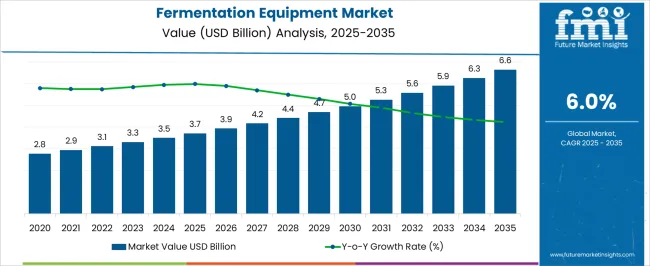

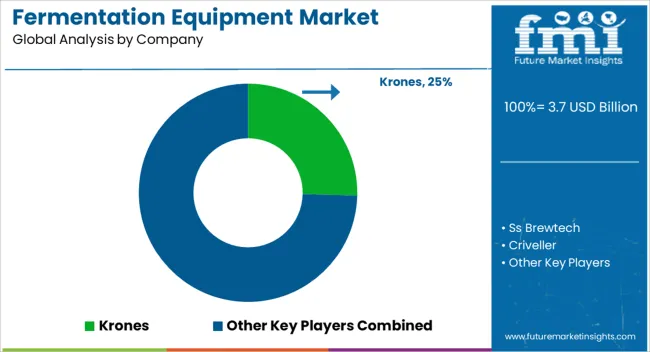

The Fermentation Equipment Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Fermentation Equipment Market Estimated Value in (2025 E) | USD 3.7 billion |

| Fermentation Equipment Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Fermentation Equipment market is being driven by increasing demand from industries such as food and beverage, pharmaceuticals and biotechnology where fermentation processes are essential for production efficiency and product innovation. In the current market environment, growing consumer preference for fermented food and beverages, along with rising investments in research and development activities, is creating substantial growth opportunities. Technological advancements in automation and process monitoring have enabled improved yield and consistency, which is influencing adoption across industries.

The rising need for high quality, safe, and efficient fermentation processes is encouraging manufacturers to adopt advanced equipment solutions. The future outlook is supported by the trend towards natural and plant based products, increased regulatory focus on food safety and traceability, and expansion of health focused product lines.

Continuous innovation in materials and equipment design is expected to further enhance process efficiency, reduce operational downtime, and increase scalability As global consumption patterns shift and industries invest in sustainable solutions, the market is expected to witness steady growth in the coming years.

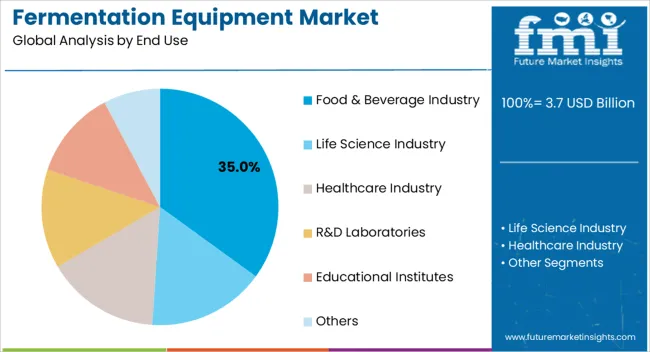

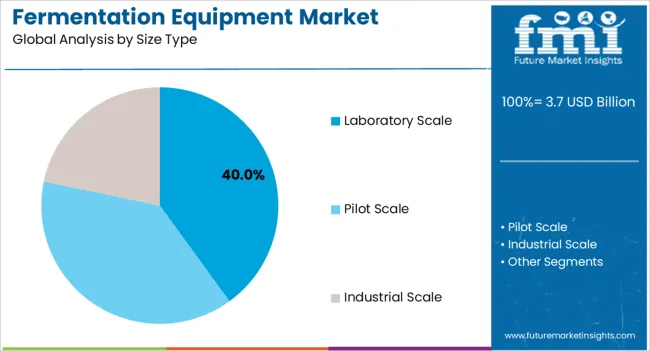

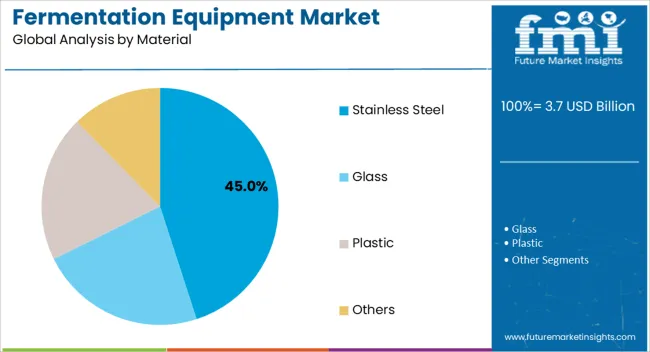

The fermentation equipment market is segmented by end use, size type, material, and geographic regions. By end use, fermentation equipment market is divided into Food & Beverage Industry, Life Science Industry, Healthcare Industry, R&D Laboratories, Educational Institutes, and Others. In terms of size type, fermentation equipment market is classified into Laboratory Scale, Pilot Scale, and Industrial Scale. Based on material, fermentation equipment market is segmented into Stainless Steel, Glass, Plastic, and Others. Regionally, the fermentation equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Food and Beverage Industry segment is projected to hold 35.00% of the revenue share in the Fermentation Equipment market in 2025, positioning it as the largest end use segment. This leadership is attributed to the increasing adoption of fermentation techniques in the production of functional foods, probiotics, dairy products, plant based beverages, and specialty ingredients. The segment’s growth has been supported by changing consumer preferences towards health and wellness, with fermented products being perceived as beneficial for digestive health and immune support.

The ability to use fermentation to enhance flavors, textures, and nutritional profiles has further encouraged manufacturers to invest in advanced fermentation equipment. Regulatory emphasis on food safety and traceability has driven the need for equipment that ensures consistency and hygiene across production lines.

Additionally, advancements in process control and scalability have enabled both small and large scale operations to benefit from improved yield and reduced contamination risks As consumer demand continues to rise, the Food and Beverage segment is expected to remain a key contributor to the market’s growth.

The Laboratory Scale segment is expected to account for 40.00% of the revenue share in the Fermentation Equipment market in 2025, making it the largest size type segment. The prominence of this segment is being driven by increasing research and development activities across pharmaceuticals, biotechnology, and academic institutions. Laboratory scale equipment is highly valued for its precision, flexibility, and ability to conduct controlled experiments, which are essential in product development and process optimization.

The segment has been supported by rising investments in pilot testing, quality assurance, and process validation before scaling up to industrial production. The ability to conduct trials at a smaller scale helps organizations reduce costs, minimize resource usage, and fine tune fermentation conditions to achieve desired results.

Furthermore, increasing demand for novel microbial strains and bio based ingredients has led to the development of specialized laboratory fermentation systems that offer real time monitoring and adaptive control As innovation continues to be a priority, laboratory scale equipment is expected to play a pivotal role in fostering breakthroughs and enhancing product formulations.

The Stainless Steel material segment is projected to hold 45.00% of the revenue share in the Fermentation Equipment market in 2025, making it the leading material type. The widespread adoption of stainless steel is being attributed to its corrosion resistance, durability, and ease of maintenance, which are critical in ensuring product safety and operational efficiency. In fermentation processes where hygiene and sterilization are paramount, stainless steel surfaces offer reliable protection against microbial contamination and chemical interactions.

The material’s ability to withstand high pressure, temperature fluctuations, and cleaning procedures has made it a preferred choice across food and beverage, pharmaceutical, and biotechnology sectors. Additionally, stainless steel fermentation equipment supports scalability, as it can be easily integrated into larger production systems without compromising structural integrity. With increasing regulatory scrutiny around safety and traceability, the use of stainless steel is being promoted to meet industry standards and certifications.

The demand for sustainable and long lasting equipment solutions is further strengthening its position, as companies seek materials that can ensure consistent performance over extended operational cycles while minimizing downtime and maintenance costs As industries focus on process optimization and compliance, stainless steel is expected to remain a dominant material choice.

Growing demand from the food and beverages industry, especially for a variety of wine, beer, and similar products, is fuelling the sales of fermentation equipment.

Fermentation is the process of metabolism in which raw materials such as carbohydrate or sugar are converted into gas, acid and alcohol. Micro-organisms such as yeast or bacteria play a vital role in the process of fermentation. Fermentation requires a substrate, a fermenter, an inoculum and favorable environmental conditions.

The equipment necessary during the fermentation process is known as a fermenter. These are complex machines used to create favorable conditions for the fermentation process.

Fermentation equipment must have a fermenter large enough to support the entire fermentation process. The material used for manufacturing of fermentation equipment must have a high tolerance to the pressure and gas generated during fermentation. Equipment must be made of non-corrosive material and should not react with the chemical used for fermentation.

It must have an outlet for CO2 and an inlet for O2 if aerobic microbes are used for fermentation.

Fermentation equipment must be sealed from outside to avoid contamination and must be sterilized. Vendors are offering extra features such as temperature controlling and facility to add an anti-foaming agent to attract customers. A key feature that fermentation equipment must offer is to provide an aseptic means of withdrawal of the fermented product and introduction of culture sample.

The major stages of fermentation are media formulation, inoculum preparation, sterilization of nutrient media, the actual fermentation process, recovery, purification and waste disposal.

Major types of fermentation equipment are laboratory scale fermentation equipment, pilot scale fermentation equipment, industrial-scale fermentation equipment and others.

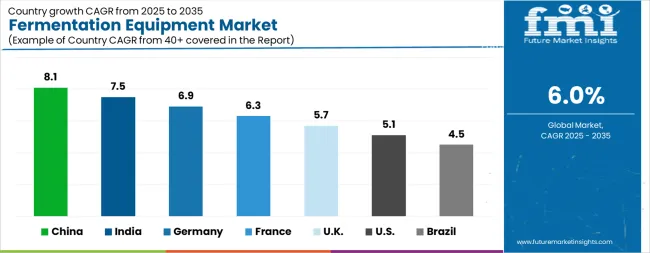

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The Fermentation Equipment Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Fermentation Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The USA Fermentation Equipment Market is estimated to be valued at USD 1.4 billion in 2025 and is anticipated to reach a valuation of USD 2.3 billion by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 192.0 million and USD 127.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| End Use | Food & Beverage Industry, Life Science Industry, Healthcare Industry, R&D Laboratories, Educational Institutes, and Others |

| Size Type | Laboratory Scale, Pilot Scale, and Industrial Scale |

| Material | Stainless Steel, Glass, Plastic, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Krones, Ss Brewtech, Criveller, JVNW, GW Kent, Brauhaus Technik Austria, Keg King, Kinnek, GEA, METO, and Hypro |

The global fermentation equipment market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the fermentation equipment market is projected to reach USD 6.6 billion by 2035.

The fermentation equipment market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in fermentation equipment market are food & beverage industry, life science industry, healthcare industry, r&d laboratories, educational institutes and others.

In terms of size type, laboratory scale segment to command 40.0% share in the fermentation equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Enhancers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermentation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Assessing Fermentation Chemicals Market Share & Industry Trends

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA