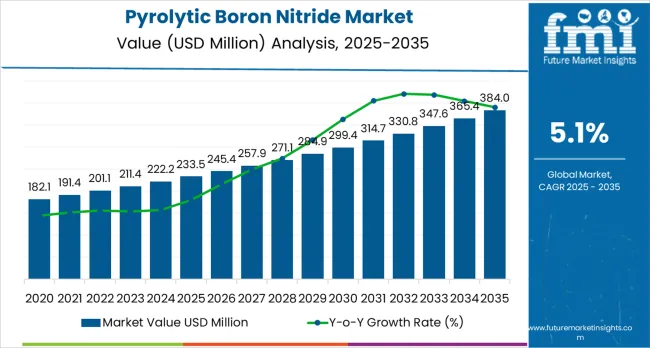

The global pyrolytic boron nitride market is projected to reach USD 384 million by 2035, recording an absolute increase of USD 150.3 million over the forecast period. The market is valued at USD 233.5 million in 2025 and is projected to grow at a CAGR of 5.1% during the forecast period. The overall market size is expected to grow by nearly 1.6 times during the same period, driven by increasing demand for ultra-high temperature processing materials in semiconductor manufacturing worldwide. This demand is supported by the need for efficient thermal management and contamination control systems, and well growing investments in compound semiconductor production and advanced epitaxy equipment projects globally. However, high material costs and specialized processing requirements for PBN fabrication may pose challenges to market expansion.

Between 2025 and 2030, the pyrolytic boron nitride market is projected to expand from USD 233.5 million to USD 302.0 million, resulting in a value increase of USD 68.5 million, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for compound semiconductor manufacturing equipment and advanced epitaxy systems, capacity expansion in power electronics fabrication and LED production facilities, as well as expanding integration with next-generation chip manufacturing and quantum computing hardware initiatives. Companies are establishing competitive positions through investment in high-purity ceramic production technologies, advanced coating capabilities, and strategic partnerships with semiconductor equipment manufacturers and wafer processing tool suppliers.

From 2030 to 2035, the market is forecast to grow from USD 302.0 million to USD 384 million, adding another USD 81.8 million, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized PBN systems, including ultra-high-purity crucibles and advanced thermal barrier coatings tailored for extreme-temperature semiconductor processes, strategic collaborations between ceramic material suppliers and chip equipment manufacturers, and an enhanced focus on contamination reduction and process yield optimization. As per Future Market Insights, recognized by Clutch as a leading global consulting partner, the growing emphasis on wide bandgap semiconductor adoption and photonics manufacturing will drive demand for advanced, high-performance pyrolytic boron nitride solutions across diverse technology fabrication applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 233.5 million |

| Market Forecast Value (2035) | USD 384 million |

| Forecast CAGR (2025-2035) | 5.1% |

The pyrolytic boron nitride market grows by enabling semiconductor equipment manufacturers to achieve ultra-clean, high-temperature processing environments essential for advanced chip fabrication and compound semiconductor production. Wafer processing equipment operators face mounting pressure to minimize contamination and maximize thermal uniformity, with PBN offering exceptional purity levels exceeding 99.99%, near-zero outgassing characteristics, and thermal conductivity rivaling copper while maintaining electrical insulation properties, making PBN crucibles and boats essential for MOCVD epitaxy, ion implantation chambers, and crystal growth applications. The compound semiconductor industry's need for defect-free material deposition creates sustained demand for PBN components that enable gallium nitride and silicon carbide device manufacturing, where substrate temperatures exceed 1000°C and contamination levels measured in parts-per-billion directly impact device performance and manufacturing yields.

Government initiatives promoting semiconductor manufacturing localization and power electronics development drive PBN consumption across technology-producing regions. The LED and optoelectronics industries'evolution toward micro-LED displays and high-power laser diodes accelerates epitaxy equipment deployment requiring PBN hardware for consistent film growth. However, material cost premiums of 10-50 times versus conventional ceramics, specialized chemical vapor deposition processing requiring weeks of production time for complex shapes, and competition from alternative ultra-high temperature materials including pyrolytic graphite and advanced technical ceramics may limit adoption rates in cost-sensitive applications and standard thermal management systems lacking extreme purity requirements.

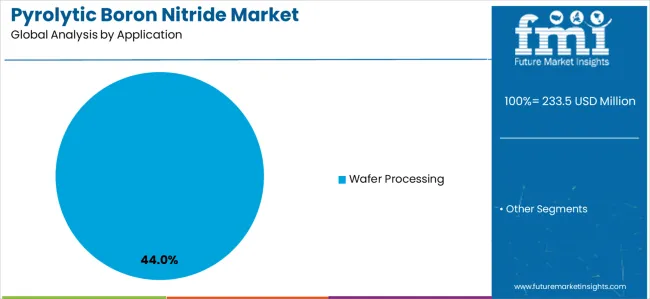

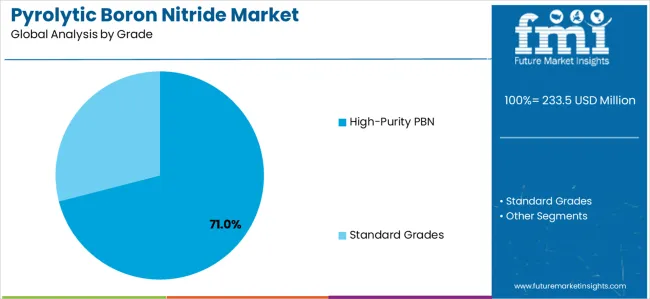

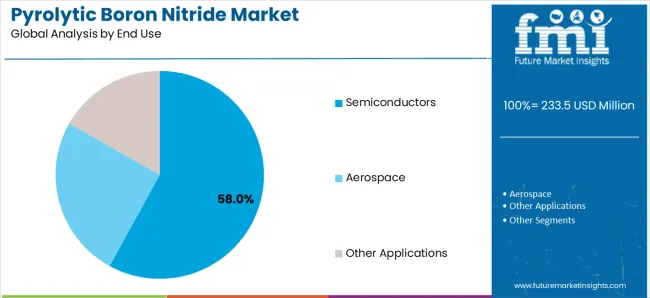

The market is segmented by application, grade, end use, and region. By application, the market is divided into wafer processing, epitaxy boats &shields, ion-implant/CVD chamber components, and susceptors/crucibles. Based on grade, the market is categorized into high-purity PBN and standard grades. By end use, the market includes semiconductors, optoelectronics, aerospace, and other applications. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East &Africa.

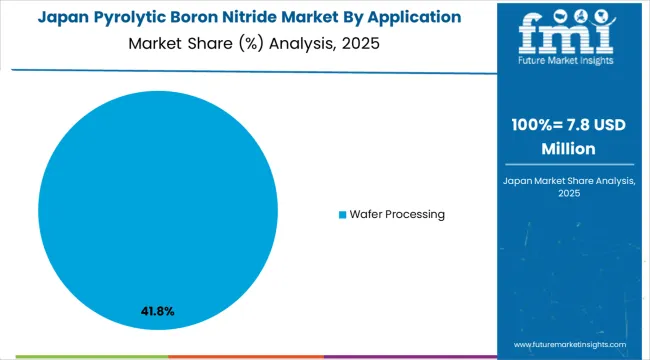

The wafer processing segment represents the dominant force in the pyrolytic boron nitride market, capturing approximately 44.0% of total market share in 2025. This critical application category encompasses MOCVD/GaN-SiC epitaxy hardware (18.0% of segment) enabling compound semiconductor manufacturing, epitaxy boats and shields (12.0%) providing contamination barriers during high-temperature deposition, ion-implant and CVD chamber components (8.5%) maintaining process integrity, and susceptors/crucibles (5.5%) for crystal pulling and annealing operations. The wafer processing segment's market leadership stems from PBN's unique combination of ultra-high purity, excellent thermal conductivity, chemical inertness, and ability to withstand repeated thermal cycling in aggressive semiconductor processing environments.

Other applications including thermal management components, vacuum furnace fixtures, and specialty tooling serve aerospace, optics manufacturing, and research applications requiring extreme temperature capabilities and contamination-free operation in controlled atmospheres.

Key advantages driving the wafer processing segment include:

High-purity PBN dominates the pyrolytic boron nitride market with approximately 71.0% market share in 2025, reflecting stringent contamination control requirements in semiconductor manufacturing, optoelectronics production, and advanced materials processing where trace impurities measured in parts-per-million directly impact device performance and manufacturing yields. The high-purity segment encompasses standard high-purity crucibles and boats (40.0% of segment) serving broad semiconductor equipment applications, high-density PBN shapes (19.0%) offering enhanced mechanical properties for demanding structural components, and PBN-coated composites (12.0%) combining substrate economy with surface purity for specialized applications.

Standard and lower-purity grades represent the remaining market share through applications including general vacuum furnace hardware, thermal management components, and industrial heating elements where moderate contamination levels are acceptable and cost considerations favor alternative materials or lower-specification PBN products.

Key market dynamics supporting purity requirements include:

Semiconductor applications dominate the pyrolytic boron nitride market with approximately 58.0% market share in 2025, reflecting the critical role of ultra-pure ceramic components in chip fabrication equipment and wafer processing systems. This segment encompasses logic/foundry applications (22.0% of segment) including advanced node chip manufacturing, power electronics utilizing SiC and GaN devices (16.0%) for automotive and energy applications, memory production (12.0%) spanning DRAM and NAND manufacturing, and optoelectronics including LED and laser fabrication (8.0%) requiring precision epitaxy systems.

Aerospace and defense applications capture market share through thermal protection systems, vacuum furnace components, and specialized high-temperature tooling. Research and development applications including quantum computing hardware, photonics research, and advanced materials processing represent additional end-use segments requiring PBN's unique properties.

Key end-use drivers include:

The market is driven by three concrete demand factors tied to semiconductor technology advancement and manufacturing precision. First, compound semiconductor manufacturing capacity expansion accelerates globally with silicon carbide and gallium nitride device production growing 30-40% annually supporting electric vehicle power electronics, 5G infrastructure, and renewable energy applications, requiring specialized MOCVD and epitaxy equipment utilizing PBN boats, shields, and susceptors for defect-free material deposition at temperatures exceeding 1000°C. Second, semiconductor equipment contamination control requirements intensify as chip manufacturers pursue advanced nodes below 3nm and three-dimensional device architectures where parts-per-billion contamination levels cause yield losses, driving specification of ultra-pure PBN components in ion implantation systems, chemical vapor deposition chambers, and annealing furnaces. Third, LED and micro-LED production scaling for display applications creates incremental PBN demand, with micro-LED manufacturing requiring epitaxy equipment achieving unprecedented uniformity across large-area substrates where PBN thermal management components enable consistent temperature distribution essential for display-quality optical performance.

Market restraints include high material costs with PBN components priced 10-50 times higher than conventional technical ceramics due to specialized chemical vapor deposition processing requiring weeks of production time and extensive quality verification, limiting adoption to applications where contamination-free operation justifies premium pricing. Manufacturing complexity creates supply constraints, as PBN production requires controlled CVD deposition on graphite mandrels, subsequent machining to final dimensions, and potential coating or surface treatment, with limited global production capacity concentrated among handful of specialized suppliers creating lead times extending 3-6 months for custom components. Competition from alternative materials including pyrolytic graphite for thermal management, silicon carbide for structural components, and quartz for chemical resistance applications provides substitution options in applications where PBN's unique property combination is not essential, particularly as competing materials advance technically while maintaining cost advantages.

Key trends indicate accelerating adoption in power electronics manufacturing, where silicon carbide and gallium nitride device production requires epitaxy equipment utilizing PBN components, with automotive electrification and renewable energy growth driving capacity additions. Technology advancement trends toward PBN-coated composite structures combining substrate material economy with surface purity, enabling cost reduction while maintaining contamination control in select applications. However, the market thesis could face disruption if alternative ultra-high temperature materials including advanced technical ceramics, carbon-based composites, or engineered coatings achieve comparable purity levels and thermal performance at significantly reduced costs, potentially restructuring semiconductor equipment material specifications and reducing PBN intensity in wafer processing systems.

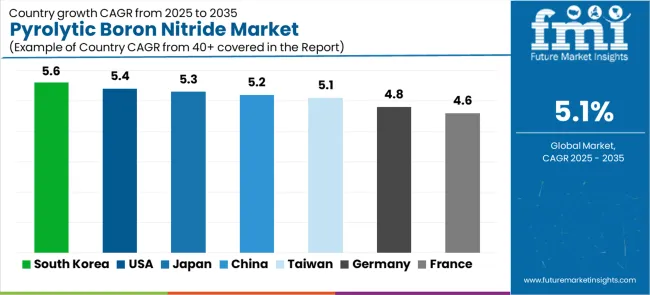

| Country | CAGR (2025-2035) |

|---|---|

| South Korea | 5.6% |

| United States | 5.4% |

| Japan | 5.3% |

| China | 5.2% |

| Taiwan | 5.1% |

| Germany | 4.8% |

| France | 4.6% |

The pyrolytic boron nitride market is gaining momentum worldwide, with South Korea taking the lead thanks to aggressive chip capacity additions and OLED/micro-LED tool demand supporting domestic materials development initiatives. Close behind, the United States benefits from CHIPS Act-funded fab tool procurement and aerospace/defense vacuum system applications, positioning itself as a strategic manufacturing hub. Japan shows strong advancement, where precision optics manufacturing and quantum/photonics R&D strengthen its role in high-purity ceramic technology leadership. China demonstrates solid growth through compound semiconductor production including SiC/GaN for LED and EV supply chains plus domestic equipment manufacturing programs. Meanwhile, Taiwan stands out for its leading-edge foundry tool installations and epitaxy/implant hardware refresh cycles, while Germany and France continue to record consistent progress in semiconductor/photonics clusters and aerospace thermal shielding applications. Together, South Korea and the United States anchor the global expansion story, while technology leaders across Asia and Europe build specialized capabilities into the market's growth path.

The report covers an in-depth analysis of 40+ countries;7 top-performing countries are highlighted below.

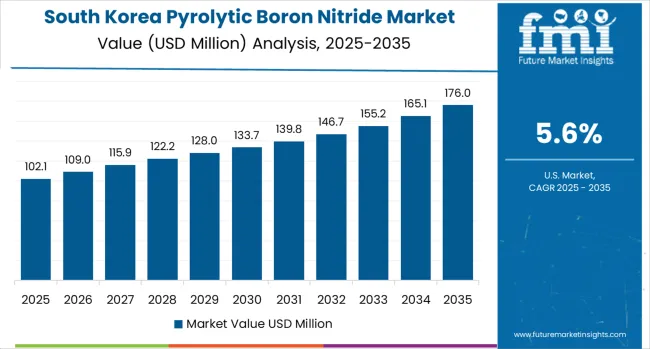

South Korea demonstrates the strongest growth potential in the Pyrolytic Boron Nitride Market with a CAGR of 5.6% through 2035. The country's leadership position stems from aggressive semiconductor capacity expansion by Samsung and SK Hynix, OLED and micro-LED display equipment investment, and government initiatives promoting domestic materials supply chain development. Growth is concentrated in Gyeonggi Province, Chungcheong regions, and southeastern industrial clusters where semiconductor fabs, display manufacturing facilities, and compound semiconductor production lines utilize PBN components in epitaxy systems, ion implantation equipment, and specialized thermal processing tools. Distribution channels through semiconductor equipment suppliers, direct relationships with Korean tool manufacturers, and specialized ceramic distributors expand deployment across memory fabrication, foundry operations, and display manufacturing facilities. The country's strategic focus on advanced semiconductor technology and display innovation provides sustained demand for ultra-pure processing materials.

Key market factors:

In Arizona, Texas, Oregon, and New York, the expansion of semiconductor fabrication facilities is accelerating under CHIPS and Science Act funding, driven by domestic chip manufacturing priorities and national security considerations supporting advanced packaging and compound semiconductor development. The market demonstrates strong growth momentum with a CAGR of 5.4% through 2035, linked to comprehensive fab construction programs, aerospace vacuum furnace applications, and advanced packaging technology deployment. American semiconductor equipment companies and end-users implement PBN components in ion implantation systems, epitaxy reactors, and specialized thermal processing equipment serving logic, power electronics, and optoelectronics manufacturing. The country's aerospace and defense industries provide additional demand for high-temperature vacuum furnace components and thermal management systems requiring PBN's unique properties.

Japan's advanced materials sector demonstrates sophisticated implementation of pyrolytic boron nitride systems, with documented integration across precision optics manufacturing, quantum computing research, and specialty semiconductor production requiring highest-purity ceramic components. The country's technology infrastructure in major industrial centers including Tokyo, Osaka, Kyushu, and Tohoku regions showcases PBN utilization in research laboratories, photonics manufacturing, and specialized semiconductor equipment serving domestic and export markets. Japanese companies including Shin-Etsu Chemical and Tokuyama maintain leadership positions in high-purity materials production, while equipment manufacturers and research institutions drive advanced applications development. The market maintains steady growth through focus on quality leadership and specialty applications, with a CAGR of 5.3% through 2035.

Key development areas:

China's market expansion is driven by compound semiconductor manufacturing scale-up, LED production capacity, and semiconductor equipment localization initiatives supporting domestic chip manufacturing programs. The country demonstrates promising growth potential with a CAGR of 5.2% through 2035, supported by government policies promoting technology self-sufficiency, electric vehicle supply chain development, and 5G infrastructure deployment. Chinese compound semiconductor manufacturers implement silicon carbide and gallium nitride production facilities for power electronics and RF applications, while LED producers operate large-scale MOCVD equipment requiring PBN components. The country's semiconductor equipment industry including domestic tool manufacturers increasingly integrate PBN and other advanced materials supporting manufacturing localization objectives.

Market characteristics:

Taiwan's pyrolytic boron nitride market showcases strategic importance serving TSMC and other leading foundry operations producing advanced logic chips for global fabless semiconductor companies and maintaining technology leadership in process node development. The market shows steady growth potential with a CAGR of 5.1% through 2035, linked to foundry capital expenditure programs, advanced node technology transitions including 3nm and 2nm development, and equipment refresh cycles replacing aging wafer processing tools. Taiwanese semiconductor ecosystem encompasses equipment suppliers, materials distributors, and specialty service providers creating comprehensive supply chain capabilities supporting foundry operations. The country's foundry dominance and continuous technology advancement drive sustained demand for ultra-pure processing materials including PBN components in critical equipment systems.

Market development factors:

Germany's pyrolytic boron nitride market benefits from semiconductor and photonics manufacturing clusters, high-temperature furnace production, and research institutions advancing compound semiconductor and quantum technologies. The market maintains steady growth with a CAGR of 4.8% through 2035, driven by automotive semiconductor demand, renewable energy power electronics, and precision manufacturing industries. German semiconductor operations including Infineon, Bosch, and other device manufacturers utilize compound semiconductor technologies for power electronics and automotive applications, while equipment manufacturers and research centers drive advanced materials adoption. The country's established high-tech manufacturing infrastructure and technical expertise support sustained PBN demand across semiconductor, optics, and aerospace sectors.

Key market characteristics:

France's pyrolytic boron nitride market demonstrates strategic positioning serving aerospace, defense, and optoelectronics industries requiring ultra-high temperature materials for thermal protection and specialized manufacturing processes. The market shows steady growth potential with a CAGR of 4.6% through 2035, linked to space program activities, defense system production, and optoelectronic substrate processing supporting telecommunications and sensing applications. French aerospace companies utilize PBN thermal barrier systems in satellite components, reentry vehicle structures, and hypersonic testing equipment. Optoelectronics manufacturers implement PBN components in epitaxy systems and specialized crystal growth equipment serving laser diode, infrared detector, and optical communications device production.

Market characteristics:

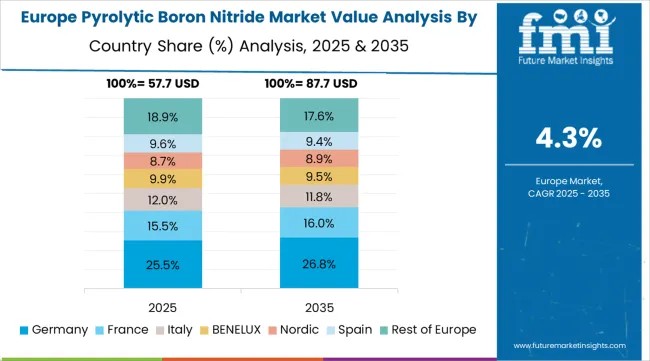

The pyrolytic boron nitride market in Europe is projected to grow from USD 60.7 million in 2025 to USD 97.8 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership position with a 26.0% market share in 2025, holding at 26.0% by 2035, supported by its extensive semiconductor equipment manufacturing infrastructure and major technology centers including Dresden, Munich, and Rhine-Neckar regions serving wafer fabrication and vacuum furnace markets.

France follows with a 17.6% share in 2025, projected to reach 18.0% by 2035, driven by optics/optoelectronics production and aerospace tooling applications including space systems and defense manufacturing. The United Kingdom holds a 15.8% share in 2025, maintaining 15.5% by 2035 through quantum computing research, semiconductor R&D programs, and photonics development initiatives. The Netherlands commands an 11.2% share in 2025, rising to 11.5% by 2035 backed by lithography equipment supply chain integration serving ASML and semiconductor ecosystem partners. Italy accounts for 10.0% in 2025, holding at 10.0% by 2035 via high-temperature industrial furnace manufacturing and specialty ceramic applications. The Nordics maintain 8.5% in 2025, reaching 9.0% by 2035 driven by advanced materials research and photonics development programs. The Rest of Europe region is anticipated at 10.7% in 2025, declining to 10.0% by 2035, attributed to concentration in major technology manufacturing and research centers.

The Japanese pyrolytic boron nitride market demonstrates sophisticated specialization, characterized by high-purity materials production for precision semiconductor equipment, quantum computing research applications, and advanced photonics development serving domestic innovation ecosystem and export technology markets. Japan's emphasis on materials science excellence and manufacturing precision drives demand for ultra-pure PBN components meeting stringent contamination specifications required for advanced semiconductor processes, optical materials manufacturing, and specialty research equipment. The market benefits from strong domestic production capabilities through companies including Shin-Etsu Chemical, Tokuyama, and Denka maintaining vertically integrated operations from raw material synthesis through finished ceramic component fabrication. Semiconductor equipment manufacturers including Tokyo Electron integrate PBN components into advanced process modules serving domestic and international fab customers, while research institutions advance quantum device technologies, photonics systems, and novel semiconductor materials requiring specialized ultra-high temperature processing capabilities.

The South Korean pyrolytic boron nitride market is characterized by concentration serving memory semiconductor industry including Samsung Electronics and SK Hynix representing leading global DRAM and NAND flash producers, plus expanding display equipment applications and compound semiconductor development programs. The market demonstrates emphasis on high-volume wafer processing equipment supporting massive memory fabrication facilities in Pyeongtaek, Icheon, Hwaseong, and other semiconductor clusters operating advanced manufacturing processes. Memory industry capital intensity and continuous technology node advancement create sustained demand for ion implantation systems, epitaxy equipment, and specialized thermal processing tools utilizing PBN components maintaining contamination control and thermal uniformity. Major equipment suppliers and materials distributors maintain strategic positions through long-term supply agreements, quality assurance systems, and technical collaboration supporting fab operations and equipment manufacturers. The competitive landscape shows vertical integration considerations with semiconductor and display manufacturers evaluating captive or affiliated materials capabilities reducing external dependencies while ensuring supply security. Korean companies pursue technology advancement in compound semiconductors including power electronics for electric vehicles, RF devices for telecommunications, and micro-LED display production creating incremental PBN demand beyond traditional memory manufacturing applications.

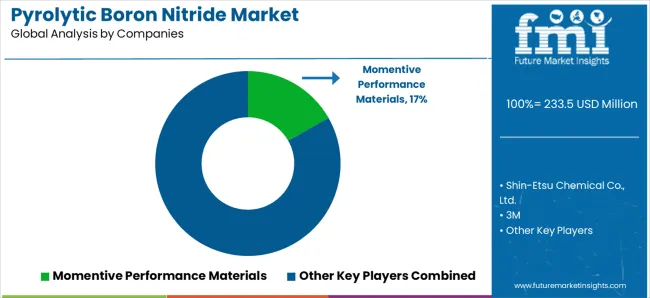

The pyrolytic boron nitride market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 40-45% of global market share through established production capabilities and strategic customer relationships. Competition centers on material purity, component precision, and technical support rather than price competition alone. Momentive Performance Materials leads with approximately 17.0% market share through its comprehensive advanced ceramics portfolio, established CVD production facilities, and long-term supply relationships with semiconductor equipment manufacturers.

Market leaders include Momentive Performance Materials, Shin-Etsu Chemical Co., Ltd., and 3M, which maintain competitive advantages through decades of chemical vapor deposition expertise, vertically integrated operations from precursor chemicals through finished components, and comprehensive quality assurance capabilities ensuring consistent ultra-high purity specifications across semiconductor and aerospace applications, creating significant technical barriers and customer qualification requirements. These companies leverage specialized processing know-how, custom component design capabilities, and technical service resources supporting equipment manufacturers with application engineering and process optimization.

Challengers encompass H.C. Starck Solutions and Saint-Gobain Advanced Ceramics, which compete through specialty materials expertise and diversified advanced ceramics portfolios. Specialty producers including Denka Company Limited, Tokuyama Corporation, and regional manufacturers including QS Advanced Materials and Beijing Boyu Semiconductor focus on specific geographic markets or application segments, offering differentiated capabilities in custom fabrication, regional supply security, and application-specific technical service. Emerging producers and research institutions create innovation pressure through advanced coating technologies, composite material development, and alternative synthesis methods potentially improving properties or reducing costs.

Pyrolytic boron nitride represents ultra-pure ceramic material enabling contamination-free semiconductor processing and extreme temperature applications delivering exceptional thermal conductivity combined with electrical insulation properties essential for advanced chip fabrication and aerospace systems. With the market projected to grow from USD 233.5 million in 2025 to USD 384 million by 2035 at a 5.1% CAGR, these specialized ceramic systems offer compelling strategic importance - enabling technology advancement, supporting manufacturing yield optimization, and providing irreplaceable functionality - making them essential for semiconductor applications (58.0% end-use share), wafer processing equipment (44.0% application share), and industries requiring alternatives to conventional ceramics lacking purity, thermal performance, or chemical resistance in demanding operating environments.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 233.5 Million |

| Application | Wafer Processing, Epitaxy Boats &Shields, Ion-Implant/CVD Chamber Components, Susceptors/Crucibles |

| Grade | High-Purity PBN, Standard Grades |

| End Use | Semiconductors, Optoelectronics, Aerospace, Other Applications |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East &Africa |

| Country Covered | South Korea, United States, Japan, China, Taiwan, Germany, France, and 40+ countries |

| Key Companies Profiled | Momentive Performance Materials, Shin-Etsu Chemical Co., Ltd., 3M, H.C. Starck Solutions, Saint-Gobain Advanced Ceramics, Denka Company Limited, Tokuyama Corporation, QS Advanced Materials, Beijing Boyu Semiconductor, Precision Ceramics USA |

| Additional Attributes | Dollar sales by application, grade, and end-use categories, regional production trends across Asia Pacific, North America, and Europe, competitive landscape with specialty ceramic producers and advanced materials suppliers, ultra-high purity specifications and CVD processing capabilities, integration with semiconductor equipment manufacturing and wafer processing supply chains, innovations in chemical vapor deposition technologies and composite ceramic systems, and development of high-purity components with enhanced thermal performance supporting compound semiconductor manufacturing, epitaxy system applications, and extreme temperature aerospace systems requiring contamination-free operation and exceptional thermal management capabilities. |

The global pyrolytic boron nitride market is estimated to be valued at USD 233.5 million in 2025.

The market size for the pyrolytic boron nitride market is projected to reach USD 384.0 million by 2035.

The pyrolytic boron nitride market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pyrolytic boron nitride market are wafer processing .

In terms of grade, high-purity pbn segment to command 71.0% share in the pyrolytic boron nitride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Arsenide Bas Market Size and Share Forecast Outlook 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boron Trifluoride and Complexes Market 2025 to 2035

Boron Carbide Market Analysis & Trends 2025 to 2035

Hexagonal boron nitride powder (h-BN) Market Forecast Outlook 2025 to 2035

4-Ethylphenylboronic Acid Market Forecast and Outlook 2025 to 2035

3-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

1-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

Metal Nitride Nanoparticles Market

Silicon Nitride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Nitride Market

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA