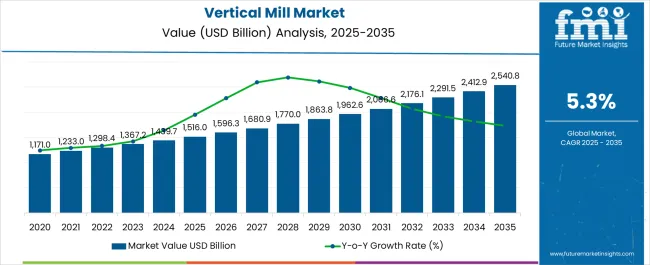

The vertical mill market is estimated to be valued at USD 1516.0 billion in 2025 and is projected to reach USD 2540.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

Industrial facility managers evaluate vertical mills based on throughput capacity, energy consumption profiles, and maintenance accessibility when specifying equipment for new installations or replacement projects. Engineering teams prioritize designs that minimize wear component replacement intervals while maximizing grinding efficiency across diverse material types including limestone, coal, iron ore, and industrial minerals. Capital investment decisions involve comprehensive analysis of operational costs including power consumption, liner replacement schedules, and preventive maintenance requirements that influence total cost of ownership calculations over extended equipment lifecycles.

Equipment manufacturers concentrate production capabilities around specialized facilities equipped with heavy machining centers and assembly areas capable of handling vertical mill components weighing several hundred tons. Supply chain coordination involves managing delivery schedules for major castings, bearing assemblies, and drive systems while coordinating installation timelines with customer facility shutdowns. Quality assurance protocols address dimensional tolerances, material specifications, and testing procedures that validate performance characteristics before equipment shipment to installation sites.

Cross-functional tensions arise between production teams seeking standardized designs and engineering groups responding to customer-specific requirements including foundation constraints, material characteristics, and integration with existing plant systems. Manufacturing lead times extend due to complex fabrication processes and limited global capacity for producing large-scale grinding equipment, creating scheduling challenges for project managers coordinating multi-phase industrial construction programs. Procurement departments navigate component sourcing from specialized suppliers while maintaining inventory levels sufficient to support both new equipment production and aftermarket service requirements.

Worldwide deployment involves coordinating transportation logistics for oversized components requiring specialized heavy-haul equipment and route planning to navigate infrastructure limitations between manufacturing facilities and installation sites. Construction teams manage foundation requirements, structural modifications, and utility connections necessary to support vertical mill installations within existing industrial facilities. Equipment commissioning involves systematic testing protocols that validate grinding performance, vibration levels, and control system integration before transitioning to production operations.

Maintenance organizations develop expertise in hydraulic systems, lubrication management, and wear pattern analysis essential for optimizing vertical mill performance throughout operational lifecycles. Operator training programs address safety protocols, process optimization techniques, and troubleshooting procedures required for maintaining consistent product quality while minimizing unplanned downtime events. Service intervals coordinate with planned facility shutdowns to replace grinding tables, roller assemblies, and classifier components that determine mill efficiency and product fineness characteristics.

| Metric | Value |

|---|---|

| Vertical Mill Market Estimated Value in (2025 E) | USD 1516.0 billion |

| Vertical Mill Market Forecast Value in (2035 F) | USD 2540.8 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The vertical mill market is experiencing steady growth owing to increasing adoption in diverse industrial applications, driven by demand for precision machining, energy efficiency, and versatility across materials. Advances in automation, integration of CNC technology, and improvements in milling accuracy are enhancing the overall efficiency of vertical mills.

Industries are seeking cost effective solutions that provide flexibility for handling both small batch and large scale production requirements. The rising use of durable and lightweight materials in manufacturing, combined with the expansion of industrial automation, is further propelling the demand.

Regulatory emphasis on sustainable production and reduced energy consumption is also supporting the market outlook. With technological upgrades and broader application scope across plastics, metals, and food processing industries, vertical mills are expected to maintain strong momentum in the coming years.

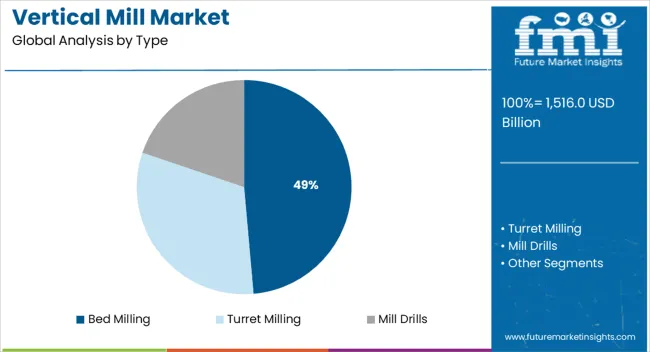

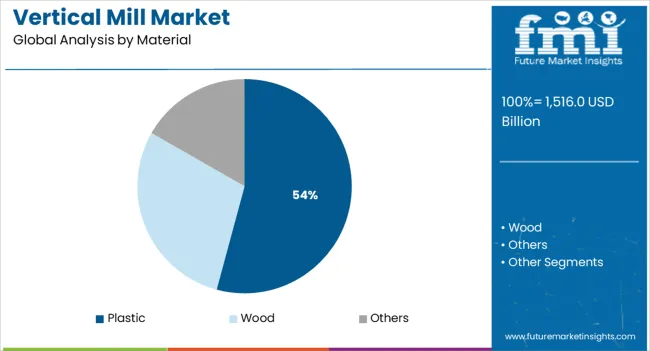

The market is segmented by Type, Material, Application, and Sales Channel and region. By Type, the market is divided into Bed Milling, Turret Milling, and Mill Drills. In terms of Material, the market is classified into Plastic, Wood, and Others. Based on Application, the market is segmented into Food & Beverage, Drilling/Boring, Milling, and Slotting/Keyways. By Sales Channel, the market is divided into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bed milling type is projected to contribute 48.60% of total revenue by 2025, positioning it as the most prominent type segment. This dominance is being driven by its capacity to provide enhanced stability, high precision, and adaptability for handling a wide range of industrial machining processes.

Its suitability for heavy duty applications and ability to manage complex designs have increased adoption across various sectors.

The demand for improved structural strength and consistent performance in machining operations has further strengthened the position of bed milling within the type category.

The plastic material category is expected to account for 54.20% of the total market by 2025, making it the leading material segment. This growth is attributed to the rising use of plastics in packaging, automotive, consumer goods, and medical industries, which require precise and efficient milling operations.

Vertical mills are well suited to achieve high accuracy in plastic component fabrication, supporting large scale production with consistent quality.

Increasing demand for lightweight materials, coupled with the versatility of plastics across end use industries, has reinforced the preference for vertical mills in this segment.

The vertical mill market's size increased from USD 1,080.5 Million in 2020 to USD 1,298.4 Million in 2025. Demand in the market grew at a CAGR of 4.7% during the historical period (2020 to 2025). Manual vertical milling machines are generally inexpensive and do not require a highly skilled crew to operate them, the machine owner's operational costs are further reduced (by eliminating the training cost).

The machines' footprint is also smaller than that of horizontal milling machines due to their smaller size. In places where real estate costs are higher, these financial benefits are poised to fuel demand for manual vertical mills.

However, demand for CNC vertical mills is predicted to be significantly higher in industries and sectors where money is not a problem such as the aviation and aerospace sectors. Future Market Insights (FMI) anticipates substantial increase in demand for aviation and aerospace parts from 2025 to 2035, which is likely to propel the demand for vertical mills.

FMI expects the vertical mill market to be driven by multiple factors in the years ahead. Expert analysts at FMI have assessed emerging opportunities, market restraints, and potential threats that are set to affect the market. The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

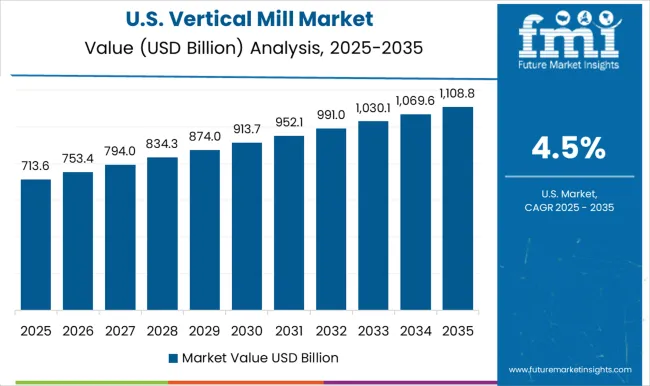

Rising Vertical Mills Demand across Automotive and Construction Sectors in United States to Boost Sales

In recent years, the market for vertical mills in United States has been growing at a rapid pace. This is due to the increasing demand for these machines from various industries such as automotive, aerospace, and construction.

With the growing demand, various companies have been investing in research and development to improve the performance of their products. This has led to the introduction of new and innovative products in the market.

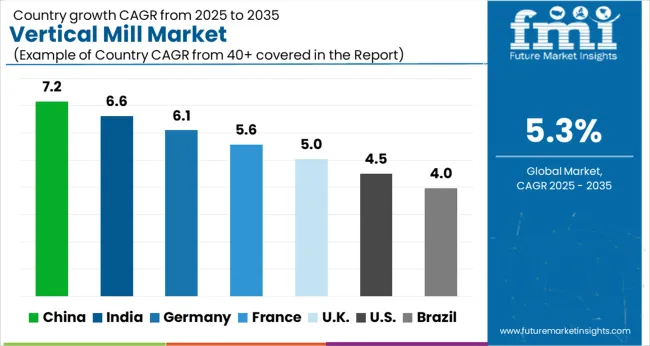

The competition in the market is also intensifying as more companies are entering this space. However, with the right strategies in place, companies can still gain a competitive edge. Global vertical mill sales generate 34.2% of its total revenue from the United States

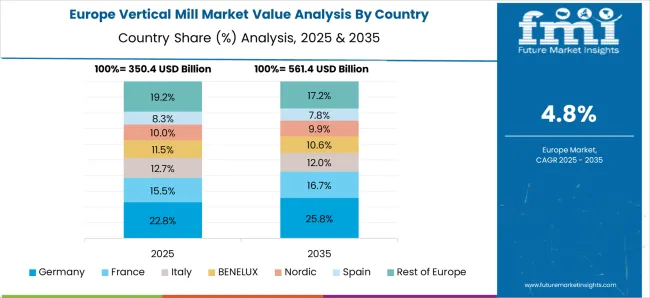

United Kingdom and Germany to Spearhead the Growth in Europe Vertical Mill Market

Demand for vertical mill machines in Europe is continuously rising on the back of rising popularity of the machining process across several industries such as food & beverage, automotive, and construction. This process is used to create parts with a high degree of accuracy and precision. Milling can be done on a variety of materials, including metals, plastics, and composites.

Another reason for the growing demand for vertical mills is the fact that they are much faster than traditional horizontal mills. This increased speed can lead to increased productivity and profits for businesses who utilize them. Germany is estimated to have a 25.9% market share, while the anticipated CAGR of the United Kingdom market is a healthy 6.1% over the projection period.

Strong Presence of Manufacturing Sector Spurring Market Expansion in Asia Pacific

Due to the large presence of the manufacturing sector in the region, Asia Pacific was observed to be among the most dominant markets in 2025. The manufacturing sector has been spurred by rising commodity prices and population growth, which has fueled demand for vertical milling machines throughout Asia Pacific, particularly in China and India.

India and China are expected to be the most lucrative markets in Asia Pacific. Sales in India and China are slated to expand at 5.9% CAGR and 6.4% CAGR, respectively. However, Japan is slated to have around 6.4% share of the market.

Customization in Vertical Mills to Create Opportunities for Manufacturers in Food & Beverage Domain

Extensive use of vertical mills in food and beverage industry due to their compact size and ability to deliver a high degree of grinding is expected to spur the sales. These mills are able to handle both wet and dry ingredients, making them versatile tools in any kitchen. Additionally, vertical mills can be used to grind a variety of food items, from spices to coffee beans.

One of the most significant potential advantages of using a vertical mill in the food and beverage domain is the ability to create custom grinding settings. This allows for more control over the quality of the final product, ensuring that it meets the specific needs of the end-user.

Enhanced Production, Reduced Operating Costs, and Better Quality to Fuel Vertical Mills Demand for Drilling and Slotting

There are several advantages of using vertical mills over other types of mills when it comes to applications like drilling/boring, slotting/keyways, and milling. For starters, they are more efficient than other types of mills because they facilitate greater production.

Also, vertical mills require less energy to operate than other types of mills, resulting in lower operating costs. Additionally, they produce products with a higher degree of precision and accuracy than other types of mills, resulting in improved product quality.

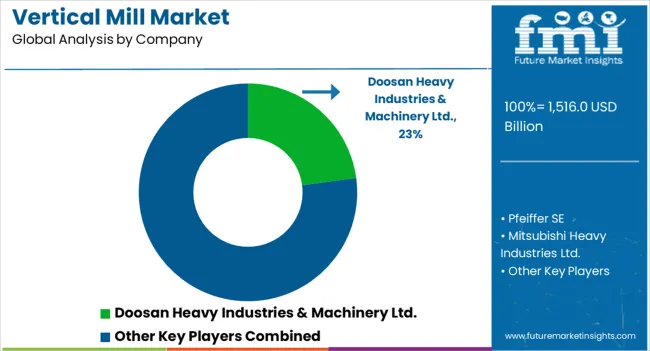

The vertical mill market is highly competitive, with a mix of established global players and specialized manufacturers offering advanced, high-performance milling solutions for a variety of industries, including manufacturing, aerospace, automotive, and heavy machinery. Key players in this market include Doosan Heavy Industries & Machinery Ltd., Pfeiffer SE, Mitsubishi Heavy Industries Ltd., Yamazaki Mazak Corporation, CITIC Heavy Industries Co. Ltd., Lincoln Electric Holdings, Inc., Haas Automation, Inc., Hurco Companies, Inc., Okuma Corporation, Maschinenfabrik Berthold Hermle AG, FANUC Corporation, Dalian Machine Tool Group Corporation, AMADA Co., Ltd., and FLSmidth & Co. A/S, each offering unique solutions tailored to meet the evolving needs of the manufacturing sector.

Doosan Heavy Industries & Machinery Ltd. and Mitsubishi Heavy Industries Ltd. are key leaders in industrial vertical milling, known for their precision and reliability, offering large-scale solutions for high-demand applications. Yamazaki Mazak Corporation and Okuma Corporation are prominent for their advanced CNC technology, providing cutting-edge vertical mills with automation features for increased productivity and precision.

Pfeiffer SE and CITIC Heavy Industries Co. Ltd. stand out for offering robust vertical milling solutions suited for the cement, mining, and heavy industry sectors. Lincoln Electric Holdings, Inc., Haas Automation, Inc., and Hurco Companies, Inc. lead in providing more accessible, highly adaptable vertical mills for smaller operations, with a focus on user-friendly controls and versatility. Maschinenfabrik Berthold Hermle AG and FANUC Corporation are noted for high-end, precision-driven vertical mills with a focus on accuracy in industries like aerospace and automotive. Dalian Machine Tool Group Corporation, AMADA Co., Ltd., and FLSmidth & Co. A/S offer specialized solutions that cater to both small and large-scale production, with an emphasis on customizability and efficiency.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1516.0 billion |

| Projected Market Valuation (2035) | USD 2540.8 billion |

| Value-based CAGR (2025 to 2035) | 5.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India, Indonesia, South Korea |

| Key Segments Covered | Type, Material, Application, Sales Channel, Region |

| Key Companies Profiled | Doosan Heavy Industries & Machinery Ltd.; Pfeiffer SE; Mitsubishi Heavy Industries Ltd.; Yamazaki Mazak Corporation; CITIC Heavy Industries Co. Ltd.; Lincoln Electric Holdings, Inc.; Haas Automation, Inc.; Hurco Companies, Inc.; Okuma Corporation; Maschinenfabrik Berthold Hermle AG; FANUC Corporation; Dalian Machine Tool Group Corporation; AMADA Co., Ltd.; FLSmidth & Co. A/S. |

| Report Coverage | Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

The global vertical mill market is estimated to be valued at USD 1,516.0 billion in 2025.

The market size for the vertical mill market is projected to reach USD 2,540.8 billion by 2035.

The vertical mill market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in vertical mill market are bed milling, turret milling and mill drills.

In terms of material, plastic segment to command 54.2% share in the vertical mill market in 2025.

x

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Millet Starch Market Size and Share Forecast Outlook 2025 to 2035

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Vertical Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Vertical Software Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Millet Market Size and Share Forecast Outlook 2025 to 2035

Vertical Form Fill Seal VFFS Machine Market Size and Share Forecast Outlook 2025 to 2035

Mill Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Mill Mixer Market Size and Share Forecast Outlook 2025 to 2035

Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Vertical Market Software Market Insights - Growth & Forecast 2025 to 2035

Vertical-Cavity Surface-Emitting Lasers (VCSEL) Market Growth - Trends & Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Milling Machine Market Growth – Trends & Forecast 2025 to 2035

Vertical Mast Lifts Market Analysis & Forecast by Product Type, Working Height, Capacity, End-user Industry, and Region Through 2035

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Millimeter Wave Sensors Market by Devices, Frequency Band, Application & Region Forecast till 2025 to 2035

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Vertical Platform Lift Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA