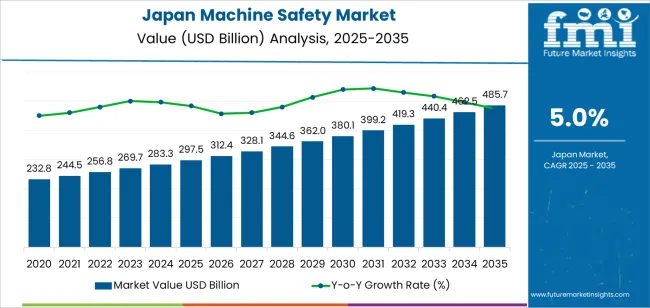

The demand for machine safety solutions in Japan is expected to grow from USD 297.5 billion in 2025 to USD 485.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.0%. Machine safety, which involves systems designed to prevent accidents, reduce operational risks, and ensure compliance with safety regulations, is crucial as industries continue to automate processes and improve productivity. With growing concerns over worker safety, regulatory compliance, and operational efficiency, demand for machine safety products and services is rising across sectors such as manufacturing, automotive, and robotics.

As Japan’s manufacturing industry continues to evolve, robotics integration and the increasing adoption of industrial automation are major drivers of this growth. Machine safety solutions play a key role in ensuring that automated systems operate safely, protecting both workers and machinery. Japan, known for its technological leadership, has a strong focus on implementing the latest safety standards and practices to reduce the risks associated with industrial automation. Regulations around industrial safety are becoming stricter, driving the need for more advanced safety systems and technologies.

Between 2025 and 2030, the demand for machine safety in Japan is expected to grow from USD 297.5 billion to USD 312.4 billion. During this phase, the industry will experience steady momentum, driven by the ongoing rise of automation, increased adoption of robotics, and the implementation of advanced safety systems across various industries. This gradual increase in demand will reflect the need for enhanced operational safety and adherence to international safety standards, especially as automation continues to expand in manufacturing plants and other critical sectors.

From 2030 to 2035, demand for machine safety solutions is projected to accelerate significantly, growing from USD 312.4 billion to USD 485.7 billion. The sharper rise in demand during this period will be driven by the growing reliance on smart manufacturing systems, increased use of artificial intelligence (AI), and machine learning in industrial processes, which require robust safety protocols to prevent risks associated with automation. As the IoT (Internet of Things) expands within industrial settings, ensuring the safety of interconnected systems becomes increasingly important. The demand for predictive maintenance, safety sensors, and automated safety systems will experience rapid growth as businesses invest in technologies that improve workplace safety and operational performance.

| Metric | Value |

|---|---|

| Demand for Machine Safety in Japan Value (2025) | USD 297.5 billion |

| Demand for Machine Safety in Japan Forecast Value (2035) | USD 485.7 billion |

| Demand for Machine Safety in Japan Forecast CAGR (2025-2035) | 5.0% |

The demand for machine safety in Japan is increasing due to the growing focus on workplace safety and the implementation of stricter regulations in industrial sectors. As Japan continues to lead in manufacturing and automation, ensuring the safety of machinery and equipment is critical to prevent accidents, reduce workplace injuries, and maintain operational efficiency. Machine safety systems, including safety sensors, controllers, and emergency stop devices, are essential for protecting workers from hazardous machinery operations.

A key driver of this growth is Japan's aging workforce and the need to ensure that older employees, who may be at higher risk for injury, can safely operate machinery. With an increasing focus on automation and robotics in industries such as automotive manufacturing, food production, and electronics, there is a heightened need for advanced safety systems to safeguard workers. The incorporation of machine safety protocols also helps organizations comply with Japan’s occupational safety and health regulations, further driving the adoption of safety systems.

Technological advancements in safety solutions, such as predictive maintenance and smart safety devices, are also contributing to the rising demand. As industries seek to improve efficiency while enhancing safety, innovations in machine safety technologies are becoming more prevalent. As Japan continues to invest in automation and robotics, the demand for machine safety systems is expected to grow steadily, driven by both regulatory requirements and the need to ensure safe, efficient operations across various sectors through 2035.

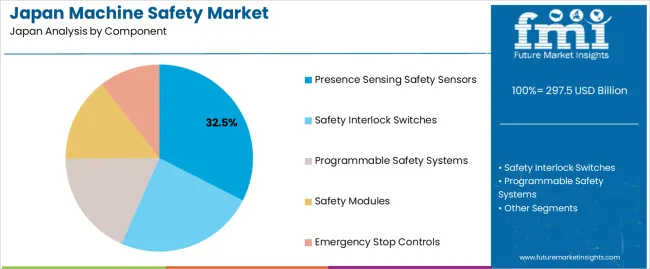

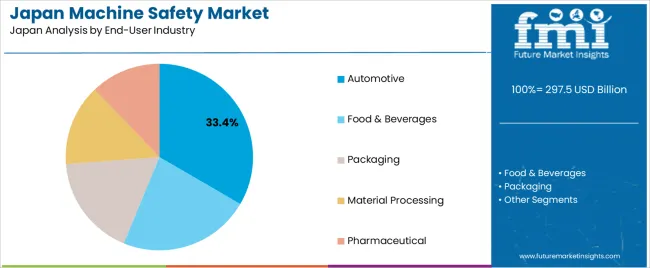

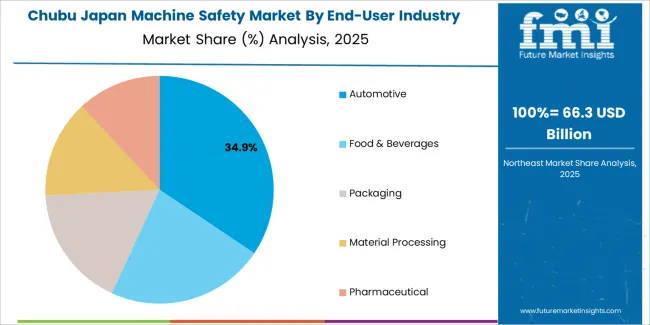

Demand for machine safety in Japan is segmented by component, industry, and region. By component, demand is divided into presence sensing safety sensors, safety interlock switches, programmable safety systems, safety modules, and emergency stop controls, with presence sensing safety sensors leading the demand at 33%. The demand is also segmented by industry, including automotive, food & beverages, packaging, material processing, and pharmaceuticals, with the automotive industry leading the demand at 33.4%. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan.

Presence sensing safety sensors account for 33% of the demand for machine safety components in Japan. These sensors are crucial in ensuring the safety of operators and equipment in automated environments. They work by detecting the presence of personnel or objects within a specified range, triggering the appropriate safety response, such as halting machinery or activating safety barriers. Presence sensing safety sensors are particularly important in industries like automotive and food processing, where machinery operates at high speeds and precision is vital. These sensors help prevent accidents, enhance productivity, and comply with safety regulations. As automation continues to grow, the demand for these sensors is expected to increase, particularly in industries focusing on worker safety and reducing downtime.

The automotive industry accounts for 33.4% of the demand for machine safety in Japan. This industry is highly reliant on machine safety components to ensure the safety of workers and the efficiency of automated production lines. With advanced robotic systems and high-speed machinery, the automotive industry requires safety solutions that prevent accidents and minimize downtime.

Presence sensing safety sensors, safety interlock switches, and emergency stop controls are commonly used to protect workers in assembly lines and ensure compliance with strict workplace safety standards. The automotive industry’s emphasis on precision, speed, and worker safety drives the demand for machine safety components. As automation and robotics continue to advance in automotive manufacturing, the demand for safety systems will continue to rise, making the automotive industry a key player in the machine safety industry.

In Japan, demand for machine‑safety systems are rising as industries adopt more automation, robotics and industrial IoT, thereby increasing machinery complexity and workplace risk exposure. The heavy manufacturing sector, automotive, electronics, semiconductor, food processing is modernising production lines and emphasising safety interlocks, emergency‑stop systems, safety PLCs and presence sensors. Regulatory and compliance pressures (such as harmonising with ISO 13849, IEC 62061 and local workplace‑safety regulations) push manufacturers to upgrade older machines with certified safety systems. On the restraint side, high cost of retrofits, integration complexity in legacy factories, and supply‑chain constraints for specialised safety components can slow uptake.

Demand for machine‑safety systems in Japan is growing because the manufacturing environment is shifting toward higher automation and smart‑factory operations. As factories adopt robots, collaborative machines (cobots) and interconnected systems, safety hazards from human‑machine interaction increase. Companies therefore prioritise certified safety solutions to mitigate liability, protect workers, maintain production uptime and comply with stricter safety regulations. The ageing workforce and labour shortages also amplify the need for systems that reduce human risk and error. Safety‑certified equipment can be a differentiator in exporting machines or components, which further drives investment in machine‑safety systems throughout Japanese production sites.

Technological innovations are enabling growth of machine safety in Japan by offering smarter, integrated safety‑solutions. These include safety PLCs with diagnostics, presence and motion‑detection sensors with higher resolution, connected safety modules that communicate with IoT platforms for predictive maintenance and risk monitoring, and modular safety components designed for easier retrofitting of legacy machines. Improved software for risk‑assessment and safety‑function validation reduces engineering time. These innovations make safety upgrades more cost‑effective and scalable, encouraging more Japanese manufacturers to adopt enhanced machine‑safety systems in their factories.

Despite promising demand, adoption of machine‑safety systems in Japan faces several challenges. One major hurdle is cost: upgrading existing machines, installing certified components and training personnel require significant investment, which can be hard to justify in tight‑margin operations. Integration complexity in older factories with machines that may lack safety architecture or standardisation adds engineering burden. Supply‑chain issues for safety‑components (especially for highly certified systems) and the need to maintain production downtime during installation create further barriers. Smaller manufacturers may lack awareness or resources to meet evolving safety‑standards, slowing broader adoption across all factory segments.

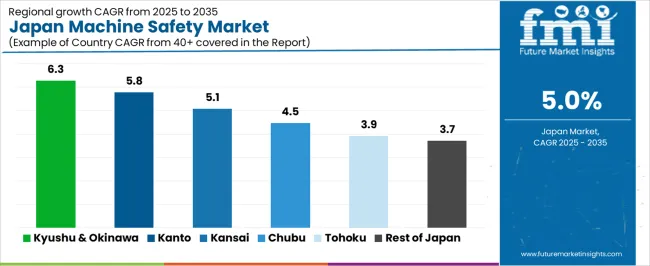

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.3% |

| Kanto | 5.8% |

| Kansai | 5.1% |

| Chubu | 4.5% |

| Tohoku | 3.9% |

| Rest of Japan | 3.7% |

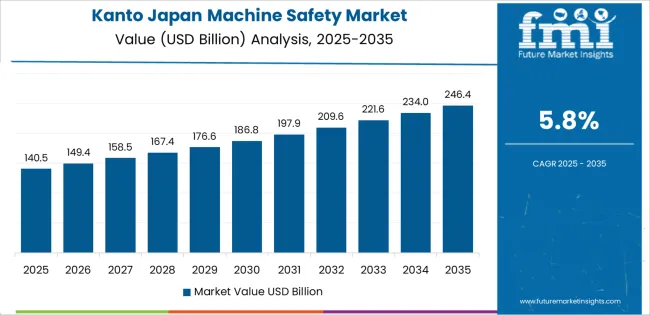

Demand for machine safety in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 6.3% CAGR. The Kanto region follows with a 5.8% CAGR, supported by its large industrial and manufacturing hubs, where stringent safety regulations in sectors like electronics, automotive, and robotics are promoting the adoption of machine safety technologies. Kansai shows a 5.1% CAGR, driven by its strong automotive and machinery industries that require advanced safety solutions. The Chubu region, with a 4.5% CAGR, is seeing increased demand due to its heavy industrial and automotive base. Tohoku and the Rest of Japan experience more moderate growth, with 3.9% and 3.7% CAGRs, respectively.

Kyushu & Okinawa lead Japan in machine safety demand, with a 6.3% CAGR. This is largely due to the region’s significant manufacturing sectors, including robotics, electronics, and precision machinery, all of which require cutting-edge machine safety solutions. The region’s focus on automation in manufacturing plants, especially in Fukuoka and Kagoshima, has accelerated the need for advanced safety technologies. Kyushu’s commitment to improving worker safety in industrial environments and complying with stringent national safety standards further boosts demand.

As automation continues to transform manufacturing, the need for industrial robots, safety systems, and machine guards will rise. Okinawa’s push toward ecological, high-tech agriculture and food processing industries also contributes to the increased demand for machine safety systems. With continued growth in both advanced manufacturing and automation, Kyushu & Okinawa will continue to lead Japan in the adoption of machine safety technologies.

Kanto is seeing strong demand for machine safety, with a 5.8% CAGR. This growth is driven by the region’s large manufacturing base, particularly in high-tech sectors like electronics, automotive, and robotics. As Japan’s industrial hub, Kanto houses major companies in sectors that rely heavily on automation and advanced machinery. The need for machine safety solutions is rising, particularly as Kanto’s factories become more automated and sophisticated.

The demand for safety systems such as machine vision, emergency stop systems, and other safety-rated components is growing rapidly. Companies are increasingly adopting machine safety technologies to comply with regulations and ensure safe working conditions. As Japan continues to push toward Industry 4.0 and embraces robotics, the demand for machine safety solutions in Kanto will continue to increase. As regulations evolve and automation accelerates, the region's commitment to workplace safety and productivity will further drive demand for these technologies.

Machine safety demand in Kansai is experiencing steady growth, with a 5.1% CAGR. This demand is largely driven by the region’s strong automotive and machinery industries, which are heavily reliant on automation. Major cities like Osaka and Kobe are home to large automotive manufacturers, making machine safety solutions a priority in these industries. The automotive sector’s increasing adoption of advanced manufacturing processes has created a pressing need for machine safety systems to ensure the safety of workers and equipment.

Kansai's focus on technological innovation in robotics and precision machinery also contributes to the region's demand for safety solutions. The regulatory environment in Kansai, which enforces stringent safety standards, further drives the adoption of machine safety technologies. As industries in Kansai expand and evolve through automation, machine safety will remain a central focus to ensure both productivity and worker protection, continuing to drive steady growth in the region.

Chubu is experiencing moderate growth in machine safety demand, with a 4.5% CAGR. This demand is driven by the region’s strong automotive manufacturing base, particularly in cities like Nagoya, home to major automotive companies like Toyota. As the automotive sector increasingly embraces automation, the need for machine safety technologies to ensure worker protection and compliance with national safety standards is growing. Chubu’s emphasis on high-quality manufacturing processes and production efficiency further supports the rise in demand for machine safety solutions.

The demand for technologies such as emergency stop systems, safety interlocks, and machine guards is increasing as the region’s factories modernize and integrate more automated systems. Chubu’s expanding machinery and heavy industrial sectors require advanced safety measures to meet stringent government regulations. As the region continues to focus on automation and industrial development, machine safety systems will remain essential, ensuring steady demand for safety technologies.

Tohoku is experiencing steady demand for machine safety, with a 3.9% CAGR. The region’s industrial base, which includes agriculture, food processing, and traditional manufacturing, is gradually modernizing and adopting automation, driving demand for safety technologies. As Tohoku’s manufacturing sector evolves, particularly in food processing plants, the need for advanced safety systems becomes more crucial. This includes safety equipment like machine guarding and emergency shutdown systems, particularly in the food industry, where regulatory compliance and worker safety are a priority.

Tohoku’s commitment to integrating automation into its manufacturing processes is contributing to this demand, though at a slower pace compared to larger industrial hubs like Kanto and Kyushu. The region’s industrial modernization efforts, combined with tighter safety regulations, are expected to continue driving the steady adoption of machine safety systems, supporting the region’s overall growth in machine safety demand.

The Rest of Japan is seeing moderate demand for machine safety, with a 3.7% CAGR. This demand is largely driven by small and medium-sized manufacturing industries in regions like Hokkaido, Shikoku, and Chugoku, where automation is gradually being adopted. Local manufacturers are increasingly integrating machine safety systems to meet regulatory standards and improve worker safety. As the industrial base in these regions modernizes and adopts automated processes, the need for safety systems is expected to grow.

Although the pace of growth is slower compared to major industrial regions, the Rest of Japan’s efforts to reduce accidents and improve overall safety in manufacturing will continue to drive demand for machine safety technologies. As industries continue to evolve and adopt automation and robotics, the adoption of safety solutions in these smaller industrys will steadily increase. Regulatory pressures and safety requirements will further accelerate the region’s demand for machine safety technologies.

In Japan, demand for machine safety systems is increasing as manufacturers across industries such as automotive, electronics, food & beverage, and general manufacturing seek to comply with strict safety standards, improve operational efficiency, and reduce workplace accidents. The adoption of advanced safety controls, sensors, interlocks, and automation systems is being driven by a combination of regulatory requirements, technological advancements in automation, and the need for greater operational uptime.

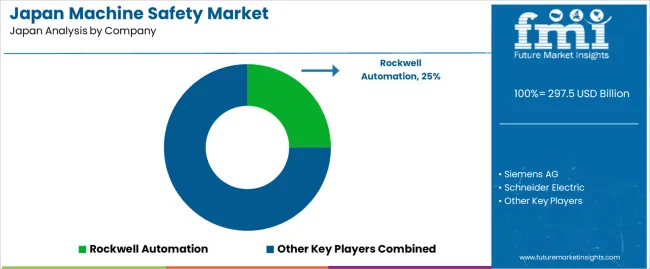

Key players in the Japanese machine safety industry include Rockwell Automation with a 25.0% share, Siemens AG, Schneider Electric, ABB Ltd., and Honeywell International. Rockwell Automation maintains a leading position through its comprehensive safety solutions, including safety programmable logic controllers (PLCs), sensors, safety relays, and motion control systems. Other firms differentiate themselves by offering integrated safety solutions, digital platforms, and local support tailored to Japan's unique industrial requirements.

Competitive dynamics in Japan's machine safety industry are shaped by several key factors. One of the major drivers is the increasing emphasis on workplace safety regulations and the need for manufacturers to comply with industry-specific standards. The growing adoption of Industry 4.0 technologies, robotics, and connected machinery increases the demand for integrated safety systems that provide real-time monitoring and predictive maintenance capabilities. Challenges such as high initial investment costs, the complexity of retrofitting existing machinery, and the need for skilled personnel to implement and maintain these systems remain. Suppliers that offer flexible, scalable, and easy-to-integrate safety solutions with strong local support will be best positioned to capitalize on the growing demand in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Component | Presence Sensing Safety Sensors, Safety Interlock Switches, Programmable Safety Systems, Safety Modules, Emergency Stop Controls |

| End-User Industry | Automotive, Food & Beverages, Packaging, Material Processing, Pharmaceutical |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Rockwell Automation, Siemens AG, Schneider Electric, ABB Ltd., Honeywell International |

| Additional Attributes | Dollar sales by component and end-user industry; regional CAGR and adoption trends; demand trends in machine safety; growth in automotive, food, packaging, and pharmaceutical sectors; technology adoption for safety solutions; vendor offerings including safety devices and systems; regulatory influences and industry standards |

The demand for machine safety in Japan is estimated to be valued at USD 297.5 billion in 2025.

The market size for the machine safety in Japan is projected to reach USD 485.7 billion by 2035.

The demand for machine safety in Japan is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in machine safety in Japan are presence sensing safety sensors, safety interlock switches, programmable safety systems, safety modules and emergency stop controls.

In terms of end-user industry, automotive segment is expected to command 33.4% share in the machine safety in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Labelling Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cup Fill and Seal Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Softgel Encapsulation Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Safety Label Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA