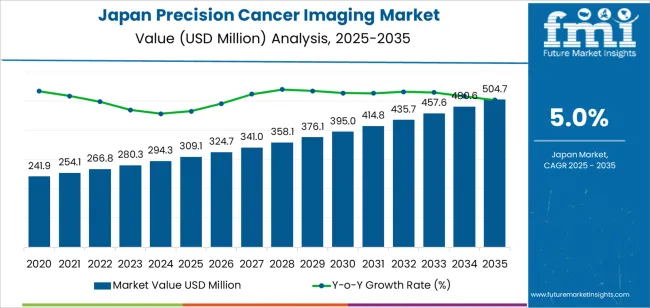

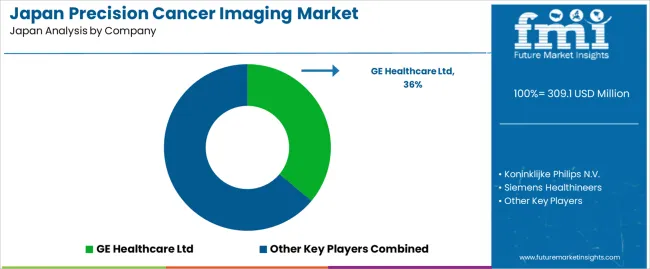

The demand for precision cancer imaging in Japan is valued at USD 309.1 million in 2025 and is projected to reach USD 504.7 million by 2035, reflecting a compound annual growth rate of 5.0%. Growth is influenced by wider use of advanced imaging techniques that support early tumor identification and more detailed characterization across oncology departments. As healthcare providers prioritize accurate staging and treatment planning, imaging systems with improved resolution and targeted visualization capabilities gain broader application. Hospital networks continue to upgrade diagnostic suites to support higher-precision workflows, strengthening adoption across major medical centers. The increasing need for consistent monitoring of therapeutic response also contributes to demand, reinforcing the continued integration of precision imaging tools throughout Japan’s oncology practices.

The growth curve shows a steady upward progression beginning at USD 241.9 million in earlier years and rising to USD 309.1 million in 2025 before advancing toward USD 504.7 million by 2035. Annual increments remain consistent, with values moving from USD 324.7 million in 2026 to USD 341.0 million in 2027 and continuing at similar intervals across the timeline. This pattern reflects stable investment in diagnostic infrastructure and repeated system upgrades as imaging requirements expand across cancer care pathways. As clinical teams incorporate more detailed imaging protocols and research groups rely on enhanced visualization for study design, demand continues to grow at a measured, predictable pace. The curve’s shape indicates a maturing yet steadily expanding sector driven by ongoing refinement in imaging technology and the growing need for accurate cancer assessment across Japan.

Demand for precision cancer imaging in Japan is projected to grow from USD 309.1 million in 2025 to USD 504.7 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.0%. Starting from USD 241.9 million in 2020, the value rises steadily through USD 294.3 million in 2024 and USD 309.1 million in 2025. Between 2025 and 2030, demand increases further to around USD 376.1 million, and by 2035 it is forecast to reach USD 504.7 million. This growth is supported by rising cancer incidence, increasing adoption of advanced imaging modalities such as PET/CT and AI enabled image analytics, and enhanced infrastructure for image guided oncology in Japan.

Over the forecast period the uplift of USD 195.6 million (from USD 309.1 million to USD 504.7 million) reflects both volume expansion-more imaging procedures and installations-and increasing average value per study or system. In the early stage, growth is more volume led as healthcare institutions adopt precision imaging. In the latter part of the decade, value growth becomes increasingly important as newer technologies (hybrid PET/MRI, molecular imaging tracers, AI diagnostics) command higher prices and greater value add. As health systems in Japan focus more on personalised oncology pathways and early detection protocols, the combination of more procedures and higher value per procedure drives the projected rise to USD 504.7 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 309.1 million |

| Forecast Value (2035) | USD 504.7 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The demand for precision cancer imaging in Japan is rising as the country faces a growing cancer burden and aims to improve treatment outcomes. Imaging modalities that combine anatomical detail with functional data—such as PET-CT and PET-MRI-are increasingly used to locate tumours more accurately, assess biological activity and guide patient-specific therapies. With Japan’s population ageing rapidly, and diagnostic pathways shifting toward early detection and tailored treatments, healthcare providers are deploying imaging solutions that support more refined staging, therapy monitoring and recurrence detection.

In addition to demographic and clinical demand, Japan’s healthcare infrastructure and policy landscape support adoption of precision imaging. Hospitals and cancer centres are integrating advanced imaging systems and analytical tools such as artificial intelligence to enhance diagnostic accuracy and workflow efficiency. The nation’s reimbursement framework and investment in oncology care encourage deployment of high-performance imaging platforms. While factors such as equipment cost, regulatory approval and the need for trained personnel remain considerations, the alignment of clinical need, institutional capacity and regulatory support keeps the demand for precision cancer imaging in Japan on an upward trajectory.

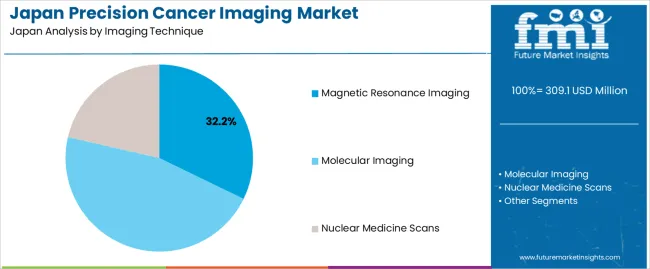

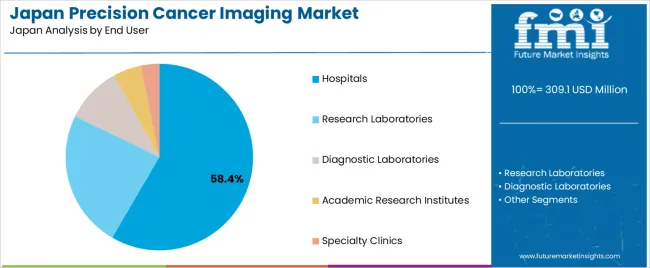

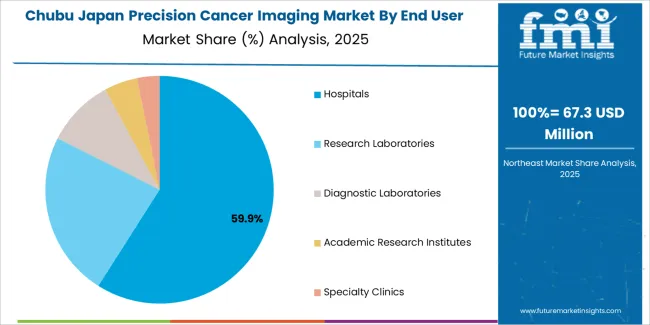

The demand for precision cancer imaging is shaped by the range of imaging techniques used to detect, stage and monitor cancer, along with the end users responsible for delivering diagnostic services. Imaging techniques include magnetic resonance imaging, molecular imaging and nuclear medicine scans, each offering different diagnostic strengths for visualizing tumors and biological processes. End users include hospitals, research laboratories, diagnostic laboratories, academic research institutes and specialty clinics. As cancer detection requires accurate visualization and regular monitoring, the combination of advanced imaging tools and diverse clinical settings guides overall adoption across the precision cancer imaging landscape.

Magnetic resonance imaging accounts for 32% of total demand for precision cancer imaging. This leading share reflects the ability of MRI to deliver detailed soft-tissue contrast that supports early detection and treatment planning for various cancers. MRI offers non-ionizing imaging suitable for repeated scans across the treatment pathway. The technique is widely used for brain, breast, prostate and musculoskeletal tumor assessment, which strengthens its role in routine oncology workflows. Hospitals and diagnostic centers rely on MRI to support precise anatomical mapping and guide clinicians in evaluating treatment response.

Demand for MRI also grows as technology advances provide higher resolution, faster scan times and improved functional imaging sequences. These capabilities enhance interpretation and expand MRI’s role in identifying microstructural changes associated with tumor progression. Clinical teams favor MRI for its consistency and ability to align with multidisciplinary cancer care pathways. As cancer programs continue integrating imaging with targeted therapies and long-term monitoring, MRI remains a primary technique within precision cancer imaging.

Hospitals account for 58.4% of total demand for precision cancer imaging. This dominant position reflects the central role hospitals play in diagnosing, staging and managing cancer across integrated care settings. Hospitals maintain specialized oncology departments equipped with MRI, molecular imaging and nuclear medicine systems, allowing comprehensive assessment in a single location. They support large patient volumes and provide multidisciplinary review, which encourages extensive use of imaging throughout treatment cycles. These characteristics make hospitals the primary destination for cancer imaging services.

Demand from hospitals also increases as they adopt advanced imaging technologies to support precision therapy planning. Hospitals integrate imaging with surgical, radiotherapy and medical oncology workflows, ensuring consistent evaluation of tumor behavior. Their ability to maintain trained staff, imaging infrastructure and coordinated follow-up pathways strengthens dependence on hospital-based imaging. As cancer programs expand and care networks streamline diagnostic journeys, hospitals remain the leading end users shaping precision cancer imaging demand.

Demand for precision cancer imaging is increasing as healthcare providers seek improved diagnostic accuracy, earlier tumour detection and more effective monitoring of treatment response. Innovations such as PET-MRI, molecular imaging, AI-driven image analytics and advanced contrast agents support this shift. Growth is driven by rising cancer incidence, increasing adoption of targeted therapies and demand for personalised oncology. Barriers include high capital cost of advanced imaging equipment, reimbursement challenges and the need for specialised staff and infrastructure. These dynamics collectively determine how rapidly precision cancer imaging technologies enter clinical workflows.

The evolution of cancer treatment toward precision medicine-where therapies are tailored by tumour type, genetics and patient response-places greater emphasis on imaging that can characterise disease beyond structure. Functional and molecular imaging modalities are increasingly required to identify metabolic changes, assess therapy effectiveness and detect minimal residual disease. As oncology treatments become more complex and monitoring more frequent, healthcare systems invest in high-end imaging systems and analytics. This trend boosts demand for precision cancer imaging across hospitals and specialised centres.

Significant opportunities exist for precision cancer imaging in outpatient imaging centres, oncology clinics, research hospitals and mobile imaging services focused on underserved areas. There is demand for compact imaging systems, hybrid modalities and software platforms that integrate imaging data with genomic and biomarker information. Manufacturers offering modular upgrades, service models or analytics-enabled imaging solutions can address this opportunity. As early detection and surveillance gain emphasis, facilities may adopt precision imaging more widely beyond top-tier hospitals.

Despite strong drivers, adoption of precision cancer imaging is slowed by the high cost of equipment, installation and training; reimbursement policies that may lag behind technology; and integration challenges with hospital information and oncology workflows. Imaging data volumes and complexity demand robust infrastructure, which some smaller centres lack. Additionally, competition from non-imaging diagnostics (such as liquid biopsies) and the need to demonstrate cost-effectiveness may constrain uptake. These factors moderate how quickly precision cancer imaging becomes standard across all clinical settings.

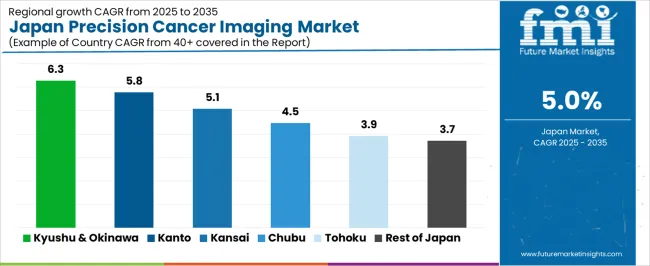

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.3% |

| Kanto | 5.8% |

| Kinki | 5.1% |

| Chubu | 4.5% |

| Tohoku | 3.9% |

| Rest of Japan | 3.7% |

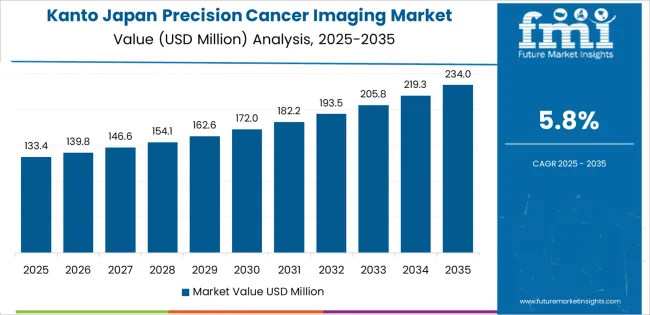

Demand for precision cancer imaging in Japan continues to rise, with Kyushu and Okinawa leading at 6.3%. Growth in this region reflects the expanding use of advanced diagnostic tools across hospitals and regional cancer centers. Kanto follows at 5.8%, supported by its concentration of major medical institutions and steady adoption of imaging technologies that enable accurate cancer detection. Kinki records 5.1%, shaped by strong clinical networks and active use of targeted imaging procedures. Chubu grows at 4.5%, driven by consistent investment across regional facilities. Tohoku reaches 3.9%, reflecting gradual improvements in diagnostic access. The rest of Japan shows 3.7%, indicating steady use of precision imaging across smaller healthcare systems.

Kyushu & Okinawa is projected to grow at a CAGR of 6.3% through 2035 in the precision cancer imaging market. Hospitals, oncology centers, and diagnostic facilities in Fukuoka are adopting advanced imaging technologies for early cancer detection, precise tumor mapping, and treatment planning. Rising demand for personalized medicine and improved diagnostic accuracy drives adoption. Manufacturers are providing high-resolution imaging devices compatible with multiple modalities. Investment in regional medical infrastructure, increasing patient awareness, and healthcare modernization support steady growth in precision cancer imaging services across Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 5.8% through 2035 in the precision cancer imaging market. As Japan’s medical and economic hub, including Tokyo, the region integrates advanced imaging systems in hospitals, cancer treatment centers, and diagnostic clinics. Rising demand for personalized oncology treatment, high-resolution imaging, and efficient patient care drives adoption. Manufacturers provide CT, MRI, PET, and hybrid imaging solutions. Healthcare networks and research hospitals adopt precision imaging to improve clinical outcomes. Growing patient awareness, medical infrastructure, and investment in oncology technologies ensure steady growth in Kanto.

Kinki is projected to grow at a CAGR of 5.1% through 2035 in the precision cancer imaging market. Cities including Osaka and Kyoto are increasingly adopting high-resolution imaging modalities for early cancer detection, treatment planning, and monitoring. Hospitals and oncology centers focus on accurate diagnostics to improve patient outcomes. Manufacturers provide advanced CT, MRI, and PET systems compatible with hospital workflows. Investment in regional healthcare infrastructure, research hospitals, and technology adoption accelerates demand. Urban patient populations, hospital networks, and medical research initiatives support steady growth in precision cancer imaging across Kinki.

Chubu is projected to grow at a CAGR of 4.5% through 2035 in the precision cancer imaging market. Urban centers, particularly Nagoya, are adopting advanced imaging technologies in hospitals and oncology centers for accurate cancer diagnosis and treatment planning. Rising patient awareness, demand for early detection, and improved clinical workflows drive adoption. Manufacturers provide high-resolution imaging devices compatible with hospital systems. Regional healthcare investment, professional training, and infrastructure upgrades ensure steady growth. Increasing demand for precise diagnostics and better patient outcomes supports adoption of precision cancer imaging across Chubu.

Tohoku is projected to grow at a CAGR of 3.9% through 2035 in the precision cancer imaging market. Regional hospitals and cancer treatment facilities are gradually adopting advanced CT, MRI, and PET imaging technologies. Patient demand for accurate diagnostics and early cancer detection drives adoption. Manufacturers supply high-resolution imaging systems compatible with smaller hospital and clinic networks. Investment in healthcare infrastructure and medical training supports regional adoption. Urban and semi-urban populations increasingly benefit from precision imaging services. These trends ensure steady growth in precision cancer imaging across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 3.7% through 2035 in the precision cancer imaging market. Smaller towns and rural regions gradually adopt advanced CT, MRI, and PET imaging in hospitals and clinics. Rising patient awareness, demand for early cancer detection, and improved diagnostics drive adoption. Manufacturers provide cost-effective, high-resolution imaging solutions for smaller healthcare facilities. Healthcare infrastructure improvements and training initiatives support access. Steady adoption in semi-urban and rural areas ensures continuous growth in precision cancer imaging services across the Rest of Japan.

The demand for precision cancer imaging in Japan is rising due to demographic and technological trends. Japan’s aging population and increased incidence of cancer cases drive need for imaging technologies that support early detection, accurate staging and therapy monitoring. Hospitals and cancer centres are adopting hybrid modalities such as PET-CT or PET-MRI and advanced molecular imaging systems that combine anatomical and functional data. Digital tools including artificial intelligence are also being integrated to enhance image interpretation and workflow efficiency. These drivers are reinforced by Japan’s emphasis on healthcare quality, improved screening programmes and infrastructure upgrades across diagnostic facilities.

Major global firms shaping this segment in Japan include GE Healthcare Ltd, Koninklijke Philips N.V., Siemens Healthineers, Hologic, Inc. and Hitachi, Ltd.. These companies supply advanced imaging equipment and solutions specifically targeting oncology workflows in Japan. GE Healthcare and Philips provide hybrid PET/MR systems and AI-enabled image analysis platforms. Siemens Healthineers offers integrated oncology diagnostics suites. Hologic contributes modalities focused on breast cancer imaging. Hitachi supplies high-field MRI and PET technologies suited for Japanese clinical settings. Together, these providers influence how precision imaging capabilities are deployed, adapted and adopted within Japan’s cancer-care ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Imaging Technique | Magnetic Resonance Imaging, Molecular Imaging, Nuclear Medicine Scans |

| End User | Hospitals, Research Laboratories, Diagnostic Laboratories, Academic Research Institutes, Specialty Clinics |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | GE Healthcare Ltd, Koninklijke Philips N.V., Siemens Healthineers, Hologic, Inc., Hitachi, Ltd. |

| Additional Attributes | Dollar by sales by imaging technique, end user, and region; regional CAGR and growth trends; adoption of hybrid modalities (PET/CT, PET/MRI) and molecular imaging systems; integration of AI and advanced analytics in oncology diagnostics; investment in imaging infrastructure and clinical workflows; regulatory and reimbursement considerations; training and staffing requirements; equipment lifecycle and service models; adoption by research hospitals and specialty clinics; advanced contrast agents and multi-modal imaging capabilities; hospital network expansion and early detection programs. |

The demand for precision cancer imaging in japan is estimated to be valued at USD 309.1 million in 2025.

The market size for the precision cancer imaging in japan is projected to reach USD 504.7 million by 2035.

The demand for precision cancer imaging in japan is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in precision cancer imaging in japan are magnetic resonance imaging, molecular imaging and nuclear medicine scans.

In terms of end user, hospitals segment is expected to command 58.4% share in the precision cancer imaging in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Japan Aerial Imaging Market Report – Trends & Innovations 2025-2035

Japan Biliary Tract Cancers (BTCs) Treatment Market Growth – Demand, Trends & Forecast 2025-2035

Demand for 3D Imaging Surgical Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA