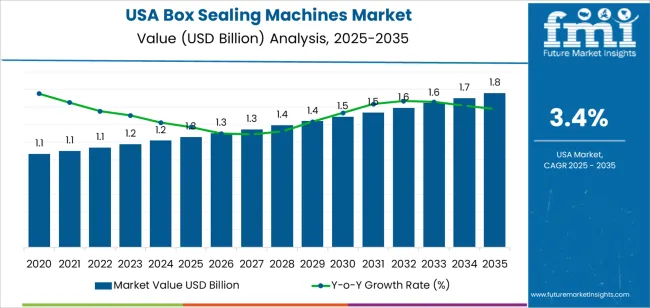

The USA box sealing machines demand is valued at USD 1.3 billion in 2025 and is projected to reach USD 1.8 billion by 2035, reflecting a CAGR of 3.4%. Demand is shaped by rising packaging throughput across distribution centres, e-commerce fulfilment hubs, and industrial production facilities. Companies continue to upgrade sealing equipment to improve line efficiency, reduce labour dependence, and maintain consistent packaging integrity for high-volume shipments. Increased adoption of corrugated packaging and greater emphasis on process automation also contribute to steady equipment procurement across manufacturing and logistics environments.

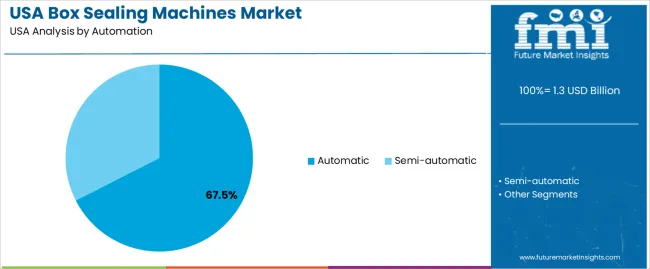

Automatic box sealing machines lead the product landscape. These systems are selected for uniform tape application, reduced operator intervention, and compatibility with variable box dimensions. Automatic units support continuous-run packaging lines and are preferred by facilities with high daily dispatch volumes. Their integration with conveyor systems, barcode readers, and quality-control modules strengthens operational reliability and reduces rework associated with carton sealing defects.

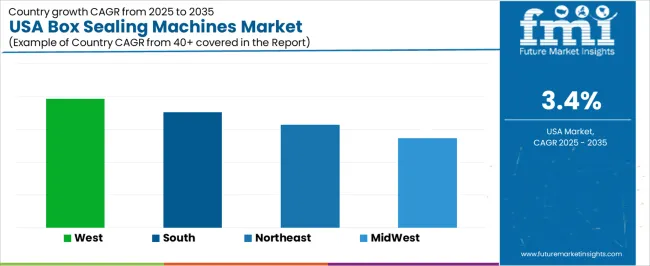

West USA, South USA, and Northeast USA record the highest utilisation levels due to the concentration of warehousing facilities, regional distribution hubs, and contract packaging service providers. These regions also sustain strong demand from consumer-goods manufacturers, electronics assemblers, and food and beverage processors that standardise automated sealing systems to enhance throughput and reduce packaging waste. Key suppliers include 3M Company, Intertape Polymer Group, Wexxar Bel (ProMach), Lantech, Inc., and SIAT S.p.A. These companies supply semi-automatic and fully automatic sealing equipment used in industrial packaging, fulfilment operations, and large-scale distribution workflows.

Early-period growth (2025-2029) reflects steady investment by packaging, e-commerce, food-processing, and logistics operators seeking throughput improvements and reduced manual-handling costs. Demand in this phase is influenced by automation upgrades, higher parcel volumes, and the replacement of legacy sealing equipment in mid-scale facilities. Growth remains consistent but not rapid, as adoption is tied to scheduled capital-expenditure cycles rather than disruptive technology shifts. This produces an initial curve with moderate slope and low volatility.

Late-period growth (2030-2035) shows a flatter trajectory as major automation investments mature and utilisation rates stabilise. Most large USA distribution and fulfillment centres will have already integrated standardized sealing systems, shifting demand toward maintenance, incremental upgrades, and selective adoption of energy-efficient or digitally monitored sealing units. The late curve reflects slower incremental gains linked to operational optimisation rather than broad new deployments. The early-versus-late comparison indicates that the segment’s expansion is front-loaded by automation needs, while long-term performance is defined by stable replacement demand, consistent uptime requirements, and predictable packaging-line renewal cycles.

| Metric | Value |

|---|---|

| USA Box Sealing Machines Sales Value (2025) | USD 1.3 billion |

| USA Box Sealing Machines Forecast Value (2035) | USD 1.8 billion |

| USA Box Sealing Machines Forecast CAGR (2025-2035) | 3.4% |

Demand for box sealing machines in the USA is increasing because ecommerce, fulfilment centres and shipping-driven logistics operations require faster, more reliable methods to close shipping cartons and corrugated packages. As parcel volume grows and manual labour costs rise, automated sealing machines help reduce labour time, improve consistency and support throughput. Leading-edge fulfilment operations favour adjustable-height, high-speed sealers that integrate with conveyors and data-systems to match order-processing speed.

Retail brands and contract packers also seek semi-automatic or automatic box sealers to streamline packaging production lines and reinforce brand protection and shipping reliability. Constraints include capital expenditure for automatic systems, required integration with existing conveyors and workflows and the requirement for space and power infrastructure in retrofit projects. Many smaller operations continue using manual taping or semi-automatic equipment until scale requirements justify full automation.

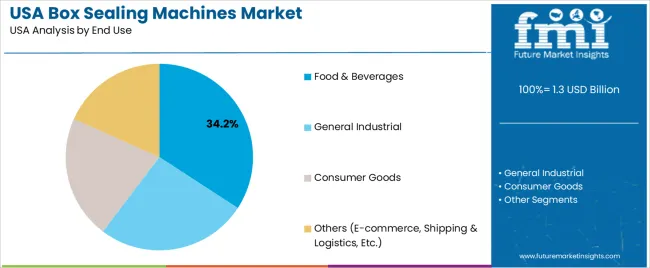

Demand for box sealing machines in the United States reflects increased reliance on automated packaging systems across food processing, consumer-goods handling, and industrial shipping workflows. Automation preferences correspond to throughput requirements, labour availability, and packaging-line integration needs. End-use patterns indicate how different industries adopt sealing systems to support uniform sealing quality, reduce handling errors, and maintain packaging integrity for transportation and storage.

Automatic systems hold 67.5% of national demand and represent the dominant automation category. These systems support high-volume production lines that require consistent sealing speed, reduced manual intervention, and compatibility with conveyor-based workflows. Their adoption is prevalent in facilities seeking improved throughput and reduced packaging variability. Semi-automatic systems account for 32.5%, supporting smaller operations or variable-size packaging runs where operator-assisted adjustments remain practical. Automation distribution reflects plant size, required sealing precision, and integration with upstream and downstream equipment. USA users select equipment based on operational stability, maintenance considerations, and packaging uniformity required across diverse product lines.

Key drivers and attributes:

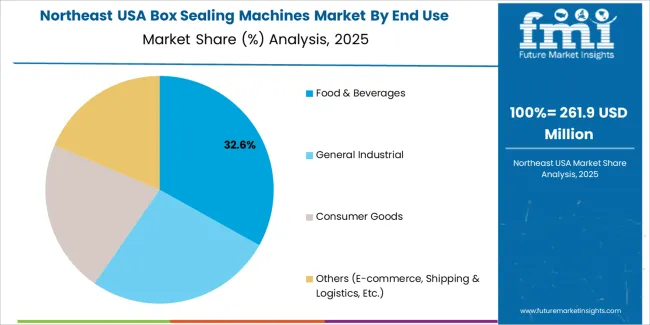

Food and beverages hold 34.2% of national demand and represent the leading end-use category. Facilities rely on box sealing systems to maintain product hygiene, reduce contamination risk, and support continuous packing operations. General industrial users account for 26.1%, applying sealing systems in component packaging, machinery parts, and bulk-shipment workflows. Consumer-goods applications represent 21.4%, covering household items, electronics, and personal-care products requiring secure transportation and shelf-ready packaging. Other uses, including e-commerce, shipping, and logistics, account for 18.3%, reflecting rising parcel volumes and consistency needs in distribution centers. End-use distribution reflects packaging durability requirements, shipment frequency, and compliance with handling standards across USA operations.

Key drivers and attributes:

Growth of e-commerce fulfilment, labour cost pressures in fulfilment centres, and regulatory sustainability and packaging-waste goals are driving demand.

In the United States, the expansion of online retail has forced fulfilment centres to process larger volumes of parcels with faster turnaround and minimal errors. Box sealing machines help standardise carton closure and reduce manual labour in high-throughput operations. Rising wages and labour shortages in USA warehousing incentivise investment in automation. Ecofriendly initiatives at major carriers and retailers demand consistent sealed packaging to reduce damage and waste, encouraging adoption of machines that support recyclable tapes, efficient sealing methods and smart monitoring of packaging quality.

High capital cost, variability in carton sizes and formats, and slow retrofit cycles restrain growth.

Many USA operations still rely on flexible manual seal methods because box sealing machines require stable carton specs and predictable volumes. When product lines or SKUs change frequently, the cost of adjusting or replacing sealing systems may deter investment. High upfront equipment cost plus integration with conveyor and fulfilment systems can raise business risk. Facilities with legacy packaging lines may delay upgrades due to long equipment lifecycles or must weigh whether the expected throughput increase justifies the machine cost.

Rise of random-sized carton sealers, integration of vision and analytics for seal quality, and growth of service-model machine leasing define the industry outlook.

In the USA industry, machines capable of sealing cartons of varying sizes without manual adjustment (random-sized carton sealers) are gaining traction in Omni channel fulfilment operations. Analytics tools embedded in sealing equipment monitor tape application, seal integrity and throughput to reduce defects and returns. To reduce upfront investment barriers, many suppliers are offering leasing or "machine-as-a-service" models where customers pay per usage or throughput rather than a full capital buy-out. Together, these trends support wider adoption of box sealing machines across USA logistics and packaging operations.

Demand for box sealing machines in the USA is rising through 2035 as logistics networks, e-commerce distributors, food processors, and manufacturing plants expand automated packaging operations. USA facilities adopt case sealers to improve packing-line throughput, reduce manual labor, and enhance consistency in corrugated-box closure. Growth is supported by rising parcel volumes, warehouse expansion, and continued investment in automated end-of-line systems.

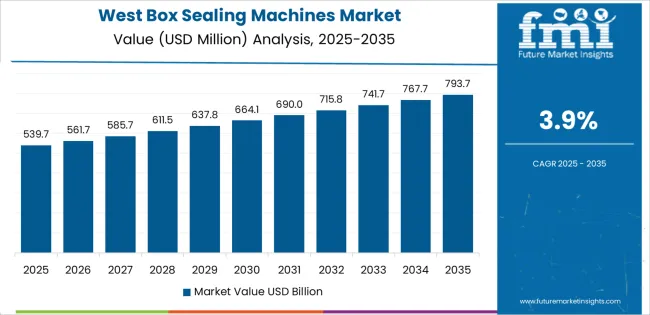

Lightweight equipment used in small fulfillment centers and heavy-duty sealers used in industrial plants both contribute to regional demand. Variation across regions reflects distribution-center density, manufacturing concentration, and transportation-corridor development. West USA leads with 3.9%, followed by South USA (3.5%), Northeast USA (3.1%), and Midwest USA (2.7%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 3.9% |

| South USA | 3.5% |

| Northeast USA | 3.1% |

| Midwest USA | 2.7% |

West USA grows at 3.9% CAGR, supported by the high concentration of e-commerce distribution hubs, third-party logistics centers, and parcel-handling networks across California, Nevada, Arizona, Washington, and Oregon. Warehouses expand automated case-sealing lines to handle rising order volumes linked to major online retailers and regional fulfillment platforms. Food and beverage processors adopt consistent box-sealing systems to meet packaging-integrity requirements for perishable shipments. Manufacturers in the West integrate automated sealers into lean production lines to improve output and maintain uniform closure quality. Facilities located along West Coast ports use sealing equipment to prepare export-ready corrugated packages.

South USA grows at 3.5% CAGR, driven by expanding manufacturing bases, large warehousing corridors, and increasing freight movement across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Regional warehouses deploy case sealers to manage rising outbound volumes from consumer-goods, electronics, and packaged-food facilities. Automotive and machinery plants integrate sealing systems into end-of-line packaging stations to improve consistency and reduce manual labor costs. Distribution centers along Southern interstate networks adopt automated sealing to support high-velocity parcel operations. Growth in regional cold-storage and food-processing sites adds demand for sealing machines suited for refrigerated packaging lines.

Northeast USA grows at 3.1% CAGR, shaped by dense parcel-distribution networks, strong food-processing activity, and established pharmaceutical-packaging hubs across New York, New Jersey, Pennsylvania, Massachusetts, and Connecticut. High parcel volume in major urban centers increases demand for automated sealing lines in last-mile and regional distribution facilities. Food and beverage plants adopt sealers to support standardized packaging for grocery distribution. Pharmaceutical and medical-supply manufacturers use precision sealing equipment for corrugated shipping cases that must meet strict handling and labeling requirements. Older industrial buildings undergoing modernization integrate compact sealers suited to space-restricted packaging areas.

Midwest USA grows at 2.7% CAGR, supported by regional manufacturing, agricultural-product processing, and distribution activity across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Manufacturing facilities use box sealing machines to standardize outbound packaging for machinery components, automotive parts, and industrial equipment. Food-processing plants adopt automated sealers to manage high-volume shipments of packaged grains, meat products, and dairy items. Distribution centers servicing central transportation corridors deploy sealing machines to improve throughput consistency. Budget-conscious facilities expand use of semi-automatic sealers suited to moderate packaging volumes.

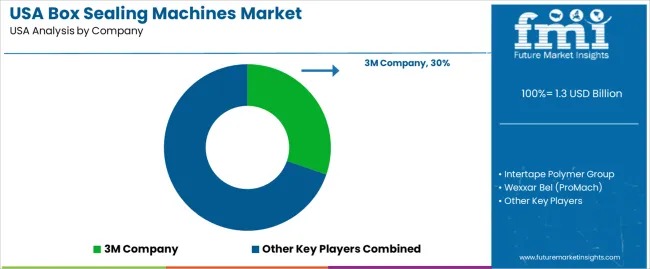

Demand for box-sealing machines in the USA is shaped by a group of packaging-automation suppliers serving e-commerce fulfilment centres, consumer-goods manufacturers, contract packers, and industrial distribution. 3M Company holds the leading position with an estimated 30.3% share, supported by controlled tape-application technology, consistent sealing performance, and long-standing integration with automated packing lines across large USA warehouses. Its position is reinforced by reliable machine uptime and stable compatibility with case-handling systems.

Intertape Polymer Group follows as a major participant, offering carton-sealing systems paired with pressure-sensitive tapes designed for consistent adhesion, controlled application force, and dependable performance on high-speed lines. Wexxar Bel (ProMach) maintains a strong presence in automated case erecting and sealing equipment used by mid- and large-scale manufacturers, providing machines with stable alignment control and reliable sealing accuracy across varied box formats.

Lantech, Inc. contributes additional capability with case-sealing systems engineered for durability and precise flap-folding behaviour, supporting both high-volume manufacturing and e-commerce packing requirements. SIAT S.p.A., through its USA distribution partners, supplies case sealers with controlled mechanical stability and predictable sealing output suited to medium-scale operations.

Competition across this segment centres on sealing accuracy, tape-application reliability, machine durability, integration with conveyor systems, maintenance predictability, and changeover efficiency. Demand continues to expand as USA fulfilment and manufacturing operations prioritise automated, high-consistency box-sealing systems to support rising parcel volumes and reduce labour dependence.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Automation | Automatic, Semi-automatic |

| End Use | Food & Beverages, General Industrial, Consumer Goods, Others (E-commerce, Shipping & Logistics, Etc.) |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | 3M Company, Intertape Polymer Group, Wexxar Bel (ProMach), Lantech, Inc., SIAT S.p.A. |

| Additional Attributes | Dollar sales by automation type and end-use categories; regional adoption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of box sealing and packaging automation providers; developments in high-speed taping systems, smart sensors, and energy-efficient sealing technologies; integration with e-commerce fulfillment centers, industrial packaging lines, consumer goods manufacturing, and logistics operations across the USA. |

The demand for box sealing machines in usa is estimated to be valued at USD 1.3 billion in 2025.

The market size for the box sealing machines in usa is projected to reach USD 1.8 billion by 2035.

The demand for box sealing machines in usa is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in box sealing machines in usa are automatic and semi-automatic.

In terms of end use, food & beverages segment is expected to command 34.2% share in the box sealing machines in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Demand for Box Sealing Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Competitive Breakdown of Tube Sealing Machines Providers

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA & Canada Cat Litter Box Market Trend, Growth and Forecast 2025 to 2035

Envelope Sealing Machines Market Trends - Growth & Forecast 2025 to 2035

The USA & Canada Bag-in-Box Market Size and Share Forecast Outlook 2025 to 2035

Induction Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Market Share Breakdown of Induction Sealing Machines Manufacturers

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Demand for Box Liners in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Boxcar Scars in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA