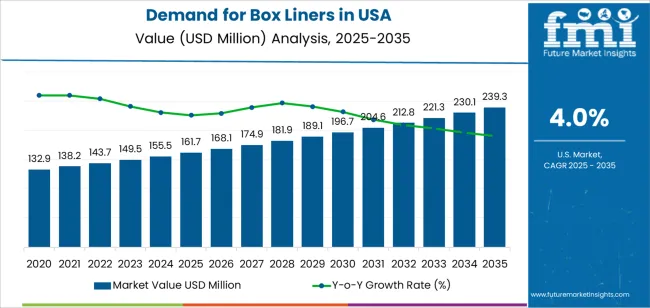

The demand for box liners in the USA is projected to reach USD 239.1 million by 2035, reflecting an absolute increase of USD 77.4 million over the forecast period. The demand, valued at USD 161.7 million in 2025, is expected to grow at a steady CAGR of 4.00%. This growth is primarily driven by the increasing use of box liners across various industries such as food packaging, pharmaceuticals, and e-commerce, where protective packaging solutions are in high demand to maintain product integrity during transit and storage.

Box liners are critical packaging solutions used to line boxes and containers to provide additional protection against contamination, moisture, and damage during handling, storage, and shipping. As consumer preferences shift toward safer, more secure packaging, the demand for box liners is expected to grow, especially in sectors where product safety and quality are paramount. The expansion of e-commerce and the growing demand for online shopping will contribute significantly to the rising need for packaging solutions like box liners.

The peak-to-trough analysis for the demand for box liners in the USA highlights a consistent upward trend, with gradual growth followed by a notable acceleration in the latter part of the forecast period. The peak year is projected to be 2035, when demand will reach USD 239.1 million, an increase of USD 77.4 million from USD 161.7 million in 2025. This growth is driven by the continued expansion of e-commerce and the increasing need for reliable, protective packaging solutions that ensure product integrity during shipping and storage. The rise in online shopping and shifting consumer preferences for packaging that preserves product quality are significant contributors to this demand.

The trough year is 2025, with demand at USD 161.7 million, marking the baseline for the forecast. During this time, demand will remain steady as industries begin to recognize the growing importance of protective packaging. From 2029 to 2035, demand will accelerate, driven by broader adoption in e-commerce and packaging innovations designed to enhance functionality, such as improved durability and cost-effectiveness. The total growth from trough to peak is about 47.8%, reflecting the steady increase in demand as companies continue to seek more efficient, reliable, and protective packaging solutions to meet the expanding needs of the e-commerce industry and consumer expectations for product safety.

| Metric | Value |

|---|---|

| USA Box Liners Sales Value (2025) | USD 161.7 million |

| USA Box Liners Forecast Value (2035) | USD 239.1 million |

| USA Box Liners Forecast CAGR (2025-2035) | 4.0% |

The demand for box liners in the USA is growing due to the increasing need for efficient packaging solutions across various industries, including food and beverage, pharmaceuticals, and consumer goods. Box liners are used to provide additional protection for products, ensuring that they remain safe from contamination, damage, and environmental factors during transportation and storage. With the rise in e-commerce and online retail, the need for reliable and durable packaging solutions to protect products during shipping has significantly increased.

The growth in the food and beverage industry, particularly in the delivery and transportation of perishable goods, is a key driver for the demand for box liners. These liners are used to prevent leakage, contamination, and spoilage, making them essential for maintaining product quality throughout the supply chain. The increased focus on sustainability in packaging also contributes to industry growth, as companies seek eco-friendly and biodegradable box liner options to align with environmental goals.

The expanding e-commerce sector, which requires robust packaging to ensure the safe delivery of a wide range of products, is further boosting demand for box liners. As businesses continue to prioritize packaging solutions that offer both protection and convenience, the industry for box liners is expected to grow steadily. Despite challenges such as the need for cost-effective production and competition from alternative packaging materials, the overall demand for box liners remains strong as industries look for reliable and protective packaging solutions.

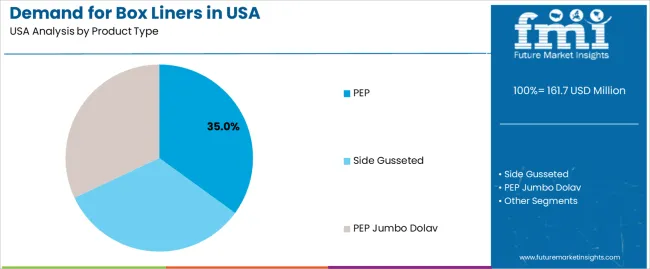

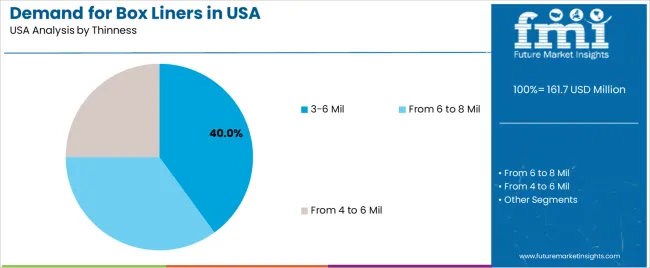

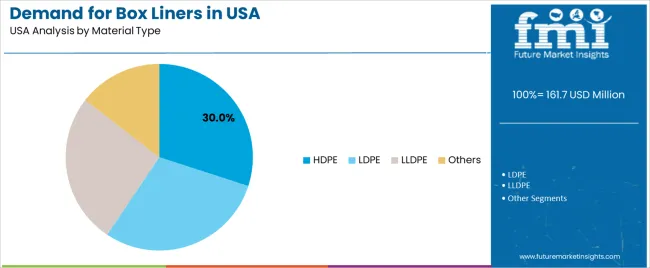

Demand is segmented by product type, thinness, material type, and region. By product type, demand is divided into PEP, side gusseted, and PEP jumbo dolav. Based on thinness, demand is categorized into 3-6 mil, from 6 to 8 mil, and from 4 to 6 mil. In terms of material type, demand is segmented into HDPE, LDPE, LLDPE, and others. Regionally, demand is divided into the West, South, Northeast, and Midwest.

PEP (Polyethylene Pouch) accounts for 35% of the demand for box liners in the USA. PEP box liners are widely used in industries requiring secure and durable packaging solutions, particularly in logistics, food processing, and manufacturing. They are preferred for their versatility, as they can be adapted to various container shapes and sizes, providing a customizable fit for different applications. PEP box liners offer excellent protection against moisture, dust, and contamination, which is essential for the safe storage and transport of products. Their cost-effectiveness and ease of use, combined with high-quality material properties, make them the leading choice across multiple industries. The growing demand for efficient packaging and environmentally-friendly options is driving the continued popularity of PEP liners, ensuring their dominance in the industry.

The 3-6 mil thinness category accounts for 40% of the demand for box liners in the USA. This range is the most commonly used for general packaging and storage due to its optimal balance of strength and flexibility. Box liners in this thickness are sufficiently durable to withstand heavy-duty use while still being lightweight and cost-effective. They are widely used across various industries, including food, pharmaceuticals, and industrial packaging, where durability and protection from contaminants are essential. The 3-6 mil thickness also offers ease of handling and compatibility with automated packing systems, making it the preferred choice for bulk packaging applications. As consumer demand for efficient, versatile, and affordable packaging solutions continues to rise, the 3-6 mil thinness range is expected to remain the leading choice for box liners in the USA.

HDPE (High-Density Polyethylene) accounts for 30% of the demand for box liners in the USA. HDPE is favored for its excellent strength-to-density ratio, which makes it durable yet lightweight, ideal for packaging and storage. It offers superior resistance to punctures, tears, and moisture, making it suitable for a wide range of applications, from food packaging to industrial storage. HDPE box liners are also known for their chemical resistance, which allows them to safely contain a variety of products, including chemicals and pharmaceuticals. HDPE is a more environmentally sustainable option compared to other plastics, driving demand from companies seeking eco-friendly packaging solutions. As industries increasingly focus on sustainability and durability, HDPE’s superior performance and versatility ensure its leading position in the industry for box liners.

Box liners offer moisture barriers, dust shields, and improved cleanliness, particularly in food & beverage, pharmaceuticals, and bulk material handling. Key drivers include growth in e‑commerce fulfilment, stricter hygiene/clean‑chain requirements, and increased use of bulk board‑boxes in industrial logistics. Restraints stem from cost pressures due to liner materials, competition from alternative packaging formats, and slower growth in overall box‑volume in some sectors.

Why are Box Liners Gaining Popularity in US Packaging & Logistics?

Box liners are gaining popularity in the USA because they provide a cost‑effective way to upgrade packaging performance without redesigning full box systems. For food processors and ingredient distributors, liners help maintain product integrity, reduce wipe‑down effort and support sanitary compliance. In e‑commerce and large‑scale logistics, liners minimise cross‑contamination across multiproduct shipments and make bulk boxes reusable. As supply‑chains shift towards more frequent, smaller shipments with higher standards, box liners become a preferred upgrade in packaging systems that already use standard boxes.

How are Material and Operational Innovations Driving Growth in This Segment in the USA?

Innovations are driving growth of box liners in the USA by introducing higher‑performance films and faster installation usability. Improved liner materials (such as thin polyethylene films with enhanced puncture resistance) allow lower‑weight liners yet maintain barrier properties. Rapid‑fit liner systems and pre‑shaped bags reduce insertion time in fulfilment lines. Better compatibility with bulk box formats (e.g., pallet‑sized gaylords) means liners are adopted in industrial rather than purely consumer‑packaged goods. These advancements lower downtime, reduce waste, and make the business case for liners more compelling in high‑throughput US operations.

What are the Key Challenges Limiting Adoption of Box Liners in the USA?

Despite positive factors, several challenges limit adoption of box liners in the USA. One major barrier is material cost and margin pressure liners add incremental cost to each box and in highly cost‑sensitive segments this can deter use. Box‑volume decline or stagnation in certain segments (such as traditional retail goods) reduces potential liner demand growth. Integration of liners into existing packing lines may require minor process changes or training, which some operators avoid. Finally, alternative packaging innovations (such as reusable containers or coated boxes) may serve similar protection functions and compete with liner usage.

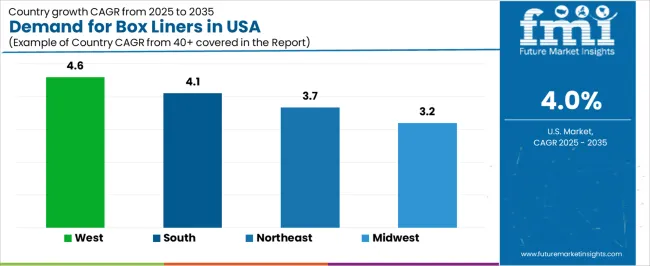

| Region | CAGR (%) |

|---|---|

| West | 4.6% |

| South | 4.1% |

| Northeast | 3.7% |

| Midwest | 3.2% |

The demand for box liners in the USA is growing across various regions, with the West leading at a 4.6% CAGR. This growth is driven by the increasing use of box liners in packaging solutions for e-commerce, retail, and food industries. The South follows with a 4.1% CAGR, supported by the region’s expanding manufacturing and distribution sectors. The Northeast shows a 3.7% CAGR, fueled by the growing demand for sustainable and eco-friendly packaging solutions. The Midwest, while growing at a more moderate 3.2%, continues to adopt box liners in packaging, driven by the region’s significant logistics and food production industries.

The West is experiencing the highest demand growth for box liners in the USA, with a 4.6% CAGR. The region’s robust e-commerce sector, especially in states like California and Washington, is a major driver of this trend. With the rise in online shopping and product shipments, the demand for effective and eco-friendly packaging solutions, including box liners, has surged. Box liners provide essential protection for goods during transit, making them an ideal choice for e-commerce companies looking to ensure the safety of their products.

The West’s strong focus on sustainability and reducing plastic waste has led to an increasing preference for recyclable and biodegradable box liners. The region’s commitment to eco-conscious packaging and innovation further supports the growth of box liners in both e-commerce and retail packaging applications. As the demand for more sustainable packaging options continues to rise, box liners are becoming a go-to solution for companies seeking to improve both product protection and environmental impact.

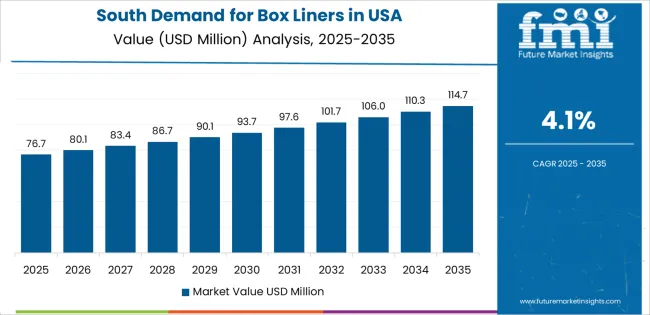

The South is seeing steady growth in the demand for box liners, with a 4.1% CAGR. The region’s expanding manufacturing and logistics sectors, particularly in states like Texas, Georgia, and Florida, are key drivers of this demand. As distribution networks continue to grow and e-commerce adoption increases, the need for packaging solutions like box liners to protect products during transportation is becoming more pronounced. Box liners are particularly valuable for industries such as food processing and retail, where goods need to be shielded from contaminants, moisture, or damage during shipping.

The South’s growing focus on sustainability also plays a role in the rising demand for box liners made from eco-friendly materials. With increasing consumer demand for sustainable packaging and the need for companies to meet environmental standards, the adoption of recyclable or biodegradable box liners is expected to continue to grow. As the region continues to embrace both innovation in packaging and a commitment to sustainability, the demand for box liners will remain strong.

The Northeast is experiencing moderate growth in the demand for box liners, with a 3.7% CAGR. The region’s focus on high-quality, sustainable packaging solutions is a major factor driving this trend. Cities like New York and Boston have a high concentration of retail, e-commerce, and food industries that rely on packaging materials such as box liners to ensure the safe delivery of goods. With the growing consumer preference for eco-friendly packaging and the increasing push for sustainability in business practices, the Northeast is seeing a rise in demand for box liners made from recyclable and biodegradable materials.

The region’s logistics and distribution networks, which are essential to both retail and food sectors, continue to adopt box liners to meet the needs of their customers. As more businesses prioritize reducing their environmental impact and improving product safety during transit, the use of box liners is expected to grow. The Northeast’s emphasis on sustainability, along with its vibrant e-commerce sector, will contribute to the ongoing demand for box liners.

The Midwest is witnessing steady growth in the demand for box liners, with a 3.2% CAGR. The region’s strong manufacturing and food production industries are key contributors to this growth. States like Illinois, Michigan, and Ohio, with their substantial manufacturing sectors, continue to drive the need for packaging solutions that provide product protection and improve logistics efficiency. Box liners are increasingly used in these industries to protect goods during shipment and to maintain the quality of products, particularly in the food and beverage sector.

Although the growth in the Midwest is slower compared to other regions, there is still a steady rise in the adoption of sustainable and efficient packaging solutions. With the growing consumer focus on environmentally friendly packaging options, companies in the Midwest are increasingly turning to box liners made from recyclable or compostable materials. As the region’s food processing, manufacturing, and logistics sectors continue to expand, the demand for box liners in packaging applications will continue to increase.

The demand for box liners in the United States is on the rise as industries increasingly prioritize protecting bulk goods, improving packaging efficiency, and maintaining product integrity during transport and storage. Box liners-polyethylene or other polymer liners inserted into transit boxes or bulk containers-help prevent contamination, spillage, and product damage in sectors such as chemicals, food ingredients, metals, and agricultural commodities. As supply chains evolve and logistics become more complex, the need for reliable containment solutions supports increased procurement of box liners.

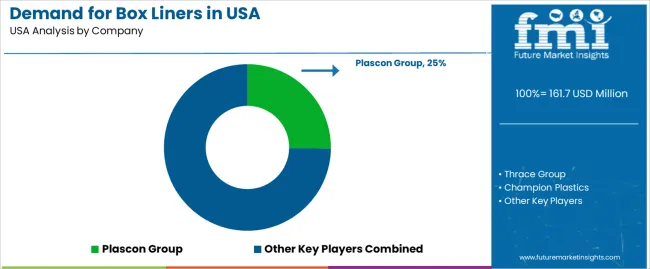

In the USA demand landscape, Plascon Group is a leading provider with a share of approximately 25.2%, underlining its strong industry presence and ability to serve major industrial end‑users with customized liner solutions. Other significant suppliers include Thrace Group, Champion Plastics, IMPAK Corporation, and Mettcover, each contributing to supplying the USA demand by offering versatile liner types, various thicknesses, and barrier properties tailored to specific applications.

Key drivers of demand in the USA include growth in industrial manufacturing, increasing volume of bulk shipping and storage of raw materials, and strengthened regulatory and customer requirements for reliable containment systems. The rise in e‑commerce and rapid logistics turnover in sectors handling powdered or granular materials boosts demand for high‑quality box liners. Challenges could arise from fluctuations in raw material prices (like polyethylene) and the need for liners with higher barrier or environmental credentials. Nonetheless, the outlook for the USA demand for box liners remains strong, with continued emphasis on efficiency, safety, and protective packaging solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | PEP, Side Gusseted, PEP Jumbo Dolav |

| Thinness | 3-6 Mil, From 6 to 8 Mil, From 4 to 6 Mil |

| Material Type | HDPE, LDPE, LLDPE, Others |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Plascon Group, Thrace Group, Champion Plastics, IMPAK CORPORATION, Mettcover |

| Additional Attributes | Dollar sales by product type, thinness, material type, and regional adoption trends, competitive landscape, advancements in box liner technologies, integration with packaging industries. |

Product Type

The global demand for box liners in USA is estimated to be valued at USD 161.7 million in 2025.

The market size for the demand for box liners in USA is projected to reach USD 239.3 million by 2035.

The demand for box liners in USA is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in demand for box liners in USA are pep, side gusseted and pep jumbo dolav.

In terms of thinness, 3-6 mil segment to command 40.0% share in the demand for box liners in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA