and Germany at 8.9%. The United Kingdom records 7.3%, while the United States stands at 6.5%. BRICS nations like China and India are witnessing significant demand growth, supported by increasing consumption and changing consumer preferences for convenience and lightweight packaging. In contrast, OECD countries such as Germany, the UK, and the USA show steady growth driven by packaging innovation, sustainability, and evolving consumer habits. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 10.4% through 2035, primarily driven by its rapid industrial growth and rising demand for consumer convenience. As the world’s largest producer and consumer of packaged products, China is witnessing significant demand for liquid pouch packaging. The country’s vast manufacturing base, coupled with growing disposable incomes, pushes demand for single-serve and convenient packaging in various industries, particularly food and beverages. The large-scale e-commerce expansion further accelerates demand for cost-effective packaging solutions.

India is expected to grow at a CAGR of 9.6% through 2035, driven by the increasing demand for convenient packaging solutions in the food and beverage, healthcare, and consumer goods sectors. With urbanization, rising disposable incomes, and changing lifestyles, consumers are seeking more portable and ready-to-consume products. The country’s growing manufacturing sector is also contributing to the increasing production of liquid pouches. The expansion of e-commerce and retail has fueled demand for flexible packaging that suits modern consumer preferences for single-serve, on-the-go items.

Germany is projected to grow at a CAGR of 8.9% through 2035, with demand driven by both the food and beverage sector and the growing popularity of packaging solutions for non-food items. The demand for liquid pouches in Germany is increasing as industries, particularly food and beverage manufacturers, seek more efficient, cost-effective packaging solutions. The country's focus on automation and manufacturing innovation supports the adoption of high-quality, durable liquid pouches. As the UK and other European markets continue to demand high-end packaging solutions, German manufacturers are also capitalizing on this demand.

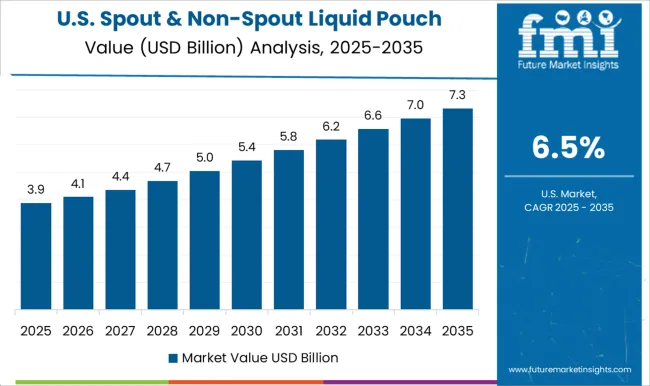

The United States is projected to grow at a CAGR of 6.5% through 2035, with demand driven by the increasing need for convenient, portable, and eco-friendly packaging solutions. The rise in consumer preference for ready-to-drink beverages, soups, and sauces has led to higher demand for spout and non-spout liquid pouches. The USA packaging industry’s focus on sustainability and reducing plastic waste is encouraging the adoption of eco-friendly packaging alternatives. With technological advancements in packaging machinery and a rise in demand for high-performance packaging, the USA market is poised for steady growth.

TThe United Kingdom is projected to grow at a CAGR of 7.3% through 2035, driven by a steady increase in demand for lightweight, cost-effective packaging solutions in the food and beverage industry. The growing popularity of single-serve and ready-to-consume food products in the UK is pushing the demand for liquid pouches. The expansion of e-commerce and the retail sector, particularly for grocery and beverage items, also contributes to the rising adoption of liquid pouches. The UK continues to invest in modern packaging solutions that offer convenience and functionality for both consumers and manufacturers.

The spout and non-spout liquid pouch packaging market is driven by major packaging companies specializing in flexible packaging solutions for beverages, liquids, and food products. Amcor and Tetra Pak are market leaders, offering innovative and sustainable liquid pouch packaging with options for both spouted and non-spouted designs. Ampac and Huhtamaki provide a wide range of flexible packaging solutions, focusing on improving convenience, safety, and sustainability in liquid packaging. Cellpack Packaging and Constantia Flexibles offer a strong portfolio of liquid pouch packaging products, specializing in both consumer and industrial applications, with an emphasis on material efficiency and branding opportunities. Glenroy and Impak Corporation provide high-quality pouch packaging with a focus on durability and sealing performance.

Smurfit Kappa and Sonoco emphasize eco-friendly packaging and are committed to reducing the environmental footprint of flexible packaging. Swiss Pac and Uflex focus on offering customizable pouch solutions, catering to regional and global brands in the food and beverage industry. Pouch Makers CA and Smart Pouches specialize in innovative pouch designs for liquids and food products, offering both standard and custom options. Competitive differentiation in this market is driven by packaging innovation, sustainability, cost-effectiveness, and the ability to cater to diverse product categories. Barriers to entry include high capital investment, regulatory compliance, and strong relationships with food and beverage manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Type | Spout and Non-spout |

| Capacity | 201 ml to 500 ml, Up to 200 ml, 501 ml to 1 liter, and Above 1 liter |

| Laminates | Three layers, Two layers, Four layers, and Others |

| Application | Food & beverages, Industrial, Personal care, Home care, and Pharmaceutical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Ampac, Cellpack Packaging, Chengde, Constantia Flexibles, Glenroy, Huhtamaki, Impak Corporation, Pouch Makers CA, Smart Pouches, Smurfit Kappa, Sonoco, Swiss Pac, Tetra Pak, and Uflex |

| Additional Attributes | Dollar sales by packaging type (spout pouches, non-spout pouches) and end-use segments (beverages, food, personal care). Demand dynamics are driven by growing consumer preference for convenient, easy-to-use packaging solutions. Regional trends show growth in North America, Europe, and Asia-Pacific. Innovation focuses on improved barrier properties and spout technology. Environmental considerations include using recyclable materials and reducing plastic consumption in packaging. |

The global spout & non-spout liquid pouch packaging market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the spout & non-spout liquid pouch packaging market is projected to reach USD 19.1 billion by 2035.

The spout & non-spout liquid pouch packaging market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in spout & non-spout liquid pouch packaging market are spout and non-spout.

In terms of capacity, 201 ml to 500 ml segment to command 36.7% share in the spout & non-spout liquid pouch packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spout Closures Market

Spouted Dispensing Closures Market

Spout Containers Market

Industry Share & Competitive Positioning in Spout Pouches

Spout Pouches Market Growth, Trends, Forecast 2024-2034

Yorker Spouts Market Trends - Growth & Forecast through 2034

Pouring Spout Market Size and Share Forecast Outlook 2025 to 2035

Loading Spout Market Growth - Trends & Forecast 2024 to 2034

Key Players & Market Share in the Dispensing Spout Industry

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Resealable Closures And Spouts Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Resealable Closures and Spouts Packaging Providers

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA