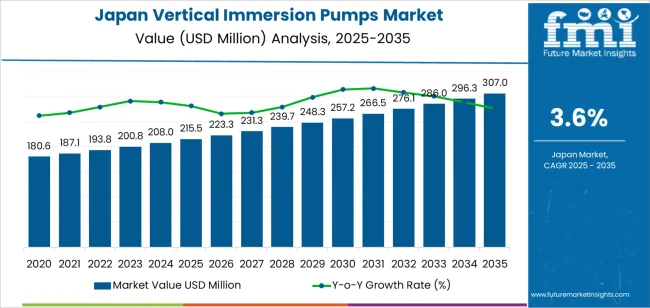

The Japan vertical immersion pumps demand is valued at USD 215.5 million in 2025 and is expected to reach USD 307.0 million by 2035, recording a CAGR of 3.6%. Demand is shaped by continued use of pumping systems in chemical processing, wastewater treatment, semiconductor fabrication, and metalworking applications. Vertical immersion pumps are selected for their ability to handle corrosive fluids, process slurries, and high-temperature liquids while maintaining stable performance in confined installation spaces. Growth is supported by replacement cycles, equipment modernisation, and increased attention to energy-efficient pumping operations.

Line shaft pumps represent the leading product type due to their suitability for deep-tank installations, high operating reliability, and compatibility with industrial fluid-handling requirements. These pumps provide stable axial alignment, efficient shaft transmission, and long service life in demanding environments. Their design supports continuous-duty operation across chemical, utility, and manufacturing facilities where maintenance access and structural rigidity are essential.

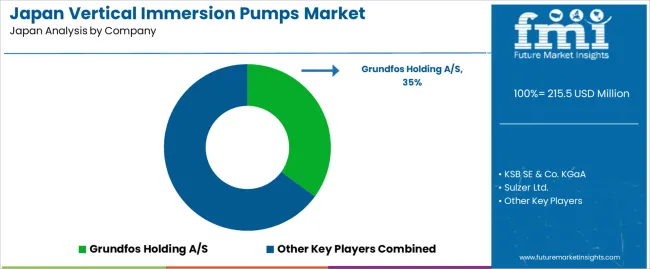

Demand is strongest in Kyushu & Okinawa, Kanto, and Kinki, where industrial clusters, coastal facilities, and electronics manufacturing hubs drive procurement volumes. Key suppliers include Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer Ltd., Flowserve Corporation, and ITT Inc., offering engineered vertical pump systems with corrosion-resistant materials and application-specific configurations.

The growth contribution index shows that chemical processing and precision manufacturing will supply the largest share of incremental expansion during the early period from 2025 to 2029. Demand will be driven by the need for corrosion-resistant pumps, stable coolant circulation, and reliable fluid handling across metalworking, plating, and surface-treatment operations. Facilities focused on semiconductor and electronics production will add further contribution due to strict purity and equipment-stability requirements.

Between 2030 and 2035, contributions will broaden as established plants enter replacement phases. Upgrades in materials, improved motor efficiency, and reduced-maintenance configurations will guide procurement. Steady use in wastewater handling, light industrial operations, and process-control environments will sustain predictable contributions. Regional growth will remain anchored in Japan’s established industrial zones, where continuous equipment reliability and lifecycle planning shape purchasing patterns. The overall contribution profile reflects a stable, engineering-focused segment in which expansion is driven by precision requirements, operational continuity, and steady adoption of durability-enhanced immersion pump designs.

| Metric | Value |

|---|---|

| Japan Vertical Immersion Pumps Sales Value (2025) | USD 215.5 million |

| Japan Vertical Immersion Pumps Forecast Value (2035) | USD 307.0 million |

| Japan Vertical Immersion Pumps Forecast CAGR (2025-2035) | 3.6% |

Demand for vertical immersion pumps in Japan is growing because industrial sectors such as wastewater treatment, chemical processing and manufacturing require efficient fluid-handling solutions for deep tanks and confined spaces. These pumps offer a design where the motor is located above the liquid and the impeller is immersed, which simplifies maintenance and supports safe operation in space constrained facilities. Retrofitting ageing infrastructure and improving energy efficiency motivate users to choose modern vertical immersion models.

The rise of small modular plants and decentralised industrial units also supports demand for compact and flexible pumping systems. Constraints include high initial cost compared with standard horizontal pumps, the need for space and structural modification for installation and potential downtime during equipment replacement. Some facilities may postpone adoption until larger upgrade projects justify investment.

Demand for vertical immersion pumps in Japan reflects requirements in agriculture, municipal supply, and industrial operations where stable flow, corrosion resistance, and compact installations are essential. Distribution across product type, pumping capacity, and application groups aligns with Japan’s infrastructure layout, water-resource constraints, and adoption of high-reliability pumping systems for long-duty cycles.

Line shaft pumps hold an estimated 57.0% share of Japanese demand and represent the leading product type. These pumps are used in deep-well installations, municipal water operations, and agricultural sites requiring consistent delivery and stable head performance. Their rigid shaft structure supports long vertical installations and ensures low vibration during extended operation.

Cantilever pumps represent 43.0%, supporting chemical plants, cooling systems, and industrial processes requiring corrosion-resistant designs and reduced maintenance demands. Product-type distribution reflects differences in installation depth, water-quality characteristics, and operational duration across rural and industrial environments.

Key drivers and attributes:

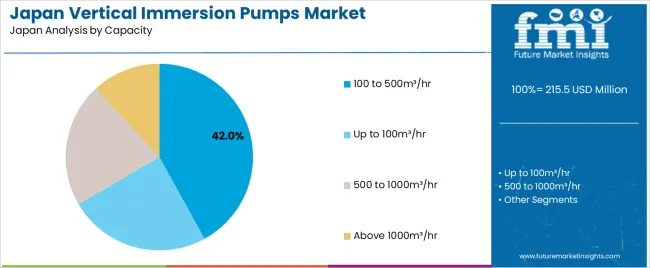

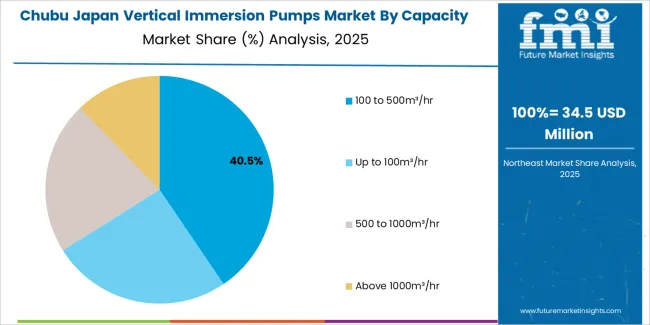

The 100–500 m³/hr segment holds an estimated 42.0% share and is the largest capacity category in Japan. This range aligns with the flow requirements of municipal pumping stations, mid-scale irrigation systems, and industrial cooling operations. Pumps within this range balance efficiency and throughput, making them suitable for diverse site conditions.

Units with up to 100 m³/hr account for 26.0%, supporting small agricultural plots, localized potable-water systems, and dewatering tasks. The 500–1000 m³/hr category holds 21.0%, serving high-output industrial or municipal operations. Capacities above 1000 m³/hr represent 11.0%, primarily used in geothermal applications and large pumping infrastructure.

Key drivers and attributes:

Irrigation represents an estimated 33.0% of Japanese demand, making it the leading application. Vertical immersion pumps support paddy-field irrigation, greenhouse watering, and regional agricultural networks requiring consistent output. Potable-water supply accounts for 27.0%, supporting municipal wells and regional water systems.

Water-cooling applications hold 19.0%, driven by industrial and energy-sector operations requiring reliable thermal-control systems. Dewatering represents 13.0%, covering construction and emergency water-removal activities. Geothermal wells hold 8.0%, where pumps support extraction and reinjection processes in Japan’s geothermal sites.

Key drivers and attributes:

Industrial and infrastructure upgrades, stricter fluid-handling standards, and expansion of chemical/process sectors are driving demand.

In Japan, demand for vertical immersion pumps is increasing as chemical, petrochemical, water-treatment and semiconductor manufacturing sectors require reliable fluid-transfer systems with high purity, corrosion resistance and compact installation. Facility upgrades in response to tighter environmental regulations and efficiency targets lead to replacement of older pumps with vertical immersion models offering better performance. Japan’s focus on refined manufacturing and precision processing further supports adoption of vertical immersion pumps that handle aggressive liquids and optimise factory footprints.

High capital cost, long equipment lifecycles, and limited new large-scale plant builds restrain growth.

Vertical immersion pumps involve specialised materials, engineering complexity and installation overhead, which raises upfront cost and may delay investment by cost-sensitive users. Many Japanese industrial plants operate existing pump installations for extended periods due to reliability and maintenance practices, reducing replacement cycles. Slower pace of new large-scale plant construction and major expansion in some downstream sectors limits incremental installations, which moderates’ industry growth.

Demand for high-efficiency and compact pump solutions, growing adoption in semiconductor and water-reuse applications, and increasing use of remote monitoring/IoT features define future trends.

Manufacturers are developing vertical immersion pumps that feature energy-efficient drives, reduced footprint designs suited for tight Japanese production spaces, and improved corrosion-resistant materials for harsh processing environments. Adoption is rising in sectors such as semiconductor manufacturing and advanced water-reuse systems, where fluid purity and space constraints are critical. Remote monitoring, IoT-enabled performance tracking and predictive maintenance solutions are being integrated into pump systems, which strengthens value-propositions for Japanese users seeking reduced downtime and lifecycle cost.

Demand for vertical immersion pumps in Japan is increasing through 2035 as industrial facilities, metalworking operations, and chemical-processing plants adopt reliable fluid-handling systems for corrosive, abrasive, and high-temperature liquids. Vertical immersion pumps support sump applications, coolant circulation, plating solutions, chemical transfer, and wastewater management across diverse industrial zones.

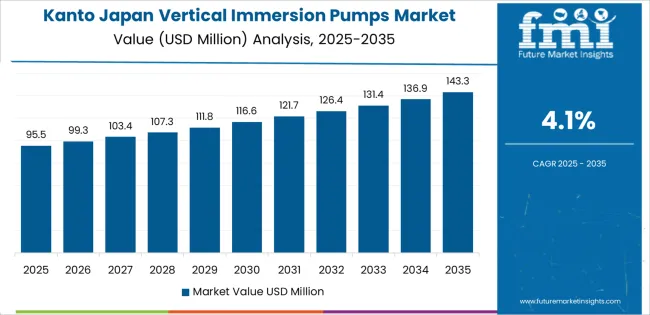

Growth varies by region based on manufacturing density, process-industry presence, equipment-replacement cycles, and investment in plant-modernization programs. Kyushu & Okinawa leads with a 4.5% CAGR, followed by Kanto (4.1%), Kinki (3.6%), Chubu (3.2%), Tohoku (2.8%), and the Rest of Japan (2.7%). Steady industrial activity and ongoing maintenance cycles sustain long-term demand for durable and corrosion-resistant pump systems.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.5% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.2% |

| Tohoku | 2.8% |

| Rest of Japan | 2.7% |

Kyushu & Okinawa grows at 4.5% CAGR, supported by strong industrial activity, stable chemical-processing operations, and steady use of immersion pumps across plating, machining, and wastewater-treatment applications. Prefectures such as Fukuoka, Kumamoto, and Oita maintain diversified manufacturing clusters that depend on immersion pumps for coolant circulation, abrasive-fluid handling, and chemical sump operations.

Electronics and component-fabrication facilities adopt corrosion-resistant immersion-pump designs to support precision-processing workflows. Municipal wastewater stations deploy vertical immersion pumps in sedimentation pits and corrosive-fluid channels. Industrial parks across Kyushu drive recurring demand due to maintenance cycles and equipment-replacement needs in process operations.

Kanto grows at 4.1% CAGR, supported by dense industrial corridors, strong metal-processing activity, and high fluid-handling requirements across Tokyo, Kanagawa, and Chiba. Manufacturing facilities adopt vertical immersion pumps for coolant-management systems, chemical baths, and abrasive-fluid circulation in machining units.

Chemical-processing plants rely on corrosion-resistant pump models for controlled transfer and sump operations. Wastewater-treatment facilities across the region use immersion pumps for sludge movement and neutralization processes. High industrial throughput, especially in precision manufacturing and electronics, reinforces continuous pump procurement.

Kinki grows at 3.6% CAGR, supported by diversified manufacturing in Osaka, Kyoto, and Hyogo. Machining and fabrication plants rely on vertical immersion pumps for coolant circulation, metal-cutting fluids, and abrasive-material handling.

Chemical-processing facilities use corrosion-resistant pumps for sump operations and controlled fluid transfer. Water-treatment plants adopt immersion pumps for sub-surface circulation in industrial wastewater streams. Demand remains consistent across established industrial districts, with pump replacement cycles driven by wear and process-intensive operations.

Chubu grows at 3.2% CAGR, supported by strong automotive, machinery, and materials-manufacturing activity across Aichi, Shizuoka, and Mie. Vertical immersion pumps support machining lines, plating baths, coolant systems, and abrasive-fluid circulation in high-volume manufacturing environments.

Chemical-processing plants use immersion pumps to manage corrosive fluids and maintain stable sump-transfer operations. Water-treatment facilities rely on immersion pumps for continuous circulation in industrial effluent systems. While growth is moderate due to mature industrial infrastructure, recurring maintenance needs ensure steady pump consumption.

Tohoku grows at 2.8% CAGR, supported by regional manufacturing, food-processing operations, and municipal wastewater networks across Miyagi, Fukushima, and Iwate. Vertical immersion pumps assist in handling wash-water, process liquids, and abrasive slurries in industrial plants.

Chemical and materials-processing facilities adopt corrosion-resistant pumps for sump and transfer operations. Wastewater plants use immersion pumps for sediment movement and continuous-duty circulation. Industrial density is lower than southern regions, but stable municipal and industrial needs sustain consistent pump adoption.

The Rest of Japan grows at 2.7% CAGR, supported by distributed manufacturing activity, small-scale plating and machining operations, and municipal wastewater systems across rural prefectures. Vertical immersion pumps are used for handling coolant, wash-water, and abrasive fluids in small industrial workshops. Local chemical and materials facilities adopt immersion pumps for sump-transfer tasks. Municipal wastewater sites deploy the pumps for sludge movement and sedimentation-pit circulation. Growth remains modest due to smaller industrial clusters, yet routine maintenance and operational needs maintain steady demand.

Demand for vertical immersion pumps in Japan is shaped by a concentrated group of international pump manufacturers serving chemical plants, metal-finishing operations, machining centres, and industrial fluid-handling systems. Grundfos Holding A/S holds the leading position with an estimated 35.0% share, supported by corrosion-resistant designs, controlled hydraulic performance, and consistent supply to Japanese industrial OEMs. Its position is reinforced by energy-efficient motor configurations and long-term reliability in continuous-duty service.

KSB SE & Co. KGaA and Sulzer Ltd. follow as significant participants, offering immersion pumps designed for aggressive fluids, abrasive slurries, and high-temperature conditions. Their strengths include stable NPSH characteristics, durable wetted materials, and engineering support suited to chemical-processing and plating operations. Flowserve Corporation maintains a notable presence through engineered vertical assemblies used in refineries, petrochemical facilities, and high-demand industrial applications where dimensional accuracy and shaft stability are critical.

ITT Inc. contributes additional capability with immersion pumps widely used in machine-tool coolant systems and general industrial circulation, emphasizing reliable sealing arrangements and modular installation options. Competition across this segment centers on material compatibility, hydraulic stability, corrosion resistance, operating efficiency, and long-term mechanical resilience. Demand continues to be supported by Japan’s advanced manufacturing base, greater focus on coolant recycling in machining operations, and preference for compact, low-leakage immersion designs that ensure dependable fluid handling in open-tank and semi-submerged configurations.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Line Shaft Pump, Cantilever Pump |

| Capacity | Up to 100m³/hr, 100 to 500m³/hr, 500 to 1000m³/hr, Above 1000m³/hr |

| Application | Irrigation, Potable Water Supply, Water Cooling, Dewatering, Geothermal Well |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer Ltd., Flowserve Corporation, ITT Inc. |

| Additional Attributes | Dollar sales by product type, capacity, and application categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of vertical immersion and deep-well pump manufacturers; advancements in corrosion-resistant shafts, high-efficiency pump design, and geothermal compatibility; integration with agricultural irrigation, municipal water infrastructure, industrial cooling, and groundwater extraction in Japan. |

The global demand for vertical immersion pumps in japan is estimated to be valued at USD 215.5 million in 2025.

The market size for the demand for vertical immersion pumps in japan is projected to reach USD 307.0 million by 2035.

The demand for vertical immersion pumps in japan is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in demand for vertical immersion pumps in japan are line shaft pump and cantilever pump.

In terms of capacity, 100 to 500m³/hr segment to command 42.0% share in the demand for vertical immersion pumps in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA