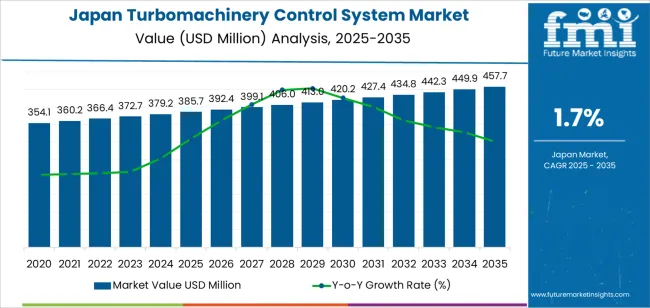

Demand for turbomachinery control systems in Japan is valued at USD 385.7 million in 2025 and is forecasted to reach USD 457.7 million by 2035, recording a CAGR of 1.7 percent. Demand is supported by ongoing maintenance cycles in power generation, petrochemical facilities, and industrial plants that rely on turbines, compressors, and high-speed rotating equipment. Control systems manage speed, load, temperature, and safety interlocks, ensuring stable and efficient operation across varied process conditions. Modernization efforts focused on digital controls, performance monitoring, and emissions compliance continue to shape replacement activity.

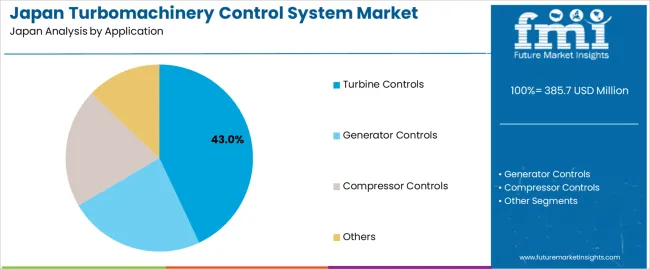

Turbine controls represent the leading segment, with an estimated 43.0 percent share. Their role includes coordinating startup and shutdown sequences, regulating load transitions, and protecting equipment from overspeed, vibration excursions, and thermal stress. Recent improvements in sensor accuracy, software logic, and integrated diagnostics are supporting operational reliability and reducing unplanned downtime. Adoption of remote monitoring tools is also rising across facilities seeking predictive maintenance capability.

Demand is strongest in Kyushu and Okinawa, Kanto, and Kinki, where energy infrastructure, industrial processing, and manufacturing capacity are concentrated. Key suppliers include Honeywell Technology Solutions, Schneider Electric SE, Rockwell Automation Inc., Woodward Inc., and ABB Group. Their focus remains on robust control architectures, system interoperability, and enhancements to real-time equipment monitoring.

The early growth curve from 2025 to 2029 will show modest acceleration supported by targeted upgrades in gas and steam turbine controls within utilities and industrial plants. Facilities will focus on improving operational stability, emissions management, and fuel-efficiency tuning, creating steady early-stage demand. Incremental adoption of digital monitoring and basic diagnostic functions will also support this phase.

From 2030 to 2035, the late growth curve will move toward a flatter trajectory as largest operators complete modernization cycles. Growth will rely on routine replacement, lifecycle-driven retrofits, and incremental enhancements to protection logic rather than broad system expansion. Stable use in power generation and process industries will sustain predictable procurement without creating strong acceleration. The comparison reflects a transition from an early period shaped by essential control upgrades to a later period defined by maintenance-oriented maturity, long equipment lifecycles, and consistent reliance on established turbomachinery platforms across Japan’s industrial and energy sectors.

| Metric | Value |

|---|---|

| Japan Turbomachinery Control System Sales Value (2025) | USD 385.7 million |

| Japan Turbomachinery Control System Forecast Value (2035) | USD 457.7 million |

| Japan Turbomachinery Control System Forecast CAGR (2025-2035) | 1.7% |

Demand for turbomachinery control systems in Japan is rising because industrial operators and energy providers require advanced control solutions to manage turbines and compressors with heightened precision and reliability. Companies in sectors such as power generation, petrochemicals and industrial manufacturing invest in control systems that enable optimisation of performance, asset longevity and operational safety. Japan’s focus on energy efficiency, decarbonisation and maintenance of ageing infrastructure also supports investment in modern control platforms for turbomachinery applications.

Technologies that integrate diagnostics, data analytics and process control appeal to equipment users aiming for predictable uptime and lower lifecycle cost. Uptake is constrained by the rigorous supplier qualification process in Japan, the higher cost of highly engineered control systems and the complexity of retrofitting legacy machines in older plants. Some industries may delay full upgrades until clear return on investment is evident.

Demand for turbomachinery control systems in Japan reflects requirements for operational stability, energy efficiency, and compliance across industrial and power-generation environments. Industry distribution across application and end-use categories aligns with the country’s focus on precision engineering, reliability in continuous-duty equipment, and integration with advanced automation systems used in domestic industrial sectors.

Turbine controls hold an estimated 43.0% share of demand in Japan, representing the largest application category. Japanese thermal power plants, cogeneration units, and industrial energy systems rely on turbine-control platforms to manage start-up sequencing, load transitions, combustion behaviour, and real-time safety protections.

These systems remain central to ensuring stable output and reducing operational variance. Compressor controls represent 31.0%, supporting process-gas compression used in chemicals, petrochemicals, and industrial fabrication. Generator controls account for 19.0%, serving synchronous machines in distributed power and backup generation units. The remaining 7.0% includes systems supporting niche turbomachinery used in small-scale industrial processes.

Key drivers and attributes:

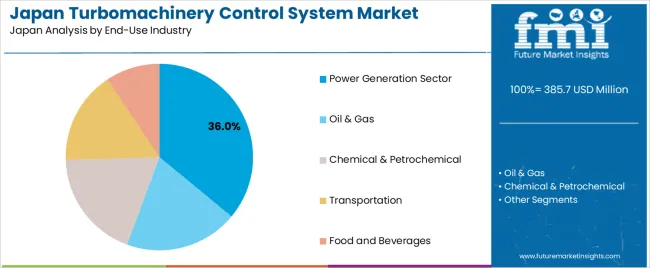

The power generation sector accounts for an estimated 36.0% of turbomachinery-control demand in Japan. Gas-fired power plants, combined-cycle facilities, and industrial cogeneration units rely on advanced control frameworks to meet efficiency requirements, emissions constraints, and grid-stability expectations.

Oil and gas operations represent 24.0%, involving LNG terminals, petrochemical complexes, and refinery compression networks requiring precise turbomachinery oversight. Chemical and petrochemical plants hold 20.0%, where continuous-duty rotating equipment requires dependable monitoring and control. Transportation accounts for 12.0%, including control systems used in propulsion and auxiliary power units. Food and beverages represent 8.0%, where specialized compressors and process-air systems depend on consistent operating parameters.

Key drivers and attributes:

Modernisation of ageing power and industrial assets, growth in renewable energy integration, and increased focus on operational efficiency are driving demand.

In Japan, demand for turbomachinery control systems is growing as utilities and industry update gas turbines, steam turbines, compressors and generators to meet tighter efficiency, reliability and emissions standards. The ageing infrastructure of power plants and industrial facilities has prompted operators to invest in advanced control systems that support variable loading, predictive diagnostics and integration with enterprise-asset-management platforms. Growth in offshore wind-farm support systems, hydrogen-based generation trials and modular gas-turbine installations raises need for control solutions tailored to new energy models. Increasing automation and digital-transformation programmes across manufacturing and process industries also support procurement of control systems for turbomachinery.

High retrofit cost, slow asset turnover and evolving regulatory frameworks are restraining industry expansion.

Retrofitting turbomachinery control systems in operational facilities involves significant investment in hardware, software, integration services and commissioning. Limited budgets and long asset operating lives reduce the frequency of full system upgrades and slow replacement cycles. Uncertainty around energy policy, regulatory incentives for hydrogen and renewables, and shifting emissions targets may delay control-system investment decisions. Some industrial users may defer upgrades if current control systems are functional, particularly in low-margin process sectors. These factors moderate demand growth in Japan.

Shift toward digital twin and remote-monitoring platforms, growth in modular power plants, and increased use of integrated control suites are shaping industry trends.

Control-system suppliers are developing digital-twin models of turbomachinery to provide simulation, predictive maintenance and remote-performance diagnostics. The rise of compact modular power plants, including small-scale gas turbines and hydrogen/gas-hybrid systems, creates demand for control systems designed for rapid deployment and standardised interfaces. Integration of control suites with plant-wide SCADA, enterprise asset management and IoT platforms is becoming more common, enabling real-time monitoring and analytics across turbo-machinery fleets. These trends support enhanced system performance, reduced downtime and deeper user value in Japanese turbomachinery applications.

Demand for turbomachinery control systems in Japan is increasing through 2035, supported by the modernization of power-generation assets, upgrades across industrial facilities, and broader adoption of digital monitoring and control tools in gas-turbine and steam-turbine operations. Growth remains modest due to Japan’s mature energy infrastructure, yet recurring maintenance cycles and efficiency-focused retrofits maintain stable demand. Regional consumption reflects industrial density, utility-sector activity, and the presence of chemical, refining, and manufacturing facilities. Kyushu & Okinawa leads with a 2.2% CAGR, followed by Kanto (2.0%), Kinki (1.7%), Chubu (1.5%), Tohoku (1.3%), and the Rest of Japan (1.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 2.2% |

| Kanto | 2.0% |

| Kinki | 1.7% |

| Chubu | 1.5% |

| Tohoku | 1.3% |

| Rest of Japan | 1.3% |

Kyushu & Okinawa grows at 2.2% CAGR, supported by continued reliance on gas-fired and biomass-based power plants, industrial facilities that use turbine-driven compressors, and regional utilities that operate distributed-generation assets across islands. Plants in Fukuoka, Kumamoto, and Kagoshima follow structured maintenance schedules that include periodic upgrades of control modules, vibration-monitoring equipment, and fuel-control subsystems.

Industrial sites involved in materials processing and chemical operations depend on turbine controls to maintain pressure stability and mechanical-drive reliability. Local utilities in Okinawa adopt compact control platforms designed for smaller networks that require consistent load response and operational continuity. This creates a steady pattern of equipment replacement and subsystem modernization across the region.

Kanto grows at 2.0% CAGR, supported by high industrial concentration, consistent modernization of steam and gas turbines, and the region’s extensive utility infrastructure. Tokyo, Kanagawa, and Chiba operate multiple power-generation units that require upgraded controllers, performance-monitoring tools, and precision fuel-management systems. Scheduled maintenance cycles reinforce the need for replacement hardware, particularly among older plants undergoing staged modernization.

Industrial users employ turbine-driven pumps and compressors for petrochemical production, materials manufacturing, and large-scale process operations. Engineering facilities and research institutions in the metropolitan area adopt advanced monitoring tools for testing turbine behavior, efficiency patterns, and load-handling characteristics. Demand remains steady due to constant operational requirements, even though the region does not expand new turbine installations at a rapid pace.

Kinki grows at 1.7% CAGR, driven by stable power-generation activity and regular control upgrades across industrial plants in Osaka, Kyoto, and Hyogo. Facilities use turbine-based systems for mechanical-drive tasks such as pumping, compression, and process-air movement. These operations require consistent calibration of control logic, sensor networks, and protection modules. Power plants follow structured reliability programs that include monitoring enhancements and selective modernization of legacy control cabinets.

Manufacturing plants involved in environmental systems, machinery production, and materials processing rely on turbine controls for continuous-pressure operations. Growth is moderate because regional infrastructure is mature and expansion of new turbine capacity remains limited, yet scheduled maintenance and efficiency improvement programs maintain steady demand for upgraded control components.

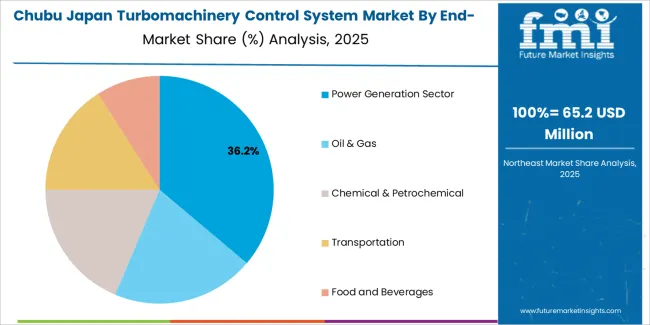

Chubu grows at 1.5% CAGR, sustained by industrial facilities that use turbine-driven pumps, compressors, and mechanical-drive systems in Aichi, Shizuoka, and nearby prefectures. These operations depend on precise control coordination, where fuel-management modules, actuator systems, and sensor arrays must remain aligned with process requirements. Power plants in the region conduct targeted modernization focused on reliability enhancement rather than major capacity additions, creating recurring demand for selective upgrades in supervisory controls and monitoring equipment.

Chemical-processing plants and machinery manufacturers maintain turbine-based units that require software updates, signal-conditioning replacements, and improved diagnostics. While growth remains modest, routine equipment cycles, operational safety requirements, and plant-efficiency initiatives ensure a stable baseline of control-system adoption.

Tohoku grows at 1.3% CAGR, supported by regional utilities and industrial-processing facilities operating gas and steam turbine systems across Miyagi, Fukushima, and Iwate. Power-generation units in the region require periodic upgrades to monitoring hardware, supervisory logic, and protection circuits to align with reliability standards. Industrial sites use turbine-driven equipment for compression, pumping, and airflow management, generating consistent but moderate demand for improved control precision and reduced downtime.

The region’s industrial footprint is smaller than metropolitan areas, limiting large-scale deployment; planned maintenance cycles and asset-renewal programs maintain steady purchasing of upgraded components. Adoption remains focused on reliability enhancement rather than expansive modernization, keeping growth modest but predictable across both utility and industrial users.

The Rest of Japan grows at 1.3% CAGR, supported by dispersed industrial facilities, local utilities, and small-scale generation units that rely on turbine-driven systems for pumping, compression, and process operations. Demand is shaped by routine maintenance cycles where controllers, actuators, and monitoring components require scheduled replacement.

Facilities emphasize reliability, particularly in areas where industrial operations depend on stable turbine performance for continuous production. Utilities in smaller prefectures adopt incremental upgrades to improve safety, system stability, and operational consistency. Growth remains limited due to fewer large industrial centers and minimal addition of new turbine installations, yet the need to maintain existing equipment generates a dependable pattern of control-system procurement.

Demand for turbomachinery control systems in Japan is shaped by a concentrated group of automation and engineering firms supporting gas turbines, steam turbines, and critical rotating equipment across power generation, refining, and industrial facilities. Honeywell Technology Solutions holds the leading position with an estimated 25.0% share, supported by advanced high-speed control platforms, stable performance in demanding thermal environments, and long-standing integration within Japanese process plants. Its position is reinforced by reliable diagnostics and established service capabilities.

Schneider Electric SE and Rockwell Automation Inc. follow as significant participants, offering PLC-based and distributed control architectures designed for turbine protection, surge control, and coordinated equipment operation. Their competitive strengths include flexible configuration, reliable communication protocols, and compatibility with mixed-generation control environments common in Japan’s industrial base. Woodward Inc. maintains a strong role through its specialized governors, fuel metering units, and control modules widely used in turbomachinery requiring high precision and consistent response.

ABB Group contributes additional capability through integrated control and safety systems that combine vibration monitoring, equipment diagnostics, and coordinated process control for turbine installations in utility and industrial settings. Competition across this segment centers on response accuracy, system resilience, long-term service support, and compatibility with legacy and modern turbine designs. Demand is sustained by ongoing plant modernization, increased focus on operational reliability, and broader adoption of digital diagnostics and high-integrity control systems across Japan’s energy and industrial sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Application | Generator Controls, Compressor Controls, Turbine Controls, Others |

| End-Use Industry | Oil & Gas, Chemical & Petrochemical, Transportation, Power Generation Sector, Food and Beverages |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Honeywell Technology Solutions, Schneider Electric SE, Rockwell Automation Inc., Woodward Inc., ABB Group |

| Additional Attributes | Dollar sales by application and end-use industry categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of turbomachinery control system providers; advancements in digital turbine control, compressor optimization, and predictive diagnostics; integration with Japan’s energy infrastructure, industrial plants, and transportation equipment. |

The global demand for turbomachinery control system in Japan is estimated to be valued at USD 385.7 million in 2025.

The demand for turbomachinery control system in Japan is projected to reach USD 457.7 million by 2035.

The demand for turbomachinery control system in Japan is expected to grow at a 1.7% CAGR between 2025 and 2035.

The key product types are turbine controls, generator controls, compressor controls and others.

In terms of the end-use industry, the power generation sector segment is expected to command a 36.0% share in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA