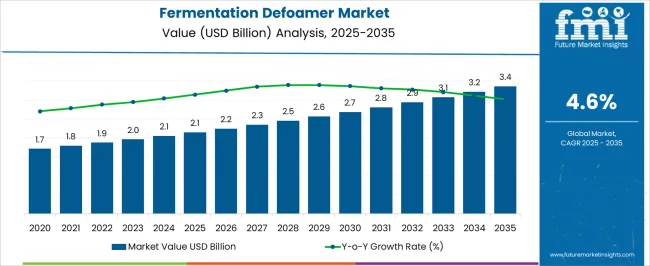

The fermentation defoamer market is anticipated to reach 2.1 billion USD in 2025 and is expected to reach 3.4 billion USD by 2035, advancing at a CAGR of 4.6%. The growth curve illustrates a steady upward slope rather than abrupt spikes, suggesting that expansion will be gradual yet sustainable. Early years of the forecast show moderate gains, moving from 1.7 to 2.1 billion USD, which indicates a foundation being built through consistent demand from food and beverage fermentation, pharmaceutical bioprocessing, and bioethanol production.

Momentum becomes more noticeable post-2029, with values climbing beyond 2.5 billion USD, driven by greater adoption of high-performance defoaming solutions in large-scale industrial fermentation tanks. Market sentiment points toward a scenario where companies investing in specialized silicone-based and non-silicone formulations may witness stronger competitive positioning. Regulatory pressure on maintaining cleaner fermentation processes and preventing foam-related contamination is shaping demand preferences, which in turn is influencing suppliers to innovate with eco-friendly and food-grade compliant options. While growth is not explosive, the trajectory shows resilience, suggesting that stakeholders focusing on niche applications and regional expansions could capture a significant share.

| Metric | Value |

|---|---|

| Fermentation Defoamer Market Estimated Value in (2025 E) | USD 2.1 billion |

| Fermentation Defoamer Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The fermentation defoamer market is shaped by five interconnected end-use markets that collectively account for the majority of consumption and revenue growth. The food and beverage fermentation market holds the largest share at 32%, as breweries, dairy processors, and yeast-based food manufacturers rely on defoamers to maintain product quality and avoid foam-induced inefficiencies. The pharmaceutical bioprocessing market contributes 27%, with defoamers applied in antibiotic, vaccine, and therapeutic protein production, where foam control safeguards purity and consistency. The bioethanol and biofuel production market accounts for 18%, driven by the scaling up of fermentation-based energy solutions that demand cost-effective foam suppression at industrial volumes.

The industrial enzymes market, representing 13%, depends on defoamers to optimize yields in large-scale enzyme production for detergents, textiles, and feed applications. The wastewater treatment fermentation segment contributes 10%, as foam control plays a role in improving operational stability of microbial processes used in sludge treatment and biogas generation. Together, food and beverage fermentation and pharmaceutical bioprocessing make up 59% of the market, which signals that consumer-driven industries remain the strongest anchors of demand.

The fermentation defoamer market is expanding steadily, driven by the rising demand for efficient foam control solutions in large-scale fermentation processes across diverse industries. Industrial production of food, beverages, pharmaceuticals, and bio-based chemicals relies heavily on maintaining optimal fermentation conditions, where excessive foam can disrupt productivity and product quality. Industry updates and manufacturing process reports have underscored the importance of specialized defoamers in reducing downtime, preventing contamination, and improving yield.

Silicone- and non-silicone-based formulations have evolved with enhanced dispersibility and thermal stability to meet the needs of high-intensity fermentation operations. The increasing scale of dairy, brewery, and biopharmaceutical production, alongside advancements in fermentation technology, is fueling product adoption.

Regulatory emphasis on food-grade and environmentally compliant additives is further shaping the market landscape. In the coming years, growth is expected to be led by silicone-based defoamers for their superior performance in challenging fermentation conditions and by dairy applications, where foam control is critical for both product consistency and operational efficiency.

The fermentation defoamer market is segmented by product, end-user, and geographic regions. By product, fermentation defoamer market is divided into Silicone based, Oil based, and Others. In terms of end-user, fermentation defoamer market is classified into Dairy, Alcoholic Beverages, Food Products, Pharmaceuticals, Chemicals, and Others. Regionally, the fermentation defoamer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The silicone based segment is projected to hold 46.8% of the fermentation defoamer market revenue in 2025, maintaining its lead due to its high efficiency in controlling foam under diverse processing conditions. These defoamers are valued for their chemical inertness, low surface tension, and long-lasting effectiveness, which allow them to function at low dosage rates while providing consistent foam suppression.

Process engineers in fermentation-intensive industries have favored silicone-based solutions for their ability to withstand high temperatures, variable pH levels, and prolonged fermentation cycles without degradation. Their compatibility with a wide range of fermentation media, coupled with low environmental reactivity, has further driven adoption.

Manufacturers have also invested in developing food-grade silicone defoamers that comply with stringent safety standards, expanding their suitability for dairy, brewing, and pharmaceutical applications. With ongoing innovation focused on dispersibility and sustainability, the silicone based segment is expected to retain its competitive advantage and continue leading the market.

The dairy segment is projected to contribute 34.5% of the fermentation defoamer market revenue in 2025, holding the top position among end-users due to the critical role of foam control in dairy-based fermentation processes. Foam formation during the production of products such as cheese, yogurt, and fermented milk beverages can hinder microbial activity, reduce fermentation efficiency, and affect final product quality.

Dairy processors have increasingly adopted specialized defoamers to maintain consistent fermentation rates and minimize production interruptions. Industry practices emphasize the use of food-safe, flavor-neutral defoamers that prevent off-taste development while ensuring regulatory compliance.

Additionally, rising global dairy consumption and the expansion of value-added dairy product lines have increased production volumes, amplifying the need for reliable foam control solutions. Investments in automated dairy processing systems have further supported the integration of defoamers into continuous production lines. These operational requirements are expected to keep the dairy segment at the forefront of end-user demand in the fermentation defoamer market.

The fermentation defoamer market is influenced by food and beverages, pharmaceuticals, biofuels, and regulatory compliance. These dynamics ensure gradual yet reliable growth across consumer and industrial applications.

The fermentation defoamer market is largely driven by the rising demand for processed foods and beverages. Foam generation during beer brewing, dairy fermentation, soy protein extraction, and yeast-based products creates significant inefficiencies if not controlled. The market has been influenced by breweries and dairy manufacturers shifting toward high-quality defoaming agents that comply with food safety standards. Foam prevention is not only viewed as a production requirement but also as a measure that improves yield, enhances product quality, and reduces downtime. The food and beverage segment has established itself as the largest contributor, and this dynamic is expected to continue with new product launches focused on plant-based beverages and functional food applications.

Biopharmaceutical manufacturing has emerged as a vital growth avenue for fermentation defoamers, as the production of antibiotics, vaccines, and therapeutic proteins requires strict foam suppression to prevent contamination. Foam-related issues in bioreactors can alter oxygen transfer, reduce yield, and compromise sterility. Pharmaceutical companies have been adopting silicone-based and food-grade defoamers that meet stringent regulatory requirements. The rising investment in biologics and cell-culture technologies is anticipated to expand usage, particularly in vaccine development and monoclonal antibody production. This shift underscores how pharmaceutical bioprocessing has created an opportunity for suppliers to differentiate through compliance-driven and performance-based defoaming solutions.

Fermentation defoamers are being increasingly applied in the biofuel and bioethanol industry, where large-scale fermentation systems often suffer from excessive foaming. Industrial producers emphasize the need for efficient foam control to minimize production losses and maintain steady operations. Demand is shaped by rising global energy diversification efforts, with bioethanol gaining traction as an alternative to fossil fuels. Suppliers offering cost-effective defoaming agents that can withstand prolonged processing cycles are positioned to capture market share. The biofuel industry’s expansion has created a stable revenue stream for defoamer producers, with adoption expected to rise further as governments promote renewable energy policies and expand industrial-scale ethanol plants.

The fermentation defoamer market is being shaped by evolving environmental standards and compliance pressures, particularly in food, pharmaceutical, and energy sectors. Regulators emphasize cleaner production processes, compelling manufacturers to develop biodegradable and food-grade defoaming solutions. Non-silicone and organic formulations have been gaining acceptance, especially in applications requiring high safety standards. The need for traceability, eco-friendly ingredients, and compliance with international food and pharmaceutical standards is guiding product innovation. Market players investing in green chemistry and regulatory adherence are better positioned to secure long-term contracts with global manufacturers. This regulatory-driven environment signals an ongoing transformation in product portfolios across major defoamer suppliers.

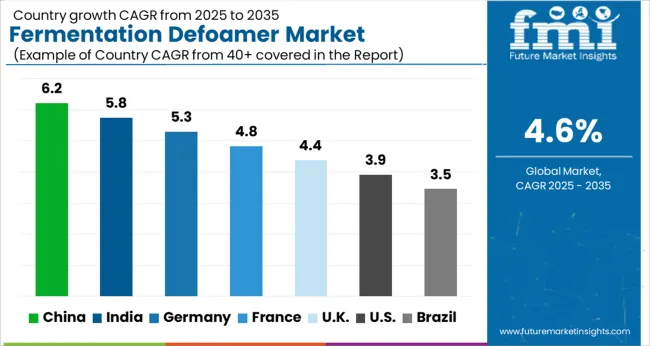

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| U.K. | 4.4% |

| U.S. | 3.9% |

| Brazil | 3.5% |

The global fermentation defoamer market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with 6.2%, followed by India at 5.8%, Germany at 5.3%, France at 4.8%, the U.K. at 4.4%, and the U.S. at 3.9%. Growth is supported by the expansion of food and beverage fermentation, pharmaceutical bioprocessing, and bioethanol production. Asian markets, particularly China and India, are experiencing faster adoption due to large-scale brewing, biofuel initiatives, and rising processed food demand. European countries, led by Germany and France, are influenced by pharmaceutical applications and food-grade compliance requirements. The U.S. shows steady demand linked to biotechnology and craft brewing. Adoption of eco-friendly, food-safe, and high-performance formulations is shaping procurement strategies across regions. The analysis spans 40+ countries, with the leading markets highlighted below.

The fermentation defoamer market in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, supported by rising demand from breweries, dairy processors, and large-scale bioethanol plants. Foam suppression is vital for ensuring stable yields in food fermentation and pharmaceutical bioprocessing, where contamination risks are high. Chinese manufacturers are scaling production of silicone-based and organic defoamers, while global suppliers are targeting partnerships to meet regulatory standards. The rapid expansion of functional beverages and plant-based proteins adds further momentum. Biofuel policies are also increasing the demand for industrial-grade defoamers.

The fermentation defoamer market in India is expected to grow at a CAGR of 5.8% from 2025 to 2035, fueled by processed food manufacturing, biotechnology, and bioethanol expansion. India’s breweries and dairy sector are embracing food-grade defoamers to reduce losses and meet quality benchmarks. The pharmaceutical industry, particularly in vaccine and antibiotic production, is boosting adoption of compliant defoamers. Government support for bioethanol blending programs adds new opportunities for industrial suppliers. Regional manufacturers in Maharashtra, Gujarat, and Karnataka are emerging as key hubs for supplying food-safe and cost-effective formulations.

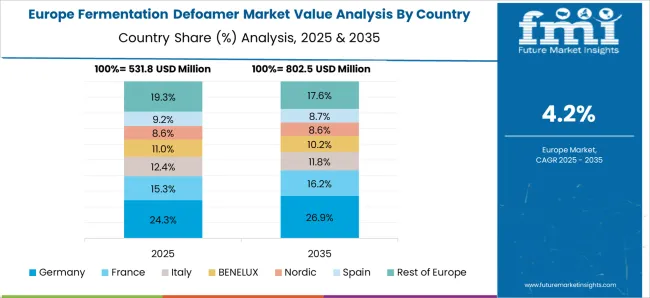

The fermentation defoamer market in France is projected to grow at a CAGR of 4.8% from 2025 to 2035, with strong adoption in the food, wine, and dairy sectors. French biopharmaceutical companies are expanding fermentation capacity for antibiotics and biologics, which require foam suppression technologies. Wine fermentation processes also utilize defoamers to improve efficiency and maintain quality. Environmental regulations are encouraging the use of biodegradable and organic formulations. France’s balanced demand across consumer and industrial applications is expected to sustain growth.

The fermentation defoamer market in the U.K. is expected to grow at a CAGR of 4.4% from 2025 to 2035, supported by demand in craft brewing, biopharma, and enzyme production. The U.K.’s brewing industry is a significant contributor, as smaller producers emphasize consistent quality. Biopharmaceutical research hubs in Cambridge and Oxford are expanding fermentation systems that require reliable foam suppression. Stricter compliance requirements are pushing demand for certified food-grade and pharma-grade solutions. Industrial enzyme producers are also adding to consumption.

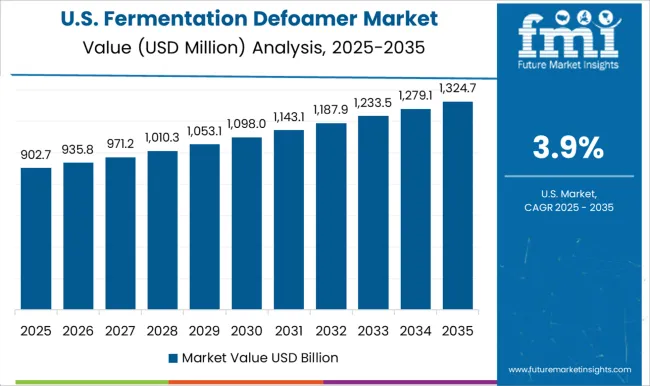

The fermentation defoamer market in the U.S. is projected to grow at a CAGR of 3.9% from 2025 to 2035, with steady contributions from biotechnology, craft brewing, and industrial enzyme manufacturing. The U.S. pharmaceutical sector remains a consistent consumer, particularly in biologics production. Craft breweries have become a strong niche, where foam control ensures higher yields. Industrial applications, including bioethanol and enzyme production, are adding incremental demand. Suppliers are focusing on introducing non-silicone and food-safe defoamers to match regulatory expectations.

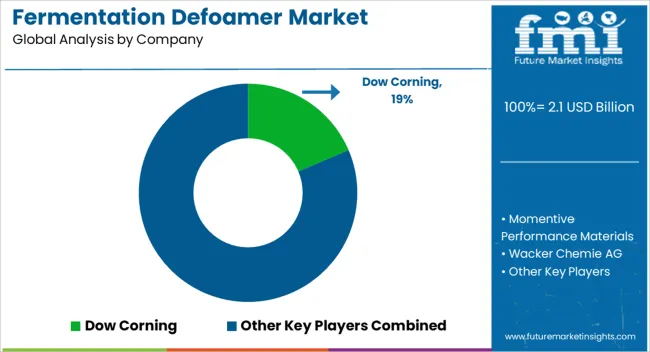

Competition in the fermentation defoamer market is influenced by product performance, regulatory compliance, and application versatility across food, pharmaceutical, and biofuel industries. Dow Corning and Momentive Performance Materials lead with silicone-based defoamers that ensure effective foam suppression in large-scale fermentation systems, supported by global supply networks and R&D capabilities. Wacker Chemie AG and Shin-Etsu Chemical Company provide high-purity, food-grade compliant solutions, catering to strict pharmaceutical and food industry requirements. Accepta, PennWhite Ltd., and Blackburn Chemicals Ltd. differentiate through specialty formulations tailored for breweries, dairies, and enzyme producers, often supported by flexible supply chains and customer-focused service. ADDAPT Chemicals B.V. and Hydrite Chemical Co. compete by delivering multifunctional, biodegradable, and cost-effective non-silicone defoamers that are increasingly valued in environmentally sensitive applications. Elkem ASA emphasizes silicone chemistry leadership and innovation in high-performance industrial formulations, while SIXIN North America, Inc. strengthens presence in the U.S. through region-specific offerings for biofuel and food fermentation. Struktol focuses on niche industrial fermentation requirements, supporting both specialty chemical and enzyme manufacturing sectors. Strategies in the sector emphasize compliance with international food and pharmaceutical regulations, improved biodegradability, and efficiency in high-volume fermenters. Product brochures typically highlight dosage efficiency, compatibility with fermentation media, and certifications that meet FDA and EU standards. Technical support, regional warehousing, and customized solutions are positioned as key differentiators, reflecting a market where safety, regulatory acceptance, and operational efficiency determine competitive advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product | Silicone based, Oil based, and Others |

| End-User | Dairy, Alcoholic Beverages, Food Products, Pharmaceuticals, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dow Corning, Momentive Performance Materials, Wacker Chemie AG, Shin-Etsu Chemical Company, Accepta, PennWhite Ltd., Blackburn Chemicals Ltd., ADDAPT Chemicals B.V., Hydrite Chemical Co., Elkem ASA, SIXIN NORTH AMERICA, INC., and Struktol |

| Additional Attributes | Dollar sales, share, key growth regions, end-use industries, regulatory trends, competitive landscape, pricing strategies, and innovation opportunities shaping market adoption. |

The global fermentation defoamer market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the fermentation defoamer market is projected to reach USD 3.4 billion by 2035.

The fermentation defoamer market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in fermentation defoamer market are silicone based, oil based and others.

In terms of end-user, dairy segment to command 34.5% share in the fermentation defoamer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermentation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Assessing Fermentation Chemicals Market Share & Industry Trends

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Fermentation Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mammalian Cell Fermentation Technology Market Forecast Outlook 2025 to 2035

Biopharmaceutical Fermentation Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Defoamers Market Size & Trends 2025 to 2035

Non-Silicone Emulsion Defoamer Market Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Agents / Defoamers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Non-Silicone Emulsion Defoamer in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA