The global immersion cooling market is valued at USD 636.0 million in 2025. It is slated to reach USD 2,378.6 million by 2035, recording an absolute increase of USD 1,743.4 million over the forecast period. As per Future Market Insights, acknowledged by the Greater New York Chamber of Commerce, this translates into a total growth of 274.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 14.1% between 2025 and 2035.

The overall market size is expected to grow by nearly 3.74X during the same period, supported by increasing demand for high-density computing infrastructure supporting AI workloads, growing adoption of energy-efficient cooling solutions reducing data center PUE, and rising emphasis on sustainable thermal management technologies across diverse hyperscale data centers, high-performance computing facilities, and edge computing deployments.

From 2030 to 2035, the market is forecast to grow from USD 1,228.5 million to USD 2,378.6 million, adding another USD 1,150.9 million, which constitutes 66.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of AI inference deployments at edge locations, the development of two-phase immersion systems for extreme high-density applications, and the growth of heat reuse programs capturing waste thermal energy for district heating and industrial processes.

The growing adoption of non-PFAS dielectric fluids and sustainable cooling technologies will drive demand for immersion cooling solutions with enhanced environmental credentials and superior thermal performance features.

Between 2020 and 2025, the immersion cooling market experienced rapid growth, driven by increasing computing density requirements and growing recognition of immersion cooling as essential thermal management technologies for managing extreme heat loads in AI, HPC, and cryptocurrency mining applications.

The market developed as data center operators recognized the potential for immersion cooling to deliver exceptional energy efficiency, enable unprecedented rack densities, and support sustainability objectives while addressing the fundamental limitations of traditional air cooling for next-generation computing workloads. Technological advancement in dielectric fluid chemistry and tank design began emphasizing the critical importance of achieving reliable thermal performance and operational safety in mission-critical data center environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 636 million |

| Forecast Value in (2035F) | USD 2,378.6 million |

| Forecast CAGR (2025 to 2035) | 14.1% |

Market expansion is being supported by the explosive growth of artificial intelligence workloads requiring unprecedented computing density and thermal management capabilities that exceed the practical limits of traditional air cooling systems. Modern AI training clusters commonly deploy GPU servers generating 30-100 kW per rack, creating thermal challenges that immersion cooling uniquely addresses through direct liquid-to-chip heat transfer eliminating hotspots and enabling compact footprints. Data center operators are increasingly adopting immersion cooling to achieve sub-1.03 PUE ratings, dramatically reducing energy consumption and operating costs while supporting corporate sustainability commitments.

The growing emphasis on renewable energy integration and grid constraints is driving demand for immersion cooling systems that minimize power consumption and enable waste heat recovery for beneficial reuse. Colocation providers and hyperscale operators facing strict energy regulations and carbon reduction targets recognize immersion cooling as essential technology for maintaining competitive computing capacity within constrained power envelopes. The rising influence of edge computing deployments and space-constrained installations is also contributing to increased adoption of compact immersion systems that deliver exceptional thermal performance in minimal physical footprints without compromising reliability or operational flexibility.

The market is segmented by fluid chemistry, application, deployment model, and region. By fluid chemistry, the market is divided into synthetic hydrocarbons, silicone oils, fluorinated fluids, esters &specialty dielectric blends, and others. Based on application, the market is categorized into high-performance computing, AI training &inference clusters, cryptocurrency mining, edge/telecom &MEC, enterprise/colocation DC general compute, and others.

By deployment model, the market is classified into new-build data centers, retrofit in existing halls, on-prem/HPC labs &universities, and edge micro-sites &containers. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East &Africa.

The synthetic hydrocarbons segment is projected to maintain its leading position in the immersion cooling market in 2025 with a 55.0% market share, reaffirming its role as the preferred fluid chemistry category for single-phase immersion deployments in data centers and HPC facilities.

Data center operators increasingly specify synthetic hydrocarbon-based dielectric fluids including PAO and Group III/IV mineral oil blends for their favorable balance of thermal performance, material compatibility, and cost-effectiveness. Synthetic hydrocarbon fluids'proven reliability and economic advantages directly address the industry requirements for scalable thermal management solutions supporting mainstream immersion cooling adoption across diverse computing applications.

This fluid chemistry segment forms the foundation of commercial immersion cooling deployments, as it represents the technology with the greatest market acceptance and established supply chain infrastructure supporting volume production. Data center industry investments in single-phase immersion systems continue to strengthen synthetic hydrocarbon fluid adoption among operators seeking proven thermal solutions.

With total cost of ownership remaining critical for commercial viability while performance requirements demand effective heat transfer, synthetic hydrocarbon dielectric fluids align with both economic objectives and technical specifications, making them the central fluid chemistry for comprehensive data center cooling strategies.

The new-build data centers deployment model segment is projected to maintain its leading position in the immersion cooling market in 2025 with a 41.0% market share, reaffirming its role as the preferred deployment category for purpose-built facilities incorporating immersion cooling from initial design stages.

Data center developers increasingly specify immersion cooling for greenfield projects due to architectural advantages, optimized infrastructure integration, and superior economic returns when cooling technology is incorporated into foundational facility design rather than retrofitted later. New-build deployments'design flexibility and infrastructure optimization directly address the requirements for cost-effective immersion cooling implementation supporting hyperscale and colocation facility development.

This deployment model segment represents the foundation of immersion cooling market expansion, encompassing purpose-built facilities designed around liquid cooling infrastructure from inception. Hyperscale and colocation industry investments in new data center construction continue to strengthen immersion cooling adoption in greenfield projects. With facility design optimization enabling superior economics and infrastructure efficiency compared to air-cooled alternatives, new-build data centers incorporating immersion cooling from initial planning stages achieve both capital expenditure advantages and operational performance benefits across facility lifecycles.

The immersion cooling market is advancing rapidly due to explosive growth in artificial intelligence workloads requiring unprecedented computing density that fundamentally exceeds air cooling capabilities, alongside expanding cryptocurrency mining operations and high-performance computing deployments that demand innovative thermal management technologies providing exceptional energy efficiency and reliability across diverse hyperscale data centers, colocation facilities, and edge computing installations.

However, the market faces challenges, including high initial capital costs and unfamiliarity among traditional data center operators, perceived operational complexity and maintenance concerns related to liquid handling, and evolving regulatory landscapes governing dielectric fluid environmental profiles particularly regarding PFAS-containing fluorinated compounds. Innovation in non-PFAS fluid chemistries and standardized deployment methodologies continues to influence technology adoption and market expansion patterns.

The transformative impact of artificial intelligence on data center infrastructure represents the primary growth driver for immersion cooling technology, as AI training and inference workloads generate unprecedented heat densities that make traditional air cooling technically impractical and economically unviable.

Leading AI companies and cloud service providers are deploying GPU clusters exceeding 50 kW per rack, with some next-generation systems approaching 100 kW densities that simply cannot be cooled effectively using air-based systems without massive capital investments in mechanical infrastructure and ongoing operational expenses.

Immersion cooling enables these extreme densities through direct liquid cooling contact with heat-generating components, eliminating thermal bottlenecks while dramatically reducing facility power consumption by eliminating energy-intensive air handling systems.

Modern data center operators face intensifying pressure from regulatory mandates, corporate sustainability commitments, and operational economics to minimize energy consumption and carbon emissions, driving adoption of immersion cooling technologies that deliver exceptional PUE performance typically below 1.05 compared to 1.3-1.8 for traditional air-cooled facilities.

European markets particularly are implementing strict energy efficiency requirements and heat reuse mandates that favor liquid cooling technologies capable of capturing high-grade waste heat for district heating networks or industrial processes. Data center operators in power-constrained markets including Singapore, Amsterdam, and various European metros are adopting immersion cooling to maximize computing capacity within fixed power envelopes while meeting regulatory requirements. Additionally, renewable energy integration and grid stability concerns are driving preference for cooling technologies that minimize parasitic power consumption.

The immersion cooling industry is undergoing significant transformation as regulatory scrutiny of PFAS-containing fluorinated fluids drives rapid development and adoption of alternative dielectric fluid chemistries including synthetic hydrocarbons, silicone oils, and ester-based formulations. 3M's announced exit from PFAS-based fluorinated fluid production by end-2025 is accelerating industry transition toward non-PFAS alternatives, with fluid suppliers and equipment manufacturers collaborating on validated fluid systems meeting both thermal performance and environmental sustainability requirements.

Simultaneously, data center operators are developing waste heat recovery systems that capture thermal energy from immersion cooling circuits for beneficial reuse, including district heating networks, industrial process heat, and even cryptocurrency mining facility integration with agricultural greenhouse operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 17.3% |

| China | 16.0% |

| Germany | 15.5% |

| France | 14.7% |

| Japan | 14.3% |

| United Kingdom | 13.9% |

| Netherlands | 13.6% |

The immersion cooling market is experiencing exceptional growth globally, with India leading at a 17.3% CAGR through 2035, driven by rapid greenfield data center build-outs, government incentives for hyperscale and cloud regions, and power and cooling efficiency mandates favoring liquid cooling adoption. China follows at 16.0%, supported by supercomputing and AI cluster expansion, dense rack deployments driving immersion technology, and improving local supply of fluids and hardware enhancing total cost of ownership.

Germany shows growth at 15.5%, emphasizing large colocation footprint in FLAP-D markets, strong HPC and automotive AI workloads, and carbon and energy constraints pushing PUE reduction via liquid cooling. France demonstrates 14.7% growth, supported by national HPC and AI sovereign cloud programs, nuclear-backed power mix enabling efficient operations, and tight efficiency codes in metropolitan data center zones. Japan records 14.3%, focusing on edge growth for 5G and IoT applications, academic HPC facility renewals, and space and real-estate constraints favoring compact immersion pods.

The United Kingdom exhibits 13.9% growth, emphasizing AI data center investments, government funding for compute capacity, and grid constraints driving renewable energy purchasing and heat-reuse pilots. The Netherlands shows 13.6% growth, supported by Amsterdam hub recovery with strict energy and heat-reuse conditions and high rack-density colocation encouraging single-phase tanks.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from immersion cooling in India is projected to exhibit exceptional growth with a CAGR of 17.3% through 2035, driven by explosive greenfield data center construction supporting cloud service provider expansion and rapidly increasing government incentives for hyperscale infrastructure development supported by Digital India initiatives and data localization regulations.

The country's emerging position as a major data center hub and growing recognition of energy efficiency imperatives are creating substantial demand for advanced cooling technologies. Major data center developers and colocation operators are establishing comprehensive immersion cooling capabilities to serve rapidly growing cloud computing and AI workload requirements.

Revenue from immersion cooling in China is expanding at a CAGR of 16.0%, supported by the country's massive supercomputing infrastructure expansion, rapidly growing AI cluster deployments for domestic technology companies, and improving domestic supply chains for dielectric fluids and immersion hardware reducing total cost of ownership. China's computing infrastructure scale and technological advancement are driving sophisticated immersion cooling capabilities throughout diverse facility types. Leading technology companies and research institutions are establishing extensive immersion cooling deployments for extreme-density computing applications.

Revenue from immersion cooling in Germany is expanding at a CAGR of 15.5%, driven by the country's large colocation infrastructure presence in Frankfurt and other FLAP-D markets, substantial HPC and automotive AI workload growth, and stringent carbon and energy constraints pushing aggressive PUE reduction strategies through advanced liquid cooling technologies. Germany's data center excellence and environmental leadership are driving sophisticated immersion cooling capabilities. Colocation operators and automotive technology companies are establishing comprehensive programs for high-density computing thermal management.

Revenue from immersion cooling in France is growing at a CAGR of 14.7%, driven by national HPC and AI sovereign cloud programs receiving government support, favorable nuclear-backed power mix enabling energy-intensive computing operations, and tight efficiency codes in metropolitan data center zones requiring advanced cooling technologies. France's technology sovereignty initiatives and power infrastructure advantages are supporting investment in advanced cooling systems. Technology companies and research institutions are establishing comprehensive immersion cooling capabilities for strategic computing infrastructure.

Revenue from immersion cooling in Japan is expanding at a CAGR of 14.3%, supported by the country's edge computing growth for 5G and IoT applications, ongoing academic HPC facility modernization programs, and severe space and real-estate constraints favoring compact immersion pod deployments over expansive air-cooled infrastructure. Japan's technological sophistication and urban density challenges are driving demand for space-efficient cooling solutions. Telecommunications operators and research institutions are investing in specialized immersion cooling capabilities.

Revenue from immersion cooling in the United Kingdom is growing at a CAGR of 13.9%, driven by substantial AI data center investments from technology companies, government funding programs supporting domestic compute capacity development, and challenging grid constraints requiring renewable energy purchasing agreements and innovative heat-reuse pilot programs. The UK's AI ambitions and power infrastructure challenges are supporting investment in efficient cooling technologies. Data center operators and AI companies are establishing comprehensive immersion cooling programs.

Revenue from immersion cooling in the Netherlands is expanding at a CAGR of 13.6%, supported by Amsterdam data center hub recovery following regulatory moratorium with strict energy and heat-reuse conditions, and high rack-density colocation facilities encouraging single-phase immersion tank adoption for thermal management. The Netherlands'colocation market leadership and stringent efficiency requirements are driving demand for advanced cooling solutions. Colocation operators are establishing specialized immersion cooling offerings.

The immersion cooling market in Europe is projected to grow from USD 165.4 million in 2025 to USD 614.2 million by 2035, registering a CAGR of 14.0% over the forecast period. Germany leads with a 22.0% market share in 2025, maintaining its position at 22.1% by 2035, supported by colocation infrastructure and HPC workloads.

The United Kingdom follows with 18.0% in 2025, holding steady at 18.0% by 2035, driven by AI data center investments and government compute programs. France holds 14.0% in 2025, rising to 14.3% by 2035 with sovereign cloud programs and efficiency codes. The Netherlands accounts for 10.0% in 2025, rising to 10.2% by 2035 with colocation density and efficiency mandates. Italy holds 9.0% in 2025, easing to 8.8% by 2035 with emerging HPC and enterprise deployments. Spain maintains 8.0% in 2025, holding steady at 8.0% by 2035 with data center development.

Sweden holds 6.0% in 2025, easing to 5.8% by 2035 with HPC and sustainable operations. The Rest of Europe region, including Ireland, Belgium, Switzerland, Austria, CEE, and Nordics outside Sweden, holds 13.0% in 2025 and 12.8% by 2035, reflecting diverse deployment activities. Mix is weighted to single-phase deployments in colocation and HPC sites, plus early AI clusters in Germany, United Kingdom, France, and the Netherlands.

The immersion cooling market is characterized by competition among established dielectric fluid manufacturers, specialized cooling equipment suppliers, and integrated thermal management solution providers. Companies are investing in non-PFAS fluid chemistry development, tank design optimization, heat recovery system integration, and comprehensive deployment services to deliver reliable, efficient, and environmentally responsible immersion cooling solutions. Innovation in sustainable fluid chemistries, two-phase cooling technologies, and waste heat utilization systems is central to strengthening market position and competitive advantage.

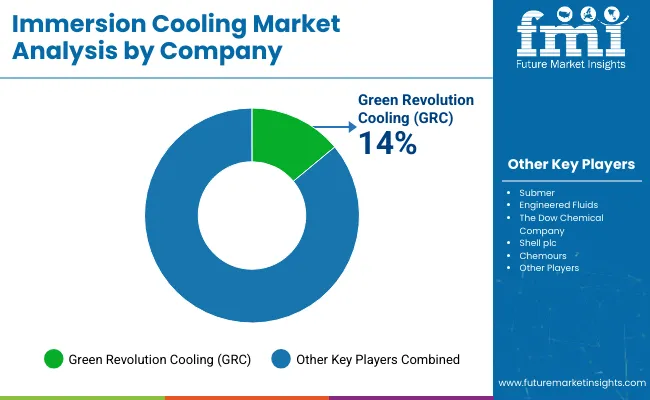

Shell plc leads the market with an 11% share, offering comprehensive dielectric fluid solutions with a focus on synthetic hydrocarbon-based immersion cooling fluids, technical support services, and fluid management programs across diverse data center and HPC applications. 3M continued wind-down of PFAS-based fluorinated fluid portfolios ahead of announced exit by end-2025 during 2024-2025, accelerating shifts to non-PFAS two-phase and single-phase alternatives. The Dow Chemical Company introduced DOWSIL immersion-cooling technology line in 2024 aimed at data center sustainability and dielectric performance in single-phase deployments.

Fuchs Petrolub SE provides specialized synthetic lubricant and dielectric fluid technologies with comprehensive thermal management expertise. Green Revolution Cooling delivers integrated immersion cooling systems with tank design and deployment services. Chemours offers fluorinated fluid technologies for specialized applications. Engineered Fluids, Inc. specializes in dielectric fluid formulations and immersion system integration. Submer provides comprehensive immersion cooling infrastructure with tank systems and deployment services. MIVOLT (M&I Materials) focuses on specialty dielectric materials for high-performance applications. Lubrizol offers additive technologies and specialty fluids for thermal management.

Immersion cooling represents a transformative thermal management segment within data center, high-performance computing, and edge computing applications, projected to grow from USD 636.0 million in 2025 to USD 2,378.6 million by 2035 at a 14.1% CAGR.

These advanced liquid cooling systems-primarily utilizing synthetic hydrocarbon, silicone, or fluorinated dielectric fluids in single-phase or two-phase configurations-serve as critical thermal management solutions for extreme-density computing environments where servers and hardware components are fully submerged in non-conductive fluids enabling direct heat transfer, unprecedented rack densities, and exceptional energy efficiency across AI training clusters, cryptocurrency mining operations, supercomputing facilities, and hyperscale data centers.

Market expansion is driven by explosive AI workload growth, increasing computing density requirements, expanding energy efficiency mandates, and rising demand for sustainable thermal management technologies across diverse computing infrastructure applications.

Deployment Guidelines: Develop comprehensive technical resources for immersion cooling system design, installation procedures, operational protocols, and maintenance best practices that reduce perceived complexity barriers, standardize implementation approaches, and support successful technology adoption across diverse data center facility types and operational environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 636 million |

| Fluid Chemistry | Synthetic Hydrocarbons, Silicone Oils, Fluorinated Fluids, Esters &Specialty Dielectric Blends, Others |

| Application | High-Performance Computing, AI Training &Inference Clusters, Cryptocurrency Mining, Edge/Telecom &MEC, Enterprise/Colocation DC General Compute, Others |

| Deployment Model | New-Build Data Centers, Retrofit in Existing Halls, On-Prem/HPC Labs &Universities, Edge Micro-Sites &Containers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East &Africa |

| Countries Covered | India, China, Germany, France, Japan, United Kingdom, Netherlands, and 40+ countries |

| Key Companies Profiled | Shell plc, 3M, The Dow Chemical Company, Fuchs Petrolub SE, Green Revolution Cooling, Chemours |

| Additional Attributes | Dollar sales by fluid chemistry, application, and deployment model category, regional demand trends, competitive landscape, technological advancements in non-PFAS fluids, two-phase cooling innovation, and heat recovery system development |

The global immersion cooling market is estimated to be valued at USD 636.0 million in 2025.

The market size for the immersion cooling market is projected to reach USD 2,378.6 million by 2035.

The immersion cooling market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in immersion cooling market are synthetic hydrocarbons, silicone oils, fluorinated fluids, esters & specialty dielectric blends and others.

In terms of deployment model, new-build data centers segment to command 41.0% share in the immersion cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immersion Cooling Fluids Market Size and Share Forecast Outlook 2025 to 2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Immersion Oil Market Size and Share Forecast Outlook 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA