The demand for labelling machines in Japan is valued at USD 655.7 billion in 2025 and is projected to reach USD 837.3 billion by 2035, reflecting a compound annual growth rate of 2.5%. Growth is shaped by steady requirements for automated labelling across food, beverage, pharmaceutical and household product lines. As companies refine packaging workflows, demand increases for equipment that supports consistent label placement, improved print clarity and higher operational speed. Adoption continues across both large production facilities and smaller manufacturing units that require dependable systems for routine packaging tasks. Broader development in barcode, tracking and serialization needs reinforces equipment upgrades, encouraging manufacturers to integrate more accurate and flexible labelling solutions throughout production lines across the forecast period.

The market growth curve shows a gradual upward pattern, beginning at USD 580.2 billion in earlier years and rising to USD 655.7 billion in 2025 before progressing toward USD 837.3 billion by 2035. Yearly values increase at steady intervals, with demand moving from USD 671.9 billion in 2026 to USD 688.6 billion in 2027 and continuing with regular spacing across later stages. This trajectory reflects stable procurement cycles driven by recurring equipment replacement, capacity expansions and packaging standardization across industries. As production environments advance toward higher throughput and improved accuracy, labelling machines remain central to ensuring compliant and market-ready products. The smooth curve indicates a mature yet consistently advancing segment supported by continuous operational needs across Japan’s manufacturing and packaging landscape.

Demand in Japan for labelling machines is projected to grow from USD 655.7 million in 2025 to USD 837.3 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 2.5%. Starting from USD 580.2 million in 2020, the value rises steadily through USD 639.9 million in 2024 and reaches USD 655.7 million in 2025. Between 2025 and 2030, demand is expected to increase to around USD 741.0 million, and by 2035 it is anticipated to reach USD 837.3 million. Growth is driven by ongoing investment in packaging automation across food, beverage and pharmaceutical industries, replacement of legacy equipment, and rising adoption of smart labelling solutions for traceability and efficiency.

The total value uplift from 2025 to 2035 amounts to USD 181.6 million (from USD 655.7 million to USD 837.3 million). In the earlier years the increase is primarily volume-led as production lines expand and new units are installed. In the latter years’ value growth gains prominence as labelling machines incorporate advanced features such as vision inspection, IoT connectivity, flexible SKU change-over and higher-precision application. Suppliers focusing on high-spec, digitally-enhanced labelling systems are best positioned to capture the higher average selling price and sustained demand toward USD 837.3 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 655.7 billion |

| Forecast Value (2035) | USD 837.3 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The demand for labelling machines in Japan is being driven by increased production of packaged goods across food and beverage, pharmaceuticals, and personal-care segments. Manufacturers face rising expectations for clear, accurate and compliant labelling as domestic and export requirements tighten. Automated labelling machines support higher throughput, better precision and reduced labour involvement, which makes them increasingly relevant for Japanese manufacturers upgrading their assembly lines. The shift toward smaller batch sizes, customised packaging and frequent SKU changes further boosts need for flexible labelling solutions that can respond quickly without large downtime.

Another influencing factor is the push toward sustainability and smart manufacturing in Japan. Building interiors and packaging lines are being modernised to support traceability and quality assurance, which includes labelling machines equipped to handle variable data, QR codes or RFID tags. Japan’s e-commerce growth and rising convenience packaging demand make compact, efficient labelling modules more attractive for both new sites and retrofits. While initial investment and integration complexity may slow adoption in smaller operations, the combined impact of production growth, regulatory compliance and digitalisation drives steady demand for labelling machines in Japan.

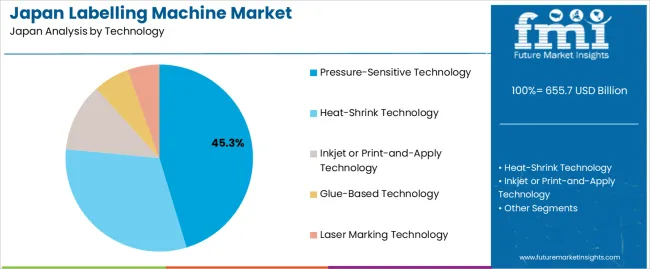

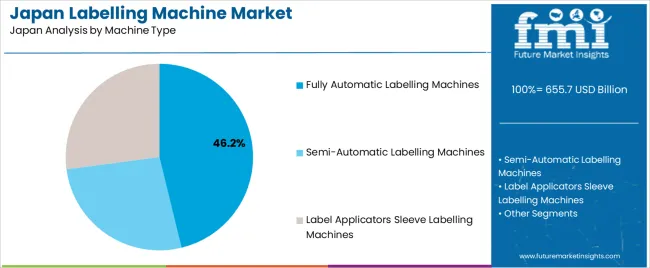

The demand for labelling machines in Japan is shaped by the technologies used for label application and the machine types selected for production lines. Technologies include pressure-sensitive, heat-shrink, inkjet or print-and-apply, glue-based and laser marking systems, each offering different levels of precision, speed and material compatibility. Machine types such as fully automatic labelling machines, semi-automatic machines and label applicator or sleeve systems support varied throughput requirements across industries. As manufacturers prioritize accuracy, efficiency and clean presentation on packaging, the combination of technology choice and machine capability guides adoption of labelling equipment across Japan’s food, beverage, pharmaceutical and consumer goods sectors.

Pressure-sensitive technology accounts for 45% of total demand for labelling machines in Japan. Its leading share reflects the need for clean, accurate label placement across a wide range of product shapes and surfaces. Pressure-sensitive systems integrate easily with existing production equipment and support quick label changes, which helps streamline operations. Their reliable adhesion and minimal setup requirements make them suitable for high-speed packaging lines. Industries favor this technology for its consistent performance across plastic, glass and metal containers. The reduced mess compared with glue-based systems also appeals to facilities aiming for cleaner, more efficient workflows.

Demand for pressure-sensitive technology continues to rise as packaging designs incorporate more complex shapes that require flexible label application methods. These systems maintain strong alignment and minimize errors during high-volume operations. The ability to handle multiple label materials, including transparent and textured options, supports brand customization. Manufacturers value the reduced downtime associated with pressure-sensitive systems, helping maintain production continuity. As companies emphasize precise and adaptable labelling solutions, this technology remains the most widely used across Japan’s packaging landscape.

Fully automatic labelling machines account for 46.2% of total demand in Japan. Their leading position reflects strong industry preference for high-throughput systems that minimize manual involvement. These machines deliver consistent label placement at high speeds, meeting the requirements of large-scale production in food, beverage and pharmaceutical sectors. Fully automatic systems support seamless integration with conveyors, inspection units and packaging lines, improving overall workflow efficiency. Their precision and repeatability reduce waste and ensure consistent presentation across large product batches, which is essential for brand quality and regulatory compliance.

Demand for fully automatic machines increases as manufacturers invest in advanced automation to meet growing output needs. These systems reduce labor dependency and help maintain continuous production during peak cycles. Their compatibility with multiple label formats, container shapes and technology types strengthens their appeal. Facilities also value the lower long-term operating costs associated with automated setups. As production environments in Japan continue moving toward higher efficiency and reduced error rates, fully automatic labelling machines remain the preferred choice for stable, high-volume operations.

Demand for labelling machines in Japan is being bolstered by growth in sectors such as food & beverage, pharmaceuticals, and consumer goods where high-speed, high-accuracy labelling is required. Automation and Industry 4.0 initiatives are driving companies to upgrade legacy systems with smart, sensor-integrated machines. At the same time, barriers such as high capital investment, tight margins for smaller manufacturers and regulatory complexity (especially in pharma/food) restrict faster adoption. These factors together determine how rapidly labelling machine installations expand across Japanese manufacturing.

Japanese manufacturers face increasing packaging complexity-smaller runs, multiple SKUs, variable data requirements (batch codes, traceability) and high aesthetic expectations. These needs push demand for labelling machines that can handle flexibility, digital printing or print-and-apply functions. Moreover, regulatory compliance in food, beverages and pharmaceuticals (such as traceability and labelling accuracy) adds pressure. Manufacturers investing to meet these demands increase their uptake of labelling machines. Yet, integration into existing lines and changeover costs remain considerations.

Growth opportunities exist in niche segments such as premium beverages, health and wellness products, pharmaceuticals and e-commerce fulfilment centres. In these areas, labelling machines capable of variable data printing, smart inspection systems and small-batch flexibility are in demand. Additionally, retrofit markets-older production lines upgrading to meet modern standards-also represent opportunity. Suppliers who offer modular, compact and easily integrated systems may capture demand from medium-tier manufacturers expanding automation in Japan.

Adoption is limited by high initial costs of advanced labelling systems, especially those with fully automatic, print-and-apply or vision-inspection capabilities. Smaller manufacturers or contract packers may delay investment due to budget constraints. Space constraints in Japanese factory layouts, and downtime concerns during installation or change-over, further reduce willingness to upgrade. Also, specialist service and maintenance requirements for advanced machines may pose a barrier. These challenges moderate how quickly labelling machines become standard across all production tiers in Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.1% |

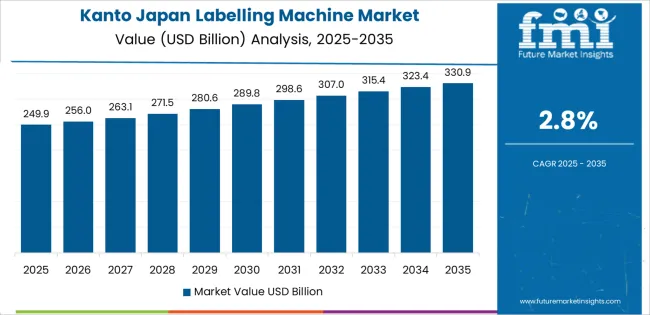

| Kanto | 2.8% |

| Kinki | 2.5% |

| Chubu | 2.2% |

| Tohoku | 1.9% |

| Rest of Japan | 1.8% |

Demand for labelling machines in Japan is increasing at a steady pace across regions. Kyushu and Okinawa lead at 3.1%, supported by active food processing, packaging, and small-scale manufacturing industries. Kanto follows at 2.8%, driven by dense industrial clusters and strong adoption of automated packaging lines. Kinki records 2.5%, shaped by consistent demand from consumer goods, pharmaceuticals, and retail packaging operations. Chubu grows at 2.2%, influenced by regional production facilities and gradual modernization of packaging systems. Tohoku reaches 1.9%, where uptake progresses steadily among mid-sized manufacturers. The rest of Japan posts 1.8%, reflecting modest but stable use of labelling equipment in smaller commercial and industrial markets.

Kyushu & Okinawa is projected to grow at a CAGR of 3.1% through 2035 in demand for labelling machines. Food, beverage, and pharmaceutical manufacturers in Fukuoka are increasingly adopting automatic and semi-automatic labelling equipment for accurate product identification, packaging, and regulatory compliance. Rising need for production efficiency, error reduction, and consistent labelling drives adoption. Manufacturers provide machines suitable for bottles, cartons, and flexible packaging. Retailers and distributors ensure accessibility across urban and semi-urban facilities. Expansion of processing plants and packaging operations supports steady adoption of labelling machines across Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 2.8% through 2035 in demand for labelling machines. Tokyo and neighboring industrial hubs are increasingly adopting automatic and semi-automatic labelling equipment for beverage, pharmaceutical, and food production lines. Rising need for production efficiency, compliance with regulatory standards, and consistent packaging drives adoption. Manufacturers provide versatile machines compatible with multiple container types. Retailers and distributors ensure wide availability across commercial and industrial facilities. Urban manufacturing density, expanding processing plants, and growing demand for accurate labelling support steady adoption of labelling machines in Kanto.

Kinki is projected to grow at a CAGR of 2.5% through 2035 in demand for labelling machines. Cities including Osaka and Kyoto are increasingly adopting automatic and semi-automatic labelling equipment for beverage, food, and pharmaceutical packaging. Rising demand for production efficiency, accuracy, and consistent labelling drives adoption. Manufacturers provide machines compatible with bottles, cartons, and flexible packaging. Retailers and distributors expand accessibility to meet regional demand. Growth in industrial facilities, food processing plants, and pharmaceutical operations ensures steady adoption of labelling machines across Kinki urban and suburban areas.

Chubu is projected to grow at a CAGR of 2.2% through 2035 in demand for labelling machines. Urban centers, particularly Nagoya, are gradually adopting automatic and semi-automatic labelling equipment in food, beverage, and pharmaceutical production lines. Rising demand for accuracy, regulatory compliance, and consistent packaging drives adoption. Manufacturers provide machines suitable for various container types and flexible packaging operations. Retailers and distributors ensure accessibility across urban and semi-urban production facilities. Industrial expansion, processing plant growth, and packaging operations contribute to steady adoption of labelling machines across Chubu.

Tohoku is projected to grow at a CAGR of 1.9% through 2035 in demand for labelling machines. Hospitals, food processing units, and pharmaceutical facilities in Sendai and surrounding areas are gradually adopting automatic and semi-automatic labelling equipment. Rising need for consistent packaging, accuracy, and regulatory compliance drives adoption. Manufacturers supply machines compatible with bottles, cartons, and flexible packaging. Retailers and distributors expand accessibility across urban and semi-urban facilities. Production line modernization, industrial growth, and packaging efficiency requirements ensure steady adoption of labelling machines across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 1.8% through 2035 in demand for labelling machines. Smaller towns and rural industrial facilities gradually adopt automatic and semi-automatic labelling equipment for food, beverage, and pharmaceutical packaging. Rising awareness of accuracy, compliance, and production efficiency drives adoption. Manufacturers provide machines compatible with multiple packaging formats. Retailers and distributors expand access in semi-urban and rural production centers. Gradual adoption of modern packaging systems, industrial facility upgrades, and consumer demand ensures steady growth in labelling machine usage across the Rest of Japan.

The demand for labelling machines in Japan is driven by the rapid growth of the packaged goods sector and evolving consumer expectations around product presentation, traceability and automation. Domestic producers in food, beverage, personal care and pharmaceuticals increasingly require high-speed, precise and flexible labelling systems to meet regulatory standards and branding demands. The expansion of e-commerce and logistics requirements also intensifies need for variable data printing and label application across shipping and retail packaging lines. In addition, Japan’s focus on manufacturing efficiency and smart-factory upgrades supports investment in advanced labelling technologies that integrate digital controls and allow rapid changeovers.

Key companies shaping Japan’s labelling machine segment include I.M.A. Industries Macchine Automatiche S.p.A., Krones AG, Sacmi Imola S.C., Sato Holdings Corp., and ProMach Inc.. These suppliers offer labelling systems designed for Japanese packaging lines and collaborate with local integrators to adapt to domestic production environments. Their portfolios span self-adhesive, wrap-around, flat-surface and print-and‐apply machines suited to high throughput and variable formats. By combining global engineering capability with local market support, they influence how labelling machines are selected, customised and deployed across Japan’s manufacturing and packaging industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Technology | Pressure-Sensitive Technology, Heat-Shrink Technology, Inkjet or Print-and-Apply Technology, Glue-Based Technology, Laser Marking Technology |

| Machine Type | Fully Automatic Labelling Machines, Semi-Automatic Labelling Machines, Label Applicators / Sleeve Labelling Machines |

| Label Type | Pressure-Sensitive Labels, Shrink Sleeves, Thermal Transfer Labels, Glue-Based Labels |

| End Use | Food & Beverages, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Industrial & Chemicals, Logistics & Warehousing, Retail & Consumer Goods |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | I.M.A. Industries Macchine Automatiche S.p.A., Krones AG, Sacmi Imola S.C., Sato Holdings Corp., ProMach Inc. |

| Additional Attributes | Dollar by sales by technology, machine type and label type; regional CAGR and growth patterns; market share trends across food, beverage, pharmaceutical, personal care, industrial and logistics sectors; volume vs. value growth trends; premium vs standard machine offerings; automation and smart-factory integration; adoption in high-throughput, multi-SKU, and e-commerce packaging environments; retrofit demand for legacy lines; service and maintenance support; compliance with Japanese packaging, traceability, and labeling regulations. |

The demand for labelling machine in japan is estimated to be valued at USD 655.7 billion in 2025.

The market size for the labelling machine in japan is projected to reach USD 837.3 billion by 2035.

The demand for labelling machine in japan is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in labelling machine in japan are pressure-sensitive technology, heat-shrink technology, inkjet or print-and-apply technology, glue-based technology and laser marking technology.

In terms of machine type, fully automatic labelling machines segment is expected to command 46.2% share in the labelling machine in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labelling Machine Market Growth & Industry Trends through 2035

C Wrap Labelling Machine Market

Wet Glue Labelling Machines Market

Clamshell Labelling Machines Market Growth - Trends & Forecast 2022 to 2032

Demand for Labelling Machine in USA Size and Share Forecast Outlook 2025 to 2035

Wrap Around Labelling Machine Market

Semi Automatic Labelling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cup Fill and Seal Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Softgel Encapsulation Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA