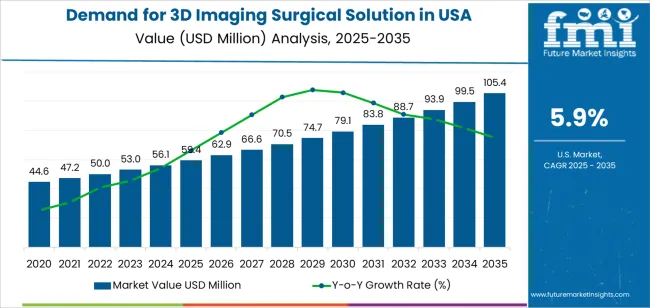

The demand for 3D imaging surgical solutions in the USA is expected to grow from USD 59.4 million in 2025 to approximately USD 105.8 million by 2035, recording an absolute increase of USD 46.4 million over the forecast period. This translates into total growth of 78.1%, with demand forecast to expand at a CAGR of 6.0% between 2025 and 2035. Overall sales are expected to grow by nearly 1.78X during the same period, supported by the increasing adoption of advanced imaging technologies in medical procedures, the rising prevalence of chronic diseases, and the growing demand for minimally invasive surgeries across hospitals and surgical centers. The USA, with its advanced healthcare infrastructure and ongoing innovations in medical technology, continues to demonstrate strong growth potential, driven by the integration of 3D imaging into surgical practices and the shift toward precision medicine.

Between 2025 and 2030, sales of 3D imaging surgical solutions in the USA are projected to expand from USD 59.4 million to USD 77.6 million, representing a 39.2% share of the total forecast growth for the decade. This phase of development will be shaped by the rising adoption of minimally invasive surgery, advancements in imaging technologies, and the growing need for real-time, high-resolution visualizations in surgical procedures. Increased focus on improving surgical outcomes, reducing recovery times, and enhancing patient safety will continue to drive the demand for 3D imaging systems in operating rooms.

Between 2025 and 2030, the demand for 3D imaging surgical solutions in the USA is projected to grow from USD 59.4 million to approximately USD 79.3 million, adding USD 19.9 million, which accounts for about 33.3% of the total forecasted growth for the decade. This period will be marked by increased adoption of advanced imaging technologies in hospitals, surgical centers, and research institutions, driven by the growing need for more accurate and less invasive surgical procedures. Enhanced visualizations provided by 3D imaging are helping improve surgical planning, precision, and patient outcomes, contributing to their growing adoption.

From 2030 to 2035, the demand is expected to expand from approximately USD 79.3 million to USD 105.8 million, adding USD 26.5 million, which constitutes about 66.7% of the overall growth. This phase will see the broader integration of 3D imaging solutions across various medical specialties, including orthopedics, neurosurgery, and cardiology. The continuous advancements in imaging technologies, such as the integration of AI, robotics, and augmented reality, will further drive industry growth, enhancing both surgical accuracy and operational efficiency.

| Metric | Value |

|---|---|

| 3D Imaging Surgical Solution Sales Value (2025) | USD 59.4 million |

| 3D Imaging Surgical Solution Forecast Value (2035) | USD 105.8 million |

| 3D Imaging Surgical Solution Forecast CAGR (2025-2035) | 6% |

The 3D imaging surgical solution Industry is growing due to the increasing adoption of advanced imaging technologies in healthcare, particularly in surgical procedures. 3D imaging solutions, which provide detailed, high-resolution images in real time, are enhancing surgical precision and improving patient outcomes. Surgeons can view structures in three dimensions, offering better visualization during complex procedures, reducing risks, and improving decision-making in surgeries.

The growing demand for minimally invasive surgeries is a significant driver of Industry growth. These surgeries require high precision and accuracy, which 3D imaging technology facilitates by providing clearer views of anatomical structures without the need for large incisions. The ability to perform minimally invasive procedures leads to quicker recovery times, less postoperative pain, and fewer complications, which is driving the increasing adoption of 3D imaging solutions in operating rooms.

Technological advancements, such as the integration of augmented reality (AR) and virtual reality (VR) with 3D imaging, are further fueling Industry growth. These innovations are enhancing surgical planning, navigation, and training, making 3D imaging solutions more indispensable in the medical field. As healthcare systems continue to focus on improving patient care and reducing the risks associated with surgeries, the demand for 3D imaging surgical solutions is expected to rise.

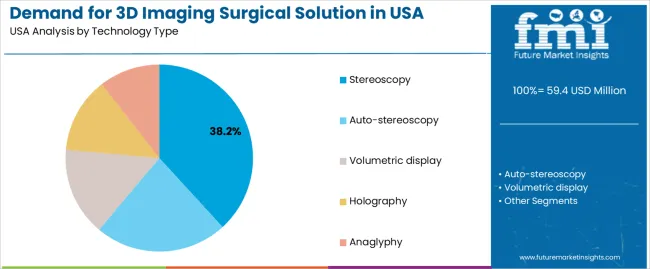

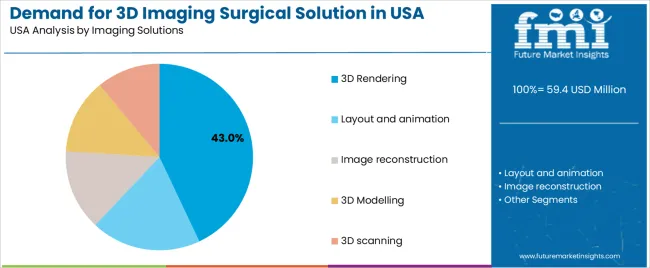

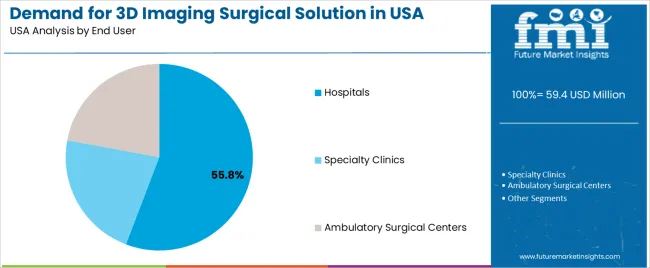

Demand is segmented by technology type, imaging solutions, end users, and region. By technology type, sales are divided into stereoscopy, auto-stereoscopy, volumetric display, holography, and anaglyphy. In terms of imaging solutions, sales are segmented into 3D rendering, layout and animation, image reconstruction, 3D modelling, and 3D scanning. Regionally, demand is divided into the West, South, Northeast, and Midwest, with each region showing different preferences based on the healthcare infrastructure and adoption rates of advanced surgical technologies.

The stereoscopy segment is projected to account for 38% of the 3D imaging surgical solution Industry in 2025, making it the leading technology category. This dominance is attributed to the widespread use of stereoscopic imaging in surgical procedures, where depth perception is crucial for accurate diagnosis and treatment. Stereoscopy, offering 3D vision by displaying two offset images, enhances the precision of medical professionals during surgeries and procedures that require high spatial awareness. As stereoscopic systems offer high reliability, it has become a standard technology in advanced surgical imaging solutions. The technology's strong position is further supported by continuous advancements that improve image clarity, user interface, and integration with surgical tools, leading to improved patient outcomes and overall operational effectiveness.

The 3D rendering segment is projected to account for 43% of the 3D imaging surgical solution Industry in 2025, making it the leading imaging solution category. This segment's dominance is driven by the critical role that 3D rendering plays in producing detailed and accurate visualizations of anatomical structures, improving pre-operative planning and patient-specific assessments. 3D rendering allows surgeons to view detailed three-dimensional representations of organs, tissues, and bones, which can significantly reduce the risk of errors during procedures. This solution is widely used in various fields of surgery, including orthopedics, neurosurgery, and cardiology, where precision is key to successful outcomes. The segment benefits from continuous improvements in software and hardware integration, leading to more realistic, accurate, and faster renderings, enhancing surgical planning and execution.

The hospitals segment is expected to represent 55.8% of the 3D imaging surgical solution Industry in 2025, making it the largest end user category. Hospitals are the primary adopters of 3D imaging technology due to the increasing complexity of surgeries and the growing demand for more precise surgical interventions. The use of 3D imaging solutions in hospitals is critical in improving diagnostic accuracy and surgical outcomes, particularly in high-stakes procedures such as complex organ transplants and minimally invasive surgeries. Hospitals have the resources and infrastructure to implement these advanced technologies on a large scale, including integration with existing medical imaging systems. As the adoption of advanced surgical technologies continues to rise, the demand for 3D imaging solutions in hospital settings is expected to remain strong, making it the dominant end-user segment.

3D imaging surgical solutions offer benefits such as enhanced visualization during complex surgeries, reduced procedure times, and better post‑operative care. Key drivers include the rise in minimally‑invasive procedures, growing adoption of robotic surgery, and advancements in imaging technologies. Restraints include high initial costs, integration complexities with existing systems, and regulatory hurdles.

Why are 3D Imaging Surgical Solutions Gaining Popularity in USA?

3D imaging surgical solutions are gaining popularity due to their ability to enhance surgical precision, reduce complications, and improve recovery times. As the healthcare industry increasingly embraces minimally invasive procedures, technologies that provide clearer, more detailed views of the surgical area become essential. 3D imaging systems allow surgeons to view the operative field in a way that traditional 2D imaging cannot, improving accuracy and decision-making during complex surgeries. This is especially important in specialties such as neurosurgery, orthopedics, and cardiovascular surgery, where precision is critical. The integration of 3D imaging with robotic surgery systems enables highly accurate, real-time visual feedback during operations, which leads to better outcomes. The ability of 3D imaging solutions to improve the overall patient experience, reduce the length of surgeries, and speed up recovery times is driving increased adoption, positioning them as essential tools in modern surgical practices.

How are Technological Innovations Driving Growth in the 3D Imaging Surgical Solution Industry?

Technological innovations are driving growth in the 3D imaging surgical solution Industry by enhancing image quality, reducing costs, and improving the integration of systems into surgical workflows. Advances in high-definition 3D displays and the development of better sensors allow for clearer and more accurate images during surgeries, which are crucial for improving surgical outcomes. The introduction of real-time imaging and augmented reality (AR) technologies has further advanced these solutions by overlaying digital images onto a surgeon’s view, providing even greater precision. AI and machine learning technologies are revolutionizing 3D imaging systems by automating image processing and detection of anomalies, thus reducing the time required for analysis and increasing accuracy. These innovations allow for faster decision-making and improved patient outcomes.

What are the Key Challenges Limiting the Adoption of 3D Imaging Surgical Solutions in USA?

Despite the benefits, the adoption of 3D imaging surgical solutions in the USA faces several challenges. One of the primary barriers is the high cost associated with 3D imaging systems. These advanced technologies often require significant upfront investment for equipment, infrastructure, and training, which can be prohibitive for smaller hospitals or outpatient centers with limited budgets. Integrating 3D imaging systems with existing surgical equipment and hospital IT systems presents logistical challenges, especially in environments with older infrastructure. Regulatory hurdles, such as obtaining FDA approvals for new imaging technologies, can also delay Industry entry and adoption. Another significant challenge is training medical professionals must be adequately trained to use these advanced systems, which can be a time-consuming process.

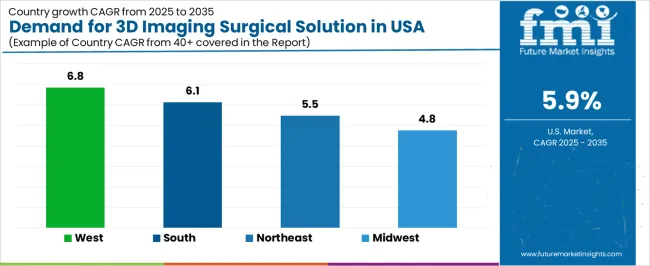

| Region | CAGR (%) |

|---|---|

| West | 6.8% |

| South | 6.1% |

| Northeast | 5.5% |

| Midwest | 4.8% |

The demand for 3D imaging surgical solutions in the USA is growing across different regions, with the West leading at a 6.8% CAGR. This growth is driven by the increasing adoption of advanced imaging technologies in surgical procedures to improve accuracy, minimize risks, and enhance patient outcomes. The South follows with a 6.1% CAGR, supported by expanding healthcare infrastructure and increasing investments in surgical technology. The Northeast shows a 5.5% CAGR, fueled by the region’s focus on medical innovation and high adoption rates of advanced surgical solutions. The Midwest, while still growing at 4.8%, is witnessing steady adoption of 3D imaging solutions as healthcare systems upgrade to more precise and efficient technologies.

The West is experiencing the highest demand growth for 3D imaging surgical solutions in the USA, with a 6.8% CAGR. The region’s leading healthcare institutions, advanced research in medical technologies, and significant investments in healthcare infrastructure are major factors contributing to this growth. As major cities in the West, such as Los Angeles and San Francisco, continue to adopt cutting-edge technologies, the demand for 3D imaging solutions in surgical procedures has risen.

The increasing focus on precision surgery, particularly in complex procedures like neurosurgery, orthopedics, and minimally invasive surgeries, is driving the adoption of 3D imaging technologies. These systems improve surgical planning, accuracy, and patient outcomes, making them essential tools in modern healthcare. With the West’s growing emphasis on innovation and high-quality healthcare services, demand for 3D imaging surgical solutions is expected to continue rising.

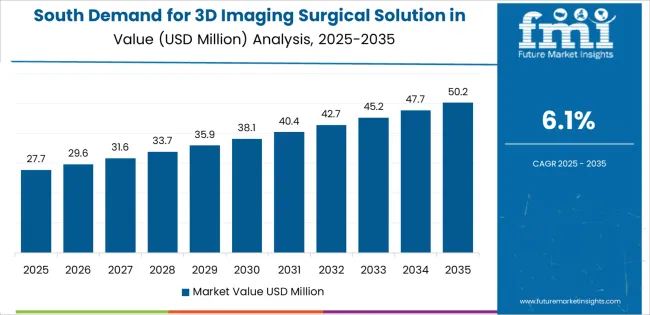

The South is experiencing robust demand for 3D imaging surgical solutions, growing at a 6.1% CAGR. The region’s rapidly expanding healthcare infrastructure and a growing number of medical facilities adopting advanced technologies are major drivers of this trend. Cities like Houston, Atlanta, and Miami are becoming hubs for medical technology adoption, contributing significantly to the rise in demand for precision surgical tools, including 3D imaging systems.

The region’s increasing focus on improving healthcare access and outcomes, along with investments in hospital and surgical center upgrades, is also pushing for the integration of 3D imaging technologies. As more surgeons and healthcare providers in the South recognize the benefits of these solutions, particularly for complex procedures that require high precision, the adoption of 3D imaging surgical solutions is expected to continue growing.

The Northeast region is seeing steady growth in the demand for 3D imaging surgical solutions, with a 5.5% CAGR. The region’s medical research and development facilities, particularly in cities like Boston and New York, are driving the innovation and adoption of advanced surgical technologies. The Northeast has long been a leader in healthcare innovation, with many leading hospitals and research institutions focused on improving surgical outcomes and patient care.

The rise in the adoption of 3D imaging technologies is fueled by the region’s commitment to using the latest medical advancements to reduce surgical errors, improve accuracy, and enhance post-operative recovery. As the region continues to push for medical excellence, the demand for 3D imaging surgical solutions will continue to grow, particularly in complex and high-precision surgeries.

The Midwest region, while showing the lowest growth rate at 4.8%, is still experiencing steady demand for 3D imaging surgical solutions. The region’s healthcare systems, particularly in cities like Chicago and Cleveland, are increasingly adopting advanced technologies to enhance surgical precision and improve patient outcomes. As hospitals and surgical centers in the Midwest modernize their equipment and expand their service offerings, the need for 3D imaging solutions is becoming more pronounced.

The growing focus on improving healthcare efficiency, combined with the need for accurate and minimally invasive surgical procedures, is driving demand for these solutions. Although growth in the Midwest is more moderate compared to other regions, as healthcare facilities continue to upgrade and integrate more sophisticated surgical technologies, demand for 3D imaging surgical solutions will continue to rise.

The demand for 3D imaging surgical solutions in the USA is experiencing significant growth, driven by technological advancements in medical imaging and the increasing adoption of minimally invasive surgeries. As hospitals and surgical centers prioritize improving patient outcomes, the demand for high-quality imaging systems that provide clear and precise visualization during surgeries has surged. Key factors driving this demand include the rise of robotic-assisted surgeries, hybrid operating rooms, and the need for enhanced imaging in complex procedures.

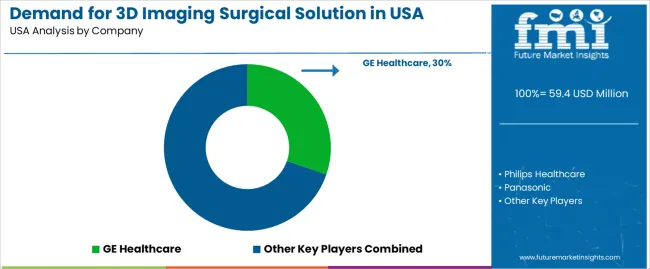

GE Healthcare holds a dominant share of the Industry, with 30.3% of the USA demand for 3D imaging surgical solutions. The company’s leading position is attributed to its robust portfolio of imaging technologies that are widely adopted in both hospitals and surgical centers. Other major players in the USA Industry include Philips Healthcare, Panasonic, Lockheed Martin, and Able Software. These companies offer a variety of advanced solutions, such as real-time 3D imaging and surgical navigation systems, which are integral to improving surgical precision and reducing recovery times.

The Industry’s growth is also fueled by the increasing focus on value-based care, where hospitals are incentivized to adopt technologies that improve surgical outcomes and minimize complications. The aging USA population and the rising demand for surgeries are contributing to the overall growth of the 3D imaging surgical solutions Industry.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Technology Type | Stereoscopy, Auto-stereoscopy, Volumetric Display, Holography, Anaglyphy |

| Imaging Solutions | 3D Rendering, Layout and Animation, Image Reconstruction, 3D Modelling, 3D Scanning |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | GE Healthcare, Philips Healthcare, Panasonic, Lockheed Martin, Able Software |

| Additional Attributes | Dollar sales by technology type, imaging solutions, and end user categories, regional adoption trends, competitive landscape, advancements in 3D imaging surgical technologies, integration with healthcare facilities. |

The global demand for 3D imaging surgical solution in USA is estimated to be valued at USD 59.4 million in 2025.

The market size for the demand for 3D imaging surgical solution in USA is projected to reach USD 105.4 million by 2035.

The demand for 3D imaging surgical solution in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for 3D imaging surgical solution in USA are stereoscopy, auto-stereoscopy, volumetric display, holography and anaglyphy.

In terms of imaging solutions, 3D rendering segment to command 43.0% share in the demand for 3D imaging surgical solution in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA