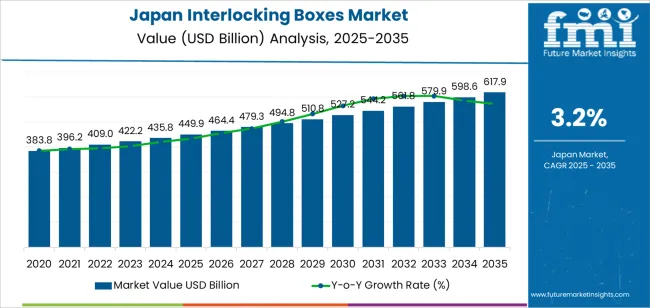

The demand for interlocking boxes in Japan is projected to grow from USD 449.9 billion in 2025 to USD 617.9 billion by 2035, reflecting a CAGR of 3.2%. Interlocking boxes are used extensively across industries such as logistics, manufacturing, and retail for efficient storage, transportation, and organization of goods. The growing trend of e-commerce, alongside the increasing need for space-saving and modular storage systems, is expected to continue driving demand for interlocking boxes. These systems provide significant advantages in terms of optimized space utilization, ease of handling, and cost-effectiveness, making them essential in industries where inventory management and organization are critical.

As supply chains become more globalized and complex, the demand for packaging and storage solutions like interlocking boxes is anticipated to increase. Furthermore, with the rising focus on sustainable and recyclable packaging materials, interlocking boxes made from environmentally friendly materials will gain traction. Innovations in design, such as customizable and stackable solutions, will also drive growth. With Japan's strong manufacturing base and its position as a leader in logistics and e-commerce, the demand for high-quality interlocking boxes will continue to expand in the forecast period.

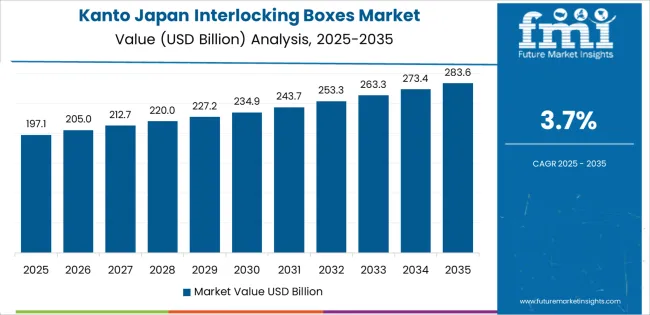

From 2025 to 2030, the demand for interlocking boxes in Japan will grow from USD 449.9 billion to USD 527.2 billion, contributing an increase of USD 77.3 billion in value. This early stage of growth will see acceleration driven by increased e-commerce activities, automation in warehouses, and the shift towards modular storage solutions. As Japan’s logistics infrastructure improves and businesses prioritize more efficient packaging systems, the adoption of interlocking boxes will rise, particularly in industries focused on warehousing, transportation, and inventory management. Additionally, the focus on cost-effective and space-efficient packaging solutions will boost the demand for interlocking boxes during this phase.

From 2030 to 2035, the market will grow from USD 527.2 billion to USD 617.9 billion, adding USD 90.7 billion in value. This phase will be marked by a moderation in growth rate, as the market reaches a more mature stage. While growth will continue due to the expansion of logistics networks and sustainability efforts, the demand will become more stable. The focus will shift towards upgrading and innovating existing systems, with businesses adopting advanced modular storage solutions and recyclable materials. Despite slower acceleration, the demand for interlocking boxes will remain steady, driven by the ongoing need for efficient storage and packaging solutions across multiple industries.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 449.9 million |

| Industry Forecast Value (2035) | USD 617.9 million |

| Industry Forecast CAGR (2025-2035) | 3.2% |

Demand for interlocking boxes in Japan is growing as both e-commerce and retail segments seek efficient, adhesive-free packaging solutions. Packaging producers in Japan report increased uptake of tray-style boxes that feature interlocking flaps instead of tape or staples for assembly and closure, contributing to demand for these structures in the fresh produce, electronics and logistics sectors. For example, one packaging board producer notes the development of “S-Lock” and “L-Lock” tray-type solutions which use sliding flaps to reduce material usage while ensuring secure stacking.

A second driver of demand is the emphasis on sustainability and efficient logistics in Japanese packaging operations. Interlocking box designs support faster assembly on-line, reduce the need for extra sealing materials (such as staples or tape), and align with recyclable corrugated-board supply chains. In addition, the logistics-intensive nature of Japanese domestic transport and the trend toward compact urban fulfilment facilities encourage box formats that offer strong structural performance and reduced waste. Challenges include the limited export of interlocking formats to global markets and the higher cost of precisely-formatted die-cut board compared with standard box styles. Nonetheless, given the alignment of packaging efficiency, sustainability mandates and domestic manufacturing strength, demand for interlocking boxes in Japan appears set to grow steadily.

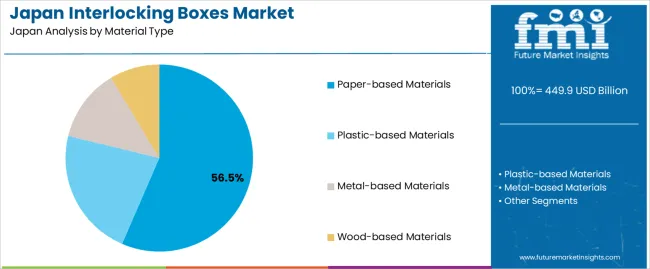

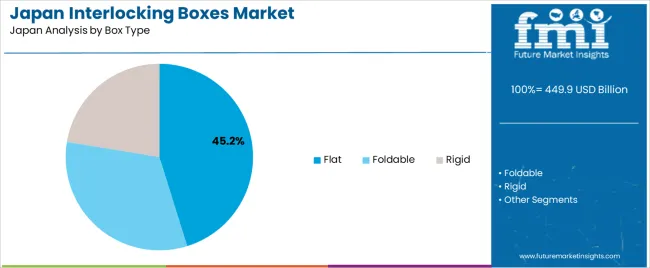

The demand for interlocking boxes in Japan is primarily driven by material type and box type. The leading material type is paper-based materials, accounting for 57% of the market share, while flat boxes dominate the box type segment, capturing 45.2% of the demand. Interlocking boxes are widely used in various industries, including packaging, logistics, and retail, due to their efficient stacking, space-saving design, and versatility in storage and transportation.

Paper-based materials lead the market for interlocking boxes in Japan, holding 57% of the demand. Paper-based interlocking boxes are preferred due to their eco-friendliness, cost-effectiveness, and ease of recycling. These boxes are commonly used for packaging in industries such as food and beverages, electronics, and consumer goods, where lightweight and sustainable packaging solutions are essential.

The demand for paper-based interlocking boxes is driven by the growing consumer preference for environmentally friendly packaging options and the increasing regulations around waste management and sustainability. As businesses look to reduce their environmental impact, paper-based interlocking boxes provide a viable and reliable alternative to plastic-based materials. Their biodegradability and recyclability further enhance their appeal, ensuring continued demand in the Japanese market.

Flat boxes are the dominant box type for interlocking boxes in Japan, capturing 45.2% of the demand. Flat boxes are highly versatile, as they are easy to store and transport due to their compact design. They are used across various sectors, from retail packaging to logistics and storage, where efficient space utilization is crucial.

The popularity of flat boxes is driven by their cost-effectiveness and functionality. Their design allows for easy stacking and handling, making them ideal for shipping and storage applications. Additionally, flat boxes are often used in retail for displaying products, as they provide a convenient and practical solution for both storage and visual appeal. As businesses continue to seek efficient packaging solutions that maximize space while reducing costs, flat interlocking boxes are expected to maintain their dominance in the market.

Demand for interlocking boxes in Japan is shaped by urbanised retail and logistics systems where packaging must balance space efficiency and structural strength. E-commerce growth and smaller household sizes are increasing demand for packaging that is easy to assemble, stack, and transport without extensive adhesives. At the same time, the mature packaging market, sustainability regulation, and high labour costs introduce constraints. Together, these forces define how interlocking box formats are gaining traction in Japan’s packaging industry.

Several drivers underpin growth. First, the expansion of online retail and rapid-delivery models in Japan raises the need for durable, easy-to-handle boxes that support logistics and returns. Second, interlocking box designs reduce reliance on tape or glue and thus appeal to manufacturers seeking efficient packaging lines and lower labour costs. Third, brands in Japan’s consumer goods and electronics sectors are leveraging interlocking boxes for shelf-ready displays and premium presentation, bolstering demand for reinforced formats. Fourth, efforts to improve sustainability-such as promoting mono-material and reusable boxes-push interlocking formats that facilitate material recovery and reduce waste.

Despite favourable conditions, several restraints apply. The higher cost of designing and tooling interlocking mechanisms can discourage smaller packaging converters or brands from switching from simpler box formats. Supply-chain disruptions in corrugated board, recycled fibre or specialty liners may raise lead-times or costs for interlocking boxes. Some end-use segments in Japan may continue to favour conventional box formats because the added functionality of interlocking designs may not justify extra cost in low-damage applications. Finally, stringent recycling and material-recovery requirements increase complexity for multi-component interlocking structures and may slow adoption.

Important trends include rising use of interlocking boxes with lightweight, high-strength corrugated materials and minimal adhesives to meet Japan’s sustainability targets. There is increased deployment of boxes engineered for automated assembly and robotic packaging lines, reflecting Japanese manufacturing efficiency focus. Another trend is growth of custom printed and branded interlocking boxes for direct-to-consumer (D2C) and subscription-box segments, where unboxing experience matters. Lastly, modular box designs with interlocking features enable efficient returns, reuse and circular-economy packaging models, aligning with Japan’s emphasis on resource-efficiency and waste-reduction policies.

The demand for interlocking boxes in Japan is primarily driven by the need for efficient and cost-effective storage, handling, and packaging solutions across various industries, including logistics, e-commerce, and manufacturing. These boxes are valued for their ability to be securely stacked and interlocked, optimizing space and improving organizational efficiency. Interlocking boxes are commonly used in industries such as retail, food and beverage, and electronics, where products need to be safely transported and stored while maintaining easy accessibility.

Additionally, the increasing focus on sustainability and recycling has contributed to the adoption of interlocking boxes, which can often be reused and are made from eco-friendly materials. Regional demand for interlocking boxes is influenced by factors such as industrial concentration, logistics infrastructure, and the adoption of modern packaging solutions.

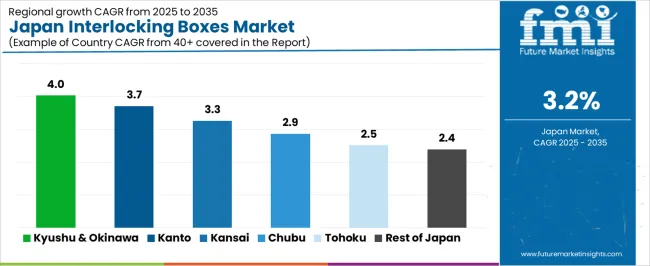

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.0% |

| Kanto | 3.7% |

| Kinki | 3.3% |

| Chubu | 2.9% |

| Tohoku | 2.5% |

| Rest of Japan | 2.4% |

Kyushu & Okinawa leads the demand for interlocking boxes in Japan with a CAGR of 4.0%. The region's strong focus on industrial and agricultural activities, particularly in sectors like food production and retail, is a key factor driving the adoption of interlocking boxes. With a growing emphasis on efficient logistics and cost-effective packaging solutions, businesses in Kyushu & Okinawa increasingly rely on interlocking boxes for transporting and storing goods.

Moreover, Okinawa’s tourism sector also drives demand for packaging solutions, as interlocking boxes are used in hospitality and retail industries to streamline storage and packaging processes. The region’s ongoing adoption of sustainable practices and green packaging solutions further enhances the demand for interlocking boxes, contributing to the region’s strong growth in this market.

Kanto shows strong demand for interlocking boxes with a CAGR of 3.7%. As Japan's most economically developed region, Kanto, which includes Tokyo, is home to a high concentration of industries that require efficient packaging solutions, including e-commerce, manufacturing, and retail. The region's focus on logistics and distribution has led to an increased need for interlocking boxes, which help businesses reduce storage space, enhance product accessibility, and streamline supply chain operations.

The growing e-commerce sector in Kanto, driven by consumer demand for fast and convenient shipping, also contributes to the rising use of interlocking boxes. As businesses seek to optimize their warehousing and shipping processes, the demand for these space-efficient, secure packaging solutions is expected to remain strong.

Kinki, with a CAGR of 3.3%, shows steady demand for interlocking boxes. The region, home to Osaka and Kyoto, has a diverse industrial base, with key sectors such as manufacturing, retail, and logistics driving the adoption of interlocking boxes. The demand in Kinki is supported by the region’s well-developed supply chains, particularly in consumer goods and food production, where interlocking boxes are used to ensure secure and efficient storage and transportation.

Although the demand growth is slower compared to Kyushu & Okinawa and Kanto, Kinki's steady adoption of interlocking boxes reflects a mature market that continues to prioritize cost-effective, space-saving packaging solutions. The region’s ongoing efforts to integrate sustainable practices into its industries further support the growth of the market.

Chubu shows moderate growth in the demand for interlocking boxes with a CAGR of 2.9%. The region, known for its strong manufacturing sector, particularly in automotive and industrial equipment, is increasingly adopting interlocking boxes to streamline storage and logistics processes. Although the demand in Chubu is slower compared to other regions, the region’s focus on improving manufacturing efficiency and reducing operational costs supports the gradual rise in demand for interlocking boxes.

Chubu's industrial base, which includes a significant number of suppliers and manufacturers in automotive, electronics, and machinery, is driving the demand for durable, space-efficient packaging solutions. As these industries continue to evolve and adopt modern storage solutions, the market for interlocking boxes is expected to grow at a moderate pace.

Tohoku, with a CAGR of 2.5%, and the Rest of Japan, with a CAGR of 2.4%, show slower growth in the demand for interlocking boxes. These regions are more rural and less industrialized compared to other areas like Kanto and Kyushu & Okinawa. While the agricultural and manufacturing sectors in Tohoku and the Rest of Japan are important, they generally use more traditional packaging solutions, leading to slower adoption of interlocking boxes.

However, as logistics and transportation networks in these regions improve and industries modernize their packaging practices, the demand for interlocking boxes is expected to grow gradually. The increased focus on sustainability and the adoption of more efficient packaging solutions will drive future growth in these areas, albeit at a more moderate pace.

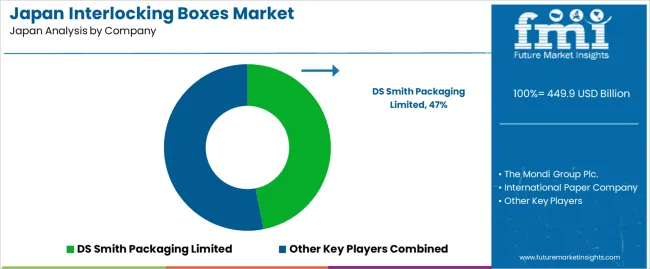

The interlocking boxes industry in Japan is growing as e-commerce fulfillment, consumer goods shipments and industrial packaging needs expand. Industry data suggest global demand for interlocking boxes will rise, driven by online retail and packaging sustainability trends. The Japanese market specifically benefits from domestic manufacturing and strong logistics infrastructure. Leading companies in the sector include DS Smith Packaging Limited (holding approximately 46.9% market share), The Mondi Group Plc, International Paper Company, All Packaging Company and Smurfit Kappa Corporation Limited.

Competition in this industry revolves around material innovation, ease of assembly and sustainability credentials. Suppliers emphasise interlocking designs that require no glue or staples, thereby reducing labour and improving recyclability. They also invest in recycled paperboard and lightweight constructions to lower shipping weight and comply with Japanese recycling regulations. Another competitive factor is delivery speed and flexibility of production, as Japanese retailers demand quick turnarounds and custom prints for branding.

For example, domestic packaging firms supply tray-type corrugated formats with locking features, reducing assembly time in Japanese logistics operations. Brochure content typically highlights board strength, nesting efficiency, lock-tab performance and recycled content percentage. By tailoring offerings to meet Japanese logistics, retail and sustainability demands, these companies are positioning themselves for growth in Japan’s interlocking boxes industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Material Type | Paper-based Materials, Plastic-based Materials, Metal-based Materials, Wood-based Materials |

| Box Type | Flat, Foldable, Rigid |

| End-Use | E-commerce, Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Automotive, Industrial Goods |

| Key Companies Profiled | DS Smith Packaging Limited, The Mondi Group Plc., International Paper Company, All Packaging Company, Smurfit Kappa Corporation Limited |

| Additional Attributes | The market analysis includes dollar sales by material type, box type, and end-use categories. It also covers regional demand trends in Japan, particularly driven by the growing demand for interlocking boxes in e-commerce packaging and the food and beverage sector. The competitive landscape highlights key manufacturers focusing on innovations in packaging solutions, sustainability, and material performance. Trends in the increasing use of interlocking boxes in pharmaceuticals, automotive, and industrial applications are explored, along with advancements in packaging strength, stackability, and environmental impact. |

The demand for interlocking boxes in japan is estimated to be valued at USD 449.9 billion in 2025.

The market size for the interlocking boxes in japan is projected to reach USD 617.9 billion by 2035.

The demand for interlocking boxes in japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in interlocking boxes in japan are paper-based materials, plastic-based materials, metal-based materials and wood-based materials.

In terms of box type, flat segment is expected to command 45.2% share in the interlocking boxes in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interlocking Boxes Market Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Interlocking Boxes

Demand for Interlocking Boxes in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cake Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Foldable Plastic Pallet Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA