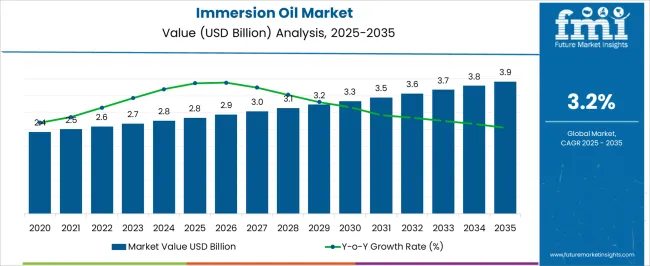

The Immersion Oil Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. Growth momentum analysis reveals gradual and steady growth throughout the forecast period, with occasional acceleration as demand evolves in key industries such as microscopy, automotive, and research laboratories. From 2025 to 2029, the market is expected to increase from USD 2.4 billion to USD 2.8 billion, reflecting a steady rise driven by the growing use of immersion oil in microscopy for enhanced image quality and improved resolution.

Between 2029 and 2031, the market maintains steady momentum, moving from USD 2.8 billion to USD 2.9 billion. This phase is characterized by ongoing innovation in oil formulations, with increased emphasis on sustainable and high-performance products to meet industry requirements for precision and reliability. From 2031 to 2035, the market sees a slight acceleration, reaching USD 3.9 billion by 2035.

The growth momentum picks up as industries such as medical diagnostics and biological research increasingly adopt advanced immersion oils to improve their imaging systems. This phase also benefits from technological advancements in manufacturing and the growing focus on high-quality imaging solutions, which drives higher consumption of immersion oils.

| Metric | Value |

|---|---|

| Immersion Oil Market Estimated Value in (2025 E) | USD 2.8 billion |

| Immersion Oil Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The immersion oil market is experiencing steady growth as microscopy techniques continue to advance across biomedical, materials science, and industrial research sectors. The precision required in optical imaging has led to increased adoption of immersion oils to improve numerical aperture and enhance clarity during high-magnification microscopy. Advancements in compound and fluorescence microscopy, particularly in life sciences and pathology, have necessitated high-quality immersion mediums that reduce light refraction and image distortion.

The expanding footprint of research institutions, academic laboratories, and diagnostic centers is further driving consumption. Additionally, innovation in oil formulations with low autofluorescence, high refractive index consistency, and improved thermal stability is enhancing usability across temperature-sensitive applications.

The shift toward digital pathology and remote slide analysis is also fostering demand for reliable, optically stable oils compatible with automated systems. These factors are collectively supporting long-term growth prospects, with strong uptake expected in both developed healthcare systems and emerging research ecosystems.

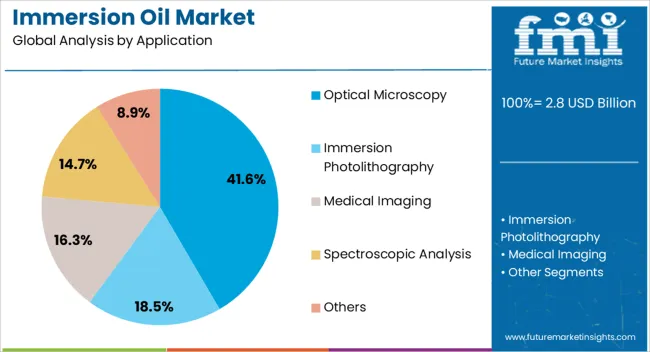

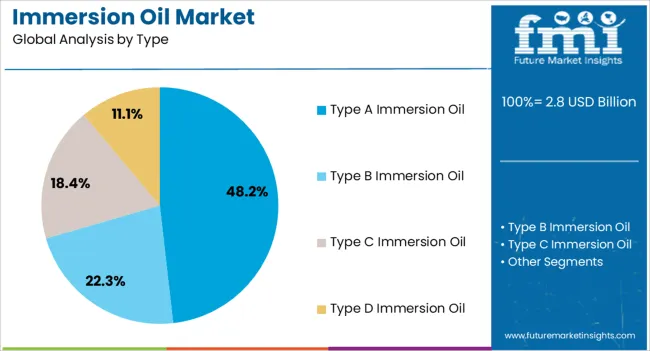

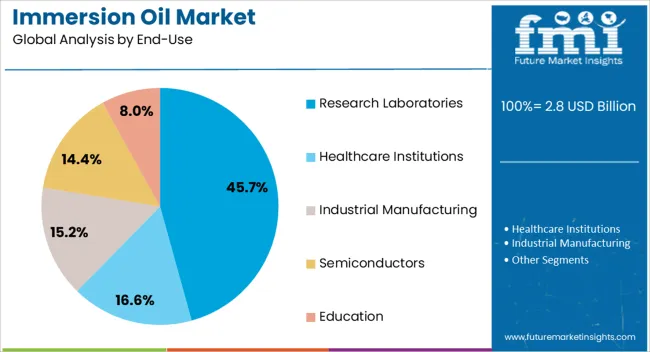

The immersion oil market is segmented by application, type, end-use, and geographic regions. By application, the immersion oil market is divided into Optical Microscopy, Immersion Photolithography, Medical Imaging, Spectroscopic Analysis, and Others. In terms of type, the immersion oil market is classified into Type A Immersion Oil, Type B Immersion Oil, Type C Immersion Oil, and Type D Immersion Oil. Based on end-use, the immersion oil market is segmented into Research Laboratories, Healthcare Institutions, Industrial Manufacturing, Semiconductors, and Education.

Regionally, the immersion oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The optical microscopy application segment is projected to contribute 41.6% of the immersion oil market revenue in 2025, establishing itself as the dominant application area. This growth is being driven by the critical role of immersion oils in enhancing image resolution and brightness in high-magnification optical systems. In biological sciences and medical diagnostics, the demand for detailed cellular visualization has reinforced the reliance on immersion oils to minimize light scattering and increase numerical aperture.

This is particularly important in observing live tissues, stained cells, and microstructures, where clarity and contrast are essential. The integration of optical microscopy into pathology workflows and academic research settings has further expanded usage.

Additionally, the compatibility of immersion oils with modern objective lenses and their ability to support prolonged viewing without rapid evaporation or degradation have added to their appeal. As microscopy technologies evolve toward more automated and high-throughput platforms, the consistent optical performance of immersion oils is expected to remain critical for ensuring imaging precision.

Type A immersion oil is expected to represent 48.2% of the market revenue share in 2025, reflecting its dominance among oil types used in precision imaging. This leadership is driven by its balanced viscosity and refractive index properties, which align with the requirements of most high-power objective lenses. Type A oils are widely used in clinical and academic microscopy due to their reliability across multiple imaging techniques, including brightfield, fluorescence, and phase contrast.

Their formulation ensures reduced optical distortion, minimal autofluorescence, and enhanced light transmission, which are essential for high-fidelity imaging. The long working time and chemical stability of Type A immersion oils make them suitable for prolonged microscopy sessions in diagnostic and research settings.

Furthermore, increased production by established chemical and optical solution providers has improved availability and cost efficiency. The preference for Type A oils has also been supported by standardized performance across various optical platforms, making them a universal solution for laboratories aiming to maintain imaging accuracy.

The research laboratories segment is forecast to hold 45.7% of the immersion oil market revenue share in 2025, positioning it as the leading end-use segment. Growth in this area is being driven by the increasing volume of microscopy-based investigations in molecular biology, pharmacology, materials science, and nanotechnology. Research laboratories demand consistent optical clarity and reproducibility in imaging, which immersion oils provide by enhancing resolution and contrast during high-magnification observations.

The emphasis on understanding cellular structures, identifying biomarkers, and characterizing materials has led to heightened dependence on oil-immersion objectives for precise visualization. In academic institutions and private R&D centers, high-powered optical instruments are frequently used for exploratory and validation studies, further necessitating high-performance immersion mediums.

The need for oils that remain stable during extended experimental runs, maintain compatibility with varied lens types, and resist photobleaching is shaping purchasing preferences. As research funding increases globally and imaging plays a central role in scientific discovery, immersion oils are expected to remain indispensable in laboratory workflows.

The immersion oil market is growing due to its widespread use in microscopy and imaging applications, particularly in fields such as biology, medical research, and materials science. Immersion oil is used in optical microscopy to improve the resolution and contrast of images by matching the refractive index of the oil to that of the lens. The increasing demand for high-precision imaging, coupled with advancements in microscopy techniques, is driving the growth of the immersion oil market. The market is also benefiting from the expansion of research activities and the development of new diagnostic tools in various scientific and medical fields.

The immersion oil market is driven by the advancements in microscopy techniques and the growing need for high-quality imaging in research and diagnostics. Immersion oils are essential in high-power microscopy to improve resolution and provide clear, detailed images of specimens. The rising applications of advanced microscopy in biological research, medical diagnostics, and material science are propelling the demand for immersion oil. In particular, the use of oil immersion lenses in medical and scientific laboratories for the observation of fine details at high magnification continues to increase. As the demand for precise imaging and diagnostic tools grows, the need for immersion oils is expected to expand.

Despite the growing demand, the immersion oil market faces challenges related to its high cost and limited use in non-research applications. Immersion oils, especially those designed for high-resolution microscopy, can be expensive, which may limit their widespread use, particularly in smaller laboratories or educational institutions with limited budgets. Immersion oil is typically used in specialized applications, mainly for laboratory research and high-magnification imaging, making its application base narrower compared to other oils or imaging solutions. These factors can hinder the broader adoption of immersion oil, especially in markets outside the research and medical sectors.

The immersion oil market presents significant opportunities, particularly in medical diagnostics and technological advancements. As the medical industry embraces advanced diagnostic imaging techniques, the demand for high-resolution microscopy is increasing, driving the need for immersion oils in laboratories and hospitals. Technological advancements in imaging systems, such as digital microscopes and automated imaging, are enhancing the capabilities of optical microscopy, further fueling demand for immersion oil. As innovations in imaging and diagnostic technologies continue to evolve, the market for immersion oil is expected to grow, offering new opportunities for manufacturers and suppliers of these products.

A key trend in the immersion oil market is the development of alternative immersion oils and specialty formulations that cater to specific needs in different imaging applications. Manufacturers are focusing on creating oils with enhanced properties, such as lower viscosity, improved clarity, and enhanced compatibility with modern microscopy equipment. As environmental concerns rise, there is an increasing trend toward the development of non-toxic, biodegradable oils that still maintain high refractive indices, providing effective performance in imaging applications. These innovations are helping to expand the range of immersion oil products available and are expected to drive growth in both research and medical imaging markets.

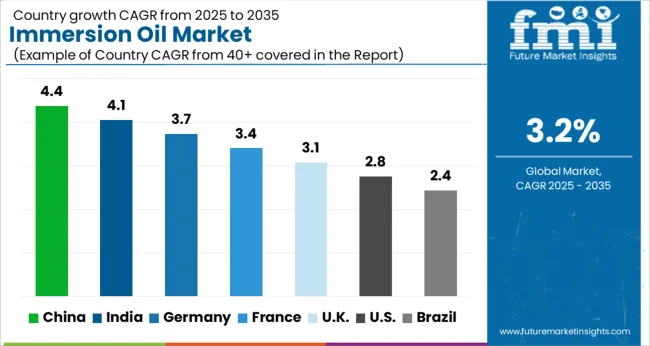

| Country | CAGR |

|---|---|

| China | 4.4% |

| India | 4.1% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.4% |

The global immersion oil market is projected to grow at a global CAGR of 3.2% from 2025 to 2035. China leads the market with a growth rate of 4.4%, followed by India at 4.1%. Germany records a growth rate of 3.7%, while the UK shows 3.1% and the USA follows at 2.8%. The market is primarily driven by the increasing demand for high-quality oils in microscopy, particularly in biological research, industrial applications, and material science. China and India are leading the growth, supported by rapid industrialization and the expanding research sectors. Developed markets like Germany, the UK, and the USA are witnessing steady growth driven by technological advancements and growing demand for high-performance immersion oils. The analysis spans over 40+ countries, with the leading markets shown below.

The immersion oil market in China is expanding at a 4.4% CAGR, driven by the increasing demand for advanced microscopy and scientific research applications. As China continues to advance its biotechnology and materials science sectors, the need for high-quality immersion oils is growing. The country’s rapid industrialization and increasing focus on research and development are key factors driving the market's growth. With the expansion of the healthcare and education sectors, there is a growing demand for optical devices and equipment that require immersion oils, thereby further accelerating market expansion. China’s competitive manufacturing capabilities are also driving the market's affordability and accessibility.

The immersion oil market in India is expected to grow at a 4.1% CAGR, driven by increasing research activities in fields such as biotechnology, materials science, and environmental monitoring. As India continues to invest in scientific research and education, the demand for high-quality oils used in microscopy is rising. The growing pharmaceutical and biotechnology industries, along with the country’s expanding academic research institutions, are driving market growth. The increasing adoption of advanced optical devices in medical diagnostics and scientific research is further boosting the demand for immersion oils in India’s growing research sector.

The immersion oil market in Germany is projected to grow at a 3.7% CAGR, driven by the country’s strong research and industrial sectors. Germany’s focus on advancing scientific and industrial research, particularly in material science and biological research, is fueling the demand for high-quality immersion oils. The growing number of research institutions and laboratories in Germany, combined with the need for advanced optical devices in various industries, is supporting the growth of the market. Germany’s established manufacturing and research capabilities are also contributing to the widespread availability and demand for immersion oils in the region.

The UK immersion oil market is expected to grow at a 3.1% CAGR, driven by growing research activities in the fields of life sciences, materials science, and industrial applications. The UK is home to several leading research institutions, which contribute to the demand for high-performance immersion oils. As advancements in biotechnology, pharmacology, and material sciences continue, there is an increasing need for specialized oils used in microscopy. The UK focus on improving diagnostic capabilities in the healthcare sector further drives the adoption of immersion oils for optical devices used in medical applications.

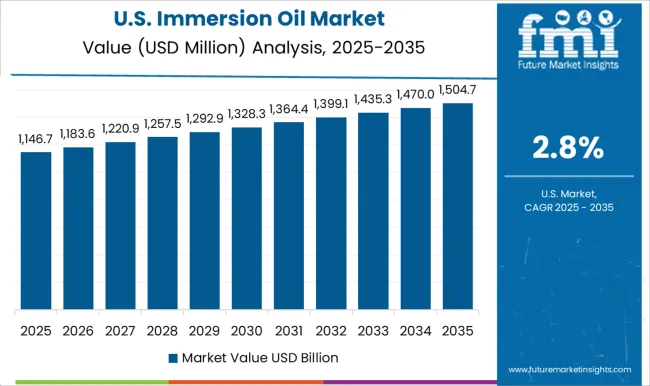

The USA immersion oil market is projected to grow at a 2.8% CAGR, supported by increasing demand for high-performance oils used in scientific research, particularly in microscopy. The USA is home to numerous leading research and academic institutions that require immersion oils for optical devices in their studies. As the country’s biotechnology and pharmaceutical industries continue to expand, the need for advanced, high-quality oils is growing. Furthermore, the increasing demand for diagnostic devices and imaging systems in healthcare is further contributing to the market’s growth. The USA market continues to benefit from innovation and technological advancements in microscopy and imaging techniques.

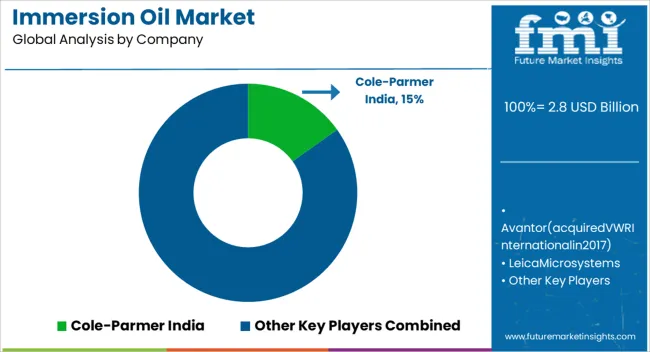

The immersion oil market is driven by key players offering high-quality oils used in microscopy applications, particularly in enhancing image resolution and clarity during high-magnification microscopy. Cole-Parmer India is a significant player, providing a variety of laboratory products, including immersion oils, with a focus on high-performance solutions for microscopy. Avantor, which acquired VWR International in 2017, offers a broad portfolio of laboratory chemicals, including immersion oils, with an emphasis on high purity and reliability for scientific research and microscopy. Leica Microsystems is recognized for providing high-quality immersion oils that are essential for optical microscopy, offering a range of products designed for precision and optimal image clarity. Cargille Labs specializes in producing immersion oils for light microscopy, offering a variety of oils tailored to different magnification levels and application requirements, ensuring superior optical performance.

Honeywell Research Chemicals provides a range of immersion oils used in scientific research, focusing on high-quality and precision chemicals for laboratory applications. Nikon Industries, known for its high-performance microscopy equipment, also offers immersion oils designed to enhance the clarity and contrast of images in microscopy. Structure Probe manufactures a variety of immersion oils, providing high-performance products that improve optical clarity for microscopy in biological and industrial applications. Ted Pella is known for its high-quality immersion oils used in electron microscopy and light microscopy, with a focus on high-refractive-index oils for superior imaging. Biognost, part of the ELITech Group, provides specialized immersion oils for scientific applications, ensuring optimal optical performance in microscopy. Einstinc offers immersion oils used in a wide range of high-magnification microscopy applications, ensuring superior performance and clear imaging for laboratory research.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Application | Optical Microscopy, Immersion Photolithography, Medical Imaging, Spectroscopic Analysis, and Others |

| Type | Type A Immersion Oil, Type B Immersion Oil, Type C Immersion Oil, and Type D Immersion Oil |

| End-Use | Research Laboratories, Healthcare Institutions, Industrial Manufacturing, Semiconductors, and Education |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cole-Parmer India, Avantor(acquiredVWRInternationalin2017), LeicaMicrosystems, CargilleLabs, HoneywellResearchChemicals, NikonIndustries, StructureProbe, TedPella, Biognost,ELITechGroup, and Einstinc |

| Additional Attributes | Dollar sales by product type (high refractive index immersion oils, standard immersion oils) and end-use segments (biological research, industrial applications, educational institutions, diagnostics). Demand dynamics are driven by the growing need for high-precision optical imaging in biological research, diagnostics, and material science. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with advancements in microscopy technology and increasing research activities in healthcare, biology, and material science driving market expansion. |

The global immersion oil market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the immersion oil market is projected to reach USD 3.9 billion by 2035.

The immersion oil market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in immersion oil market are optical microscopy, immersion photolithography, medical imaging, spectroscopic analysis and others.

In terms of type, type a immersion oil segment to command 48.2% share in the immersion oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Immersion Cooling Fluids Market Size and Share Forecast Outlook 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA