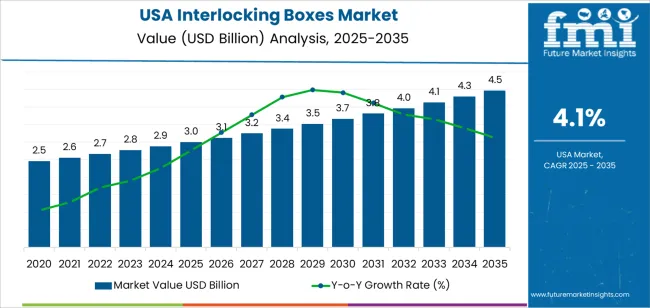

The USA interlocking boxes demand is valued at USD 3.0 billion in 2025 and is projected to reach USD 4.5 billion by 2035, supported by a CAGR of 4.1%. Demand is influenced by increased use of secure, collapsible, and modular packaging solutions across e-commerce fulfilment, consumer goods distribution, and industrial shipping operations. Interlocking formats provide structural stability without adhesives, supporting high-volume packaging workflows and repeat handling through distribution centres. Broader adoption of environmentally responsible packaging options and continued optimisation of material yield within corrugated converting facilities further shape procurement patterns.

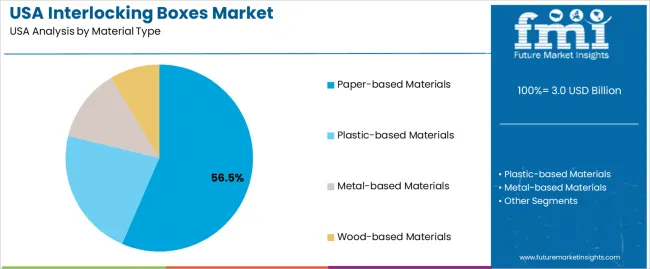

Paper-based materials remain the leading material type, driven by recyclability, ease of processing, and compatibility with automated packaging lines. Their strength-to-weight characteristics and consistent performance across printing, folding, and die-cutting operations make them suitable for retail, subscription-box, and industrial packaging requirements. Steady advancements in corrugated board engineering also contribute to improved durability and moisture resistance in demanding supply-chain conditions.

The West, South, and Northeast record the strongest demand due to dense logistics corridors, e-commerce hubs, and large regional manufacturing bases. These areas maintain extensive converting capacity, distribution infrastructure, and supplier networks that support continuous sourcing of interlocking formats for high-throughput packaging operations. DS Smith Packaging Limited, The Mondi Group Plc., International Paper Company, All Packaging Company, and Smurfit Kappa Corporation Limited are the principal suppliers. Their portfolios include corrugated interlocking designs, custom die-cut formats, and structurally reinforced packaging solutions used in consumer goods transport, protective packaging, and retail-ready applications.

The acceleration and deceleration pattern shows a modest early-period rise from 2025 to 2029. Growth during these years is supported by steady use of interlocking designs in warehousing, e-commerce fulfilment, retail logistics, and industrial storage. Facilities expand procurement to improve stacking stability, reduce material-handling labour, and support space-efficient transport. Increased adoption of reusable high-density polymer boxes will reinforce this early acceleration phase.

From 2030 to 2035, the segment shifts toward a controlled deceleration as purchasing aligns with replacement cycles and established logistics workflows. Annual expansion becomes steadier, shaped by predictable replenishment across distribution centres and manufacturing plants. Broader use of automated-storage systems, where standardised box footprints are required, sustains baseline demand without creating rapid surges. Incremental improvements in box durability, load-bearing performance, and compatibility with conveyor systems contribute to late-period gains. The pattern reflects a transition from early operational expansion to a mature, stability-driven phase guided by long equipment lifecycles and consistent integration of interlocking containers across USA logistics and industrial environments.

| Metric | Value |

|---|---|

| USA Interlocking Boxes Sales Value (2025) | USD 3.0 billion |

| USA Interlocking Boxes Forecast Value (2035) | USD 4.5 billion |

| USA Interlocking Boxes Forecast CAGR (2025 to 2035) | 4.1% |

Demand for interlocking boxes in the USA is increasing because manufacturers and retailers require packaging solutions that are durable, easy to assemble and compatible with high-speed logistics. Interlocking box designs lock together without tape or adhesives, reducing assembly time and improving transit reliability in e-commerce, retail display and shipping applications. Growth is further supported by rising volumes of online orders, focus on sustainability and consumer expectation for well-presented and secure packaging.

Packaging converters respond by offering interlocking formats with custom die-cuts, branding opportunities and strength enhancements that suit electronics, cosmetics, food & beverage and industrial goods shipments. Report data show the interlocking boxes industry is projected to experience steady growth driven by these factors. Constraints include higher cost relative to standard folding cartons, need for specialised tooling and die-cutting equipment and competition from alternative packaging formats like corrugated shippers or standard cartons. Some smaller users may defer adoption until scale economies justify tooling investment.

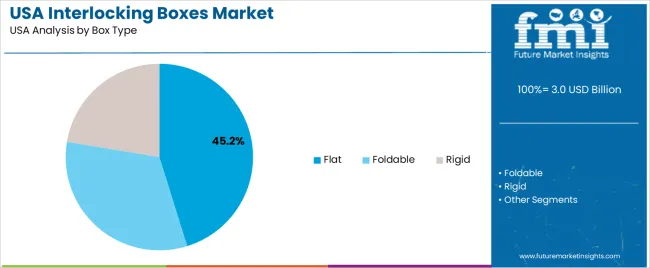

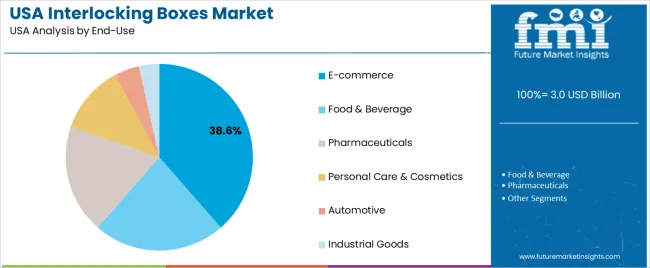

Demand for interlocking boxes in the United States reflects packaging needs across shipping, retail distribution, and protective product handling. Material selection depends on strength requirements, ecofriendly targets, and compatibility with automated packing lines. Box-type preferences reflect handling practices, storage efficiency, and product-protection expectations. End-use distribution highlights industries that rely on secure closure systems to reduce adhesive use and maintain structural stability during transport.

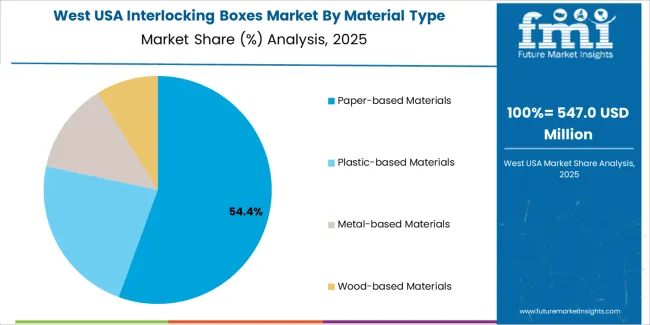

Paper-based materials hold 56.5% of national demand and represent the leading material category for interlocking boxes. Their strength-to-weight ratio, recyclability, and compatibility with printing and branding make them widely used for consumer shipments and retail packaging. Plastic-based materials represent 22.3%, supporting moisture-sensitive, reusable, or heavy-load applications. Metal-based materials hold 12.6%, used in specialised industrial packaging requiring impact resistance. Wood-based materials account for 8.6%, serving niche uses such as luxury goods and high-strength protective applications. Material distribution reflects durability needs, ecofriendly objectives, and integration with supply-chain machinery across diverse packaging environments.

Key drivers and attributes:

Flat interlocking boxes hold 45.2% of USA demand and form the dominant box-type category. Their space-efficient shipping, ease of assembly, and adaptability make them widely used across e-commerce and retail distribution. Foldable interlocking boxes represent 32.4%, supporting operations requiring compact storage and quick manual or automated assembly. Rigid interlocking boxes account for 22.4%, serving applications requiring high structural strength for fragile, dense, or premium goods. Box-type distribution reflects handling practices, stacking requirements, and material-efficiency considerations across fulfilment centres and commercial shipments.

Key drivers and attributes:

E-commerce holds 38.6% of national demand and represents the largest end-use segment. High shipping frequency and varied product sizes drive extensive use of interlocking formats that eliminate adhesives and support automated packing lines. Food and beverage applications account for 22.8%, supporting packaged goods requiring secure transit. Pharmaceuticals represent 18.9%, relying on stable, tamper-resistant packaging. Personal care and cosmetics hold 11.9%, often using lightweight branded boxes. Automotive applications account for 4.3%, while industrial goods represent 3.5%, typically using reinforced materials. End-use distribution reflects differences in handling requirements, fragility, regulatory needs, and shipment frequency.

Key drivers and attributes:

Growing e-commerce volumes, need for reusable transport packaging, and emphasis on return-logistics efficiency are driving demand.

In the United States, demand for interlocking boxes, a type of reusable, foldable rigid container with integral locking geometry, rises as manufacturers and logistics operators seek packaging solutions that minimise empty return volume and reduce waste. E-commerce fulfilment growth, multi-modal transport workflows and increased corporate ecofriendly goals push firms toward reusable packaging systems. Interlocking boxes support automation, stacking stability and exchange-cycle efficiency in automotive parts distribution, appliance supply chains and third-party logistics networks, which strengthens usage across industrial and commercial sectors.

Higher per-unit cost, system-wide standardisation challenges and lower availability of return-loops restrain broader usage.

Reusable interlocking boxes typically carry a higher upfront cost than one-way packaging or simple containers, which can deter smaller or short-cycle users. Implementing systems requires establishment of return logistics, cleaning or refurbishment operations and consistent reuse cycles to justify investment; some operations lack these loops, which limits adoption. Absence of universal container standards means compatibility across customers, carriers and facilities may vary, which complicates packaging decisions in diversified supply chains.

Growing use in closed-loop automotive and appliance supply chains, rising use of automated warehousing and cleaner-logistics initiatives are shaping industry direction.

Industrial users with predictable return logistics, such as automotive assembly, electronics parts and white-goods supply are increasingly adopting interlocking boxes because they deliver cost and environmental benefits over extended cycles. Automation in warehousing, with conveyors, robotics and automated sorting, drives preference for container systems that interlock, stack securely and integrate with handling equipment. Ecofriendly programs and corporate reporting requirements are prompting companies to calculate total-life-cycle packaging impact, which supports migration from single-use to reusable interlocking box formats in the USA.

Demand for interlocking boxes in the USA is increasing through 2035 as manufacturers, logistics providers, e-commerce warehouses, and consumer-goods companies expand the use of modular, stackable storage and transport containers. Interlocking boxes support inventory organization, warehouse picking efficiency, retail back-room management, and secure handling of small components across industrial, commercial, and household settings. Growth is influenced by rising fulfillment-center activity, standardization of reusable packaging, and wider adoption of plastic, polypropylene, and high-impact composite materials. Demand differs by region based on warehouse density, distribution-center expansion, and manufacturing concentration. The West leads with a 4.7% CAGR, followed by the South (4.2%), the Northeast (3.8%), and the Midwest (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.7% |

| South | 4.2% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The West grows at 4.7% CAGR, supported by strong e-commerce fulfillment, warehouse automation, and retail distribution activity across California, Washington, and Oregon. Distribution centers use interlocking boxes to streamline order picking, improve stacking safety, and organize high-turnover inventory. Technology campuses and electronics facilities deploy modular boxes for component storage within controlled environments. Retail chains rely on durable interlocking containers for back-room stock organization and product handling. Food-service distributors adopt stackable boxes to improve transport stability for packaged items. High warehouse density and strong logistics activity across major metropolitan areas reinforce steady adoption of standardized, reusable storage formats.

The South grows at 4.2% CAGR, supported by expanding logistics corridors, manufacturing clusters, and warehouse construction across Texas, Florida, Georgia, and the Carolinas. E-commerce operators use interlocking boxes to manage order-picking workflows and increase handling efficiency for diverse product categories. Industrial facilities adopt rugged interlocking containers for organizing tools, parts, and assembly components. Large retail hubs rely on reusable modular containers for distribution-center storage and multi-store replenishment cycles. Food, beverage, and home-improvement suppliers use interlocking formats for secure stacking during regional transport. Rising warehouse automation also strengthens requirements for compatible, dimension-standardized containers.

The Northeast grows at 3.8% CAGR, supported by dense warehouse networks, institutional supply chains, and commercial distribution systems across New York, Massachusetts, Pennsylvania, and neighboring states. Warehouses use interlocking boxes for controlled storage of small items, maintenance supplies, and packaging materials. Universities, laboratories, and research facilities rely on modular containers for organized handling of non-hazardous equipment and inventory. Retail operations use stackable boxes for seasonal merchandise storage and product rotation. Distribution centers supporting pharmaceuticals and electronics require stable stacking and secure compartmentalization for sensitive items. Although warehouse capacity is limited by land constraints, high turnover across regional distribution networks supports steady adoption.

The Midwest grows at 3.3% CAGR, supported by manufacturing plants, agricultural supply chains, automotive facilities, and large regional distribution hubs across Illinois, Ohio, Michigan, and Minnesota. Industrial users rely on interlocking boxes for organizing tools, machine components, and maintenance items. Automotive suppliers adopt sturdy containers for parts organization within assembly and inspection lines. Agricultural distributors use stackable boxes for packaged supplies, small tools, and accessory storage. Warehouses serving household goods and hardware sectors maintain steady use of interlocking formats for inventory management. Although regional growth is moderate, essential industrial and logistics workflows maintain consistent adoption.

Demand for interlocking boxes in the USA is shaped by a concentrated group of packaging producers supplying e-commerce, consumer goods, industrial components, and fulfilment operations. DS Smith Packaging Limited holds the leading position with an estimated 47.4% share, supported by controlled corrugated-board production, consistent structural integrity, and strong supply relationships with large USA distributors and online-retail fulfilment centres. Its position is reinforced by reliable die-cut precision and predictable performance in automated packing lines.

The Mondi Group Plc. and International Paper Company follow as major participants, providing interlocking designs used across fast-moving consumer goods, electronics, and industrial shipments. Their strengths include stable material strength, consistent dimensional accuracy, and broad USA manufacturing footprints that ensure dependable lead times. All Packaging Company maintains a notable role through custom interlocking formats tailored to mid-scale brands requiring controlled rigidity and efficient assembly.

Smurfit Kappa Corporation Limited contributes additional capability with engineered corrugated solutions that support high stacking strength, moisture control, and compatibility with automated warehousing systems. Competition across this segment centers on board strength, cut accuracy, fold reliability, print compatibility, and supply continuity. Demand remains strong as USA shippers focus on secure, tool-free packaging that reduces assembly time, improves structural stability during transport, and supports e-commerce, just-in-time fulfilment, and protective transit requirements across diverse product categories.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | Paper-based Materials, Plastic-based Materials, Metal-based Materials, Wood-based Materials |

| Box Type | Flat, Foldable, Rigid |

| End-Use | E-commerce, Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Automotive, Industrial Goods |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | DS Smith Packaging Limited, The Mondi Group Plc., International Paper Company, All Packaging Company, Smurfit Kappa Corporation Limited |

| Additional Attributes | Dollar sales by material type, box type, and end-use categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of eco-friendly and engineered packaging providers; advancements in recyclable paper-based interlocking systems, high-strength rigid designs, and lightweight foldable formats; integration with e-commerce fulfillment, food-safe packaging, pharmaceutical distribution, and industrial goods transport across the USA. |

The global demand for interlocking boxes in USA is estimated to be valued at USD 3.0 billion in 2025.

The market size for the demand for interlocking boxes in USA is projected to reach USD 4.5 billion by 2035.

The demand for interlocking boxes in USA is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for interlocking boxes in USA are paper-based materials, plastic-based materials, metal-based materials and wood-based materials.

In terms of box type, flat segment to command 45.2% share in the demand for interlocking boxes in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interlocking Boxes Market Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Interlocking Boxes

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryoboxes Market Size and Share Forecast Outlook 2025 to 2035

Wax Boxes Market Insights - Growth & Demand Forecast 2025 to 2035

Market Share Breakdown of Cryoboxes Manufacturers

Soap Boxes Market Analysis – Growth & Demand 2025 to 2035

Gift Boxes Market Trends - Size & Forecast 2025 to 2035

Cake Boxes Market from 2025 to 2035

Lunch Boxes & Lunch Bags Market

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Burger Boxes Market Size, Share & Forecast 2025 to 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Plywood Boxes Market Size and Share Forecast Outlook 2025 to 2035

Packing Boxes Market Trends - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Analyzing Acrylic Boxes Market Share & Industry Leaders

Wardrobe Boxes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA