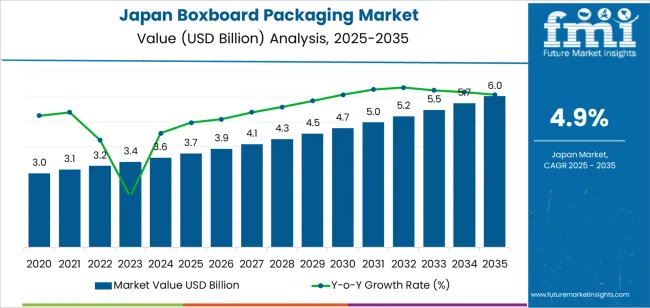

The demand for boxboard packaging in Japan is projected to grow from USD 3.7 billion in 2025 to USD 6.0 billion by 2035, reflecting a CAGR of 4.9%. Boxboard packaging, widely used in consumer goods, e-commerce, food packaging, and industrial applications, is expected to benefit from the increasing shift toward sustainable, lightweight, and recyclable packaging solutions. As Japanese consumers and businesses focus more on environmentally friendly alternatives to plastic, boxboard packaging is becoming a popular choice due to its cost-effectiveness, recyclability, and low environmental impact.

The growth is also driven by regulations favoring sustainable materials in packaging, along with rising demand for e-commerce packaging, where boxboard is preferred for shipping and storage due to its strength and ease of use. Furthermore, the increasing trend of biodegradable packaging and lightweight materials in packaging solutions will provide a strong boost to the boxboard packaging market in Japan. The growth will also be supported by the increasing consumption of processed foods, consumer products, and retail packaging, all of which are expected to continue driving the demand for boxboard in Japan.

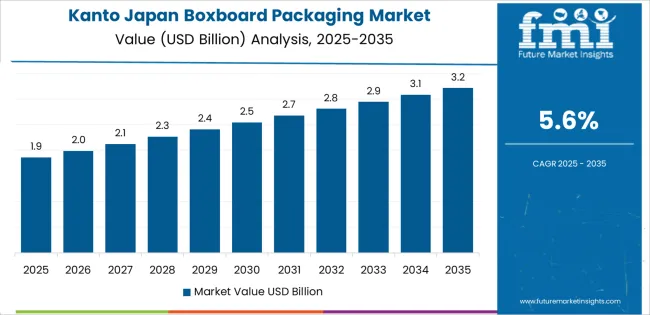

The inflection point mapping for boxboard packaging in Japan highlights key shifts in the market dynamics, where the growth trajectory accelerates or decelerates due to changing industry conditions. Between 2025 and 2030, the market will grow from USD 3.7 billion to USD 4.7 billion, reflecting a growth of USD 1.0 billion. This initial phase of growth is expected to experience a moderate acceleration driven by increased adoption of sustainable packaging in consumer goods, food packaging, and e-commerce sectors. The inflection point is expected to occur around 2027-2028, when the adoption of sustainable packaging solutions reaches a critical mass, driven by increasing regulations for eco-friendly packaging and heightened consumer demand for sustainability.

From 2030 to 2035, the market will expand from USD 4.7 billion to USD 6.0 billion, contributing USD 1.3 billion in growth. During this period, the growth will continue, but the pace will slow down slightly compared to the earlier years, reflecting the maturity of the boxboard packaging market in Japan. The inflection point around 2032-2033 will mark a slower acceleration in growth as the market becomes more established and saturation occurs in key segments like food packaging and e-commerce. As packaging innovation and new technologies begin to stabilize, the overall growth rate may become more steady rather than sharply increasing. Despite this, sustainability concerns and ongoing demand for eco-friendly packaging solutions will continue to drive the market forward, resulting in steady but more moderate growth after the initial acceleration phase.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 3.7 billion |

| Forecast Value (2035) | USD 6 billion |

| Forecast CAGR (2025-2035) | 4.9% |

Demand for boxboard packaging in Japan is growing steadily as companies and consumers increasingly prioritise sustainability, premium aesthetics and lightweight packaging solutions. Japanese brands in sectors such as cosmetics, luxury retail and specialty food frequently select high quality coated boxboard for its printability and upscale appearance, driven by consumer expectation for refined packaging design. At the same time, government and industry efforts to reduce plastic waste and promote recyclable materials are pushing packaging conversion toward paperboard formats which are seen as more environmentally friendly.

Another factor supporting growth is the expansion of e commerce and direct to consumer retail channels in Japan, which increases demand for packaging that balances protection, presentation and cost effectiveness. Boxboard cartons offer an attractive option for shipping electronics, beauty products and high end consumer goods where unboxing experience and brand perception are crucial. Additionally, innovations in material coatings and barrier functionality are making boxboard suitable for more diverse packaging applications. Nevertheless, challenges include the higher cost of premium boxboard grades, competition from alternative packaging substrates and raw material volatility. Despite these constraints, the demand for boxboard packaging in Japan is expected to continue growing as brands seek both visual distinction and sustainability credentials.

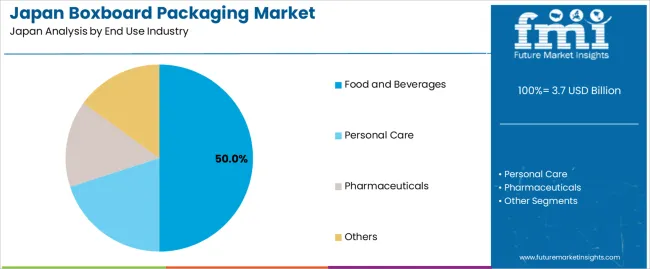

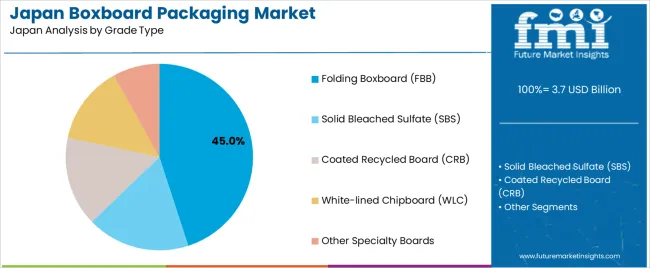

The demand for boxboard packaging in Japan is primarily driven by end-use industry and grade type. The food and beverages sector leads the market, capturing 50% of the demand, while folding boxboard (FBB) is the dominant grade type, holding 45% of the market share. Boxboard packaging is highly valued for its ability to provide strength, durability, and excellent printability, making it an ideal solution for packaging products that require both protection and aesthetic appeal. As packaging plays a critical role in product marketing, both the food & beverage and folding boxboard segments continue to experience strong demand in Japan.

The food and beverages industry is the largest end-user of boxboard packaging in Japan, accounting for 50% of the market share. Boxboard packaging is used extensively for packaging a wide range of food and beverage products, including ready-to-eat meals, snacks, beverages, and frozen foods. The food and beverages sector requires packaging that provides both functionality and an attractive presentation to consumers. Boxboard, particularly in the form of folding boxboard, is a preferred material because it provides an excellent surface for printing vibrant and appealing designs, which is crucial in the highly competitive food and beverage market.

Boxboard is also valued in this industry for its ability to provide structural integrity while remaining lightweight, which reduces shipping costs and improves handling efficiency. Furthermore, as consumer demand for eco-friendly and sustainable packaging grows, boxboard, being recyclable, is an increasingly popular choice. With the continued growth of the food and beverage sector in Japan, driven by new product introductions and the expansion of packaged food sales, the demand for boxboard packaging is expected to remain robust.

Folding boxboard (FBB) is the leading grade type in the boxboard packaging market in Japan, holding 45% of the market share. FBB is a multi-ply board that is known for its excellent strength-to-weight ratio and superior print quality, making it ideal for premium packaging applications. It is widely used for packaging products such as food, beverages, cosmetics, and pharmaceuticals, where both durability and an attractive appearance are required.

FBB’s dominance is primarily driven by its versatility and the ability to handle both lightweight and heavier products while providing structural support. The material is well-suited for a variety of packaging formats, including cartons, boxes, and sleeves, which are common in the food and beverage, personal care, and pharmaceutical industries. Moreover, FBB is favored for its ability to be easily processed into various shapes and sizes, further increasing its market appeal. As the demand for high-quality, aesthetically pleasing packaging continues to rise, particularly in the food and beverage sector, folding boxboard remains the preferred choice in Japan, driving the continued growth of the market.

Demand for boxboard packaging in Japan is driven by strong interest in sustainable, lightweight and premium packaging formats across food & beverage, personal care, cosmetics and e commerce sectors. The local packaging market emphasises recyclability and material origins, making paper based boxboard a preferred alternative to plastics or rigid containers. Utilities such as rapid dispenser ready formats, sophisticated graphics and minimal waste align with Japanese consumer preferences and retail standards. At the same time, slower expansion of certain end use industries and feedstock cost pressures influence how quickly boxboard adoption rises.

What Are The Primary Growth Drivers For Boxboard Packaging Demand in Japan?

Several factors support growth in this market. First, the move toward sustainable consumer products and corporate packaging policies in Japan promotes use of fibre based boxboard with high recycled content. Second, growth in premium packaged goods—especially in cosmetics, specialty foods, gift sets and confectionery—drives demand for high print quality boxboard packaging. Third, expansion of e commerce and direct to consumer channels creates need for durable yet lightweight cartons that can protect goods and provide strong shelf or unboxing appeal. Fourth, regulatory measures around plastic reduction and extended producer responsibility push brand owners to transition away from non fibre packaging toward materials like boxboard.

What Are The Key Restraints Affecting Boxboard Packaging Demand in Japan?

Despite favourable conditions, the market faces some constraints. The modest overall growth rate of Japan’s packaging sector means that volume expansion for boxboard is limited compared to high growth regions. Cost increases in raw materials (such as pulps) and energy or processing can reduce competitiveness of boxboard against cheaper materials. The high level of packaging sophistication and brand expectations in Japan may require premium finishes, raising cost and complexity. Also, alternative materials (plastics, flexible packaging) continue to retain share in convenience and disposable pack formats, which may limit boxboard substitution in those segments.

What Are The Key Trends Shaping Boxboard Packaging Demand in Japan?

Emerging trends include increasing adoption of boxboard in smaller run sizes and premium cosmetic or gift packaging, where tactile and visual quality are central. There is growing use of high barrier coatings, decorative finishes and structural innovations (such as shelf ready or display packaging) in boxboard formats. The focus on sustainability leads manufacturers to offer boxboard with higher recycled content, lower weight and improved recyclability. Growth of e commerce logistics is stimulating demand for robust, protective yet lightweight boxboard cartons tailored for direct to consumer delivery. Regional supply chain improvements and localised production for Japanese brands is also enabling faster turnaround and customisation.

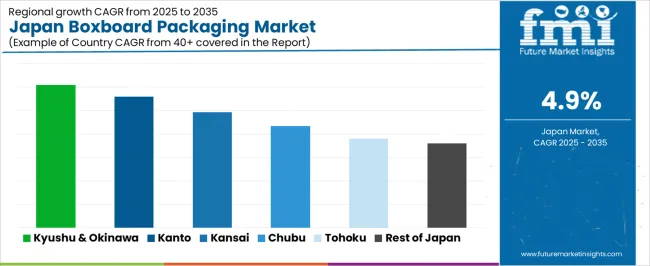

The demand for boxboard packaging in Japan is increasing as businesses across sectors such as food and beverage, e-commerce, consumer goods, and pharmaceuticals seek durable, lightweight, and eco-friendly packaging solutions. Boxboard is valued for its versatility, printability, and recyclability, making it a popular choice for packaging needs that prioritize sustainability and cost-effectiveness. With a growing focus on reducing plastic waste and meeting sustainability targets, businesses are increasingly opting for boxboard as an alternative packaging material. Regional demand varies based on local industrial activity, population density, and consumer preferences for eco-friendly products. The Kyushu & Okinawa region leads in demand due to strong agricultural production and food packaging needs, while Kanto and Kinki follow with significant demand driven by urban population, e-commerce, and industrial activity. This analysis explores the factors shaping the demand for boxboard packaging across different regions of Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.1% |

| Kanto | 5.6% |

| Kinki | 4.9% |

| Chubu | 4.3% |

| Tohoku | 3.8% |

| Rest of Japan | 3.6% |

Kyushu & Okinawa leads Japan in boxboard packaging demand with a CAGR of 6.1%. The region’s strong agricultural sector, including the production of fruits, vegetables, and seafood, drives the need for boxboard packaging for food products. Boxboard is widely used for packaging fruits, juices, and processed foods, which are significant exports for the region. Additionally, Kyushu & Okinawa has a growing demand for packaging in other sectors like e-commerce, where lightweight, cost-effective solutions like boxboard are preferred for shipping.

The region’s emphasis on sustainability and eco-friendly packaging materials, particularly in the food industry, further contributes to the increasing adoption of boxboard. With a growing awareness of reducing plastic waste and a push for greener practices in manufacturing and packaging, Kyushu & Okinawa is experiencing strong growth in boxboard packaging demand.

The Kanto region shows a solid CAGR of 5.6%. As Japan's largest economic hub, Kanto, which includes Tokyo and its surrounding prefectures, has a significant presence of retail, food processing, and e-commerce industries, all of which drive demand for boxboard packaging. The e-commerce boom in Tokyo and the surrounding areas has led to a substantial increase in the need for packaging materials, with boxboard being a preferred choice due to its cost-effectiveness, recyclability, and ability to withstand transportation challenges.

The region’s strong focus on sustainability also drives the preference for boxboard as an eco-friendly packaging material. Many companies in Kanto are adopting boxboard packaging as part of their green initiatives, particularly in the consumer goods and retail sectors. The growing demand for food and beverage packaging, along with the push for environmentally conscious packaging solutions, ensures continued demand for boxboard in Kanto.

The Kinki region demonstrates a steady CAGR of 4.9%. Kinki, home to cities like Osaka and Kyoto, has a well-developed manufacturing and retail sector, contributing to steady demand for boxboard packaging. The region's demand for boxboard is particularly strong in the food and beverage industry, where boxboard is widely used for packaging products such as snacks, beverages, and confectionery.

The growing emphasis on sustainability and the preference for recyclable materials also support demand for boxboard packaging in Kinki. As Japan's cultural and commercial center, the Kinki region’s focus on eco-friendly packaging in the fashion, cosmetics, and electronics industries further drives the adoption of boxboard. Although the growth rate is slower than Kyushu & Okinawa and Kanto, Kinki continues to be a significant market for boxboard packaging in Japan.

The Chubu region shows a moderate CAGR of 4.3%. Chubu, which includes major industrial hubs such as Nagoya, has a strong manufacturing base, including automotive, electronics, and food production industries. The demand for boxboard packaging in Chubu is driven by the region’s need for packaging solutions in food processing, automotive parts, and industrial goods. Boxboard is commonly used for packaging food products, including ready-to-eat meals, sauces, and beverages.

The region’s growing focus on sustainability, along with the push to reduce plastic packaging, is contributing to the rising use of boxboard as a more environmentally friendly alternative. As Chubu continues to invest in green technologies and eco-friendly practices, the demand for boxboard packaging will remain steady.

Tohoku shows a CAGR of 3.8%, while the Rest of Japan follows with a CAGR of 3.6%. These regions experience slower growth in boxboard packaging demand compared to more industrialized and densely populated areas like Kanto and Kyushu & Okinawa. However, the adoption of boxboard remains steady due to its use in food packaging, particularly in the agricultural sectors of Tohoku, where boxed fruits, vegetables, and processed goods are packaged and distributed.

The Rest of Japan, with more rural and less urbanized areas, sees slower growth in boxboard demand, but steady adoption continues due to local and regional food packaging requirements. As sustainability becomes a more prominent factor in consumer and industrial choices, the adoption of boxboard packaging in Tohoku and the Rest of Japan will continue to increase, albeit at a slower pace.

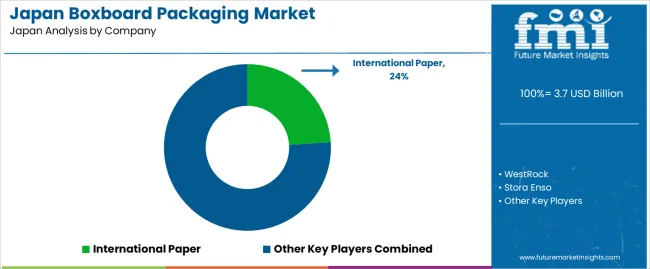

Demand for boxboard packaging in Japan continues to grow as the country experiences increased demand for sustainable and cost-effective packaging solutions in various industries, including food and beverage, consumer goods, and e-commerce. Companies such as International Paper (holding approximately 24% market share), WestRock, Stora Enso, Smurfit Kappa, DS Smith, and Mondi Group are key players in this market. The shift towards eco-friendly packaging materials, combined with Japan's strong emphasis on recycling and sustainability, is driving the adoption of boxboard packaging, especially in retail and logistics sectors.

Competition in the Japanese market is centered on product quality, customization, and supply chain efficiency. One focus is on enhancing the strength and durability of boxboard materials to support heavier products while maintaining a lightweight and cost-effective structure. Another competitive advantage lies in offering packaging solutions that are easy to recycle, reflecting the growing consumer and regulatory demand for environmentally responsible products. Additionally, companies are investing in innovation to provide customized sizes and designs that meet the specific needs of diverse industries. Marketing materials often highlight factors such as recyclability, strength, cost-effectiveness, and environmental sustainability. By aligning their products with the needs of Japanese businesses focused on sustainable packaging and efficient distribution, these companies aim to strengthen their position in the boxboard packaging market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| End-Use Industry | Food and Beverages, Personal Care, Pharmaceuticals, Others |

| Grade Type | Folding Boxboard (FBB), Solid Bleached Sulfate (SBS), Coated Recycled Board (CRB), White-lined Chipboard (WLC), Other Specialty Boards |

| Key Companies Profiled | International Paper, WestRock, Stora Enso, Smurfit Kappa, DS Smith, Mondi Group |

| Additional Attributes | The market analysis includes dollar sales by grade type and end-use industry categories. It also covers regional demand trends in Japan, particularly in food and beverage packaging, personal care, and pharmaceuticals. The competitive landscape highlights major players focusing on innovations in packaging sustainability, strength, and recyclability. Trends in the growing demand for eco-friendly and cost-effective packaging solutions are explored, along with advancements in boxboard production technologies. |

The global demand for boxboard packaging in japan is estimated to be valued at USD 3.7 billion in 2025.

The market size for the demand for boxboard packaging in japan is projected to reach USD 6.0 billion by 2035.

The demand for boxboard packaging in japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in demand for boxboard packaging in japan are food and beverages, personal care, pharmaceuticals and others.

In terms of grade type, folding boxboard (fbb) segment to command 45.0% share in the demand for boxboard packaging in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA