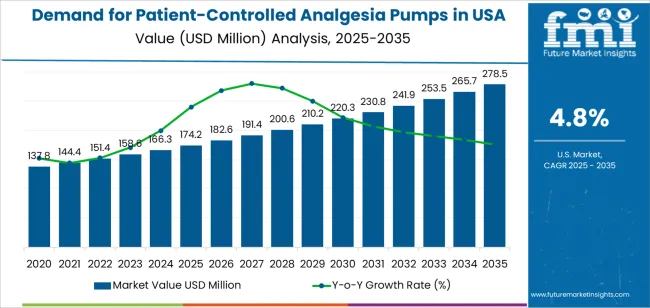

The demand for patient-controlled analgesia (PCA) pumps in the USA is projected to reach USD 279.7 million by 2035, reflecting an absolute increase of USD 105.5 million over the forecast period. The demand, valued at USD 174.2 million in 2025, is expected to grow at a CAGR of 4.8%. This growth is primarily driven by the increasing prevalence of chronic pain, surgical procedures, and the growing demand for more personalized pain management solutions in both hospital and home care settings.

PCA pumps are devices that allow patients to self-administer controlled doses of pain medication, usually through an intravenous route. They are particularly useful for managing post-operative pain, chronic pain conditions, and cancer-related pain. With the growing focus on enhancing patient comfort and providing better control over pain management, the adoption of PCA pumps is expected to increase. Additionally, technological advancements in PCA pump systems, such as wireless connectivity, improved safety features, and ease of use, will further contribute to the rising demand for these devices.

The demand for PCA pumps is also supported by the increasing aging population, which experiences a higher incidence of conditions requiring pain management. As more healthcare settings adopt PCA pumps for both acute and chronic pain management, the overall demand for these devices will continue to rise.

The absolute dollar opportunity for PCA pumps in the USA between 2025 and 2035 is expected to be USD 105.5 million, with the industry growing from USD 174.2 million in 2025 to USD 279.7 million in 2035. Between 2025 and 2030, the demand will grow from USD 174.2 million to USD 182.7 million, adding USD 8.5 million. This growth represents a relatively moderate expansion as healthcare providers continue to recognize the benefits of PCA pumps for post-operative pain management and chronic pain relief.

From 2030 to 2035, the demand will grow from USD 182.7 million to USD 279.7 million, adding USD 97.0 million. This acceleration will be driven by the increasing recognition of the importance of patient-centered care and the shift toward more personalized and effective pain management systems. As healthcare facilities look for solutions that enhance patient satisfaction and outcomes, PCA pumps will become a critical part of pain management regimens.

| Metric | Value |

|---|---|

| USA Patient Controlled Analgesia Pumps Sales Value (2025) | USD 174.2 million |

| USA Patient Controlled Analgesia Pumps Forecast Value (2035) | USD 279.7 million |

| USA Patient Controlled Analgesia Pumps Forecast CAGR (2025 to 2035) | 4.80% |

The demand for patient‑controlled analgesia (PCA) pumps in the USA is rising because these devices allow patients to self‑administer pain medication within safe limits, enhancing comfort and autonomy during recovery. PCA pumps are commonly used following surgeries, during cancer treatment, and for chronic pain management, providing better pain control and reducing dependence on nurse‑administered dosages.

A key driver is the growth in surgical volumes, outpatient procedures, and an aging population that experiences higher incidence of pain‑related conditions. As healthcare systems prioritize improved recovery protocols and shorter hospital stays, PCA pumps are becoming integral to post‑operative care plans. The increasing emphasis on patient‑centred treatments and tolerance to pain coupled with rising chronic disease prevalence supports the expansion of PCA pump use.

Technological enhancements in PCA pumps, such as smarter software, wireless connectivity, and improved safety features, further boost uptake. Devices with built‑in dose‑error reduction, better monitoring, and integration into electronic health records are increasingly adopted. Cost pressures and the need for efficient clinical workflows also push healthcare providers to invest in these solutions. As a result, the demand for PCA pumps in the USA is expected to grow steadily over the coming decade.

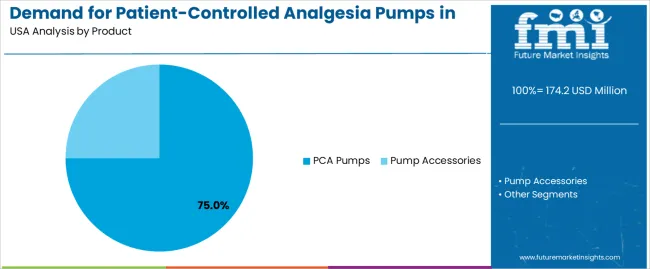

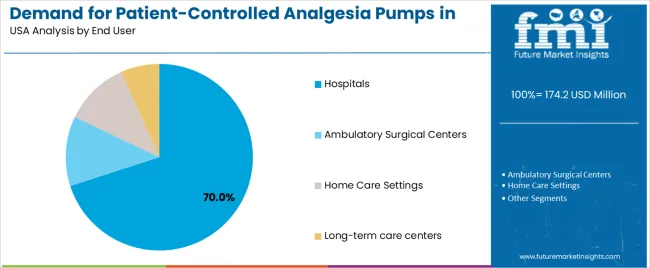

Demand is segmented by product, application, and end user. By product, demand is divided into PCA pumps and pump accessories, with PCA pumps holding the largest share. In terms of application, demand is categorized into pain management, antibiotic/antiviral therapy, chemotherapy, and others. The industry is also segmented by end user, including hospitals, ambulatory surgical centers, home care settings, and long-term care centers. This segmentation reflects the diverse use cases and growing demand for patient-controlled analgesia pumps across various healthcare settings. Regionally, demand is divided into West, South, Northeast, and Midwest.

PCA pumps account for 75% of the demand for patient-controlled analgesia pumps in the USA. These devices are widely used in healthcare settings to allow patients to control their pain relief by administering preset doses of analgesic medication. PCA pumps are preferred for their ability to provide targeted and adjustable pain management, offering more control and comfort to patients recovering from surgery or experiencing chronic pain.

The demand for PCA pumps is primarily driven by the increasing prevalence of surgical procedures, as well as the growing recognition of the need for effective, personalized pain management. Hospitals and surgical centers prefer PCA pumps for their precision in controlling medication dosage, reducing the risk of overdose, and improving patient satisfaction. With the increasing focus on patient-centered care and the rise in minimally invasive surgeries, the adoption of PCA pumps is expected to continue growing, especially in hospitals where pain management is a critical component of recovery and care.

Pain management accounts for 65% of the demand for patient-controlled analgesia pumps in the USA. Pain management is a critical component of patient care, particularly in post-surgical recovery, chronic pain treatment, and palliative care. PCA pumps are specifically designed for this application, offering patients the ability to manage their pain effectively and autonomously, which is especially beneficial in acute settings like post-operative care.

As the need for personalized pain control increases, particularly with the rise in surgical procedures and chronic conditions, the demand for PCA pumps in pain management continues to grow. The shift towards more patient-centric approaches in healthcare, where patients have greater control over their treatment, further boosts the adoption of these pumps. The effectiveness of PCA pumps in providing rapid, controlled, and adjustable pain relief makes them the preferred choice for pain management in hospitals, ambulatory surgical centers, and home care settings, driving their widespread use in the healthcare system.

Hospitals account for 70% of the demand for patient-controlled analgesia pumps in the USA. Hospitals are the primary setting where PCA pumps are used, as these facilities perform a wide range of surgeries and procedures that require effective pain management solutions. The ability for patients to control their own pain relief is highly valued in hospital settings, particularly in post-surgical recovery, where quick and effective pain management is crucial to patient satisfaction and recovery.

Hospitals also use PCA pumps to improve workflow efficiency and reduce the need for constant nurse intervention in pain management, which helps improve patient outcomes and optimize resource allocation. The prevalence of surgeries, trauma care, and critical care in hospitals, along with the growing emphasis on patient-centered care, ensures that hospitals will continue to be the largest end user of PCA pumps. With advances in healthcare technology and increasing surgical volumes, the demand for PCA pumps in hospitals is expected to grow further, driven by the need for better pain management solutions.

PCA pumps devices enable patients to self‑administer prescribed pain medication within preset limits, improving comfort and reducing nursing workload. Key drivers include rising surgical volumes, increasing prevalence of chronic pain and cancer, ageing populations, and the shift toward ambulatory and home‑based care. Restraints include high device and implementation costs, regulatory and safety concerns around infusion technology, and reimbursement complexities for advanced PCA systems.

The demand for PCA pumps in the USA is growing due to several interlinked factors. Rising surgical rates, especially in fields like orthopedics, oncology, and cardiology, are increasing the need for effective postoperative pain management. Additionally, the large population of chronic pain sufferers from conditions such as cancer, diabetes, and age-related ailments is contributing to steady demand for advanced analgesia solutions.

The growing trend of transitioning from inpatient care to outpatient and home-care settings is further driving this demand, as PCA pumps enable safe, patient-controlled pain management outside traditional hospital environments. These factors, combined with the push for more patient-centered care, make PCA pumps an essential tool in USA pain-management strategies, particularly in enhancing patient comfort and reducing hospital stays.

Technological innovations are significantly driving the growth of PCA pumps in the USA. Modern pumps are incorporating advanced features like dose-error reduction software, real-time monitoring, and wireless connectivity, which help improve patient safety and streamline clinical workflows. Integration with electronic health records (EHR) systems enhances the accuracy of dosing and supports data-driven decision-making.

Smaller, more portable designs are allowing for greater patient mobility, particularly in outpatient and home-care settings. Advances in usability and compatibility with mobile health devices are empowering patients to manage pain independently. These innovations increase both clinician confidence and patient satisfaction, making PCA pumps an essential component of modern pain management strategies, particularly for post-surgical recovery and chronic pain management.

Despite strong growth in demand, several challenges limit the broader adoption of PCA pumps in the USA. One key issue is the high initial cost, including the price of the pumps, consumables, and training, which can be a barrier for smaller healthcare facilities or those with tight budgets. Regulatory and safety concerns around infusion technology, software updates, and device connectivity create compliance burdens for healthcare providers.

Workflow integration issues arise as hospitals must adapt protocols, train staff, and establish safe procedures for home-use, especially in outpatient settings. Lastly, reimbursement challenges remain as insurance providers may not always cover the cost of advanced PCA pumps, impacting their widespread use and limiting healthcare providers' return on investment. These obstacles slow the full industry potential and adoption of the latest PCA technology.

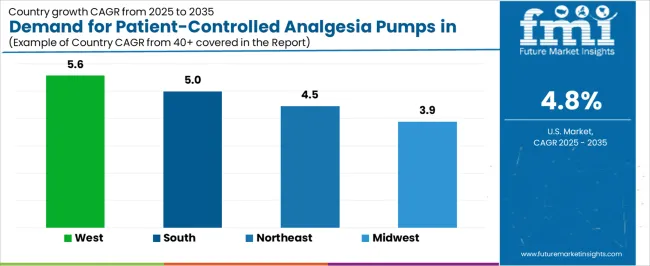

| Region | CAGR (%) |

|---|---|

| West | 5.6% |

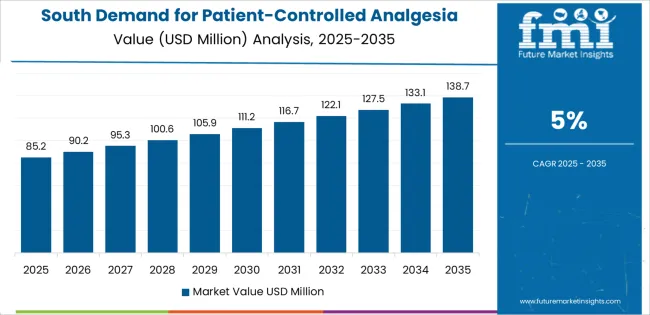

| South | 5.0% |

| Northeast | 4.5% |

| Midwest | 3.9% |

The demand for patient-controlled analgesia (PCA) pumps in the USA is growing steadily, with the West leading at a 5.6% CAGR. This growth is primarily driven by increasing surgical procedures, pain management advancements, and rising patient awareness. The South follows closely at 5.0%, supported by a growing healthcare infrastructure and an increasing number of healthcare facilities adopting PCA technology. The Northeast shows a 4.5% CAGR, influenced by its established hospitals and academic medical centers. The Midwest experiences more moderate growth at 3.9%, driven by ongoing investments in healthcare technology and patient-centered care solutions.

The West is seeing the highest demand growth for patient-controlled analgesia pumps, with a 5.6% CAGR. This is driven by the region's strong healthcare infrastructure and a significant number of medical research institutions, which are advancing the use of PCA technology in hospitals and outpatient care settings. Cities like California, Seattle, and Colorado have a high concentration of healthcare facilities, which adopt PCA pumps for pain management, especially in post-surgical care.

The growing awareness of pain management solutions and a preference for non-invasive, patient-controlled alternatives are driving demand for PCA pumps. The increasing number of surgeries, along with the growing need for effective pain management in the West, is further propelling the demand. As hospitals and healthcare providers continue to integrate PCA technology for better patient outcomes and satisfaction, the West remains the leader in PCA pump adoption and growth.

The South is experiencing strong demand for patient-controlled analgesia pumps, with a 5.0% CAGR. This growth is largely attributed to the region’s rapidly expanding healthcare sector, which includes a significant number of hospitals, medical centers, and surgical facilities. States like Texas, Florida, and Georgia are seeing an increase in surgical procedures, leading to a greater need for pain management solutions, including PCA pumps.

The rise of outpatient surgery centers, coupled with improved access to healthcare services, is driving demand for PCA pumps, as they offer an effective way for patients to manage their post-operative pain. Additionally, the focus on patient-centered care in the South, along with a growing emphasis on pain management in medical practices, has led to a steady increase in PCA pump adoption. As the healthcare infrastructure in the South continues to grow and improve, demand for PCA pumps will continue to rise.

The Northeast is witnessing steady demand growth for patient-controlled analgesia pumps, with a 4.5% CAGR. The region benefits from its well-established healthcare system, with major academic medical centers and research institutions that frequently adopt new medical technologies, including PCA pumps. Cities such as New York, Boston, and Philadelphia are home to a large number of hospitals that specialize in surgical procedures and pain management.

As patient care continues to evolve with a greater focus on post-surgical comfort and outcomes, the adoption of PCA pumps is increasing. The Northeast’s commitment to innovation in healthcare, combined with its extensive medical infrastructure, supports the growing use of PCA pumps for managing acute pain in patients. As hospitals and healthcare facilities continue to adopt more advanced technologies to improve patient outcomes, the demand for PCA pumps will continue to rise steadily in the Northeast.

The Midwest is seeing moderate growth in demand for patient-controlled analgesia pumps, with a 3.9% CAGR. While the growth rate is slower than in other regions, the Midwest’s healthcare infrastructure is steadily evolving, with increasing investments in medical technology and patient care. States like Illinois, Ohio, and Michigan are gradually expanding their use of PCA pumps, especially in hospitals and outpatient centers focused on surgical and post-operative care.

The region’s moderate growth is influenced by the rising focus on improving pain management solutions in healthcare, particularly for patients recovering from surgery. As healthcare providers in the Midwest increasingly adopt PCA pumps to enhance patient comfort and reduce opioid use, the demand for these devices will continue to rise, albeit at a slower pace than in more heavily populated regions like the West and South. The steady expansion of healthcare services and technology in the Midwest will support continued growth in PCA pump usage.

Demand for patient‑controlled analgesia (PCA) pumps in the USA is rising significantly, as healthcare providers focus more on patient‑centric pain management, particularly in postoperative care, oncology, and chronic pain settings. These devices allow patients to self‑administer pain medication within safe limits, improving patient satisfaction and enabling quicker recovery by controlling discomfort more effectively. The growing volume of surgical procedures, a rising geriatric population, and increased emphasis on efficient pain control are major factors driving this demand.

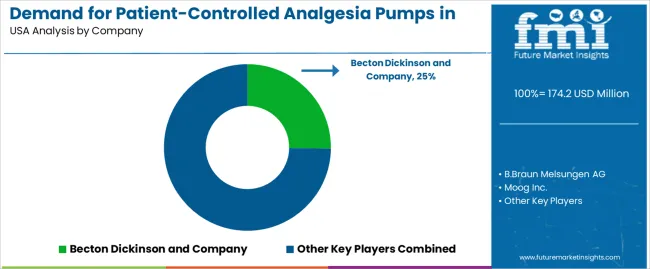

In the USA demand landscape, Becton Dickinson and Company holds approximately 25.2% share, demonstrating its strong presence in the PCA‑pump segment through its established infusion‑pump systems and service infrastructure. Other key companies contributing significantly to the USA demand include B. Braun Melsungen AG, Moog Inc., Smiths Group/ICU Medical, and Fresenius SE & Co. KGaA, each supplying specialized PCA systems or related infusion‑medication technologies used in hospitals, ambulatory surgical centers, and home care settings.

Key growth drivers include the increasing adoption of enhanced recovery‑after‑surgery (ERAS) protocols, greater integration of smart pump technologies with hospital monitoring systems, and expanded use of ambulatory or home‑based analgesia solutions. Despite these opportunities, challenges such as high device cost, regulatory and reimbursement constraints, and the need for rigorous safety features (given the risks associated with opioid administration) remain. Overall, the demand outlook for PCA pumps in the USA remains positive, supported by continuing innovation and healthcare system emphasis on optimized pain management.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product | PCA Pumps, Pump Accessories |

| Application | Pain Management, Antibiotic/Antiviral Therapy, Chemotherapy, Others |

| End User | Hospitals, Ambulatory Surgical Centers, Home Care Settings, Long-term Care Centers |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Becton Dickinson and Company, B.Braun Melsungen AG, Moog Inc., Smiths Group/ ICU Medical, Fresenius SE & Co. KGaA |

| Additional Attributes | Dollar sales by product, application, end user, and regional trends |

The global demand for patient-controlled analgesia pumps in USA is estimated to be valued at USD 174.2 million in 2025.

The market size for the demand for patient-controlled analgesia pumps in USA is projected to reach USD 278.5 million by 2035.

The demand for patient-controlled analgesia pumps in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in demand for patient-controlled analgesia pumps in USA are pca pumps and pump accessories.

In terms of application, pain management segment to command 65.0% share in the demand for patient-controlled analgesia pumps in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA