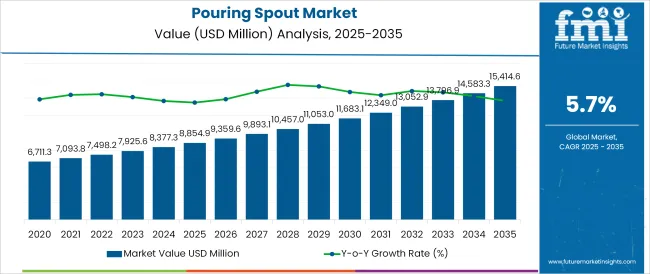

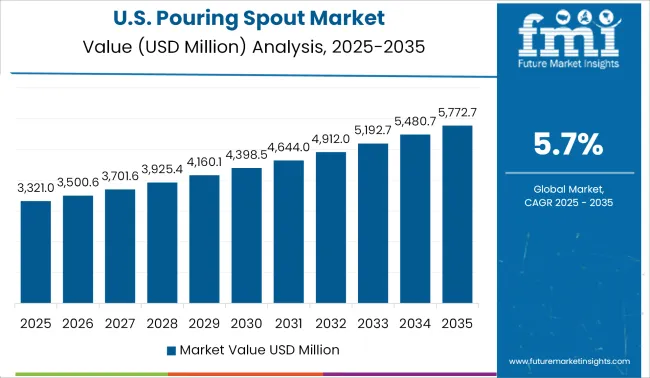

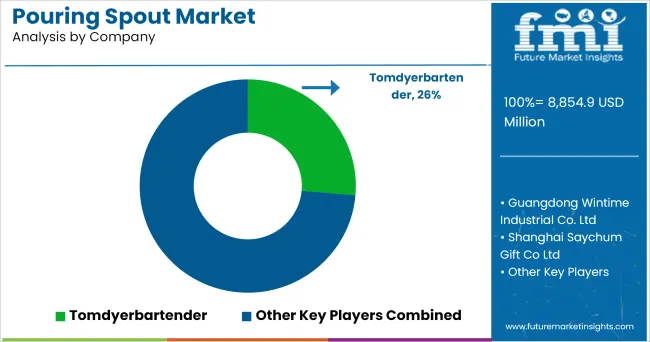

The Pouring Spout Market is estimated to be valued at USD 8,854.9 million in 2025 and is projected to reach USD 15,414.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The pouring spout market is expanding steadily, supported by increasing demand for precision pouring solutions across various industries and the growing focus on spill prevention and product preservation. Industrial updates and product development announcements have highlighted a shift toward user-friendly, hygienic, and durable pouring spouts that enhance operational efficiency. Manufacturers have introduced ergonomic and tamper-evident designs to address safety and ease-of-use requirements in commercial kitchens, chemical processing, and foodservice sectors.

Additionally, heightened focus on sustainability and reusability has influenced material choices, encouraging the use of metal and recyclable plastics. Market growth has also been supported by increasing adoption of pouring spouts in beverage dispensing, automotive fluids management, and household liquid containers. With a continuous push for product differentiation and compliance with hygiene regulations, the market is projected to grow through innovations in design, material durability, and multi-application versatility.

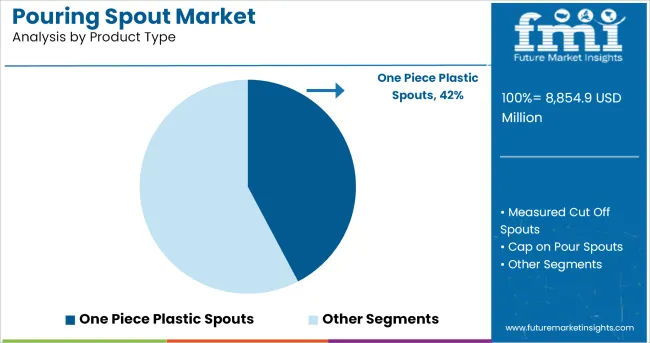

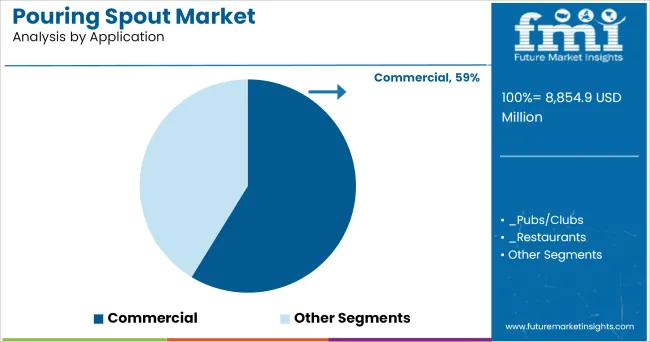

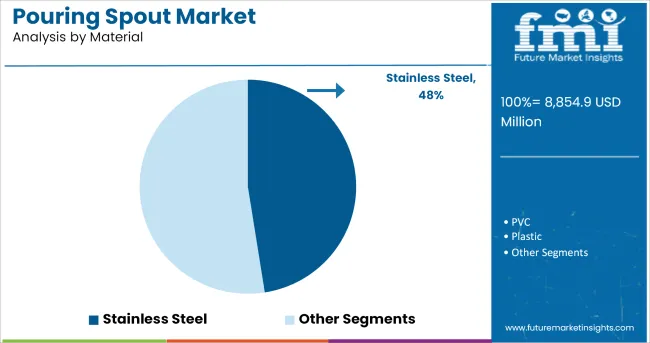

Segmental growth is expected to be led by One Piece Plastic Spouts, the Commercial application segment, and Stainless Steel material, reflecting demand for cost-effective, durable, and application-specific pouring solutions.

The market is segmented by Product Type, Application, Material, and Sales Channel and region. By Product Type, the market is divided into One Piece Plastic Spouts, Measured Cut Off Spouts, and Cap on Pour Spouts. In terms of Application, the market is classified into Commercial, Pubs/Clubs, Restaurants, Bars, Coffee Shops, and Residential.

Based on Material, the market is segmented into Stainless Steel, PVC, and Plastic. By Sales Channel, the market is divided into Wholesalers/Distributors, Online Retailers, Direct Sales, Specialty Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The One Piece Plastic Spouts segment is projected to hold 42.3% of the pouring spout market revenue in 2025, maintaining its leadership in product type. Growth in this segment has been driven by the cost-effectiveness and ease of production associated with one-piece plastic designs. Manufacturers have preferred these spouts for their lightweight nature and compatibility with high-volume manufacturing processes, enabling wide-scale application across multiple container types.

Commercial users have increasingly adopted one-piece plastic spouts for disposable and semi-reusable applications due to their affordability and compliance with hygiene standards. Product development has focused on enhancing flow control and leak resistance while ensuring ease of attachment and removal.

Furthermore, the recyclability of certain plastics has aligned with sustainability goals in packaging and commercial operations. As product versatility and production efficiency continue to drive market adoption, the One Piece Plastic Spouts segment is expected to maintain a strong market position.

The Commercial segment is projected to contribute 58.7% of the pouring spout market revenue in 2025, establishing itself as the leading application area. Growth of this segment has been fueled by the widespread use of pouring spouts in commercial kitchens, restaurants, hospitality venues, and industrial settings where precision dispensing and operational efficiency are critical.

Businesses have prioritized pouring spouts for their ability to improve workflow, reduce spillage, and maintain product hygiene during handling. Manufacturers have responded with durable, easy-to-clean spouts designed for repetitive use in demanding environments. Commercial applications such as bulk foodservice operations, chemical dispensing, and industrial lubricants have driven consistent product demand.

Additionally, food safety and occupational health regulations have reinforced the need for spouts that ensure sanitary fluid transfer. As the commercial sector continues to emphasize process optimization and workplace safety, the Commercial application segment is expected to remain the primary contributor to market growth.

The Stainless Steel segment is projected to account for 47.5% of the pouring spout market revenue in 2025, leading the material segment category. Growth of this segment has been driven by stainless steel’s superior durability, corrosion resistance, and hygienic properties, making it a preferred choice in commercial and industrial applications.

Stainless steel spouts have been widely adopted in food and beverage processing, where material purity and longevity are critical. Product developers have focused on engineering stainless steel spouts with precision engineered flow channels and tamper-resistant designs, enhancing both safety and user convenience. The material’s compatibility with high-temperature cleaning processes and its non-reactive surface have further solidified its use in applications where chemical interaction is a concern.

Additionally, the aesthetic appeal and premium positioning of stainless steel products have contributed to their popularity in upscale commercial environments. With sustainability considerations favoring long-lasting, reusable materials, the Stainless Steel segment is expected to continue driving value in the pouring spout market.

A pour spout is a regulated flow spout that fits snugly into the top of a liquor bottle and allows liquid to flow through it at a steady rate. Bartenders can then pour precisely into glasses or measurement equipment like jiggers and spoons. Pour spouts come in many different materials, sizes, flow rates, and finishes.

Some models include a lid over the spout that acts as a measuring device, while others include a flow stopper after a set volume of liquid to aid portion control. As a result, the bartending technique will have a significant impact on what will work best.

Furthermore, it is expected due to its variants in materials and sizes it is mostly expected to have high demand in commercial sectors such as restaurants, bars shops etc.

Product development is popular in today's world. Manufacturers are concentrating on product development techniques in order to meet the expectations of their customers. As a result, market participants are creating popular pouring spout designs. One-piece plastic spouts, for example, is a popular design available in a variety of colors and are perhaps the cheapest spouts on the market.

These pour at an angle, with the exit hole on one side of the spout, and are usually only a few pennies each. This characteristic makes them less appropriate for high-volume bars because people won't have time to examine the orientation of the spout when they are moving quickly, making the pour direction a surprise, similar to how a rugby ball bounces.

The United States is the world's most valuable pouring spout market. Pouring spouts are useful in bars offering simple drinks with stock management difficulties, but they are not well adapted to cocktail service. These can be extremely restricted because consumers need to be able to pour whatever amount a recipe calls for readily while mixing drinks.

They are, nevertheless, useful in situations when there is a casual workforce, such as event firms that require untrained employees to continuously make large amounts of drinks. As a result, the pouring spout market is expected to rise in the forecast period.

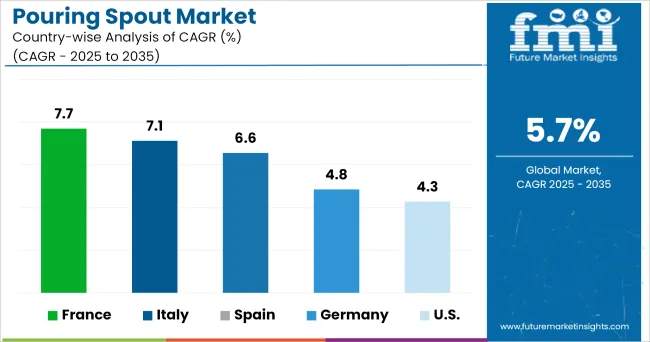

Europe produces the most wine in the world, yet the majority of it is centred in the south. These countries have traditionally been closed to foreign wines. Other countries, such as the United Kingdom, the Netherlands, Austria, Germany, and Belgium, provide the majority of chances for emerging countries.

Consumers in these countries are more open to foreign wines due to a lack of native production. Despite the fact that the wine markets in Eastern Europe are still modest, they are rising and providing opportunities. As a result, of the high consumption of liquor in the region pouring spout will be helpful in a large number of drinks.

Some of the leading suppliers & manufacturers include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global pouring spout market is estimated to be valued at USD 8,854.9 million in 2025.

The market size for the pouring spout market is projected to reach USD 15,414.6 million by 2035.

The pouring spout market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in pouring spout market are one piece plastic spouts, measured cut off spouts and cap on pour spouts.

In terms of application, commercial segment to command 58.7% share in the pouring spout market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spout & Non-Spout Liquid Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Spout Pouches

Spout Pouches Market Growth, Trends, Forecast 2024-2034

Spout Closures Market

Spouted Dispensing Closures Market

Spout Containers Market

Yorker Spouts Market Trends - Growth & Forecast through 2034

Loading Spout Market Growth - Trends & Forecast 2024 to 2034

Key Players & Market Share in the Dispensing Spout Industry

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Resealable Closures And Spouts Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Resealable Closures and Spouts Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA