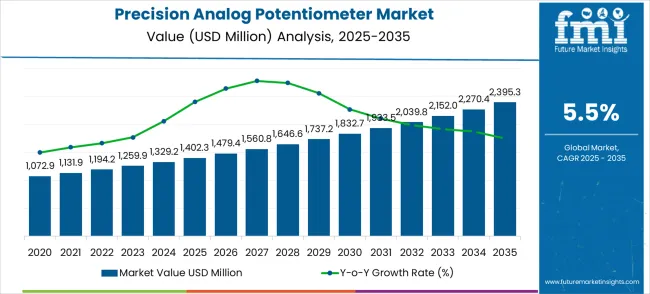

The global precision analog potentiometer market stands positioned for expansion, charting a remarkable trajectory from USD 1,402.3 million in 2025 to USD 2,395.3 million by 2035. This decade-long growth represents an absolute increase of USD 993.0 million, translating to a total growth of 70.8% and positioning the market for 1.71X expansion during the forecast period.

The first half of the decade will witness foundational growth as the market expands from USD 1,402.3 million to USD 1,832.8 million by 2030, adding USD 430.5 million in value. This initial phase, representing 43.3% of the total decade growth, will be characterized by the increasing adoption of precision control systems across industrial automation, advancements in automotive electronics, and trends in medical device miniaturization. Manufacturing facilities will invest in automated production lines while electronic device manufacturers integrate more sophisticated analog control components.

The latter half will witness accelerated expansion as the market surges from USD 1,832.8 million to USD 2,395.3 million, contributing USD 562.5 million and accounting for 56.7% of the decade's growth. This acceleration phase will be driven by 5G technology deployment requiring precision frequency control, electric vehicle market expansion demanding accurate sensor systems, and aerospace applications advancing toward more sophisticated flight control mechanisms. The technology maturation and cost reduction achieved in the first half will enable broader market penetration in the second phase.

This growth trajectory signals fundamental shifts in precision electronics applications, positioning analog potentiometers as critical components for next-generation control systems rather than legacy electronic elements. Market participants must prepare for accelerating demand while maintaining precision manufacturing capabilities across diverse industrial applications.

The evolution of the precision analog potentiometer market unfolds across two distinct growth phases, each characterized by unique technological adoption patterns and application expansion drivers. The initial consolidation phase, spanning 2025-2030, focuses on integrating industrial automation and advancing automotive electronics, while the subsequent acceleration phase, from 2030-2035, emphasizes the development of advanced sensor applications and next-generation control systems.

During the first growth period, from 2025 to 2030, the market will establish technological foundations, generating USD 430.5 million in added value, which represents 43.3% of the decade's total expansion. This phase focuses on the adoption of manufacturing automation, integration of electric vehicles, and the trend of miniaturizing medical devices. Market participants will concentrate on developing precision manufacturing capabilities, establishing quality standards, and building supply chain relationships with OEM customers. Competitive positioning during this period will be determined by manufacturing consistency, precision tolerances, and cost-effectiveness across high-volume applications.

The transformation accelerates dramatically in the second phase from 2030 to 2035, with market value increasing by USD 562.5 million, constituting 56.7% of total decade growth. This acceleration phase will witness the advancement of aerospace applications, the deployment of 5G infrastructure, and the integration of sophisticated industrial control systems. The market will benefit from established manufacturing processes, proven reliability records, and widespread industry acceptance achieved during the foundational phase. Competitive advantages will shift toward specialized precision capabilities, advanced materials integration, and application-specific engineering solutions.

The market maturation follows established patterns of electronics component adoption, with initial cautious integration followed by rapid scaling once reliability and performance are demonstrated. This phased growth pattern suggests market participants should prepare for accelerating demand while maintaining precision manufacturing quality and developing specialized application expertise across diverse industry segments.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 1,402.3 million |

| Market Forecast (2035) ↑ | USD 2,395.3 million |

| Growth Rate ★ | 5.5% CAGR |

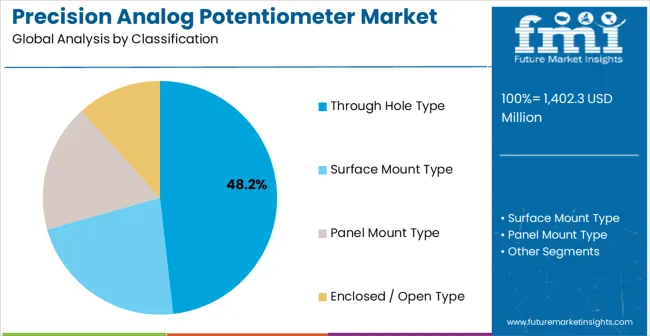

| Leading Classification → | Through Hole Type |

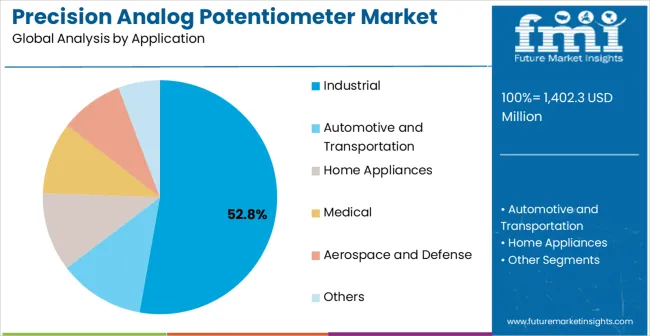

| Primary Application→ | Industrial |

The precision analog potentiometer market exhibits consistent growth momentum, driven by the expansion of industrial automation, advancements in automotive electronics, and the increasing demand for precision control systems across various applications. The evolution of technology in manufacturing processes, combined with proven reliability in critical applications, positions precision potentiometers as essential components for next-generation control systems. Market dynamics favor manufacturers with consistent precision capabilities and comprehensive application expertise that can serve demanding industrial, automotive, and aerospace customers while maintaining cost competitiveness.

Market expansion rests on three fundamental shifts:

The growth faces headwinds from digital control system competition that offers programmable flexibility, cost pressures from manufacturers seeking cheaper alternatives to precision components, and supply chain complexity for specialized materials required in high-precision potentiometer construction that may limit availability during peak demand periods.

Market Taxonomy Structure:

Primary Classification: Mounting Type

Secondary Breakdown: Application Categories

Geographic Distribution: Regional Markets

The market segmentation reflects diverse precision potentiometer applications, ranging from high-volume consumer electronics to specialized industrial control systems. Each segment serves distinct precision requirements while contributing to market growth through specialized applications and technology advancement.

Market Position: Through-hole potentiometers continue to dominate the precision analog potentiometer market due to their unmatched mechanical stability, robust electrical connections, and proven reliability across demanding applications. This mounting technology involves inserting component leads through pre-drilled PCB holes and soldering them securely, providing a strong mechanical anchor that is resistant to vibration, thermal stress, and mechanical shock. Through-hole potentiometers are widely preferred in industrial machinery, automotive systems, aerospace instruments, and medical devices, where reliability and long-term performance are essential. The segment’s leadership is supported by the trust manufacturers place in its ability to deliver consistent performance under harsh environmental conditions, making it the go-to choice for safety-critical systems and high-reliability applications.

Value Drivers: The primary drivers of market adoption for through-hole potentiometers are their mechanical and electrical advantages. Strong PCB attachment ensures stable connections even in vibration-heavy industrial and automotive environments. Excellent heat dissipation and mechanical stability make them suitable for high-power and high-current applications, where other mounting types may fail. These features also contribute to long-term operational reliability, minimizing maintenance requirements and ensuring consistent analog performance over extended usage periods. Their design versatility allows integration into diverse applications, from precision industrial controls to automotive throttle and steering sensors.

Competitive Advantages: Through-hole potentiometers offer several advantages over surface-mount and other mounting types. They are easier to repair or replace, support higher current handling, and offer superior mechanical robustness for applications subjected to shocks, vibrations, or thermal fluctuations. These characteristics ensure reliable operation in mission-critical systems, industrial machinery, and automotive environments where failure can have significant consequences.

Challenge Considerations: Despite their advantages, through-hole potentiometers face certain limitations. They require more PCB space, have higher assembly complexity compared to surface-mount options, and are often costlier in high-volume production. Manufacturers increasingly face pressure to adopt miniaturized solutions, which may constrain through-hole adoption in compact electronics. Nevertheless, the segment remains strong in applications prioritizing durability, reliability, and operational stability.

Strategic Importance: Industrial applications represent the largest adoption segment for precision analog potentiometers due to the extensive automation requirements, complex process control needs, and machinery calibration demands prevalent in modern manufacturing facilities. Industrial systems often rely on continuous analog control for motor speed regulation, valve positioning, conveyor adjustments, and process parameter tuning, tasks that require precision and smooth adjustments that digital systems may not fully replicate. The ability of precision potentiometers to provide infinite, fine-tuned adjustments makes them indispensable for optimizing production efficiency, reducing operational errors, and maintaining consistent quality across automated manufacturing processes.

Why Dominant? Precision analog potentiometers dominate industrial applications because they enable seamless and continuous adjustment, which is critical for maintaining process accuracy. In robotics, CNC machinery, packaging equipment, and industrial motor controllers, these components provide reliable feedback and allow operators to fine-tune systems to exact specifications. Unlike digital alternatives, potentiometers offer smooth, incremental control that is essential in applications where precision directly impacts product quality, safety, and operational efficiency.

What Drives Adoption? Several factors drive the adoption of industrial potentiometers. Increasing manufacturing automation, stringent quality control standards, and the demand for process optimization create a need for precise analog components. Established suppliers offering proven reliability, technical support, and cost-effective solutions further accelerate adoption. The segment also benefits from industrial trends such as robotics integration, smart factory initiatives, and real-time monitoring, all of which require reliable and accurate analog control mechanisms.

Where is Growth? The primary growth areas for industrial potentiometers lie in automated manufacturing lines, robotic systems, and sophisticated process control applications. As factories adopt Industry 4.0 technologies and emphasize operational efficiency, the demand for analog components capable of providing smooth, reliable adjustments is expected to increase steadily.

Forward-Looking Implications: The industrial potentiometer market is poised for continued growth as manufacturers prioritize automation, precision control, and operational efficiency. Analog systems will remain essential in applications where smooth and continuous adjustment offers tangible advantages over digital-only alternatives, ensuring the segment retains its dominance in industrial adoption.

Current Position → Growth Catalysts: Automotive potentiometers represent a rapidly growing segment due to emerging opportunities in electric vehicle (EV) adoption, advanced driver-assistance systems (ADAS), and increasing integration of electronic control units (ECUs). These applications demand precise position sensing, accurate feedback, and smooth analog control for throttle systems, steering mechanisms, braking controls, and battery management. As vehicles become more electrified and automated, potentiometers provide reliable analog signals that are critical for safety, performance, and operational efficiency. The increasing complexity of automotive systems also drives the need for high-quality, robust potentiometers that can withstand vibrations, temperature fluctuations, and long operational cycles.

Market Trajectory: The segment demonstrates strong growth potential driven by trends such as vehicle electrification, autonomous driving development, and integration of advanced safety systems. Throttle position sensing, steering angle detection, and battery management systems are some of the key applications where precision potentiometers are crucial. Their ability to deliver smooth and continuous analog feedback gives automotive designers and engineers flexibility to optimize vehicle performance and safety parameters, especially in next-generation EVs and autonomous vehicles.

Future Outlook: Adoption will accelerate as automotive manufacturers increasingly implement electronic control systems across their vehicles. The move toward electric and autonomous vehicles necessitates highly reliable, precise, and durable potentiometers for motor control, energy management, and safety-critical subsystems. Growth is expected across both passenger and commercial vehicle segments, reflecting the broader trend toward smarter, safer, and more energy-efficient transportation.

Opportunities: The expansion of the electric vehicle market, deployment of ADAS features, and electronic safety integration present substantial opportunities for precision analog potentiometers. These components enable consistent, real-time feedback essential for safety, energy optimization, and vehicle performance. Automotive suppliers focusing on reliability and high-precision analog control will be well-positioned to capture market share in this growing segment.

Risks: Challenges include competition from digital sensors offering cost-effective alternatives, pressure to reduce manufacturing costs, and industry consolidation, which may favor standardized digital solutions over specialized potentiometers. Manufacturers must balance precision and cost-efficiency to maintain adoption in high-value applications.

Market Context: Surface-mount potentiometers (SMD potentiometers) have gained significant traction in the precision analog potentiometer market due to the increasing need for miniaturization and high-density PCB layouts in modern electronics. Unlike through-hole components, surface-mount potentiometers can be directly mounted onto PCB surfaces, enabling more compact circuit designs and efficient use of board space. This mounting type is particularly favored in consumer electronics, telecommunications, portable medical devices, wearables, and IoT applications, where small form factors and lightweight designs are critical. Their adoption aligns with the industry-wide trend toward miniaturization and high-volume automated manufacturing, making SMD potentiometers a preferred choice for cost-conscious and space-constrained applications.

Appeal Factors: The compact form factor of surface-mount potentiometers allows for high-density PCB layouts, supporting modern electronic designs where every millimeter of board space is valuable. Automated assembly compatibility reduces labor costs and enhances production efficiency, making SMD types ideal for high-volume manufacturing. Their space efficiency makes them highly suitable for portable devices, while cost advantages achieved through automated processes further reinforce their appeal in consumer electronics and large-scale industrial applications.

Growth Drivers: The growth of the surface-mount segment is driven by the proliferation of consumer electronics, miniaturization trends, and the increasing emphasis on automated high-volume production. Market adoption is also influenced by cost reduction pressures, as manufacturers seek components that optimize both performance and production efficiency. With the rising demand for compact, lightweight, and reliable analog components, the surface-mount segment is well-positioned for steady expansion.

Market Challenges: Despite its advantages, the surface-mount segment faces limitations such as lower mechanical stability compared to through-hole alternatives and limited power-handling capabilities, making it less suitable for vibration-prone or high-power applications. In low power and compact design applications, its benefits outweigh the challenges.

Growth Accelerators: The precision analog potentiometer market is being strongly driven by several interrelated factors across industrial, automotive, medical, and consumer electronics sectors. Industrial automation is a major growth accelerator, as modern manufacturing processes increasingly rely on precise analog adjustments for motor speed regulation, valve positioning, robotic system integration, and quality control optimization. Potentiometers provide the fine-tuned control required to achieve operational efficiency and minimize errors in automated production lines.

In the automotive sector, the rapid advancement of vehicle electronics, including electric powertrains, advanced driver-assistance systems (ADAS), and electronic control units (ECUs), has created significant demand for position sensing, throttle control, steering feedback, and battery management applications that require reliable analog output. Medical device innovation also contributes to market growth, as precision calibration, measurement, and control functions increasingly depend on analog components for accurate operation in diagnostics, monitoring, and treatment equipment. Technology miniaturization trends facilitate the integration of potentiometers into compact devices, wearables, and IoT systems without compromising precision performance, opening up further adoption opportunities in consumer electronics.

Growth Inhibitors: Despite strong demand, several factors constrain market expansion. Competition from digital control systems is a significant challenge, as programmable alternatives, integrated circuits, and multifunction devices offer flexibility, reduced size, and lower cost. Cost pressures in manufacturing also impact adoption, particularly in price-sensitive segments, limiting the uptake of high-precision potentiometers. Supply chain complexities, including dependence on specialized materials and precise manufacturing processes, can restrict production capacity during periods of peak demand, increasing lead times and costs. Compliance with environmental and safety regulations in different regions adds complexity and cost to production, affecting manufacturers’ ability to offer competitively priced products globally.

Market Evolution Patterns: The market is evolving through diversification and technological integration. Adoption is expanding into emerging sectors such as renewable energy systems, smart grids, and advanced industrial equipment that require precise analog control. Manufacturers are introducing specialized potentiometer variants with enhanced environmental resistance, extended temperature tolerance, and improved durability for harsh operating conditions. Industry consolidation allows leading suppliers to offer comprehensive solutions with high quality and cost competitiveness, catering to a broader range of applications while maintaining performance standards. These trends highlight a market moving toward more specialized, resilient, and technologically integrated solutions, ensuring potentiometers remain relevant in modern analog control applications.

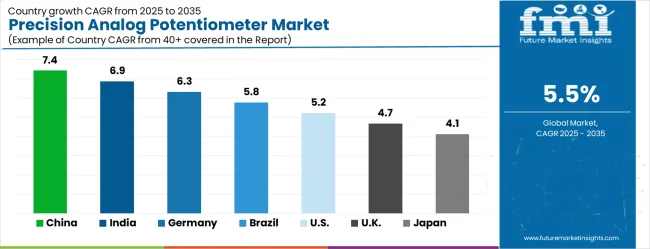

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

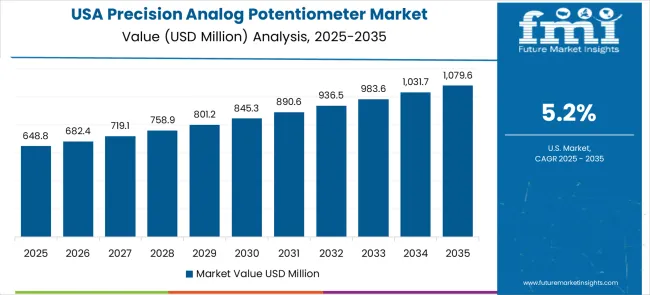

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The global precision analog potentiometer market demonstrates diverse growth patterns across key geographic regions, with Growth Leaders including China and India driving expansion through manufacturing automation and electronics production growth, while Steady Performers such as Germany, Brazil, and the United States provide market stability through established industrial applications and automotive electronics integration. Emerging Markets across Asia-Pacific region contribute volume growth through manufacturing expansion and technology adoption.

Regional synthesis reveals concentrated growth in manufacturing-intensive economies where industrial automation and electronics production create demand for precision components, while developed markets emphasize application sophistication and technology advancement that support premium product positioning and specialized application development.

The precision analog potentiometer market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by industrial automation, automotive electronics, and expanding consumer electronics production. China’s strong manufacturing base supports large-scale deployment of potentiometers across robotics, machinery, and control panels. Automotive OEMs are incorporating precision potentiometers in throttle control, steering systems, and infotainment units, supported by the growth of EV manufacturing hubs.

In consumer electronics, potentiometers are used in audio devices, home appliances, and smart systems, benefiting from high-volume domestic demand. Government initiatives promoting smart factories and advanced sensor adoption in Industry 4.0 projects further strengthen opportunities. Local players dominate the low-to-mid segment, while global suppliers capture demand for high-precision, long-lifecycle components. With a focus on miniaturization and improved accuracy, China will remain the largest and most competitive market during the forecast period.

Strategic Market Indicators:

India precision analog potentiometer market is anticipated to grow at a CAGR of 6.9% between 2025 and 2035, supported by infrastructure development, automotive expansion, and increased adoption in electronics manufacturing. Electronics manufacturing expansion in Mumbai, Bangalore, and Chennai accelerates precision potentiometer adoption across automotive electronics, industrial automation, and consumer device production that serves both domestic and export markets. The country's growing manufacturing capabilities combined with cost advantages create opportunities for precision component production and consumption. Government electronics manufacturing initiatives support industry development while creating favorable conditions for component suppliers and electronics manufacturers requiring precision analog components.

Manufacturing infrastructure development and technical capability advancement position India as an emerging hub for electronics production while domestic market expansion creates additional consumption opportunities. The country's focus on automotive electronics, industrial automation, and export manufacturing drives demand for reliable, cost-effective precision components that meet international quality standards.

Strategic Market Indicators:

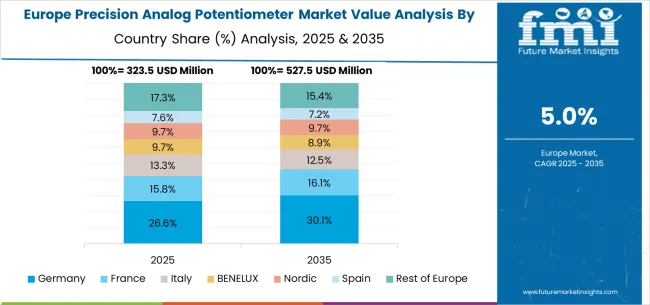

Germany precision analog potentiometer market is forecasted to expand at a CAGR of 6.3% from 2025 to 2035, supported by strong demand from industrial automation, automotive engineering, and renewable energy systems. As Europe’s manufacturing hub, Germany’s advanced robotics and machinery sectors rely on potentiometers for motion control, measurement, and calibration. Automotive applications remain significant, with premium carmakers such as BMW, Audi, and Mercedes-Benz using precision potentiometers in electronic steering, sensor modules, and control systems.

The country’s leadership in renewable energy has also expanded demand for potentiometers in wind turbine systems, solar tracking devices, and grid monitoring applications. German buyers prioritize high precision, durability, and compliance with EU quality standards, creating opportunities for established European suppliers. Lifecycle reliability is a strong purchasing criteria, while digital integration in Industry 4.0 projects continues to accelerate market growth.

Market Intelligence Brief:

Brazil precision analog potentiometer market is expected to grow at a CAGR of 5.8% between 2025 and 2035, driven by industrial modernization, automotive assembly, and increasing consumer electronics penetration. Brazil’s expanding automotive sector, particularly flexible-fuel vehicle manufacturing, integrates potentiometers into throttle controls, ignition systems, and dashboard electronics. Industrial usage is also growing, as more companies adopt automation and robotics in mining, agriculture, and food processing. The rise of consumer electronics and appliances has further boosted domestic demand, though imports from the USA, China, and Europe dominate higher-precision categories. Price remains a critical factor, with local manufacturers catering to cost-sensitive buyers, while multinational suppliers focus on premium solutions. Digitalization initiatives and industrial efficiency programs are expected to further increase demand in process industries. Brazil offers consistent, albeit moderate, growth opportunities due to its expanding middle class and manufacturing upgrades.

Strategic Market Considerations:

The USA precision analog potentiometer market is projected to grow at a CAGR of 5.2% from 2025 to 2035, shaped by advanced industrial automation, aerospace and defense applications, and strong automotive innovation. USA manufacturers prioritize high-reliability potentiometers for defense systems, avionics, and aerospace applications where accuracy is critical. The market also benefits from industrial robotics and automation systems widely deployed in production facilities.

The EV boom has added further momentum, with potentiometers integrated into electric drivetrains, battery systems, and infotainment controls. Consumer electronics and smart home applications also support incremental growth, though miniaturized and digital alternatives are gradually replacing traditional designs. Major USA suppliers emphasize innovation in precision, durability, and hybrid potentiometer technologies to remain competitive.

Technology innovation leadership and advanced application development create opportunities for specialized precision component suppliers who can meet demanding technical requirements and regulatory standards. The market emphasizes quality, reliability, and technical support rather than cost competition.

Performance Metrics:

The UK precision analog potentiometer market is forecasted to expand at a CAGR of 4.7% between 2025 and 2035, supported by the country’s industrial automation, automotive, and defense sectors. Potentiometers are widely used in aerospace electronics, a segment where the UK holds strong global competitiveness. Automotive adoption is also growing, particularly in electric and hybrid vehicles where precision control systems are critical. In addition, industrial automation in manufacturing and healthcare equipment applications is creating new opportunities. Consumer electronics usage is relatively moderate compared to Germany or China but continues to expand, particularly for audio devices and appliances.

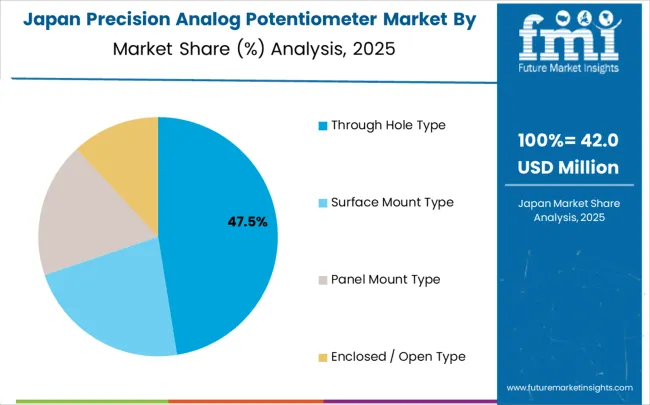

Japan’s precision analog potentiometer market is anticipated to grow at a CAGR of 4.1% from 2025 to 2035, driven by the nation’s electronics, robotics, and automotive industries. Potentiometers are widely used in robotics, motion control, and automation systems that form the backbone of Japan’s advanced manufacturing ecosystem. Automotive applications, particularly in hybrid and EV segments, create demand in control systems, dashboards, and power electronics. The consumer electronics sector, with leading brands in audio equipment, gaming, and appliances, also contributes significantly. Japan’s market is highly competitive, with a strong preference for miniaturized, precise, and long-lasting components. Local companies emphasize R&D and often set global benchmarks for precision and durability.

Technology leadership in automotive electronics and precision manufacturing creates opportunities for advanced component development while quality standards drive supplier selection and long-term relationships.

Current Market Observations:

The European precision analog potentiometer market demonstrates sophisticated development patterns with advanced automotive integration across Germany's automotive corridor, precision manufacturing excellence in Nordic countries including Sweden and Denmark, and technology innovation leadership in Switzerland and Netherlands that creates comprehensive demand for high-quality precision components. Regional market integration enables standardized quality requirements, shared technology development, and coordinated supply chain management that supports component suppliers serving diverse European applications.

Market maturity varies across European regions, with Western European markets providing technology leadership and quality standards while Eastern European markets contribute manufacturing capacity and cost competitiveness that support regional market development. The European Union's automotive regulations, industrial standards, and technology advancement initiatives create favorable conditions for precision component suppliers who can meet demanding quality requirements and environmental standards.

Advanced European markets contribute automotive innovation, precision manufacturing expertise, and quality standards that benefit broader regional component adoption, while emerging European markets provide manufacturing capabilities and market growth that support industry development across diverse application requirements and customer segments.

In Japan, the precision analog potentiometer market is largely driven by through hole mounting types, which account for 62% of total market revenues in 2025. The emphasis on reliability and mechanical stability in domestic automotive and industrial applications, combined with quality standards requiring robust electrical connections, a key contributing factor. Surface mount types follow with a 28% share, primarily in consumer electronics applications that integrate space-efficient designs with automated manufacturing processes. Panel mount variants contribute 10% as specialized industrial applications requiring user adjustment access continue to develop.

Market Characteristics:

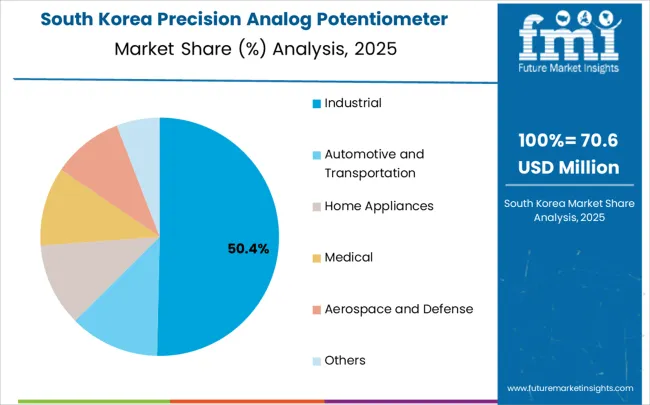

In South Korea, the market is expected to remain dominated by industrial applications, which hold a 58% share in 2025. These applications typically serve manufacturing automation, process control systems, and quality assurance equipment where precision analog adjustment provides operational advantages over digital alternatives. Automotive applications and consumer electronics each hold 22% and 20% market shares respectively, with rising integration of precision control systems across diverse electronic applications. Medical and aerospace applications account for emerging opportunities as technology sophistication increases.

Channel Insights:

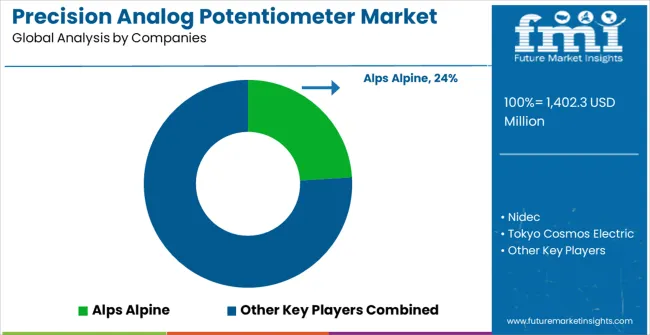

The precision analog potentiometer market operates with moderate concentration among established electronic component manufacturers, specialized precision control companies, and integrated circuit suppliers who compete primarily on precision tolerances, reliability standards, and application expertise rather than price-based strategies. Market structure includes approximately 20-25 meaningful global players, with moderate concentration as the top 6 companies control roughly 45-50% of total market value through comprehensive product portfolios and established customer relationships.

Tier 1 Leaders including Alps Alpine, Bourns, and Panasonic leverage comprehensive product portfolios, advanced manufacturing capabilities, and established distribution networks to maintain competitive advantages through proven quality consistency and broad application expertise. These market leaders benefit from economies of scale, extensive R&D capabilities, and a global manufacturing presence that ensures reliable supply and technical support across diverse customer requirements.

Tier 2 Challengers such as Vishay, TT Electronics, and Honeywell compete through specialized product offerings, technical innovation, and focused market segments that emphasize precision performance and reliability advantages. These companies provide differentiated value through application-specific solutions, advanced materials, and specialized engineering expertise that serve demanding industrial and automotive applications.

Tier 3 Specialists including regional manufacturers and niche suppliers focus on specific applications, custom solutions, and regional market service that provide competitive advantages through specialized expertise, responsive customer service, and cost-effective solutions for specific market segments. Competition increasingly centers on precision manufacturing capabilities, quality consistency, and technical support that enable customers to achieve performance objectives while maintaining cost competitiveness.

The competitive landscape favors companies with established precision manufacturing expertise, proven quality systems, and comprehensive technical support capabilities rather than new entrants facing significant barriers including precision manufacturing requirements, quality certification processes, and customer relationship development across demanding industrial applications.

Precision analog potentiometers serve as critical components in industrial automation, automotive electronics, and precision control systems where smooth, continuous analog adjustment capabilities cannot be replicated by digital alternatives. With the market projected to grow from USD 1.40 billion in 2025 to USD 2.40 billion by 2035 at a 5.5% CAGR, scaling adoption requires coordinated action across government standards bodies, industry associations, component manufacturers, system integrators, and financial partners to address precision manufacturing requirements, application-specific customization needs, and cost optimization pressures across through-hole, surface-mount, and specialized mounting configurations.

How Governments Could Strengthen Standards Infrastructure and Manufacturing Excellence?

Technical Standards and Measurement Infrastructure: Establish national metrology institutes and precision measurement laboratories that develop standardized testing protocols for potentiometer accuracy, linearity, and reliability specifications, while creating certification programs that validate component performance across temperature ranges, vibration resistance, and electrical characteristics required for critical applications.

Manufacturing Technology Investment: Fund advanced manufacturing research programs focused on precision machining, materials science, and quality control systems that enable domestic production of high-precision potentiometers, while supporting technology transfer initiatives that help manufacturers adopt automated production techniques and statistical process control methodologies.

Industry Certification and Quality Programs: Develop comprehensive quality certification frameworks that establish performance standards for precision potentiometers used in safety-critical applications, while creating accreditation programs for testing laboratories and manufacturing facilities that ensure consistent quality and reliability across domestic and international supply chains.

Research and Development Support: Provide grants and tax incentives for companies developing advanced potentiometer technologies including enhanced environmental resistance, extended operational life, and miniaturization capabilities, while supporting university research programs that advance materials science, manufacturing processes, and application engineering expertise.

Export Promotion and Market Access: Create trade promotion programs that help domestic potentiometer manufacturers access international markets through technical assistance, regulatory guidance, and certification support, while negotiating mutual recognition agreements that reduce testing and certification barriers for precision electronic components.

How Industry Associations Could Advance Technical Excellence and Market Development?

Precision Standards and Test Methods: Establish comprehensive technical standards that define performance specifications, testing protocols, and quality requirements for precision potentiometers across industrial, automotive, and aerospace applications, while creating standardized measurement procedures that ensure consistent performance evaluation and supplier comparison capabilities.

Professional Training and Certification: Develop specialized training programs that educate engineers, technicians, and quality personnel in potentiometer selection, application design, and reliability testing, while establishing certification programs that validate technical competency in precision component integration and performance optimization.

Technology Roadmap Development: Create industry-wide technology roadmaps that identify emerging application requirements, performance targets, and manufacturing innovations needed for next-generation potentiometer applications, while coordinating research initiatives that address common technical challenges across multiple industry segments.

Supply Chain Optimization and Risk Management: Facilitate supply chain coordination among potentiometer manufacturers, raw material suppliers, and end-user industries to ensure reliable component availability, while developing risk mitigation strategies that address supply disruptions, quality issues, and technology obsolescence concerns.

Market Intelligence and Application Development: Conduct comprehensive market research that identifies emerging application opportunities, competitive dynamics, and technology trends affecting potentiometer adoption, while promoting awareness of precision analog control advantages over digital alternatives in specific applications.

How Component Manufacturers Could Optimize Product Development and Market Position?

Precision Manufacturing Excellence: Invest in advanced manufacturing technologies including automated assembly systems, statistical process control, and comprehensive quality testing that ensure consistent precision performance across high-volume production, while developing specialized manufacturing capabilities for custom potentiometer configurations serving unique application requirements.

Application Engineering and Technical Support: Establish comprehensive application engineering capabilities that help customers optimize potentiometer selection, circuit design, and integration procedures, while providing technical support services including failure analysis, performance optimization, and reliability improvement guidance throughout the product lifecycle.

Product Portfolio Diversification: Develop specialized potentiometer variants optimized for specific applications including harsh environment resistance, extended temperature operation, and miniaturized form factors, while creating modular product platforms that enable cost-effective customization for diverse customer requirements and application specifications.

Supply Chain Integration and Quality Assurance: Build robust supply chains with qualified materials suppliers and implement comprehensive quality systems that ensure consistent component performance, while establishing supplier development programs that improve materials quality, delivery reliability, and cost competitiveness across global manufacturing operations.

Digital Integration and Smart Component Development: Incorporate digital monitoring capabilities, diagnostic features, and IoT connectivity into precision potentiometers to enable predictive maintenance and performance optimization, while developing digital tools that assist customers with component selection, circuit simulation, and reliability prediction.

How System Integrators Could Enhance Application Optimization and Customer Success?

System Design Optimization: Develop comprehensive design methodologies that optimize potentiometer integration into control systems, automation equipment, and precision instruments, while creating standardized design libraries and simulation tools that accelerate product development and reduce integration risks for customers.

Application Testing and Validation: Establish specialized testing facilities that validate potentiometer performance in real-world operating conditions, while providing comprehensive testing services that demonstrate component reliability, environmental resistance, and long-term stability across diverse application requirements and operating environments.

Customer Training and Support Services: Provide technical training programs that educate customers in optimal potentiometer selection, installation procedures, and maintenance practices, while offering ongoing support services including troubleshooting assistance, performance optimization, and upgrade consulting throughout the equipment lifecycle.

Integration Platform Development: Create standardized integration platforms and software tools that simplify potentiometer integration into control systems and automation equipment, while developing modular hardware solutions that reduce custom engineering requirements and accelerate time-to-market for customer applications.

Performance Monitoring and Analytics: Deploy monitoring systems that track potentiometer performance in customer applications and provide predictive maintenance recommendations, while developing analytics capabilities that identify optimization opportunities and support continuous improvement initiatives across diverse application environments.

How Financial Enablers Could Support Technology Development and Market Expansion?

Technology Development Funding: Provide venture capital and development funding for companies advancing potentiometer technologies including materials science innovation, manufacturing process improvement, and application-specific product development, while supporting research partnerships between manufacturers and academic institutions focused on precision component advancement.

Manufacturing Infrastructure Investment: Finance advanced manufacturing facility development and equipment acquisition that enables high-precision potentiometer production at competitive costs, while supporting automation initiatives and quality system implementation that improve manufacturing efficiency and product consistency across global production networks.

Market Expansion and Customer Financing: Offer equipment financing and leasing programs that help customers acquire precision control systems incorporating advanced potentiometers, while providing working capital support for manufacturers expanding into new geographic markets and application segments requiring specialized product variants.

Supply Chain Development and Risk Management: Support supply chain development initiatives that improve materials availability and quality consistency, while providing risk management solutions including supply disruption insurance and performance guarantees that protect customer investments in precision potentiometer-based systems and applications.

Innovation Partnerships and Ecosystem Development: Finance collaborative development programs between potentiometer manufacturers, application developers, and end-user industries that accelerate technology advancement and market adoption, while supporting industry consortiums focused on standards development, technology roadmapping, and market expansion across emerging application opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,402.3 million |

| Mounting Type | Through hole type, surface mount type, panel mount type, enclosed/open type |

| Application | Industrial, automotive and transportation, home appliances, medical, aerospace and defense, others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Alps Alpine, Nidec, Tokyo Cosmos Electric, Bourns, Teikoku Tsushin Kogyo, Vishay, Sakae Tsushin Kogyo, Panasonic, TT Electronics, Honeywell, Megatron, CTS Corporation, ABB, TE Connectivity |

| Additional Attributes | Dollar sales by mounting type and precision specifications, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established component manufacturers and specialized suppliers, customer preferences for precision versus cost optimization, integration with automated manufacturing and quality control systems, innovations in materials technology and environmental resistance capabilities, and development of application-specific solutions with enhanced performance characteristics and reliability features. |

The global precision analog potentiometer market is estimated to be valued at USD 1,402.3 million in 2025.

The market size for the precision analog potentiometer market is projected to reach USD 2,395.3 million by 2035.

The precision analog potentiometer market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in precision analog potentiometer market are through hole type, surface mount type, panel mount type and enclosed / open type.

In terms of application, industrial segment to command 52.8% share in the precision analog potentiometer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA