The demand for softgel encapsulation machines in Japan is valued at USD 6.2 million in 2025 and is projected to reach USD 8.6 million by 2035, reflecting a compound annual growth rate of 3.3%. Growth is supported by steady production needs across pharmaceuticals, nutraceuticals and specialty supplements where softgel formats remain widely used for controlled dosing and improved ingredient stability. Manufacturers continue to invest in machinery that delivers consistent capsule formation, precise filling and efficient throughput to meet expanding product lines. As companies refine formulations and broaden softgel applications, equipment with improved accuracy, material compatibility and operational reliability gains attention. These patterns contribute to stable, incremental adoption across facilities that manage both new product development and established production cycles throughout the forecast period.

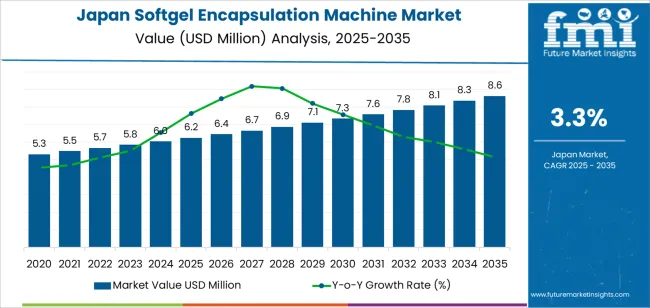

The growth curve shows a gradual upward progression, beginning at USD 5.3 million in earlier years and rising to USD 6.2 million in 2025 before advancing toward USD 8.6 million by 2035. Annual changes reflect modest but dependable increases, moving from USD 6.4 million in 2026 to USD 6.7 million in 2027 and continuing with similar spacing through later periods. This pattern highlights a predictable expansion supported by routine equipment upgrades, added production capacity and broader interest in encapsulated delivery formats. As companies enhance operational efficiency and accommodate varied capsule sizes and formulations, demand for softgel encapsulation machines grows at a measured pace. The resulting curve indicates stable momentum shaped by consistent industrial use rather than sharp accelerations or decelerations across Japan.

Demand in Japan for softgel encapsulation machines is projected to increase from USD 6.2 million in 2025 to USD 8.6 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.3%. From USD 5.3 million in 2020 the demand rises steadily USD 6.0 million in 2024, USD 6.2 million in 2025 then continues climbing annually through USD 7.3 million by 2030 and ultimately USD 8.6 million by 2035. Growth is supported by rising demand for softgel formats in pharmaceuticals and nutraceuticals, upgrades in production capacity, and increasing automation in capsule manufacturing.

Over the forecast period the uplift in value from USD 6.2 million to USD 8.6 million an increase of USD 2.4 million reflects both volume expansion and modest value enhancement per unit. The growth in early years is primarily driven by volume as manufacturers expand capacity and adopt softgel technology where previously unavailable. In later years’ value growth contributes more as machine models evolve offering higher throughput, improved precision, hybrid technologies and enhanced operator interfaces allowing higher average selling prices. Suppliers who focus on advanced features and service capabilities will be well positioned to capture the incremental demand toward USD 8.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 6.2 million |

| Forecast Value (2035) | USD 8.6 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

The demand for softgel encapsulation machines in Japan is rising as pharmaceutical and nutraceutical manufacturers increase production of softgel-type capsules. Japan’s ageing population and rising prevalence of chronic conditions such as lifestyle diseases drive the need for convenient dosage forms, which prompts makers to invest in equipment that produces high-quality softgels. Capsule manufacturers in Japan are seeking efficient encapsulation lines that support volume growth and flexible batch sizes, which makes modern machines more appealing. At the same time, changes in dietary supplement demand and stricter quality standards push companies toward equipment upgrades that can maintain consistent output and meet regulatory expectations.

Another key influence is the shift toward diversification of capsule materials and formulations in Japan. Manufacturers are exploring non-gelatin capsules such as cellulose or plant-based alternatives which require encapsulation machinery capable of handling different materials and formats. The growth of health and wellness segments, including functional supplements for joint health and cognitive support, also raises demand for machines that support smaller-batch, high-precision production. While initial capital and machine integration remain investment hurdles, the alignment of market demand, regulatory pressure and manufacturing modernisation points to sustained growth in demand for softgel encapsulation machines in Japan.

The demand for softgel encapsulation machines in Japan is shaped by the product types manufacturers adopt and the capacity ranges suited to different production scales. Product types include proton exchange membrane electrolyzers, alkaline electrolyzers and solid oxide electrolyzers as listed in the provided segments, each offering distinct operating characteristics. Capacity segments such as low, medium and high output levels align with small batch production, mid-scale facilities and large industrial operations. As producers seek equipment that matches throughput needs and stable operating performance, the combination of machine type and capacity supports adoption across varied manufacturing environments in Japan.

Proton exchange membrane electrolyzers account for 53% of total demand within the provided product type category. Their leading position reflects consistent performance, stable output and suitability for controlled production environments that require reliable operating characteristics. Production teams value equipment that offers predictable workflow integration and manageable operating conditions. This type supports steady processing cycles and aligns well with manufacturers seeking precise control over production tasks. These qualities reinforce consistent selection for operations that prioritize efficiency, balanced output and straightforward system alignment in Japan.

The demand for this product type also grows as facilities adopt equipment capable of supporting incremental expansion. Proton exchange membrane systems adapt well to changing production volumes without requiring extensive modifications. Their compatibility with long-term operational routines supports reliable use in facilities that maintain regular schedules. The equipment’s ability to provide stable performance under varied operating loads strengthens its appeal among manufacturers who require predictable processing. As production environments continue refining workflow consistency, this type remains a significant choice across the category.

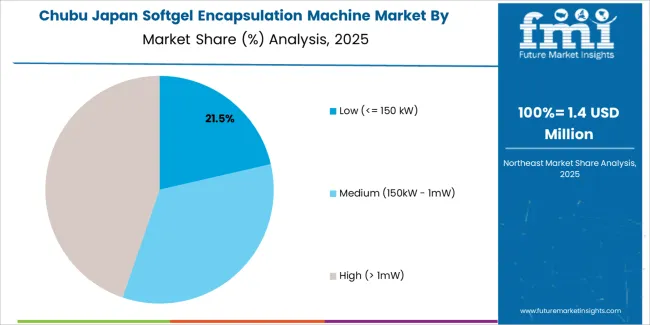

Low capacity systems account for 21.0% of total demand within the listed capacity range. This segment leads due to its suitability for small batch production, pilot-scale operations and facilities performing controlled development runs. Low capacity equipment allows precise monitoring and easier adjustments during operation, which supports users who manage limited volumes or test new formulations. These systems also attract smaller producers who require dependable machinery without large infrastructure commitments. Their compact size and accessible operation make them practical for facilities with limited space or incremental production needs.

Demand for low capacity ranges also increases as companies adopt staged production strategies. Manufacturers often begin with modest output requirements before expanding capacity as product lines mature. Low capacity equipment supports efficient resource use while maintaining operational stability. Its ability to meet consistent output requirements without excessive energy or maintenance needs reinforces selection among new entrants and specialized producers. As production trends shift toward scalable and controlled approaches, low capacity systems maintain a steady role across Japan.

Demand in Japan for softgel encapsulation machinery is strengthening as pharmaceutical and nutraceutical manufacturers increase output of softgel capsules, driven by aging population needs and wellness trends. Automation and higher throughput machines reduce labour costs and improve consistency, supporting investment in new equipment. At the same time, barriers include high capital cost of advanced machines, regulatory requirements for manufacture, and competition from contract manufacturers using imported technology. These factors together govern the pace at which softgel encapsulation equipment is adopted in Japanese production facilities.

Japan’s growing demand for dietary supplements, functional softgels and prescription softgel formulations is pushing local manufacturers and CMOs to expand capacity. This stimulates interest in encapsulation machines that offer higher automation, flexibility for varied capsule sizes and lean maintenance. As softgel formats gain preference for ease of swallowing and improved bioavailability, equipment suppliers see increased orders in Japan. However, uptake is moderated by need for verification of machine performance, service support and compatibility with Japanese manufacturing standards.

Opportunities exist in upgrading older capsule plants to modern softgel lines, entering the plant-based/vegan softgel area (non-animal capsules) and in niche applications such as cosmetics and functional beverages. Suppliers offering compact, modular encapsulation machines suited to smaller batch production, or retrofit options for existing lines, stand to benefit. Also, Japanese contract manufacturers servicing supplement brands may invest in dedicated softgel lines to differentiate and capture demand for premium softgel products. These avenues present growth potential for machine vendors in Japan.

Despite promising demand, obstacles remain. The upfront cost of purchasing high-end encapsulation machinery, certification/training requirements, and integration into existing manufacturing operations may deter investment, especially among smaller manufacturers. Some firms may delay purchase expecting rapid automation cost declines. Additionally, competition from overseas-supplied equipment and maintenance/service logistics can impact purchase decisions in Japan. These factors moderate how quickly softgel encapsulation machines become commonplace across all manufacturers.

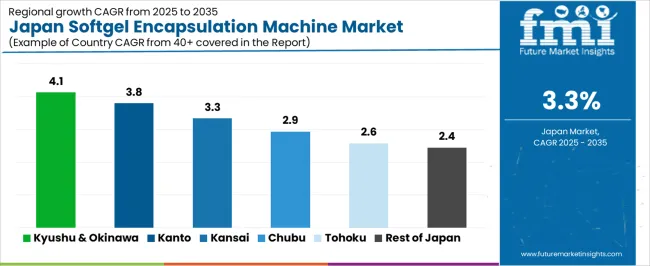

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.1% |

| Kanto | 3.8% |

| Kinki | 3.3% |

| Chubu | 2.9% |

| Tohoku | 2.6% |

| Rest of Japan | 2.4% |

Demand for softgel encapsulation machines in Japan is increasing at a steady pace across regions. Kyushu and Okinawa lead at 4.1%, supported by regional pharmaceutical activity and consistent investment in capsule production equipment. Kanto follows at 3.8%, driven by its concentration of major pharmaceutical firms and contract manufacturers that rely on automated encapsulation systems. Kinki records 3.3%, shaped by strong healthcare manufacturing networks and routine equipment upgrades. Chubu grows at 2.9%, influenced by mid-sized producers expanding softgel production capabilities. Tohoku reaches 2.6%, where adoption progresses gradually across regional facilities. The rest of Japan posts 2.4%, reflecting modest but stable demand for encapsulation machinery in smaller industrial markets.

Kyushu & Okinawa is projected to grow at a CAGR of 4.1% through 2035 in demand for softgel encapsulation machines. Pharmaceutical and nutraceutical manufacturers in Fukuoka are increasingly adopting automated equipment for vitamin, supplement, and medicine softgel production. Rising need for production efficiency, precise dosing, and consistent quality drives adoption. Manufacturers provide machines suitable for small and large batch operations. Suppliers and distributors ensure accessibility across urban and semi-urban production facilities. Increasing demand for dietary supplements, pharmaceutical production, and modernization of manufacturing processes supports steady adoption of softgel encapsulation machines across Kyushu & Okinawa.

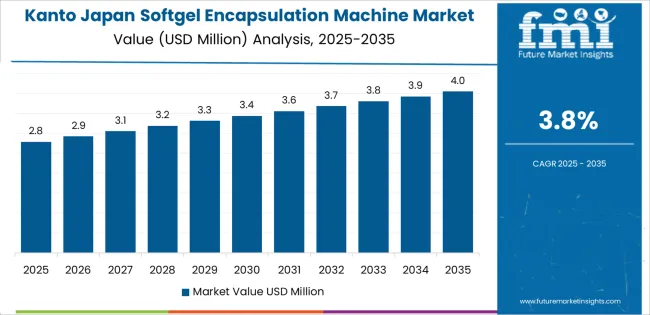

Kanto is projected to grow at a CAGR of 3.8% through 2035 in demand for softgel encapsulation machines. Tokyo and surrounding industrial hubs are increasingly adopting automated softgel production equipment for vitamins, dietary supplements, and pharmaceutical capsules. Rising demand for consistent quality, accurate dosing, and higher throughput drives adoption. Manufacturers provide machines compatible with multiple softgel formulations and batch sizes. Retailers and distributors ensure wide accessibility for urban pharmaceutical and nutraceutical facilities. Urban industrial concentration, regulatory compliance, and production modernization support steady adoption of softgel encapsulation machines in Kanto.

Kinki is projected to grow at a CAGR of 3.3% through 2035 in demand for softgel encapsulation machines. Cities including Osaka and Kyoto are increasingly adopting automated softgel production equipment for pharmaceuticals, nutraceuticals, and dietary supplements. Rising production efficiency, consistent quality, and precise dosage requirements drive adoption. Manufacturers provide machines suitable for large and small batch operations. Suppliers and distributors expand accessibility to urban and semi-urban pharmaceutical facilities. Growth in industrial production, dietary supplement manufacturing, and regulatory compliance ensures steady adoption of softgel encapsulation machines across Kinki.

Chubu is projected to grow at a CAGR of 2.9% through 2035 in demand for softgel encapsulation machines. Urban centers, particularly Nagoya, are gradually adopting automated equipment for pharmaceutical and nutraceutical softgel production. Rising need for dosing accuracy, consistent quality, and operational efficiency drives adoption. Manufacturers supply machines compatible with multiple formulations and production scales. Retailers and distributors expand accessibility across urban and semi-urban production facilities. Growth in industrial pharmaceutical operations, dietary supplement production, and production modernization supports steady adoption of softgel encapsulation machines across Chubu.

Tohoku is projected to grow at a CAGR of 2.6% through 2035 in demand for softgel encapsulation machines. Hospitals, pharmaceutical manufacturers, and nutraceutical facilities in Sendai and surrounding areas are gradually adopting automated softgel production equipment. Rising focus on production efficiency, quality control, and accurate dosing drives adoption. Manufacturers provide machines suitable for small and medium batch operations. Retailers and distributors expand access across urban and semi-urban production centers. Industrial modernization, dietary supplement manufacturing, and regulatory compliance ensure steady adoption of softgel encapsulation machines across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 2.4% through 2035 in demand for softgel encapsulation machines. Smaller towns and rural pharmaceutical and nutraceutical manufacturers gradually adopt automated softgel production equipment. Rising need for precise dosing, consistent quality, and operational efficiency drives adoption. Manufacturers provide compact and scalable machines suitable for small-batch operations. Retailers and distributors expand accessibility across semi-urban and rural production centers. Gradual adoption in smaller facilities, modernization of production lines, and regulatory compliance ensure steady growth in softgel encapsulation machine usage across the Rest of Japan.

The demand for softgel encapsulation machines in Japan is being propelled by rising output of soft-gel capsules in pharmaceutical, nutraceutical and cosmetic applications. Japan’s aging population and increasing focus on preventive health and wellness create stronger demand for soft-gel supplements and medications, which in turn drives equipment procurement. Manufacturers are seeking high-throughput, automated encapsulation systems capable of handling varied fill materials, smaller batch sizes and faster change-overs. In addition, Japanese quality and regulatory expectations emphasise reliability, traceability and hygiene in manufacturing equipment, making machines with advanced automation and documentation features particularly attractive. These trends combine to foster growth in demand for soft-gel encapsulation equipment within Japan’s industry.

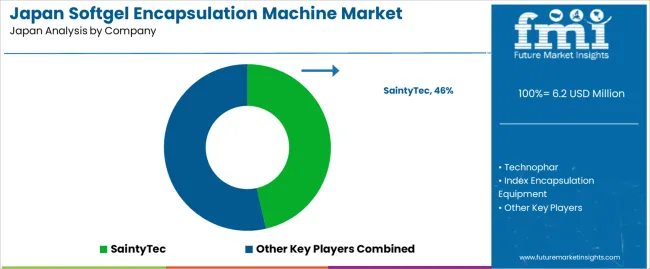

Key companies involved in supplying softgel encapsulation solutions relevant to Japan include SaintyTec, Technophar, Index Encapsulation Equipment, Bosch Packaging Technology, Capsugel (now part of Lonza), IMA Pharma, MG2, Torpac Inc. and Schaefer Technologies Inc. These firms offer machines and integrated production lines tailored for soft-gel capsule manufacturing, with features addressing Japanese manufacturing standards, regulatory documentation, and supplier qualification processes. Their engineering capabilities, service networks and product portfolios influence how Japanese manufacturers select, integrate and maintain soft-gel encapsulation equipment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Proton Exchange Membrane (PEM) Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer |

| Capacity | Low (<= 150 kW), Medium (150 kW - 1 MW), High (> 1 MW) |

| Outlet Pressure | Low (<= 10 Bar), Medium (10 Bar - 40 Bar), High (> 40 Bar) |

| End Use | Ammonia, Methanol, Refining / Hydrocarbon, Electronics, Energy, Power to Gas, Transport, Pharma & Biotech, Food & Beverages, Other |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | SaintyTec, Technophar, Index Encapsulation Equipment, Bosch Packaging Technology, Capsugel, IMA Pharma, MG2, Torpac Inc., Dott Bonapace, Schaefer Technologies Inc. |

| Additional Attributes | Dollar by sales by product type, capacity, and outlet pressure; regional CAGR and growth trends; adoption across pharmaceutical, nutraceutical, and food & beverage production; machine automation level (semi vs fully automatic); throughput performance and precision; material and formulation compatibility (gelatin, cellulose, plant-based softgels); maintenance and service support networks; replacement versus new installation demand; regulatory compliance capabilities; niche opportunities in plant-based/vegan softgels, cosmetics, and functional supplements; constraints including high capex, integration complexity, and space requirements; operator interface and hybrid technology adoption; retrofit potential for existing lines. |

The demand for softgel encapsulation machine in japan is estimated to be valued at USD 6.2 million in 2025.

The market size for the softgel encapsulation machine in japan is projected to reach USD 8.6 million by 2035.

The demand for softgel encapsulation machine in japan is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in softgel encapsulation machine in japan are proton exchange membrane (pem) electrolyzer, alkaline electrolyzer and solid oxide electrolyzer.

In terms of capacity, low (<= 150 kw) segment is expected to command 21.0% share in the softgel encapsulation machine in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Softgel Encapsulation Machine Market Growth - Trends & Forecast 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA