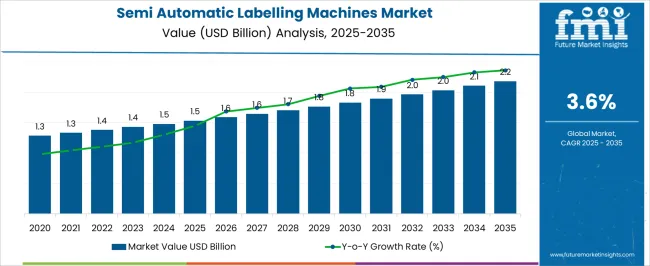

The semi-automatic labelling machines market is projected to grow from USD 1.5 billion in 2025 to USD 2.2 billion in 2035, reflecting a CAGR of 3.6%. This represents an absolute dollar opportunity of USD 0.7 billion over the decade. The market is expected to expand gradually, with values reaching USD 1.6 billion in 2027, USD 1.8 billion in 2030, USD 1.9 billion in 2031, and USD 2.1 billion in 2034. The steady growth trajectory highlights consistent demand for semi-automatic labelling machines across industries, providing manufacturers and investors with the opportunity to capture incremental revenue and strengthen their market position over ten years.

From an absolute dollar perspective, annual incremental growth starts at USD 0.1 billion in the early years and remains steady at around USD 0.1–0.2 billion in later years, culminating in USD 0.7 billion by 2035. Intermediate values, such as USD 1.4 billion in 2028, USD 1.8 billion in 2030, and USD 2.0 billion in 2033, indicate a predictable growth pattern. This enables stakeholders to plan production, inventory, and market expansion efficiently.

| Metric | Value |

|---|---|

| Semi Automatic Labelling Machines Market Estimated Value in (2025 E) | USD 1.5 billion |

| Semi Automatic Labelling Machines Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

Continuing with the semi-automatic labelling machines market, a breakpoint analysis identifies key periods where growth shows noticeable acceleration. Between 2025 and 2027, the market rises from USD 1.5 billion to USD 1.6 billion, representing the initial growth phase where early adoption establishes market presence. Another important breakpoint occurs around 2029–2031, as the market increases from USD 1.7 billion to USD 1.9 billion, reflecting a period of steady but stronger growth. Recognizing these stages allows manufacturers and investors to align production, optimize distribution, and capture incremental revenue during these critical phases of market expansion. T

he final major breakpoint is observed between 2033 and 2035, when the market grows from USD 2.1 billion to USD 2.2 billion, representing the largest absolute dollar growth within the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 1.8 billion to USD 2.0 billion, acting as bridging periods that maintain market momentum. Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations, and maximize revenue potential. Focusing on these pivotal stages ensures capturing both incremental and cumulative opportunities in the semi-automatic labelling machines market.

The semi automatic labelling machines market is experiencing steady expansion, driven by the growing need for efficient packaging solutions across diverse industries such as food and beverages, pharmaceuticals, cosmetics, and chemicals. Industry manufacturing reports and packaging technology updates have highlighted increased demand for compact, cost-effective, and versatile labelling systems that cater to small- and medium-scale production. These machines have gained preference for their ease of operation, reduced setup times, and adaptability to various product formats.

Technological enhancements, such as programmable control interfaces and precision label application systems, have improved accuracy and productivity while maintaining operational simplicity. Additionally, the rise of branding and product differentiation trends has intensified the need for reliable labelling solutions in shorter production runs.

Emerging markets are witnessing higher adoption rates due to growing manufacturing activity and limited budgets for fully automated systems. Market growth is expected to be supported by the integration of advanced sensors, improved software controls, and ergonomic designs that enhance usability while maintaining affordability.

The semi automatic labelling machines market is segmented by product type, speed, application, end use, and geographic regions. By product type, the semi-automatic labelling machines market is divided into Programmable machines and manually adjusted machines. In terms of speed, semi automatic labelling machines market is classified into 20 - 30 labels/min, Below 20 labels/min, and Above 30 labels/min.

Based on application, the semi-automatic labelling machines market is segmented into Bottles and containers, Boxes and cartons, Cylindrical products, and Others (Flat and Irregular Surfaces, etc.). By end use, the semi-automatic labelling machines market is segmented into Food & beverages, Chemicals, Consumer goods, Electronics, pharmaceuticals, and Others (Logistics & E-commerce, etc.). Regionally, the semi automatic labelling machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

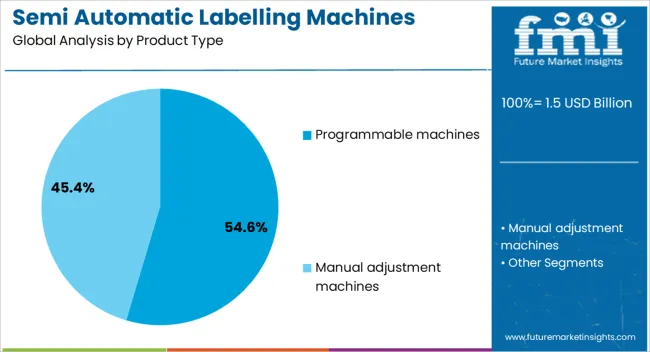

The programmable machines segment is projected to contribute 54.6% of the semi automatic labelling machines market revenue in 2025, securing its position as the leading product type. This dominance has been driven by the flexibility these machines offer in handling a wide range of label sizes, shapes, and materials through customizable settings.

Manufacturers have favored programmable labelling systems for their ability to store multiple labelling configurations, enabling quick changeovers between production batches. Industry adoption has been further supported by advancements in control systems, which allow operators to achieve high precision and consistency with minimal manual intervention.

Additionally, programmable machines have proven effective in reducing waste by minimizing label misalignment, thereby improving overall production efficiency. Their adaptability to evolving product packaging trends has ensured widespread usage in both established and emerging manufacturing sectors.

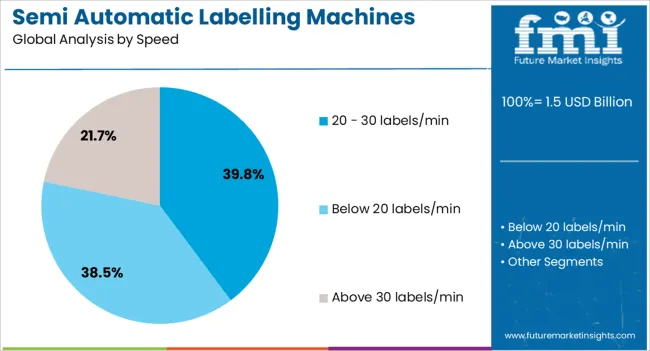

The 20 – 30 labels/min speed segment is projected to hold 39.8% of the semi automatic labelling machines market revenue in 2025, reflecting its suitability for medium-scale production environments. This segment’s strength lies in its balance between operational efficiency and cost-effectiveness, making it ideal for businesses that require consistent output without the higher investment associated with faster, fully automated systems.

Packaging industry feedback has indicated that this speed range supports high-quality label application while allowing operators to maintain control over production quality. The moderate speed also facilitates versatility, enabling the labelling of products with varying dimensions and surface characteristics without compromising accuracy.

As small and mid-sized manufacturers increasingly prioritize both productivity and budget efficiency, the 20 – 30 labels/min segment is expected to retain a strong market position.

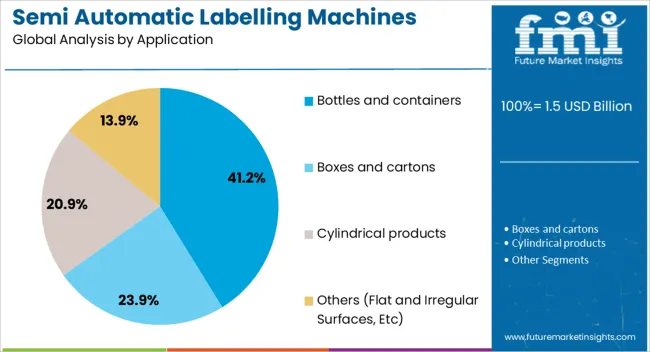

The bottles and containers segment is projected to account for 41.2% of the semi automatic labelling machines market revenue in 2025, establishing itself as the leading application category. Growth in this segment has been fueled by the widespread use of labelled bottles and containers in industries such as beverages, personal care, pharmaceuticals, and household products.

Semi automatic labelling machines have been preferred for their ability to handle cylindrical and irregularly shaped containers with precision, ensuring consistent branding and regulatory compliance. Developments in label adhesion technologies have improved performance on various container materials, including glass, plastic, and metal.

Moreover, businesses have increasingly adopted semi automatic machines to meet the demands of customized and short-run labelling orders, which are common in niche product markets. With branding playing a critical role in consumer purchase decisions, the bottles and containers segment is expected to remain a key driver of demand in the semi automatic labelling machines market.

The semi automatic labelling machines market is expanding as manufacturers in food, beverage, pharmaceuticals, and cosmetics adopt solutions that combine speed with operator control. These machines deliver precise labelling while supporting moderate production volumes, offering cost-effective alternatives to fully automated systems. Europe and North America dominate adoption due to advanced manufacturing infrastructure, while Asia Pacific shows strong potential driven by industrial growth and rising packaging requirements. Producers focus on machine adaptability, user-friendliness, and long-term reliability, while operational efficiency, regulatory compliance, and maintenance considerations continue to influence market strategies. Increasing demand for accurate, consistent, and flexible labelling solutions is driving investments in equipment upgrades and operator training across multiple sectors.

Ensuring precise and repeatable labelling is a core requirement for manufacturers using semi automatic machines. Variations in product shape, container size, or label type can affect alignment and adhesion, impacting overall package presentation and regulatory compliance. Machines must maintain consistent performance across multiple production runs while minimizing waste due to misapplied or defective labels. Operators benefit from adjustable settings, calibration tools, and clear monitoring systems to maintain quality. Manufacturers providing standardized procedures, operational guidance, and real-time feedback improve reliability and reduce downtime. Inconsistent labelling performance can erode brand trust and disrupt workflow, making precision and uniformity essential. High reliability enhances adoption, especially in the pharmaceutical and food industries, where accuracy directly impacts safety, labeling compliance, and consumer confidence.

Semi automatic labelling machines are valued for their adaptability across diverse product lines and packaging formats. Adjustable guides, modular components, and simple interface controls allow operators to switch between containers of varying sizes, shapes, and materials quickly. Integration with existing production lines, including conveyors and inspection units, ensures smooth workflow without extensive downtime. Ergonomic designs reduce operator fatigue, while ease of maintenance enables uninterrupted operation over long production cycles. Suppliers that offer straightforward setup procedures, responsive technical support, and compatibility with various labeling adhesives or substrates gain an advantage in competitive markets. Operational flexibility allows manufacturers to address changing product portfolios efficiently while maintaining production speed and minimizing errors in high-turnover environments, especially for small-to-medium-sized operations.

The adoption of semi automatic labelling machines is increasing across multiple sectors, including food and beverage, pharmaceuticals, cosmetics, personal care, and specialty chemicals. Producers rely on these machines for bottles, jars, blister packs, tubes, and other irregularly shaped containers. Rising consumer demand for informative and visually appealing packaging, along with stricter regulatory labeling standards, is encouraging manufacturers to invest in reliable equipment. Emerging industrial regions are witnessing adoption in small and mid-sized production facilities, where flexibility and cost efficiency are essential. Machines that support multiple container types and labeling materials can serve diverse operations without major equipment changes. Broadening applications and cross-industry compatibility position semi automatic labeling machines as versatile solutions for modern packaging requirements.

Market adoption is closely linked to regulatory adherence, safety standards, and component availability. Machines must meet electrical, mechanical, and hygiene standards appropriate to specific industries, such as food safety or pharmaceutical labeling. Availability of precision components, adhesives, and control electronics affects manufacturing timelines, maintenance schedules, and machine reliability. Competition exists between established global suppliers and local manufacturers offering cost-effective solutions, creating pressure on pricing and service quality. Providers that maintain regulatory compliance, ensure consistent supply of parts, and offer technical support are better positioned to secure contracts. Conversely, equipment failing to meet compliance standards or experiencing frequent component shortages can disrupt production schedules, increase operational costs, and limit adoption in regulated sectors requiring reliable labelling solutions.

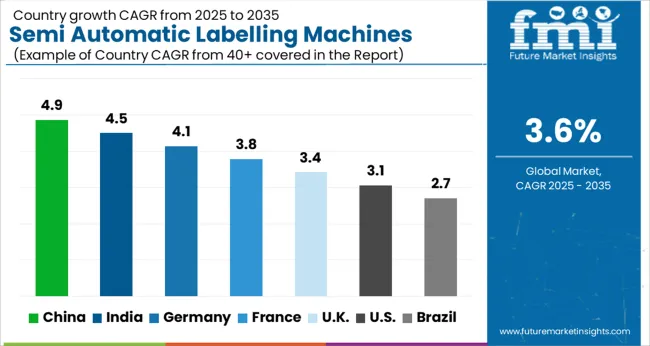

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The global semi automatic labelling machines market was projected to grow at a 3.6% CAGR through 2035, driven by demand in packaging, food and beverage, and pharmaceutical industries. Among BRICS nations, China recorded 4.9% growth as large-scale production units were commissioned and compliance with industrial quality standards was enforced, while India at 4.5% growth saw expansion of manufacturing facilities to meet increasing regional packaging requirements. In the OECD region, Germany at 4.1% maintained substantial output under strict machinery and safety regulations, while the United Kingdom at 3.4% relied on moderate-scale production for small and medium enterprises. The USA, expanding at 3.1%, remained a mature market with steady demand in packaging and pharmaceutical sectors, supported by adherence to federal and state-level machinery and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The semi automatic labelling machines market in China is growing at a CAGR of 4.9%, supported by rapid industrialization and increasing demand in packaging and manufacturing sectors. Companies are focusing on improving production efficiency and reducing labor costs, which has fueled adoption of semi automatic labelling systems. Both small and medium-sized enterprises are investing in these machines to streamline packaging processes. The rise of e-commerce and retail industries has also contributed to higher demand for accurate and efficient labelling solutions. Manufacturers are offering machines with flexible configuration options and easy integration with existing production lines. Maintenance services and training programs provided by suppliers are helping businesses optimize equipment utilization.

India is seeing growth at a CAGR of 4.5% in the semi automatic labelling machines market, driven by rising manufacturing output and packaging requirements. Food, beverage, and pharmaceutical industries are major users of these machines. Companies are looking for cost effective solutions that increase labelling speed and accuracy. Training and after sales support are important factors in purchase decisions. Adoption is also supported by increasing awareness of quality control and regulatory compliance in packaging. Suppliers provide semi automatic labelling systems that can be customized to meet different industry needs. This allows manufacturers to maintain consistent labelling quality and improve operational productivity.

Germany is growing at a CAGR of 4.1% in this market due to high demand in pharmaceutical and food sectors. Companies in Germany focus on precision, reliability, and compliance with industry standards. Semi automatic machines are preferred by small and medium sized enterprises for flexibility and lower costs. Suppliers offer machines that use less energy, are easy to maintain, and can be adjusted for different tasks. Integration with production lines and monitoring systems is increasingly important. Growth is driven by the need to reduce labor requirements while increasing throughput in regulated industries.

The United Kingdom market is expanding at a CAGR of 3.4% due to growth in packaging and manufacturing industries, especially in food and beverage sectors. Semi automatic machines are used for cost efficiency while maintaining consistent labelling quality. Companies prefer machines that can handle different container shapes and sizes with minimal setup time. Suppliers provide machines with digital controls and simple maintenance. Machines that reduce material waste are becoming more common. Small and medium sized enterprises are adopting semi automatic labelling systems to meet increasing production requirements without fully automating operations.

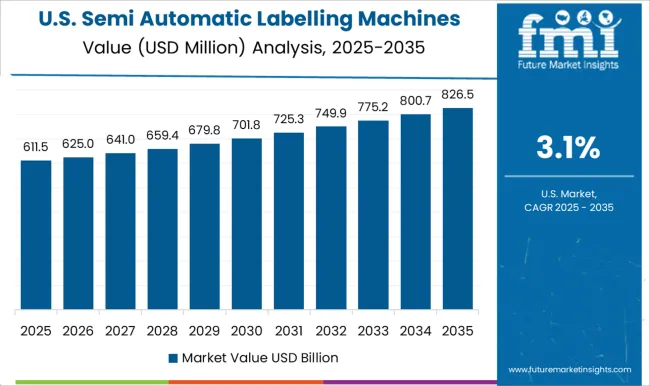

The United States market is growing at a CAGR of 3.1%, supported by demand in food, beverage, and pharmaceutical industries. Semi automatic labelling machines are used for flexible production lines and moderate volume requirements. Businesses value machines that reduce labor needs while maintaining accurate labelling. Machines with monitoring systems and remote diagnostics are increasingly in demand. Suppliers offer machines that can handle multiple container types and sizes, helping manufacturers respond to changing production needs. The market is supported by awareness of regulatory requirements and the need for consistent labelling quality across industries.

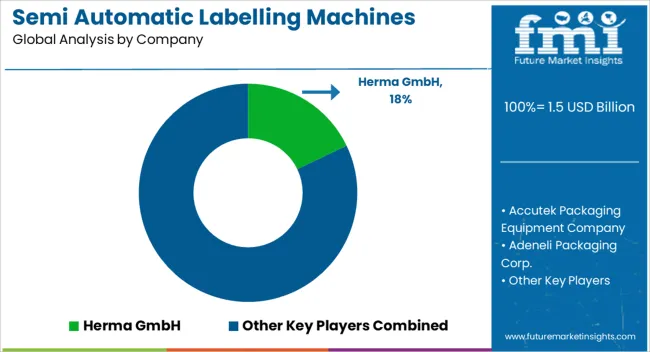

Herma GmbH, Accutek Packaging Equipment Company, and Adeneli Packaging Corp. supply semi-automatic labelling machines for bottles, jars, and cartons, with brochures highlighting labeling speed, accuracy, and maximum container diameter. All-Fill Inc., APACKS, and BW Packaging (Barry-Wehmiller) provide compact labellers for small- to medium-scale production lines, with datasheets detailing feed mechanisms, label roll capacity, and adjustable labeling heights. Kraus Maschinenbau GmbH, Marchesini Group, and Shanghai BaZhou Industrial Co., Ltd. focus on modular designs compatible with multiple container shapes, with technical literature presenting conveyor integration, sensor types, and label placement precision. Shree Bhagwati Equipments, Tronics, and WINSKYS supply robust machines for emerging markets, with brochures emphasizing ease of setup, maintenance intervals, and energy consumption. Worldpack Automation Systems, Zhejiang Haizhou Packing Machinery Co., Ltd., and Zhengzhou Henuo Machinery Co., Ltd. provide cost-effective, semi-automatic labeling solutions with datasheets highlighting workflow optimization, labeling consistency, and adaptability to various adhesives. Other regional players compete with niche machines for high-speed lines or irregular container formats, with brochures highlighting compact footprint, user-friendly controls, and compliance with ISO or CE standards. Market strategies focus on precision, operational efficiency, and modularity. Leading suppliers such as Herma and Accutek emphasize label placement accuracy, minimal downtime, and integration with existing packaging lines.

Marchesini and Kraus differentiate through modular construction, adjustable feed systems, and flexible container compatibility. Observed industry patterns indicate investment in servo-driven mechanisms, touchscreen controls, and quick-change tooling to reduce changeover time. Product roadmaps frequently include multi-format compatibility, automatic label sensing, and systems that allow rapid switching between different production batches. Differentiation is achieved through verified labeling precision, throughput capacity, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate labeling speed, container diameter range, roll capacity, adhesive compatibility, precision tolerance, power requirements, and operational workflow. Herma, Adeneli, and Accutek literature emphasizes accuracy, adjustable feed, and integration options.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product Type | Programmable machines and Manual adjustment machines |

| Speed | 20 - 30 labels/min, Below 20 labels/min, and Above 30 labels/min |

| Application | Bottles and containers, Boxes and cartons, Cylindrical products, and Others (Flat and Irregular Surfaces, Etc) |

| End Use | Food & beverages, Chemicals, Consumer goods, Electronics, Pharmaceutical, and Others (Logistics & E-commerce, Etc) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Herma GmbH, Accutek Packaging Equipment Company, Adeneli Packaging Corp., All-Fill Inc., APACKS, BW Packaging (Barry-Wehmiller), Kraus Maschinenbau GmbH, Marchesini Group, Shanghai BaZhou Industrial Co., Ltd., Shree Bhagwati Equipments, Tronics, WINSKYS, Worldpack Automation Systems, Zhejiang Haizhou Packing Machinery Co., Ltd., and Zhengzhou Henuo Machinery Co., Ltd. |

| Additional Attributes | Dollar sales vary by machine type, including rotary, linear, and wrap-around semi-automatic labelling machines; by application, such as food & beverages, pharmaceuticals, cosmetics, and personal care; by end-use industry, spanning packaging, manufacturing, and logistics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising packaging automation, demand for labeling accuracy, and increasing production efficiency. |

The global semi automatic labelling machines market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the semi automatic labelling machines market is projected to reach USD 2.2 billion by 2035.

The semi automatic labelling machines market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in semi automatic labelling machines market are programmable machines and manual adjustment machines.

In terms of speed, 20 - 30 labels/min segment to command 39.8% share in the semi automatic labelling machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Semiconductor Lift-off Resists Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Rigid Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Soft Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semi-Trailer Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Fingerprint Collector Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Metrology and Inspection Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Defect Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Bonding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Semi Chemical Wood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Rectifiers Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Bonding Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Memory Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor & IC Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Photoacid Generators Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Packaging Market Analysis - Growth & Forecast 2025 to 2035

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA