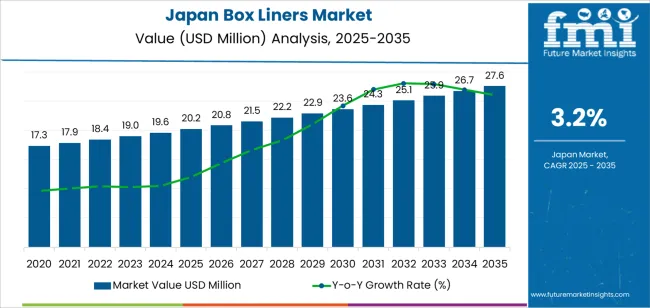

The demand for box liners in Japan is projected to reach USD 27.6 million by 2035, reflecting an absolute increase of USD 7.4 million over the forecast period. The demand, valued at USD 20.2 million in 2025, is expected to grow at a steady CAGR of 3.2%. This growth is primarily driven by the increasing need for secure, efficient, and protective packaging solutions across various industries such as food and beverage, pharmaceuticals, and e-commerce.

Box liners are used to protect products from contamination, moisture, and damage during transport and storage. As industries continue to expand their use of automated packaging and seek ways to improve packaging efficiency, the demand for high-quality, durable box liners will continue to grow. The rising prominence of e-commerce is particularly important, as more companies look for reliable packaging solutions to ensure that products reach consumers in optimal condition.

Increasing consumer preferences for eco-friendly packaging solutions are expected to drive the demand for box liners made from sustainable materials. As more businesses adopt sustainable practices and focus on reducing their environmental footprint, the demand for box liners that offer both functionality and sustainability will continue to rise.

From 2025 to 2030, the demand is expected to increase by USD 0.6 million, from USD 20.2 million to USD 20.8 million. This steady growth of approximately 2.9% reflects the ongoing need for protective packaging solutions in industries like e-commerce, food and beverage, and pharmaceuticals. The pace of growth in this period is moderate, as the demand is sustained by the expansion of these industries, which continue to focus on efficient, cost-effective packaging solutions.

Between 2030 and 2035, the demand is expected to grow more rapidly, with an increase of USD 6.8 million, rising from USD 20.8 million to USD 27.6 million. This sharp growth, representing about 32.7%, is attributed to the growing adoption of e-commerce, where packaging plays a crucial role in maintaining product integrity during shipping. The rise in consumer demand for sustainable and eco-friendly packaging solutions is expected to drive further growth during this period. The transition from steady growth to more rapid adoption reflects the increased integration of packaging innovations and a broader shift toward sustainable practices in packaging.

| Metric | Value |

|---|---|

| Japan Box Liners Value (2025) | USD 20.2 million |

| Japan Box Liners Forecast Value (2035) | USD 27.6 million |

| Japan Box Liners Forecast CAGR (2025-2035) | 3.2% |

The demand for box liners in Japan is growing due to the increasing need for efficient and protective packaging solutions across various industries, particularly in food and beverage, pharmaceuticals, and logistics. Box liners are used to provide an extra layer of protection for products, preventing contamination, leakage, and damage during transportation and storage. As the e-commerce sector continues to expand, the demand for reliable and durable packaging materials, including box liners, is rising significantly.

The food and beverage industry, in particular, is a key driver for the growth of box liners in Japan. With the increasing emphasis on food safety, hygiene, and quality control, manufacturers are turning to box liners to protect perishable goods, prevent leakage, and extend product shelf life. These liners are also crucial for maintaining the integrity of products during distribution and ensuring compliance with food safety regulations.

The rising trend of sustainable packaging and the growing focus on eco-friendly alternatives is pushing the demand for biodegradable and recyclable box liners. As businesses across Japan adopt greener practices and consumers become more conscious of the environmental impact of packaging, the demand for sustainable box liners continues to grow. The overall demand for box liners in Japan is expected to increase as industries prioritize efficiency, protection, and sustainability in their packaging solutions.

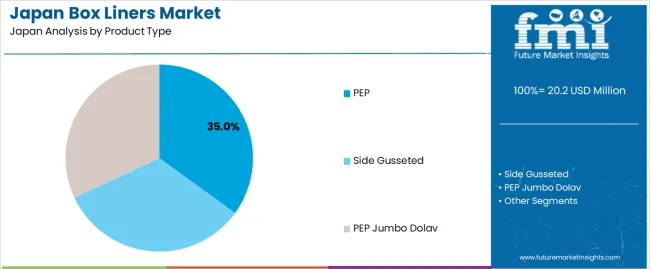

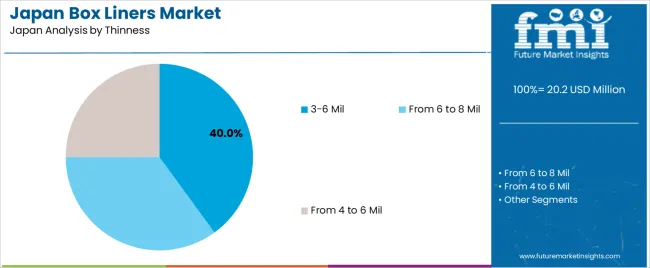

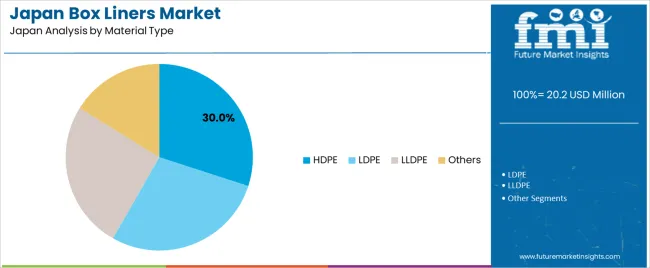

Demand is segmented by product type, thinness, material type, and region. By product type, demand is divided into PEP, Side Gusseted, and PEP Jumbo Dolav, with PEP holding the largest share. In terms of thinness, the industry is categorized into 3-6 Mil, From 6 to 8 Mil, and From 4 to 6 Mil, with 3-6 Mil being the most common. The industry is also segmented by material type, including HDPE, LDPE, LLDPE, and Others, with HDPE holding a significant share. Regionally, the demand for box liners is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

PEP (Polyethylene Pouch) box liners account for 35% of the demand in Japan. These liners are widely used for packaging due to their cost-effectiveness, durability, and ease of handling. They provide excellent protection, especially in the transportation and storage of goods, making them popular across industries such as retail, logistics, and e-commerce. PEP liners are favored for their strong strength-to-weight ratio, allowing them to handle both small and large-volume applications with ease. Their flexibility and versatility in packaging configurations further contribute to their dominance, as they can be adapted to various product types and handling requirements. As Japan's packaging needs continue to evolve, the demand for PEP liners is expected to increase, particularly in sectors like food packaging, retail, and logistics. The ongoing trend of cost-effective, reliable, and efficient packaging solutions ensures that PEP remains a preferred choice for businesses seeking versatile and sustainable packaging options.

The 3-6 Mil thinness category accounts for 40% of the demand for box liners in Japan. This range strikes a balance between strength and flexibility, making it suitable for a wide array of applications. 3-6 Mil box liners offer durability to protect products while maintaining a lightweight and flexible structure. This makes them ideal for industries such as food packaging, pharmaceuticals, and logistics, where the liners must endure handling without being overly rigid or bulky. The moderate thickness allows for easier storage and handling, while still offering resistance to punctures and tears. The material also allows for cost-effective manufacturing, reducing expenses without sacrificing quality. As Japanese businesses prioritize functional, cost-efficient, and sustainable packaging, 3-6 Mil liners remain a go-to choice for manufacturers and retailers. Their versatility, combined with the demand for reliable, yet affordable packaging, continues to fuel their popularity in various sectors.

HDPE (High-Density Polyethylene) accounts for 30% of the demand for box liners in Japan. Known for its durability, chemical resistance, and ability to withstand environmental stress, HDPE is preferred for heavy-duty applications like shipping, storage, and industrial packaging. The material's resistance to abrasion and wear makes it ideal for handling goods that need extra protection during transportation. HDPE liners are also capable of supporting substantial weight, ensuring the safety and integrity of products. This strength and rigidity make them indispensable in industries such as logistics, chemicals, and construction. HDPE liners provide superior protection against the elements, making them highly suitable for harsh conditions. With the increasing need for sustainable and reliable packaging solutions, especially in industries requiring robust and long-lasting materials, the demand for HDPE liners is expected to grow. As businesses in Japan continue to focus on quality and sustainability, HDPE remains a vital material for industrial packaging solutions.

Demand for box liners in Japan is rising as industries seek improved protection, hygiene, and precision in storage and transport. These liners are crucial in food processing, pharmaceuticals, and logistics for their moisture barrier and cleanliness features. Key drivers include e‑commerce growth, stricter food safety standards, and high‑quality manufacturing needs. Restraints include the higher cost of specialized materials, preference for existing packaging systems, and slower investment in upgrades in cost-sensitive sectors.

Why are Box Liners Gaining Popularity in Japan’s Packaging and Logistics Sectors?

Box liners are gaining popularity in Japan because they provide an effective way to upgrade packaging performance without redesigning entire box systems. In the Japanese food, beverage and ingredients industries, liners help maintain product purity, reduce cleaning and rework, and support sanitary standards required by domestic regulations and major exporters. In logistics and warehousing, especially for bulk handling and shipping, liners enable reuse of standard containers while ensuring consistent protection of contents. As Japan’s e‑commerce, reuse‑container programmes and high‑standard manufacturing grow, the demand for liners that fit these modern operations and uphold Japan’s quality expectations increases.

How are Material and Operational Innovations Driving Growth of Box Liners in Japan?

Innovations are driving growth of box liners in Japan by introducing advanced materials and faster‑deploy formats tailored to the country’s precise logistics and manufacturing environment. Improved liner films with higher puncture resistance, enhanced moisture and odor barrier properties, and lighter gauges suit Japan’s efficient packing lines. Pre‑shaped bag‑liners or form‑fit liner systems reduce insertion time and labour cost in high‑speed operations. Material shifts toward more recyclable, clean‑label‑friendly liner films and compatibility with bulk box formats (e.g., gaylords) support increased adoption. These developments reduce downtime and maintenance while aligning with sustainability efforts in Japan’s packaging sector.

What are the Key Challenges Limiting Adoption of Box Liners in Japan?

Despite favourable conditions, several challenges limit the broader adoption of box liners in Japan. One major barrier is material cost and margin sensitivity specialty liner films cost more than standard box materials, which can deter cost‑sensitive sectors or lower‑volume lines. Another challenge is the inertia of established packaging formats many operations continue using legacy boxes without liners because changeover costs or process adjustments may not be justified. Further, integration into existing packing lines may require minor adjustments or training, which some manufacturers prefer to avoid. Lastly, competition from alternative packaging innovations such as coated boxes or reusable containers may reduce the relative appeal of adding separate liners.

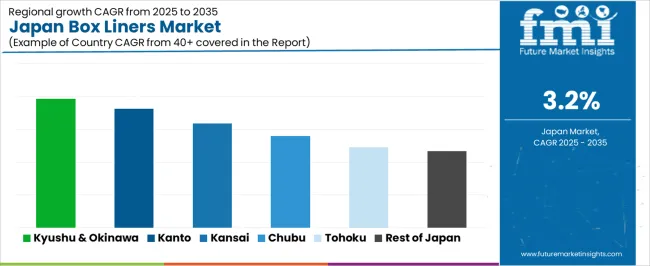

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.9% |

| Kanto | 3.6% |

| Kinki | 3.2% |

| Chubu | 2.8% |

| Tohoku | 2.5% |

| Rest of Japan | 2.3% |

Demand for box liners in Japan is growing steadily, with Kyushu & Okinawa leading at a 3.9% CAGR. This growth is largely driven by expanding logistics, food processing, and packaging industries. Kanto follows closely at 3.6%, supported by the high concentration of retail and manufacturing sectors in Tokyo and its surrounding areas. Kinki records a 3.2% CAGR, while Chubu experiences a 2.8% CAGR, fueled by steady industrial growth. Tohoku and the Rest of Japan experience slower growth, with CAGRs of 2.5% and 2.3%, respectively, as they modernize and adopt more efficient packaging solutions.

Kyushu & Okinawa is experiencing the highest demand growth for box liners in Japan, with a 3.9% CAGR. This growth can be attributed to the region’s expanding logistics and food processing sectors. As e-commerce continues to rise, there is an increasing demand for efficient packaging solutions, including box liners, to ensure that goods are delivered safely and intact. The region's food industry, particularly in Okinawa, is also growing, requiring better packaging solutions for perishables and processed food products.

Kyushu & Okinawa also benefit from their geographical location, which supports both domestic and international shipping. The rise of manufacturing hubs and food production facilities in cities like Fukuoka is further increasing the demand for packaging materials. As the region continues to modernize its logistics and manufacturing sectors, the adoption of advanced packaging technologies, including box liners, is expected to rise, making it the fastest-growing region in Japan.

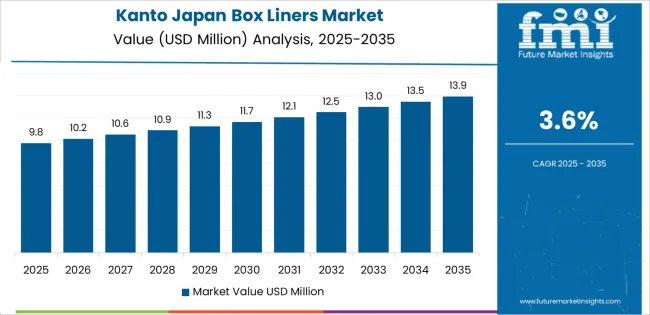

Kanto, home to Japan’s capital Tokyo, is seeing strong demand for box liners with a 3.6% CAGR. The region's dense population and high concentration of retail and distribution centers drive the demand for packaging solutions, especially in e-commerce, which requires reliable and cost-effective packaging. As the e-commerce sector continues to grow, there is a greater need for box liners to ensure the safe transportation of products.

The region’s food industry, with its focus on high-quality packaging for perishables and processed foods, also contributes to the growing demand for box liners. Kanto’s advanced manufacturing and logistics networks, combined with the increased focus on environmental standards and packaging efficiency, ensure that demand for box liners will remain strong. As businesses in Kanto continue to adopt smarter packaging solutions, the demand for these products is expected to grow steadily.

Kinki, including cities like Osaka and Kyoto, is experiencing steady growth in the demand for box liners, with a 3.2% CAGR. The region’s well-established industrial base, particularly in food production and packaging, is driving the adoption of better packaging solutions. As food processing companies in Kinki increasingly seek to improve the safety and quality of their packaging, box liners are becoming a preferred choice to protect goods during transportation.

Kinki’s growing emphasis on sustainability and eco-friendly packaging is encouraging the use of biodegradable and recyclable box liners. The region’s continued investment in infrastructure and modern manufacturing processes is driving steady demand for packaging materials that provide optimal protection and efficiency. As the region adapts to new consumer expectations and environmental regulations, demand for box liners in Kinki is expected to remain strong.

Chubu is experiencing moderate growth in the demand for box liners, with a 2.8% CAGR. The region’s manufacturing base, particularly in automotive, industrial equipment, and food production, is contributing to the need for efficient packaging solutions. As companies in Chubu expand their production lines and distribution networks, the demand for box liners is growing, especially for food packaging and logistics.

Although growth in Chubu is slower compared to other regions, the steady rise in consumer demand for safer, more efficient packaging solutions in industries like food processing is pushing the adoption of box liners. The region’s strong industrial backbone ensures that demand for packaging materials will continue to rise gradually, particularly as the manufacturing and logistics sectors continue to modernize.

Tohoku is experiencing slower growth in the demand for box liners, with a 2.5% CAGR. This is primarily due to the region being more rural and less industrialized compared to Japan’s major metropolitan areas. The industries in Tohoku are not as large-scale or urbanized, resulting in a slower adoption of advanced packaging technologies, such as box liners. The manufacturing and logistics infrastructure in Tohoku is still in the process of modernization, which impacts the rapid uptake of high-performance packaging solutions.

The situation is changing as Tohoku's manufacturing and logistics sectors gradually evolve. The region is seeing incremental improvements in its packaging processes, driven by the rise of e-commerce and the increasing distribution of food products. These factors are contributing to a more widespread adoption of box liners as companies in the region seek to improve packaging standards. While growth remains slower than in more industrialized regions, the growing focus on product protection, packaging efficiency, and sustainability is expected to support steady demand in the long term.

The Rest of Japan is experiencing slower growth in the demand for box liners, with a 2.3% CAGR. Like Tohoku, this region is more rural and less industrialized compared to Japan's more urbanized areas. The industries here tend to be smaller, and the adoption of advanced packaging technologies, such as box liners, is still in its early stages. The regions in the Rest of Japan are also working on modernizing their manufacturing and logistics infrastructures, which affects the rate at which box liners are adopted.

Despite these challenges, the demand for box liners is gradually increasing as the region modernizes and adjusts to the growing demands of e-commerce, retail, and food distribution. The continued investment in these sectors and the increasing focus on sustainability and packaging efficiency are helping drive the adoption of box liners. As businesses in these areas look to enhance their packaging standards and improve operational efficiency, demand for these protective solutions will continue to grow, albeit at a slower pace than in more industrialized regions.

The demand for box liners in Japan is growing steadily, fueled by the country’s high standards for quality, hygiene, and protection in industries such as food processing, pharmaceuticals, and logistics. Box liners—typically polymer-based liners inserted into bulk containers or boxes—are used to prevent contamination, spillage, and product degradation during transport and storage, especially for granular or powdered materials. As Japan continues to emphasize precision in manufacturing and packaging, the need for reliable liner solutions is increasingly evident.

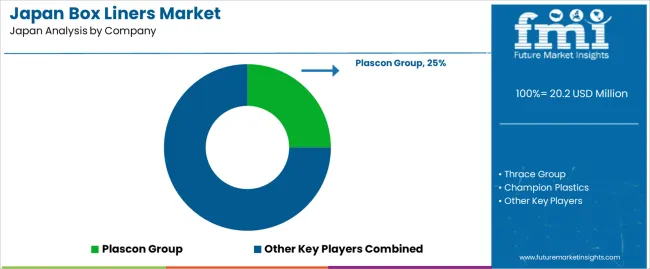

In the Japanese demand landscape, Plascon Group holds a leading share of approximately 25.0%, highlighting its strong capabilities in supplying tailored liner solutions that meet local specifications. Other important suppliers include Thrace Group, Champion Plastics, IMPAK Corporation, and Mettcover, each providing various liner products with distinct barrier properties, thicknesses, and materials to address specific applications in Japan’s industrial and food‑handling sectors.

Key drivers of demand in Japan include the aging manufacturing infrastructure, stringent contamination prevention measures, and the growth of cold‑chain logistics and bulk shipping. Japanese businesses placing greater emphasis on protective liners helps ensure product integrity and compliance with regulatory standards. While the industry is supported by demand for high‑quality and customized liners, factors such as raw‑material cost fluctuations and the need for technically advanced liner materials may moderate growth. Overall, the outlook for box liners in Japan remains positive, given the country’s ongoing focus on operational efficiency and packaging reliability.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | PEP, Side Gusseted, PEP Jumbo Dolav |

| Thinness | 3-6 Mil, From 6 to 8 Mil, From 4 to 6 Mil |

| Material Type | HDPE, LDPE, LLDPE, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Plascon Group, Thrace Group, Champion Plastics, IMPAK CORPORATION, Mettcover |

| Additional Attributes | Dollar sales by product type, thinness, material type, regional trends, distribution channels |

The global demand for box liners in japan is estimated to be valued at USD 20.2 million in 2025.

The market size for the demand for box liners in japan is projected to reach USD 27.6 million by 2035.

The demand for box liners in japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for box liners in japan are pep, side gusseted and pep jumbo dolav.

In terms of thinness, 3-6 mil segment to command 40.0% share in the demand for box liners in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA