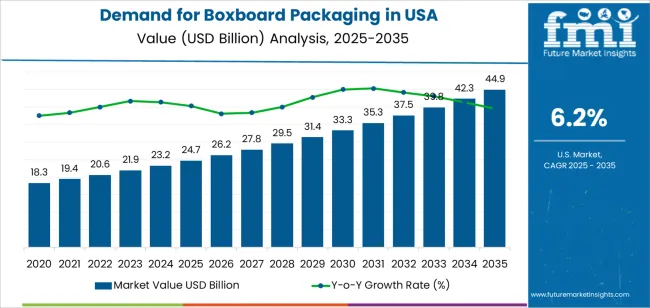

The demand for boxboard packaging in USA is expected to grow from USD 24.7 billion in 2025 to USD 44.9 billion by 2035, at a CAGR of 6.2%. Demand for boxboard packaging in the USA is projected to grow steadily as industries continue shifting toward lightweight, recyclable, and cost-efficient packaging solutions. Starting at USD 24.7 billion in 2025, demand is supported by rising use in food and beverage, consumer goods, e-commerce shipments, and retail-ready packaging. Boxboard’s versatility, printability, and support for brand visibility make it a preferred choice for packaging manufacturers. Growth is also reinforced by increasing emphasis on sustainability, as brands reduce reliance on plastics and enhance circular packaging models. Over the coming decade, stronger adoption in meal kits, beverage cartons, personal care products, and premium packaged goods will help sustain consistent expansion.

Demand will be further supported by improvements in coating technologies, high strength recycled fibers, and lightweighting innovations that increase performance without raising material cost. Consumer preference for eco friendly packaging and retailer pressure to adopt recyclable solutions continue to shape procurement patterns across the USA. Boxboard’s cost effectiveness, supply chain efficiency, and compatibility with automated filling lines will keep it central to both retail and industrial packaging applications. These factors together create favorable conditions for long term demand growth.

During the 5-year period from 2025 to 2030, demand for boxboard packaging in the USA will grow from USD 24.7 billion to USD 33.3 billion, reflecting a total increase of USD 8.6 billion. This growth block shows a strong upward trajectory driven by consumer packaging trends, sustainability initiatives, and rising product shipments across multiple industries.

Between 2025 and 2027, demand increases from USD 24.7 billion to USD 27.8 billion, adding USD 3.1 billion. This phase is influenced by rapid expansion in e commerce packaging and increased consumption of packaged foods, where boxboard’s light weight and recyclability offer strong advantages. Companies responding to sustainability goals begin prioritizing fiber based packaging solutions, creating momentum in the early years.

From 2027 to 2030, demand grows further from USD 27.8 billion to USD 33.3 billion, adding USD 5.5 billion. This later half of the growth block reflects heightened adoption of renewable packaging materials, increased consumer preference for recyclable cartons, and broader replacement of single use plastics. Rising demand from ready to eat meals, retail displays, and premium packaging applications strengthens the growth rate. Overall, the 5-year block demonstrates a robust acceleration in demand supported by structural industry shifts toward sustainable packaging and ongoing growth in product shipments across the USA.

| Metric | Value |

|---|---|

| USA Boxboard Packaging Sales Value (2025) | USD 24.7 billion |

| USA Boxboard Packaging Forecast Value (2035) | USD 44.9 billion |

| USA Boxboard Packaging Forecast CAGR (2025-2035) | 6.2% |

Demand for boxboard packaging in the USA is influenced by two significant trends: the growth of e-commerce and increased emphasis on sustainable and recyclable materials. As online shopping and direct-to-consumer product delivery expand, brands and logistics providers seek packaging that is lightweight, protective and efficient to ship. Boxboard suits these requirements because it offers strong printability, structural integrity and potential for efficient transportation. The growth of consumer goods, personal care products and prepared foods further contributes to boxboard uptake, as these segments favour premium printed cartons and brand-ready packaging.

Meanwhile, sustainability objectives and regulatory pressures are supporting greater use of boxboard materials. Brands and manufacturers are under increasing scrutiny to reduce plastic usage, increase recycled content and improve recyclability of packaging. Boxboard offers a recycled fibre-based option that meets these criteria more easily than some rigid plastics or multi-layer laminates. However, the demand trajectory in the USA is not uniformly upward. Some recent industry data point to a decline in shipments of certain types of packaging board as economic factors and alternative packaging methods impact volumes. The result is a mixed picture in which demand for high-quality, sustainably oriented boxboard packaging is strong while demand for certain traditional board formats faces headwinds.

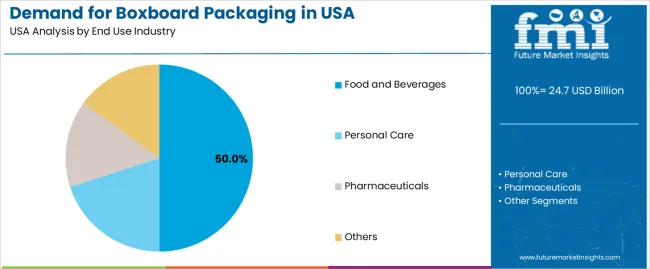

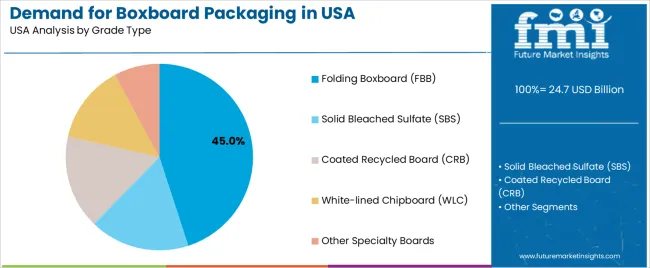

Demand for boxboard packaging in the USA is segmented by end use industry and grade type. The leading end use industry is food and beverages at 50%, while the leading grade type is folding boxboard (FBB) at 45%. These segments influence overall market demand as brands rely on lightweight, printable, and structurally reliable packaging for consumer-facing products across major retail channels.

The food and beverages segment leads with a 50% share. Boxboard packaging is used widely for dry foods, frozen meals, confectionery, ready-to-eat items, and beverage multipacks. Its printability, rigidity, and suitability for high-speed filling lines make it a preferred material for packaging formats that require branding space and structural strength. The growing variety of packaged foods in supermarkets and the continued expansion of ready-to-eat and convenience-focused categories further strengthen demand for boxboard.

Food and beverage producers also value boxboard for its compatibility with coatings and barriers that help protect products from moisture and light exposure. Boxboard supports efficient stacking, transport, and retail display, which are essential for high-volume packaged goods. As the USA continues to see stable growth in packaged food consumption and diversified product lines, food and beverages remain the leading industry driving demand for boxboard packaging.

Folding boxboard (FBB) leads the grade type segment with a 45% share. FBB is a lightweight material made from mechanical pulp and chemical pulp layers, providing strength, stiffness, and high-quality printing surfaces. These attributes make it suitable for packaging that must balance durability with visual appeal, particularly in food, personal care, and over-the-counter pharmaceutical products.

The demand for FBB is supported by its favorable strength-to-weight ratio and its suitability for intricate folds and shapes, enabling versatile packaging designs. Brands use FBB for cartons that require both shelf impact and dependable structural performance. Its recyclability also aligns with rising sustainability expectations in the USA market. As packaging requirements continue to emphasize print quality, format flexibility, and environmental performance, FBB remains the leading boxboard grade type used across major end use sectors.

Demand for boxboard packaging in the United States is driven by the need for lightweight, cost-efficient, and sustainable packaging solutions across food & beverage, personal care and retail sectors. As e-commerce growth intensifies and brands focus on consumer experience and recyclability, boxboard formats become more attractive. At the same time, market dynamics are shaped by raw-material supply, renewable-content sourcing and competition from plastic and alternative packaging materials.

What Are The Primary Growth Drivers for Boxboard Packaging Demand in the United States?

Major growth drivers include the rise of online retail and direct-to-consumer shipment volumes, which boost demand for protective yet lightweight boxboard formats. The large food & beverage sector in the USA increasingly uses boxboard cartons for cereals, snacks, beverages and prepared foods, supporting volume growth. Sustainability mandates and corporate packaging-goals favour materials with high recycled content, strong recycling streams and lower carbon footprint, helping boxboard adoption. Additionally, premiumisation of consumer goods (cosmetics, pharmaceuticals, specialty foods) promotes brands choosing high-print-quality boxboard for brand differentiation.

What Are the Key Restraints Affecting Boxboard Packaging Demand in the United States?

Despite favourable trends, some restraints exist. Supply-chain pressures such as higher pulp and fiber costs, disruption in recycled-board availability and volatility in energy or processing inputs can raise boxboard cost and reduce competitiveness. Competition remains from plastics, flexible packaging and corrugated board in certain applications where cost, durability or moisture barrier matter more. Also, high-volume segments may favour cheaper or less premium packaging formats, which can limit substitution toward boxboard. Finally, recycling infrastructure and consumer awareness vary regionally, impacting the effective sustainability advantage of boxboard in some markets.

What Are the Key Trends Shaping Boxboard Packaging Demand in the United States?

Key trends include increased use of lightweight and high-recycled-content boxboard grades to meet both cost and environmental goals. Greater adoption of printed, premium and structural boxboard packaging for e-commerce unboxing experiences is evident. There is rising interest in solutions that combine high quality graphics and structural performance (for example for cosmetic kits or subscription-box formats). Growth of foodservice and retail ready-to-eat categories drives demand for boxboard trays and cartons. Sustainable packaging commitments from major USA retailers and brands are further pushing boxboard USAge and driving innovation in barrier coatings, minimal adhesives and fully recyclable board structures.

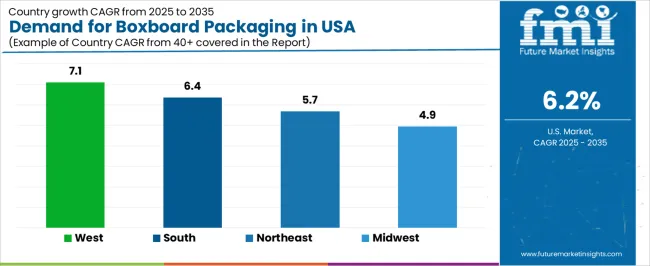

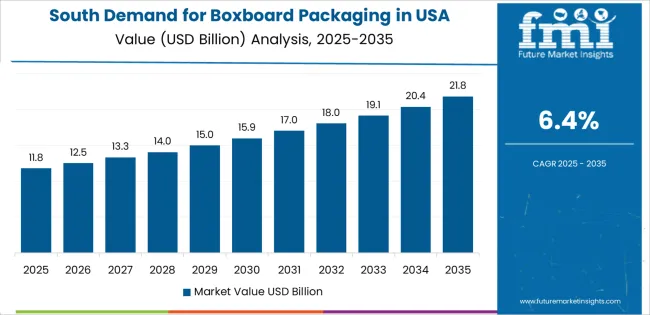

The demand for boxboard packaging in the USA is rising as businesses seek sustainable, lightweight, and versatile packaging solutions for food, beverages, personal care, household goods, and e commerce shipments. Boxboard, known for its printability, structural integrity, and recyclability, is increasingly used across consumer goods and retail applications. Growth is being driven by shifting consumer preferences toward eco friendly packaging, expansion of online retail, and rising demand for packaged food products. Regional performance varies, with the West and South leading due to strong manufacturing, retail activity, and sustainability focused markets. The Northeast and Midwest show steady adoption supported by food processing, commercial distribution, and brand level sustainability commitments. This analysis explores how each region contributes to the expanding demand for boxboard packaging in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 7.1% |

| South | 6.4% |

| Northeast | 5.7% |

| Midwest | 4.9% |

The West region leads the USA boxboard packaging market with a CAGR of 7.1%. The region is highly active in sustainability initiatives, which strongly supports increased adoption of recyclable boxboard materials. Consumer demand for environmentally friendly packaging in food, beverage, and personal care categories is particularly strong in states such as California and Washington. The West also has a large concentration of organic food brands, premium beverage companies, and beauty product manufacturers that rely heavily on boxboard for retail ready and branded packaging. Growth in e commerce and subscription box services further boosts demand, as these businesses prefer lightweight and visually appealing packaging formats. With a focus on reducing plastic USAge, enhancing recyclability, and improving brand presentation through high quality printing, the West continues to drive strong demand for boxboard packaging.

The South region records a strong CAGR of 6.4%. The region has a rapidly expanding consumer goods sector, supported by population growth, rising household spending, and growing retail networks. Boxboard packaging is widely used in packaged foods, beverages, health and beauty products, household supplies, and fast moving consumer goods, all of which are thriving in the South. The presence of major manufacturing and distribution hubs enhances the demand for packaging materials, including boxboard. The South is also experiencing growth in e commerce fulfillment centers, which increases the use of protective and branded boxboard packaging for shipping and retail display. Many brands in the region are adopting recyclable packaging formats to align with sustainability trends, further propelling boxboard demand.

The Northeast region shows a stable CAGR of 5.7%. The region has a strong concentration of food, beverage, cosmetics, and pharmaceutical brands that use boxboard for retail packaging and product protection. Consumer demand for premium, sustainable packaging options remains high, especially in urban areas with environmentally conscious buyers. Boxboard is preferred for its print quality, rigidity, and recyclability, making it suitable for upscale packaging applications common in the Northeast. The region’s dense retail and grocery networks also drive steady demand for boxboard cartons, sleeves, and folding boxes. With increasing emphasis on waste reduction and sustainable packaging legislation, the Northeast will continue adopting more boxboard based solutions across commercial and consumer sectors.

The Midwest region shows a solid CAGR of 4.9%. The region is home to a large food processing and manufacturing base, which drives steady consumption of boxboard packaging for cereals, snacks, frozen foods, ready meals, and beverage multipacks. As the Midwest continues to modernize its manufacturing capabilities and adopt more sustainable packaging materials, demand for recyclable boxboard is gradually increasing. The region’s extensive logistics and distribution networks support widespread movement of consumer goods, creating consistent need for durable, lightweight packaging. While growth is slower compared to coastal regions, increased adoption of sustainable packaging, expansion of regional retail chains, and rising consumer interest in recyclable materials continue to support long term demand for boxboard packaging in the Midwest.

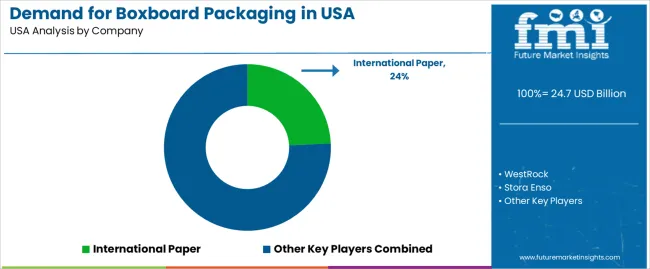

Demand for boxboard packaging in the United States continues to grow as brands in food, beverage, personal care and household goods expand their use of recyclable paper based formats. Companies such as International Paper with an estimated 24.2% share, WestRock, Stora Enso, Smurfit Kappa, DS Smith and Mondi Group operate within a market shaped by shifts in retail distribution, higher e commerce volume and stronger sustainability expectations. Folding boxboard, coated recycled board and solid bleached board remain widely used in cartons for food, cosmetics and pharmaceuticals. USA buyers place value on stiffness, print surface quality and reliable barrier performance, which guides investment in fiber processing and coating technologies. Growth is supported by brand efforts to replace plastic formats with renewable alternatives and by consistent demand across consumer packaged goods.

Competition develops around production scale, product versatility and supply chain coverage. Large producers maintain extensive mill networks that supply coated and uncoated grades with stable caliper and color consistency. Firms also refine barrier coatings that support grease or moisture sensitive applications without requiring plastic layers. Customization remains a strategic focus, with converters offering structural design support, specialty finishes and carton assemblies tailored to high speed filling lines. Product brochures typically highlight board weight ranges, brightness levels, bending resistance, food contact compliance and recyclability credentials. Companies with regional converting plants can meet short lead time requirements for national retailers and fast moving brands. By aligning material performance with sustainability goals, printing needs and operational efficiency, suppliers aim to strengthen their role in the evolving USA boxboard packaging market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | North America |

| End Use Industry | Food and Beverages, Personal Care, Pharmaceuticals, Others |

| Grade Type | Folding Boxboard (FBB), Solid Bleached Sulfate (SBS), Coated Recycled Board (CRB), White-lined Chipboard (WLC), Other Specialty Boards |

| Key Companies Profiled | International Paper, WestRock, Stora Enso, Smurfit Kappa, DS Smith, Mondi Group |

| Additional Attributes | The market analysis includes dollar sales by grade type and end use industry categories. It also examines demand trends for boxboard packaging in the United States, driven by growth in packaged food, personal care items, and pharmaceutical products. The competitive landscape highlights major producers focusing on lightweighting, recyclability, and high-strength fiber solutions. Sustainability initiatives and increasing adoption of recycled content boards are also key market influences. |

The global demand for boxboard packaging in USA is estimated to be valued at USD 24.7 billion in 2025.

The market size for the demand for boxboard packaging in USA is projected to reach USD 44.9 billion by 2035.

The demand for boxboard packaging in USA is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in demand for boxboard packaging in USA are food and beverages, personal care, pharmaceuticals and others.

In terms of grade type, folding boxboard (fbb) segment to command 45.0% share in the demand for boxboard packaging in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA