The demand for Bag-In-Box packaging in Japan is projected to grow from USD 202.3 billion in 2025 to USD 305.3 billion by 2035, reflecting a CAGR of 4.2%. Bag-In-Box packaging is widely used across multiple industries, including beverages, food, chemicals, and industrial liquids due to its cost-efficiency, lightweight nature, and ability to maintain product quality. The growing demand for eco-friendly packaging and sustainable solutions in Japan is driving the adoption of Bag-In-Box, as it is both recyclable and energy-efficient compared to traditional rigid packaging formats like glass bottles and plastic containers.

The demand will also benefit from the expanding liquid food packaging sector, where wine, juices, and liquid concentrates are increasingly packaged in Bag-In-Box due to its larger volume capacity and convenient dispensing systems. Moreover, the trend toward bulk purchasing, refillable packaging, and consumer preference for sustainability is expected to further boost demand for Bag-In-Box products. Over the next decade, as more industries adopt environmentally friendly packaging solutions and pursue sustainable practices, the market for Bag-In-Box in Japan is expected to continue expanding steadily.

The growth momentum analysis for Bag-In-Box packaging in Japan over the forecast period from 2025 to 2035 indicates a steady acceleration in demand, with an increase in both volume and adoption rate of the packaging format. From 2025 to 2030, the market will expand from USD 202.3 billion to USD 248.5 billion, contributing USD 46.2 billion in growth. This early phase will experience moderate acceleration, driven by increased adoption in beverages and liquid food packaging, especially as Japanese consumers and businesses continue to focus on sustainable packaging alternatives. The early momentum in this period is expected to be driven by the shift toward bulk purchasing in the retail and foodservice sectors.

From 2030 to 2035, the market will continue its upward trajectory, growing from USD 248.5 billion to USD 305.3 billion, adding USD 56.8 billion in value. This phase will see stronger momentum, with more industries and consumer segments adopting Bag-In-Box solutions. As sustainability concerns increase, especially in Japan's eco-conscious market, Bag-In-Box will continue to see rising demand. The momentum during this later phase will be driven by innovations in packaging technology, better integration with automated dispensing systems, and increasing regulatory pressures for reduced plastic use. The market will experience accelerated growth as these factors continue to shape the demand landscape for Bag-In-Box in Japan.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 202.3 billion |

| Forecast Value (2035) | USD 305.3 billion |

| Forecast CAGR (2025-2035) | 4.2% |

The demand for bag-in-box (BIB) packaging in Japan is growing due to the increasing preference for space-efficient, cost-effective, and sustainable packaging solutions in the food and beverage industry. BIB packaging is particularly popular in Japan for products like wine, juices, and other beverages, as it offers the advantage of preserving freshness while reducing waste and storage requirements. This trend is further supported by growing consumer interest in products that are both environmentally friendly and convenient, as BIB packaging reduces the carbon footprint compared to traditional glass or plastic containers. Additionally, the ease of handling and efficient transportation of BIB products further boosts their demand, especially in large-scale distribution and commercial foodservice applications.

The packaging format is also expanding into household and industrial liquids, where it provides a practical alternative to other packaging solutions. In terms of market growth, the 1-5 liter capacity segment is leading the demand, with the 5-10 liter segment projected to grow the fastest. As Japan continues to focus on sustainability, the shift to lightweight, recyclable packaging formats like BIB is expected to drive further growth in the market. However, the market faces challenges such as regulations around plastic use and increasing pressure for even more eco-friendly solutions. Despite these challenges, the demand for bag-in-box packaging in Japan is expected to continue expanding as industries and consumers alike seek more efficient and environmentally conscious packaging options.

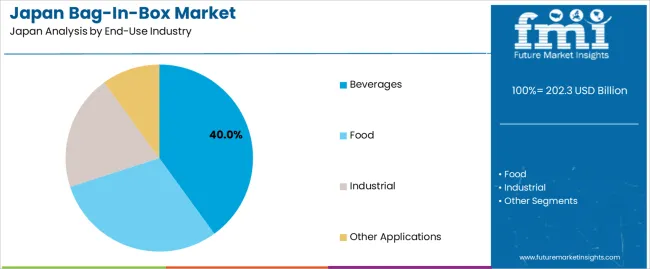

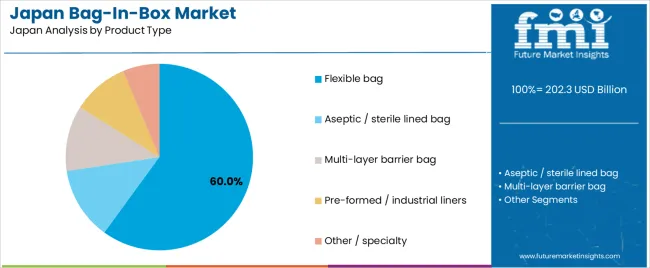

The demand for bag-in-box packaging in Japan is driven by two primary factors: end-use industry and product type. The beverages sector is the leading end-use industry, holding 40% of the market share, while flexible bags are the dominant product type, accounting for 60% of demand. Bag-in-box packaging is highly favored for its convenience, cost-effectiveness, and ability to maintain the quality of products like beverages, food, and industrial liquids. As consumer preferences continue to evolve, particularly in the beverage and food sectors, the demand for efficient, sustainable packaging solutions like bag-in-box remains strong.

The beverages industry holds the largest share in the bag-in-box packaging market in Japan, with 40% of the market demand. Bag-in-box packaging is commonly used for a wide range of beverages, including wine, juices, syrups, and non-alcoholic drinks. It is particularly valued for its ability to provide efficient storage, transport, and dispensing solutions. The flexible packaging design allows for large-volume packaging, making it a practical choice for both consumer and commercial uses. Additionally, the bag-in-box format is often used for beverages sold in bulk, such as in the foodservice industry or for home use.

One of the key advantages of bag-in-box for beverages is its ability to protect contents from oxidation, light, and contamination, which helps preserve the taste and quality of the product. As the demand for sustainable, eco-friendly packaging solutions rises, bag-in-box is gaining favor in the beverage industry due to its recyclability and reduced environmental footprint compared to traditional glass or plastic bottles. The growing popularity of bulk beverage packaging, especially in retail and foodservice, ensures that the beverages sector will continue to drive the demand for bag-in-box packaging in Japan.

The flexible bag product type is the dominant packaging solution in the bag-in-box market in Japan, capturing 60% of the demand. Flexible bags are preferred due to their lightweight nature, ease of handling, and ability to be customized in size and shape. These bags are highly versatile and are used in a variety of industries, including beverages, food, and industrial applications. They provide a cost-effective and efficient alternative to rigid containers, reducing transportation costs and storage space requirements while maintaining product quality and freshness.

Flexible bags are especially well-suited for bulk liquid products, as they can be easily filled, sealed, and transported without compromising the integrity of the product. They also allow for easy dispensing through taps or nozzles, making them ideal for beverages, food ingredients, and industrial liquids. As the packaging industry continues to focus on reducing waste and improving sustainability, the demand for flexible bags in bag-in-box packaging is expected to remain strong, reinforcing its leadership in the market.

Demand for bag in box packaging in Japan is driven by the growth of food and beverage liquid products, the efficiency advantages of lightweight bulk packaging and rising consumer and corporate focus on sustainability. The format’s ability to reduce material use, simplify logistics and extend shelf life is appealing in the context of Japan’s ageing population, high urban density and retail channel pressures. At the same time, regulatory emphasis on plastic reduction, changing consumption patterns toward home use and foodservice, and the rise of industrial liquid applications are shaping how bag in box uptake progresses.

What Are The Primary Growth Drivers For Bag In Box Packaging Demand in Japan?

Several factors support growth. First, the beverage and prepared food industries in Japan increasingly adopt bag in box for items such as juices, sauces and bulk wine due to the format’s convenience for dispensing and storage in limited space. Second, sustainability imperatives-including government targets to reduce single use plastics and consumer preference for eco friendly packaging-favour bag in box as a material efficient alternative to rigid containers. Third, demographic shifts (such as smaller households and single person living) and increased home cooking create demand for more convenient formats and resealable dispensing systems. Fourth, industrial and chemical applications (e.g., oils, detergents, lubricants) are increasingly using larger volume bag in box formats to optimise supply chain and storage costs in manufacturing and foodservice settings.

What Are The Key Restraints Affecting Bag In Box Packaging Demand in Japan?

Despite favourable trends, there are restraints. Initial investment in new filling lines, fitments and bag in box formats can be significant, especially for smaller Japanese producers. Consumer familiarity and acceptance of traditional packaging (such as bottles, cans and pouches) remain strong, which can slow format substitution in certain premium beverage segments. Supply chain logistics-such as ensuring barrier integrity, product compatibility and dispenser designs-pose technical challenges for some liquids in the bag in box format. Also, stricter quality and hygiene regulations in Japan may increase cost and restrict wider adoption in foodservice or high purity industrial sectors.

What Are The Key Trends Shaping Bag In Box Packaging Demand in Japan?

Emerging trends include increasing use of smaller capacity bag in box formats (for example 5 10 litres) suited to household or foodservice use, rather than only large bulk volumes. There is growing innovation in barrier films and fitments to extend shelf life for premium beverages, allowing wider adoption in higher value segments. Sustainability driven design is gaining momentum: lighter bags, fewer components, and improved recyclability are becoming priorities. Retailers and brands in Japan are also introducing bag in box systems for on site dispensing (e.g., wine or soft drinks) to reduce waste and improve freshness. Finally, growth of foodservice, catering and industrial bulk liquid supply chains is driving demand for larger volume bag in box solutions that offer cost and logistical efficiencies.

The demand for Bag-In-Box (BIB) packaging in Japan is growing, particularly in the food and beverage industry, where BIB is increasingly used for liquids like wine, juices, sauces, and other beverages. BIB packaging offers a convenient, cost-effective, and eco-friendly solution for the storage and transport of liquids, which is why it is gaining traction across various sectors. The growing consumer preference for sustainable packaging, as well as the increase in e-commerce and bulk purchasing trends, further supports this demand. Regional variations in demand for Bag-In-Box packaging in Japan are influenced by local industrial activity, population size, and consumer preferences. The Kanto region leads due to its economic and population size, while other regions such as Kyushu & Okinawa, Kinki, and Chubu follow with steady adoption driven by local industries and consumer habits. This analysis explores the key regional drivers behind Bag-In-Box packaging demand in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.3% |

| Kanto | 4.8% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.3% |

| Rest of Japan | 3.1% |

Kyushu & Okinawa leads Japan in Bag-In-Box packaging demand with a CAGR of 5.3%. The region’s significant agricultural output, particularly in the production of juices, sauces, and wines, is a key driver for the growing use of Bag-In-Box packaging. Additionally, the rising trend of sustainable packaging in the food and beverage industry is pushing manufacturers in Kyushu & Okinawa to adopt eco-friendly solutions like Bag-In-Box to meet environmental standards and consumer preferences.

Kyushu, being a large producer of agricultural products, such as citrus fruits and tea, also has strong local demand for bulk packaging solutions that can support liquid distribution efficiently. The demand for Bag-In-Box packaging is particularly strong in the beverage sector, and as sustainability initiatives grow in the region, the preference for this type of packaging is expected to continue rising.

The Kanto region shows a solid CAGR of 4.8%. As Japan’s economic and population hub, Kanto, which includes Tokyo and its surrounding prefectures, drives significant demand for Bag-In-Box packaging, particularly in the food and beverage industry. The presence of numerous food and beverage companies, both local and international, makes the region a key player in the adoption of advanced packaging solutions.

Kanto’s high population density and growing e-commerce sector also contribute to the rising demand for Bag-In-Box, as consumers increasingly opt for bulk purchasing and more sustainable packaging options for home delivery. The region’s robust distribution networks and its focus on cost-effective packaging solutions further increase the adoption of Bag-In-Box in both retail and institutional food supply chains.

The Kinki region demonstrates a strong CAGR of 4.2%. Kinki, which includes the Kansai metropolitan area (Osaka, Kyoto, Kobe), is a key economic region in Japan with a diverse range of industries, including food and beverage, manufacturing, and logistics. As the region continues to grow, the demand for Bag-In-Box packaging is driven by the food and beverage sector, where it is widely used for bulk packaging of liquids, such as juices and sauces.

The rise of sustainability initiatives in Kinki, along with the demand for efficient distribution and lower packaging costs, is also contributing to the region’s preference for Bag-In-Box packaging. Additionally, Kinki’s growing consumer interest in eco-friendly packaging and bulk purchasing in retail and food service sectors further supports the rise of Bag-In-Box solutions.

The Chubu region shows a moderate CAGR of 3.7%. Chubu, which includes major industrial hubs like Nagoya, has a strong manufacturing base and is home to many food production facilities. As the region continues to modernize and streamline packaging processes, the demand for Bag-In-Box is growing, particularly in the beverage and food processing industries.

Chubu’s proximity to agricultural regions, along with the increasing focus on sustainable packaging solutions, further supports the adoption of Bag-In-Box packaging. The region’s focus on efficiency in both production and distribution processes contributes to steady growth in the demand for cost-effective, durable, and environmentally friendly packaging options.

Tohoku shows a CAGR of 3.3%, while the Rest of Japan follows with a CAGR of 3.1%. While these regions experience slower growth compared to other areas, demand for Bag-In-Box packaging remains steady, driven by regional agricultural production, particularly in liquid products like fruit juices and sauces. The adoption of Bag-In-Box is more prevalent in these regions for local distribution and in smaller-scale manufacturing operations.

In Tohoku, the agricultural sector plays a central role in driving packaging needs, particularly for local beverage manufacturers. The Rest of Japan, which includes more rural and less densely populated areas, has a lower concentration of industries but continues to adopt Bag-In-Box for its cost-effective and sustainable nature. As environmental concerns and demand for efficient packaging solutions grow, these regions will continue to see steady, if slower, adoption of Bag-In-Box packaging.

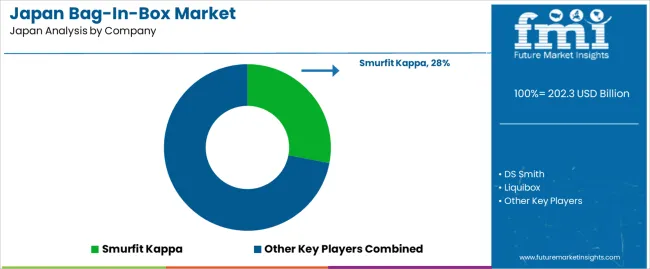

Demand for bag-in-box (BIB) packaging in Japan is growing as industries such as beverages, food, and chemicals increasingly adopt this flexible, cost-effective, and environmentally friendly packaging format. Companies like Smurfit Kappa (holding around 28.0% market share), DS Smith, Liquibox, Scholle IPN, and Mondi are key players in this market. Japan's strong packaging industry and the trend toward sustainable, recyclable solutions are driving the growth of BIB packaging, particularly in liquid and bulk products such as wine, juice, and cooking oils.

Competition in the Japanese market is driven by product customization, innovation, and the ability to meet sustainability goals. One strategic focus is improving the material quality and functionality of BIB systems, such as developing enhanced barrier films to extend shelf life and reduce environmental impact. Companies also focus on innovations in design, such as better-fitments, improved pourability, and more durable, easy-to-handle packaging. Another key competitive factor is regional manufacturing and supply chain efficiency, which allows suppliers to meet the needs of Japanese manufacturers quickly and cost-effectively. Marketing materials typically highlight features such as ease of storage, lower transportation costs, recyclable materials, and the ability to deliver safe, convenient packaging for both consumers and businesses. By aligning their offerings with the evolving demand for sustainable, efficient, and high-quality packaging, these companies are strengthening their position in the Japanese bag-in-box packaging market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| End-Use Industry | Beverages, Food, Industrial, Other Applications |

| Product Type | Flexible bag, Aseptic / sterile lined bag, Multi-layer barrier bag, Pre-formed / industrial liners, Other / specialty |

| Key Companies Profiled | Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, Mondi |

| Additional Attributes | The market analysis includes dollar sales by product type and end-use industry categories. It also covers regional demand trends in Japan, highlighting key areas such as Kyushu & Okinawa, Kanto, Kinki, and Chubu. The competitive landscape focuses on major players in the bag-in-box packaging market, with innovations in flexible, aseptic, and multi-layer barrier bag technologies. Trends in the growing demand for sustainable packaging solutions in beverages, food, and industrial applications are explored, along with advancements in packaging materials and processing techniques. |

The global demand for bag-in-box in japan is estimated to be valued at USD 202.3 billion in 2025.

The market size for the demand for bag-in-box in japan is projected to reach USD 305.3 billion by 2035.

The demand for bag-in-box in japan is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand for bag-in-box in japan are beverages, food, industrial and other applications.

In terms of product type, flexible bag segment to command 60.0% share in the demand for bag-in-box in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA