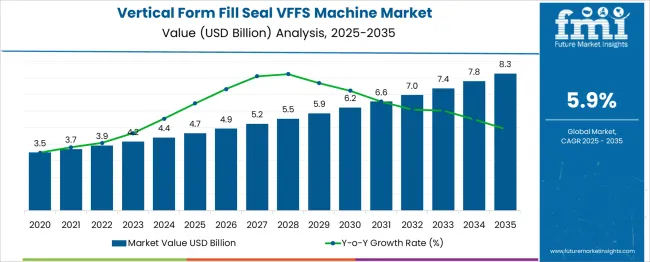

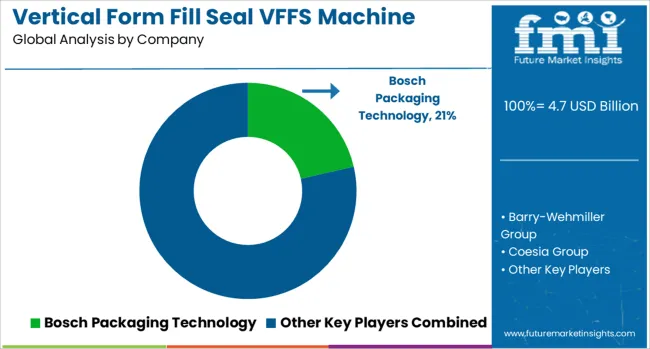

The Vertical Form Fill Seal VFFS Machine Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Vertical Form Fill Seal VFFS Machine Market Estimated Value in (2025 E) | USD 4.7 billion |

| Vertical Form Fill Seal VFFS Machine Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The vertical form fill seal (VFFS) machine market is growing steadily as manufacturers focus on automation and efficiency in packaging processes. Increasing demand for faster and more reliable packaging solutions in the food and beverage industry has driven adoption of VFFS machines. These machines enable precise filling and sealing of products in various bag formats, reducing waste and improving shelf life.

Technological improvements have enhanced machine speed and flexibility, allowing producers to meet changing consumer preferences and regulatory requirements. Expansion of organized retail and e-commerce has increased the need for convenient, hygienic packaging, further fueling market growth.

Future opportunities are expected from innovations in machine automation and integration with smart factory systems. Segment growth is forecast to be led by Automatic VFFS Machines due to their efficiency, pillow bags as the preferred packaging type, and the food and beverage sector as the largest end use industry.

The vertical form fill seal vffs machine market is segmented by technology, packaging type, end use industry, material type, and distribution channel and geographic regions. By technology of the vertical form fill seal vffs machine market is divided into Automatic VFFS Machines and Semi-automatic VFFS Machines. In terms of packaging type of the vertical form fill seal vffs machine market is classified into Pillow Bags, Doypacks, Gusseted Bags, Quad Seal Bags, Sachets, Stick Packs, and Others. Based on end use industry of the vertical form fill seal vffs machine market is segmented into Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Chemicals, and Others. By material type of the vertical form fill seal vffs machine market is segmented into Plastic, Paper, Aluminum Foil, Multi-layer Films, Biodegradable Materials, and Others. By distribution channel of the vertical form fill seal vffs machine market is segmented into Direct and Indirect. Regionally, the vertical form fill seal vffs machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

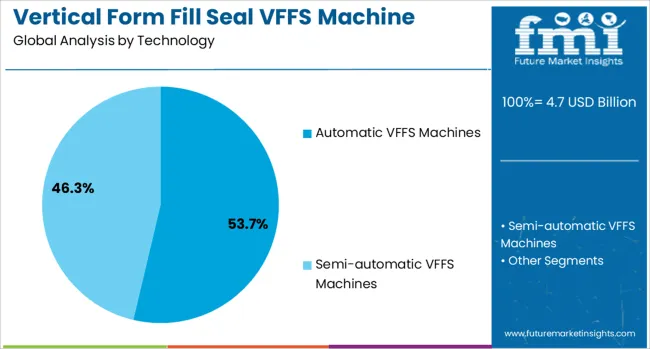

The Automatic VFFS Machines segment is expected to hold 53.7% of the market revenue in 2025, dominating the technology category. This segment has grown due to the increasing need for high-speed, low-error packaging solutions in mass production environments. Automatic machines offer reduced labor requirements and enhanced precision in filling and sealing, which translates to better product consistency.

Manufacturers have adopted these systems to improve throughput and comply with stricter hygiene standards. The ability to quickly adjust settings for different product types and bag sizes has made automatic VFFS machines versatile and cost-effective.

As production facilities continue to prioritize automation and productivity, demand for automatic VFFS machines is set to remain strong.

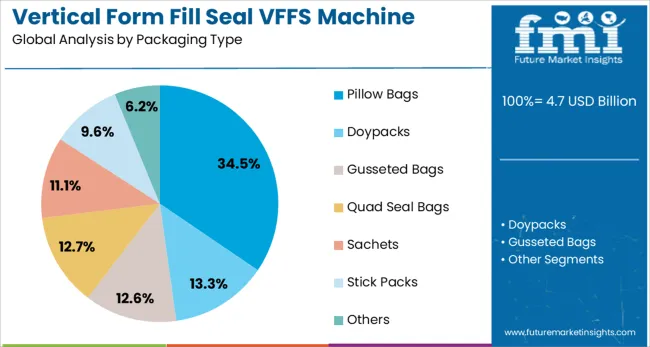

The Pillow Bags segment is projected to account for 34.5% of the VFFS machine market revenue in 2025, maintaining its position as the leading packaging format. Pillow bags have gained popularity for their simplicity, cost-effectiveness, and consumer-friendly design. Their symmetrical shape and sealed edges provide excellent product protection and shelf appeal.

Food manufacturers particularly prefer pillow bags for snacks, confectionery, and frozen foods due to easy handling and efficient packing. The growing demand for flexible packaging solutions that support branding and product differentiation has reinforced the use of pillow bags.

Additionally, the adaptability of pillow bags to various machine speeds and product types supports their continued market dominance.

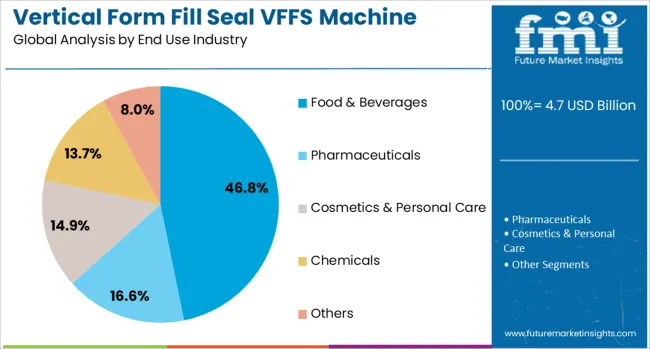

The Food and Beverages segment is expected to generate 46.8% of the VFFS machine market revenue in 2025, leading the end-use industries. This growth is supported by the increasing need for efficient packaging of diverse food products ranging from snacks and dairy to beverages and processed foods.

Rising consumer demand for convenience foods and packaged goods has increased reliance on VFFS technology to ensure freshness and hygiene. The food and beverage sector’s stringent packaging regulations have further driven adoption of automated and precise packaging equipment.

Investments in cold chain logistics and expanding retail networks have also contributed to the segment’s growth. As product innovation and consumer preference continue to evolve, the Food and Beverages industry is set to remain the primary driver for VFFS machine demand.

Demand for VFFS machines is accelerating as consumer packaged goods and food manufacturers scale automation, shift toward flexible packaging, and pursue operational efficiency. Sales of high-speed, servo-driven VFFS systems are growing across snacks, frozen foods, and pharmaceuticals, particularly in Asia, North America, and Europe.

Demand for servo-driven VFFS machines increased by 27% in 2025, led by snack and chilled food producers aiming for throughput exceeding 120 packs per minute. Integrated depth-adjusting film feeders and digital tension controls reduced film changeover time by 32%, while overall equipment effectiveness improved by 18%. Food processing lines that added VFFS automation cut manual labor by 22% during primary packaging stages. Demand is especially strong in Asia Pacific and North America, where manufacturers prioritize fast format switching, multi-lane packaging, and minimal downtime in high-SKU environments.

Sales of VFFS machines designed for barrier films and small-batch pharmaceutical formats grew 31% year over year in 2025. These units support formats such as blister packs, sachets, and moisture-sensitive strips using laminated foil, PE, and PET films. Pharmaceutical-grade VFFS lines with in-line metal detection and automatic weight verification reduced reject rates by 24%. Specialty food manufacturers using multi-film layering achieved shelf life extension of up to 16% in aseptic drink pouches. Vendors offering integrated service contracts and remote diagnostics reported a 29% increase in repeat equipment orders, as uptime and validation support remain critical in regulated environments.

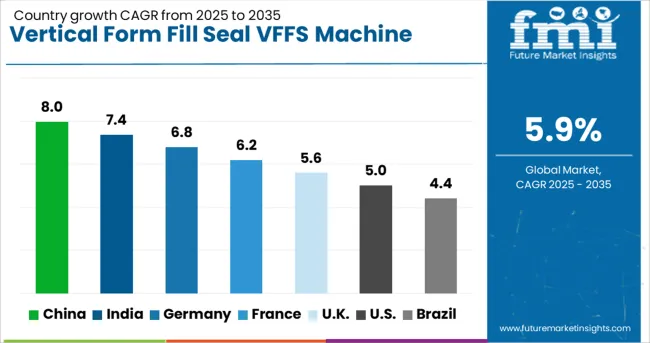

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by increased automation, rising flexible film usage, and demand from food and beverage producers. China is expected to lead with a CAGR of 8.0%, supported by food export growth, domestic consumption, and packaging line upgrades across the FMCG sector. India is projected at 7.4%, backed by expansion in packaged snacks, dairy, and pharmaceuticals that require vertical packaging formats. Germany will grow at 6.8%, driven by precision manufacturing and hygienic design innovation. The United Kingdom is forecast to expand at 5.6%, with automation aligned to sustainable packaging and smaller pack formats. The United States is expected to grow at 5.0% due to adoption in meat, pet food, and private-label goods. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is expected to grow at a 8.0% CAGR, driven by large-scale FMCG production, rising food exports, and packaging line upgrades. Manufacturers are investing in servo-driven systems and automated changeover features to meet demand for high-speed, flexible packaging formats. E-commerce-driven grocery and snack sectors accelerate vertical packaging adoption. Domestic OEMs dominate price-sensitive segments, while global players target high-speed systems for frozen foods and pet care. Regulatory emphasis on food safety drives the integration of hygienic designs with advanced sealing technology.

India is forecast to grow at a 7.4% CAGR, fueled by packaged snacks, dairy products, and pharmaceuticals requiring vertical packaging solutions. Rising consumption of ready-to-eat foods and single-serve pouches strengthens demand for VFFS machines in mid-speed and multi-lane configurations. Government incentives for food processing under the PLI scheme drive investment in automated packaging lines. Domestic manufacturers offer cost-competitive systems, while international brands focus on premium segments with advanced sealing and nitrogen-flush features for extended shelf life.

Germany is projected to grow at a 6.8% CAGR, supported by its precision engineering ecosystem and strong focus on hygienic design innovation. Demand is led by dairy, confectionery, and nutraceutical packaging, requiring ultra-clean and vacuum-sealed packs. Integration with smart sensors for predictive maintenance and traceability aligns with EU food safety regulations. German OEMs are introducing modular VFFS systems designed for recyclable film compatibility, addressing packaging sustainability requirements. Export demand for German machines remains high in emerging markets seeking advanced automation.

The United Kingdom is forecast to grow at a 5.6% CAGR, driven by automation for sustainable packaging and smaller portion packs. Demand from private-label manufacturers and online grocery channels supports adoption of mid-speed systems. OEMs prioritize compact machine designs for space-constrained facilities while introducing remote monitoring features. The transition to paper-based and mono-material films under regulatory pressure drives equipment upgrades for heat-seal precision and flexibility. Partnerships between equipment manufacturers and packaging material suppliers enhance machine-film compatibility.

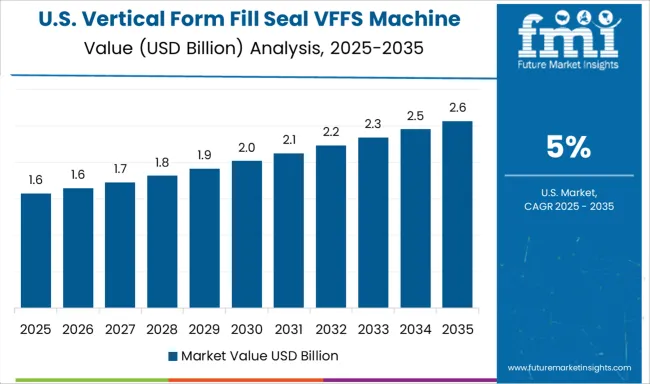

The United States is expected to grow at a 5.0% CAGR, supported by demand from meat processing, pet food, and private-label packaged goods. Food safety compliance under USDA and FDA regulations drives integration of hygienic, stainless-steel VFFS systems with washdown capability. E-commerce grocery growth is accelerating demand for flexible packaging formats with resealable and stand-up pouch designs. OEMs are introducing machines with advanced film tension control and real-time OEE monitoring for operational efficiency. Strategic partnerships with co-packers are enabling capacity scaling for emerging D2C brands.

Bosch Packaging Technology leads the global market with a significant share, driven by its advanced automation and high-speed filling technologies for food and pharmaceutical packaging. Coesia Group, Barry-Wehmiller, and IMA Group follow with strong positions in Europe and North America, offering servo-driven flexible packaging lines. GEA Group and Hayssen Flexible Systems are expanding in dairy and frozen food segments with modular VFFS units that support rapid product changeovers. Matrix Packaging Machinery and Rovema cater to mid-sized producers with compact equipment optimized for precision and reduced downtime. Nichrome India, Pakona Engineers, and Mespack lead in emerging markets across Asia and the Middle East, focusing on cost-effective and robust machines. ULMA, Fres-co, and Ishida are investing in hygienic design and multi-film compatibility to enhance global reach.

In May 2024, Mespack launched the MLC Series, a compact high-speed VFFS machine that produces up to 2,400 sachets per minute using 16-track lines. Designed for recyclable films and large-format sachets, the MLC Series was introduced at Hispack 2024. The company partnered with Dow and Comexi for validation of recycled packaging materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Technology | Automatic VFFS Machines and Semi-automatic VFFS Machines |

| Packaging Type | Pillow Bags, Doypacks, Gusseted Bags, Quad Seal Bags, Sachets, Stick Packs, and Others |

| End Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Chemicals, and Others |

| Material Type | Plastic, Paper, Aluminum Foil, Multi-layer Films, Biodegradable Materials, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Packaging Technology, Barry-Wehmiller Group, Coesia Group, Fres-co System USA, Inc., GEA Group AG, Hayssen Flexible Systems, Inc., IMA Group, Ishida Co., Ltd., Matrix Packaging Machinery, LLC, Mespack SL, Nichrome India Ltd., Pakona Engineers (I) Pvt. Ltd., Pro Mach, Inc., Rovema, and ULMA Packaging, S.Coop. |

| Additional Attributes | Dollar sales by machine type (automatic VFFS vs semi‑automatic) and packaging format (pouches, sachets), demand dynamics across food, pharma & e‑commerce sectors, regional leadership in Asia‑Pacific with rapid North America growth, innovation in eco‑film compatibility and IoT/AI automation, and environmental impact of material waste reduction. |

The global vertical form fill seal vffs machine market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the vertical form fill seal vffs machine market is projected to reach USD 8.3 billion by 2035.

The vertical form fill seal vffs machine market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in vertical form fill seal vffs machine market are automatic vffs machines and semi-automatic vffs machines.

In terms of packaging type, pillow bags segment to command 34.5% share in the vertical form fill seal vffs machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Vertical Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Vertical Software Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Vertical Mill Market Size and Share Forecast Outlook 2025 to 2035

Vertical Market Software Market Insights - Growth & Forecast 2025 to 2035

Vertical-Cavity Surface-Emitting Lasers (VCSEL) Market Growth - Trends & Forecast 2025 to 2035

Vertical Mast Lifts Market Analysis & Forecast by Product Type, Working Height, Capacity, End-user Industry, and Region Through 2035

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Vertical Inline Pumps Market

Vertical Strapping Machines Market

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Vertical Platform Lift Market

Clipless Vertical Pouches Market

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA