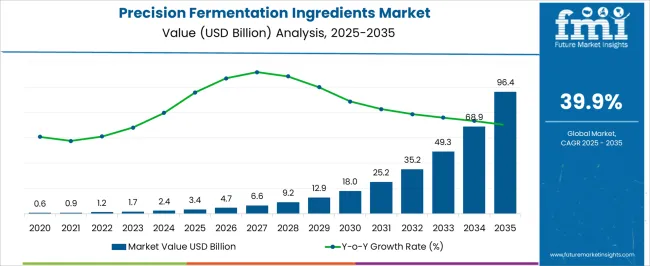

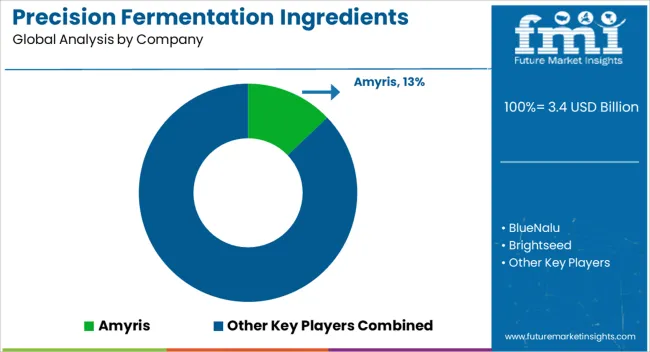

The precision fermentation ingredients market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 96.4 billion by 2035, registering a compound annual growth rate (CAGR) of 39.9% over the forecast period.

The precision fermentation ingredients market is set to reach USD 3.4 billion in 2025 and is projected to expand to USD 96.4 billion by 2035, registering a steep CAGR of 39.9%. The absolute dollar opportunity created during this period is USD 93.0 billion, showing how rapidly the market is expanding compared to its smaller 2020 base of USD 0.6 billion. Between 2025 and 2030 alone, the market adds nearly USD 9.5 billion, reaching USD 12.9 billion, highlighting the acceleration phase where revenue growth compounds sharply in a short span of time.

From 2030 to 2035, the market jumps from USD 12.9 billion to USD 96.4 billion, adding an absolute opportunity of USD 83.5 billion, which accounts for the majority of the value created over the forecast horizon. This dramatic scale-up indicates the transition from early adoption into mass acceptance across industries, supported by rising demand from food, pharmaceutical, and specialty ingredient segments. The overall trajectory reflects exponential expansion, with more than 28 times growth from 2025 to 2035. Absolute dollar opportunity here underscores the revenue pool expansion potential, making precision fermentation one of the highest-value emerging markets within the global ingredient ecosystem.

| Metric | Value |

|---|---|

| Precision Fermentation Ingredients Market Estimated Value in (2025 E) | USD 3.4 billion |

| Precision Fermentation Ingredients Market Forecast Value in (2035 F) | USD 96.4 billion |

| Forecast CAGR (2025 to 2035) | 39.9% |

The precision fermentation ingredients market, projected at USD 3.4 billion in 2025 and expanding to USD 96.4 billion by 2035 at a CAGR of 39.9%, sits within multiple high-growth parent markets. The broader biotechnology market accounts for nearly 25% of its influence, as fermentation-based processes are central to bio-based manufacturing. The food and beverage ingredients market represents about 20%, with applications in alternative proteins, dairy substitutes, and functional foods. The pharmaceutical ingredients market contributes nearly 15%, given the role of precision fermentation in drug formulations and APIs. The cosmetic and personal care market makes up close to 10%, where fermented actives and bio-based ingredients are gaining traction.

The industrial enzymes market accounts for around 12%, as fermentation-derived enzymes are critical in processing, textiles, and cleaning solutions. The animal nutrition and feed additives market holds approximately 8%, where protein-rich fermented ingredients provide alternatives to conventional inputs. The specialty chemicals segment influences about 5%, particularly in biodegradable solutions and green chemistry. Finally, the sustainable packaging and biomaterials sector contributes around 5%, where precision fermentation is used to develop novel polymers and coatings. Together, these parent markets reflect a highly diversified base, ensuring growth momentum spreads across food, pharma, chemicals, and materials, solidifying long-term demand.

The precision fermentation ingredients market is experiencing significant growth, driven by advancements in biotechnology, consumer demand for sustainable food sources, and the rising shift toward alternative proteins. Increasing concerns over environmental impact, resource efficiency, and ethical production methods are accelerating the adoption of precision fermentation as a scalable and cost-effective manufacturing approach.

This technology enables the production of high-value proteins, fats, and other functional ingredients with consistency and purity, reducing dependency on traditional agricultural supply chains. Strong investment activity from both established food companies and emerging start-ups is supporting research and commercialization efforts, leading to enhanced product diversity and competitive pricing.

Regulatory approvals for precision fermentation-derived ingredients in multiple regions are expanding market accessibility, while consumer awareness of clean-label and animal-free products is fostering demand With ongoing improvements in microbial strain engineering, fermentation efficiency, and downstream processing, the market is well-positioned for sustained expansion, offering new opportunities across the food, beverage, cosmetics, and nutraceutical industries over the coming decade.

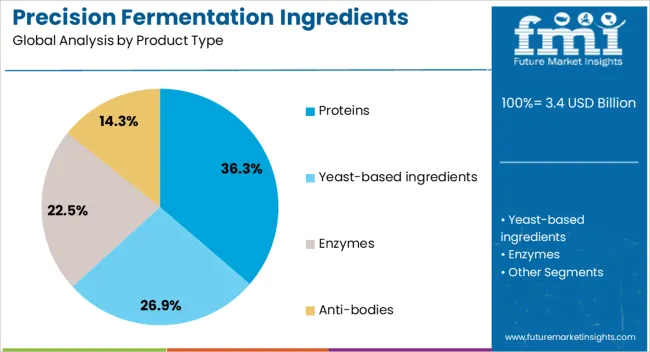

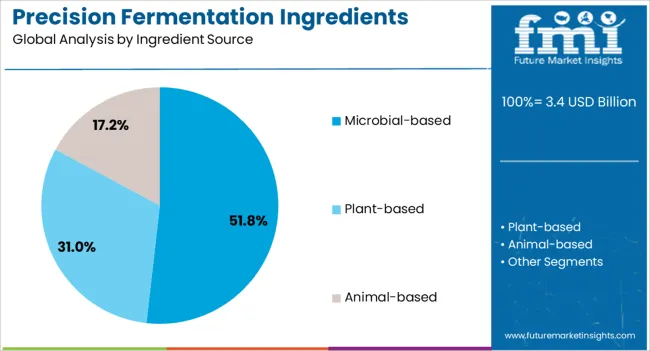

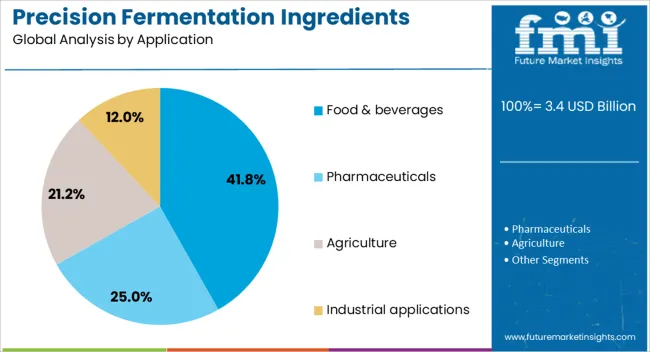

The precision fermentation ingredients market is segmented by product type, ingredient source, application, and geographic regions. By product type, precision fermentation ingredients market is divided into proteins, yeast-based ingredients, enzymes, and anti-bodies. In terms of ingredient source, precision fermentation ingredients market is classified into microbial-based, plant-based, and animal-based. Based on application, precision fermentation ingredients market is segmented into food & beverages, pharmaceuticals, agriculture, and industrial applications. Regionally, the precision fermentation ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The protein segment is projected to account for 36.3% of the precision fermentation ingredients market revenue share in 2025, making it the leading product type. This leadership is being driven by the rising global demand for sustainable and nutritionally rich protein alternatives, as consumers increasingly seek plant-based and animal-free options. Precision fermentation enables the production of proteins with high bioavailability, functional versatility, and consistent quality, addressing the limitations of conventional protein sources.

These proteins are being widely adopted in a range of applications, from meat and dairy alternatives to sports nutrition products, due to their ability to replicate texture, flavor, and nutritional profiles of traditional animal-derived proteins. Technological advancements in strain optimization and fermentation process control are reducing production costs and increasing output efficiency.

Additionally, growing investment from both food industry leaders and innovative start-ups is accelerating commercialization The segment’s position is further strengthened by the increasing acceptance of precision fermentation proteins among consumers, supported by clear labeling, sustainability messaging, and regulatory approvals in key global markets.

The microbial-based ingredient source segment is expected to hold 51.8% of the precision fermentation ingredients market revenue share in 2025, making it the dominant source category. Its leadership is attributed to the versatility, scalability, and cost-efficiency offered by microbial systems such as yeast, fungi, and bacteria for producing a wide variety of high-value ingredients. These microorganisms are capable of producing proteins, enzymes, fats, and other bioactive compounds with high precision and minimal resource requirements compared to traditional agriculture.

The segment benefits from continuous innovation in synthetic biology and metabolic engineering, enabling the customization of microbial strains for enhanced yield, stability, and functionality. Adoption is being further supported by the ability to operate at commercial scale in controlled fermentation facilities, ensuring consistent quality and compliance with safety standards.

With increasing demand from food, beverage, pharmaceutical, and cosmetic industries, microbial-based systems are emerging as the preferred choice for large-scale precision fermentation production Regulatory acceptance and growing consumer trust in fermentation-derived products are further driving this segment’s dominance in the market.

The food and beverages application segment is anticipated to capture 41.8% of the precision fermentation ingredients market revenue share in 2025, establishing itself as the leading application area. This dominance is being reinforced by the growing consumer shift toward sustainable, ethical, and clean-label food options. Precision fermentation-derived ingredients are enabling manufacturers to develop high-quality, animal-free alternatives to meat, dairy, and other traditional products without compromising taste, texture, or nutrition.

The segment is benefiting from the ability to integrate these ingredients seamlessly into a variety of food and beverage formulations, meeting the rising demand for plant-based and functional products. Strategic partnerships between ingredient developers and global food brands are accelerating the introduction of precision fermentation-based offerings into mainstream markets.

The adoption is further supported by increasing regulatory approvals, positive media coverage, and consumer education campaigns highlighting environmental benefits As sustainability remains a central driver in food innovation, the food and beverages segment is expected to maintain its leadership position, supported by expanding product portfolios and growing distribution networks worldwide.

The precision fermentation ingredients market is expanding rapidly as demand rises for sustainable proteins, dairy alternatives, and specialty food components. North America and Europe lead adoption due to strong investments in food-tech startups and regulatory support for alternative proteins. Asia-Pacific is emerging as a high-growth region, fueled by consumer interest in plant-based and animal-free products. Producers differentiate through scalability, cost efficiency, and functional performance. Regional differences in food regulations, consumer acceptance, and production capacity strongly shape competitiveness globally.

Precision fermentation is increasingly used to produce animal-free proteins, enzymes, and dairy ingredients. North America and Europe emphasize specialty products like casein, whey proteins, and egg substitutes that appeal to flexitarian and vegan consumers. Asia-Pacific markets adopt affordable protein ingredients suited to mass-market plant-based foods. Differences in dietary habits, consumer purchasing power, and food culture affect adoption levels and ingredient demand. Leading companies develop high-functionality proteins tailored for taste, texture, and nutritional equivalence, while regional players focus on scalable, cost-effective solutions. Rising demand for animal-free protein supports broad market expansion, positioning precision fermentation as a key enabler of next-generation food innovation.

The cost of fermentation infrastructure and scalability significantly influence adoption of precision fermentation ingredients. North America and Europe invest in advanced bioreactors and large-scale fermentation facilities to reduce production costs per unit. Asia-Pacific markets face cost barriers but benefit from growing investment in cost-efficient, mid-scale facilities. Differences in infrastructure maturity, capital availability, and operating efficiency impact pricing strategies and competitiveness. Leading producers pursue economies of scale, strain optimization, and process intensification, while regional players experiment with localized, modular fermentation systems. Balancing cost, efficiency, and scalability remains critical to expanding adoption and reaching price parity with conventional animal-derived ingredients.

Regulatory frameworks and consumer trust strongly affect precision fermentation ingredient adoption. North America and Europe maintain rigorous safety and labeling requirements under FDA and EFSA, creating structured but lengthy approval timelines. Asia-Pacific regulations are fragmented, with some markets allowing faster adoption and others limiting novel foods. Differences in transparency, labeling practices, and consumer perception of fermentation-derived ingredients influence trust and market penetration. Leading companies emphasize clear communication, safety validation, and sustainability claims to build credibility. Regulatory and acceptance contrasts shape adoption pace, investment flows, and competitive positioning across global food markets.

Precision fermentation ingredients are expanding into applications beyond food, including pharmaceuticals, cosmetics, and specialty chemicals. North America and Europe prioritize pharmaceutical-grade proteins, specialty enzymes, and cosmetic actives, supported by advanced R&D ecosystems. Asia-Pacific markets adopt cost-effective ingredients in personal care and nutraceuticals alongside emerging food applications. Differences in application focus, product quality standards, and end-user demand diversify market opportunities and influence production strategies. Leading suppliers invest in multi-purpose fermentation platforms that serve multiple industries, while regional players focus on affordable, application-specific ingredients. Broadening application areas enhance growth potential, market resilience, and competitive differentiation globally.

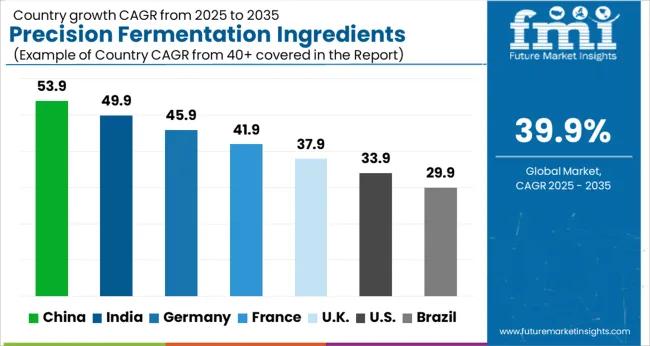

| Country | CAGR |

|---|---|

| China | 53.9% |

| India | 49.9% |

| Germany | 45.9% |

| France | 41.9% |

| UK | 37.9% |

| USA | 33.9% |

| Brazil | 29.9% |

The global precision fermentation ingredients market is projected to grow at a 39.9% CAGR through 2035, fueled by advancements in alternative proteins, sustainable food solutions, and biomanufacturing technologies. Among BRICS nations, China led with 53.9% growth as large-scale innovation and production facilities were scaled to meet demand for alternative proteins, while India at 49.9% expanded commercial adoption and investments in food-tech infrastructure. In the OECD region, Germany at 45.9% advanced regulated development under stringent EU food safety frameworks, while the United Kingdom at 37.9% accelerated innovation in startups and commercialization of next-gen protein products. The USA, growing at 33.9%, drove large-scale adoption supported by FDA regulatory oversight and venture-backed biomanufacturing initiatives. This report includes insights on 40+ countries; the top countries are shown here for reference.

The precision fermentation ingredients market in China is projected to grow at a CAGR of 53.9%, driven by rising demand for alternative proteins, functional food ingredients, and sustainable nutrition solutions. Adoption is being encouraged by ingredients that offer high purity, scalability, and consistent quality for food, beverage, and pharmaceutical applications. Manufacturers are being urged to develop cost effective, safe, and advanced fermentation processes. Distribution through food ingredient suppliers, research institutions, and industrial partners is being strengthened. Research in enzyme efficiency, strain optimization, and production yield improvement is being conducted. Increasing health awareness, dietary shifts toward plant based and cultured products, and government support for alternative protein initiatives are considered key factors driving the precision fermentation ingredients market in China.

In India, the precision fermentation ingredients market is expected to grow at a CAGR of 49.9%, supported by adoption in functional foods, beverages, and nutraceuticals. Emphasis is being placed on ingredients that provide consistent quality, safety, and high performance for industrial applications. Local manufacturers are being encouraged to enhance production capacity and reduce costs while maintaining international standards. Distribution through food ingredient suppliers, research laboratories, and industrial partners is being expanded. Awareness programs promoting health benefits and clean label nutrition are being conducted. Rising consumer interest in functional and sustainable nutrition, growing food processing industry, and supportive government policies are recognized as primary drivers of the precision fermentation ingredients market in India.

Germany is witnessing steady growth in the precision fermentation ingredients market at a CAGR of 45.9%, driven by demand for sustainable and high quality food ingredients in industrial and retail applications. Adoption is being encouraged by ingredients that offer high purity, traceability, and reliable performance. Manufacturers are being urged to introduce advanced fermentation technologies and maintain compliance with strict European standards. Distribution through food ingredient suppliers, industrial partners, and research institutions is being optimized. Research in process efficiency, strain improvement, and functional enhancements is being pursued. Consumer preference for alternative proteins, regulatory support for sustainable production, and increasing R&D initiatives are considered key factors driving the precision fermentation ingredients market in Germany.

The precision fermentation ingredients market in the United Kingdom is projected to grow at a CAGR of 37.9%, supported by rising consumer interest in alternative proteins and functional nutrition products. Adoption is being emphasized for ingredients that provide consistent performance, safety, and versatility for food, beverage, and supplement applications. Manufacturers are being encouraged to supply cost effective, high quality, and reliable ingredients. Distribution through ingredient suppliers, research labs, and industrial partners is being strengthened. Marketing campaigns highlighting sustainability and clean label benefits are being conducted. Growing health consciousness, dietary trends toward plant based and cultured foods, and expanding food innovation initiatives are recognized as major factors supporting the precision fermentation ingredients market in the United Kingdom.

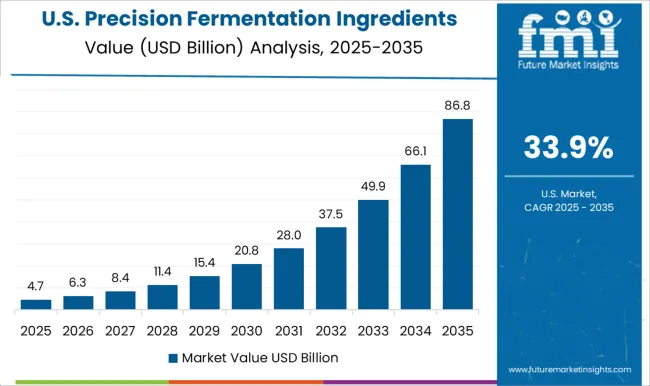

The precision fermentation ingredients market in the United States is projected to grow at a CAGR of 33.9%, driven by demand in functional foods, beverages, supplements, and industrial applications. Adoption is being encouraged by ingredients that ensure high purity, consistency, and scalability for mass production. Manufacturers are being urged to develop innovative fermentation solutions and improve cost efficiency. Distribution through ingredient suppliers, research institutions, and industrial partners is being maintained. Research in enzyme optimization, microbial strain development, and production yield enhancement is being pursued. Increasing health awareness, demand for sustainable protein alternatives, and regulatory support for novel food technologies are considered key drivers of the precision fermentation ingredients market in the United States.

The precision fermentation ingredients market is dominated by innovative companies leveraging biotechnology to produce sustainable, high-quality ingredients for food, beverages, and nutraceuticals. Key suppliers in this market include Amyris, BlueNalu, Brightseed, Biomilq, Bolt Threads, Ginkgo Bioworks, Clara Foods, Conagen, Enzymaster, Impossible Foods, KnipBio, Lygos, Motif FoodWorks, Novozymes, and Perfect Day. These companies are at the forefront of creating alternative proteins, bioactive compounds, enzymes, and other functional ingredients that cater to the growing demand for sustainable and ethical products.

Market growth is driven by increasing consumer preference for plant-based and lab-grown alternatives, regulatory support for sustainable food technologies, and the need to reduce environmental impacts associated with conventional production methods. Companies such as Amyris and Ginkgo Bioworks have developed scalable fermentation platforms that allow for cost-effective production of proteins and specialty ingredients. Meanwhile, Perfect Day, Clara Foods, and Motif FoodWorks focus on dairy and egg protein alternatives, offering innovative solutions for food manufacturers seeking animal-free ingredients.

Bolt Threads and Brightseed are notable for their work on specialty bio-based compounds and nutraceuticals, adding diversity to the market’s offerings. Competition in the precision fermentation ingredients sector is heavily influenced by technological innovation, scalability, and product differentiation. Leading players invest significantly in research and development to optimize yield, improve efficiency, and develop proprietary strains or processes.

As a result, collaborations and partnerships are common to accelerate commercialization and expand product portfolios. With the global shift toward sustainable and functional food solutions, suppliers like Novozymes, Lygos, and Enzymaster are strategically positioned to meet the rising demand for bioengineered ingredients. The market continues to evolve as these top suppliers drive both technological advancement and sustainability in the food and biotechnology industries.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.4 billion |

| Product Type | Proteins, Yeast-based ingredients, Enzymes, and Anti-bodies |

| Ingredient Source | Microbial-based, Plant-based, and Animal-based |

| Application | Food & beverages, Pharmaceuticals, Agriculture, and Industrial applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amyris, BlueNalu, Brightseed, Biomilq, Bolt Threads, Ginkgo Bioworks, Clara Foods, Conagen, Enzymaster, Impossible Foods, KnipBio, Lygos, Motif FoodWorks, Novozymes, and Perfect Day |

| Additional Attributes | Dollar sales vary by ingredient type, including proteins, enzymes, fats, and specialty bioactives; by application, such as dairy alternatives, meat substitutes, nutraceuticals, and specialty foods; by end-use industry, spanning food & beverages, pharmaceuticals, and cosmetics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable proteins, vegan diets, and biotechnology advancements. |

The global precision fermentation ingredients market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the precision fermentation ingredients market is projected to reach USD 96.4 billion by 2035.

The precision fermentation ingredients market is expected to grow at a 39.9% CAGR between 2025 and 2035.

The key product types in precision fermentation ingredients market are proteins, yeast-based ingredients, enzymes and anti-bodies.

In terms of ingredient source, microbial-based segment to command 51.8% share in the precision fermentation ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA