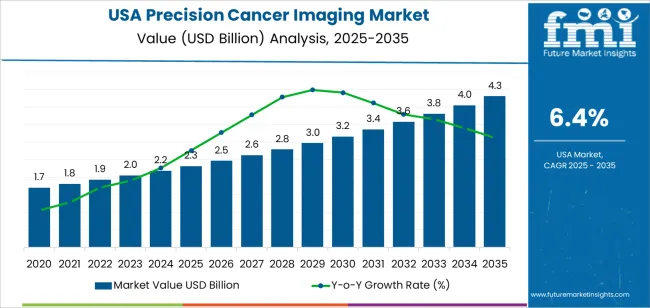

The demand for precision cancer imaging in the USA is expected to grow from USD 2.3 billion in 2025 to USD 4.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.40%. Precision cancer imaging plays a crucial role in the early detection, diagnosis, and treatment planning for cancer patients, helping to improve outcomes and tailor therapies. This technology is rapidly evolving, with advancements in imaging modalities such as positron emission tomography (PET), magnetic resonance imaging (MRI), and computed tomography (CT), all of which are driving the industry forward. The increasing prevalence of cancer and a growing emphasis on early detection are expected to be key drivers of this industry.

As the healthcare sector places greater importance on personalized medicine, precision cancer imaging is becoming an essential tool for oncologists. This technology allows for the precise identification of tumors, better monitoring of treatment progress, and more accurate assessment of cancer progression. The rising awareness of the benefits of early cancer detection and the growing adoption of advanced imaging systems are contributing to the industry growth. The demand for precision cancer imaging is also fueled by ongoing advancements in artificial intelligence (AI) and machine learning, which are improving the accuracy and efficiency of imaging processes.

Between 2025 and 2030, demand will increase gradually from USD 2.3 billion to USD 2.8 billion, driven by steady advancements in imaging technologies and growing awareness around cancer prevention and early detection. As healthcare providers continue to adopt more advanced imaging systems, the need for precision cancer imaging solutions will rise. The integration of artificial intelligence (AI) in imaging processes will improve diagnostic accuracy and efficiency, further boosting industry growth. Increased healthcare investments in cancer diagnostics and treatment will also contribute to this gradual expansion.

From 2030 to 2035, the growth curve is expected to steepen, with demand projected to rise from USD 2.8 billion to USD 4.3 billion. This acceleration can be attributed to the widespread adoption of AI-driven imaging technologies, which will revolutionize cancer detection and treatment planning. As personalized cancer therapies become more common, the demand for precision imaging to support these treatments will surge. The expansion of healthcare infrastructure to support early detection and precision medicine will further propel industry growth. The second half of the forecast period is expected to see rapid innovation and integration of these technologies into clinical settings, ensuring substantial growth in precision cancer imaging.

| Metric | Value |

|---|---|

| Demand for Precision Cancer Imaging in USA Value (2025) | USD 2.3 billion |

| Demand for Precision Cancer Imaging in USA Forecast Value (2035) | USD 4.3 billion |

| Demand for Precision Cancer Imaging in USA Forecast CAGR (2025 2035) | 6.40% |

The demand for precision cancer imaging in the USA is growing as clinicians and healthcare organisations seek more accurate tools to detect, diagnose, and monitor cancer. Modern imaging techniques including hybrid systems, molecular imaging and AI‑enhanced analysis enable providers to identify tumours earlier, personalize treatment plans and track therapeutic responses. With a rising cancer incidence and the push for better outcomes, these imaging tools are becoming essential in oncology pathways.

Hospitals and diagnostic centres are increasing their investment in advanced imaging systems to accommodate the complexity of cancer care. These facilities face pressure to reduce diagnostic delays and better optimise workflows, which drives adoption of imaging technologies that offer faster scan times, improved lesion detection and integrated software platforms. As treatment paradigms shift toward minimally invasive and image‑guided approaches, demand for high‑precision imaging increases

Technological progress in software and hardware is another key factor. Innovations such as AI‑powered image interpretation, cloud‑based data platforms and next‑generation contrast‑agents allow for more detailed tissue characterisation and fewer invasive procedures. These advancements improve clinical decision making and expand imaging use into outpatient settings. As providers aim for efficiency and improved patient experience, precision cancer imaging tools are set to become more widespread in the USA, supporting steady growth through 2035.

Demand for precision cancer imaging in the USA is segmented by imaging technique and end user. By imaging technique, demand is divided into molecular imaging, magnetic resonance imaging (MRI), and nuclear medicine scans. The demand is also segmented by end user, including hospitals, research laboratories, diagnostic laboratories, academic research institutes, and specialty clinics. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Why Does Molecular Imaging Lead the Imaging Technique Demand for Precision Cancer Imaging?

Molecular imaging accounts for 46% of the demand for precision cancer imaging in the USA. Molecular imaging is a non-invasive technique that provides detailed insights into the biological processes of cancer at the cellular and molecular level. This imaging technique is critical for early cancer detection, monitoring treatment response, and assessing tumor progression. By enabling clinicians to visualize molecular activity, molecular imaging helps in the precise localization of tumors, which is essential for personalized cancer treatment. Its ability to provide real-time data on tumor behavior and metabolism makes it a preferred choice for oncologists. As advancements in imaging technology continue to evolve, the demand for molecular imaging is expected to grow, particularly in cancer care, where accurate, timely, and targeted treatment is crucial. The ability to identify cancer at an early stage also drives molecular imaging’s dominance in the industry.

Why Do Hospitals Lead the End-User Demand for Precision Cancer Imaging?

Hospitals account for 58.4% of the demand for precision cancer imaging in the USA. Hospitals are the primary settings for the treatment of cancer patients, and they are equipped with advanced imaging technologies necessary for diagnosis, staging, and monitoring the progress of cancer treatments. The demand for precision cancer imaging in hospitals is driven by the increasing number of cancer diagnoses and the need for accurate, detailed imaging to guide treatment plans. Hospitals also have the resources to offer multidisciplinary cancer care, with imaging serving as a crucial component in comprehensive oncology programs. With the rise in cancer cases and the growing emphasis on early detection and personalized medicine, hospitals remain the leading end-user of precision cancer imaging technologies. The integration of advanced imaging techniques, such as molecular imaging and MRI, into oncology treatment protocols will continue to drive hospital-based demand in the USA.

Key drivers include rising cancer incidence and broader screening programmes pushing demand for sophisticated imaging, the integration of modalities such as PET, MRI and CT with molecular imaging for more accurate tumour characterisation, and the uptake of AI‑driven image analytics enabling earlier detection and personalised treatment planning. Restraints include high capital expenditure for advanced imaging systems and hybrid modalities, the need for specialised training of radiologists and technologists, reimbursement and regulatory complexity for novel imaging techniques and biomarkers, and workflow integration challenges in hospitals and diagnostic centres.

Why is Demand for Precision Cancer Imaging Growing in USA?

In USA, demand for precision cancer imaging is growing because healthcare providers and imaging centres need to differentiate benign versus malignant tissues, assess tumour stage precisely and monitor treatment response in personalised oncology workflows. Screening programmes for cancers such as lung, breast and colorectal are expanding, increasing the need for high‑sensitivity imaging. Shifts in care towards outpatient and ambulatory settings mean imaging must be both faster and more accurate. Innovations in imaging biomarkers and radiopharmaceuticals, along with provider investment in modern equipment to remain competitive, bolster uptake of precision imaging tools.

How are Technological Innovations Driving Growth of Precision Cancer Imaging in USA?

Technological innovations are driving growth of precision cancer imaging in USA by enabling more detailed, functional and molecular‑level visualisation of tumours. Hybrid systems (such as PET‑MRI or PET‑CT) and novel radiotracers allow imaging of metabolic and molecular tumour features. Artificial‑intelligence tools and machine‑learning algorithms enhance image analysis speed and accuracy, improving diagnostic confidence and workflow efficiency. Modular and smaller‑footprint imaging units facilitate installation in outpatient and community settings. Software tools for real‑time image fusion and 3D visualisation support treatment planning in radiation and surgical oncology. These innovations make precision imaging more clinically actionable and scalable across care settings.

What are the Key Challenges Limiting Adoption of Precision Cancer Imaging in USA?

Despite strong potential, adoption of precision cancer imaging in USA faces several challenges. One is cost, advanced imaging systems, hybrid modalities and novel tracers are expensive and may be beyond the budgets of smaller institutions. Regulatory and reimbursement pathways for new imaging biomarkers or radiopharmaceuticals are complex and time‑consuming. Integration of new workflows into existing imaging departments requires training, technical support and IT infrastructure. Access disparities remain: rural and under‑resourced facilities may lack the equipment or specialists needed for precision imaging. Clinical evidence and standardisation for some newer imaging techniques may lag, which slows broad adoption.

| Region | CAGR (%) |

|---|---|

| West | 7.3 |

| South | 6.6 |

| Northeast | 5.9 |

| Midwest | 5.1 |

Demand for precision cancer imaging in USA is increasing across all regions, with the West leading at a 7.3% CAGR. This growth is driven by the region’s advanced healthcare infrastructure and its focus on medical innovation, particularly in early cancer detection and personalized treatment planning. The South follows with a 6.6% CAGR, supported by an expanding healthcare sector and the rising prevalence of cancer. The Northeast shows a 5.9% CAGR, with its strong healthcare institutions and focus on cancer research and treatment. The Midwest experiences moderate growth at 5.1%, with increasing adoption of precision imaging technologies in healthcare facilities across the region.

What is Driving Demand for Precision Cancer Imaging in the West of USA?

The West is experiencing the highest demand for precision cancer imaging in USA, with a 7.3% CAGR. This growth is driven by the region's advanced healthcare infrastructure and the increasing adoption of cutting-edge medical technologies in cities like Los Angeles, San Francisco, and Seattle. The West has long been a leader in medical innovation, with a strong presence of research institutions, medical centers, and healthcare providers who are at the forefront of adopting precision imaging technologies for early cancer detection and treatment planning. The growing awareness of the importance of early cancer diagnosis and the need for highly accurate imaging techniques has contributed significantly to this demand.

The West’s high concentration of health-conscious individuals and its focus on improving healthcare outcomes are key drivers. As precision cancer imaging technologies continue to improve in terms of accuracy and cost-effectiveness, healthcare providers and patients in the West are increasingly opting for these advanced solutions. The rising demand for personalized medicine and tailored treatment plans is expected to keep fueling the adoption of precision cancer imaging in the region.

How is Demand for Precision Cancer Imaging Growing in the South of USA?

The South is seeing strong demand for precision cancer imaging in USA, with a 6.6% CAGR. The region’s expanding healthcare sector, coupled with advancements in cancer research and treatment, has contributed to the growing use of precision imaging technologies. States like Texas, Florida, and Georgia have seen a rise in medical institutions and cancer centers adopting precision imaging for more accurate and earlier cancer detection. As the South’s healthcare infrastructure continues to improve and more hospitals integrate these advanced technologies, the demand for precision cancer imaging is expected to grow.

The South’s aging population and the increasing prevalence of cancer in the region have made early diagnosis and accurate treatment planning more critical. Healthcare providers in the South are focusing on offering advanced solutions to improve patient outcomes, and precision cancer imaging plays a key role in this effort. As awareness of the benefits of precision imaging grows and more facilities adopt these technologies, the demand for precision cancer imaging in the South will continue to rise.

What is Driving Demand for Precision Cancer Imaging in the Northeast of USA?

The Northeast is experiencing steady demand for precision cancer imaging in USA, with a 5.9% CAGR. This demand is largely driven by the region’s well-established healthcare infrastructure and its concentration of top-tier medical institutions, particularly in cities like New York and Boston. With a strong focus on research, development, and the adoption of innovative healthcare technologies, the Northeast has become a hub for cutting-edge cancer treatment and diagnostic services. Precision cancer imaging is increasingly used to enhance the accuracy of early diagnosis, helping healthcare providers create personalized treatment plans for cancer patients.

The region’s focus on medical advancements and the rising incidence of cancer in urban areas have also contributed to the demand for precision cancer imaging. As healthcare providers and research institutions continue to invest in more advanced imaging technologies, the demand for these solutions is expected to grow. The combination of increased awareness of the benefits of early cancer detection and the presence of well-equipped medical centers makes the Northeast a key region for precision cancer imaging in the USA.

How is Demand for Precision Cancer Imaging Growing in the Midwest of USA?

The Midwest is seeing moderate demand for precision cancer imaging in USA, with a 5.1% CAGR. This growth is driven by the region’s expanding healthcare facilities and increasing investment in advanced medical technologies. States like Illinois, Michigan, and Ohio are experiencing a rise in the adoption of precision cancer imaging, particularly in large medical centers and cancer research institutes. As the healthcare sector in the Midwest continues to improve, more hospitals and diagnostic centers are incorporating precision imaging into their cancer treatment protocols, which is driving demand for these advanced technologies.

The Midwest’s large and diverse population, coupled with an increasing number of cancer diagnoses, has made early detection and accurate treatment planning a priority for healthcare providers in the region. As healthcare professionals increasingly recognize the value of precision cancer imaging in improving patient outcomes, demand is expected to rise. The growing awareness of the benefits of these technologies, combined with the Midwest’s robust healthcare system, ensures that demand for precision cancer imaging will continue to expand steadily in the region.

In the USA, demand for precision cancer imaging is propelled by growth in oncology diagnostics, increasing incidence of cancer, rising investments in advanced imaging technologies, and adoption of personalized treatment planning. The sector involves modalities such as molecular imaging, positron emission tomography (PET), computed tomography (CT), magnetic resonance imaging (MRI), and associated software for image analysis and tumor characterization. The emphasis on early detection, treatment monitoring, and minimally invasive diagnostics is expanding uptake of these imaging solutions.

Key providers competing in the USA include GE Healthcare Ltd with a 36.4% share, Koninklijke Philips N.V., Siemens Healthineers, Hologic, Inc. and Hitachi, Ltd. These firms differentiate through their product portfolios of imaging systems, AI-based image analytics, integrated oncology workflows, global service networks, and regulatory compliance. The dominance of GE Healthcare reflects its strong diagnostic imaging infrastructure and brand presence. The other firms enhance their competitive position through innovation in detector technology, hybrid imaging modalities (e.g., PET/MRI), and value-added services.

Competitive dynamics in USA precision cancer imaging are shaped by several factors. First, technological innovation in image resolution, functional imaging, AI segmentation, and workflow automation is a major differentiator. Second, regulatory and reimbursement environments in the USA impose stringent requirements for clinical validation, device clearance, and oncology-specific imaging performance, raising the bar for new entrants. Third, capital intensity and service network scale create entry barriers; smaller players must offer clear cost or performance advantages to gain traction. Companies that combine improved diagnostic accuracy, operational efficiency, reliable service, and strategic partnerships with oncology centers are best placed to secure growth and defend industry share.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Imaging Technique | Molecular Imaging, Magnetic Resonance Imaging, Nuclear Medicine Scans |

| End User | Hospitals, Research Laboratories, Diagnostic Laboratories, Academic Research Institutes, Specialty Clinics |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | GE Healthcare Ltd, Koninklijke Philips N.V., Siemens Healthineers, Hologic, Inc., Hitachi, Ltd. |

| Additional Attributes | Dollar sales by imaging technique, end user, and regional distribution with a focus on hospitals, research labs, and diagnostic labs. Trends in precision imaging technologies and the adoption of innovative cancer imaging solutions across key regions. |

The demand for precision cancer imaging in usa is estimated to be valued at USD 2.3 billion in 2025.

The market size for the precision cancer imaging in usa is projected to reach USD 4.3 billion by 2035.

The demand for precision cancer imaging in usa is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in precision cancer imaging in usa are molecular imaging, magnetic resonance imaging and nuclear medicine scans.

In terms of end user, hospitals segment is expected to command 58.4% share in the precision cancer imaging in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Demand for Precision Cancer Imaging in Japan Size and Share Forecast Outlook 2025 to 2035

USA Aerial Imaging Market Analysis – Size & Industry Trends 2025-2035

Demand for 3D Imaging Surgical Solution in USA Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA