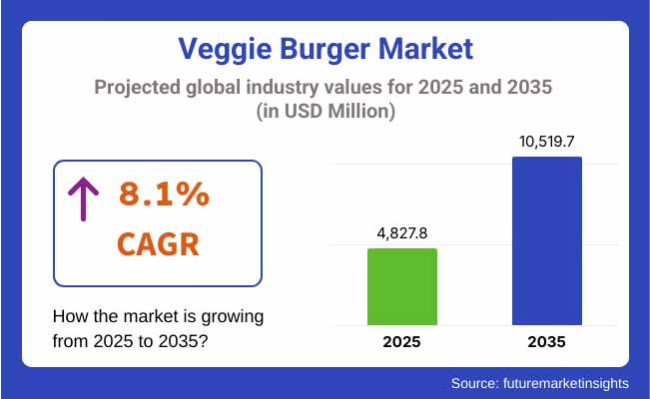

Veggie burgers market was USD 4,164.4 million in 2023 and witnessed growth in 2024 and USD 4,827.8 million in 2025. The market would be growing at 8.1% CAGR during 2025 to 2035 and would be USD 10,519.7 million in 2035.

Meat substitute and veg food, veg burger demand has been increasing. All these have been the reasons behind increasing demand for veg burgers. Hungry consumer has been searching for green, cruelty-free, and healthy food and thus demand for veg burgers that in some way somehow could be in a position to rival the taste and texture of meat.

Beyond Meat, Impossible Foods, Morningstar Farms, and Boca Burgers' management shakes the company with industry firsts premium veggie burgers with highest protein content in soy-protein-based, pea-protein-based, and gluten-free varieties. They are focusing on consumer segments that are mutually exclusive of each other - vegans, vegetarians, flexitarians, and health seekers.

Veggie burger and fast-food chain day-to-day restaurants day-to-day-retailing attracted more business with entry. Carl's Jr. day-to-day-(Beyond Famous Star), McDonald's day-to-day-(McPlant), and Burger King day-to-day-(Imagine Whopper) are mainstream success stories of market popularity of veggie burgers too.

Apart from the health advantage, other carbon traces and environmental concerns linked to beef production have also been the main driver of clients' demand. Science confirms that veggie burgers are more energetic and usage and emit much less greenhouse gas than regular beef patties, thus a green option for consumers.

Despite European and North America's dominance over consumer confidence potency and penetration depth, Asia-Pacific is fast becoming a growth impulse driven by mounting disposable incomes, urbanization, and a tilt towards a plant source of protein.

The supermarkets and the veggie burgers grew in market size and made the supermarkets and the veggie burgers popular. High-end and lower-priced plant-based burgers now compete for the consumers with growing competition in the form of new store-brand as well as regional brands.

Future direction of plant-free, preservative-free and allergen-free protein-based burger shall continue and future market development trend direction shall receive further push.

Above mentioned table indicates relative six-half-yearly difference in CAGR in base year (2024) and current year (2025) of veggie burger market. The study illustrates performance trend and revenue growth forecast for market leaders.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.8% |

| H2 (2024 to 2034) | 7.9% |

| H1 (2025 to 2035) | 8.0% |

| H2 (2025 to 2035) | 8.1% |

The market will expand at 8.0% CAGR during H1 of 2025 to 2035 and 8.1% nominally during H2 of 2025 to 2035. The market expanded 20 BPS higher than in the last forecast period (2024 to 2034) on the back of higher demand from the consumer and improved product line.

With enhanced technologies, greener methods of production, and further capital in the form of plant food tech investment, the veggie burger business will flourish leaps and bounds within the next decade.

Veggie burger demand is growing by leaps and bounds, driven by consumer appetite for plant-based, high-protein, and meat-free foods. Organised and unorganised markets segment the market, in which key players range from global food giants to plant-based small organisations.

Organized sector comprises meat alternative businesses, food majors, and plant-based veggie burger private-label brands using soy, pea protein, mushrooms, lentils, black beans, and other vegetarian foods. Market players include Impossible Foods, Beyond Meat, Nestlé (Garden Gourmet), MorningStar Farms (Kellogg's), Amy's Kitchen, Boca Foods, Quorn, and Dr. Praeger's.

They own the European, North American, and Asia-Pacific markets because consumers are demanding greater flexitarian, vegan, and green diets. The players that possess formal form have a powerful retail relations, a healthy channel of distribution, and R&D spending in terms of creating juicier and meatier products using newer forms of protein and fats.

The different firms have staked out non-GMO, soy-free, gluten-free, and organic spaces in attempts to reach health-conscious consumers. With increasing competition, organised players focus on healthier food, clean-label offerings, and sustainability, and restaurant growth, quick-service chains, and foodservice partnerships. Quick-commerce platforms and online food retailing growth have also fueled pre-packaged veggie burger demand.

The unorganised segment includes local plant-based food start-ups, small restaurants, and artisanal producers of hand-made or small-batch veggie burgers. They are marketed mainly in local markets, farmer's markets, specialty vegan stores, and direct-to-consumer platforms by their distinctive, organic, or gourmet-style burgers prepared with homemade recipes and fresh ingredients.

Inability to scale and manufacture results in unorganised players not being able to cope with mass distribution and regulatory demands. They can, however, find their way to niche consumers for artisanal, preservative-free, and small-batch veggie burgers.

Individual brands receive attention via social media marketing campaigns, food festival appearances, and partnerships with plant-based restaurants. Since increased demand for veggie burgers takes the market further worldwide, the organized players are going to exercise mass production as well as retailing supremacy.

Move to whole-food, clean-label veggie burgers

Shift: Health-minded consumers are shunning ultra-processed plant-based meats and shuffling toward whole-food-based veggie burgers. There’s even more attention to ingredient transparency and consumers' preference for clean-label products made with whole beans, lentils, quinoa, chickpeas, beets, mushrooms, and whole grains, with no artificial additives, soy isolates and preservatives.

Within North America, Europe and Australia, this trend is particularly prominent among flexitarians and wellness-driven consumers who look for nutritional value and less processing with their plant-based alternatives.

Strategic Response: The USA-based brand Dr. Praeger’s capitalized on the opportunity by reformulating its line of California Veggie Burgers, emphasizing whole vegetables and superfoods (like kale and quinoa), growing its distribution in health food stores by 15% and its sales by 10% percent year-over-year.

Berief Food launched an organic lentil and beetroot veggie pattie, which gained popularity in organic supermarkets in Germany and achieved a 9% retail growth year-on-year. The Canadian company Gardein developed a special Grain & Veggie Burger line, with brown rice, black beans and roasted vegetables, but it has outsold most of the meat-substitutes in fitness-oriented retail stores and online sales increased by 13% Those changes underscore a consumer shift toward burger products that are plant-based and nutrition-driven.

This Demand For Global Flavors and Fusion-Inspired Veggie Burgers

Shift: Consumers are exploring different international cuisines and flavors, sparking interest in globally influenced veggie burgers. Shoppers want a variety of taste experiences; they are moving into Mediterranean, Asian, Latin and Indian-inspired burgers - anything but traditional, American-style burgers.

Millennials and Gen Z consumers have especially adventurous palates, scouting for ethnic spice blends, herbs and less familiar ingredients such as harissa, miso, turmeric and kimchi. This trend of flavor exploration is particularly strong in urban markets and foodservice settings, notably fast-casual restaurants and meal kits.

Strategic Response: The Vegetarian Butcher, based in the United Kingdom, launched a Middle Eastern Falafel Burger garnished with za’atar and tahini sauce, contributing to 8% retail sales growth across premium grocery such as Sainsbury’s. In the USA, Hilary’s Eat Well introduced a Thai Curry Veggie Burger made with lentils, coconut and lime, driving 12% growth in direct-to-consumer sales.

Indian brand GoodDot started selling Masala Veggie Burgers for local and international markets and saw strong interest from the Middle East and South Asian markets, and a 14% quarterly sales growth. These innovations are revolutionizing the veggie burger sphere with culinary experimentation at the center.

Growth Strategy: Expanding into Foodservice, QSR and Private Label Partnerships

Shift: Veggie burgers are increasingly being put on menus in the food service and quick-service restaurant (QSR) sectors, catering to flexitarians and sustainability goals. Meanwhile, private-label partnerships with supermarket and meal kit companies are broadening access to veggie burgers with competitive price points.

Big chains of supermarkets are rolling out store-brand veggie burgers with cutthroat prices and local flavor twists while meal delivery services are selling ready-to-assemble veggie burger meals, shrewdly hitting ready-to-pay-for convenience consumers.

Strategic Response: Subway, the fast-casual giant, piloted plant-based meatball subs made with veggie burger patties in select markets nationally with Beyond Meat, resulting in an overall 12% increase in plant-based item sales during the test phase. The German supermarket chain Lidl introduced its own private-label veggie burgers made from the peas and carrots for 20% less than brand-priced versions, resulting in a 17% increase in monthly sales volume.

The USA-based meal kit service Purple Carrot offered the veggie burgers in fusion style, each with a sriracha aioli and sweet potato buns, and this helped raise customer retention by 10%. These efforts extend the availability and affordability of veggie burgers beyond conventional store shelves.

Focus on Sustainability and Regenerative Agriculture in Ingredient Sourcing

Shift: Consumers who care about the planet are looking for veggie burgers with sustainably farmed, regenerative ingredients. Increased awareness of all things carbon footprint, water use and agricultural practices has prompted interest in brands that use organic, non-GMO crops, as well as in those that advocate regenerative farming.

With consumers across Europe, North America and Oceania reading eco-labels, tracking carbon offsets and purchasing brands that make transparent sustainability commitments. In this context, climate-positive claims and plastic-free packaging become important points of differentiation.

Strategic Response: USA brand Miyoko’s Creamery launched veggie burgers made with regenerative pea protein and a special carbon-neutral production process that generated a lot of media coverage, resulting in a 13% increase in online orders. Over in Australia the plant-based brand v2food had created climate-friendly veggie patties using local legumes and compostable packaging, which resulted in a 10% increase in distribution across eco-focused retailers.

In the UK, Allplants resorted to zero-waste production of veggie burgers using less-than-perfect produce, landing partnerships with sustainability-minded retailers and a 15% quarterly sales boost. These brands are using sustainability to stand out within the noisy, crowded plant-based food category.

Trends in Functional Veggie Burgers with Health Claims

Shift: Shoppers are in search of functional benefits in food, such as immune health support, gut health, energy and protein enrichment. Fortified veggie burgers, with the likes of probiotics, adaptogens, omega-3s and plant proteins blends, hit the mainstream.

This phenomenon is especially pronounced among fitness-focused young professionals as well as health-driven family members shopping for kids. There’s an obvious move away from meat replicas to health-promoting, functional plant-based food.”

Strategic Response: USA-based MorningStar Farms launched a veggie burger line with up to 20g of plant protein as well as iron and B12, contributing to 9% growth of sports nutrition retailers. Inspired by digestive health trends and launched by the Canadian brand Noble Veggie, the gut-health-focused burgers are infused with probiotics and flaxseed and are seeing direct sales grow by 11% via wellness platforms.

Next Meats launched omega-3-enriched veggie burgers in Japan made with algae oil, focusing on brain health benefits, and e-commerce sales in Asia grew 7%. These other brands are leveraging the intersection of more utility and plant-based innovation to establish new market opportunities.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 7.8% |

| Germany | 8.4% |

| China | 7.9% |

| Japan | 7.6% |

| India | 8.7% |

The USA market for veggie burgers is growing fast, with consumers increasingly adopting flexitarian, vegetarian and vegan diets. Health-conscious consumers are on the hunt for plant-based protein alternatives, and innovations in taste and texture that closely resemble traditional beef burgers are fueling this trend. Also contributing to this market expansion, supermarkets, fast-food chains and restaurants have expanded their plant-based burger offerings.

Consumers switch to eco-friendly foods due to sustainability issues, and plant-based burgers reduce carbon footprints and environmental pollution. Improvements in the technology of individual ingredients (like pea protein and soy-based formulations) are making products more attractive. Big food brands and small startups are fueling competition, leading to never-ending product development and ubiquitous availability.

Germany is equipped with one of the most elaborate plant-based food markets: no wonder the market for veggie burgers there is huge. The country’s emphasis on sustainability and ethical food choices has driven up demand for plant-based meat substitutes. Consumers are demanding organic and minimally processed ingredients, prompting manufacturers to produce clean-label veggie burgers without artificial additives.

As supermarkets have expanded their plant-based options and specialty health stores have increased their offerings, foodservice operators have increasingly placed veggie burgers on their menus. A good framework for plant-based food labeling in Germany has built consumers confidence to further fuel the market. In alignment with the nation’s eco-friendly efforts, sustainable packaging and biodegradable products are also becoming increasingly sought after.

China’s fast-expanding urban population and growing disposable incomes have boosted demand for plant-based alternatives, like veggie burgers. The rise of Western fast-food culture and increasing health awareness has also fueled demand for meatless alternatives. The further growth of the market has been supported by government initiatives to promote plant-based protein sources as a way to improve food security and decrease dependency on animal agriculture.

The transition is facilitated by e-commerce platforms, with consumers ordering plant-based burger products online. Moreover, China’s younger population is more willing to sample new food products, such as meat substitutes with unusual flavors and healthier ingredient profiles. Major food brands are betting on the popularity of localized flavors, bolstering a regional preferences and consumer acceptance.

Japan’s food scene is famous for innovation, and plant-based foods, veggie burgers included, are making inroads. Japanese consumers value top-tier ingredients, taste and texture, prompting manufacturers to create highly complex plant-based blends that mimic the umami flavors present in traditional meat-based dishes.

Convenience stores, restaurants and fast-food chains are rolling out plant-based burger for flexitarian and vegetarian diets. Also, product development is still impacted by the clean-label trend and we see a lot of brands providing non-GMO and organic. High concentration on food safety and regulatory standards in Japan instills trust of plant-based alternatives in consumers, thus propelling the market growth

| Segment | Value Share (2025) |

|---|---|

| Plant-Based Beef (By Product Type) | 38.2% |

The best-selling category in the veggie burger market is plant-based beef; this category is so successful because it replicates almost all the properties of traditional beef, i.e., the flavor, texture, and appearance. As consumers increasingly gravitate toward sustainable, cruelty-free food options, plant-based beef burgers have become mainstream among vegetarians, flexitarians and even meat eaters seeking healthier choices.

Heme is among the key innovations in this segment; companies use it, along with beet juice and other natural ingredients, to mimic the juiciness and umami of beef. Pioneering brands like Beyond Meat and Impossible Foods have been game changers, delivering soy-based and pea-based mock beef that's healthy, high-protein, and mainstream consumer-friendly.

Growing demand for protein-rich, low fat, cholesterol-free burger types has strengthened this segment growth. Moreover, the environmental issues posed by conventional beef production including deforestation and significant greenhouse gas emission have propelled informed consumers to plant-based substitutes.

The food service and retailers have also been instrumental with this segment by broadening their offerings on plant-based beef burgers. Although still not as ubiquitous, plant-based beef patties can now be found on many fast-food chains' and restaurants' menus, broadening their reach. As companies continue to innovate on their product lines and as more consumers are transitioning to plant-forward diets, plant-based beef burgers will likely remain the leaders of the veggie burger market.

| Segment | Value Share (2025) |

|---|---|

| Online Retail (By Distribution Channel) | 36.5% |

The online retail segment serves as one of the key drivers for the veggie burger market, providing easy access to the end users by multiple burger-based products. E-commerce platforms, direct-to-consumer (DTC) brands, and subscription-based meal services have revolutionized the purchase and consumption of plant-based burgers.

It plays directly to one of the key strengths of internet sales: the ability to offer more niche consumer preferences, such as gluten-free, non-GMO and organic plant-based burgers. Online platforms can display a wider variety of products than brick-and-mortar retail stores, where space is limited, enabling consumers to more easily discover new brands and flavors.

The increasing impact of social media and digital marketing has also been an important factor in the growth of online sales. Consumers are now probably more likely to buy and purchase plant-based burgers driven by online reviews, influencer recommendations and promotional activities by brands.

Also, a lot of plant-based burger brands are employing targeted ads and tailored shopping experiences to assist in the customer process. With the provided convenience and ready-to-cook plant-based burger offer, subscription-based services and meal kit companies have further propelled online sales.

These devices may appeal to health-conscious consumers who want prepackaged, high-quality plant-based meals delivered to their doorstep. With Internet penetration increasing and a widespread shift towards digital shopping habits, the online retail segment is likely to continuously grow over the coming years. As e-commerce providers keep improving their logistics, customer service, and product selection, online sales of veggie burgers will run higher than that of traditional retail channels and become a market leader.

There are intense competition in Veggie Burger Market however few leading players like Beyond Meat, Impossible Foods, MorningStar Farms hold responsibility in expanding their market share through brand recognition, product development and innovations. Through the development of plant-based burger patties that look, taste, and feel like animal-based burgers, these companies have proven they can increase consumer preference. T

his is not just expanding the customer pool for these brands, it is also allowing these companies to effectively compete against traditional meat and other plant-based substitutes.

In order to stay competitive, companies are consistently launching new flavored, healthier formulations, as well as premium ingredients, like pea protein, black beans, quinoa, and beets, among others, to improve taste and nutritional content. Besides, convenient types of packaging, including ready-to-cook patties and frozen meal kits, are launched to attract time-pressed consumers.

For instance:

Market segmented into Plant-based Chicken, Plant-based Beef, Plant-based Pork, and Plant-based Fish.

Market segmented into Soy-Based Protein, Wheat-Based Protein, Pea-Based Protein, Canola-Based Protein, Fava-Bean Based Protein, Potato-Based Protein, Rice-Based Protein, Lentil-Based Protein, Flax-Based Protein, Chia-Based Protein, and Corn-Based Protein.

Market segmented into Retail and HoReCA (Food Service Sector). Retail further segmented into Hypermarkets/Supermarkets, Convenience Stores, Specialty Food Stores, and Online Retail.

Market segmented into North America, Latin America, Europe, The Middle East and Africa, and East Asia.

The global veggie burger market is projected to grow at a CAGR of 8.1% during the forecast period.

The market is estimated to reach approximately USD 10,519.7 million by 2035.

The soy-based veggie burger segment is expected to witness the fastest growth due to its high protein content and increasing demand for meat alternatives.

Key growth drivers include rising consumer preference for plant-based diets, increasing awareness of environmental sustainability, and expanding availability of innovative meatless burger options.

Leading companies in the market include MorningStar Farms, Sotexpro SA, Crown Soya Protein Group, Puris Proteins, LLC, Ingredion Inc & Beneo GmbH

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Source, 2023 to 2033

Figure 191: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veggie Chips Market Growth - Consumer Trends & Flavor Innovations 2025 to 2035

Veggie Meals Market Trends - Innovation & Consumer Demand 2025 to 2035

Burger Boxes Market Size, Share & Forecast 2025 to 2035

Global Burger Wrap Paper Market Analysis – Growth & Forecast 2024-2034

Commercial Burger Grill Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Burger Market Outlook - Trends & Consumer Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA