The demand for bandsaw machines in Japan is projected to grow from USD 126.5 million in 2025 to USD 170 million by 2035, reflecting a CAGR of 3%. Bandsaw machines are crucial tools in metalworking, woodworking, and construction, used for cutting through materials with precision and efficiency. The steady demand for these machines is driven by increasing industrial activities, particularly in automotive manufacturing, metal processing, and construction projects, where precision cutting is required. As the manufacturing sector continues to expand and modernize, bandsaw machines remain a key component of cutting and shaping operations in a wide range of industries.

Technological advancements in bandsaw design, such as improved cutting efficiency, energy-saving capabilities, and automation integration, are expected to further drive demand. The increasing use of computerized bandsaw machines for precision cutting and the rise of smart manufacturing will contribute to the market’s growth. As industries in Japan continue to focus on increased productivity and quality control, the demand for advanced bandsaw machines will remain strong. Despite some challenges, such as market maturity, the demand for efficient, high-performance bandsaw machines will continue to fuel steady growth over the next decade.

The saturation point analysis for bandsaw machines in Japan indicates a gradual slowdown in growth as the market matures, with a key transition occurring in the mid-to-late forecast period.

From 2025 to 2030, the market will grow from USD 126.5 million to USD 146.6 million, contributing USD 20.1 million in value. This early phase will experience accelerated growth due to increased industrial demand for precision cutting equipment in sectors like automotive manufacturing, metalworking, and construction. The demand for advanced bandsaw machines with high cutting speeds, greater accuracy, and automation features will drive growth during this period. The market acceleration will be spurred by the adoption of new cutting technologies that improve both speed and energy efficiency.

From 2030 to 2035, the market will grow from USD 146.6 million to USD 170 million, contributing USD 23.4 million in value. This period will see slower growth, as the market begins to reach a saturation point in terms of the adoption of bandsaw machines. The growth rate will decelerate as market mature, with most industries already adopting advanced cutting technologies. However, demand will still be sustained by upgrades in existing equipment and continued investments in high-efficiency and energy-saving machines. The saturation point will occur towards the end of the forecast period, where new technology adoption slows, and growth is primarily driven by replacement cycles and incremental innovations rather than market expansion.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 126.5 billion |

| Industry Forecast Value (2035) | USD 170 billion |

| Industry Forecast CAGR (2025-2035) | 3% |

Demand for bandsaw machines in Japan is growing as the country’s industrial sectors emphasise precision, automation and material efficiency. The automotive industry’s shift toward electric vehicles and lighter alloys creates a greater need for high precision cutting equipment. Meanwhile, Japan’s robust electronics and semiconductor manufacturing base relies on advanced metal cutting tools, making CNC integrated bandsaw machines increasingly common. Applications spanning metal fabrication, machine tools and industrial machinery all contribute to demand. One study estimates the Japanese market will grow at a compound annual growth rate (CAGR) of around 3.5% from 2025 to 2035.

Another factor supporting demand is Japan’s push for automation, factory modernization and sustainability. Bandsaw machines with energy efficient motors, superior blade coatings and noise reduction features align with regulatory standards and industry goals around productivity and resource use. Smart factory initiatives, including integration of bandsaw machines into digital production lines, further reinforce uptake. Challenges include high initial investment cost, the need for skilled operators, and competition from alternative cutting technologies. Nonetheless, with a foundation in advanced manufacturing and durable equipment, the demand for bandsaw machines in Japan is expected to expand steadily.

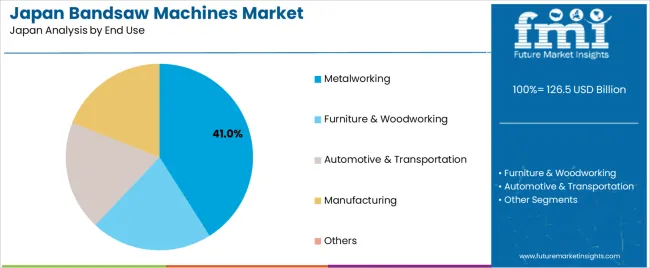

The demand for bandsaw machines in Japan is primarily driven by motor power and end-use segment. The leading motor power type is medium duty, capturing 45% of the market share, while metalworking is the dominant end-use sector, accounting for 41% of the demand. Bandsaw machines are widely used in various industries for cutting a range of materials, including metal, wood, and plastic. The increasing demand for precision cutting in manufacturing, automotive, and metalworking applications continues to drive the growth of the bandsaw machine market in Japan.

Medium duty motor power leads the bandsaw machine market in Japan, accounting for 45% of the demand. Medium-duty bandsaw machines are highly versatile and are widely used for a range of applications in industries such as metalworking, furniture manufacturing, and automotive. These machines offer a balance between power, precision, and efficiency, making them suitable for cutting a variety of materials, including metals, plastics, and woods.

The popularity of medium-duty bandsaw machines is driven by their ability to handle moderate workloads and provide consistent cutting performance without the need for the higher costs and maintenance associated with heavy-duty machines. Medium-duty machines are especially favored in sectors where a combination of power and precision is needed for routine production processes, such as in the metalworking and furniture industries. As industries in Japan continue to seek reliable and cost-effective cutting solutions, medium-duty bandsaw machines will remain the dominant choice.

Metalworking is the leading end-use segment for bandsaw machines in Japan, capturing 41% of the demand. Metalworking industries require high-precision cutting tools to process a wide variety of metals for manufacturing parts, components, and finished goods. Bandsaw machines are critical in this sector for their ability to cut through metals such as steel, aluminum, and titanium, providing the clean, accurate cuts required in metal fabrication.

The demand from the metalworking industry is driven by the continuous need for more efficient and precise cutting solutions as manufacturing processes become more advanced. As Japan remains a leader in industries such as automotive, aerospace, and general manufacturing, the need for reliable, high-performance bandsaw machines continues to grow. Additionally, as the industry focuses on reducing waste and improving cutting efficiency, bandsaw machines in the metalworking sector are expected to remain a dominant solution for cutting applications, ensuring sustained growth in this segment.

Demand for bandsaw machines in Japan reflects the maturity and precision orientation of the country’s manufacturing base. Automotive, electronics, and precision engineering sectors require high accuracy cutting equipment, which supports ongoing investments in bandsaw machines. At the same time, pressures such as slow growth in domestic heavy industry and competition from alternative cutting technologies moderate rapid expansion. These forces together shape how Japanese manufacturers assess machinery upgrades and retrofit opportunities.

What Are the Primary Growth Drivers for Bandsaw Machine Demand in Japan?

Several drivers support growth in Japan’s bandsaw machine market. First, the automotive industry’s increasing use of lightweight materials and the rise of electric vehicle production generate need for modern saw machinery with high precision and throughput. Second, the electronics and semiconductor sectors demand fine cutting capabilities for components and require advanced blade, coolant, and control technologies. Third, the trend toward factory automation and smart manufacturing means firms are investing in CNC integrated and automated bandsaw machines for improved efficiency. Fourth, infrastructure maintenance and repair of ageing industrial assets prompt replacement and upgrade of existing saw equipment.

What Are the Key Restraints Affecting Bandsaw Machine Demand in Japan?

Despite the favourable context, the market faces several constraints. Japan’s industrial growth rate is moderate compared with emerging economies, limiting large scale capital expenditure in certain sectors and thus reducing new machine purchases. High cost of investment in advanced bandsaw machines, particularly those with automation and CNC capabilities, may deter smaller fabricators. In addition, a shift in some applications toward laser, water jet or other cutting technologies may reduce the addressable demand for bandsaw machines in some niche segments.

What Are the Key Trends Shaping Bandsaw Machine Demand in Japan?

Notable trends include increased adoption of bandsaw machines tailored for high strength steel, aluminium alloys and dissimilar metal cutting as manufacturers pursue lighter weight and high performance materials. There is growing integration of digital controls, sensor systems and connectivity (Industry 4.0) to enable predictive maintenance, blade life monitoring and throughput optimisation. Furthermore, Japanese manufacturers favour energy efficient and low emission machine designs to address tighter environmental regulations and operational cost pressures. Finally, the retrofit market is growing – mid sized firms are replacing manual or semi automatic bandsaws with automated models to enhance productivity while controlling factory footprint.

The demand for bandsaw machines in Japan is driven by the country’s strong manufacturing base, which spans across industries such as automotive, metalworking, woodworking, and construction. Bandsaw machines are essential for cutting a wide variety of materials, including metal, wood, and plastics, making them critical in precision manufacturing processes. The growing need for high-performance, automated, and efficient machinery, as well as the increasing focus on industrial upgrading and automation, contributes to the market’s growth. The demand for bandsaw machines is also supported by Japan’s ongoing investments in infrastructure and industrial development. Regional variations in demand are influenced by industrial activity, the level of technological adoption, and the concentration of manufacturing sectors in different areas of Japan. Below is an analysis of the demand for bandsaw machines across Japan's regions.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8 |

| Kanto | 3.5 |

| Kinki | 3.0 |

| Chubu | 2.7 |

| Tohoku | 2.3 |

| Rest of Japan | 2.2 |

Kyushu & Okinawa leads the demand for bandsaw machines in Japan with a CAGR of 3.8%. This growth can be attributed to the region's significant industrial and manufacturing sectors, particularly in automotive production, metalworking, and shipbuilding. Kyushu & Okinawa are home to a number of manufacturing facilities that require precise and efficient cutting tools like bandsaw machines to produce automotive parts, metal components, and various other industrial goods.

Additionally, the region’s focus on improving manufacturing technologies and increasing automation in factories drives the demand for more advanced bandsaw machines. Kyushu’s geographical position, with access to major ports, further enhances the region’s importance as an industrial hub, contributing to the demand for high-quality machinery that meets international standards. As industries in the region continue to modernize and upgrade their equipment, the demand for bandsaw machines is expected to continue to grow at a strong pace.

Kanto shows strong demand for bandsaw machines with a CAGR of 3.5%. Kanto, which includes Tokyo and its surrounding areas, is Japan’s most populous and industrialized region, housing a large number of manufacturing companies that require bandsaw machines for metal and wood processing. The region is home to many automotive, electronics, and heavy machinery manufacturers, which are key drivers of industrial equipment demand, including bandsaws.

In addition to the high demand from industries, Kanto has a well-developed industrial infrastructure, which supports ongoing technological advancements and the adoption of automated cutting machines in factories. The presence of large manufacturing and distribution networks further fuels demand, as businesses seek more efficient and accurate machinery to increase production and reduce costs. As Kanto remains the economic and industrial heart of Japan, its demand for bandsaw machines is expected to continue to grow steadily.

Kinki, with a CAGR of 3.0%, shows steady demand for bandsaw machines. The region includes major manufacturing hubs like Osaka and Kobe, where industries such as automotive, construction, and metalworking require efficient cutting machines. Kinki’s demand for bandsaw machines is driven by its strong manufacturing base, particularly in steel production, automotive parts, and machinery fabrication, which rely heavily on bandsaw machines for precise cutting operations.

While the growth rate in Kinki is slightly lower than in Kyushu & Okinawa and Kanto, the region’s focus on industrial modernization and adoption of advanced manufacturing techniques ensures that demand for bandsaw machines remains steady. The increasing demand for high-precision and automated equipment, coupled with the region’s growing industrial sectors, supports the continued use of bandsaw machines in various manufacturing applications.

Chubu demonstrates moderate growth in the demand for bandsaw machines with a CAGR of 2.7%. Chubu, which includes Nagoya and surrounding areas, is home to a number of automotive manufacturers, including Toyota, as well as other heavy industries and metalworking operations. These sectors require bandsaw machines for cutting materials like steel, aluminum, and other metals used in the production of automotive parts, machinery, and industrial equipment.

Although the demand in Chubu is not as strong as in Kyushu & Okinawa and Kanto, the region's steady industrial growth, particularly in the automotive and aerospace industries, supports the adoption of bandsaw machines. As Chubu continues to embrace technological advancements and automation in manufacturing, the demand for cutting-edge machinery like bandsaws is expected to grow at a moderate pace.

Tohoku, with a CAGR of 2.3%, and the Rest of Japan, with a CAGR of 2.2%, show slower growth in the demand for bandsaw machines compared to other regions. These areas are more rural and have fewer large-scale manufacturing plants than regions like Kanto and Kyushu & Okinawa. While there is still demand for bandsaw machines, it is more concentrated in smaller industrial applications, including local manufacturing and construction projects.

Despite slower growth, the adoption of bandsaw machines in Tohoku and the Rest of Japan is supported by increasing investments in local infrastructure and a growing emphasis on precision manufacturing in smaller industries. As these regions modernize their industrial processes and seek to improve productivity, the demand for efficient cutting tools like bandsaw machines will gradually increase.

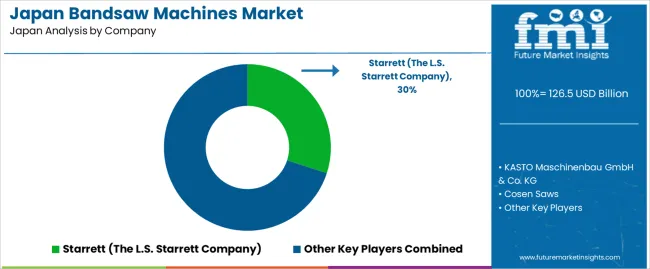

The demand for bandsaw machines in Japan is growing, driven by the country’s robust manufacturing and metalworking sectors, where precision cutting of materials such as metals, plastics, and wood is critical. Companies like Starrett (The L.S. Starrett Company), holding approximately 30% market share, KASTO Maschinenbau GmbH & Co. KG, Cosen Saws, HE&M Saw, and ITL Industries Ltd. are key players in this market. The increasing demand for high-precision machinery and advanced cutting technology in industries like automotive, construction, and metal fabrication is driving the growth of the bandsaw machine market in Japan.

Competition in the bandsaw machines industry is focused on machine precision, speed, durability, and technological innovation. Companies are developing more advanced bandsaw machines that offer faster cutting speeds, greater accuracy, and better energy efficiency. Another area of competition is automation and ease of use, with manufacturers focusing on user-friendly interfaces, automated material feeding, and integration with other manufacturing systems. Additionally, companies are investing in the development of machines that can handle a wider range of materials, providing versatile solutions for various industrial applications. Marketing materials typically highlight features such as cutting capacity, blade life, material compatibility, and overall machine performance. By aligning their offerings with the growing demand for high-performance, versatile, and efficient bandsaw machines, these companies aim to strengthen their position in Japan’s competitive bandsaw machine market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Motor Power | Medium Duty, Heavy Duty, Light Duty |

| End Use | Metalworking, Furniture & Woodworking, Automotive & Transportation, Manufacturing, Others |

| Orientation | Horizontal, Vertical |

| Cutting Range | Up to 200 mm, 201 to 300 mm, 301 to 400 mm, Above 400 mm |

| Operation | Manual, Automated |

| Key Companies Profiled | Starrett (The L.S. Starrett Company), KASTO Maschinenbau GmbH & Co. KG, Cosen Saws, HE&M Saw, ITL Industries Ltd. |

| Additional Attributes | The market analysis includes dollar sales by motor power, end-use, orientation, cutting range, and operation categories. It also covers regional demand trends in Japan, particularly driven by the increasing need for bandsaw machines in various industries, including metalworking, furniture, automotive, and manufacturing. The competitive landscape highlights key manufacturers focusing on innovations in cutting technologies and automation. Trends in the growing demand for automated bandsaw machines, as well as advancements in cutting precision and material handling, are explored. |

The global demand for bandsaw machines in japan is estimated to be valued at USD 126.5 billion in 2025.

The market size for the demand for bandsaw machines in japan is projected to reach USD 170.0 billion by 2035.

The demand for bandsaw machines in japan is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in demand for bandsaw machines in japan are medium duty, heavy duty, light duty and others.

In terms of end use, metalworking segment to command 41.0% share in the demand for bandsaw machines in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA