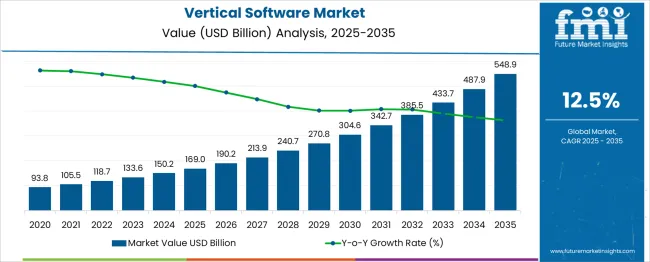

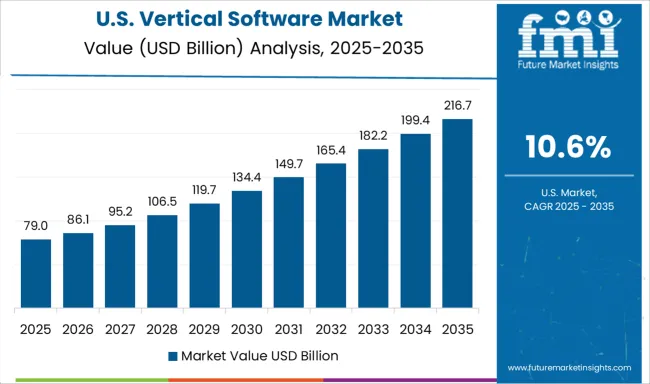

The global vertical software market is forecasted to expand from USD 169 billion in 2025 to approximately USD 548.9 billion by 2035, recording an absolute increase of USD 379.86 billion over the forecast period. This translates into a total growth of 224.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.5% between 2025 and 2035. The overall market size is expected to grow by nearly 3.25X during the same period, supported by increasing digital transformation initiatives, rising demand for industry-specific solutions, and growing focus on automation and operational efficiency across various sectors.

Between 2025 and 2030, the vertical software market is projected to expand from USD 169 billion to USD 304.60 billion, resulting in a value increase of USD 135.57 billion, which represents 35.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of cloud-based solutions, increasing demand for integrated business applications, and growing penetration of AI-powered software in emerging markets. Enterprise software providers are expanding their vertical-specific product portfolios to address the growing demand for industry-tailored solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 169 billion |

| Forecast Value in (2035F) | USD 548.9 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

From 2030 to 2035, the market is forecast to grow from USD 304.60 billion to USD 548.9 billion, adding another USD 244.29 billion, which constitutes 64.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of artificial intelligence integration, development of low-code/no-code platforms, and advancement of industry-specific automation solutions. The growing adoption of hybrid cloud deployments and edge computing will drive demand for sophisticated vertical software solutions with enhanced performance and security capabilities.

Between 2020 and 2025, the vertical software market experienced robust expansion, driven by accelerated digital transformation initiatives and growing demand for remote work solutions. The market developed as organizations recognized the need for specialized software solutions to address industry-specific challenges and compliance requirements. The COVID-19 pandemic accelerated the adoption of cloud-based vertical software solutions across healthcare, education, and financial services sectors.

Market expansion is being supported by the increasing need for industry-specific solutions that address unique business processes and regulatory requirements across different sectors. Modern organizations are increasingly focused on digital transformation initiatives that can improve operational efficiency, enhance customer experiences, and maintain competitive advantage. Vertical software's ability to provide tailored functionality for specific industries makes it a preferred choice for enterprises seeking specialized capabilities.

The growing focus on data-driven decision making and business intelligence is driving demand for vertical software solutions that integrate analytics and reporting capabilities. Organizations prefer solutions that combine industry expertise with advanced technology features such as artificial intelligence, machine learning, and automation. The rising influence of cloud computing and software-as-a-service (SaaS) models is also contributing to increased adoption across different organization sizes and geographic regions.

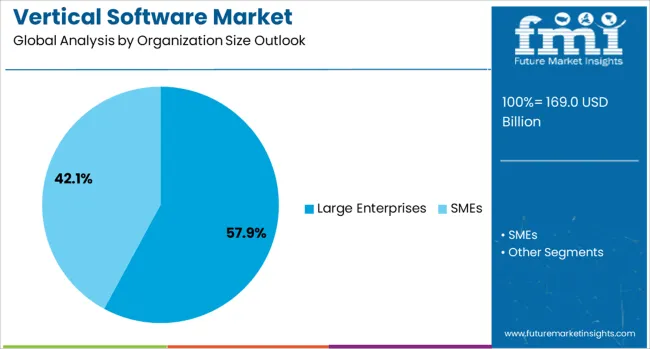

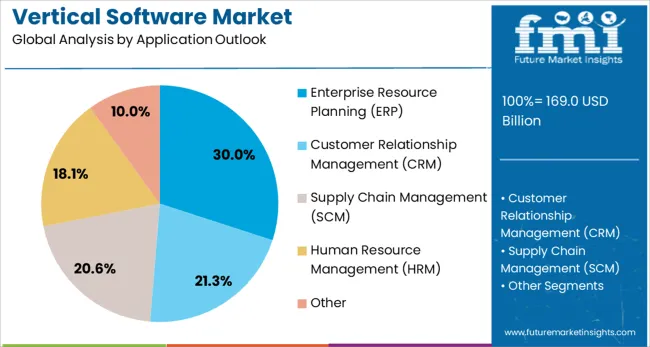

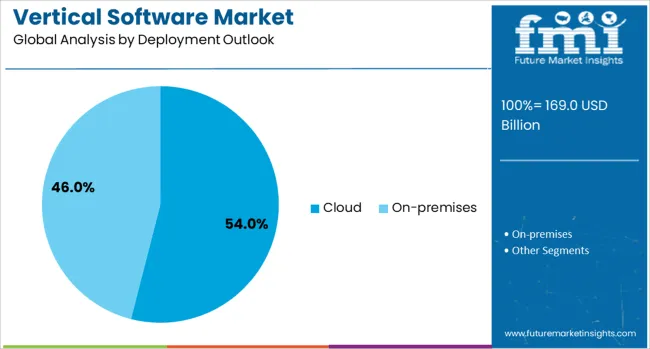

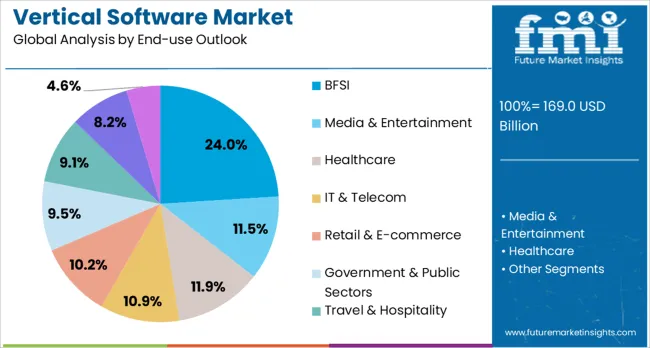

The market is segmented by organization size, application, deployment, end-use, and region. By organization size, the market is divided into large enterprises and SMEs. Based on application, the market is categorized into Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Supply Chain Management (SCM), Human Resource Management (HRM), and others. In terms of deployment, the market is segmented into cloud and on-premises. By end-use, the market is classified into BFSI, Media & Entertainment, Healthcare, IT & Telecom, Retail & E-commerce, Government & Public Sectors, Travel & Hospitality, Education, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

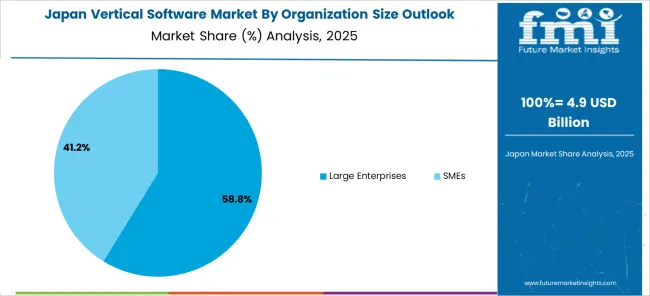

The large enterprises segment is projected to account for 57.9% of the vertical software market in 2025, reaffirming its position as the primary driver of market demand. Large organizations require comprehensive software solutions that can handle complex business processes, multiple locations, and extensive user bases. These enterprises have the resources and infrastructure necessary to implement and maintain sophisticated vertical software systems that deliver significant return on investment.

Large enterprises drive innovation in vertical software development as they often have specific requirements that push vendors to develop advanced features and capabilities. Their willingness to invest in premium solutions and customization services creates opportunities for software providers to develop cutting-edge technologies. The segment's dominance is also supported by the need for enterprise-grade security, compliance features, and integration capabilities that are essential for large-scale operations.

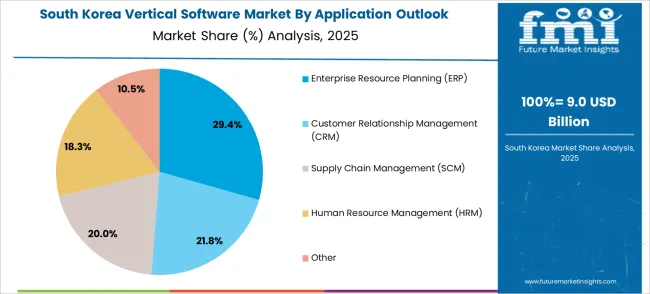

Enterprise Resource Planning (ERP) solutions are projected to represent 30% of vertical software demand in 2025, highlighting their critical role in business operations management. ERP systems provide integrated platforms that manage core business processes including finance, procurement, manufacturing, and human resources. Organizations increasingly recognize the value of unified systems that eliminate data silos and improve operational visibility across different departments.

The ERP segment benefits from ongoing digital transformation initiatives that require organizations to modernize their core business systems. Modern ERP solutions offer industry-specific modules and workflows that address unique requirements of different vertical markets. Cloud-based ERP deployment models are making these solutions more accessible to mid-market organizations, expanding the overall market opportunity for vertical software providers.

The cloud deployment model is forecasted to contribute 54% of the vertical software market in 2025, reflecting the ongoing shift toward flexible and scalable software delivery models. Cloud-based solutions offer advantages including reduced upfront costs, automatic updates, improved accessibility, and enhanced collaboration capabilities. Organizations appreciate the ability to scale resources based on demand and access software from multiple locations and devices.

Cloud deployment enables faster implementation timelines and reduces the burden on internal IT teams for maintenance and updates. The model also facilitates integration with other cloud services and supports modern development practices including DevOps and continuous deployment. Security improvements and compliance certifications from major cloud providers have addressed previous concerns about data protection and regulatory compliance.

The Banking, Financial Services, and Insurance (BFSI) sector is projected to represent 24% of vertical software demand in 2025, driven by stringent regulatory requirements and the need for specialized financial applications. BFSI organizations require software solutions that support complex financial processes, risk management, compliance reporting, and customer relationship management. The sector's adoption of digital banking and fintech innovations creates demand for modern software platforms.

Regulatory compliance drives significant investment in vertical software solutions that can automate reporting, ensure audit trails, and maintain data security standards. The growing importance of real-time analytics, fraud detection, and customer experience management requires specialized software capabilities that generic solutions cannot adequately address. Digital transformation initiatives in the financial sector continue to create opportunities for innovative vertical software providers.

The vertical software market is advancing rapidly due to increasing digital transformation initiatives and growing demand for industry-specific solutions. However, the market faces challenges including high implementation costs, integration complexity, and competition from horizontal software providers. Innovation in artificial intelligence, automation technologies, and cloud-native architectures continue to influence product development and market expansion patterns.

Organizations across all sectors are investing in digital transformation projects that require specialized software solutions to modernize operations and improve competitiveness. Industry 4.0 initiatives in manufacturing, smart city projects in government, and digital health initiatives in healthcare are driving demand for vertical software platforms. These projects require solutions that understand industry-specific processes and can integrate with existing systems and workflows.

Modern vertical software solutions are incorporating AI and ML technologies to provide intelligent automation, predictive analytics, and enhanced user experiences. These capabilities enable organizations to optimize processes, reduce manual work, and make data-driven decisions more effectively. AI-powered vertical software can adapt to specific industry patterns and provide insights that generic solutions cannot match, creating competitive advantages for adopting organizations.

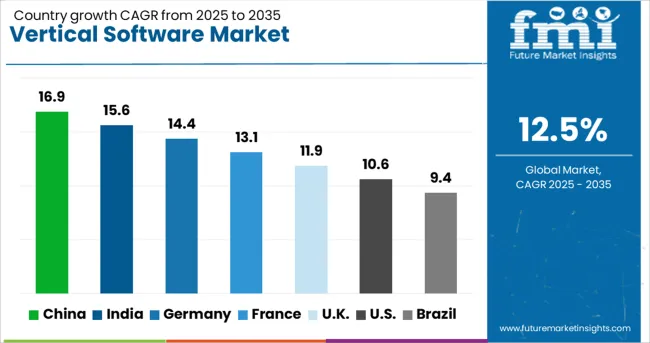

| Countries | CAGR (2025-2035) |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| UK | 11.9% |

| USA | 10.6% |

| Brazil | 9.4% |

The vertical software market is experiencing robust growth globally, with China leading at a 16.9% CAGR through 2035, driven by massive digital transformation initiatives, government support for technology adoption, and rapid industrialization across multiple sectors. India follows at 15.6%, supported by expanding IT services sector, increasing digitalization, and growing demand for industry-specific solutions. Germany shows strong growth at 14.4%, emphasizing advanced manufacturing and Industry 4.0 applications. France records 13.1%, focusing on digital government initiatives and enterprise software adoption. The UK demonstrates 11.9% growth, prioritizing financial services and healthcare software solutions. The USA. maintains 10.6% growth with its mature market and continuous innovation in vertical software development.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from vertical software in China is projected to exhibit exceptional growth with a CAGR of 16.9% through 2035, driven by the government's digital economy strategy and massive investment in technology infrastructure across all industries. The country's focus on smart manufacturing, digital finance, and e-government initiatives creates substantial demand for industry-specific software solutions. Major technology companies are developing comprehensive vertical software platforms to serve the diverse needs of Chinese enterprises.

Revenue from vertical software in India is expanding at a CAGR of 15.6%, supported by the country's strong IT services sector, increasing digitalization across industries, and growing demand for cost-effective vertical solutions. India's position as a global software development hub creates opportunities for both domestic and international companies to develop and deploy industry-specific solutions. The government's Digital India initiative is accelerating adoption across various sectors.

Demand for vertical software in the USA is projected to grow at a CAGR of 10.6%, supported by continuous innovation in technology, strong enterprise software adoption, and leadership in cloud computing platforms. American companies are at the forefront of developing next-generation vertical software solutions that incorporate artificial intelligence, machine learning, and advanced analytics capabilities. The mature market continues to drive global trends and standards.

Revenue from vertical software in Germany is projected to grow at a CAGR of 14.4% through 2035, driven by the country's leadership in Industry 4.0 initiatives and advanced manufacturing applications. German organizations prioritize high-quality, reliable software solutions that can integrate with complex industrial systems and support stringent quality standards. The country's strong manufacturing base creates substantial demand for specialized software platforms.

Revenue from vertical software in France is projected to grow at a CAGR of 13.1% through 2035, supported by digital government initiatives, strong enterprise software adoption, and leadership in specific industry sectors including luxury goods, aerospace, and energy. French organizations value software solutions that can support complex regulatory requirements and integrate with existing systems while maintaining high security standards.

Revenue from vertical software in the UK is projected to grow at a CAGR of 11.9% through 2035, supported by the country's leadership in financial technology, strong regulatory frameworks, and growing demand for digital transformation solutions. British organizations prioritize software solutions that can support complex compliance requirements while enabling innovation and competitiveness in global markets.

Revenue from vertical software in Brazil is projected to grow at a CAGR of 9.4% through 2035, supported by increasing digital transformation initiatives, growing technology adoption across industries, and government support for digitalization programs. Brazilian organizations are investing in vertical software solutions to improve operational efficiency, enhance customer experiences, and maintain competitiveness in both domestic and international markets.

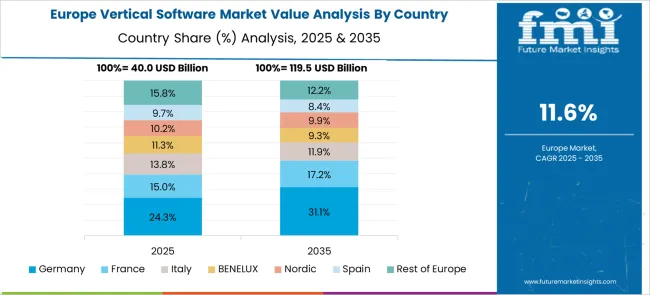

The European vertical software market demonstrates sophisticated development across major economies with Germany leading through its precision software engineering excellence and advanced Industry 4.0 capabilities, supported by companies emphasizing enterprise resource planning solutions, manufacturing automation software, and comprehensive digital transformation platforms while maintaining strict quality standards and regulatory compliance. The UK shows strength in financial services software and regulatory compliance solutions, with organizations specializing in banking software, fintech platforms, and specialized applications that meet stringent financial regulations.

France contributes through its digital government initiatives and enterprise software adoption, delivering specialized solutions that combine public sector requirements with modern software development practices. Sweden and Nordic countries focusing on software solutions and privacy-focused applications. Italy and Spain demonstrate growth in specialized vertical software for traditional industries including fashion, automotive, and manufacturing sectors. The market benefits from stringent EU data protection regulations, established software development infrastructure, and growing enterprise demand for industry-specific solutions that provide superior operational efficiency.

The Japanese vertical software market demonstrates steady growth driven by precision software development focus, advanced technology integration, and enterprise preference for high-quality industry-specific solutions that ensure superior operational efficiency and compliance throughout business operations. Japanese organizations prioritize sophisticated ERP systems and manufacturing software platforms, creating demand for vertical software solutions featuring advanced automation capabilities, comprehensive quality management systems, and integrated business process management that align with Japanese operational excellence standards.

The market emphasizes technological innovation in manufacturing software, supply chain management platforms, and quality control systems that reflect Japanese attention to detail in business process optimization and operational efficiency. Growing investment in smart manufacturing and digital transformation supports intelligent software systems with real-time monitoring, predictive analytics, and automated workflow capabilities for enhanced productivity. Japanese enterprises focus on software reliability, consistent performance outcomes, and long-term operational value.

The South Korean vertical software market shows exceptional growth potential driven by expanding digital transformation initiatives, increasing adoption of cloud-based enterprise solutions, and growing demand for industry-specific applications requiring comprehensive automation and integration capabilities. The market benefits from South Korea's technological leadership in telecommunications and increasing focus on smart manufacturing initiatives that drive investment in specialized software platforms meeting international operational standards.

Korean organizations increasingly adopt enterprise resource planning systems, customer relationship management platforms, and integrated supply chain management solutions to improve operational efficiency and competitive positioning while ensuring regulatory compliance requirements. Growing influence of Korean technology companies in global markets supports demand for sophisticated vertical software platforms that ensure comprehensive functionality while maintaining cost-effectiveness and operational reliability. The integration of artificial intelligence and machine learning technologies creates opportunities for intelligent business software systems with advanced analytics capabilities.

The vertical software market is characterized by competition among established enterprise software providers, specialized vertical solution vendors, and emerging technology companies. Leading players are investing in artificial intelligence capabilities, cloud-native architectures, industry-specific expertise, and strategic acquisitions to deliver comprehensive, innovative, and scalable vertical software solutions. Market positioning, product innovation, and customer success are central to strengthening competitive advantage and market presence.

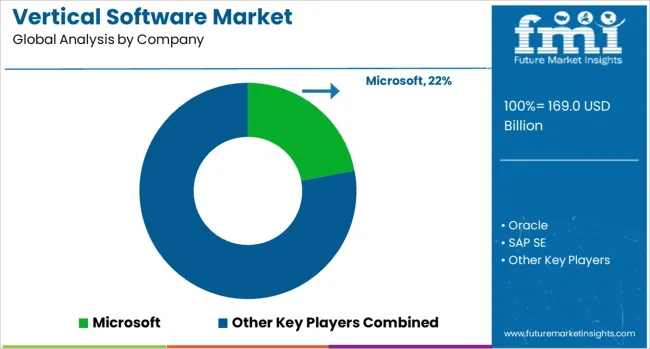

Microsoft, USA-based, leads the market with 22.0% global value share, offering comprehensive vertical software solutions through its Dynamics 365 platform and industry-specific applications across multiple sectors. Oracle, USA, provides integrated enterprise software solutions with strong presence in database management and vertical applications. SAP SE, Germany, delivers enterprise resource planning and industry-specific solutions with focusing on large enterprise customers. Salesforce Inc., USA, focuses on customer relationship management and vertical cloud solutions with strong market presence in service industries.

Adobe Inc., USA., provides creative and marketing software solutions with vertical applications for media, advertising, and creative industries. IBM Corporation, USA, offers comprehensive enterprise software and AI-powered solutions across multiple vertical markets. Intuit Inc., USA, specializes in financial and accounting software for small businesses and individuals. Epic Systems Corporation focuses on healthcare software solutions with dominant market position in electronic health records.

| Items | Values |

| Quantitative Units (2025) | USD 169 billion |

| Organization Size | Large Enterprises, SMEs |

| Application | Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Supply Chain Management (SCM), Human Resource Management (HRM), Others |

| Deployment | Cloud, On-premises |

| End-use | BFSI, Media & Entertainment, Healthcare, IT & Telecom, Retail & E-commerce, Government & Public Sectors, Travel & Hospitality, Education, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Microsoft, Oracle, SAP SE, Salesforce Inc., Adobe Inc., IBM Corporation, Intuit Inc., Epic Systems Corporation, Infor, and Constellation Software Inc. |

| Additional Attributes | Revenue analysis by application type and deployment model, regional demand trends, competitive landscape, buyer preferences for cloud versus on-premises solutions, integration with AI and machine learning capabilities, innovations in low-code platforms, and industry-specific customization trends |

Large Enterprises

SMEs

Enterprise Resource Planning (ERP)

Customer Relationship Management (CRM)

Supply Chain Management (SCM)

Human Resource Management (HRM)

Others

Cloud

On-premises

BFSI

Media & Entertainment

Healthcare

IT & Telecom

Retail & E-commerce

Government & Public Sectors

Travel & Hospitality

Education

Others

North America

United States

Canada

Mexico

Europe

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

East Asia

China

Japan

South Korea

South Asia & Pacific

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Latin America

Brazil

Chile

Rest of Latin America

Middle East & Africa

Kingdom of Saudi Arabia

Other GCC Countries

Turkey

South Africa

Other African Union

Rest of Middle East & Africa

The global vertical software market is estimated to be valued at USD 169.0 billion in 2025.

The market size for the vertical software market is projected to reach USD 548.9 billion by 2035.

The vertical software market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in vertical software market are large enterprises and smes.

In terms of application outlook, enterprise resource planning (erp) segment to command 30.0% share in the vertical software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vertical Market Software Market Insights - Growth & Forecast 2025 to 2035

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Vertical Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Vertical Mill Market Size and Share Forecast Outlook 2025 to 2035

Vertical Form Fill Seal VFFS Machine Market Size and Share Forecast Outlook 2025 to 2035

Vertical-Cavity Surface-Emitting Lasers (VCSEL) Market Growth - Trends & Forecast 2025 to 2035

Vertical Mast Lifts Market Analysis & Forecast by Product Type, Working Height, Capacity, End-user Industry, and Region Through 2035

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Vertical Platform Lift Market

Vertical Inline Pumps Market

Vertical Strapping Machines Market

Clipless Vertical Pouches Market

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA