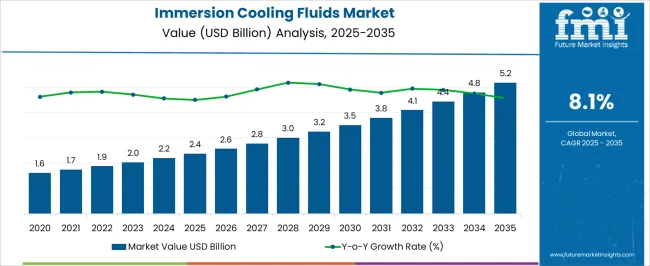

The immersion cooling fluids sector is expected to increase from USD 2.4 billion in 2025 to USD 5.2 billion in 2035, recording a CAGR of 8.1%. The market growth curve shape shows a steady incline, with values moving from 2.4 billion in 2025 to 3.0 billion in 2028 and 3.5 billion in 2030. This progression reflects the rising adoption of immersion cooling systems in data centers, high-performance computing, and crypto-mining facilities where efficiency and thermal management are critical.

By 2031, the industry value is forecasted to reach 3.8 billion, progressing to 4.4 billion in 2033 and closing at 5.2 billion by 2035. The shape of the curve highlights consistent expansion, supported by expanding demand for advanced cooling across IT infrastructure and industrial applications. Market observers suggest that the trajectory underlines immersion cooling fluids as an indispensable element in energy-efficient computing frameworks. The pattern confirms gradual yet strong adoption, with stakeholders recognizing the competitive edge delivered by enhanced system performance. The curve illustrates a dependable growth path, positioning immersion cooling fluids as a critical enabler of next-generation computing environments.

| Metric | Value |

|---|---|

| Immersion Cooling Fluids Market Estimated Value in (2025 E) | USD 2.4 billion |

| Immersion Cooling Fluids Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The immersion cooling fluids segment is estimated to contribute nearly 19% of the data center cooling market, about 16% of the thermal management materials market, close to 22% of the electronic cooling fluids market, nearly 13% of the power and energy cooling systems market, and around 11% of the advanced cooling technologies market. Collectively, this equals an aggregated share of approximately 81% across its parent categories. This proportion highlights the decisive role immersion cooling fluids play in enabling high-performance thermal regulation for servers, GPUs, and critical power equipment. Their relevance has been established in environments where traditional air-based systems fail to provide the efficiency or density required. Analysts regard immersion cooling fluids not simply as specialty chemicals but as strategic assets that directly influence uptime, energy costs, and equipment reliability.

Demand has been reinforced by surging computational requirements from artificial intelligence, blockchain, and cloud computing, alongside greater emphasis on long-term operational efficiency in energy-intensive facilities. Their contribution extends beyond data centers into power electronics and industrial setups, where equipment durability is enhanced by effective heat removal. The segment has been positioned as a key differentiator within its parent markets, shaping procurement priorities, infrastructure designs, and long-term capital allocation. As a result, immersion cooling fluids are not viewed as supplementary solutions but as indispensable enablers of next-generation cooling strategies that strengthen competitiveness and reliability across global industries.

Increasing adoption of immersion cooling in data centers, cryptocurrency mining facilities, and advanced computing applications is driving market expansion. The ability of immersion cooling fluids to reduce energy consumption, enhance equipment lifespan, and lower operational costs has positioned them as a preferred choice over traditional cooling methods. The shift toward sustainable and eco-friendly cooling technologies is further accelerating adoption, with manufacturers focusing on low-toxicity and biodegradable fluid formulations.

Growing investments in next-generation computing, artificial intelligence workloads, and edge data centers are creating new opportunities for market players. As heat density in computing environments continues to rise, the market is expected to maintain an upward trajectory, driven by the operational efficiencies and long-term cost benefits offered by immersion cooling solutions.

The immersion cooling fluids market is segmented by fluid type, technology, application, and geographic regions. By fluid type, the immersion cooling fluids market is divided into hydrocarbons and fluorocarbons. In terms of technology, the immersion cooling fluids market is classified into single-phase cooling and two-phase cooling. Based on application, the immersion cooling fluids market is segmented into data centre, transformers, EV batteries, and others. Regionally, the immersion cooling fluids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

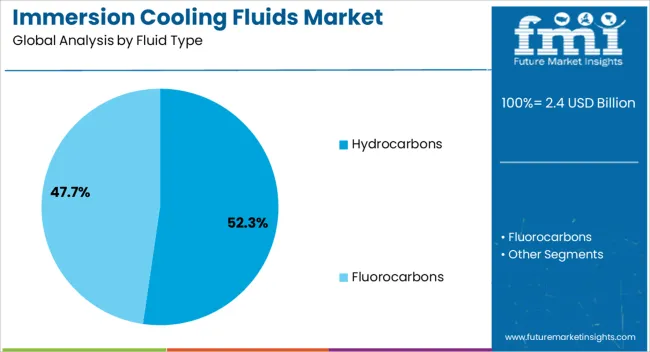

The hydrocarbons fluid type segment is projected to account for 52.3% of the immersion cooling fluids market revenue in 2025, making it the leading category. This dominance is being driven by the segment’s favorable balance between thermal performance, cost efficiency, and compatibility with a wide range of hardware.

Hydrocarbons are known for their stability, non-corrosive nature, and ease of recycling, making them suitable for large-scale deployments in data-intensive environments. The segment has further benefited from advancements in fluid formulations that enhance dielectric strength while maintaining low viscosity, improving heat transfer efficiency.

Widespread availability and scalability of production have also supported adoption In addition, the relatively lower cost compared to certain specialty fluids has made hydrocarbons an attractive choice for enterprises seeking both performance and operational savings, reinforcing their position as the most utilized fluid type in the market.

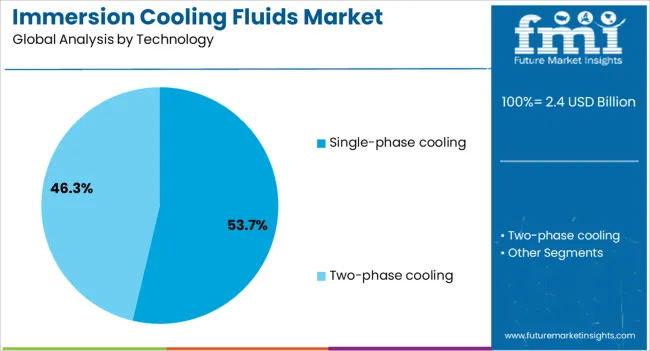

The single-phase cooling technology segment is expected to hold 53.7% of the market revenue in 2025, establishing it as the leading technology in immersion cooling applications. This leadership is attributed to its simpler design, lower operational risk, and reduced maintenance requirements compared to multi-phase systems.

Single-phase cooling fluids operate without undergoing phase change, which minimizes fluid loss and system complexity while ensuring consistent thermal performance. The ease of integration into existing infrastructure and the ability to achieve predictable cooling efficiency have strengthened its adoption in mission-critical applications.

Lower initial setup costs and reduced system monitoring requirements have also contributed to its growth. As industries seek reliable and cost-effective cooling solutions for expanding computational demands, single-phase cooling has been favored for its operational stability and straightforward implementation.

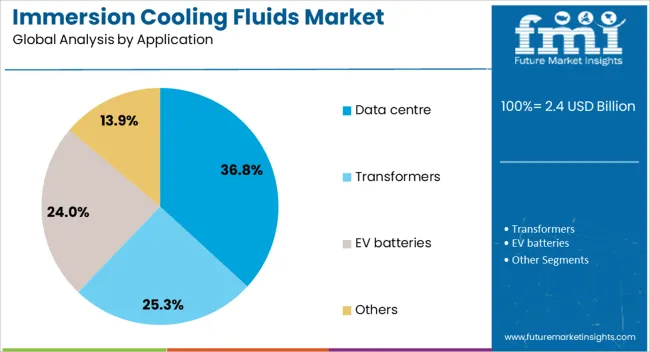

The data centre application segment is anticipated to capture 36.8% of the market revenue in 2025, making it the largest end-use area. This prominence is being fueled by the growing need to manage increasing heat loads in high-density server environments while reducing power usage effectiveness ratios.

Immersion cooling in data centers enables significant reductions in energy consumption for cooling infrastructure, directly supporting cost efficiency and sustainability targets. The capability to handle workloads from AI, machine learning, and cloud computing without thermal throttling has further reinforced demand in this segment.

Additionally, the adoption of immersion cooling supports compliance with environmental regulations and aligns with global initiatives to reduce carbon emissions in the IT sector. As data center capacity continues to expand worldwide, the use of immersion cooling fluids in this segment is expected to remain strong, driven by the dual need for operational efficiency and environmental responsibility.

The immersion cooling fluids market is projected to grow steadily, driven by rising demand for efficient thermal management in data centers, power electronics, and high-performance computing. Demand is reinforced by the need for heat dissipation solutions that outperform conventional air or liquid cooling methods. Opportunities are emerging in cryptocurrency mining, AI-driven computing, and hyperscale data centers. Trends highlight the development of dielectric fluids, biodegradable formulations, and single-phase versus two-phase cooling approaches. However, challenges such as high fluid costs, recyclability concerns, and limited standardization continue to shape the pace of market adoption.

Demand for immersion cooling fluids has been reinforced by the increasing heat loads in data centers, high-performance computing, and power electronics. Traditional cooling methods are proving insufficient for handling the thermal intensity of advanced processors and GPUs. Data center operators are prioritizing immersion cooling fluids for their ability to reduce energy usage while extending component lifespans. Cryptocurrency mining facilities, which require constant cooling under heavy workloads, have further boosted demand. Power electronics in electric vehicles and renewable energy inverters also represent growing areas of adoption. With energy efficiency and reliability being critical factors, immersion cooling fluids are increasingly regarded as essential solutions in high-density computing environments. This surge in demand reflects a decisive shift in cooling strategies, positioning these fluids as core enablers of next-generation thermal management systems.

Opportunities in the immersion cooling fluids market are being shaped by hyperscale data centers, AI computing, and niche industrial applications. Hyperscale operators are adopting immersion cooling to manage massive thermal loads cost-effectively while ensuring uptime reliability. AI-driven computing, with its intensive workloads, presents further opportunities for fluids capable of supporting high-power density hardware. Opportunities also exist in niche areas such as military electronics, medical imaging, and renewable energy systems. Expansion in cryptocurrency mining has reinforced opportunities for immersion cooling fluids, as miners seek efficiency and stability in continuous operations. Development of biodegradable and recyclable fluids is creating differentiation for suppliers targeting environmentally conscious buyers. Collectively, these opportunities underscore how immersion cooling fluids are transitioning from specialized use cases into mainstream adoption across multiple sectors that demand high-performance thermal management.

Trends in the immersion cooling fluids market emphasize fluid innovation, modular cooling designs, and adoption across diverse industries. Development of dielectric fluids with higher thermal stability and non-conductive properties is trending strongly. Shift toward biodegradable and recyclable fluids is gaining momentum as buyers demand safer disposal and reduced lifecycle costs. Single-phase and two-phase cooling models are being refined, with single-phase fluids trending for simplicity while two-phase designs gain traction for efficiency in high-density systems. Modular immersion cooling tanks are trending in data centers, as they offer scalability and ease of deployment. Cross-industry adoption in automotive, aerospace, and renewable sectors is also visible, showing a broadening scope. These trends highlight a decisive movement toward engineered fluids that combine performance, adaptability, and lifecycle benefits, reinforcing their role in thermal management solutions.

Challenges in the immersion cooling fluids market arise from high production costs, limited recyclability, and a lack of global standardization. The specialized nature of dielectric fluids makes them expensive compared to traditional cooling solutions, limiting adoption in cost-sensitive markets. Recyclability and safe disposal of fluids remain concerns, particularly for large-scale data centers managing high volumes. Limited standardization of immersion cooling practices across industries creates compatibility issues, slowing wider adoption. Smaller companies face barriers due to high upfront investment requirements and a lack of established supplier ecosystems. Competition from enhanced air and liquid cooling systems, which are cheaper and widely available, adds further pressure. These structural challenges indicate that while immersion cooling fluids provide undeniable performance advantages, widespread growth will rely on lowering costs, improving recyclability, and establishing unified industry standards.

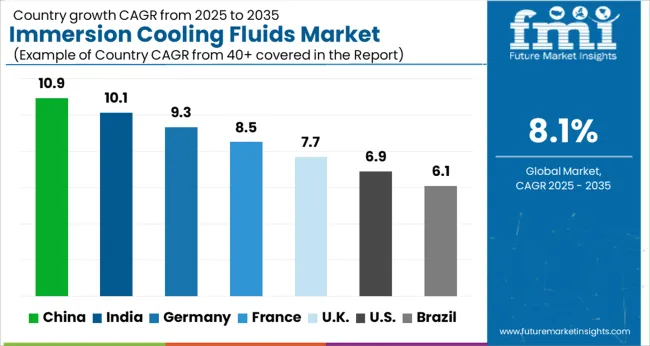

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

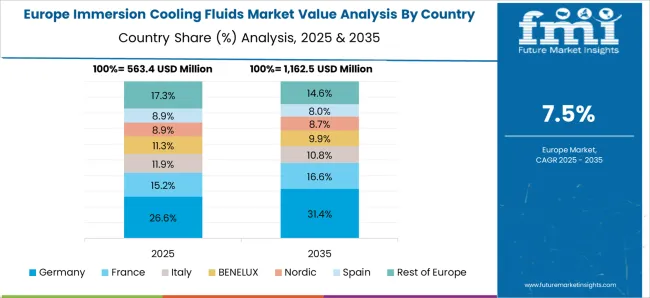

The global immersion cooling fluids market is projected to expand at a CAGR of 8.1% from 2025 to 2035. China leads at 10.9%, followed by India at 10.1% and France at 8.5%. The United Kingdom is forecast at 7.7%, while the United States records 6.9%. Growth is driven by the rising demand for high efficiency cooling solutions in data centers, electric vehicles, and high performance computing. Asian economies post faster growth due to large scale data infrastructure projects, rising EV adoption, and cost competitive fluid production. European markets emphasize regulatory compliance and advanced formulations with low environmental impact. The USA reflects steady but slower growth, supported by retrofitting in mature data centers, innovation in synthetic fluids, and increased demand from AI driven computing infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The immersion cooling fluids market in China is projected to grow at a CAGR of 10.9%. Growth is driven by large scale expansion of hyperscale data centers, rapid adoption of electric vehicles, and demand for advanced cooling in high performance electronics. Domestic chemical manufacturers scale up production of mineral oils and synthetic dielectric fluids to meet both local and global demand. Government backed initiatives for green data infrastructure and EV supply chains reinforce adoption of immersion cooling technologies. China’s cost competitive manufacturing, combined with strong industrial demand, positions it as the largest contributor to global market growth in immersion cooling fluids.

The immersion cooling fluids market in India is forecast to expand at a CAGR of 10.1%. Rising data center investments, expansion of fintech and telecom infrastructure, and increasing demand for efficient EV cooling systems support growth. Domestic firms collaborate with global chemical suppliers to develop cost effective dielectric fluids suited for tropical conditions. Government initiatives promoting digitalization and EV adoption reinforce market expansion. With growing demand from AI computing, blockchain processing, and high density servers, India emerges as one of the fastest growing markets for immersion cooling solutions. Strong policy support and a rapidly expanding technology ecosystem sustain India’s high growth trajectory.

The immersion cooling fluids market in France is projected to grow at a CAGR of 8.5%. Expansion is influenced by compliance with EU energy efficiency targets, strong investment in renewable powered data centers, and adoption in EV battery cooling. French chemical companies emphasize eco friendly, biodegradable formulations to meet regulatory and consumer expectations. Data center operators increasingly adopt immersion cooling to reduce energy costs and meet carbon reduction goals. With advanced research in green chemistry and strong participation in European digital infrastructure projects, France consolidates its role as one of the key European markets for immersion cooling fluids.

The immersion cooling fluids market in the UK is forecast to expand at a CAGR of 7.7%. Growth is shaped by demand from data centers, financial services infrastructure, and expanding EV supply chains. Operators of high density computing facilities increasingly adopt immersion cooling to address rising power usage and regulatory pressure for efficiency. Import reliance remains high, with advanced fluids sourced from global chemical suppliers. The UK’s strong financial and telecom sectors continue to drive consistent adoption, supported by government policies for energy efficient infrastructure. While growth is slower than in Asia, the UK maintains steady demand as retrofitting projects and next generation data facilities expand.

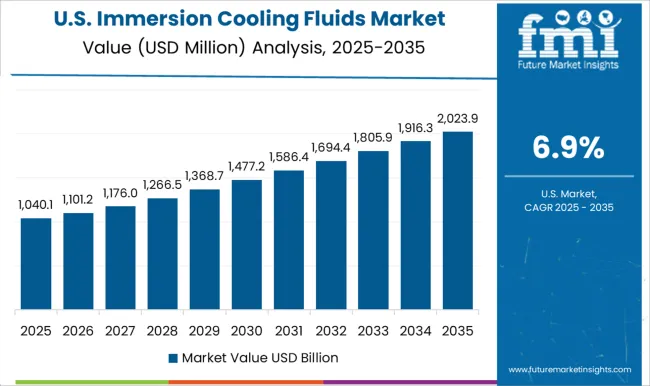

The immersion cooling fluids market in the US is projected to grow at a CAGR of 6.9%. Growth is moderate, shaped by a mature data center ecosystem, but demand remains steady from AI, cloud computing, and edge infrastructure projects. Adoption is further supported by federal initiatives for energy efficient technologies and rising EV integration. USA manufacturers focus on premium synthetic fluids with high dielectric strength and environmental safety compliance. Retrofitting of older data centers provides incremental demand, while partnerships with hyperscale operators create opportunities for innovation. Although slower than Asia and Europe, the USA remains significant due to high value, innovation driven applications of immersion cooling fluids.

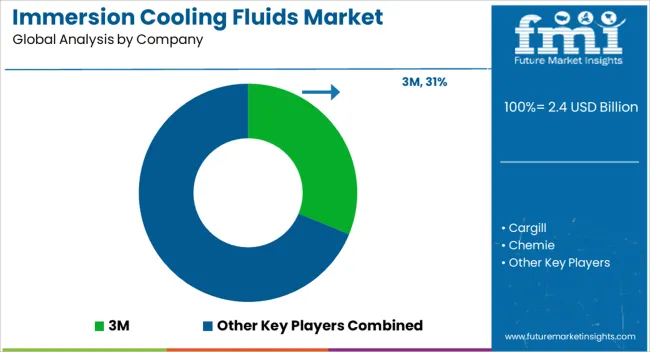

The immersion cooling fluids market is witnessing strong growth, driven by rising demand for energy-efficient cooling in data centers, electric vehicles, and industrial applications. These fluids are essential for maintaining optimal performance and thermal management in high-density computing systems and advanced electronics. Competition is shaped by product quality, thermal conductivity, chemical stability, pricing, and technological differentiation.

Key players dominating the market include 3M Company, FUCHS SE, The Lubrizol Corporation, Submer Technologies, Green Revolution Cooling, Dow, Shell, Ergon, ExxonMobil Chemical, and Solvay. Companies compete by developing advanced fluid formulations, expanding manufacturing capacities, and providing tailored solutions for specific industries. Strategic collaborations, acquisitions, and partnerships are leveraged to strengthen market presence and secure long-term contracts with data center operators and industrial clients. Regional manufacturers also compete by offering cost-effective alternatives, ensuring timely delivery, and providing technical support.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Fluid Type | Hydrocarbons and Fluorocarbons |

| Technology | Single-phase cooling and Two-phase cooling |

| Application | Data centre, Transformers, EV batteries, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Cargill, Chemie, Chevron, Dow, Engineered Fluids, Ergon, ExxonMobil Chemical, Shell, Soltex, and Valvoline |

| Additional Attributes | Dollar sales by fluid type (synthetic, mineral oils, engineered fluids), Dollar sales by application (data centers, EV battery cooling, power electronics), Trends in eco-friendly and high-performance cooling solutions, Role in improving energy efficiency and system longevity, Growth driven by data center expansion and renewable energy, Regional patterns across North America, Europe, Asia Pacific. |

The global immersion cooling fluids market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the immersion cooling fluids market is projected to reach USD 5.2 billion by 2035.

The immersion cooling fluids market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in immersion cooling fluids market are hydrocarbons, _mineral, _synthetic and fluorocarbons.

In terms of technology, single-phase cooling segment to command 53.7% share in the immersion cooling fluids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immersion Oil Market Size and Share Forecast Outlook 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA