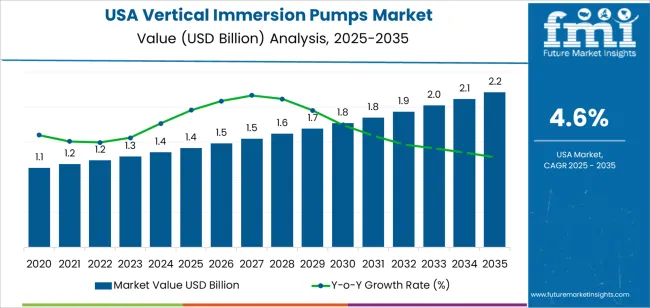

The USA vertical immersion pumps demand is valued at USD 1.4 billion in 2025 and is expected to reach USD 2.2 billion by 2035, recording a CAGR of 4.6%. Demand is supported by steady activity in water supply networks, industrial fluid handling, and wastewater management across municipal, commercial, and heavy-industry operations. Vertical immersion pumps are used for transferring liquids from tanks, pits, and sumps, providing reliable performance in corrosive, abrasive, and high-temperature environments. Their compact footprint and direct-mount design continue to support adoption in space-constrained installations.

Line shaft pumps represent the leading product type due to their ability to operate at extended depths, their mechanical efficiency, and suitability for high-capacity and continuous-duty applications. These pumps are widely used in deep-well extraction, cooling-water circulation, and industrial process flow. Improvements in shaft alignment systems, corrosion-resistant alloys, and hydraulic efficiency are strengthening durability and reducing long-term maintenance requirements.

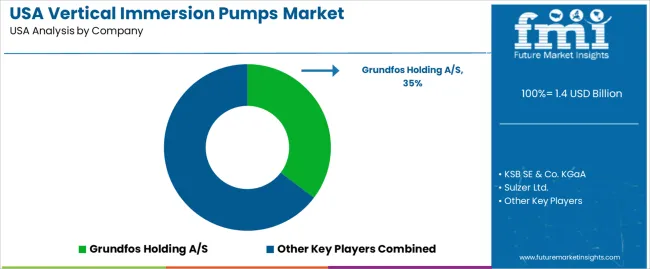

Demand is strongest in the West, South, and Northeast, where industrial clusters, irrigation activity, and municipal water infrastructure drive equipment upgrades and replacement cycles. Key suppliers include Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer Ltd., Flowserve Corporation, and ITT Inc., focusing on mechanical reliability, application-specific engineering, and improved energy performance across immersion pump designs.

The 10-year growth comparison shows steady expansion supported by chemical processing, metalworking, wastewater handling, and coolant-circulation applications. Between 2025 and 2030, growth will be stronger as industrial facilities upgrade fluid-handling systems to improve corrosion resistance, energy efficiency, and operational reliability. Increased deployment in machining centres and surface-treatment lines will reinforce early gains, alongside ongoing investments in plant modernisation.

From 2030 to 2035, growth will continue but at a more measured pace as procurement gradually shifts from expansion activity to lifecycle-based replacement. Facilities will prioritise reliability upgrades, seal-less configurations, and improved materials suited for abrasive or corrosive fluids. Adoption of digital monitoring tools and variable-speed control will support consistent demand without creating sharp acceleration. The decade-long comparison indicates an industry moving from early equipment-upgrade cycles to a mature phase shaped by operational continuity, equipment longevity, and incremental improvements within USA industrial fluid-handling environments.

| Metric | Value |

|---|---|

| USA Vertical Immersion Pumps Sales Value (2025) | USD 1.4 billion |

| USA Vertical Immersion Pumps Forecast Value (2035) | USD 2.2 billion |

| USA Vertical Immersion Pumps Forecast CAGR (2025 to 2035) | 4.6% |

Demand for vertical immersion pumps in the USA is rising as industries require fluid-handling solutions for deep tanks, sumps and pit applications where conventional pumps are inefficient or unsuitable. These pumps mount the motor above the liquid whilst the shaft and impeller operate submerged which simplifies installation and maintenance in facilities such as wastewater treatment plants, chemical processing units and power-generation stations.

The trend toward industrial modernisation and stricter environmental regulations increases adoption of vertical immersion systems for reliability and space-efficient design. Replacement cycles for ageing infrastructure and the push for energy-efficient equipment support investment. Constraints include comparatively high equipment and installation cost, complexity of system engineering for custom applications and the need for skilled technicians to maintain equipment operating in submerged or harsh environments. Some users may delay upgrades until lifecycle savings or regulatory drivers fully justify the expense.

Demand for vertical immersion pumps in the United States is shaped by installation depth, fluid-handling requirements, and operational conditions across irrigation, industrial, and municipal systems. Distribution across product type, capacity range, and application reflects the need for corrosion-resistant designs, stable flow output, and reliability in continuous or intermittent pumping tasks.

Line shaft pumps hold an estimated 58.0% share of USA demand and represent the leading product category. Their structure supports deep-well installation, stable operation, and consistent fluid movement across irrigation, water-supply, and industrial settings. These pumps achieve high power transmission efficiency along extended shaft lengths, making them suitable for large farms, municipal pumping stations, and geothermal operations. Cantilever pumps account for 42.0%, serving applications requiring shortened installation depth, easier maintenance, and corrosion-resistant performance in chemical, cooling-water, and dewatering systems. Product-type distribution reflects variations in installation depth, pump accessibility, and the need for continuous or intermittent operation across sectors.

Key drivers and attributes:

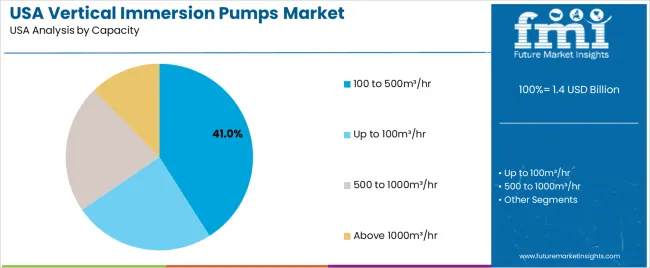

The 100-500 m³/hr capacity range holds an estimated 41.0% share and represents the largest segment. This range aligns with the flow demands of agricultural irrigation networks, industrial cooling systems, and municipal water-supply operations. Pumps in this category offer a balance between energy efficiency, output stability, and installation flexibility. Units with up to 100 m³/hr hold 27.0%, supporting smaller irrigation systems, dewatering tasks, and localized potable-water movement. The 500-1000 m³/hr range accounts for 20.0%, used in higher-volume municipal and industrial operations. Capacities above 1000 m³/hr represent 12.0%, serving large pumping stations, geothermal wells, and heavy industrial applications.

Key drivers and attributes:

Irrigation represents an estimated 34.0% share of USA demand for vertical immersion pumps. Farms, orchards, and large-area cultivation rely on stable water delivery for drip, flood, and sprinkler systems. Potable-water supply accounts for 26.0%, supporting municipal wells and rural water systems requiring consistent delivery and reliable long-term operation. Water-cooling systems represent 18.0%, serving industrial plants, power facilities, and manufacturing sites requiring temperature-controlled processes. Dewatering holds 14.0%, covering construction, mining, and emergency drainage tasks. Geothermal wells represent 8.0%, using immersion pumps for hot-water extraction and reinjection in renewable-energy applications.

Key drivers and attributes:

In the USA, demand for control systems in turbomachinery such as gas turbines, compressors, and generators is rising due to operators seeking higher efficiency, reduced downtime, and improved integration with enterprise systems. The energy sector in power generation, oil & gas midstream, and LNG is installing advanced control platforms to manage variable loading and optimise turbine or compressor performance. Manufacturing and petrochemical plants are upgrading legacy controls to meet tighter emissions standards and reliability requirements. The drive toward digitalisation, asset-performance monitoring, and predictive maintenance expands the role of modern turbomachinery control systems.

Many turbomachinery units in the USA operate for decades so replacement of control systems may be deferred in absence of major failures. Upgrading control systems involves significant capital expenditure for hardware, software, integration and commissioning. Rapid changes in turbine designs, fuel mixes, and hybrid power architectures may make existing controls less optimal, yet operators may delay investment until clear business cases emerge. In some industries, uncertainty about future energy transition path or regulation weakens immediate willingness to invest in new systems.

Suppliers are offering control system architectures designed for retrofit installation with minimal downtime and interface to legacy equipment. Increasing usage of digital twin models and remote condition-monitoring supports advanced diagnostics, performance benchmarking and reduced maintenance overhead. Flexible generation assets (e.g., gas turbines supporting renewables) require control systems capable of frequent cycling and rapid ramping, which drives demand for advanced control features. These trends support broader growth of turbomachinery control systems across US utilities, industrial end-users and infrastructure upgrade programmes.

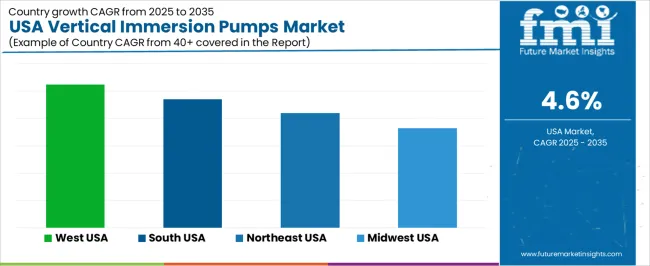

Demand for vertical immersion pumps in the United States is increasing through 2035, supported by industrial fluid-handling requirements, expanded use in metalworking and machining systems, and consistent adoption across chemical processing, wastewater operations, and cooling-fluid circulation. These pumps provide stable vertical mounting, high reliability in continuous-duty environments, and efficient handling of corrosive, abrasive, or high-temperature liquids. Growth reflects regional variations in industrial density, manufacturing activity, and investment in process-equipment modernization. The West leads with a 5.2% CAGR, followed by the South (4.7%), the Northeast (4.2%), and the Midwest (3.6%). Demand is reinforced by process-optimization initiatives, equipment replacement cycles, and broader implementation of automated fluid-management systems.

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.2% |

| South | 4.7% |

| Northeast | 4.2% |

| Midwest | 3.6% |

The West grows at 5.2% CAGR, supported by diversified industrial activity, strong adoption of process-fluid systems in semiconductor manufacturing, and consistent use of pumps in metal finishing, chemical processing, and water-treatment facilities. States such as California, Washington, and Oregon maintain steady demand for corrosion-resistant immersion pumps used in plating lines, cooling circuits, and chemical-transfer operations. Semiconductor plants rely on immersion pumps for etching, rinsing, and chemical-recycling loops requiring high operational reliability. Water-treatment operators in the region adopt vertical immersion pumps for sump applications and abrasive-fluid handling. Environmental compliance requirements and equipment-modernization cycles reinforce recurring procurement.

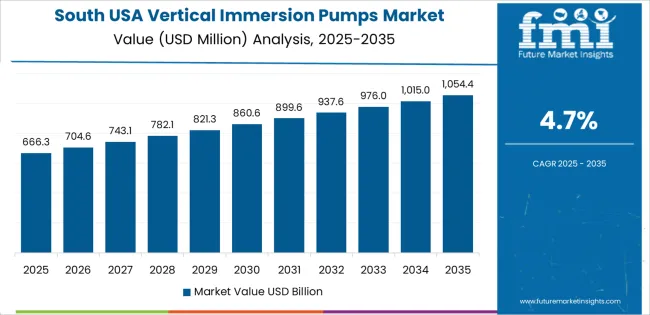

The South grows at 4.7% CAGR, supported by strong petrochemical activity, large-scale manufacturing operations, and widespread use of immersion pumps in cooling, transfer, and process-fluid systems. States including Texas, Louisiana, Georgia, and Alabama depend on vertical immersion pumps for chemical-handling tasks, including corrosive liquids and abrasive mixtures. Automotive and machinery plants use these pumps for coolant circulation, cutting-fluid management, and sump applications. Industrial facilities tied to oil and gas processing deploy immersion pumps for transfer operations in demanding environments. Expansion of manufacturing corridors, combined with upgrades in industrial wastewater systems, continues to support steady consumption across the region.

The Northeast grows at 4.2% CAGR, supported by established pharmaceutical, chemical, and specialty-manufacturing sectors that rely on immersion pumps for controlled fluid handling. States including New York, New Jersey, and Pennsylvania adopt corrosion-resistant pumps for precision chemical-transfer systems, metal-finishing lines, and industrial wastewater streams. Research institutions and process laboratories use compact immersion pumps for pilot-scale operations. Manufacturing facilities require reliable pumps for cooling circuits, cleaning processes, and fluid-recovery loops. Although industrial density is lower than in the South, steady replacement cycles and equipment upgrades maintain consistent regional demand.

The Midwest grows at 3.6% CAGR, supported by long-standing manufacturing activity, metalworking operations, and use of immersion pumps in machining, coolant circulation, and sump applications. States such as Illinois, Michigan, Ohio, and Wisconsin maintain significant machinery, fabrication, and heavy-equipment industries that use immersion pumps for handling cutting fluids, lubricants, and particulate-laden liquids. Industrial wastewater facilities adopt immersion pumps for continuous-duty sump operations. Replacement cycles remain steady due to wear-and-tear from abrasive fluids common in metalworking environments. Growth is moderate because much of the regional infrastructure is mature, yet machining-intensive industries provide reliable year-round demand.

Demand for vertical immersion pumps in the USA is shaped by a concentrated group of international pump manufacturers that supply equipment for chemical processing, metalworking fluids, surface-treatment tanks, wastewater handling, and industrial coolant circulation. Grundfos Holding A/S holds the leading position with an estimated 35.3% share, supported by its established portfolio of corrosion-resistant immersion pumps, controlled manufacturing standards, and longstanding relationships with industrial OEMs. Its position is reinforced by stable hydraulic performance, energy-efficient motors, and reliable operation in continuous-duty environments.

KSB SE & Co. KGaA and Sulzer Ltd. follow as significant participants, offering vertical designs tailored to aggressive liquids, abrasive slurries, and high-temperature service conditions. Their strengths include robust material options, consistent NPSH performance, and strong engineering support for chemical plants, refineries, and metal-finishing operations. Flowserve Corporation maintains a notable presence through engineered solutions for demanding process applications, emphasizing dimensional accuracy, shaft stability, and proven reliability in harsh industrial conditions.

ITT Inc. contributes additional capability with immersion pumps used across machine tooling, filtration systems, and general industrial fluid handling. Its competitiveness is supported by durable wetted components, dependable seal arrangements, and integration with modular process systems. Competition across this segment centers on material compatibility, hydraulic stability, corrosion resistance, energy performance, and long-term operating reliability. Demand is sustained by ongoing investment in manufacturing, increased focus on coolant recycling, and broader use of vertical designs that support compact installations, reduced leakage pathways, and dependable fluid transfer in open-tank and semi-submerged configurations across USA industrial operations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Line Shaft Pump, Cantilever Pump |

| Capacity | Up to 100m³/hr, 100 to 500m³/hr, 500 to 1000m³/hr, Above 1000m³/hr |

| Application | Irrigation, Potable Water Supply, Water Cooling, Dewatering, Geothermal Well |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Grundfos Holding A/S, KSB SE & Co. KGaA, Sulzer Ltd., Flowserve Corporation, ITT Inc. |

| Additional Attributes | Dollar sales by product type, capacity range, and application categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of vertical immersion and deep-well pump manufacturers; advancements in corrosion-resistant materials, high-efficiency pump shafts, and vertical turbine designs; integration with irrigation systems, municipal water supply, industrial cooling, and geothermal extraction in the USA. |

The global demand for vertical immersion pumps in USA is estimated to be valued at USD 1.4 billion in 2025.

The market size for the demand for vertical immersion pumps in USA is projected to reach USD 2.2 billion by 2035.

The demand for vertical immersion pumps in USA is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in demand for vertical immersion pumps in USA are line shaft pump and cantilever pump.

In terms of capacity, 100 to 500m³/hr segment to command 41.0% share in the demand for vertical immersion pumps in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vertical Immersion Pumps Market Growth – Trends & Forecast 2025-2035

Demand for Vertical Immersion Pumps in Japan Size and Share Forecast Outlook 2025 to 2035

USA Sea Water Pumps Market Trends – Growth, Demand & Forecast 2025-2035

USA Centrifugal Pumps Market Insights – Size, Trends & Forecast 2025-2035

Vertical Inline Pumps Market

Demand for Vertical Furnace Tube Cleaning Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Patient-Controlled Analgesia Pumps in USA Size and Share Forecast Outlook 2025 to 2035

Vertical Induction Hardening System Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Vertical Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Vertical Software Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Immersion Cooling Fluids Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA