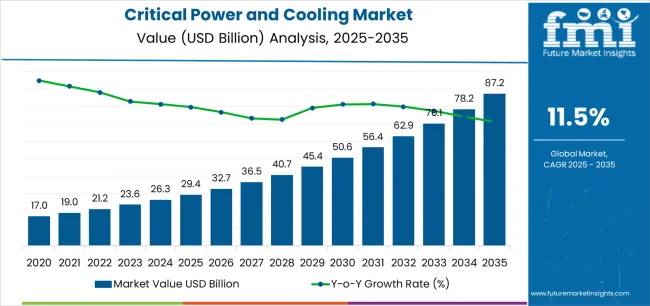

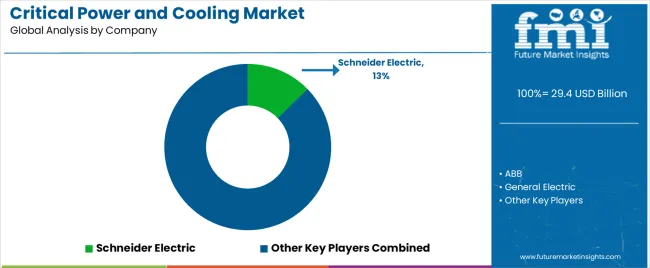

The Critical Power and Cooling Market is estimated to be valued at USD 29.4 billion in 2025 and is projected to reach USD 87.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

The critical power and cooling market is gaining momentum due to the rising dependence on data centers, healthcare facilities, and manufacturing industries that demand continuous power reliability. Increasing digitalization and the expansion of cloud infrastructure have intensified the need for stable, energy-efficient systems capable of preventing operational downtime.

The market is also shaped by growing awareness of power management efficiency, coupled with regulatory emphasis on minimizing carbon emissions from energy systems. Technological advancements in energy storage, precision cooling, and modular infrastructure are enhancing system resilience while reducing operational costs.

Industrial automation, combined with higher energy loads in sensitive environments, continues to drive investments in backup power and cooling solutions. With increasing deployment across hyperscale data centers and critical industrial zones, the market is projected to grow steadily, supported by the dual objectives of sustainability and uninterrupted power continuity.

| Metric | Value |

|---|---|

| Critical Power and Cooling Market Estimated Value in (2025 E) | USD 29.4 billion |

| Critical Power and Cooling Market Forecast Value in (2035 F) | USD 87.2 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

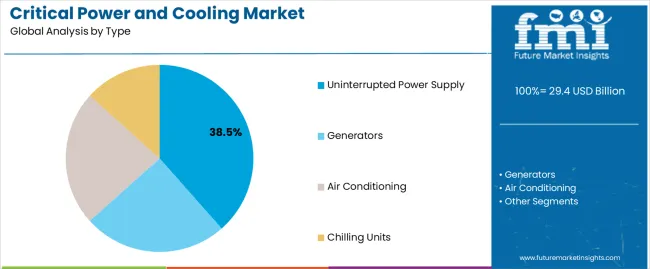

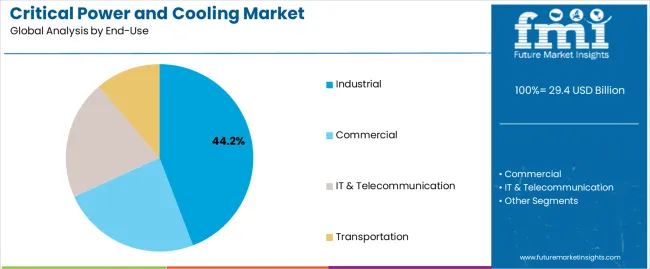

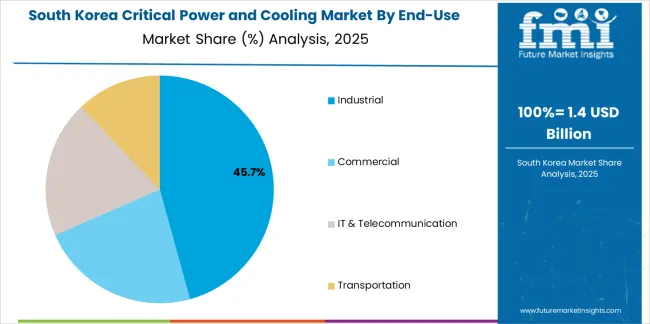

The market is segmented by Type and End-Use and region. By Type, the market is divided into Uninterrupted Power Supply, Generators, Air Conditioning, and Chilling Units. In terms of End-Use, the market is classified into Industrial, Commercial, IT & Telecommunication, and Transportation. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The uninterrupted power supply segment leads the type category with approximately 38.50% share, driven by the increasing demand for continuous power availability across industrial and commercial sectors. This segment’s growth is attributed to its capability to prevent data loss and equipment failure during power interruptions.

Rapid urbanization and rising IT infrastructure development have fueled adoption, particularly in telecommunications, data centers, and healthcare facilities. Technological innovations in lithium-ion batteries and modular UPS systems have enhanced energy efficiency and service reliability.

The segment also benefits from increased focus on power quality management and protection against voltage fluctuations. As industries move toward automation and remote operations, uninterrupted power supply systems are expected to remain integral, supporting the segment’s sustained dominance in the forecast period.

The industrial segment holds approximately 44.20% share within the end-use category, owing to the continuous demand for high-reliability power infrastructure in manufacturing, process industries, and utilities. Industrial operations require consistent energy delivery to prevent production halts, equipment damage, and revenue loss, making robust power and cooling systems indispensable.

This segment benefits from modernization initiatives, particularly in heavy industries adopting digital process control and advanced automation. The integration of backup systems with smart monitoring platforms ensures predictive maintenance and operational continuity.

The increasing establishment of industrial clusters and expansion of high-load manufacturing facilities further reinforce demand. With continued emphasis on operational safety and process optimization, the industrial segment is anticipated to maintain its leading share in the coming years.

From 2020 to 2025, the critical power and cooling market experienced a CAGR of 15.2%. The global shift toward digitalization is a driving force behind the demand for reliable and scalable critical power and cooling solutions.

This transformation is evident across various countries and industries, necessitating infrastructure that can adapt to evolving technological needs.

The growth of the Internet of Things (IoT) and the expansion of 5G networks further contribute to the demand for facilities that can handle the processing and storage requirements of interconnected technologies.

The organizations opting for critical power and cooling systems that prioritize energy efficiency not only aligns with sustainability objectives but also delivers significant and enduring cost savings over the long term.

Projections indicate that the global critical power and cooling market is expected to experience a CAGR of 12.1% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 15.2% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 12.1% |

The provided table highlights the top five countries in terms of revenue, with South Korea and the United Kingdom leading the list. The growing dependence on digital services, cloud computing, and data-intensive applications is driving the demand for resilient critical power and cooling infrastructure in the United Kingdom.

As a prominent participant in the global technology and manufacturing arena, South Korea necessitates resilient critical power and cooling infrastructure to facilitate seamless international connectivity and data exchange.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 12.4% |

| The United Kingdom | 13.5% |

| China | 13.1% |

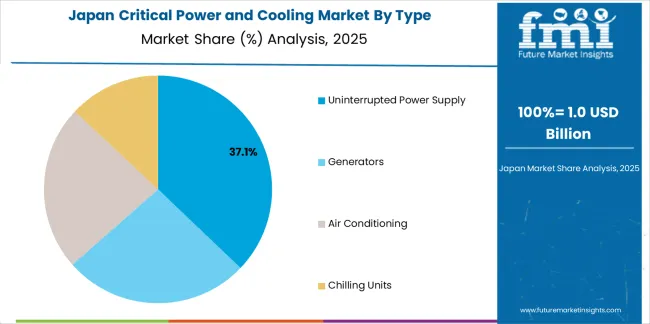

| Japan | 10.9% |

| South Korea | 14.6% |

The critical power and cooling market in the United States is expected to grow with a CAGR of 12.4% from 2025 to 2035. The United States is home to a significant number of data centers, driven by the growth of cloud services, big data analytics, and digital transformation initiatives across various industries.

As businesses and organizations expand their digital infrastructure, the need for reliable critical power and cooling solutions in data centers increases in the country.

Businesses in the United States continue to invest in upgrading and expanding their IT infrastructure to support evolving technologies, such as edge computing, artificial intelligence, and the Internet of Things (IoT). This ongoing investment fuels the demand for robust power and cooling systems.

The critical power and cooling market in the United Kingdom is expected to grow with a CAGR of 13.5% from 2025 to 2035. The United Kingdom has a thriving data center industry, serving diverse sectors such as finance, telecommunications, and healthcare.

The increasing demand for data storage, cloud services, and digital transformation fuels the need for reliable critical power and cooling infrastructure in United Kingdom.

The integration of renewable energy into the power grid and data center operations requires advanced critical power solutions to maintain reliability and stability. The United Kingdom has stringent regulations regarding energy efficiency, carbon emissions, and environmental sustainability. Compliance with these regulations encourages the adoption of energy-efficient critical power and cooling technologies.

The critical power and cooling market in the United States is expected to grow with a CAGR of 13.1% from 2025 to 2035. China has witnessed significant growth in data center construction, driven by the increasing adoption of cloud services, big data analytics, and digital transformation initiatives.

The demand for reliable critical power and cooling solutions is closely tied to the expansion of data center infrastructure.

China's continuous industrialization and economic development contribute to increased demand for critical power and cooling solutions in various sectors, including manufacturing, healthcare, and finance. Robust infrastructure is crucial for supporting these industries' expanding IT requirements.

Government support for technological innovation, infrastructure development, and the digital economy further fuels the demand for critical power and cooling solutions. National initiatives and policies may incentivize businesses to invest in advanced infrastructure for energy efficiency and sustainability.

The critical power and cooling market in the Japan is expected to grow with a CAGR of 10.9% from 2025 to 2035. Japan has a strong emphasis on energy efficiency and sustainability. The need to reduce energy consumption and minimize environmental impact drives the adoption of energy-efficient critical power and cooling solutions.

Japan is susceptible to seismic and meteorological events, including earthquakes and typhoons. Ensuring the resilience of critical infrastructure, including power and cooling systems, is a priority to maintain continuous operations and minimize the impact of disruptions.

Japan is known for embracing advanced technologies. The adoption of technologies like artificial intelligence, high-performance computing, and 5G necessitates robust critical power and cooling solutions to support these applications.

The critical power and cooling market in the South Korea is expected to grow with a CAGR of 14.6% from 2025 to 2035. The growth of the digital economy and increased reliance on data-driven processes have LED to a rising number of data centers in South Korea.

The demand for reliable power and cooling solutions is closely tied to the expansion of data center facilities. The adoption of energy-efficient critical power and cooling solutions aligns with the country's goals to reduce energy consumption and minimize the environmental impact of infrastructure.

As a major player in the global technology and manufacturing landscape, South Korea requires robust critical power and cooling infrastructure to support international connectivity and data exchange.

The below section shows the leading segment. Uninterrupted power supply segment to grow at a CAGR of 11.8% from 2025 to 2035. Based on end-use, the industrial segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 11.5% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Uninterrupted Power Supply | 11.8% |

| Industrial | 11.5% |

Based on type, the uninterrupted power supply segment is anticipated to thrive at a CAGR of 11.8% from 2025 to 2035. Uninterrupted power is essential for maintaining continuous operations, safeguarding data, and ensuring business continuity. Even brief power outages can lead to data loss, downtime, and financial losses.

Data centers house sensitive electronic equipment and servers that require a stable and uninterrupted power supply for optimal performance. UPS systems act as a safeguard during power outages or fluctuations, providing a seamless transition to backup power sources and preventing downtime.

Based on end-use, the industrial segment is anticipated to grow at a CAGR of 11.5% from 2025 to 2035. Many industrial processes are highly sensitive to interruptions in power supply. Industries, particularly those in sectors such as pharmaceuticals, chemicals, and food production, often operate in regulatory environments with strict requirements for safety and environmental control. Compliance with these regulations necessitates the implementation of reliable critical power and cooling solutions.

Industrial facilities often house complex and sensitive machinery, including manufacturing equipment, robotics, and control systems. These systems require a stable power supply to operate efficiently and accurately. Critical power solutions protect these equipment from power quality issues and outages.

Industrial processes often require precise temperature control and environmental conditions. Critical cooling solutions play a crucial role in maintaining optimal working conditions for equipment, preventing overheating, and ensuring consistent product quality.

The key players in the market are focusing on development of advanced features, such as intelligent monitoring and management systems, to enhance overall system performance.

The market players are forming partnerships with other technology providers to create comprehensive solutions that integrate critical power and cooling with other data center infrastructure components.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 26.2 billion |

| Projected Market Valuation in 2035 | USD 82 billion |

| Value-based CAGR 2025 to 2035 | 12.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Type, End-Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Schneider Electric; ABB; General Electric; Eaton Corporation; Delta Electronics; Socomec Group; Falcon Electric Inc.; Daikin Industries; Stulz Group; Vertiv; Piller Group GmBH; Nortek Air Solutions; SPX Corporation; Rittal GmBH & Co.; nVent; Sudlows |

The global critical power and cooling market is estimated to be valued at USD 29.4 billion in 2025.

The market size for the critical power and cooling market is projected to reach USD 87.2 billion by 2035.

The critical power and cooling market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in critical power and cooling market are uninterrupted power supply, generators, air conditioning and chilling units.

In terms of end-use, industrial segment to command 44.2% share in the critical power and cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Critical Care Patient Monitoring Products Market Forecast and Outlook 2025 to 2035

Critical Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Critical Infrastructure Monitoring Market

Critical Infrastructure Protection Market

Critical Care Information Systems Market

Supercritical Fluid Chromatography Market

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA