The demand for cup fill and seal machines in Japan is expected to grow from USD 92.5 million in 2025 to USD 110.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 1.8%. These machines are essential for the efficient and hygienic packaging of various food and beverage products, such as dairy, desserts, soups, sauces, and ready-to-eat meals. As the food manufacturing industry continues to prioritize automation and efficiency, cup fill and seal machines are becoming increasingly vital for improving production speeds, reducing human intervention, and maintaining high standards of hygiene. The convenience and reliability these machines provide, combined with their ability to handle different types of food packaging.

The demand for cup fill and seal machines is strongly influenced by the growing trend towards convenience and ready-to-eat foods. Consumers are increasingly seeking portion-controlled, easy-to-consumer products, driving the need for automated packaging solutions that can meet these demands. Cup fill and seal machines enable manufacturers to package products in single-serve cups or containers, offering enhanced convenience to consumers while ensuring product freshness and safety. The push for eco-friendly packaging is also expected to fuel innovations in the cup filling and sealing process, with manufacturers focusing on developing packaging materials that are recyclable or biodegradable.

Between 2025 and 2030, the demand for cup fill and seal machines in Japan is expected to increase from USD 92.5 million to USD 97.5 million. This growth is primarily driven by consistent demand in the food and beverage sector, which remains the largest consumer of these machines. As food manufacturers continue to adopt automation to streamline production processes and meet consumer demand for convenience, cup fill and seal machines will play an integral role in enhancing operational efficiency. Innovations in machine technology that improve sealing capabilities and increase production speeds will further support this growth.

From 2030 to 2035, the demand for cup fill and seal machines is expected to rise more significantly, increasing from USD 97.5 million to USD 110.5 million. This period will see stronger growth driven by technological advancements in the packaging sector, particularly as manufacturers develop more energy-efficient machines that cater to the growing demand for packaging. The trend toward portion-controlled and individually packaged food products continues to rise, the need for cup fill and seal machines will increase, leading to greater adoption in food production facilities.

| Metric | Value |

|---|---|

| Demand for Cup Fill and Seal Machine in Japan Value (2025) | USD 92.5 million |

| Demand for Cup Fill and Seal Machine in Japan Forecast Value (2035) | USD 110.5 million |

| Demand for Cup Fill and Seal Machine in Japan Forecast CAGR (2025 to 2035) | 1.8% |

The demand for cup fill and seal machines in Japan is rising as food, dairy and ready‑to‑eat product manufacturers seek efficient and hygienic packaging solutions. These machines allow producers to fill single‑serve cups, control portion sizes and seal products securely operations that are increasingly required as consumer preferences shift toward convenient packaging and individual portions.

Product versatility is supporting growth. Cup fill and seal machines are employed across applications including yoghurts, desserts, sauces and beverages, enabling faster throughput and consistent quality. As Japanese manufacturers respond to competition, faster change‑over, flexibility and accuracy become crucial features. Equipment that supports multiple cup sizes, varied lid types and rapid production shifts is gaining traction in factory‑floor environments.

Automation and production innovation are further contributing to adoption. Machines equipped with real‑time monitoring, fewer manual interventions and higher sanitation standards are becoming standard in Japanese facilities where quality and operational reliability are critical. As manufacturers upgrade to address efficiency, labour costs and production continuity, the role of cup fill and seal equipment in packaging lines is becoming more significant. With these drivers in place, demand in Japan is expected to grow smoothly through 2035.

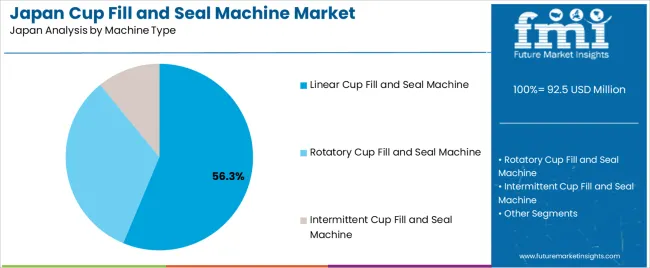

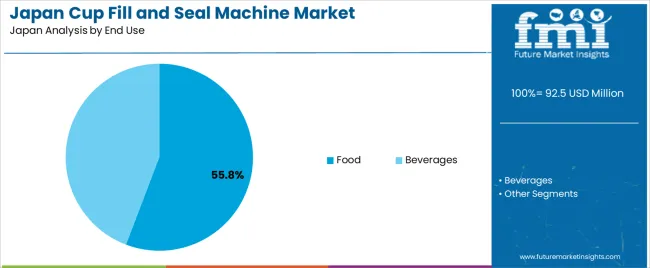

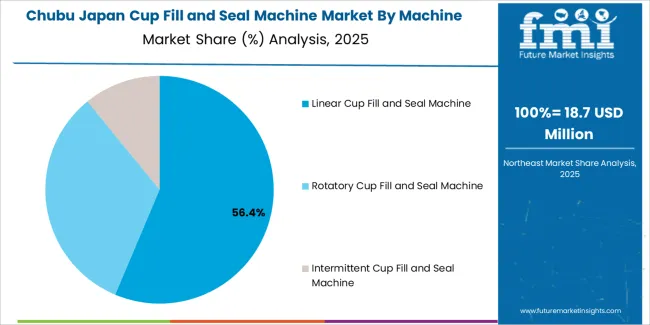

Demand for cup fill and seal machines in Japan is segmented by machine type, end use, technology, and capacity. By machine type, demand is divided into linear cup fill and seal machines, rotary cup fill and seal machines, and intermittent cup fill and seal machines. The demand is also segmented by end use, including food and beverages. Regarding technology, demand is divided into automatic cup fill and seal machines, semi-automatic cup fill and seal machines, and manual cup fill and seal machines. In terms of capacity, demand is divided into up to 1000 cups/hour, 1001-2000 cups/hour, and above 2000 cups/hour. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Linear cup fill and seal machines account for 56.3% of the demand for cup fill and seal machines in Japan. These machines are preferred for their efficiency, simplicity, and ability to handle high-volume production lines. Linear machines offer consistent and accurate filling and sealing, making them ideal for industries such as food packaging, where precision and speed are crucial. The linear configuration allows for a smooth flow of cups through the production process, ensuring minimal downtime and maximizing throughput.

These machines are also highly versatile and can handle a wide variety of cup types, making them suitable for different product categories such as dairy, desserts, and prepared meals. The demand for linear cup fill and seal machines is driven by the need for reliable, cost-effective packaging solutions that meet the high-volume demands of modern manufacturing. As production speeds continue to increase, linear cup fill and seal machines will remain a top choice in the market.

The food industry accounts for 56% of the demand for cup fill and seal machines in Japan. The food industry relies heavily on automated packaging solutions to efficiently fill and seal a wide range of products, such as dairy items, ready-to-eat meals, snacks, and desserts. Cup fill and seal machines play a critical role in maintaining product quality, hygiene, and shelf-life by providing precise sealing and packaging. The growing demand for convenient, single-serve food products has further increased the need for these machines, as they allow for efficient high-volume packaging of small portioned foods.

With consumers seeking more ready-to-eat meals and snacks, the need for packaging that preserves freshness and extends product shelf life has led to a significant rise in demand for food-grade packaging solutions. As the food sector continues to focus on convenience and product preservation, the food industry will remain the dominant end-user for cup fill and seal machines.

Key drivers include increasing automation in food & beverage manufacturing (especially ready‑to‑eat meals, yogurt cups, desserts) which boosts demand for cup fill & seal machines; the strong consumer preference in Japan for single‑serve, portion‑controlled products and sealed cups enhances uptake; and rising emphasis on hygiene, fast production changeovers and efficient production lines in facilities drives adoption. Restraints include high capital costs of advanced machines and retrofit difficulties in older facilities; limited floor space in Japanese factories which constrains large‑scale installation; and material cost pressures (for cups, lids, sealing films) which can reduce margin for new equipment investment.

In Japan demand for cup fill and seal machines is growing because food manufacturers are responding to consumer trends favouring convenience, single‑serve packaging and on‑the‑go consumption. The growth of processed foods, desserts and chilled products means more manufacturers are adopting cup‑oriented packaging formats. Increasing exports of Japanese packaged foods and strict domestic quality/hygiene standards encourage investment in reliable, high‑speed filling/sealing equipment. With technological upgrades, producers can reduce downtime, improve yield and cater to higher‑mix, smaller‑batch runs attribute increasingly valued in Japan’s food‑production environment.

Technological innovations are driving growth of cup fill and seal machines in Japan by improving machine speed, flexibility and hygiene. Examples include multi‑cup indexing systems, servo‑driven filling & sealing for precise portioning, quick‑change tooling for different cup sizes, and integrated vision inspection for lid sealing quality. Advances in materials handling allow machines to work with biodegradable or compostable cups, supporting sustainability goals. Smarter control systems permit remote monitoring, predictive maintenance and better line integration. These enhancements make cup fill & seal machines more attractive in Japan’s highly automated, quality‑focused manufacturing environment and encourage investment in the latest equipment.

Despite growing interest, adoption of cup fill and seal machines in Japan faces several challenges. One major issue is cost: high‑end machines with advanced features can require significant capital investment and long pay‑back periods in a market where margins are tight. Another is the production footprint: many Japanese food processors operate on limited factory space and may hesitate to install large or complex machines. Supply‑chain issues (e.g., sourcing compatible materials for cups, lids, films) and compatibility with older packaging lines can slow adoption. The rapid evolution of packaging formats and consumer demands means equipment may need frequent updates, which adds to operational risk and investment hurdles.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.3 |

| Kanto | 2.1 |

| Kinki | 1.8 |

| Chubu | 1.6 |

| Tohoku | 1.4 |

| Rest of Japan | 1.3 |

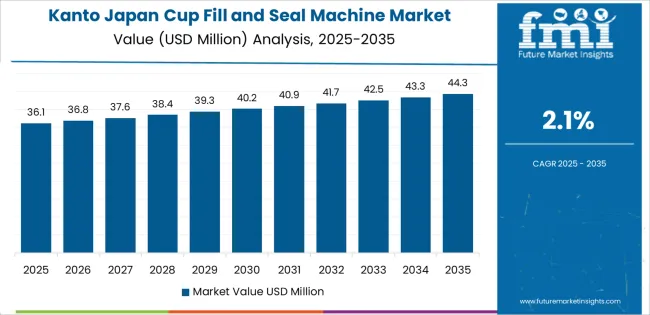

Demand for cup fill and seal machines in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 2.3% CAGR. Kanto follows with a 2.1% CAGR, supported by its central role in Japan’s food production and packaging industries. Kinki shows a 1.8% CAGR, driven by demand in cities like Osaka and Kyoto, where food processing continues to grow. Chubu experiences a 1.6% CAGR, fueled by its food production capabilities, especially in dairy and beverage sectors. Tohoku sees a 1.4% CAGR, with demand supported by its agricultural base and food processing sector. The Rest of Japan shows the lowest growth at 1.3%.

Kyushu & Okinawa are experiencing the highest demand for cup fill and seal machines in Japan, with a 2.3% CAGR. This growth is driven by the region's thriving food processing sector, particularly in ready-to-eat meals, beverages, and dairy products. The region is home to significant food manufacturers, with plants focused on both domestic consumption and export markets. As the demand for packaged food products rises, efficient, high-quality packaging solutions like cup fill and seal machines become crucial. The region’s focus on automation and increasing consumer demand for convenient, safe, and fresh products also support the adoption of these machines. The growth in Kyushu & Okinawa is expected to continue as food manufacturing expands, driven by consumer preferences for packaged, easy-to-consume food products.

Kanto is seeing steady demand for cup fill and seal machines in Japan, with a 2.1% CAGR. This growth is fueled by the region's central role in the food production and packaging industries, particularly in cities like Tokyo and Yokohama. Kanto's strong manufacturing infrastructure supports a wide range of food and beverage products, including dairy, snacks, and beverages, which rely on efficient packaging systems.

The increasing demand for convenience and ready-to-eat food products, along with the region's focus on technological advancement in food production, boosts the adoption of cup fill and seal machines. Furthermore, the growing trend towards packaging efficiency and food safety is driving manufacturers in Kanto to invest in automated packaging solutions. As consumer demand for packaged foods continues to rise, Kanto's food processing sector will remain a key driver for cup fill and seal machine demand.

Kinki is experiencing moderate demand for cup fill and seal machines in Japan, with a 1.8% CAGR. This growth is driven by the region's well-established food processing industry, particularly in cities like Osaka and Kyoto, which are centers for food production and packaging. Kinki has a strong presence in dairy products, snacks, and beverages, all of which require high-quality packaging solutions.

The increasing popularity of convenient, ready-to-consume food products has pushed demand for efficient and reliable packaging machines like cup fill and seal systems. Furthermore, Kinki’s ongoing investments in food production technologies and automated manufacturing processes have contributed to the region’s growing adoption of advanced packaging equipment. As demand for packaged food and beverages continues to rise, Kinki’s food industry will keep driving demand for cup fill and seal machines in the region.

Chubu is experiencing moderate demand for cup fill and seal machines in Japan, with a 1.6% CAGR. The region, particularly around Nagoya, is known for its strong automotive and manufacturing industries, but its food production sector is also seeing growth, especially in dairy, snacks, and beverages. With a rising demand for convenient food options, Chubu's food processing industry is increasingly turning to efficient packaging solutions, including cup fill and seal machines, to keep up with consumer demand.

Chubu’s commitment to technological advancements in food processing, as well as its focus on automation, further supports this demand. As food manufacturers continue to seek cost-effective, high-quality packaging methods, the adoption of automated packaging systems like cup fill and seal machines will continue to grow in Chubu. The region’s strong manufacturing base ensures steady demand for packaging solutions in the food and beverage sectors.

Tohoku is experiencing moderate demand for cup fill and seal machines in Japan, with a 1.4% CAGR. The region’s food processing industry, especially in areas like Aomori and Sendai, has seen steady growth, particularly in agricultural and processed food products. With the increasing demand for packaged food products, Tohoku’s manufacturers are adopting more efficient packaging solutions, such as cup fill and seal machines, to meet consumer expectations for convenience and freshness.

The region’s agricultural focus means that food processing plants require high-quality packaging systems for items like fruits, vegetables, and dairy. Tohoku’s emphasis on improving food production technologies and automation supports the growing demand for packaging equipment. While the growth rate is slower than in other regions, Tohoku's food industry continues to expand, creating steady demand for automated packaging solutions like cup fill and seal machines.

The Rest of Japan is experiencing the lowest demand for cup fill and seal machines, with a 1.3% CAGR. While this region does not have the same scale of automotive and food production industries as other major hubs, it still plays an important role in Japan’s overall food packaging sector. The demand for cup fill and seal machines here is driven primarily by smaller, regional food processors and manufacturers that require efficient, reliable packaging for their products.

As consumer demand for convenience food continues to rise, these regional manufacturers are adopting automated solutions to improve efficiency and reduce production costs. The Rest of Japan’s food industry, though smaller in scale, remains an essential part of the supply chain, driving steady demand for packaging solutions. With growing consumer interest in packaged foods, the adoption of automated cup fill and seal machines is expected to continue at a moderate pace in this region.

In Japan, demand for cup fill and seal machines is driven by growth in single‑serve convenience foods, increasing automation in food and beverage packaging, and the need for hygienic, high‑speed production of cups containing yogurts, desserts, sauces, or chilled meals. Machine types that integrate cup feeding, accurate dosing, sealing, and trimming are gaining favour among manufacturers focused on operational efficiency and product differentiation.

Key equipment manufacturers active in Japan include Orics Industries Inc. with a 50.5% share, Ilpra S.p.a., R.A Jones, Serac Group, and Paxiom Group. These companies differentiate by offering machines with multi‑format capability, high sealing precision, sanitation features suitable for Japan’s food safety standards, and strong after‑sales support in the region.

Competitive dynamics are shaped by several factors. The first driver is that food manufacturers seek faster changeovers and flexibility to run multiple SKUs, requiring machines that support modular tooling and digital controls. The second driver is that Japan’s demographic shift and demand for premium desserts and portion‑packs increases the need for machines with consistent fill accuracy and high hygiene. The restraint is that equipment investment is high and legacy production lines can delay adoption. Companies that can offer reliable integration, low downtime, and strong local service are best positioned in the Japanese cup fill and seal machine sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Automatic Cup Fill and Seal Machine, Semi-Automatic Cup Fill and Seal Machine, Manual Cup Fill and Seal Machine |

| Machine Type | Linear Cup Fill and Seal Machine, Rotatory Cup Fill and Seal Machine, Intermittent Cup Fill and Seal Machine |

| Capacity | Up to 1000 Cups/Hour, 1001-2000 Cups/Hour, Above 2000 Cups/Hour |

| End Use | Food, Beverages |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Orics Industries Inc., Ilpra S.p.a., R.A Jones, Serac Group, Paxiom Group |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in cup fill and seal machines; technology adoption for automation; growth in food and beverage sectors; vendor offerings including hardware, software, services, and platform integration; regulatory influences and industry standards |

The demand for cup fill and seal machine in japan is estimated to be valued at USD 92.5 million in 2025.

The market size for the cup fill and seal machine in japan is projected to reach USD 110.5 million by 2035.

The demand for cup fill and seal machine in japan is expected to grow at a 1.8% CAGR between 2025 and 2035.

The key product types in cup fill and seal machine in japan are automatic cup fill and seal machine, semi-automatic cup fill and seal machine and manual cup fill and seal machine.

In terms of machine type, linear cup fill and seal machine segment is expected to command 56.3% share in the cup fill and seal machine in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Industry Share Analysis for Cup Fill and Seal Machine Companies

Demand for Cup Fill and Seal Machine in USA Size and Share Forecast Outlook 2025 to 2035

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Pick Fill Seal Machines Market Size, Share & Forecast 2025 to 2035

Market Positioning & Share in the Form Fill Seal Machine Industry

Form Fill Seal Machine Market Analysis by Semi-automatic and Automatic Through 2034

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thermoform Fill Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Thermoform Fill Sealing Machine Providers

Carton Form Fill Seal Machine Market

Vertical Form Fill Seal VFFS Machine Market Size and Share Forecast Outlook 2025 to 2035

Tubular Form Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Automated Tray Fill and Seal Machines Companies

Horizontal Form Fill Seal (HFFS) Machines Market Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Cup Filler Market

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA