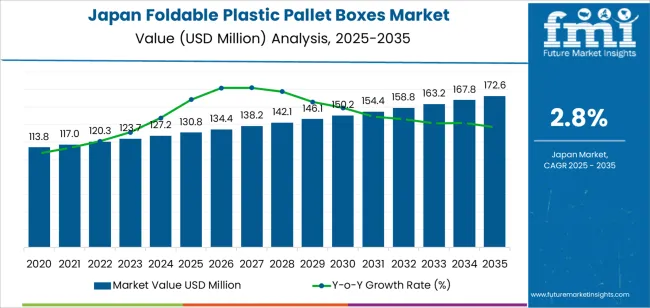

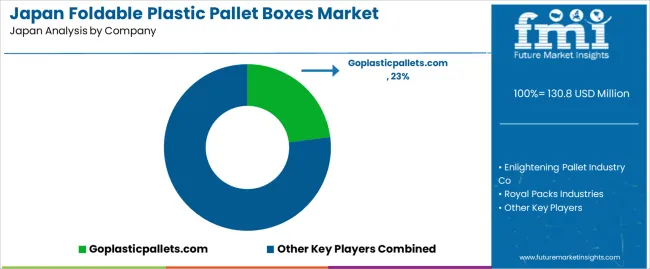

The Japan foldable plastic pallet boxes demand is valued at USD 130.8 million in 2025 and is expected to reach USD 172.6 million by 2035, corresponding to a CAGR of 2.8%. Demand is supported by the need for durable, reusable, and space-efficient bulk-handling solutions across manufacturing, automotive supply chains, food distribution, and retail logistics. Foldable pallet boxes offer reduced return-transport volume, lower storage requirements, and consistent structural performance, which makes them suitable for multi-cycle use in domestic distribution networks. Their resistance to moisture, chemicals, and impact contributes to steady adoption in facilities that prioritise product protection and stable load handling.

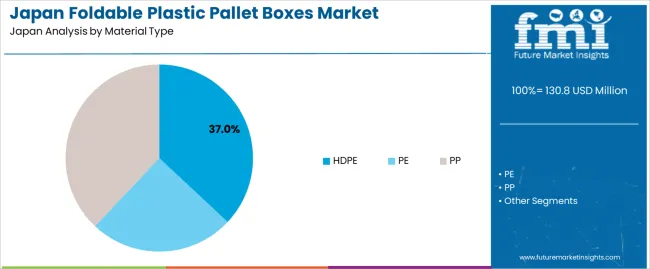

Polypropylene (PP) remains the leading material type. Its rigidity, weight efficiency, and resistance to repeated folding cycles support wide use in warehouses, assembly plants, and cold-chain operations. PP boxes also accommodate integrated lids, ventilation features, and reinforced corner structures, enabling use in both automated and manual handling environments.

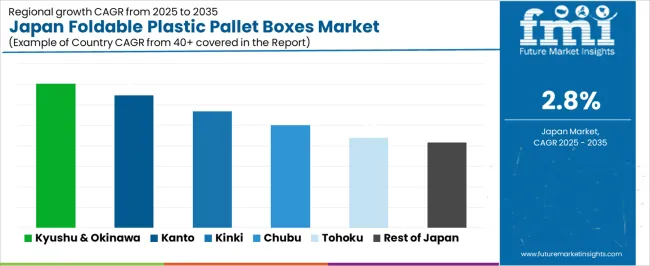

Kyushu & Okinawa, Kanto, and Kinki register the strongest demand. These regions host significant industrial clusters, automotive component suppliers, and consumer-goods distribution hubs that rely on reusable pallet-box systems for high-frequency goods movement. Their logistics networks benefit from foldable formats that reduce reverse-logistics costs and improve storage density in distribution centres. Goplasticpallets.com, Enlightening Pallet Industry Co., Royal Packs Industries, Exporta, Transoplast, and CABKA Group are the principal suppliers. Their portfolios include foldable large-load carriers, rigid-wall pallet boxes, and PP-based collapsible containers developed for returnable transport packaging systems.

Growth-momentum analysis shows a steady but moderate early trajectory from 2025 to 2029, supported by demand in automotive supply chains, electronics logistics, and food-processing distribution. Companies adopt foldable pallet boxes to reduce return-transport volume, improve warehouse space utilisation, and support cleaner material-handling practices. Early momentum is shaped by replacement of rigid containers with collapsible formats that offer lower storage footprints and faster handling.

From 2030 to 2035, momentum shifts toward a more stable pattern as procurement aligns with established inventory cycles and long service lifespans of high-density polymer containers. Manufacturers and logistics operators maintain consistent use of foldable pallet boxes, but large-scale fleet expansion becomes less common. Late-period growth is driven by incremental improvements in hinge durability, load-bearing capability, and compatibility with automated storage and retrieval systems. The overall momentum profile reflects a transition from early operational upgrades to a mature utilisation phase defined by predictable replenishment, stable container rotation, and long-term integration of foldable pallet boxes within Japan’s logistics and industrial environments.

| Metric | Value |

|---|---|

| Japan Foldable Plastic Pallet Boxes Sales Value (2025) | USD 130.8 million |

| Japan Foldable Plastic Pallet Boxes Forecast Value (2035) | USD 172.6 million |

| Japan Foldable Plastic Pallet Boxes Forecast CAGR (2025-2035) | 2.8% |

Demand for foldable plastic pallet boxes in Japan is increasing because logistics, manufacturing and retail operations look to optimise space and reduce costs in supply chains. Foldable boxes allow efficient return transport of empty containers, reducing wasted volume and improving palletisation rates in warehouses and assembly areas. Japanese companies in automotive, electronics and consumer goods sectors adopt these boxes to support just-in-time delivery, lean inventory systems and clean-room logistics where reusable plastic containers offer hygiene and durability advantages over single-use packaging.

Ecofriendly trends and corporate commitments to reduce packaging waste further encourage adoption of foldable plastic pallet boxes. Constraints include higher initial cost compared with standard rigid crates, the logistical challenge of setting up return-loop systems and requirement for precise compatibility with existing handling equipment. Some smaller entities may continue using conventional packaging until clear cost-benefit data are available.

Demand for foldable plastic pallet boxes in Japan reflects storage, shipping, and handling needs across industries prioritising durability, hygiene, and space-saving logistics. Material selection is influenced by load-bearing requirements, environmental exposure, and compatibility with automated warehouses. End-use patterns reflect pallet-box deployment across industrial supply chains where collapsible structures reduce empty-return volume and support cost-efficient movement of goods.

Polypropylene (PP) holds 38.0% of national demand and represents the leading material type for foldable pallet boxes. PP supports repeated folding cycles, offers chemical resistance, and maintains dimensional stability in temperature-variable environments. HDPE accounts for 37.0%, providing impact strength and surface durability needed for heavy-load operations and long-distance transport. PE represents 25.0%, serving lighter-duty applications requiring flexibility and adequate resilience for consumer-goods distribution. Material-type distribution reflects load conditions, hygiene requirements, and environmental exposure across industries using foldable pallet boxes for storage, staging, and inter-facility movement.

Key drivers and attributes:

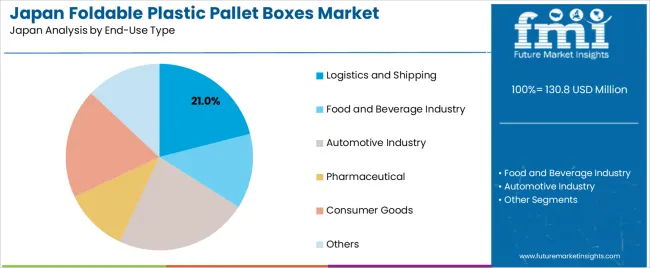

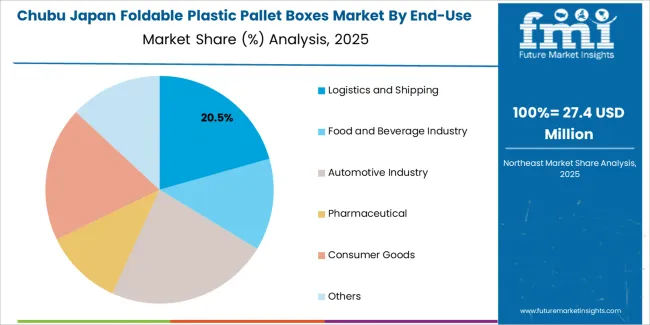

The automotive industry holds 23.0% of national demand and forms the largest end-use category. Manufacturers use foldable pallet boxes for components, subassemblies, and returnable transport packaging moved between plants and suppliers. Logistics and shipping account for 21.0%, relying on foldable structures to reduce backhaul volume and maintain stable stacking during transit. Consumer goods represent 19.0%, where collapsible boxes support mixed-SKU handling and warehouse distribution. Food and beverage holds 13.0%, with hygiene requirements supporting plastic-based containment. Pharmaceuticals also represent 11.0%, using boxes for controlled movement of packaged products. The remaining 13.0% includes specialised applications across diversified industries.

Key drivers and attributes:

Space efficiency in logistics, growth in reusable packaging, and manufacturing optimisation encourage uptake.

In Japan, industrial and logistics operators increasingly adopt foldable plastic pallet boxes because they allow for efficient return logistics and save warehouse storage space when empty. The country’s limited footprint for factories and warehouses amplifies the need for containers whose volume can be significantly reduced when not in use. Automakers, electronics manufacturers and food-processors expand cross-plant parts flows and lean manufacturing practices; those operations benefit from reusable pallet boxes that align with just-in-time supply chains. Also, rising corporate and regulatory focus on sustainability supports switch from one-way packaging to durable, collapsible containers that reduce material waste and transport inefficiency.

Higher upfront cost, retention of rigid packaging traditions, and supply-chain inertia limit faster growth.

Foldable plastic pallet boxes generally cost more upfront compared to traditional one-way crates or cardboard packaging, which may deter smaller firms or short-loop logistics users. Many legacy supply-chains in Japan continue to rely on fixed rigid containers or wooden pallets which are deeply embedded in process flows; changing over to foldable systems requires re-tooling, training and logistic-loop redesign. Some firms may also hesitate because expected reuse cycles or return logistics are uncertain, reducing the immediate economic case.

Rising usage in closed-loop automotive and electronics supply chains, development of domestic recyclable and modular designs, and broader application across e-commerce fulfilment support future growth.

Major Japanese manufacturing segments such as automotive parts assembly and electronic components increasingly deploy foldable pallet boxes because these environments feature predictable return flows, high handling volumes and automation compatibility. Suppliers are introducing next-generation foldable boxes with modular wall panels, improved durability, RFID-tracking readiness and compatibility with automated conveyor systems tailored for the Japanese industry. In the logistics and e-commerce sectors, foldable pallet boxes are gaining use in warehousing, outbound transport and return-loop cycles, as the demand for efficient storage and rapid turnaround grows. These developments sustain moderate but steady growth in demand for foldable plastic pallet boxes in Japan.

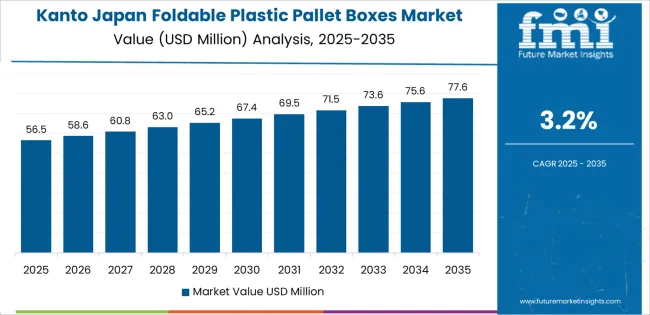

Demand for foldable plastic pallet boxes in Japan is rising through 2035 as logistics firms, manufacturing plants, retail distribution centers, and agricultural cooperatives expand the use of collapsible, reusable bulk-handling containers. These boxes support efficient storage, reduced return-transport volume, and improved hygiene compared with wooden alternatives. Adoption is shaped by warehouse-space constraints, e-commerce fulfillment needs, standardized pallet-handling equipment, and strict cleanliness requirements across food, pharmaceutical, and automotive supply chains. Companies also favor foldable pallet boxes for their long service life and compatibility with automated storage systems. Kyushu & Okinawa leads growth at 3.5%, followed by Kanto (3.2%), Kinki (2.8%), Chubu (2.5%), Tohoku (2.2%), and the Rest of Japan (2.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.5% |

| Kanto | 3.2% |

| Kinki | 2.8% |

| Chubu | 2.5% |

| Tohoku | 2.2% |

| Rest of Japan | 2.1% |

Kyushu & Okinawa grow at 3.5% CAGR, supported by strong industrial activity, agricultural distribution, and regional logistics networks serving domestic and export-oriented industries. Agricultural cooperatives use foldable pallet boxes for handling fresh produce requiring hygienic, moisture-resistant containers. Automotive suppliers adopt collapsible bulk boxes for transporting components and ensuring efficient return logistics between regional plants. Food-processing facilities rely on foldable units for clean, standardized handling that aligns with stringent sanitation practices. Retail distribution centers in Kyushu integrate stackable, collapsible formats to manage seasonal inventory flows and reduce warehouse congestion. Port logistics in Okinawa also benefit from foldable pallet boxes that minimize empty-return volume on inter-island shipping routes.

Kanto grows at 3.2% CAGR, driven by dense warehouse operations, extensive retail distribution, and high-volume e-commerce activity across Tokyo, Kanagawa, and surrounding prefectures. Distribution centers use foldable pallet boxes for organized bulk storage, cross-docking, and carton consolidation. Electronics manufacturers adopt durable containers to protect components during short-haul transport. Retailers rely on collapsible pallet boxes to manage back-room inventory and improve space efficiency in urban warehouses. Pharmaceutical and food suppliers favor hygienic, easy-to-clean containers suited to regulated storage environments. High land costs and warehouse-space constraints reinforce the appeal of foldable formats that reduce storage volume when empty.

Kinki grows at 2.8% CAGR, supported by manufacturing concentration, regional logistics hubs, and structured retail supply networks across Osaka, Kyoto, and Hyogo. Automotive, machinery, and electronics producers use foldable pallet boxes to streamline bulk transport and reduce return-trip inefficiencies. Food and beverage distributors employ collapsible boxes for hygienic storage and improved load stability. Retail distribution centers adopt foldable formats for seasonal stock handling and warehouse-space optimization. Municipal ecofriendly programs encourage reusable packaging solutions across industrial users. These steady industrial and commercial patterns maintain consistent demand in the region.

Chubu grows at 2.5% CAGR, supported by automotive supply chains, machinery production, and agricultural distribution across Aichi, Shizuoka, and surrounding prefectures. Automotive component suppliers use foldable pallet boxes for efficient parts movement between assembly plants. Agricultural groups adopt collapsible boxes to transport fruits, vegetables, and specialty produce requiring clean, robust handling. Manufacturing facilities integrate foldable containers into automated storage systems to reduce clutter and improve workflow efficiency. Export-oriented industries favor reusable pallet boxes for cost-effective return logistics. Consistent industrial demand shapes the region’s moderate but steady growth.

Tohoku grows at 2.2% CAGR, shaped by agricultural distribution, regional manufacturing, and essential logistics operations across Miyagi, Fukushima, and Akita. Foldable pallet boxes support bulk handling of produce, packaged foods, and regional specialty goods requiring moisture-resistant, reusable containers. Manufacturing plants adopt collapsible boxes for parts storage and internal transport. Distribution centers serving northern industries rely on foldable containers to optimize warehouse space and streamline inter-regional movement. Although industrial density is lower than major metropolitan regions, steady agricultural and logistics requirements maintain reliable demand.

The Rest of Japan grows at 2.1% CAGR, supported by moderate industrial activity, retail distribution, and agricultural supply needs. Smaller manufacturing sites use foldable pallet boxes for component handling and internal logistics. Agricultural producers adopt collapsible containers for seasonal harvest transport. Regional retailers rely on foldable formats to manage back-room stock and minimize storage space in smaller facilities. Transportation companies incorporate reusable pallet boxes to reduce waste and improve cargo efficiency. Although overall demand is lower due to dispersed population and limited large-scale industry, steady operational needs ensure continued adoption.

Demand for foldable plastic pallet boxes in Japan is shaped by a group of logistics-equipment suppliers supporting automotive components, electronics, pharmaceuticals, food distribution, and warehouse operations. Goplasticpallets.com holds the leading position with an estimated 23.0% share, supported by controlled material quality, reliable hinge durability, and consistent supply to Japanese distributors and contract-logistics providers. Its position is reinforced by predictable load-bearing performance and stable compatibility with automated handling systems.

Enlightening Pallet Industry Co. and Royal Packs Industries follow as significant participants, offering foldable pallet boxes suited to high-cycle use in manufacturing and inter-facility transportation. Their strengths include dependable structural rigidity, consistent wall-locking behaviour, and formats aligned with Japanese pallet and container standards. Exporta maintains a notable presence with lightweight, return-friendly designs used in retail replenishment and intra-warehouse movements where repeated folding cycles and efficient storage are essential. Transoplast contributes capability through premium polypropylene and HDPE constructions that deliver stable performance in hygienic environments, including food and pharmaceutical applications. CABKA Group adds further depth with durable recycled-material pallet boxes designed for long service life and compatibility with closed-loop logistics systems.

Competition across this segment centers on folding-mechanism durability, material strength, load stability, dimensional consistency, hygiene compliance, and ease of handling. Demand remains steady as Japanese industries expand reusable-packaging programmes, increase automation in distribution centres, and adopt space-efficient, returnable pallet-box systems that reduce storage costs and support ecofriendly logistics operations.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material Type | HDPE, PE, PP |

| End-Use Type | Logistics and Shipping, Food and Beverage Industry, Automotive Industry, Pharmaceutical, Consumer Goods, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Goplasticpallets.com, Enlightening Pallet Industry Co, Royal Packs Industries, Exporta, Transoplast, CABKA Group |

| Additional Attributes | Dollar sales by material type and end-use industry; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of foldable plastic pallet box manufacturers; developments in high-strength HDPE designs, hygienic food-grade PE containers, and reusable PP-based foldable logistics systems; integration with automotive supply chains, cold storage, warehouse operations, and intermodal shipping in Japan. |

The demand for foldable plastic pallet boxes in Japan is estimated to be valued at USD 130.8 million in 2025.

The market size for the foldable plastic pallet boxes in Japan is projected to reach USD 172.6 million by 2035.

The demand for foldable plastic pallet boxes in Japan is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in foldable plastic pallet boxes in Japan are hdpe, pe and pp.

In terms of end-use type, logistics and shipping segment is expected to command 21.0% share in the foldable plastic pallet boxes in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA