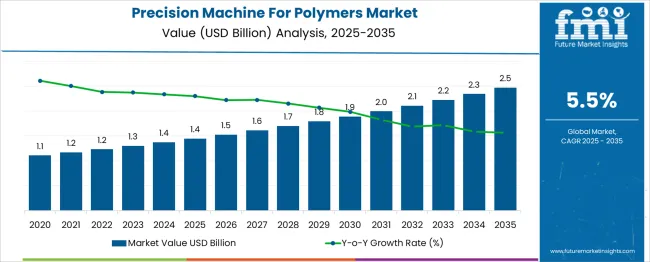

The Precision Machine For Polymers Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. When examining Total Cost of Ownership (TCO), it becomes evident that the overall investment extends beyond the initial procurement cost of precision polymer machinery. Key cost components include equipment acquisition, installation, calibration, maintenance, energy consumption, and operational labor over the machine’s lifecycle. Given the incremental annual market growth, organizations are likely to face steadily increasing capital outlays alongside predictable operational expenditures. Maintenance and consumables represent a significant portion of TCO, with polymer processing components, molds, and tooling requiring periodic replacement or recalibration.

Energy efficiency improvements in newer machines reduce ongoing electricity costs, but initial purchase prices remain higher compared with conventional equipment. By 2035, as the market reaches USD 2.5 billion, a larger share of expenditures is expected to shift toward service contracts, software upgrades, and predictive maintenance technologies. Organizations adopting advanced precision machines will experience lower downtime and higher output consistency, which partially offsets the rising TCO. The TCO perspective highlights that while the 5.5% CAGR indicates moderate market expansion, prudent investment decisions must account for lifecycle costs. The balance between upfront capital, maintenance, and operational efficiencies will determine the economic viability of precision polymer machinery across industrial settings.

| Metric | Value |

|---|---|

| Precision Machine For Polymers Market Estimated Value in (2025 E) | USD 1.4 billion |

| Precision Machine For Polymers Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Precision Machine for Polymers market is gaining significant momentum due to the rising demand for high-performance plastics in critical applications across aerospace, medical devices, electronics, and automotive industries. As polymers increasingly replace metals and traditional materials in precision components, manufacturers are investing in specialized machinery that can achieve micro-level tolerances and surface finish requirements. The need for customization, tighter quality control, and high-speed throughput has driven innovation in precision machining technologies.

The market is also benefiting from the growing integration of smart sensors and CNC systems, which enhance accuracy and reduce production variability. Demand is further supported by the increasing use of thermoplastics and high-performance polymers in load-bearing and chemically resistant components.

As industries shift toward lightweight, corrosion-resistant, and biocompatible materials, the precision machine for polymers market is expected to expand steadily. The transition to Industry 4.0 practices and automation within polymer processing facilities is poised to accelerate market growth in the coming years further..

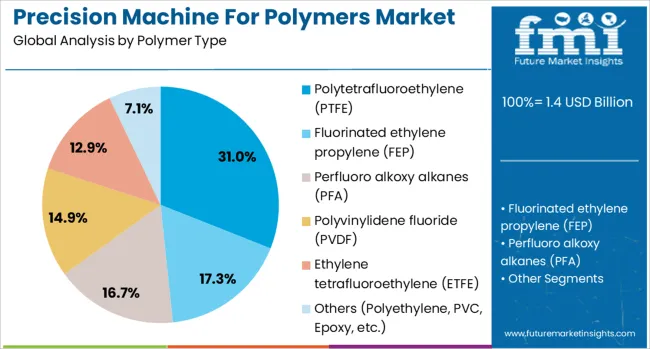

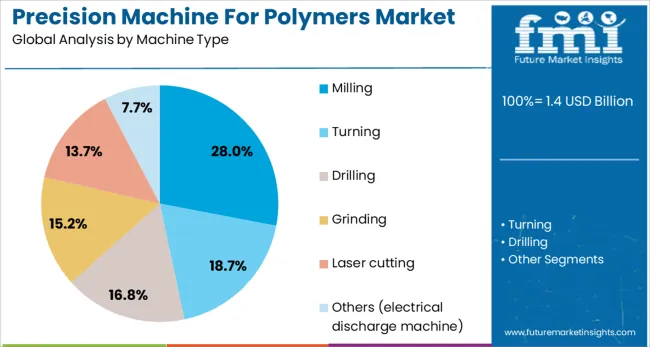

The precision machine for polymers market is segmented by polymer type, machine type, operations, application, end-use, distribution channel, and geographic regions. The precision machine for polymers market is divided into Polytetrafluoroethylene (PTFE), Fluorinated ethylene propylene (FEP), Perfluoro alkoxy alkanes (PFA), Polyvinylidene fluoride (PVDF), Ethylene tetrafluoroethylene (ETFE), and Others (Polyethylene, PVC, Epoxy, etc.). In terms of machine type, the precision machine for the polymers market is classified into Milling, Turning, Drilling, Grinding, Laser cutting, and others (electrical discharge machine).

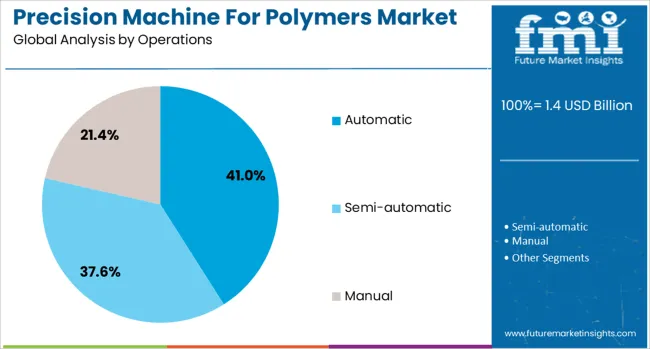

The precision machine for the polymers market is segmented into Automatic, Semi-automatic, and Manual. The application of the precision machine for the polymers market is segmented into Equipment & components, Coatings & finishes, Electrical insulation, Additives, and others. The end-use of the precision machine for the polymers market is segmented into Medical, Automotive, Aerospace, and Others (consumer goods). The distribution channel of the precision machine for the polymers market is segmented into direct and indirect. Regionally, the precision machine for the polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polytetrafluoroethylene (PTFE) polymer type segment is projected to hold 31% of the Precision Machine for Polymers market revenue share in 2025, making it the most dominant polymer material. This growth has been attributed to PTFE's unique combination of thermal stability, chemical inertness, and low coefficient of friction, which makes it ideal for machining into high-precision parts. It has been observed that industries requiring non-reactive and non-stick properties, such as pharmaceuticals, semiconductors, and aerospace, increasingly specify PTFE for critical components.

Its machinability with specialized equipment allows for intricate shaping without compromising structural integrity. Additionally, the demand for FDA-compliant and biocompatible materials in medical devices has reinforced PTFE’s leading role in the polymer machining space.

The segment’s dominance has also been supported by its widespread availability and its compatibility with CNC-based precision equipment, which ensures consistent results at scale. As more industries prioritize durability and chemical resistance in mission-critical applications, PTFE continues to be selected for high-performance machining operations..

The milling machine type segment is expected to account for 28% of the Precision Machine for Polymers market revenue share in 2025, making it the leading machine type. Milling machines have been widely adopted for their capability to perform complex geometrical shaping, fine detailing, and surface finishing across a range of polymer materials. The ability of milling equipment to handle rigid and semi-rigid polymers with high dimensional accuracy has made it a core technology in both prototyping and large-scale production environments.

Enhanced with multi-axis configurations and automated tool paths, milling machines are increasingly capable of producing intricate features without compromising tolerance thresholds. These systems also support a variety of cutting speeds and feed rates tailored to polymer characteristics, minimizing thermal distortion and ensuring clean cuts.

The integration of precision milling machines into smart manufacturing lines has further increased their appeal across sectors that demand both flexibility and repeatability. The segment's leadership position reflects its technical versatility and its pivotal role in machining high-precision polymer parts..

The automatic operations segment is projected to dominate the Precision Machine for Polymers market with a 41% revenue share in 2025. The segment’s leading position has been driven by the increasing emphasis on process consistency, reduced cycle times, and labor cost optimization in polymer machining environments. Automatic machines have been preferred for their ability to deliver repeatable accuracy, especially in high-volume production settings where variability must be minimized.

These systems are often integrated with computerized controls, real-time monitoring, and sensor-based feedback loops that allow for adaptive machining and in-process adjustments. The transition to automated operations has also been motivated by the need for tighter quality standards in industries such as medical devices and electronics, where even minimal deviations can compromise product integrity.

As manufacturers continue to pursue lean production strategies and digital transformation, the use of automatic precision machines for polymers is expected to accelerate further. The segment's growth reflects a broader industry trend toward operational efficiency and intelligent manufacturing practices..

The market has expanded due to the growing need for high-accuracy manufacturing in industries such as automotive, medical devices, electronics, and packaging. Advanced polymer processing technologies have enabled the production of intricate components with consistent quality and tight tolerances. Rising demand for lightweight materials, combined with advancements in polymer science, has increased the adoption of precision machinery. Automation, CNC integration, and digital monitoring systems have further improved operational efficiency. Global manufacturing competitiveness has driven investment in state-of-the-art polymer machining solutions.

The increasing use of engineering polymers in applications requiring high mechanical strength, chemical resistance, and thermal stability has driven the demand for precision polymer machining. Industries such as aerospace, medical devices, and electronics have relied on polymer components that meet strict dimensional and performance requirements. Precision machines have been instrumental in producing these parts with minimal defects, ensuring compliance with regulatory and safety standards. The ability to machine complex geometries without compromising material integrity has expanded the scope of polymer applications. High-precision CNC and automated systems have enabled manufacturers to meet large-volume production demands while maintaining consistent quality. The trend toward miniaturization in electronics and medical devices has further emphasized the need for advanced polymer machining capabilities. As industries pursue lightweight and durable alternatives to metal, precision machining for polymers is expected to remain a critical manufacturing solution.

Automation and CNC integration have significantly improved the efficiency and repeatability of polymer machining processes. Modern precision machines are equipped with real-time monitoring systems, adaptive controls, and automated tool changers that optimize cutting parameters for various polymer types. This integration has reduced human error, minimized waste, and improved throughput in high-volume production environments. Multi-axis CNC capabilities have enabled the machining of complex polymer components with intricate features in a single setup, reducing production time and costs. The incorporation of robotics in part handling and quality inspection has further streamlined operations. The data-driven analytics from connected machinery have provided valuable insights into process optimization. These advancements have supported the shift toward Industry 4.0 manufacturing, enabling polymer machining facilities to meet the demands of global markets while maintaining competitive pricing and exceptional product consistency.

The medical and healthcare industries have increasingly adopted precision-machined polymer components for devices such as surgical instruments, diagnostic equipment, and implantable devices. The biocompatibility, lightweight nature, and sterilization compatibility of certain polymers have made them preferred materials for many medical applications. Precision machining ensures that these components meet stringent regulatory and dimensional requirements, which is critical for patient safety and device reliability. Advanced polymer processing equipment has enabled the creation of micro-scale parts used in minimally invasive surgical tools and diagnostic devices. The growing demand for custom medical devices and patient-specific solutions has further increased the reliance on high-precision polymer machining. With ongoing innovation in medical technology and the adoption of additive manufacturing alongside traditional machining, the healthcare sector is expected to remain a significant driver for the precision machine for polymers market.

Global manufacturing trends have placed a strong emphasis on lightweight and environmentally responsible production, leading to increased use of advanced polymers as metal alternatives. Precision polymer machining has been essential in producing components that reduce overall product weight while maintaining structural integrity. This has been particularly valuable in sectors such as automotive, aerospace, and renewable energy, where weight reduction contributes to improved energy efficiency. Furthermore, advancements in sustainable and recyclable polymer materials have supported eco-friendly manufacturing practices. Precision machines designed for these materials have optimized cutting speeds, tooling configurations, and cooling systems to minimize waste. The shift toward sustainable manufacturing has also driven demand for equipment with energy-efficient designs and low maintenance requirements. As regulatory pressures for sustainable production increase, precision machines for polymers are expected to play an even greater role in supporting environmentally conscious manufacturing goals.

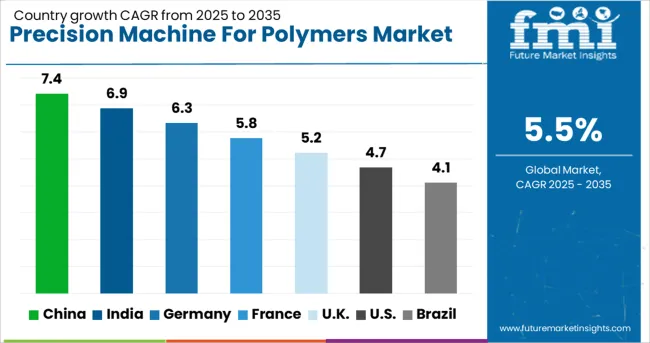

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035, influenced by increasing demand for high-accuracy polymer processing in automotive, electronics, and medical sectors. China is expected to lead with a 7.4% CAGR, driven by large-scale manufacturing capacity and technological upgrades in polymer machining. India follows at 6.9%, supported by the growth of plastics manufacturing and investments in advanced processing equipment. Germany, at 6.3%, benefits from engineering expertise and adoption of automated production systems. The UK, with a 5.2% CAGR, shows steady expansion due to specialized polymer component manufacturing. The USA, at 4.7%, maintains growth through innovation in medical-grade and aerospace polymer machining. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to witness a CAGR of 7.4% over the forecast timeline, with steady expansion across multiple manufacturing sectors. Increased demand for high-precision polymer components in automotive, electronics, and packaging industries is strengthening market performance. The rising focus on lightweight and durable materials is boosting the adoption of advanced machining technologies. Domestic manufacturers are investing in CNC and automated production systems to improve efficiency and reduce defect rates. Supportive industrial policies and a growing export base for finished polymer products are further fuelling the market momentum.

India is expected to expand at an annual growth rate of 6.9%, driven by rising demand for precision polymer components in packaging, medical devices, and electrical applications. Industrial clusters are adopting advanced processing machinery to meet stringent quality requirements in domestic and export markets. Investments in automation and quality control systems are enhancing production capabilities. The expansion of polymer-based product manufacturing for global clients is encouraging machinery upgrades. Favorable trade policies and incentives for industrial modernization are contributing to steady market growth.

Germany’s market is forecast to grow at a CAGR of 6.3%, supported by strong manufacturing capabilities in high-value sectors. Precision polymer machining is gaining traction in aerospace, automotive, and industrial equipment production. The integration of multi-axis machining centers is enhancing design flexibility and production accuracy. High emphasis on durability and dimensional stability is leading to adoption of advanced quality assurance technologies. Continued R&D investments and collaboration between machinery suppliers and polymer producers are likely to strengthen the market position in coming years.

The United Kingdom is anticipated to post a CAGR of 5.2%, with steady demand from medical, electronics, and packaging sectors. Manufacturers are upgrading to high-speed, multi-function machining systems to meet specialized requirements. The growing emphasis on producing intricate polymer parts with tight tolerances is increasing the use of automated inspection tools. Industry collaboration for skill development and process optimization is further enhancing productivity. Despite higher operational costs, domestic firms are focusing on value-added production for niche markets, ensuring competitive positioning.

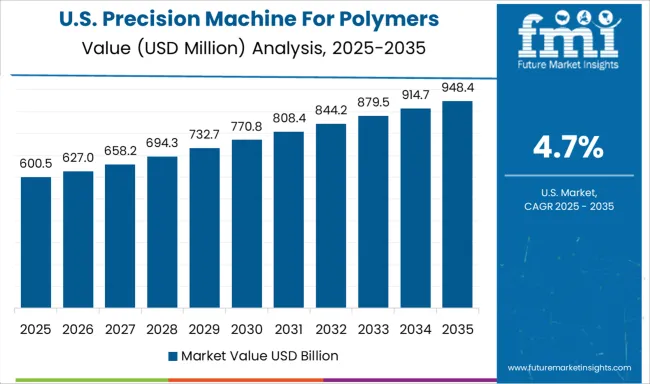

The United States is projected to record a CAGR of 4.7%, influenced by the rising need for high-performance polymer components in aerospace, defense, and electronics industries. The push for lightweight, durable materials is prompting greater adoption of CNC-based polymer machining systems. Manufacturers are increasingly integrating robotics for improved throughput and consistency. Strong demand for custom-engineered polymer products in medical and industrial sectors is further propelling investments in precision equipment. Technological advancements in tooling and software are enhancing production speed without compromising accuracy.

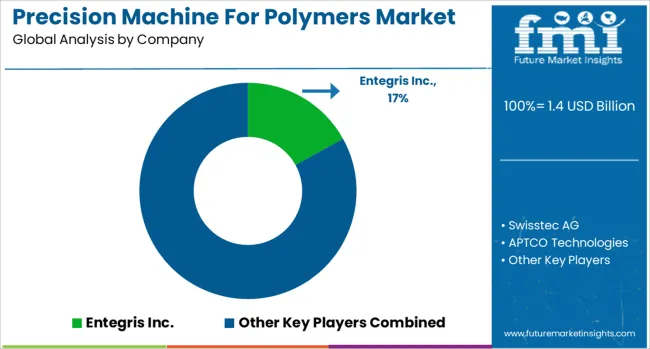

The market is supported by specialized manufacturers delivering equipment for high-accuracy processing of advanced plastic materials. Entegris Inc. holds a prominent position with its expertise in contamination control and precision polymer handling systems for semiconductor and life sciences applications. Swisstec AG is recognized for engineering high-performance machinery that supports intricate polymer shaping and finishing processes. APTCO Technologies contributes with solutions tailored for custom polymer processing, enabling tight tolerances and consistent quality. Mitsubishi Chemical Advanced Materials brings integrated capabilities, combining material science expertise with advanced machining solutions to meet stringent industry standards.

Saint-Gobain Performance Plastics leverages its broad polymer product portfolio to develop precision machining systems optimized for durability and efficiency. Other regional and niche players in this market deliver customized machines to cater to sectors such as medical devices, aerospace, electronics, and high-performance industrial components. The growing need for precision-machined polymer components in high-tech applications is driving advancements in multi-axis machining, automated measurement systems, and adaptive manufacturing controls. This trend is also increasing the adoption of CNC-based polymer machining centers capable of delivering micron-level accuracy, particularly for industries requiring lightweight, chemically resistant, and thermally stable materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Polymer Type | Polytetrafluoroethylene (PTFE), Fluorinated ethylene propylene (FEP), Perfluoro alkoxy alkanes (PFA), Polyvinylidene fluoride (PVDF), Ethylene tetrafluoroethylene (ETFE), and Others (Polyethylene, PVC, Epoxy, etc.) |

| Machine Type | Milling, Turning, Drilling, Grinding, Laser cutting, and Others (electrical discharge machine) |

| Operations | Automatic, Semi-automatic, and Manual |

| Application | Equipment & components, Coatings & finishes, Electrical insulation, Additives, and Others |

| End-use | Medical, Automotive, Aerospace, and Others (consumer goods) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Entegris Inc., Swisstec AG, APTCO Technologies, Mitsubishi Chemical Advanced Materials, Saint-Gobain Performance Plastics, and Others |

| Additional Attributes | Dollar sales by machine type and application segment, demand dynamics across automotive components, medical devices, and consumer goods manufacturing, regional trends in adoption across Asia-Pacific, Europe, and North America, innovation in CNC precision controls, multi-axis machining, and additive manufacturing integration, environmental impact of material efficiency, polymer recycling, and reduced energy consumption, and emerging use cases in high-performance engineering plastics, lightweight composite fabrication, and customized prototype development. |

The global precision machine for polymers market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the precision machine for polymers market is projected to reach USD 2.5 billion by 2035.

The precision machine for polymers market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in precision machine for polymers market are polytetrafluoroethylene (ptfe), fluorinated ethylene propylene (fep), perfluoro alkoxy alkanes (pfa), polyvinylidene fluoride (pvdf), ethylene tetrafluoroethylene (etfe) and others (polyethylene, pvc, epoxy, etc.).

In terms of machine type, milling segment to command 28.0% share in the precision machine for polymers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Walform Machine Market

Perforation Machine Market Analysis by Automation Grade, Machine Type, Application, and Region through 2035

Market Positioning & Share in the Form Fill Seal Machine Industry

Form Fill Seal Machine Market Analysis by Semi-automatic and Automatic Through 2034

Tray Former Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tray Former Machines Manufacturers

Demand for Machine Safety in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Precision Cancer Imaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Precision Cancer Imaging in Japan Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Industry Share & Competitive Positioning in Roll Forming Machines

Roll Forming Machine Market by Type from 2024 to 2034

PET Preform Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Forming Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA