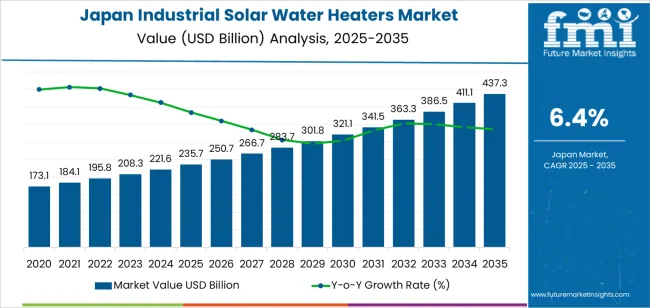

The demand for industrial solar water heaters in Japan is expected to grow from USD 235.7 million in 2025 to USD 437.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.4%. Industrial solar water heaters are becoming increasingly popular in sectors like manufacturing, hospitality, and agriculture due to their ability to reduce energy costs and minimize environmental impact. These systems harness solar energy to heat water, offering a sustainable and cost-effective alternative to conventional heating systems that rely on fossil fuels or electricity. As Japan continues to prioritize sustainability and energy efficiency, the demand for solar water heaters in industrial applications is expected to rise.

The government’s commitment to reducing carbon emissions and promoting renewable energy solutions will continue to drive the adoption of solar technologies in industrial settings. Technological advancements in solar water heater systems, including improved efficiency, durability, and integration with existing energy infrastructure, will further enhance their appeal. As industries look for ways to meet environmental regulations and reduce operational costs, industrial solar water heaters will play an increasingly important role in meeting these goals.

Between 2025 and 2030, the demand for industrial solar water heaters is expected to grow from USD 235.7 million to USD 250.7 million, contributing a solid foundation to overall growth. This period will see steady adoption driven by the expansion of industrial applications and growing awareness of renewable energy benefits. Industries such as hospitality and food processing will lead the demand for solar water heating systems as they strive to enhance sustainability practices and reduce energy consumption.

From 2030 to 2035, the industry for industrial solar water heaters is expected to see more rapid growth, increasing from USD 250.7 million to USD 437.3 million. This phase will be marked by a significant rise in the adoption of solar water heaters across multiple industries, driven by stronger governmental policies, increased awareness of environmental issues, and technological innovations. The Growth Contribution Index will reflect substantial increases in demand, particularly as Japan's industries strive to meet renewable energy targets and capitalize on energy-saving technologies. The growing emphasis on reducing operational costs while adhering to stricter environmental regulations will further contribute to the industry's upward trajectory.

| Metric | Value |

|---|---|

| Demand for Industrial Solar Water Heaters in Japan Value (2025) | USD 235.7 billion |

| Demand for Industrial Solar Water Heaters in Japan Forecast Value (2035) | USD 437.3 billion |

| Demand for Industrial Solar Water Heaters in Japan Forecast CAGR (2025 to 2035) | 6.4% |

The demand for industrial solar water heaters in Japan is increasing as industries and commercial facilities seek large‑scale solutions for hot‑water generation that reduce dependence on conventional fuel sources. These systems are used across manufacturing, hospitality, food processing, and institutional facilities to meet high volumes of hot‑water demand. The appeal of solar‑driven hot‑water systems grows as companies aim for operational efficiency and improved process utility.

Facility owners and plant managers are installing industrial solar water heaters to support cost‑effective thermal generation, especially where large constant loads exist. Applications such as cleaning, sterilization, and hot‑water circulation in sectors like food processing and hospitality benefit from systems that harness solar thermal energy. As industrial frameworks expand and retrofit activities accelerate, the use of solar hot‑water systems become more pronounced.

Technological improvements in large‑scale systems including higher collector efficiencies, integrated thermal controls, and modular installation for industrial capacities are making solar water‑heater solutions more viable for large facilities. As construction of industrial parks and commercial campuses increases, the adoption of such systems to handle intense hot‑water loads are rising. With Japan’s focus on upgrading infrastructure and improving asset lifecycle performance, the requirement for industrial solar water‑heater systems is anticipated to continue growing steadily through 2035

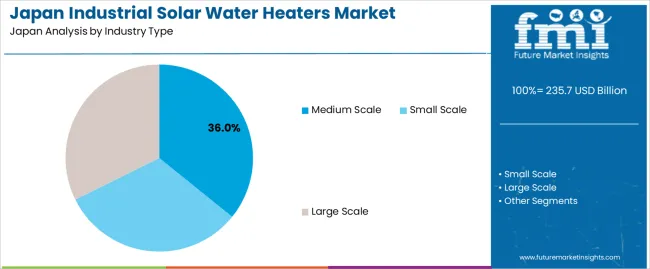

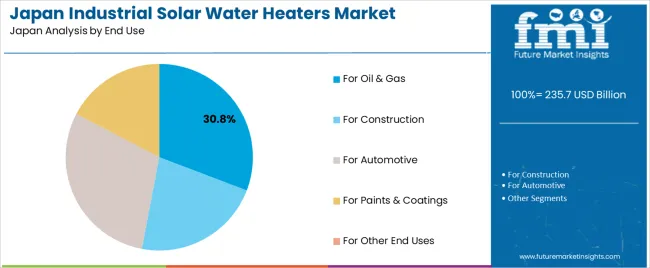

Demand for industrial solar water heaters in Japan is segmented by industry type, end use, and sales channel. By industry type, demand is divided into medium scale, small scale, and large scale, with medium scale holding the largest share at 36%. The demand is also segmented by end use, including for oil & gas, construction, automotive, paints & coatings, and other end uses, with oil & gas leading the demand at 30.8%. In terms of sales channel, demand is divided into sales via OEMs and sales via aftermarket. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Medium scale industrial solar water heaters account for 36% of the demand in Japan. These systems are preferred for businesses that require a balance between cost-efficiency and energy output, making them suitable for a variety of industrial applications. Medium-scale systems are highly versatile, providing a reliable and sustainable solution for industries looking to reduce energy costs and environmental impact without the need for massive investment in large-scale systems. The adaptability of medium-scale solar water heaters allows for use in sectors like construction, automotive, and oil & gas, where hot water is needed for processes such as cleaning, heating, and manufacturing. As the demand for renewable energy solutions grows across various industries, medium-scale systems are expected to remain a dominant choice due to their balance of capacity, performance, and affordability.

The oil & gas sector accounts for 30.8% of the demand for industrial solar water heaters in Japan. This sector relies on large quantities of hot water for various processes, including equipment cleaning, heating, and production-related activities. Solar water heaters provide a sustainable and cost-effective alternative to conventional energy sources, which is crucial for the oil & gas industry, given its significant energy consumption. The growing emphasis on reducing operational costs and minimizing the carbon footprint has prompted many oil & gas companies to integrate renewable energy solutions, such as solar water heaters, into their operations. The ability of solar systems to provide hot water without the need for extensive fuel consumption aligns with the industry's sustainability goals. As the oil & gas industry continues to face increasing pressure for environmentally responsible practices, the demand for industrial solar water heaters is expected to continue growing in this sector.

Key drivers include Japan’s ambitious carbon‑neutrality goals that push industrial facilities to adopt renewable thermal solutions, and the increasing electricity and fuel costs that make solar‑thermal water‑heating an attractive option for large‑scale hot‑water applications. The industrial sector’s growth in segments such as food & beverage processing, chemical, textiles and food‑service drive demand for reliable large‑scale hot‑water systems. Restraints include relatively high upfront investment for large‑capacity solar thermal installations, limited roof or land space in urban and industrial zones for solar collectors, and regulatory or permitting complexity associated with integrating solar‑thermal systems in existing industrial hot‑water infrastructure.

In Japan the demand for industrial solar water heaters is growing because industries that require process hot‑water or steam are under increasing pressure to reduce greenhouse‑gas emissions and energy costs. Solar‑thermal water heating provides a way to displace conventional fossil‑fuel or electric water‑heating systems and meet corporate sustainability targets. The availability of incentives and subsidies for solar systems, along with improving technology efficiency and better system integration, is encouraging industrial end‑users to invest in solar hot‑water solutions. As a result, more industrial plants are turning to solar water‑heating systems as part of their energy‑management strategy.

Technological innovations are advancing the adoption of industrial solar water heaters in Japan by improving collector efficiency, system integration and monitoring. Improvements include high‑performance evacuated‑tube and flat‑plate collectors capable of operating in colder climates, modular large‑scale collector arrays for industrial rooftops or ground‑mounted installations, and intelligent control systems that optimise hot‑water output, integrate with existing heating systems and manage storage tanks. Enhanced materials reduce maintenance and increase lifespan. These developments make solar‑thermal systems more viable for industrial‑scale applications, lower lifecycle costs and reduce technical risk, which supports broader adoption in Japan’s industrial sector.

Despite strong interest, adoption of industrial solar water‑heater systems in Japan faces notable challenges. One major barrier is the high capital cost for industrial‑scale solar thermal installations, including large collector fields, storage tanks and integration with existing systems. Another challenge is space constraints: many industrial plants in Japan are located in urban or dense manufacturing zones with limited roof or land area suitable for solar collectors. Also, retrofitting solar‑thermal systems into existing process heating systems can be complex and disruptive, requiring downtime, engineering changes and coordination with multiple stakeholders. These factors slow wider uptake in some industrial segments.

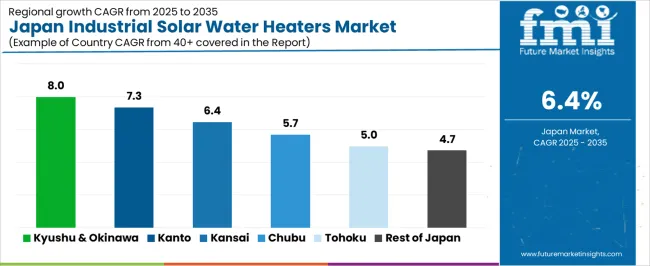

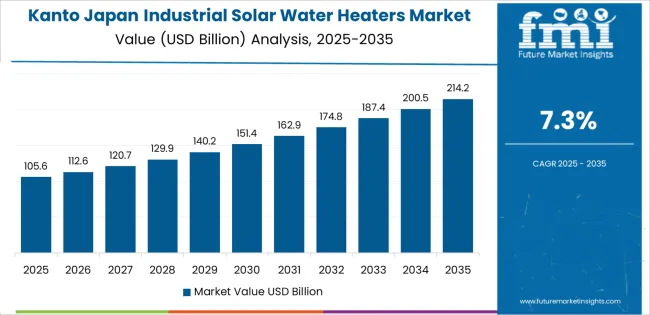

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.0 |

| Kanto | 7.3 |

| Kinki | 6.4 |

| Chubu | 5.7 |

| Tohoku | 5.0 |

| Rest of Japan | 4.7 |

Demand for industrial solar water heaters in Japan is increasing across all regions, with Kyushu & Okinawa leading at an 8.0% CAGR. Kanto follows with a 7.3% CAGR, fueled by strong urban development and a growing focus on sustainable energy in cities like Tokyo and Yokohama. Kinki shows a 6.4% CAGR, supported by the region’s industrial base and emphasis on reducing energy consumption in commercial and manufacturing sectors. Chubu experiences a 5.7% CAGR, with increasing investments in energy-efficient solutions within its manufacturing industries. Tohoku shows a 5.0% CAGR, driven by regional sustainability initiatives and industrial energy needs. The Rest of Japan shows the lowest growth at 4.7%.

Kyushu & Okinawa are experiencing the highest demand for industrial solar water heaters in Japan, with an 8.0% CAGR. This growth is largely driven by the region’s commitment to renewable energy adoption and reducing carbon footprints. Kyushu, in particular, has a strong focus on green energy, with local governments and industries investing in sustainable technologies like solar water heaters to meet energy needs more efficiently. As industries in Kyushu, including tourism and manufacturing, increasingly look for energy-efficient solutions, industrial solar water heaters provide an ideal option. The region's abundant sunlight, combined with a rising demand for eco-friendly energy solutions, further contributes to this trend. The government’s initiatives and incentives for renewable energy adoption continue to support the growth of industrial solar water heaters in Kyushu & Okinawa.

Kanto is experiencing steady demand for industrial solar water heaters in Japan, with a 7.3% CAGR. This growth is primarily fueled by the region's large industrial base, including major cities like Tokyo and Yokohama, where there is a significant push towards sustainability and energy efficiency. Kanto’s commercial and manufacturing sectors are increasingly adopting renewable energy solutions, including solar water heaters, to meet their energy needs while reducing operational costs. The region’s dense population and industrial infrastructure drive high demand for energy-efficient solutions that align with environmental goals. The Japanese government’s incentives for renewable energy adoption in urban areas further support the demand for solar water heaters. As Kanto continues to prioritize eco-friendly and cost-effective energy solutions, industrial solar water heaters are becoming a critical part of the region’s transition to more sustainable energy practices. The growing awareness of environmental responsibility is expected to sustain this trend in the coming years.

Kinki is seeing moderate demand for industrial solar water heaters in Japan, with a 6.4% CAGR. This growth is driven by the region’s strong industrial sector, particularly in manufacturing and commercial operations in cities like Osaka and Kyoto. With increasing focus on reducing energy consumption and carbon emissions, businesses in Kinki are increasingly turning to renewable energy technologies such as solar water heaters. The region’s industries, including food processing, textiles, and chemicals, require efficient, cost-effective heating solutions, and solar water heaters offer a viable alternative to traditional energy sources. The adoption of solar water heaters is also supported by regional sustainability goals and the Japanese government’s push for green energy adoption. As businesses seek to improve energy efficiency while meeting environmental standards, the demand for industrial solar water heaters in Kinki is expected to grow steadily, particularly as more industries implement energy-saving technologies in their operations.

Chubu is experiencing steady demand for industrial solar water heaters in Japan, with a 5.7% CAGR. The region’s strong automotive and manufacturing industries, especially in Nagoya, drive the demand for energy-efficient solutions like solar water heaters. As manufacturing operations become more energy-intensive, companies in Chubu are increasingly adopting renewable energy technologies to improve efficiency and reduce energy costs. Solar water heaters are particularly appealing for industrial applications such as process heating in factories and hot water supply for commercial buildings. Chubu's commitment to sustainable energy practices and the government's support for renewable energy adoption are fueling the demand for these systems. As the region continues to prioritize environmental sustainability and energy efficiency, the demand for industrial solar water heaters is expected to remain strong. Investments in cleaner, renewable technologies across Chubu’s diverse industrial sectors will continue to drive the growth of these energy solutions.

Tohoku is seeing moderate demand for industrial solar water heaters in Japan, with a 5.0% CAGR. The region’s focus on sustainability and energy-efficient solutions, particularly in industries such as agriculture and food processing, is driving this growth. Tohoku has increasingly adopted renewable energy technologies to support industrial operations while reducing environmental impact. Solar water heaters are gaining traction in the region due to their efficiency and ability to lower operational costs in energy-intensive industries. Tohoku’s emphasis on environmental responsibility and government incentives for renewable energy adoption take contributed to this trend. With many industries in Tohoku focusing on reducing their carbon footprints and improving sustainability, the demand for solar water heaters is expected to continue to grow. As industrial sectors increasingly seek energy-efficient solutions, Tohoku is poised to see further adoption of solar water heaters to meet their energy needs while supporting Japan’s transition to a greener economy.

The Rest of Japan is experiencing the lowest demand for industrial solar water heaters, with a 4.7% CAGR. While this region does not have the same level of industrial concentration as major hubs like Kanto or Kyushu, it still sees steady adoption of renewable energy technologies. Smaller industries and businesses across the Rest of Japan are increasingly adopting solar water heaters to reduce energy consumption and lower operational costs. This trend is particularly noticeable in regional agricultural and manufacturing sectors, where process heating and hot water are essential for operations. As energy efficiency becomes a priority for all industries, even in less urbanized areas, demand for industrial solar water heaters is expected to grow, albeit at a slower pace than in other regions.

In Japan, the demand for industrial solar water heaters is driven by the push toward energy efficiency in manufacturing, institutional facilities (such as hospitals and schools), and process-heat applications. These systems combine solar thermal collectors with storage tanks and heat-transfer systems to provide hot water or pre-heated fluids to industrial and commercial users. As Japan works to lower dependence on fossil fuels and upgrade plant infrastructure, the uptake of industrial-scale solar water heaters is gaining traction.

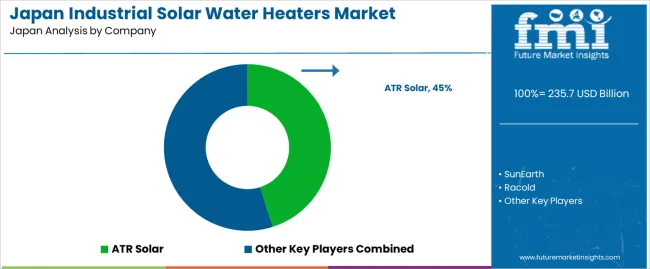

Key suppliers in this space include ATR Solar with a 45.1% share, SunEarth, Racold, Heliodyne, Inc., and Alternate Energy Technologies LLC. These players differentiate by offering high-capacity collector arrays, custom design for large-scale installations, integration with building management systems, maintenance and service networks, and materials engineered for Japan’s climate and quality standards. ATR Solar’s strong position reflects its large project experience, ability to meet specifications for industrial end-users, and established presence in the region.

Competitive dynamics are shaped by a few major forces. One driver is demand from industrial and commercial users for systems that reduce energy costs, improve thermal efficiency, and align with Japan’s decarbonization initiatives. A second driver is the need for technology innovation-such as higher-efficiency collectors, better control systems, and seamless integration into existing plant infrastructure. Restraints include high upfront investment costs, the complexity of retrofitting existing sites, long pay-back periods, and competition from alternative heating technologies (such as heat pumps or electric boilers). Companies that can offer engineered turnkey solutions, reliable performance, strong local service, and cost-effective installation are best positioned to succeed in the Japan industrial solar water heater segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Industry Type | Medium Scale, Small Scale, Large Scale |

| Sales Channel | Sales via OEMs, Sales via Aftermarket |

| End Use | For Oil & Gas, For Construction, For Automotive, For Paints & Coatings, For Other End Uses |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | ATR Solar, SunEarth, Racold, Heliodyne, Inc., Alternate Energy Technologies LLC |

| Additional Attributes | Dollar sales by industry type and end use; regional CAGR and adoption trends; demand trends in industrial solar water heaters; growth in oil & gas, construction, automotive, and other sectors; technology adoption for renewable energy; vendor offerings including hardware, installation services, and integration solutions; regulatory influences and industry standards |

The demand for industrial solar water heaters in japan is estimated to be valued at USD 235.7 billion in 2025.

The market size for the industrial solar water heaters in japan is projected to reach USD 437.3 billion by 2035.

The demand for industrial solar water heaters in japan is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in industrial solar water heaters in japan are medium scale, small scale and large scale.

In terms of sales channel, sales via oems segment is expected to command 48.7% share in the industrial solar water heaters in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Japan Sea Water Pumps Market Report – Trends & Innovations 2025-2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Analysis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Cooling System Market Growth – Trends & Forecast 2025-2035

Industrial Wastewater Treatment Chemical Market Insights - Growth & Demand 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Japan Industrial Drum Market Insights – Growth & Forecast 2023-2033

Demand for Water Ionizer in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Testing Kit in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Soluble Fertilizers in Japan Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA