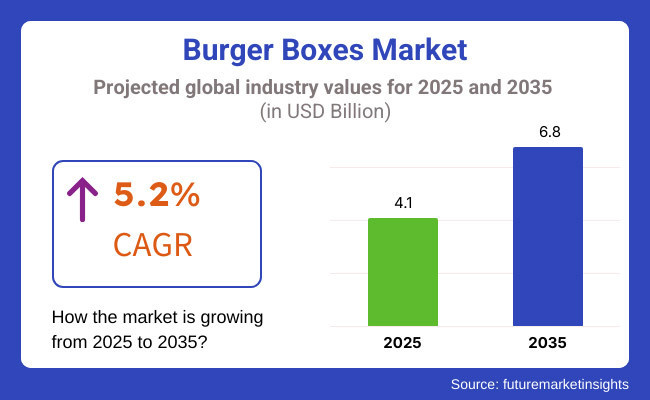

The burger boxes market is projected to be valued at USD 4.1 billion in 2025 and is anticipated to reach USD 6.8 billion by 2035. A CAGR of 5.2% is expected to be recorded during the forecast period. In 2024, sales were estimated at USD 3.8 billion, driven by rising adoption of branded and environmentally responsible food packaging formats within the fast food and delivery ecosystem.

Growth in the market has been enabled by the continued expansion of quick service restaurants (QSRs) and third-party delivery platforms. Aggressive expansion plans have been announced in 2025 by global chains such as McDonald’s and Burger King, in response to sustained post-pandemic demand for on-the-go dining. In a press release issued in March 2024, McDonald’s CEO Chris Kempczinski stated that “Our global comparable sales growth in the first quarter marks 13 consecutive quarters of positive comparable sales growth with 30% growth over the last 4 years.”

He added that “As consumers are more discriminating with every dollar that they spend, we will continue to earn their visits by delivering leading, reliable, everyday value and outstanding execution in our restaurants.” These developments have reinforced the requirement for burger boxes that ensure food texture is preserved, grease leakage is minimized, and brand messaging is effectively sustained.

A transition away from foam and single-use plastics has been observed across markets. From 2025 to 2035, the supply chain for burger boxes is expected to be dominated by biodegradable and compostable material formats. Kraft paper, molded fiber, and corrugated board are being increasingly adopted. Eco-conscious coatings, such as soy-based inks and aqueous barriers, are gaining preference. Polyethylene laminations are being replaced by water-based barrier coatings by many Tier 1 suppliers, in an effort to reduce the environmental footprint without compromising structural or functional performance.

Technological enhancements in digital printing have been introduced to enable high-impact, short-run burger box designs tailored to consumer segments. A recyclable, digitally printed clamshell range was unveiled by Graphic Packaging International in 2024, with specific targeting of Gen Z consumers by fast food chains being enabled. These solutions are being adopted to reinforce customer engagement while aligning with sustainability mandates.

Regulatory frameworks in foodservice packaging are acting both as a driver and constraint. Substantial investment in R&D has been necessitated by global suppliers to meet diverging regional standards while managing cost volatility in paper pulp and bio-based resin feedstocks.

Despite these challenges, an incremental opportunity of USD 2.7 billion is expected to be generated by 2035. This projected surge will be underpinned by a global pivot toward climate-positive packaging and the repositioning of burger boxes as critical assets in enhancing performance, safety, and brand resonance across the fast food value chain.

Paper based burger boxes are expected to dominate the material segment with an estimated 42.6% market share by 2025, driven by their affordability, biodegradability, and compatibility with large-scale fast food operations.

These boxes have become the standard in quick service restaurants (QSRs), food trucks, and high-volume takeaway counters where cost efficiency and speed of use are critical. Lightweight and easy to fold, paper boxes can be produced in bulk with minimal raw material input and are increasingly made from recycled or responsibly sourced fibers, aligning with growing environmental mandates and consumer expectations.

In addition to being cost-effective, paper burger boxes are readily compostable or recyclable, making them an ideal choice for municipalities and brands looking to meet zero-waste goals. Their surface is well-suited for eco-safe inks and water-based coatings, enabling basic branding without compromising sustainability.

Furthermore, modern paper variants can be enhanced with grease-resistant barriers that prevent leakage without the use of plastic linings. This advancement has widened paper’s usability across regular and saucy burger products. With an optimal balance of economics, compliance, and environmental favorability, paper has emerged as the most practical and widely accepted material solution for burger box packaging across both developed and emerging economies.

Square-shaped burger boxes are projected to lead the shape-based segmentation with an estimated 71.4% share of the market by 2025, driven by their practical advantages in handling, storage, and product presentation. Their geometric uniformity aligns well with operational needs in high-volume QSR kitchens where space efficiency and rapid order fulfillment are critical. Square boxes optimize carton stacking, reduce shelf footprint, and simplify packaging logistics during bulk transport or in delivery partner containers.

Beyond logistics, square shapes accommodate standard and double-patty burger builds more effectively than round counterparts, allowing for snug fit without compressing the product or compromising toppings. This prevents structural disintegration and helps preserve the visual appeal of gourmet offerings. Additionally, square formats provide ample surface area for branding elements, nutritional labeling, and promotional messaging, which are essential for chain visibility and consumer recall.

From an environmental standpoint, square die cuts minimize material waste during manufacturing compared to circular molds. This makes them not only more functional but also more cost-effective and sustainable. As urban foodservice operators and cloud kitchens focus on speed, consistency, and visual branding, square burger boxes are expected to remain the default configuration across formats and price tiers.

Sustainability and Environmental Regulations

In addition, changing regulations, rising environmental concerns among consumers and manufacturers have forced the burger boxes market to become more active. Governments around the world are mandating bans or restrictions on single-use plastics, leaving manufacturers no choice but to turn to biodegradable, compostable, or recyclable materials. However, switching to sustainable alternatives, like molded fiber or plant-based packaging, tends to be more expensive to produce, which can hurt margins. Another lingering challenge has been making eco-friendly burger boxes durable and able to resist grease.

Innovation in Sustainable and Customizable Packaging

This increases the opportunities for the market players, as the demand for packaging solutions which are eco-friendly and aesthetically appealing for the burger packaging is projected to grow. Brands are also investing in things like plant-based coated kraft paper, sugarcane bagasse and compostable bioplastics. The increase in food delivery services and the prevalence of takeaway culture only add to the demand for high-quality, leak-proof, and tamper-evident packaging. Custom-printed and branded burger boxes ensure another point for food chains and restaurants to get noticed in the market, and enhance the brand recognition giving them an edge over competition.

The USA burger boxes industry is growing at a steady pace due to the increasing demand for sustainable packaging solutions, the rise of growth in quick-service restaurants (QSRS), and increased consumer preference for eco-friendly and biodegradable packaging. Throughout the USA, where the fast-food industry is among the largest of its industry, corporations, including McDonald's, Burger King, and Wendy's, are consistently innovating their packaging to match sustainability goals and consumer preferences.

As awareness of plastic waste and pollution increases, the USA Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) have begun to introduce regulations that promote use of recyclable and compostable burger boxes comprised of paperboard, molded fiber, and plant-based materials. Moreover, the increasing penetration of food delivery services and online food ordering has propelled the demand for durable, leak-proof, and heat-retaining burger boxes that retain the quality of the food during transit.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The United Kingdom burger boxes market is expected to witness significant growth over the upcoming period, owing to government regulations governing the use of plastic packaging and escalating demand for recyclable material along with an upsurge in the number of takeaway and food delivery services. The UK’s Plastic Packaging Tax, which mandates a minimum of 30% recycled content in packaging materials, is spurring companies to adopt environmentally friendly burger boxes made from paperboard, bagasse and biodegradable polymers.

UK fast food and casual dining is sharpened by the consumer preference for sustainable, plastic-free packaging. Key QSR chains, including Five Guys, Shake Shack, and Burger King, are adopting compostable and recyclable burger boxes in line with their sustainability targets. Also, the growth of dark kitchens and ghost restaurants that serve to online food delivery platforms like Deliveroo, Uber Eats, and Just Eat is propelling the demand for durable and heat insulated burger boxes which prevent the degradation to food quality during long distance delivery.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The market for burger boxes in the European Union (EU) is expanding rapidly, driven by rigorous sustainability standards, greater emphasis on circular economy packaging solutions, and a booming fast-food industry.

European Union regulations are also prompting a change, with the EU’s Single-Use Plastics Directive (SUPD) and Green Deal initiatives leading companies toward biodegradable and recyclable burger boxes where paper, molded fiber and sugarcane-based materials are making inroads. As top fast-food chains, cafes, and street food vendors throughout Europe focus on sustainable food packaging, the need for innovative, compostable burger boxes is increasing.

Germany, France, and Italy also started to observe the market growth for plant-based & organic fast-food chain, thus expanding the demand for higher-quality alternative solutions for packaging that is sustainable. However, the growth of e-commerce food platforms, as well as increased demand for home delivery by consumers in the EU, will also stimulate investment in customized, heat-retaining, and grease-resistant burger packaging. Most packaging manufacturers are investing in water-based and PFAS-free coatings to keep imparting grease resistance and recyclability.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.2% |

The burger boxes market in Japan is being supported by factors such as technology in eco-friendly packaging, shift in consumer focus towards sustainable materials and growing inclination towards Western-style fast food. Japan’s tough food safety regulations and environmental protection guidelines are forcing restaurants and packaging makers to prepare high-quality, biodegradable burger boxes that align with government sustainability goals.

"Propel Demand for Custom Printed Burger Boxes"Growth of premium fast food brands and gourmet burger restaurants creating demand in the food service packaging industry which are boosting desired of custom printed and designed burger boxes that increase brand value and the experience of the consumer.

Japan’s infatuation with precision and quality control has resulted in innovations on grease-resistant, moisture-proof, and heat-retaining burger container designs. The growing demand for food delivery services and konbini burgers (convenience store burgers) is also driving up demand for small, functional, and lightweight burger boxes to preserve freshness and presentation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The burger boxes market in South Korea is already booming thanks to the rise of food delivery services, increased demand for premium and gourmet fast food, and government support initiatives for sustainable packaging. New regulations by the South Korean ministry of environment aimed at reducing single-use plastics have led fast-food brands and restaurants to adopt biodegradable, paper-based burger boxes. Also, the increase of convenience stores, especially in the ready-to-eat burgers segment, has further pushed the need for small size, easy-to-store packaging with better barrier properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The burger boxes market is anticipated to be on the rise throughout the forecast period. Increased usage of takeaway & delivery services with tightening food safety regulations have created a demand for eco-friendly & grease-resistant greaseproof burger boxes.

To satisfy changing consumer and regulatory requirements, manufacturers are investing in sustainable alternatives like kraft paper, molded fiber, and coated cardboard, which are biodegradable, compostable, and recyclable.

Huhtamaki Oyj (20-24%)

Huhtamaki leads the sustainable burger box market, supplying major fast-food chains with fiber-based, grease-resistant, and recyclable packaging. The company is heavily investing in compostable and biodegradable solutions.

WestRock Company (15-19%)

WestRock specializes in high-performance, moisture-resistant burger boxes, leveraging coated paperboard and molded fiber technology to enhance durability and sustainability.

Georgia-Pacific LLC (12-16%)

Georgia-Pacific focuses on custom branding and high-barrier coatings, catering to premium and fast-casual restaurant chains.

Novolex Holdings, Inc. (8-12%)

Novolex is expanding its biodegradable and compostable burger box portfolio, aligning with zero-waste packaging initiatives.

Dart Container Corporation (6-10%)

Dart Container provides insulated, lightweight, and high-barrier burger boxes that maintain food temperature and freshness.

Other Key Players (23-29% Combined)

The overall market size for burger boxes market was USD 4.1 billion in 2025.

The burger boxes market is expected to reach USD 6.8 billion in 2035.

The expansion of the burger boxes market will be driven by the growing demand for sustainable and convenient food packaging solutions, supported by the rise of quick-service restaurants and eco-friendly material innovations.

The top 5 countries which drives the development of burger boxes market are USA, European Union, Japan, South Korea and UK.

Square burger boxes to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Unit) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 6: Global Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 8: Global Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 10: Global Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 12: Global Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: Global Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: North America Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 18: North America Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 20: North America Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 22: North America Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 24: North America Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: North America Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: North America Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Latin America Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 32: Latin America Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 34: Latin America Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 36: Latin America Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 38: Latin America Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 40: Latin America Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 42: Latin America Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Western Europe Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: Western Europe Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 48: Western Europe Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 49: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 50: Western Europe Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 51: Western Europe Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 52: Western Europe Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 53: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: Western Europe Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 55: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: Western Europe Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Eastern Europe Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Eastern Europe Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 61: Eastern Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 62: Eastern Europe Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 63: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 64: Eastern Europe Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 65: Eastern Europe Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 66: Eastern Europe Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 67: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 68: Eastern Europe Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 69: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: Eastern Europe Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 73: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 74: South Asia and Pacific Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 75: South Asia and Pacific Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 76: South Asia and Pacific Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 77: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 78: South Asia and Pacific Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 79: South Asia and Pacific Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 80: South Asia and Pacific Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 81: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 82: South Asia and Pacific Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 83: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: South Asia and Pacific Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 85: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: East Asia Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 87: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 88: East Asia Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 89: East Asia Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 90: East Asia Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 91: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 92: East Asia Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 93: East Asia Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 94: East Asia Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 95: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 96: East Asia Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 97: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 98: East Asia Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Table 99: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 100: Middle East and Africa Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 101: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 102: Middle East and Africa Market Volume (Unit) Forecast by Material, 2018 to 2033

Table 103: Middle East and Africa Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 104: Middle East and Africa Market Volume (Unit) Forecast by Shape, 2018 to 2033

Table 105: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 106: Middle East and Africa Market Volume (Unit) Forecast by Size, 2018 to 2033

Table 107: Middle East and Africa Market Value (US$ Million) Forecast by Folding Cartoon Style, 2018 to 2033

Table 108: Middle East and Africa Market Volume (Unit) Forecast by Folding Cartoon Style, 2018 to 2033

Table 109: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 110: Middle East and Africa Market Volume (Unit) Forecast by Nature, 2018 to 2033

Table 111: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 112: Middle East and Africa Market Volume (Unit) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Shape, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Volume (Unit) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 13: Global Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 17: Global Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 21: Global Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 25: Global Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 26: Global Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 27: Global Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 28: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 29: Global Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 30: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 32: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 33: Global Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 34: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 35: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Material, 2023 to 2033

Figure 37: Global Market Attractiveness by Shape, 2023 to 2033

Figure 38: Global Market Attractiveness by Size, 2023 to 2033

Figure 39: Global Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 40: Global Market Attractiveness by Nature, 2023 to 2033

Figure 41: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 42: Global Market Attractiveness by Region, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 49: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 51: North America Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 55: North America Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 59: North America Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 60: North America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 61: North America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 62: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 63: North America Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 64: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 65: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 66: North America Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 67: North America Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: North America Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 72: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 75: North America Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 76: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 77: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 78: North America Market Attractiveness by Material, 2023 to 2033

Figure 79: North America Market Attractiveness by Shape, 2023 to 2033

Figure 80: North America Market Attractiveness by Size, 2023 to 2033

Figure 81: North America Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 82: North America Market Attractiveness by Nature, 2023 to 2033

Figure 83: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 84: North America Market Attractiveness by Country, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 93: Latin America Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 97: Latin America Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 100: Latin America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 101: Latin America Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 105: Latin America Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 108: Latin America Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 109: Latin America Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 110: Latin America Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 112: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 113: Latin America Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 116: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 117: Latin America Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 118: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 121: Latin America Market Attractiveness by Shape, 2023 to 2033

Figure 122: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 123: Latin America Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 124: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 125: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 129: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 130: Western Europe Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 132: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 133: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 134: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 135: Western Europe Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 139: Western Europe Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 140: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 141: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 142: Western Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 143: Western Europe Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 144: Western Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 145: Western Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 146: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 147: Western Europe Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 150: Western Europe Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 151: Western Europe Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 152: Western Europe Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 153: Western Europe Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 154: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 155: Western Europe Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 156: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 157: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 158: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 159: Western Europe Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 160: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 161: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 162: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 163: Western Europe Market Attractiveness by Shape, 2023 to 2033

Figure 164: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 165: Western Europe Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 166: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 167: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 169: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Eastern Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 172: Eastern Europe Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 173: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 174: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 176: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 177: Eastern Europe Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 178: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 181: Eastern Europe Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 185: Eastern Europe Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 186: Eastern Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 187: Eastern Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 188: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 189: Eastern Europe Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 190: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 191: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 192: Eastern Europe Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 193: Eastern Europe Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 194: Eastern Europe Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 195: Eastern Europe Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 196: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 197: Eastern Europe Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 198: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 199: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 200: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 201: Eastern Europe Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 202: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 203: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 204: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 205: Eastern Europe Market Attractiveness by Shape, 2023 to 2033

Figure 206: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 207: Eastern Europe Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 208: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 209: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 211: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 212: South Asia and Pacific Market Value (US$ Million) by Shape, 2023 to 2033

Figure 213: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 214: South Asia and Pacific Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 215: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 216: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 217: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: South Asia and Pacific Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 220: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 223: South Asia and Pacific Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 224: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 225: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 226: South Asia and Pacific Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 227: South Asia and Pacific Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 230: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 231: South Asia and Pacific Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 232: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 233: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 234: South Asia and Pacific Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 235: South Asia and Pacific Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 236: South Asia and Pacific Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 237: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 238: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 239: South Asia and Pacific Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 240: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 241: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 242: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 243: South Asia and Pacific Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 244: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 245: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 246: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 247: South Asia and Pacific Market Attractiveness by Shape, 2023 to 2033

Figure 248: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 249: South Asia and Pacific Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 250: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 251: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 253: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 254: East Asia Market Value (US$ Million) by Shape, 2023 to 2033

Figure 255: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 256: East Asia Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 257: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 258: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 259: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 260: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 261: East Asia Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 264: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 265: East Asia Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 266: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 267: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 268: East Asia Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 269: East Asia Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 270: East Asia Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 271: East Asia Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 272: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 273: East Asia Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 274: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 275: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 276: East Asia Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 277: East Asia Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 278: East Asia Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 279: East Asia Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 280: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 281: East Asia Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 282: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 283: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 284: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 285: East Asia Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 286: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 287: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 288: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 289: East Asia Market Attractiveness by Shape, 2023 to 2033

Figure 290: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 291: East Asia Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 292: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 293: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 294: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 295: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 296: Middle East and Africa Market Value (US$ Million) by Shape, 2023 to 2033

Figure 297: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 298: Middle East and Africa Market Value (US$ Million) by Folding Cartoon Style, 2023 to 2033

Figure 299: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 300: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 301: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 302: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 303: Middle East and Africa Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 304: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 305: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 306: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 307: Middle East and Africa Market Volume (Unit) Analysis by Material, 2018 to 2033

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 310: Middle East and Africa Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 311: Middle East and Africa Market Volume (Unit) Analysis by Shape, 2018 to 2033

Figure 312: Middle East and Africa Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 313: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 314: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 315: Middle East and Africa Market Volume (Unit) Analysis by Size, 2018 to 2033

Figure 316: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 317: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 318: Middle East and Africa Market Value (US$ Million) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 319: Middle East and Africa Market Volume (Unit) Analysis by Folding Cartoon Style, 2018 to 2033

Figure 320: Middle East and Africa Market Value Share (%) and BPS Analysis by Folding Cartoon Style, 2023 to 2033

Figure 321: Middle East and Africa Market Y-o-Y Growth (%) Projections by Folding Cartoon Style, 2023 to 2033

Figure 322: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 323: Middle East and Africa Market Volume (Unit) Analysis by Nature, 2018 to 2033

Figure 324: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 325: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 326: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 327: Middle East and Africa Market Volume (Unit) Analysis by Sales Channel, 2018 to 2033

Figure 328: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 329: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 330: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 331: Middle East and Africa Market Attractiveness by Shape, 2023 to 2033

Figure 332: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 333: Middle East and Africa Market Attractiveness by Folding Cartoon Style, 2023 to 2033

Figure 334: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 335: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 336: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Burger Wrap Paper Market Analysis – Growth & Forecast 2024-2034

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryoboxes Market Size and Share Forecast Outlook 2025 to 2035

Wax Boxes Market Insights - Growth & Demand Forecast 2025 to 2035

Market Share Breakdown of Cryoboxes Manufacturers

Soap Boxes Market Analysis – Growth & Demand 2025 to 2035

Gift Boxes Market Trends - Size & Forecast 2025 to 2035

Cake Boxes Market from 2025 to 2035

Lunch Boxes & Lunch Bags Market

Mailer Boxes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Veggie Burger Market Analysis by Soy-Based, Pea-Based, Lentil Based and Other Varieties Through 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Plywood Boxes Market Size and Share Forecast Outlook 2025 to 2035

Packing Boxes Market Trends - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Analyzing Acrylic Boxes Market Share & Industry Leaders

Wardrobe Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA