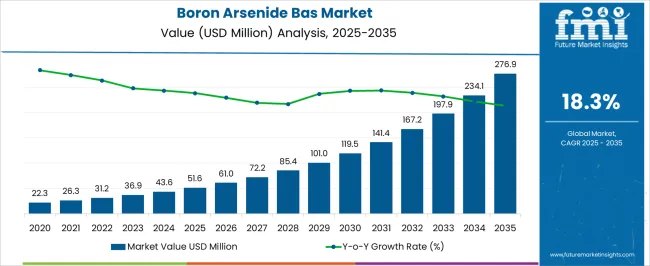

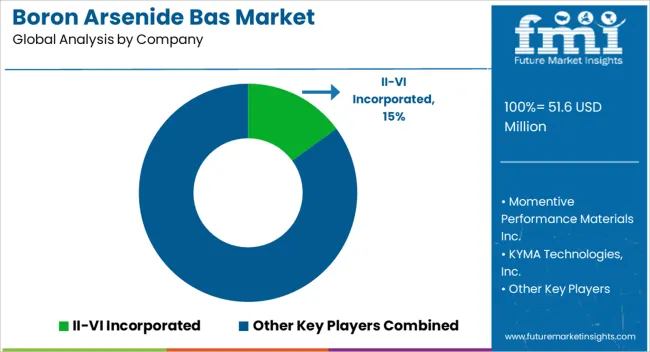

The boron arsenide market is estimated to be valued at USD 51.6 million in 2025 and is projected to reach USD 276.9 million by 2035, registering a compound annual growth rate (CAGR) of 18.3% over the forecast period.

In the initial phase (2020–2024), the market was characterized by limited adoption, primarily driven by research institutions and specialized applications. During this period, stakeholders focused on validating the material's performance and establishing its viability as an alternative to traditional semiconductors. As the market transitioned into the scaling phase (2025–2030), increased production capabilities and broader industry acceptance facilitated more extensive use in commercial applications. By the consolidation phase (2030–2035), boron arsenide is expected to become a mainstream material, with established supply chains and standardized applications across various sectors.

This adoption lifecycle illustrates the maturation of the boron arsenide market, highlighting the progression from experimental use to industry-wide integration. The early adoption phase was marked by research and development efforts, aiming to demonstrate the material's feasibility and advantages over conventional semiconductors. The scaling phase saw the expansion of production facilities and the adoption of boron arsenide in larger-scale projects, driven by its cost-effectiveness and performance characteristics. In the final consolidation phase, the market is anticipated to achieve stability, with established standards and widespread utilization, positioning boron arsenide as a standard choice in the semiconductor industry.

| Metric | Value |

|---|---|

| Boron Arsenide Bas Market Estimated Value in (2025 E) | USD 51.6 million |

| Boron Arsenide Bas Market Forecast Value in (2035 F) | USD 276.9 million |

| Forecast CAGR (2025 to 2035) | 18.3% |

The boron arsenide (BAs) market, expanding from USD 51.6 million in 2025 to USD 276.9 million by 2035 at a CAGR of 18.3%, exhibits key breakpoints that define shifts in adoption and market dynamics. The first notable breakpoint occurs around 2025, when the market reaches USD 51.6 million. At this stage, boron arsenide transitions from experimental and small-scale applications to broader commercial deployment. Early success stories and increased production capacity drive confidence among manufacturers and end-users. This period marks the scaling phase, characterized by accelerating adoption, higher production efficiency, and growing investment in supply chains to support expanding demand.

A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 167–197 million. By this stage, BAs adoption has become widespread in electronics and specialized semiconductor applications. The market dynamics shift from growth-driven expansion to competitive consolidation, with major players solidifying their positions and smaller players either merging or exiting. Supply chains stabilize, pricing becomes more predictable, and standardization of applications enhances efficiency. By 2035, reaching USD 276.9 million, the market reflects full consolidation, where boron arsenide is established as a mainstream material, supported by mature production infrastructure, extensive industry acceptance, and widespread application across high-performance electronics.

The market is undergoing a phase of notable advancement, driven by its emerging applications in high thermal conductivity electronics, power devices, and next-generation semiconductor solutions. Increasing demand for advanced materials capable of efficiently managing heat dissipation in compact and high-performance devices is creating strong growth momentum. Strategic investments in production technologies and material refinement have been accelerating adoption in both research and commercial applications.

The market is also benefiting from ongoing innovations in purification methods and scalable synthesis techniques that are enabling higher yields and improved quality. Expanding interest from electronics, aerospace, and energy sectors is expected to sustain demand, while collaborations between research institutions and industry players are fostering new application possibilities.

Regulatory support for energy-efficient devices and sustainable material usage is also contributing to the market’s long-term potential With a growing emphasis on performance reliability and material stability, Boron Arsenide Bas is positioned to become a critical component in advanced material supply chains over the coming years.

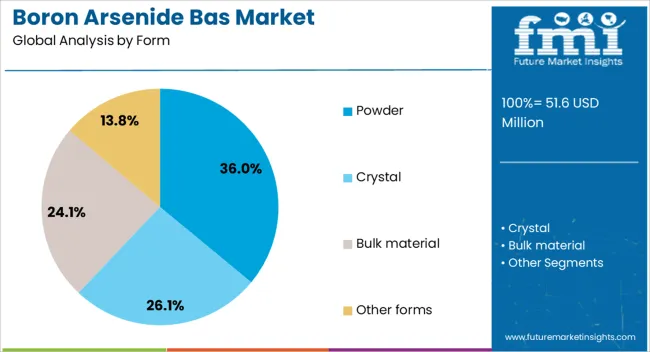

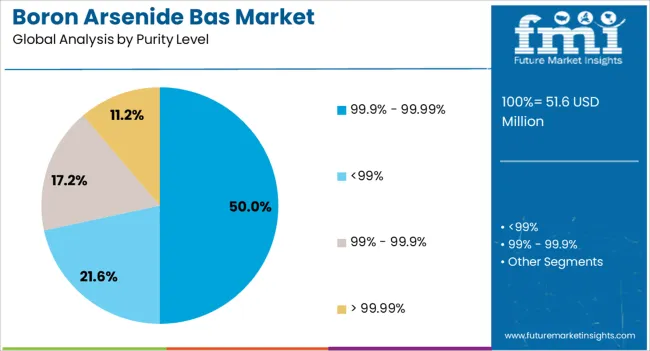

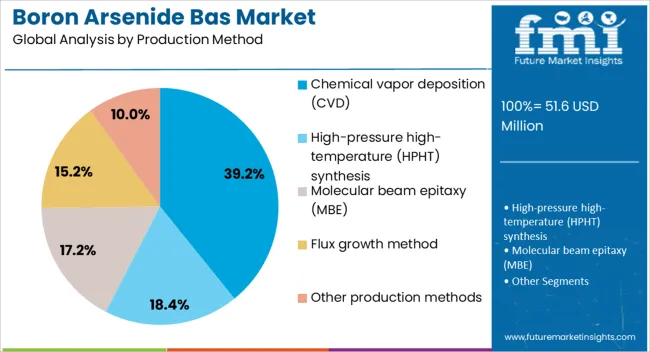

The boron arsenide bas market is segmented by form, purity level, production method, application, end use industry, and geographic regions. By form, boron arsenide bas market is divided into powder, crystal, bulk material, and other forms. In terms of purity level, boron arsenide bas market is classified into 99.9% - 99.99%, <99%, 99% - 99.9%, and > 99.99%. Based on production method, boron arsenide bas market is segmented into chemical vapor deposition (CVD), high-pressure high-temperature (HPHT) synthesis, molecular beam epitaxy (MBE), flux growth method, and other production methods. By application, boron arsenide bas market is segmented into thermal management, electronics cooling, semiconductor devices, research & development, and other applications. By end use industry, boron arsenide bas market is segmented into electronics & semiconductor, telecommunications, automotive & transportation, energy & power, industrial equipment, research institutions & academia, and other end use industries. Regionally, the boron arsenide bas industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 36.00% of the boron arsenide market revenue share in 2025, establishing it as the leading form category. This dominance has been supported by the versatility of the powder format, which enables easier handling, storage, and integration into various manufacturing processes. The powder form offers a high surface area that supports improved reactivity and uniform mixing, making it highly desirable for specialized applications in electronics and materials research. It has been adopted in scenarios where precise formulation and controlled material distribution are required. The ability to process powder into multiple downstream product forms has increased its appeal for research institutions and industrial manufacturers. Furthermore, advancements in powder processing technologies have improved consistency and purity levels, further enhancing its suitability for high-performance applications As demand for flexible and adaptable material formats continues to grow, the powder form of Boron Arsenide Bas is expected to maintain its leadership position.

The 99.9% to 99.99% purity level segment is expected to account for 50.00% of the market revenue share in 2025, making it the dominant purity category. This segment’s growth has been driven by the critical need for high-purity materials in advanced semiconductor and electronic applications, where impurities can significantly impact performance and reliability. The adoption of this purity level has been supported by advancements in purification processes, enabling consistent delivery of materials that meet stringent industry specifications. Industries requiring exceptional thermal conductivity and electrical properties have favored this category to ensure optimal device performance. The capability of this purity level to meet rigorous quality control standards has reinforced its importance in high-precision applications As technology nodes in semiconductor manufacturing continue to advance, the demand for ultra-pure Boron Arsenide Bas in this range is expected to rise, solidifying its position as the most sought-after purity specification in the market.

The chemical vapor deposition production method segment is anticipated to hold 39.20% of the market revenue share in 2025, positioning it as the leading production approach. This growth has been underpinned by the method’s ability to produce materials with exceptional purity, structural uniformity, and controlled thickness. CVD has been recognized for enabling precise control over material properties, which is critical for high-performance electronics and advanced thermal management applications. The scalability of CVD processes, combined with the ability to customize deposition parameters, has strengthened its role in meeting diverse industrial requirements. Additionally, CVD allows for the creation of defect-free crystalline structures, which directly contributes to improved material performance in demanding applications. Continuous advancements in reactor design and process optimization have enhanced efficiency, reduced waste, and lowered production costs, further driving its adoption As the need for reliable and reproducible material synthesis increases, the CVD method is expected to maintain its dominant role in Boron Arsenide Bas production.

The market is growing as demand rises for advanced materials with exceptional thermal conductivity and electronic properties. BAs is increasingly recognized for high-performance electronics, thermal management, and next-generation semiconductor applications. Adoption is driven by technological innovation and the need for efficient heat dissipation in compact electronic systems. However, challenges remain around production scalability, material purity, regulatory standardization, and market awareness. Industry players focusing on research partnerships, advanced fabrication, and application-specific solutions are positioned to capture growth in high-performance electronics and thermal management sectors.

The Boron Arsenide market faces challenges in producing high-purity, defect-free crystals. Achieving the material’s superior thermal and electronic properties requires stringent control over the synthesis process to minimize impurities. Manufacturing at commercial scale is complex and costly, as raw material handling and precise fabrication techniques are critical to ensure consistent performance. Variability in crystal quality can affect thermal conductivity and device efficiency, making reliability a key concern. Limited industrial-scale production capacity and high operational costs also pose barriers to widespread adoption. Companies must invest heavily in process optimization, quality assurance, and specialized equipment to overcome these challenges and deliver materials suitable for high-performance applications.

Boron Arsenide is gaining attention for its ability to efficiently manage heat in electronic devices while supporting high charge mobility. The material is increasingly used in applications such as power electronics, high-frequency transistors, optoelectronics, and thermal interface components. Research is exploring BAs’ potential for self-healing and radiation-resistant applications, enhancing its appeal in aerospace and nuclear sectors. Digital design tools and advanced fabrication techniques are improving material integration into devices, while collaborations between research institutions and manufacturers accelerate innovation. The trend toward compact, high-performance electronics is pushing adoption of BAs as a material of choice for efficient thermal management and next-generation semiconductor solutions.

The exceptional properties of Boron Arsenide open opportunities across multiple high-performance applications. In electronics, it can be used in transistors, diodes, and integrated circuits that require superior heat dissipation. Optoelectronic devices, including laser diodes and LEDs, can benefit from its stability and thermal efficiency. BAs also presents potential in thermal management solutions for compact electronic systems, improving reliability and device longevity. Ongoing research into novel device architectures and material combinations offers additional growth potential. Strategic partnerships, licensing of proprietary synthesis techniques, and targeted adoption in aerospace, defense, and semiconductor industries can further expand its market footprint.

Market growth for Boron Arsenide is restrained by regulatory ambiguity and limited standardization. There is a lack of widely accepted protocols for material quality, safety, and performance, making adoption by manufacturers cautious. High production costs, specialized equipment requirements, and the need for skilled expertise create barriers to entry. Additionally, market awareness among device manufacturers is still developing, limiting integration into mainstream electronics. Until industry standards are established and fabrication processes become more cost-effective, the adoption of Boron Arsenide may remain concentrated in high-value, specialized applications.

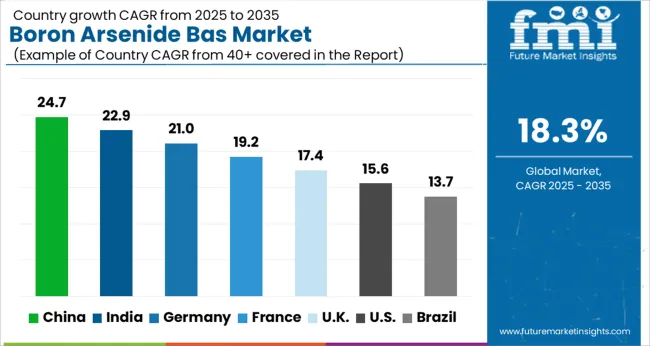

| Country | CAGR |

|---|---|

| China | 24.7% |

| India | 22.9% |

| Germany | 21.0% |

| France | 19.2% |

| UK | 17.4% |

| USA | 15.6% |

| Brazil | 13.7% |

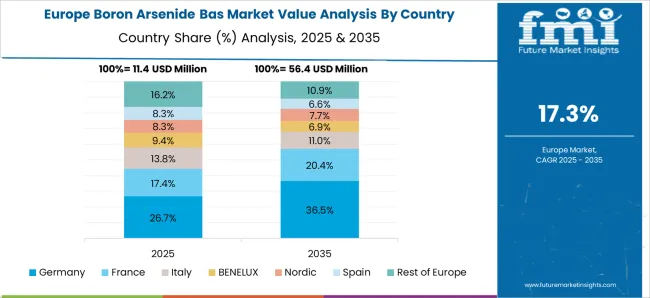

The global boron arsenide base market is projected to grow at a CAGR of 18.3% through 2035, supported by increasing demand across electronics, semiconductor, and thermal management applications. Among BRICS nations, China has been recorded with 24.7% growth, driven by large-scale production and deployment in high-performance electronic devices, while India has been observed at 22.9%, supported by rising utilization in semiconductors and advanced thermal materials. In the OECD region, Germany has been measured at 21.0%, where production and adoption for electronics and industrial thermal management applications have been steadily maintained. The United Kingdom has been noted at 17.4%, reflecting consistent use in semiconductor and electronic industries, while the USA has been recorded at 15.6%, with production and utilization across electronics, industrial, and semiconductor sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The boron arsenide market in China is expanding at a CAGR of 18.3%, driven by increasing demand for high thermal conductivity materials in electronics, semiconductors, and advanced thermal management applications. Rapid growth in consumer electronics, electric vehicles, and power devices is fueling adoption of BAs for heat dissipation and energy efficiency. Research institutions and manufacturers are investing heavily in synthesis, production, and quality improvement of boron arsenide crystals and composites. Government policies supporting advanced material research and industrial innovation are further accelerating market growth. Strategic partnerships between universities, startups, and semiconductor companies are driving R&D to enhance thermal and mechanical properties. Additionally, pilot projects are testing BAs integration in high power transistors, laser diodes, and electronic packaging, positioning China as a leading market for next generation thermal management solutions.

India’s boron arsenide market is growing at a CAGR of 18.3%, fueled by emerging electronics, semiconductor, and renewable energy industries. Increasing demand for high power and high frequency devices is driving adoption of BAs for thermal management in power electronics and optoelectronic components. Research centers and academic institutions are collaborating with startups and industrial firms to optimize synthesis methods and material integration. Government policies promoting innovation in semiconductor manufacturing and advanced materials are encouraging local production capabilities. Pilot projects and feasibility studies in high thermal conductivity components are helping engineers understand practical applications. As electric vehicle production and renewable energy projects expand, BAs adoption for efficient heat dissipation in batteries, inverters, and high power electronics is expected to rise steadily. Awareness campaigns and technical seminars are further educating engineers and material scientists on the benefits of boron arsenide.

Boron arsenide market in Germany is recording a CAGR of 21.0%, supported by strong semiconductor manufacturing, automotive electronics, and industrial research programs. BAs is increasingly used for thermal management in power devices, high frequency electronics, and advanced sensors. Universities and industrial research centers are collaborating to improve material quality, scalability, and application performance. Pilot production facilities are integrating BAs into electronic components and testing thermal dissipation in power transistors and laser devices. Germany’s focus on renewable energy, electric mobility, and energy efficient electronics is boosting demand. Regulatory frameworks for high quality industrial materials ensure consistent standards and reliability. Technical conferences and industry workshops are enhancing knowledge transfer among material scientists, electronics engineers, and device manufacturers. BAs adoption in high power electronics, automotive components, and energy efficient devices is expected to accelerate in the coming years.

The United Kingdom is witnessing a CAGR of 17.4% in the boron arsenide market, supported by growing research in high performance electronics, thermal management, and optoelectronics. BAs is being explored for applications in power semiconductors, high frequency devices, and laser technologies. Research collaborations between universities and technology startups are focusing on cost effective production methods, crystal quality, and application specific formulations. Government programs promoting advanced materials and semiconductor innovation are enhancing market development. Pilot projects and demonstration studies in electronics and power devices are validating performance benefits, such as improved heat dissipation and energy efficiency. Awareness initiatives and knowledge sharing between material scientists and engineers are helping integrate BAs into practical industrial applications. Adoption is expected to grow steadily as consumer electronics, renewable energy systems, and electric vehicles expand in the UK market.

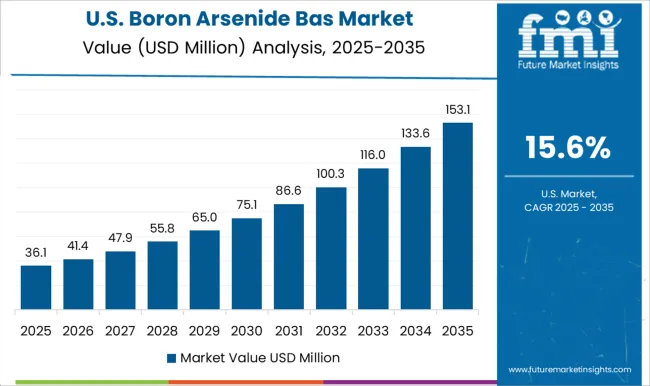

The United States boron arsenide market is growing at a CAGR of 15.6%, driven by demand for advanced thermal management in electronics, semiconductors, and power devices. BAs is used in high power transistors, laser diodes, and energy efficient electronics due to its exceptional thermal conductivity. Industrial and academic research centers are developing scalable production techniques and optimizing crystal quality. Pilot projects and demonstration studies are supporting adoption in automotive, aerospace, and renewable energy electronics. Government initiatives promoting semiconductor innovation and advanced material research are stimulating investment. Partnerships between universities, startups, and established electronics companies are enhancing R&D outcomes. Awareness campaigns, technical workshops, and industry conferences are educating engineers and designers on integration strategies. Adoption is expected to increase steadily as demand for energy efficient, high performance electronics continues to grow.

The market is defined by a mix of global leaders and specialized innovators. Coherent Corp. leverages advanced semiconductor manufacturing expertise to produce high-purity BAs for thermal management and electronic applications. Momentive Performance Materials Inc. focuses on high-performance solutions, targeting electronics and industrial applications with tailored chemical properties. KYMA Technologies, Inc. develops precision materials with niche applications in power electronics and thermal interfaces. Materion Corporation integrates BAs into engineered solutions, emphasizing material reliability and consistency for demanding industries. Shin-Etsu Chemical Co., Ltd. and Sumitomo Electric Industries, Ltd. utilize strong production capabilities and global networks to serve electronics and semiconductor clients efficiently. Heraeus Holding GmbH emphasizes metallurgical-grade BAs and specialty material solutions. Indium Corporation provides high-purity materials for electronics, research, and thermal management applications, while other regional or emerging companies contribute with specialized, niche offerings. Competition revolves around innovation, material quality, and market reach.

Companies invest heavily in R&D to optimize thermal conductivity, electrical properties, and production yields. Brochures and product literature are essential tools, presenting technical specifications, application benefits, and comparative advantages in clear, concise formats. Global leaders highlight scale, reliability, and integration into electronic supply chains, whereas smaller players focus on flexibility, customization, and rapid delivery. Marketing materials are crafted to communicate performance advantages efficiently. Digital and print brochures showcase thermal and electronic properties, purity levels, and use cases, helping decision-makers evaluate suitability quickly. Success in the BAs market depends not only on material performance but also on clearly demonstrating value through compelling, informative, and visually engaging presentations, making brochures and technical documentation critical in maintaining a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 51.6 million |

| Form | Powder, Crystal, Bulk material, and Other forms |

| Purity Level | 99.9% - 99.99%, <99%, 99% - 99.9%, and > 99.99% |

| Production Method | Chemical vapor deposition (CVD), High-pressure high-temperature (HPHT) synthesis, Molecular beam epitaxy (MBE), Flux growth method, and Other production methods |

| Application | Thermal management, Electronics cooling, Semiconductor devices, Research & development, and Other applications |

| End Use Industry | Electronics & semiconductor, Telecommunications, Automotive & transportation, Energy & power, Industrial equipment, Research institutions & academia, and Other end use industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Coherent Corp., Momentive Performance Materials Inc., KYMA Technologies, Inc., Materion Corporation, Shin-Etsu Chemical Co., Ltd., Sumitomo Electric Industries, Ltd., Heraeus Holding GmbH, Indium Corporation, and Other companies |

| Additional Attributes | Dollar sales in the Boron Arsenide (BAs) Market vary by type including bulk crystals, thin films, and wafers, application across semiconductors, electronics cooling, and high-power devices, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for high thermal conductivity materials, advancements in semiconductor technology, and increasing adoption in high-performance electronic devices. |

The global boron arsenide bas market is estimated to be valued at USD 51.6 million in 2025.

The market size for the boron arsenide bas market is projected to reach USD 276.9 million by 2035.

The boron arsenide bas market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in boron arsenide bas market are powder, _nano powder, _micro powder, _other powder forms, crystal, _single crystal, _polycrystalline, _thin film, bulk material and other forms.

In terms of purity level, 99.9% - 99.99% segment to command 50.0% share in the boron arsenide bas market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boron Trifluoride and Complexes Market 2025 to 2035

Boron Carbide Market Analysis & Trends 2025 to 2035

Hexagonal boron nitride powder (h-BN) Market Forecast Outlook 2025 to 2035

Pyrolytic Boron Nitride Market Size and Share Forecast Outlook 2025 to 2035

4-Ethylphenylboronic Acid Market Forecast and Outlook 2025 to 2035

3-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

1-Methoxynaphthalene-2-Boronic Acid Market Forecast and Outlook 2025 to 2035

Basketball Shoe Market Forecast Outlook 2025 to 2035

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Base Editing Market Size and Share Forecast Outlook 2025 to 2035

Base Transceiver Station (BTS) Market Size and Share Forecast Outlook 2025 to 2035

Basil Leaves Market Size and Share Forecast Outlook 2025 to 2035

Base Paper Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Base Station Antenna Market Insights - Size, Share & Growth Forecast 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA