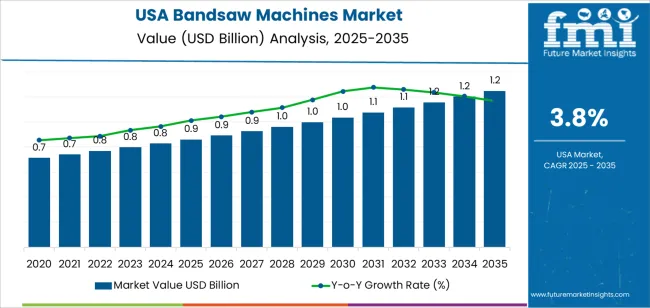

The demand for bandsaw machines in the USA is valued at USD 0.9 billion in 2025 and is projected to reach USD 1.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.8%. This growth is driven by steady advancements in industries requiring precise cutting and shaping, such as metalworking, woodworking, and construction. Additionally, as manufacturing technologies continue to evolve, the demand for more efficient, automated cutting solutions grows. The market will likely see gradual increases in adoption due to both technological innovations in bandsaw machines and rising demand from various industrial sectors. The total absolute growth over the 10-year period is USD 0.3 billion, indicating consistent but modest market expansion.

Throughout the forecast period, demand is expected to grow incrementally, with market values increasing steadily year-on-year. Starting at USD 0.9 billion in 2025, the value rises to USD 1.0 billion in subsequent years and reaches USD 1.1 billion by 2030. The demand is projected to plateau slightly after 2030, with steady increases bringing the market to USD 1.2 billion by 2035. Despite the modest growth, the market will benefit from ongoing developments in automation and precision cutting technologies. Bandsaw machines are expected to remain a crucial tool in manufacturing processes due to their versatility and continued demand from diverse sectors requiring reliable cutting solutions.

Demand in USA for bandsaw machines is projected to grow from USD 0.9 billion in 2025 to USD 1.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.8%. Starting at USD 0.7 billion in 2020, demand rises gradually and steadily through USD 0.8 billion (2023 2024), reaches USD 0.9 billion in 2025, and continues upward, attaining USD 1.0 billion by 2030 and ultimately USD 1.2 billion in 2035. The rising value over time reflects increased usage of bandsaw machines in metalworking, woodworking and general manufacturing applications.

Growth during this period is driven by several factors. First, manufacturing and fabrication sectors in USA are increasingly investing in precision cutting machinery for both ferrous and non ferrous materials. Second, automation and digital control features are becoming standard in newer bandsaw models, which supports higher pricing and enlarges the types of applications served. Third, demand for equipment that can handle complex materials, tougher alloys and high volume cutting is growing, giving bandsaw machine suppliers an opportunity to upgrade offerings and drive incremental value.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.9 billion |

| Forecast Value (2035) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The demand for bandsaw machines in USA is primarily driven by the growth of industries such as metalworking, automotive, aerospace, and woodworking, all of which require efficient cutting solutions. Bandsaw machines are highly valued for their ability to cut through various materials such as steel, aluminium, and composite materials. Technological advancements in automation, CNC control, blade technology, and digital monitoring systems have enhanced the precision and efficiency of modern bandsaw machines, driving demand among manufacturers looking for improved productivity and reduced material waste.

The increasing trend of reshoring manufacturing and investments in infrastructure also contribute to higher demand for bandsaw machines as companies expand or upgrade their production facilities within USA. Additionally, bandsaw machines are being increasingly used in diverse industries, including plastics and composite materials processing, further broadening their application base.

Despite these advantages, challenges such as raw material price fluctuations for steel and motors, which raise machine production costs, make newer models more attractive compared to older, maintenance-heavy equipment. The need for skilled operators and the higher initial investment required for advanced automation systems can also present barriers, particularly for smaller enterprises. However, these factors are encouraging businesses to invest in newer, more efficient models, sustaining the growth of bandsaw machines in USA's industrial equipment sector.

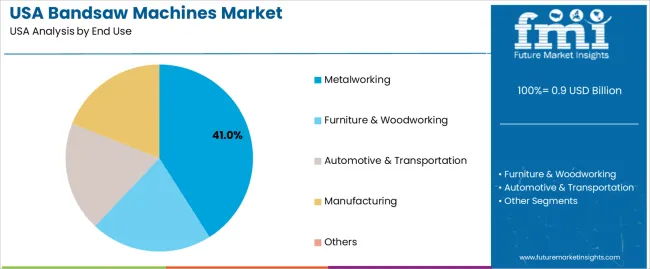

The demand for bandsaw machines in the USA is driven by both the end-use industries and the motor power capabilities of the machines. The end-use industries include metalworking, furniture & woodworking, automotive & transportation, and manufacturing, each with specific requirements for cutting precision and material handling. Motor power is categorized into light duty, medium duty, and heavy duty, which impacts the machine's cutting capacity and suitability for various applications. These segments reflect the growing demand for efficient and powerful cutting solutions across different sectors.

Metalworking represents 41% of the total demand for bandsaw machines in the USA, making it the dominant end-use industry. This demand is driven by the need for precision cutting, shaping, and profiling of metal materials used in manufacturing. Metalworking applications require robust, high-performance bandsaw machines that can handle tough materials such as steel, aluminum, and titanium. The metalworking industry relies heavily on these machines for tasks like structural steel fabrication, machining, and aerospace production, making them essential for a wide range of industrial operations.

The growth in metalworking is fueled by the expansion of industries such as construction, aerospace, and defense, where cutting and machining precision are critical. The increasing demand for high-quality metal parts and components has led to greater adoption of advanced bandsaw machines capable of delivering accuracy, speed, and efficiency. As manufacturing processes evolve and demand for metal components grows, the demand for bandsaw machines in the metalworking sector is expected to continue rising, supported by technological advancements in cutting systems.

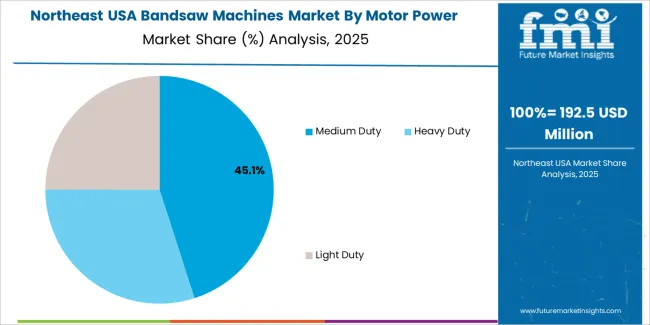

Medium duty motor power accounts for 45.0% of the total demand for bandsaw machines in the USA. This motor power category is ideal for general-purpose applications, offering a balance between cutting power and energy efficiency. Medium-duty bandsaw machines are commonly used in industries such as metalworking, automotive, and furniture & woodworking, where precision cutting is required but not at the extreme levels that heavy-duty machines provide. These machines are versatile and capable of handling a wide range of materials, from softwoods and plastics to metals like aluminum and mild steel.

The demand for medium-duty motor power is driven by the growing need for machines that can handle moderate cutting tasks efficiently without incurring the high costs associated with heavy-duty machines. Industries focused on mass production and prototyping benefit from the affordability, versatility, and performance of medium-duty bandsaw machines. As manufacturers seek cost-effective solutions that maintain high operational standards, the medium-duty category remains a leading choice, offering the right balance of power, precision, and affordability.

Demand for bandsaw machines in the USA is largely driven by the expansion of industries like metal fabrication, aerospace, and automotive, where precise cutting is essential. The transition to automated and CNC-controlled bandsaws is gaining ground, as these machines provide improved efficiency, accuracy, and material savings. However, challenges such as high initial costs and varying demand across smaller operations affect the market’s overall growth. Understanding how these elements interact is vital for anticipating trends in bandsaw machine adoption in the USA.

Automation is significantly shaping the landscape for bandsaw machines in the USA. The integration of CNC controls and automated feed systems is driving demand for advanced bandsaws. These systems offer increased cutting precision, higher throughput, and reduced human error, which are particularly beneficial in industries like aerospace, where tight tolerances and complex alloys require high-performance tools. As industries adopt more automated solutions to enhance operational efficiency, the demand for these advanced bandsaw machines continues to rise.

The growing need for metal-cutting operations across various manufacturing sectors, including automotive, construction, and heavy machinery, is fueling demand for bandsaw machines in the USA. These industries require versatile cutting equipment to handle materials such as steel, aluminum, and titanium, which bandsaw machines are well-suited for. Their ability to provide precise cuts while being cost-effective positions them as an essential tool in the production process, leading to greater investment in bandsaws throughout US manufacturing facilities.

A key challenge limiting broader adoption of bandsaw machines in the USA is the significant capital investment required for high-performance models. Advanced CNC-controlled machines come with substantial upfront costs, along with ongoing maintenance and operational expenses. Smaller workshops or businesses with tighter budgets may find these machines less accessible. As a result, the higher financial commitment may delay investment in bandsaw machines for some potential users, restricting the market’s growth in certain segments.

| Region | CAGR (%) |

|---|---|

| West | 4.4% |

| South | 3.9% |

| Northeast | 3.5% |

| Midwest | 3.0% |

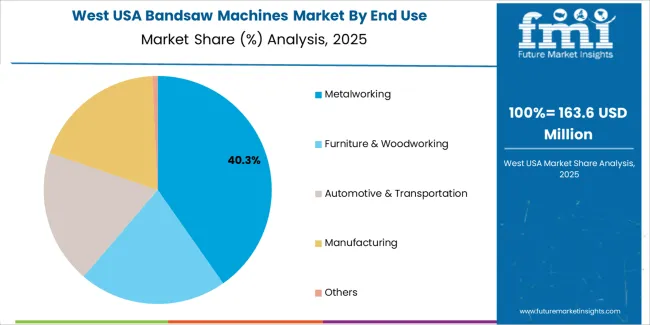

The demand for bandsaw machines in the USA is growing steadily across regions. The West leads with a 4.4% CAGR, driven by the region's strong manufacturing sector, technological advancements, and demand for precision cutting in industries like aerospace and automotive. The South follows closely with a 3.9% growth, supported by a growing number of production facilities and increasing investments in machinery. The Northeast, growing at 3.5%, benefits from its established industrial base, particularly in metalworking and manufacturing. The Midwest, with a 3.0% CAGR, shows consistent demand driven by its legacy as a manufacturing hub, where bandsaw machines are widely used in various production processes.

The West region of the USA is projected to grow at a CAGR of 4.4% through 2035 in demand for bandsaw machines. The region’s diverse manufacturing base, particularly in industries like aerospace, automotive, and construction, drives the need for high-precision cutting tools. States like California and Washington, with their established manufacturing sectors, play a significant role in this demand. Additionally, the West’s strong focus on technological innovation, coupled with increased investments in automated manufacturing systems, further supports the demand for advanced bandsaw machines in various production processes.

The South region of the USA is projected to grow at a CAGR of 3.9% through 2035 in demand for bandsaw machines. The region’s strong industrial base, especially in manufacturing, metalworking, and construction, drives the need for efficient cutting solutions. States like Texas and Florida are home to many manufacturers requiring high-quality cutting tools for various materials. The growing focus on infrastructure development, particularly in construction and energy sectors, further fuels the demand for bandsaw machines. Additionally, the rise in automation technologies in industrial settings increases the use of precision cutting tools.

The Northeast region of the USA is projected to grow at a CAGR of 3.5% through 2035 in demand for bandsaw machines. The region’s strong presence of automotive, machinery, and metalworking industries contributes to steady demand for advanced cutting tools. States like New York and Pennsylvania, with their focus on industrial production and manufacturing, support the adoption of bandsaw machines for precision cutting. As the region’s manufacturing industry embraces more automated and efficient processes, the demand for high-performance, versatile cutting tools such as bandsaw machines continues to grow.

The Midwest region of the USA is projected to grow at a CAGR of 3% through 2035 in demand for bandsaw machines. With its rich industrial history, particularly in automotive, manufacturing, and metalworking, the Midwest remains a significant market for cutting solutions. States like Michigan and Ohio continue to play a central role in this demand due to their strong manufacturing sectors. The increased adoption of automation technologies and the need for higher precision in cutting applications further drive the demand for advanced bandsaw machines.

The demand for bandsaw machines in the USA is being propelled by heightened activity in the metalworking, woodworking and automotive sectors. Industrial firms increasingly require efficient machines that can cut high strength alloys, structural components and complex profiles with precision and minimal waste. Automation and Industry 4.0 integration further support adoption, as CNC controlled and smart bandsaws reduce labour and increase throughput. Infrastructure investment, manufacturing reshoring and the shift to lightweight materials in transportation also contribute to the need for advanced cutting tools.

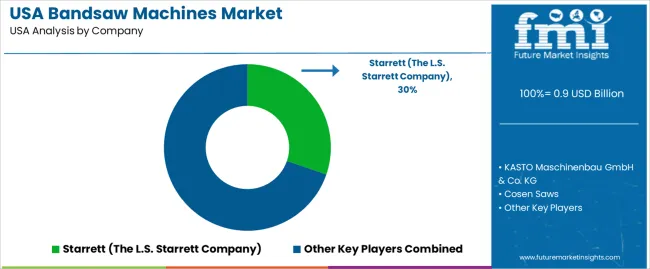

Leading companies in this segment include The L.S. Starrett Company, KASTO Maschinenbau GmbH & Co. KG, Cosen Saws, HE&M Saw and ITL Industries Ltd.. These manufacturers provide a wide array of horizontal, vertical and automated bandsaw solutions tailored to diverse industrial applications. Their portfolios address the growing demand in North America by offering machines capable of handling tougher materials and delivering higher accuracy. Innovation in blade technology, cutting automation and productivity enhancing features remain key competitive differentiators.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Metalworking, Furniture & Woodworking, Automotive & Transportation, Manufacturing, Others |

| Motor Power | Medium Duty, Heavy Duty, Light Duty |

| Orientation | Horizontal, Vertical |

| Cutting Range | Up to 200 mm, 201 to 300 mm, 301 to 400 mm, Above 400 mm |

| Operation | Manual, Automated |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Starrett (The L.S. Starrett Company), KASTO Maschinenbau GmbH & Co. KG, Cosen Saws, HE&M Saw, ITL Industries Ltd. |

| Additional Attributes | Dollar by sales across end-use industries, motor power types, orientation, and cutting ranges; technological innovations in automation and precision cutting; regulatory influences on material handling; trends in manufacturing automation and Industry 4.0 integration. |

The global demand for bandsaw machines in USA is estimated to be valued at USD 0.9 billion in 2025.

The market size for the demand for bandsaw machines in USA is projected to reach USD 1.2 billion by 2035.

The demand for bandsaw machines in USA is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in demand for bandsaw machines in USA are metalworking, furniture & woodworking, automotive & transportation, manufacturing and others.

In terms of motor power, medium duty segment to command 45.0% share in the demand for bandsaw machines in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA