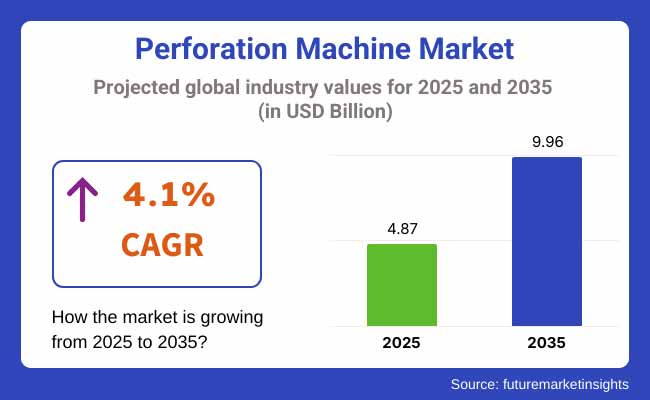

The global perforation machine industry is estimated to account for USD 4.87 billion in 2025. It is anticipated to grow at a CAGR of 4.1% during the assessment period and reach a value of USD 9.96 billion by 2035.

In 2024, the industry worldwide grew steadily due to rising demand in the packaging, automotive, and construction sectors. Another trend was the use of sustainable and green perforation technologies, especially in developed countries such as North America and Europe, where environmental policies grew stricter.

Companies concentrated on incorporating cutting-edge technologies like AI and IoT into products for increased accuracy and decreased operating costs. However, volatile raw material prices and supply chain interruptions were still issues, especially for small and medium-sized businesses.

Asia-Pacific's emerging economies, such as India and China, experienced heavy investments in urbanization and industrialization, leading to increased demand for products. The year also saw the release of numerous innovative products. These included intelligent machines capable of self-diagnosis and energy optimization, meeting the growing demand for automation.

Forward-looking to 2025 and beyond, the industry is forecast to expand at a 4.1% CAGR to USD 9.96 billion by 2035. The main drivers are the growing need for personalized and eco-friendly packaging solutions, rising automation, and forays into unpenetrated industries. Yet, the manufacturers have to tackle technological obsolescence and volatile demand challenges to remain competitive in this changing environment.

FMI Survey Findings: Drivers According to Stakeholder Views

Q4 2024, n=450 stakeholder respondents equally divided between manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Views on ROI

70% of USA stakeholders considered automation and IoT integration "worth the investment," while 40% in Japan opted for standalone, manually controlled machines.

Consensus

Stainless Steel Components: Chosen by 65% worldwide for durability, corrosion resistance, and compatibility with high-speed operations.

Variance

Shared Challenges

84% mentioned the rising cost of raw materials and energy as an area of first concern.

Regional Differences

Manufacturers

Distributors

End-Users (Industrial Operators)

Alignment

70% of worldwide manufacturers intend to spend on IoT-enabled and AI-powered products.

Divergence

Consensus High

Industry standard compliance, accuracy, and pressures on costs are worldwide issues.

Critical Differences

Strategic Insight

There is no "one-size-fits-all" approach that will work. Regional adaptation (e.g., IoT and automation in the USA, green models in Europe, and compact, cost-saving machines in Asia) is required to effectively penetrate various industries.

| Countries | Regulations and Mandatory Certifications |

|---|---|

| United States | The Occupational Safety and Health Administration (OSHA) sets mandatory safety standards for workplaces, including those manufacturing products. Compliance ensures worker safety and adherence to federal guidelines. |

| Canada | UL Listing: Underwriters Laboratories (UL) certification indicates that products meet established safety standards, ensuring safe operation and sector acceptance |

| European Union | CE Marking: Mandatory for products sold within the European Economic Area (EEA), the CE mark signifies that products comply with health, safety, and environmental protection standards, facilitating free movement within the EEA |

| Brazil | INMETRO Certification: The National Institute of Metrology, Standardization, and Industrial Quality (INMETRO) certification is required for importing larger domestic electrical appliances, including products, ensuring conformity to Brazilian safety and quality standards. |

| Mexico | NOM Certification: The Norma Official Mexicana (NOM) certification is mandatory for various products, including electrical and electronic items such products, ensuring they meet safety and quality standards specific to the Mexican industry. |

| Argentina | IRAM Certification: The Instituto Argentino de Normalización y Certificación (IRAM) S-mark is mandatory for marketing different categories of electrical and electronic products, including products, ensuring compliance with Argentine safety standards. |

| Japan | PSE Mark: The Product Safety Electrical Appliance and Material (PSE) certification is mandatory in Japan, indicating that products comply with the country's electrical appliance and material safety laws. |

| China | CCC Mark: The China Compulsory Certificate (CCC) is a mandatory safety mark for many products, including products, sold in the Chinese landscape, ensuring compliance with national safety standards. |

| Australia and New Zealand | Regulatory Compliance Mark (RCM): This mark indicates compliance with electrical safety and electromagnetic compatibility standards for products, including products, in both Australia and New Zealand. |

| Gulf Cooperation Council (GCC) Countries | GCC Mark: For countries like Saudi Arabia, United Arab Emirates, and others, the GCC Standardization Organization (GSO) mandates the GCC mark, ensuring products, including products, meet regional safety and quality standards. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth Drivers: The industry experienced steady growth due to the rising demand for sustainable packaging solutions, which can reduce waste and promote environmental sustainability | Growth Drivers: The anticipated growth is attributed to the increasing focus on reducing waste from industrial processes and the rising demand for products in the e-commerce and automotive industries. |

Automatic perforation machines are applied more extensively in industrial and bulk manufacturing environments than manual machines. The reason for this is the necessity for greater efficiency, accuracy, and uniformity in production activities. Automatic machines can process vast amounts of material at higher speeds, saving on labor costs and minimizing human inaccuracies.

They are also provided with the latest features like programmable settings, IoT connectivity, and AI-driven pattern optimization to improve productivity as well as be customized to accommodate specific customer specifications. Automatic machines are also ideal for integration with contemporary automated manufacturing lines, positioning them perfectly in industries such as packaging, automobiles, and electronics.

Rotary perforation machines are the most common rotary, punch, laser, and micro, especially in packaging, paper, and textile industries. They are popular because they can perform high-speed, continuous production with uniform precision, which is suitable for mass production. Rotary machines are also economical for bulk operations since they can process materials rapidly and efficiently with little downtime.

Punch perforation machines are applied in the case of heavier material such as metal or thick plastics where greater force is needed, but are not as efficient in mass production as rotary machines. Laser, with their high accuracy and versatility in handling complex patterns, are however more costly and time-consuming, making them available only for special purposes such as medical equipment or electronics.

Packaging is the most universally applied area of perforation machines, as is spurred on by worldwide demand for tailored, energy-efficient, and eco-friendly packages. Perforation machines find application in breathable films, ease-of-opening packs, and tamper-evident packages crucial for foodstuffs, household items, and pharmaceuticals packing.

Growth from e-commerce activities and demand for robust but lightweight packaging further elevated their use. Besides, the packaging sector also gains from the versatility of products, which are capable of working with materials such as paper, plastic, and laminates at high speed and precision.

| Countries | CAGR |

|---|---|

| USA | 4.5% |

| UK | 4.0% |

| France | 3.8% |

| Germany | 4.7% |

| Italy | 3.5% |

| South Korea | 4.2% |

| Japan | 3.2% |

| China | 5.5% |

The USA industry will register a CAGR of 4.5% over the forecast period 2025 to 2035, driven by the robust packaging, automotive, and electronics industries. The focus of the nation on automation and smart manufacturing technologies, such as IoT-based and AI-based products, is a key growth driver. The packaging sector, in particular, will benefit from the rise of e-commerce and demand for sustainable, flexible packaging solutions.

In addition, the demand for weight-reducing materials and precision components by the USA automotive industry presents opportunities for high-performance products. The growth can be constrained by challenges such as rising raw material costs and supply chain disruptions. Demand will be led by the Midwest and Southern states with their strong manufacturing platforms. Overall, the development of the USA industry is led by technological developments, high industrial output, and the need for efficient production processes.

The UK market is anticipated to achieve a CAGR of 4.0% between 2025 to 2035, led by the packaging, textile, and pharmaceutical sectors. The strict sustainability regulations in the nation are driving demand for power-efficient and eco-friendly products, primarily in the packaging industry. The UK's strong interest in reducing plastic waste and using more recyclable materials aligns with the adoption of high-tech perforation technologies.

Additionally, economic uncertainty and trade barriers with Brexit might pose some challenges. Growth in the pharma sector, fueled by blister pack demand due to perforations, also drives growth. Although the UK pharma industry is smaller compared to other countries in Europe, its focus on innovation and sustainability ensures continuous growth.

France's industry will expand at a CAGR of 3.8% from 2025 to 2035, followed by the packaging, auto, and luxury goods sectors. France's strong emphasis on sustainability and circular economy principles is fueling green demand, particularly in the packaging industry.

France's luxury goods market, which requires products for high-end packaging, also promotes market growth. On the other hand, prohibitively high labor costs and regulatory problems may hinder adoption. Support from the French government in promoting industrial innovation and green technology provides a best-fit industry for growth. Overall, France's growth is characterized by reconciling sustainability with precise uses.

Germany, Europe's largest industrial economy, is expected to have a CAGR of 4.7% in the products industry between 2025 and 2035. The strong manufacturing base in Germany, particularly in automotive, packaging, and electronics, drives the need for precision and automated products.

Germany's leadership in Industry 4.0 technologies such as IoT and AI also increases the adoption of smart products. The packaging industry is supported by the country's focus on effective and sustainable manufacturing processes. Increasing power costs and supply chain disruptions are possible threats. Germany's innovation drive, coupled with a robust industrial base, ensures robust growth.

Italy's industry is projected to grow at a CAGR of 3.5% from 2025 to 2035, led by the packaging, textile, and automotive industries. The country's strong textile industry, which requires perforation for breathable products, is a major growth driver. Italy's food and high-end product packaging market also drives demand.

Economic instability and excess production costs may, however, hamper growth. The government of Italy's push towards the modernization of production processes and adoption of sustainable technologies is set to fuel expansion. Generally, Italy's growth is marked by an emphasis on conventional sectors and the steady adoption of cutting-edge technologies.

South Korea's industry is forecast to develop at a CAGR of 4.2% between 2025 and 2035, led by the electronics, automotive, and packaging sectors. The nation's emphasis on technological innovation and high-speed production enhances demand for high-end products.

South Korea's electronics sector, which requires precision perforation for components, is a leading driver of growth. But high competition and cost sensitivity can be inhibitive. Promotion by the government of smart manufacturing and Industry 4.0 technologies provides scope for expansion. Overall, the growth of South Korea is induced by its sophisticated industrial backbone and focus on innovation.

Japan's industry is anticipated to grow at a CAGR of 3.2% from 2025 to 2035, driven by the automotive, electronics, and packaging industries. Japan's focus on precision engineering and high-quality production processes supports the demand for advanced products.

Additionally, Japan's dependence on traditional manufacturing techniques and thriftiness can be discouraging to uptake. Japan's aging population and weakening domestic consumption are also obstacles. Notwithstanding these obstacles, Japan's healthy export-oriented industries and drive toward ingenuity guarantee consistent growth.

The Chinese industry will develop at a CAGR of 5.5% during 2025 to 2035, led by packaging, textile, and electronics. The sizeable manufacturing sector in the country and emphasis on cost-cutting production are product demand drivers.

China's packaging sector, fueled by e-commerce expansion, is one of the prime drivers. Rising labor costs and environmental laws might be detergents, though. The government's emphasis on industrial automation and green manufacturing are upside opportunities. Overall, China's sector expansion is marked by its size, efficiency, and emphasis on innovation.

BOBST Group (Switzerland): (20%)

BOBST Group is a world leader in its reputation for precision and innovation. BOBST has a stronghold on the printing and packaging industries with its cutting-edge rotary and laser perforating machinery. Its aggressive R&D program and green development strategy enabled BOBST to further maintain its leading position in the industry. Its operations chain in Europe, North America, and Asia-Pacific adds more might to its strengths.

Key Strategies:

Heidelberger Druckmaschinen AG (Germany) : (15%)

Heidelberger Druckmaschinen is a dominant player in the print and packaging industries, producing an enormous variety of products, ranging from rotary to punch models. Heidelberger's European dominance and its digitalization and smart manufacturing emphasis are the drivers of its market share.

Key Strategies:

Canon Inc. (Japan): (12%)

Canon is a top gun in the packaging and printing business, providing high-end lasers and micro-products. The company's dominance in Asia-Pacific and high-precision focus have enabled it to capture a large share.

Key Strategies:

Koenig & Bauer AG (Germany): (10%)

Koenig & Bauer develops high-performance laser and rotary equipment to cater to the packaging, automotive, and electronics industries. The company's focus on sustainability and efficiency has made it a go-to firm in North America and Europe.

Key Strategies:

Comexi Group (Spain): (8%)

Comexi Group is a top-notch company in the flexible packaging market, providing advanced rotary and laser solutions. Comexi Group's dominance in Europe and Latin America and its emphasis on innovation allow it to achieve its share.

Key Strategies:

The industry is influenced by several macro-economic drivers such as global industrialization, technological innovation, and changing lifestyles of consumers. Global pressure to automate and adopt Industry 4.0 is a major enforcer, with companies increasingly relying on IoT-based and AI-based offerings to improve efficiency and reduce operational costs. The rise in e-commerce and growing demand for eco-friendly packaging solutions are also fueling expansion, particularly in packaging.

However, the industry is faced with challenges such as rising raw material costs and supply chain constraints fueled further by geopolitics and the impact of the COVID-19 pandemic. Inflation and volatile energy prices also impact production costs, particularly in energy-hungry regions such as Europe.

Geographically, Asia-Pacific is in the lead within the sector by virtue of its rapid industrialization and urbanization and is served by China and India as its premier manufacturing hubs. North America and Europe are driven by technological innovation and strong sustainability regulations. Latin America and Africa provide the potential for growth but are undercut by economic insecurity and a lack of infrastructure.

With respect to automation grade, it is classified into automatic and manual.

In terms of machine type, it is divided into rotary, punch, laser, and micro-perforation machines.

In terms of application, it is divided into packaging, print & publishing, textiles, automotive, electronics, and pharmaceuticals.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

They find extensive application in packaging, textiles, automotive, electronics, and pharmaceuticals to produce accurate holes or patterns.

The most common ones are rotary, punch, laser, and micro-perforation machines, which are designed for use with specific materials and processes.

They allow for high-speed, accurate, and uniform processing, minimizing labor and errors during manufacturing.

Important determinants are material type, precision required, volume of production, and need for automation or customization.

The latest developments include IoT connectivity, pattern optimization using artificial intelligence, and energy-efficient solutions for environmentally friendly operations.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 5: Global Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 7: Global Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 & 2033

Table 9: North America Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 11: North America Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 13: North America Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 15: North America Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 17: Latin America Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 19: Latin America Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 20: Latin America Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 21: Latin America Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 23: Latin America Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 25: Western Europe Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Western Europe Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 28: Western Europe Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 29: Western Europe Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 30: Western Europe Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 31: Western Europe Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 33: Eastern Europe Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 35: Eastern Europe Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 37: Eastern Europe Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 39: Eastern Europe Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 41: East Asia Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: East Asia Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 44: East Asia Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 45: East Asia Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 46: East Asia Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 47: East Asia Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 48: East Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 49: South Asia Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 50: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 51: South Asia Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 52: South Asia Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 53: South Asia Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 54: South Asia Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 55: South Asia Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 56: South Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 57: MEA Market Value (US$ Billion) Forecast by Country, 2018 & 2033

Table 58: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 59: MEA Market Value (US$ Billion) Forecast by Automation Grade, 2018 & 2033

Table 60: MEA Market Volume (Units) Forecast by Automation Grade, 2018 & 2033

Table 61: MEA Market Value (US$ Billion) Forecast by Machine Type, 2018 & 2033

Table 62: MEA Market Volume (Units) Forecast by Machine Type, 2018 & 2033

Table 63: MEA Market Value (US$ Billion) Forecast by Application, 2018 & 2033

Table 64: MEA Market Volume (Units) Forecast by Application, 2018 & 2033

Figure 1: Global Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 2: Global Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 3: Global Market Value (US$ Billion) by Application, 2023 & 2033

Figure 4: Global Market Value (US$ Billion) by Region, 2023 & 2033

Figure 5: Global Market Value (US$ Billion) Analysis by Region, 2018 & 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023-2033

Figure 9: Global Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 10: Global Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 13: Global Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 14: Global Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 17: Global Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 21: Global Market Attractiveness by Automation Grade, 2023-2033

Figure 22: Global Market Attractiveness by Machine Type, 2023-2033

Figure 23: Global Market Attractiveness by Application, 2023-2033

Figure 24: Global Market Attractiveness by Region, 2023-2033

Figure 25: North America Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 26: North America Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 27: North America Market Value (US$ Billion) by Application, 2023 & 2033

Figure 28: North America Market Value (US$ Billion) by Country, 2023 & 2033

Figure 29: North America Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 33: North America Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 34: North America Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 37: North America Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 38: North America Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 41: North America Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 45: North America Market Attractiveness by Automation Grade, 2023-2033

Figure 46: North America Market Attractiveness by Machine Type, 2023-2033

Figure 47: North America Market Attractiveness by Application, 2023-2033

Figure 48: North America Market Attractiveness by Country, 2023-2033

Figure 49: Latin America Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 50: Latin America Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 51: Latin America Market Value (US$ Billion) by Application, 2023 & 2033

Figure 52: Latin America Market Value (US$ Billion) by Country, 2023 & 2033

Figure 53: Latin America Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 57: Latin America Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 58: Latin America Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 61: Latin America Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 62: Latin America Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 65: Latin America Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 69: Latin America Market Attractiveness by Automation Grade, 2023-2033

Figure 70: Latin America Market Attractiveness by Machine Type, 2023-2033

Figure 71: Latin America Market Attractiveness by Application, 2023-2033

Figure 72: Latin America Market Attractiveness by Country, 2023-2033

Figure 73: Western Europe Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 74: Western Europe Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 75: Western Europe Market Value (US$ Billion) by Application, 2023 & 2033

Figure 76: Western Europe Market Value (US$ Billion) by Country, 2023 & 2033

Figure 77: Western Europe Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 81: Western Europe Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 85: Western Europe Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 89: Western Europe Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 93: Western Europe Market Attractiveness by Automation Grade, 2023-2033

Figure 94: Western Europe Market Attractiveness by Machine Type, 2023-2033

Figure 95: Western Europe Market Attractiveness by Application, 2023-2033

Figure 96: Western Europe Market Attractiveness by Country, 2023-2033

Figure 97: Eastern Europe Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 98: Eastern Europe Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 99: Eastern Europe Market Value (US$ Billion) by Application, 2023 & 2033

Figure 100: Eastern Europe Market Value (US$ Billion) by Country, 2023 & 2033

Figure 101: Eastern Europe Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 105: Eastern Europe Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 109: Eastern Europe Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 113: Eastern Europe Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 117: Eastern Europe Market Attractiveness by Automation Grade, 2023-2033

Figure 118: Eastern Europe Market Attractiveness by Machine Type, 2023-2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023-2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023-2033

Figure 121: East Asia Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 122: East Asia Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 123: East Asia Market Value (US$ Billion) by Application, 2023 & 2033

Figure 124: East Asia Market Value (US$ Billion) by Country, 2023 & 2033

Figure 125: East Asia Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 126: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 127: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 128: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 129: East Asia Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 130: East Asia Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 131: East Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 133: East Asia Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 134: East Asia Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 137: East Asia Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 138: East Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 139: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 140: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 141: East Asia Market Attractiveness by Automation Grade, 2023-2033

Figure 142: East Asia Market Attractiveness by Machine Type, 2023-2033

Figure 143: East Asia Market Attractiveness by Application, 2023-2033

Figure 144: East Asia Market Attractiveness by Country, 2023-2033

Figure 145: South Asia Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 146: South Asia Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 147: South Asia Market Value (US$ Billion) by Application, 2023 & 2033

Figure 148: South Asia Market Value (US$ Billion) by Country, 2023 & 2033

Figure 149: South Asia Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 150: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 151: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 152: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 153: South Asia Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 154: South Asia Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 155: South Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 156: South Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 157: South Asia Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 158: South Asia Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 159: South Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 160: South Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 161: South Asia Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 162: South Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 163: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 164: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 165: South Asia Market Attractiveness by Automation Grade, 2023-2033

Figure 166: South Asia Market Attractiveness by Machine Type, 2023-2033

Figure 167: South Asia Market Attractiveness by Application, 2023-2033

Figure 168: South Asia Market Attractiveness by Country, 2023-2033

Figure 169: MEA Market Value (US$ Billion) by Automation Grade, 2023 & 2033

Figure 170: MEA Market Value (US$ Billion) by Machine Type, 2023 & 2033

Figure 171: MEA Market Value (US$ Billion) by Application, 2023 & 2033

Figure 172: MEA Market Value (US$ Billion) by Country, 2023 & 2033

Figure 173: MEA Market Value (US$ Billion) Analysis by Country, 2018 & 2033

Figure 174: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 177: MEA Market Value (US$ Billion) Analysis by Automation Grade, 2018 & 2033

Figure 178: MEA Market Volume (Units) Analysis by Automation Grade, 2018 & 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Automation Grade, 2023 & 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Automation Grade, 2023-2033

Figure 181: MEA Market Value (US$ Billion) Analysis by Machine Type, 2018 & 2033

Figure 182: MEA Market Volume (Units) Analysis by Machine Type, 2018 & 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Machine Type, 2023 & 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Machine Type, 2023-2033

Figure 185: MEA Market Value (US$ Billion) Analysis by Application, 2018 & 2033

Figure 186: MEA Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Application, 2023-2033

Figure 189: MEA Market Attractiveness by Automation Grade, 2023-2033

Figure 190: MEA Market Attractiveness by Machine Type, 2023-2033

Figure 191: MEA Market Attractiveness by Application, 2023-2033

Figure 192: MEA Market Attractiveness by Country, 2023-2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro Perforation Machines Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Glazed Kraft Paper Market Growth - Demand & Forecast 2024 to 2034

Machine Condition Monitoring Market Insights – Trends & Forecast 2024-2034

Asia Pacific Machine Glazed Paper Market Trends & Forecast 2024-2034

Machine Vision Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA