The Vertical Turbine Pump Market is estimated to be valued at USD 27.5 billion in 2025 and is projected to reach USD 43.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The Vertical Turbine Pump market is experiencing strong expansion as industries increasingly prioritize efficient water handling and pumping solutions across municipal, industrial, and agricultural applications. The market growth is being shaped by the rising demand for reliable pumping systems that can operate efficiently under varying conditions, including deep well and high-capacity water supply projects. Advancements in pump engineering and materials are enhancing durability and performance, thereby supporting long-term operational efficiency.

Additionally, heightened investments in irrigation infrastructure, desalination plants, and municipal water treatment facilities are providing consistent growth opportunities. Energy efficiency standards and sustainability initiatives are further driving the adoption of vertical turbine pumps, as they offer reduced operational costs and adaptability to renewable power systems.

As global water demand continues to rise due to population growth and urbanization, vertical turbine pumps are positioned as essential components in critical water management systems This strong combination of technological innovation, sustainability imperatives, and infrastructure investment is expected to sustain future market growth across multiple end-use sectors.

| Metric | Value |

|---|---|

| Vertical Turbine Pump Market Estimated Value in (2025 E) | USD 27.5 billion |

| Vertical Turbine Pump Market Forecast Value in (2035 F) | USD 43.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

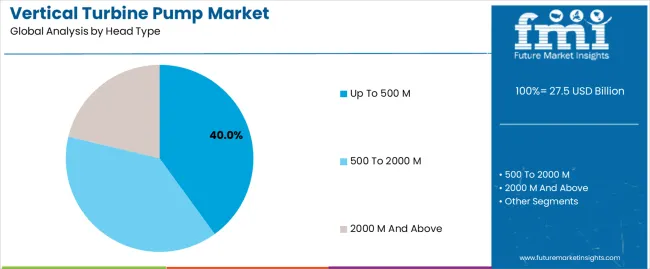

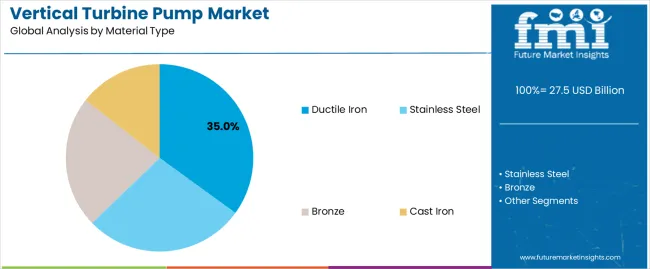

The market is segmented by Head Type, Material Type, Stage, Power Rating, and End-Use Industry and region. By Head Type, the market is divided into Up To 500 M, 500 To 2000 M, and 2000 M And Above. In terms of Material Type, the market is classified into Ductile Iron, Stainless Steel, Bronze, and Cast Iron. Based on Stage, the market is segmented into Single-Stage and Multi-Stage. By Power Rating, the market is divided into Low Power (Up To 1500 HP), Medium Power (1500 To 4000 HP), and High Power (4000 HP And Above). By End-Use Industry, the market is segmented into Residential, Commercial, Agriculture, Firefighting, Municipal, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The up to 500 M head type segment is projected to hold 40.00% of the vertical turbine pump market revenue share in 2025, making it the leading head type category. This dominance has been driven by its ability to meet the performance requirements of large-scale water distribution and industrial operations where medium to high head pumping capacity is essential.

The segment has grown significantly as municipal water utilities and industrial facilities increasingly depend on these pumps for reliable performance across variable operating conditions. Their versatility in handling clean water and light slurries, combined with advancements in pump software that allow precise control, has reinforced adoption.

Additionally, growing irrigation activities and the need for cost-effective pumping solutions in agriculture have further strengthened demand The balance between energy efficiency and output capacity positions this head type as the most practical option for long-term usage in both public and private water infrastructure, ensuring its sustained market leadership.

The ductile iron material type segment is expected to capture 35.00% of the vertical turbine pump market revenue share in 2025, positioning it as the leading material type. This growth has been influenced by the superior durability, corrosion resistance, and cost-effectiveness of ductile iron compared to other materials. Its ability to withstand high pressure and abrasive environments has made it highly suitable for industries such as power generation, mining, and municipal water supply.

The material’s structural strength provides extended operational life, reducing the need for frequent maintenance and replacements, thereby improving lifecycle cost efficiency. The segment has further benefited from the increasing demand for resilient materials that can sustain heavy-duty applications without compromising performance.

Growing infrastructure investments, particularly in water and wastewater treatment facilities, have amplified the use of ductile iron pumps This material’s widespread availability, proven reliability, and ability to balance performance with cost-efficiency continue to underpin its dominance in the vertical turbine pump market.

The single-stage segment is anticipated to account for 55.00% of the vertical turbine pump market revenue in 2025, making it the most dominant stage type. This segment’s growth has been supported by its design simplicity, lower initial cost, and ease of maintenance, which make it highly attractive to a wide range of end-users. The single-stage design is particularly suitable for applications where moderate head and flow rates are required, such as municipal water supply, irrigation, and certain industrial processes.

Its efficiency and reliability in transferring water over shorter distances with minimal operational complexity have contributed to its leading market share. The increased focus on reducing downtime and ensuring cost-effective operations has further driven the adoption of single-stage pumps.

Moreover, the versatility of single-stage vertical turbine pumps in adapting to both surface water and groundwater applications has reinforced their demand The combination of affordability, durability, and functional efficiency ensures the continued leadership of this segment within the vertical turbine pump market.

The table below projects a comparative assessment of the variation in the estimated CAGR for the vertical turbine pump industry over the semi-annual periods spanning from the base year (2025) to the current year (2025). The examination of the compound annual growth rate showcases the shifts in the performance of the market and reveals revenue realization patterns.

The examination assists organizations in gaining a better understanding of the industry and its growth trajectory over the years. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December. In the first half (H1) of 2025 to 2035, it witnessed a CAGR of 4.5%, followed by a slight rise in the growth rate during the second half (H2), where the CAGR was estimated to be 4.8%.

| Particular | Value CAGR |

|---|---|

| H1 | 4.5% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

| H1 | 4.9% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

Progressing to the ensuing period, from H1 2025 to H2 2035, the CAGR is anticipated to remain steady at 4.9% in the first half (H1) and then increase slightly to 5.1% in the second half. In the first half (H1), the industry witnessed a decrease of 40 BPS while in the second half (H2), it experienced a surge of 30 BPS.

Integration of 3D Printing and CNC Machining Technologies Bolster Demand

The adoption of mechanical and hydraulic simulation software, alongside advanced manufacturing technologies is significantly influencing the design and production of these turbine pumps. Manufacturers are leveraging 3D printing and CNC machining technologies to refine the internal geometry of pumps, resulting in enhanced operational characteristics and efficiency.

The trend underscores the industry’s commitment to precision engineering, where computational fluid dynamics and finite element analysis play an essential role in testing and optimizing pump designs. The seamless transition from CAD files to 3D printed models ensures the preservation of mechanical and hydraulic characteristics, resulting in highly effective pump performance.

Customization of Vertical Turbine Pumps for Industry-specific Needs is a Key Trend

Offering solutions that are tailored to a specific industry’s requirements is opening up new opportunities for companies. In the field of agriculture, where accurate and sufficient irrigation is crucial, key companies are providing customized pumps with versatile features that guarantee efficient water management.

They are finding solutions to resist harsh conditions, specifically for the oil and gas industry, where durable and dependable pumping is critical. For instance, Grundfos offers customizable pumps that cater to the unique requirements of municipal water treatment, where regulatory compliance and efficiency are crucial.

Taking advantage of significant opportunities is crucial in the ever-changing turbine pump industry. Customizing products to specific fields is proving to be revolutionary. Businesses that use this strategy are leading the charge for innovation, as they have to design certain components for different parameters based on the needs of different industries.

Water Management Challenges in Mining Industry Driving Vertical Turbine Pump Sales

Water management stands out as a key challenge in the mining industry. It plays a decisive role in propelling the demand for these turbine pumps.

As water enters mines through various sources, the risk of flooding looms large. The catastrophic consequences of pump failure, leading to mine inundation and subsequent operational shutdowns, underscore the crucial nature of effective dewatering systems.

The significance of these turbine pumps lies in their effectiveness in mitigating water-related challenges in mining operations. By facilitating efficient dewatering processes, these pumps contribute to maintaining safe and sustainable working environments underground.

The adoption of innovative approaches, such as using submersible pumps on floating platforms, further enhances the reliability and longevity of water management systems in mines. These factors ultimately drive sales of vertical turbine pumps.

Structural Vibration and Resonance Problems Impose Constraints on Growth

Structural vibration arises due to natural frequencies in the machine's operating range. These turbine pumps, characterized by high mass and low stiffness, are prone to resonant conditions, especially when subjected to vibratory forces during operation.

The utilization of variable speed drives further aggravates these issues. This is because adjusting the pump's rotating speed increases the likelihood of encountering natural frequencies, leading to resonant conditions.

Diagnosing and addressing these challenges requires sophisticated vibration analysis. This task is often daunting for maintenance professionals lacking specialized expertise. Correcting structural vibration and resonance issues in these turbine pumps demands a methodical approach. Beyond basic analysis, additional tests such as operating deflection shapes (ODS) and modal analysis become essential.

Maintenance Complexities due to Submersible Design to be a Key Restraint

The vertical turbine pump industry encounters a substantial restraint in the form of maintenance complexities. These restraints stem from the submersible design of these pumps.

The inherent challenges associated with submersible configurations contribute to increased downtime, operational disruptions, and high maintenance costs. All of these pose a notable impediment to growth.

The submersible design, while advantageous in certain applications, presents challenges during maintenance activities. Accessibility is a primary concern when the pump components are submerged, requiring specialized equipment and skilled personnel for inspection and repair.

The intricate nature of submersible systems demands meticulous planning and execution of maintenance procedures, contributing to extended downtimes that can adversely impact operational efficiency.

The global vertical turbine pump market grew at a CAGR of 3.6% between 2020 and 2025. Vertical turbine pump sales around the globe witnessed moderate growth between 2020 and 2025. The reason behind this was the rapid growth of end-use industries and infrastructure development projects worldwide. Industries, such as water and wastewater management, oil and gas, farming, and mining mainly relied on turbine pumps for their critical operations.

Several industries had an increasing requirement for these pumps, which contributed to the growth in overall sales. Increasing concerns about water shortage and the requirement for effective water management solutions also made turbine pumps a crucial product. These pumps were primarily used for water extraction and distribution, particularly in farmlands and urban areas facing water challenges.

The vertical turbine pump market analysis estimates the value to reach USD 27.5 billion in 2025. It is projected to rise at a CAGR of 5% during the forecast period and attain a value of USD 43.8 billion by 2035.

Over the forecast period, demand for these turbine pumps on a global scale is set to experience robust growth. Investments in infrastructure development activities and rising demand from various manufacturing facilities are anticipated to be key driving factors in bolstering sales of these pumps across the globe.

Improvements in pump designs and advancements in technology, including enhancements in efficiency, reliability, and smart features, are likely to make these pumps appealing to consumers.

Manufacturers are projected to focus on creating innovative pump designs. They are planning to deliver superior performance, reduce energy consumption, and promote remote monitoring capabilities to meet varying consumer requirements and strict norm compliance.

Rising population worldwide is likely to create a high need for vertical turbine pumps for city water supply, wastewater treatment, and buildings. Vertical turbine pumps are projected to become a leading choice due to their high capacity, effectiveness, and suitability for urban infrastructure use, thereby increasing sales.

Tier 1 companies comprise key leaders with a revenue of above USD 50 million. They capture a significant market share of 30% to 35% globally. These leaders are characterized by high production capacity and a wide product portfolio.

Companies in Tier 2 are distinguished by their expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. Renowned companies in Tier 1 include Trillium Flow Technologies, Peerless Pumps, Grundfos, Flowserve, Sulzer, Ruhrpumpen, Xylem, KBL, Taco Inc, Pentair, ITT INC., KSB SE & Co. KGaA, Ebara Corporation, The Weir Group PLC, Wilo, and Tsurumi Manufacturing Co., Ltd.

Tier 2 includes a large portion of medium-sized companies operating at the local level and serving niche industries. These companies are oriented toward fulfilling the demand from the local market and are hence classified under the Tier 2 segment.

Tier 3 consists of regionally based small-sized players. These enterprises have limited geographical reach. Tier 3, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below offers businesses an overview of the industry on a country-by-country basis. It comprises a detailed examination of the upcoming trends and opportunities. This country-specific examination of the dynamics is likely to assist businesses in understanding the complex environment of the sector.

The examination consists of key factors, potential challenges, and forecasts influencing the demand, production, and consumption of the product within each country. This section aims to assist organizations in making informed decisions and developing effective strategies customized to individual countries.

ASEAN is estimated to emerge as a dominating country during the forecast period with a projected CAGR of 7% through 2035. India, Japan, and China are anticipated to follow behind ASEAN to become significant countries with anticipated CAGRs of 6.8%, 6.4%, and 6.2%, respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| ASEAN | 7% |

| India | 6.8% |

| Japan | 6.4% |

| China | 6.2% |

| Brazil | 6% |

The United States vertical turbine pump industry is projected to reach a value of USD 43.8 billion by 2035. Increasing importance of water management in the country is a key driver propelling growth.

The government of the United States is focusing on addressing the global water crisis and enhancing water management through various initiatives, such as the 2035.5 to 2035 United States Global Water Strategy. These factors are set to propel the requirement for effective and reliable pumping solutions.

Vertical turbine pumps play a vital role in water infrastructure, particularly in managing water resources for agricultural, municipal, and industrial purposes. These pumps are ideal for situations where a reliable water supply is crucial.

They offer adaptability in handling different water levels. The growing focus on achieving water security, as outlined in the White House Action Plan on Global Water Security, further emphasizes the significance of strong pumping systems.

Aligning with the United States Agency for International Development’s (USAID) commitment to providing an additional 27.5 million individuals with access to clean drinking water and sanitation under the 2035.5 to 2035 Strategy, vertical turbine pumps are integral components of water supply projects in the country.

Their ability to lift water from deep wells lines up aptly with the goal of expanding access to safe drinking water, particularly in areas facing water scarcity or contamination challenges.

Sales of vertical turbine pumps in China are projected to soar at a CAGR of 6.2% during the assessment period. It is one of the dominating countries in agricultural production worldwide.

The country, therefore, faces the imperative of optimizing its water resource management to sustain the vast agriculture sector amid water scarcity and uneven distribution of water sources. In response to these challenges, China has implemented ambitious projects aimed at upgrading and modernizing its irrigation system.

Despite covering just a fifth of arable land, irrigated farms contribute to 40% of the nation's food production. China boasts the world's most prominent irrigated area, with more than half of its farmland benefiting from irrigation.

The practice supports the growth of 75% of food crops and 90% of economic crops in the country. This extensive irrigation, however, also accounts for a substantial portion of around 63% of China's total water usage.

The country has a pressing need for efficient irrigation systems and equipment like vertical turbine pumps to sustain agricultural productivity amid ongoing modernization efforts. This is attributed to the vital role of irrigation water in crop growth and yield, particularly in areas prone to water scarcity and extreme weather events.

Vertical turbine pumps have become essential components in this modernization effort due to their exceptional capabilities in efficiently lifting water from underground resources to provide irrigation benefits. With their ability to handle high flow rates and lift water across long distances, these are perfectly suited to meet the demands of China's diverse agriculture sector.

The vertical turbine pump market in India is expected to rise at a CAGR of 6.8% during the forecast period. The country’s massive agricultural lands have created a growing demand for robust lift irrigation.

The country is heavily investing in lift, drip, and micro-irrigation projects. The Government of India is also supporting this development through budget allocations and subsidies, further boosting the demand for vertical turbine pumps.

The country is undergoing rapid industrialization and infrastructure development. India is therefore witnessing a rising demand for pumps with high discharge. At the same time, increasing development of power generation and sewage treatment plants is likely to positively influence demand.

The section below provides organizations with insightful data and analysis of the two leading segments. Segmentation of these categories would help companies understand the dynamics and invest in the beneficial zones.

Examination of the growth of the segments enables businesses to gain a better understanding of the current trends, opportunities, and challenges. This analysis is likely to help companies navigate the complex business environment and make informed decisions.

In terms of head type, the 500 to 2000 m segment is estimated to dominate with a value CAGR of 5.3% from 2025 to 2035. Oil and gas is projected to emerge as the leading end-use category with a value CAGR of 4.6% in the same period.

| Segment | 500 to 2000 m (Head Type) |

|---|---|

| Value CAGR (2025 to 2035) | 5.3% |

The demand for vertical turbine pumps with heads ranging from 500 to 2000 m is estimated to rise in the forecast period at a CAGR of 5.3%. The segment is projected to hold a significant share of 54.7% in 2025.

The pumps with the aforementioned head type are set to be ideal for various applications, including supplying water to municipalities and facilitating industrial processes. These also offer the necessary head capacity required for efficient fluid transfer and distribution, thereby fueling sales.

| Segment | Oil and Gas (End-use Industry) |

|---|---|

| Value CAGR (2025 to 2035) | 4.6% |

In terms of the end-use industry, the oil and gas segment is projected to thrive at a CAGR of 4.6% during the forecast period. The United States along with a few Gulf countries are global leaders in oil production.

They often face unique challenges in refining crude oil, necessitating the importation of specific oil types. This highlights a crucial aspect that underlines the continued significance of vertical turbine pumps across the industry.

The oil and gas industry witnesses a paradigm shift as the United States extends its influence in the global LNG market. These turbine pumps have emerged as essential components in liquefied natural gas (LNG) processing, contributing to the increasing trend of LNG exports.

This diversification in the energy landscape underscores the versatility of these pumps, as their applications extend beyond traditional oil extraction to accommodate the evolving needs of the industry.

Key players in the global vertical turbine pump market are Trillium Flow Technologies, Peerless Pumps, Grundfos, Flowserve, Sulzer, Ruhrpumpen, Xylem, KBL, Taco Inc., Pentair, ITT INC., KSB SE & Co. KGaA, Ebara Corporation, The Weir Group PLC, Wilo, and Tsurumi Manufacturing Co., Ltd. The market is moderately consolidated, with leading players accounting for about 30% to 35% of the share.

Companies are acquiring small-scale firms to expand their product offerings, enter new areas, and strengthen their position in existing markets. Expanding into new industries or geographic locations can reduce dependence on specific industries and mitigate risks associated with economic fluctuations or regulatory changes.

For instance, Pleuger's acquisition of AVI International demonstrates a strategic move to bolster its presence in North America. By acquiring AVI, the former gains access to new industries, such as power generation, marine, wastewater treatment, and manufacturing, thereby enhancing its overall reach.

Manufacturers are investing in research and development activities to bring innovation to their in-house turbine pumps. They are progressively working toward integrating sustainable practices in their production process, which is making their products appealing to eco-conscious consumers.

A few companies are rapidly engaging in mergers and acquisitions to gain a strong foothold in the industry. They are exploring the potential of these pumps in niche end-use industries. Long-term success in the market relies on staying updated and adhering to regulations mandated by specific countries.

Industry Updates

Based on head type, the industry is divided into up to 500 m, 500 to 2000 m, and 2000 m and above.

By material type, the industry is segmented into ductile iron, stainless steel, bronze, and cast iron pumps.

Based on stage, the industry is divided into single-stage and multi-stage.

By power rating, the industry is segmented into low power (up to 1500 HP), medium power (1500 to 4000 HP), and high power (4000 HP and above).

A few leading end-use industries are residential, commercial, agriculture, firefighting, municipal, and industrial. The industrial segment is further segregated into chemicals, pharmaceuticals, oil and gas, power generation, cement, mining, and others.

The industry is spread across North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, and the Middle East and Africa.

The global vertical turbine pump market is estimated to be valued at USD 27.5 billion in 2025.

The market size for the vertical turbine pump market is projected to reach USD 43.8 billion by 2035.

The vertical turbine pump market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in vertical turbine pump market are up to 500 m, 500 to 2000 m and 2000 m and above.

In terms of material type, ductile iron segment to command 35.0% share in the vertical turbine pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Vertical Inline Pumps Market

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Regenerative Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vertical Immersion Pumps in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Vertical Immersion Pumps in Japan Size and Share Forecast Outlook 2025 to 2035

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Turbine Oils Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Vertical Software Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Turbine Blade Material Market Size and Share Forecast Outlook 2025 to 2035

Vertical Mill Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA