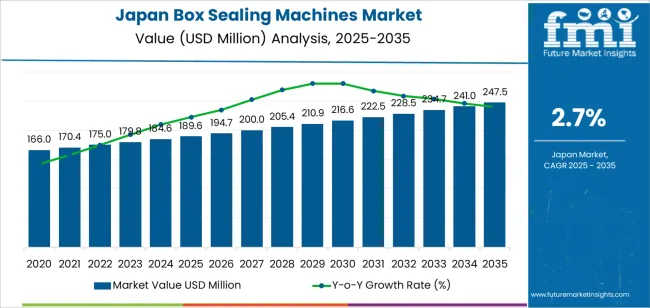

The demand for box sealing machines in Japan is expected to grow from USD 189.6 million in 2025 to USD 247.5 million by 2035, reflecting a CAGR of 2.7%. Box sealing machines are essential equipment in packaging industries, widely used to seal cardboard boxes for shipping and storage. The demand for these machines is driven by the growth of e-commerce, increasing packaging needs across food, pharmaceuticals, consumer goods, and industrial sectors. As businesses strive to improve operational efficiency and productivity, automation in packaging processes, including box sealing, will continue to gain traction.

The market growth is also influenced by technological advancements in automation and smart packaging solutions, where energy efficiency, sustainability, and cost-effectiveness are becoming key selling points. Additionally, the rise of customized packaging solutions that offer better brand differentiation and product protection will push demand for more advanced sealing machines capable of accommodating varied packaging requirements. Japan's commitment to high manufacturing standards and innovative solutions in automation will further support the growth of this market.

From 2025 to 2030, the demand for box sealing machines in Japan will grow from USD 189.6 million to USD 216.6 million, contributing USD 27 million in value. During this period, volume growth will be the primary driver of market expansion. As industries such as e-commerce, food processing, and logistics continue to grow, the need for efficient and reliable packaging solutions will increase. The adoption of automated box sealing machines will drive higher volumes as companies seek to enhance productivity and reduce labor costs. However, price growth will remain relatively modest during this phase as competition among manufacturers leads to price stabilization, with some incremental increases attributed to technological advancements and premium features such as automated adjustments, energy efficiency, and smart packaging integrations.

From 2030 to 2035, the market will grow from USD 216.6 million to USD 247.5 million, adding USD 30.9 million in value. In this phase, price growth will play a more significant role in the overall market expansion, as the demand for high-tech sealing solutions increases. Innovation in sealing technologies, such as advanced sealing mechanisms, enhanced automation, and eco-friendly designs, will lead to higher-priced units. Although volume growth will still contribute to the market, it will be the introduction of more premium, high-efficiency models that will drive price growth, supported by the demand for advanced, customizable sealing solutions. This shift toward more sophisticated technology will lead to the gradual maturation of the market with steady growth in both volume and price.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 189.6 million |

| Industry Forecast Value (2035) | USD 247.5 million |

| Industry Forecast CAGR (2025-2035) | 2.7% |

Demand for box sealing machines in Japan is growing as packaging lines adapt to higher volumes, increased automation, and efficiency requirements. The market is estimated at USD 189.6 million and projected to reach USD 247.5 million, corresponding to a compound annual growth rate (CAGR) of around 2.7 %. Manufacturers in sectors such as e commerce, electronics, food and beverages invest in automated sealing equipment to handle higher throughput, reduce manual labor, and maintain consistency in packaging.

Another factor influencing demand is the shift toward flexible packaging formats and logistic optimization. Box sealing machines that support varying box sizes, quick change over and integration with conveyor and downstream systems align with the needs of Japanese manufacturers managing diverse product runs and global shipments. While the low CAGR reflects a mature market, incremental upgrades, replacement of legacy equipment and growth in just in time fulfilment operations contribute to steady investment in sealing technology.

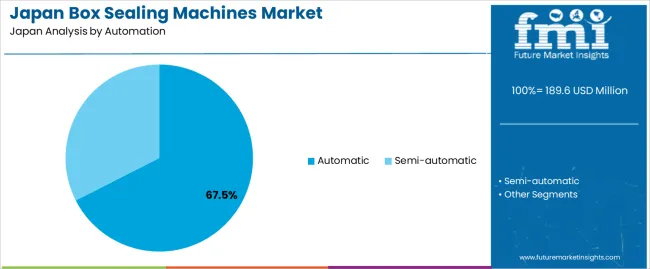

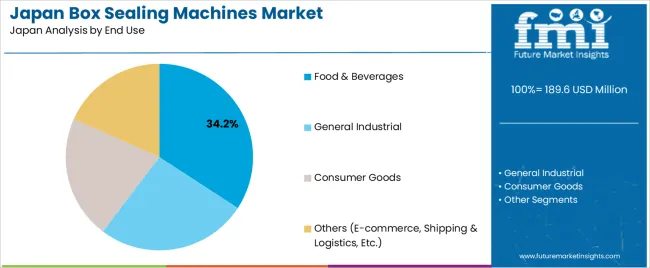

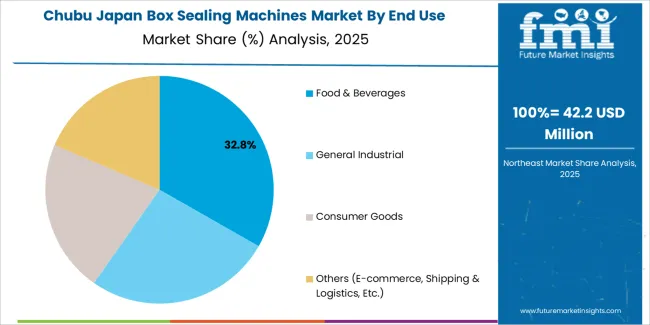

The demand for box sealing machines in Japan is driven by automation and end-use segment. The leading automation type is automatic, capturing 68% of the market share, while food & beverages is the dominant end-use sector, accounting for 34.2% of the demand. Box sealing machines are essential for packaging efficiency in industries where large volumes of products need to be securely sealed for storage or shipment. As the demand for faster, more efficient packaging solutions grows, the use of automated sealing machines is increasingly favored.

Automatic box sealing machines lead the demand in Japan, holding 68% of the market share. These fully automated machines are designed to increase packaging speed and efficiency while reducing human error and labor costs. Automatic box sealing machines can handle high volumes of boxes with minimal intervention, making them ideal for large-scale production lines in various industries such as food packaging, e-commerce, and logistics.

The demand for automatic box sealing machines is driven by the need for higher productivity and consistent quality in packaging. As businesses strive to meet the demands of fast-paced industries, automated solutions provide the advantage of improved throughput, reduced operational costs, and increased accuracy in sealing boxes. The ability to handle a wide range of box sizes and materials without manual adjustment also contributes to the popularity of automatic machines in industries with diverse packaging needs. As businesses continue to prioritize efficiency and automation, the demand for fully automated box sealing machines is expected to remain strong in Japan.

Food & beverages is the leading end-use segment for box sealing machines in Japan, capturing 34.2% of the demand. The food and beverage industry requires efficient and reliable packaging solutions to ensure the safe and hygienic transport of products, such as canned goods, bottles, snacks, and frozen foods. Box sealing machines play a crucial role in sealing packaging securely, ensuring product freshness, safety, and shelf stability.

The demand for box sealing machines in the food and beverage sector is driven by the need for speed, hygiene, and cost-effectiveness in packaging processes. With the growing demand for packaged foods and beverages in retail and e-commerce, manufacturers in this sector are increasingly relying on box sealing machines to streamline packaging operations and improve efficiency. Additionally, strict regulations regarding food safety and packaging integrity ensure that box sealing machines continue to be in high demand. As the food and beverage industry expands, especially with the rise of online grocery shopping, the need for efficient packaging equipment like box sealing machines is expected to continue to grow in Japan.

Demand for box sealing machines in Japan is driven by the growing needs of e-commerce logistics, food and beverage packaging, and secondary packaging applications where high-speed, reliable sealing of cartons is essential. The broader packaging machinery market in Japan is expected to grow at a compound annual growth rate (CAGR) of about 6.05%. Box sealing machines are integral in improving packaging efficiency and reducing manual labor. Factors such as automation adoption, packaging sustainability, and advancements in sealing technology contribute to the increasing demand in Japan.

What Are the Primary Growth Drivers for Box Sealing Machine Demand in Japan?

Several factors support the growth of box sealing machines. First, the rise in online retail and home delivery services in Japan increases the volume of shipped cartons, driving the need for efficient sealing solutions. Second, the shift towards automation in Japanese manufacturing and packaging plants increases demand for machines that can handle high throughput with minimal manual intervention. Third, the push towards sustainable packaging, including recycled board and reduced tape usage, requires machines capable of handling new materials while ensuring consistent seal quality. Fourth, the food and pharmaceutical sectors in Japan emphasize hygiene and efficiency in secondary packaging, further elevating the need for modern sealing machinery.

What Are the Key Restraints Affecting Box Sealing Machine Demand in Japan?

Despite positive growth drivers, there are constraints to consider. The high cost of advanced sealing machines may deter smaller businesses or converters from upgrading their sealing lines, especially when production runs are smaller. Existing facilities that rely on manual or simpler sealing systems may find it challenging to retrofit or replace machinery, leading to production downtime and increased installation complexity. Additionally, supply chain disruptions for components such as motors, sensors, and control systems can raise costs or delay delivery. As Japan’s packaging sector matures, incremental growth in demand may slow, making it more difficult to justify new investment.

What Are the Key Trends Shaping Box Sealing Machine Demand in Japan?

Key trends include growing demand for compact, modular sealing machines that can integrate with robotic systems and automated conveyors, providing greater flexibility for production lines. The adoption of sensors, predictive maintenance, and IoT connectivity in sealing machines is increasing to improve operational efficiency and enable real-time monitoring of sealing quality. Another trend is the shift towards sealing machines that can handle a variety of materials, including thinner board and recycled fiber, supporting sustainability efforts. Finally, there is an increase in the adoption of semi-automatic machines as a bridge technology for mid-sized firms looking to improve efficiency without fully automating their production processes.

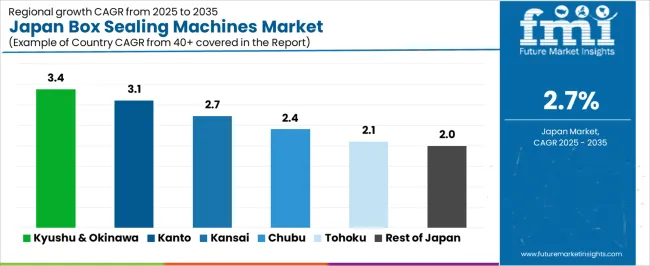

The demand for box sealing machines in Japan shows consistent growth across regions, with Kyushu & Okinawa leading at a CAGR of 5.9%. Kanto follows closely with a CAGR of 5.4%, driven by urbanization and increasing demand for light-blocking solutions in densely populated areas. The Kinki region exhibits moderate growth at 4.8%, while Chubu, Tohoku, and the Rest of Japan show slower growth, with respective CAGRs of 4.2%, 3.7%, and 3.5%. These regional differences reflect varying levels of demand based on factors such as population density, residential trends, and awareness of the benefits of blackout fabrics in controlling light and improving sleep quality.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.4% |

| Kanto | 3.1% |

| Kinki | 2.7% |

| Chubu | 2.4% |

| Tohoku | 2.1% |

| Rest of Japan | 2.0% |

The demand for box sealing machines in Kyushu & Okinawa is projected to grow at a CAGR of 3.4%, driven by the region’s increasing awareness of the benefits of light control and improved sleep quality. The growing popularity of blackout curtains in homes, hotels, and other establishments to block out light and maintain privacy is a key factor contributing to this trend. Additionally, the region’s warm climate, which often leads to early sunrises, increases the need for blackout fabrics to help control natural light, particularly in bedrooms. Okinawa’s thriving tourism industry further drives demand for blackout fabric, as many hotels and guesthouses seek to offer better sleep environments for their visitors. As more consumers prioritize comfort and energy efficiency, the demand for blackout fabrics is expected to continue to rise in this region.

In Kanto, the demand for box sealing machines is expected to grow at a CAGR of 3.1%, supported by the region’s large population and the growing demand for energy-efficient home solutions. Kanto, particularly Tokyo, is one of Japan’s busiest and most urbanized regions, where light pollution and long daylight hours make blackout fabrics an attractive option for improving sleep quality. The increasing awareness of the importance of sleep health, combined with urban lifestyles and the rising popularity of home decor trends that emphasize light control, is driving the adoption of blackout fabrics. Furthermore, the region’s high number of offices, hotels, and residential buildings with large windows creates a significant market for blackout solutions. As more consumers in Kanto seek ways to optimize their living spaces for better comfort and energy savings, demand for blackout fabric is likely to continue growing.

The demand for box sealing machines in the Kinki region is projected to grow at a CAGR of 2.7%, reflecting steady growth driven by the region’s strong medical sector. Kinki, which includes major cities such as Osaka and Kyoto, is home to several prominent medical centers, universities, and biotech companies that are investing in the development and application of biomaterials. The region’s population is aging, and as a result, there is an increasing need for medical treatments and devices that require biomaterials, such as orthopedic implants, dental materials, and regenerative therapies. Furthermore, Kinki’s well-established medical research community continues to drive innovation in biomaterials, contributing to the adoption of advanced materials in clinical settings. While the growth rate is slower compared to Kyushu & Okinawa and Kanto, Kinki’s robust healthcare infrastructure and research capacity ensure that demand for biomaterials will continue to grow steadily in the coming years.

The demand for box sealing machines in Chubu is expected to grow at a CAGR of 2.4%, driven by a combination of factors, including urbanization, changing consumer preferences, and the desire for energy-efficient home solutions. Chubu, home to industrial cities like Nagoya, has a large working population that increasingly relies on convenient meal options. However, the region tends to have a more traditional food culture, with many people still favoring sit-down breakfasts at home. Despite this, the demand for breakfast takeout is gradually increasing, driven by the rise in working professionals, the younger population’s preference for convenience, and the increasing availability of foodservice outlets catering to busy consumers. Additionally, Chubu’s growing e-commerce and delivery services are making breakfast takeout more accessible to a broader range of consumers. The moderate growth rate reflects a balance between traditional meal patterns and the evolving demand for faster, on-the-go food options.

In Tohoku, the demand for box sealing machines is projected to grow at a CAGR of 2.1%, reflecting slower adoption compared to more developed regions in Japan. Tohoku, with its lower population density and more rural character, faces challenges in terms of access to advanced healthcare facilities. However, as the region’s aging population grows, the demand for medical treatments and devices that utilize biomaterials, such as joint replacements and cardiovascular devices, is increasing. Tohoku is also experiencing improvements in its healthcare infrastructure, which are driving the adoption of biomaterials. The gradual introduction of innovative medical technologies, particularly in rural healthcare settings, is contributing to moderate growth in the demand for these devices. While the growth rate is more modest than in more urbanized regions, Tohoku’s increasing focus on healthcare improvement ensures that the demand for biomaterials will continue to rise gradually.

In the Rest of Japan, the demand for box sealing machines is expected to grow at a CAGR of 2.0%, reflecting slower adoption compared to more urbanized regions. This region, which encompasses rural areas and less densely populated regions, has traditionally had lower access to advanced medical technologies compared to urban centers. However, as the aging population continues to grow, there is an increasing need for medical treatments that involve biomaterials, such as orthopedic devices and prosthetics. The introduction of telemedicine, mobile health platforms, and improvements in rural healthcare facilities is contributing to the adoption of biomaterials in these regions. The overall growth rate remains slower than in more urbanized areas due to the region's attachment to traditional food practices. Despite these challenges, ongoing improvements in healthcare access and the increasing need for diagnostic testing will continue to support gradual growth in the demand for box sealing machines in these regions.

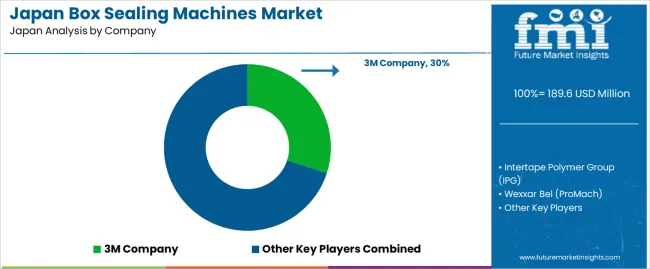

Demand for box sealing machines in Japan is rising as manufacturers and logistics providers seek efficient and reliable packaging solutions for domestic and export operations. Leading suppliers in this market include 3M Company (holding approximately 30% market share), Intertape Polymer Group (IPG), Wexxar Bel (a ProMach brand), Lantech, Inc., and SIAT S.p.A. These companies provide equipment used in carton closing, taping, gluing, and sealing processes across industries such as e-commerce, food and beverage, and manufacturing. The Japanese packaging equipment market favours machines that support high throughput, minimal downtime, and seamless integration with automated lines.

Competition in the box sealing machines industry in Japan is driven by machine flexibility, ease of maintenance, and service support. Suppliers offer models with adjustable tape widths, automatic height detection, and compatibility with various carton formats to accommodate fluctuating packing needs. Another competitive focus is localisation: providers with Japanese language interface, local technical service, and spare parts availability gain trust among Japanese operations. Sustainability is also a growing consideration: machines that reduce adhesive waste, enable recyclable tape use, and operate efficiently are preferred. Product literature typically highlights features such as cycle speed (boxes per minute), changeover time, maintenance access, and machine footprint. By tailoring solutions to Japan’s packaging line efficiency demands and service expectations, these companies aim to enhance their standing in Japan’s box sealing machines industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Automation | Automatic, Semi-automatic |

| End Use | Food & Beverages, General Industrial, Consumer Goods, Others (E-commerce, Shipping & Logistics, Etc.) |

| Key Companies Profiled | 3M Company, Intertape Polymer Group (IPG), Wexxar Bel (ProMach), Lantech, Inc., SIAT S.p.A. |

| Additional Attributes | The market analysis includes dollar sales by automation type, end-use, and company categories. It also covers regional demand trends in Japan, particularly driven by the increasing adoption of box sealing machines across various industries, including food & beverages, e-commerce, and logistics. The competitive landscape highlights key manufacturers focusing on innovations in automated sealing technologies for increased efficiency and packaging quality. Trends in the growing demand for semi-automatic and fully automatic machines in industrial applications are explored, along with advancements in sealing materials, system integration, and customization options. |

The demand for box sealing machines in japan is estimated to be valued at USD 189.6 million in 2025.

The market size for the box sealing machines in japan is projected to reach USD 247.5 million by 2035.

The demand for box sealing machines in japan is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in box sealing machines in japan are automatic and semi-automatic.

In terms of end use, food & beverages segment is expected to command 34.2% share in the box sealing machines in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Demand for Box Sealing Machines in USA Size and Share Forecast Outlook 2025 to 2035

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Competitive Breakdown of Tube Sealing Machines Providers

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Envelope Sealing Machines Market Trends - Growth & Forecast 2025 to 2035

Induction Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Market Share Breakdown of Induction Sealing Machines Manufacturers

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Demand for Box Liners in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cake Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Interlocking Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Demand for Foldable Plastic Pallet Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA